BECTORFOOD

BECTORFOOD : Going long for about 0.625% of the net capitalTechnical Overview :

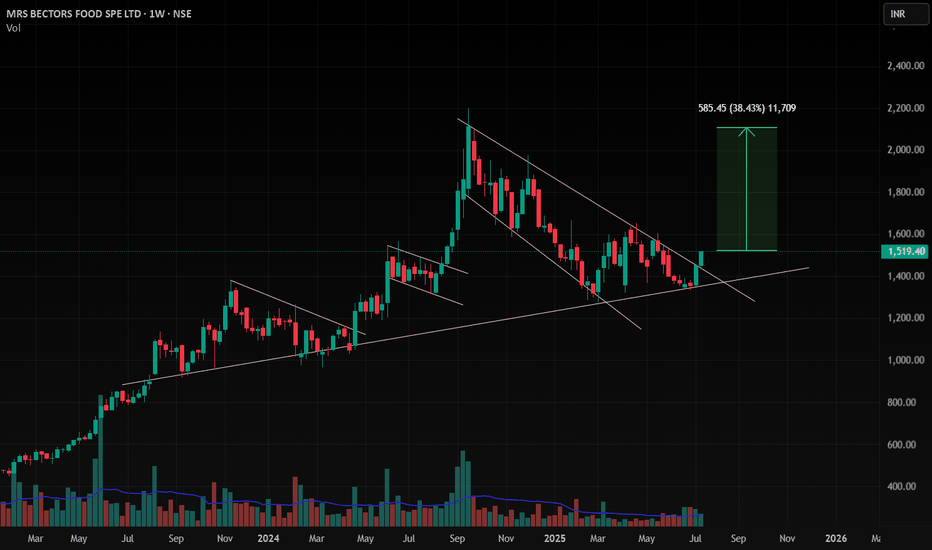

Took a position for about 0.625% of the net capital from a level closer to the lower trendline of the descending channel. Will be targeting the high of the descending channel for a potential move of about 43% from the current average entry price.

Fundamental Overview :

Mrs. Bectors Food Specialities Limited, a prominent player in India's fast-moving consumer goods (FMCG) sector, has exhibited notable financial performance in recent quarters.

For the fiscal year ending March 31, 2024, Mrs. Bectors reported a revenue from operations of ₹16,239.45 million, marking a 19.22% increase from ₹13,621.39 million in the previous year. The net profit for the year stood at ₹1,403.61 million, reflecting a 55.78% growth compared to ₹900.74 million in FY23.

The company's operating profit margin for FY24 was 15%, with a net profit of ₹145 crore, indicating robust operational efficiency.

Mrs. Bectors Food Specialities Limited has demonstrated strong financial growth, driven by strategic initiatives in product development and market expansion. The significant increases in both revenue and net profit across its key segments underscore the company's solid market position and effective operational strategies.

📢📢📢

If my perspective changes or if I gather additional fundamental data that influences my views, I will provide updates accordingly.

Thank you for following along with this journey, and I remain committed to sharing insights and updates as my trading strategy evolves. As always, please feel free to reach out with any questions or comments.

Other posts related to this particular position and scrip, if any, will be attached underneath. Do check those out too.

Disclaimer : The analysis shared here is for informational purposes only and should not be considered as financial advice. Trading in all markets carries inherent risks, and past performance is not indicative of future results. It’s essential to conduct your own research and assess your risk tolerance before making any investment decisions. The views expressed in this analysis are solely mine. It’s important to note that I am not a SEBI registered analyst, so the analysis provided does not constitute formal investment advice under SEBI regulations.

BECTORFOODS Trading within Demand Zone of ₹1651 to ₹1581.05BECTORFOODS' current price stands at ₹1617, placing it within a demand zone ranging from ₹1651 to ₹1581.05. this may serve as a critical support level. Investors might consider watching this range closely for potential signs of a price reversal or consolidation, which could present a buying opportunity if the stock rebounds from this support area.

#BARBEQUE 733 - 20% upside Buy recommended - Rachit SethiaNSE:BARBEQUE

BARBEQUE 733

TGT 890

SL 660

TF <6 M

RR >2

Return > 21%

Factors: BULLISH WEDGE BREAKOUT Trend Following Rising Volume with rising Prices. Flag pattern breakout. Pennant Pattern Breakout with Bullish Candle. Retest Successful. Higher Highs & Higher Lows. Broken above RESISTANCE levels Trading at SUPPORT levels Earnings are strong. Bullish Wedge Breakout Risk Return Ratio is healthy. And Rising from Double Bottom Pattern to Flag Pattern forming. If you like my work KINDLY LIKE SHARE & FOLLOW this page for free Stock Recommendations. With 💚 from Rachit Sethia