BEL20 - finishing minor 2 up, next move is downwardsBel20 continues on its way down to new lows. In the shorter term view, it is ending minor wave 2 soon. After this, the next move should be minor 3, where the most probable target is is below 3,000. If prices crosses up 3,570, this analysis should be reviewed. FOLLOW SKYLINEPRO TO GET UPDATES.

BEL 20

BEL20 - reaching the end of counter trend rallyBEL20 is reaching the most probable target for wave 2 counter trend rally at 0.618 of retracement of wave 1. The wave count for wave C that will complete primary wave 2 is almost complete. The possible target is at 3,518 before the trend turns down in direction to new lows , but it does not need to arrive at this level to do so. For more confirmation, a move below 3199 would mean the odds are that the downturn is already occurring. FOLLOW SKYLINEPRO TO GET UPDATES.

These are the same but then they are also not. Solvac EURONEXT:SOLV is a mono-holding, it owns 30% of $SOLB EURONEXT:SOLB

So I imagined they would both go up and down the same amount.

However, they don't.

Interesting.

I imagine the reason for this is that SOLVAC is owned mostly by the family that used to fully own Solvay chemicals.

fun side fact SOLVAC also pays a higher dividend which is interesting.

It's interesting to see what this company does.

For example, It is selling a lot to airline manufacturers and was counting on 40k new planes being ordered this year.

hmmm logically they withdrew all that guidance.

Will take a second look at them over the weekend.

Rabbi

Short BEL 20 indexAs seen there is a historical low resistance level @3123.7, and a fibonacci ratio of 0.382 @3091.265

I've tried to draw the small bullish trendline which will be colliding with these very soon.

This might indicate an end of this short term increase and a fallback to the bearish trend known as the CoVid19 crash or atleast a long term battle trying to break through this heavy resistance level.

telenet buy opportunityi posted yesterday a trade about it! bu the chart was on the weekly timeframe!

It will more clear on daily timeframe.

just buy it!

good luck

Already +7% since yesterday :)

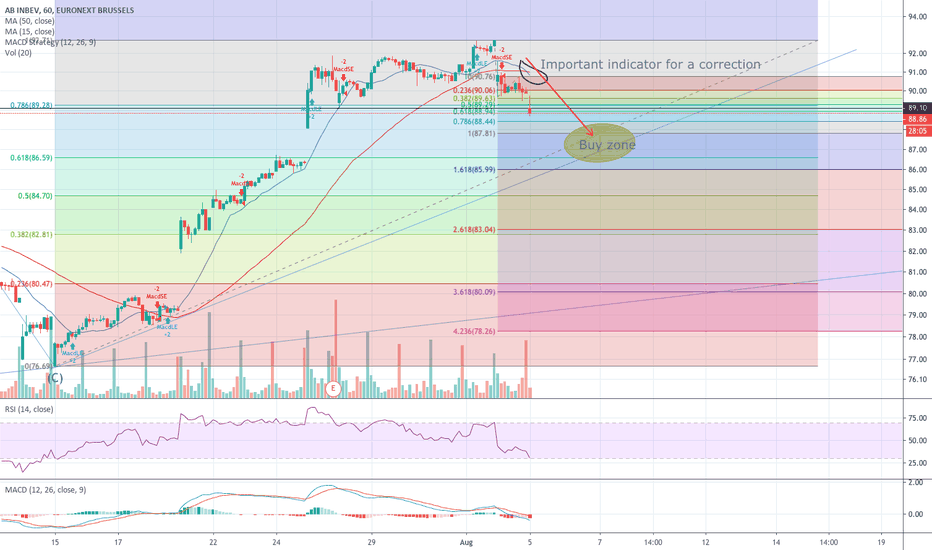

Correction on AB Inbev ongoingthe MA15 and 50 were already strating to go closer together the last 2 weeks and after the red day on the BEL20 index last Friday they finally crossed.

Last time this happened a correction came, so I expect the same to happen now.

Looking at the fibo levels we might go to the 85-86€ level

ABI is playing an inception move on usHi all,

this is my first idea. Don't know if it can be of any use to anyone... In case it is, then thanks for liking it ;-)

According to my (maybe amateuristic) analysis I noticed that ABI is playing an inception move on us. It actually formed a nice cup and handle, in the handle of a major cup and handle.

Further more the MA's show that there might be a slight correction towards the 80€ area. Maybe a buying opportunity?

Then it should take off again towards +- 84€ and on a later stage towards the 95€ area

BEL20: Lower long term buy opportunity on the Belgian market.The Belgian stock market is on an aggressive sell of since late April (1D RSI = 31.496, MACD = -58.680, Highs/Lows = -51.2357) after it failed to break the 3,870 - 3,910 1W Resistance Zone. The symmetry on a peculiar 1M Head and Shoulders pattern is uncanny so we will be using the 3,200 - 3,330 supply zone (red rectangle) as a continuous buy entry until the 1W Resistance Zone breaks. Our TP is initially 3,800. Keep an eye also for a potential Golden Cross as confirmation.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

DAX (EU leading index) - Promising short term inverse H&SIn a previous post on the DAX I emphasized a very bearish stance regarding the DAX on the mid term. I still stand by that thesis completely . However, in the short term, there is an inverse head and shoulders forming , which would - if the neckline were to be broken - give us around 13.200EUR as a break-out target (probably a bit too high, looking at the left shoulder of the long term graph - see further). This is especially interesting if we take into account the mid-long term, as I'm actually bearish on the overall graph . By this, I mean that this short term pattern will allow me and you to get out of our DAX positions (or similar/other EU indexes) with some additional profit.

Looking at the short term graph, we clearly see an inverse head and shoulders. The weekly is very very clear on that (see graph of the post above), but also on the daily we see something similar (albeit, indicators here are somewhat bearish on the shorter term, likely in order to complete the shoulder).

Yet, looking at the weekly, we see a clear bull cross in the MACD and upward momentum building in the RSI. This confirms / increases the odds of the inverse H&S scenario panning out.

Now, that's the short term, and I believe we will be able to make some profits out of this figure, but the longer trend is definitely bearish, with the BIG bearish head and shoulder figure clearly being formed ever since I mentioned it in my previous post almost 2 months ago.

Post of March 2:

See the three red circles showing the head and shoulder figure on today's chart:

Also note the double top in the head!

For more background on my longer term stance, very thoroughly explained, please refer to my previous post.

Conclusion:

- Short term inverse head and shoulders, allowing us to take some additional profit when exiting our positions, as we will have to exit them in my humble opinion, because we have a big head and shoulders figure, are at the top of the long term trend channel, and even see a double top. That's almost textbook, so the odds are in favor of that bearish scenario.

- Good luck with your investments and with your trades.

- A thumbs up on the post is very welcome if it helped you out, you found it interesting, gained you a million bucks :-)