BERAUSDT Major Breakout in Progress? Early Signal of a Potential📊 Full Technical Analysis

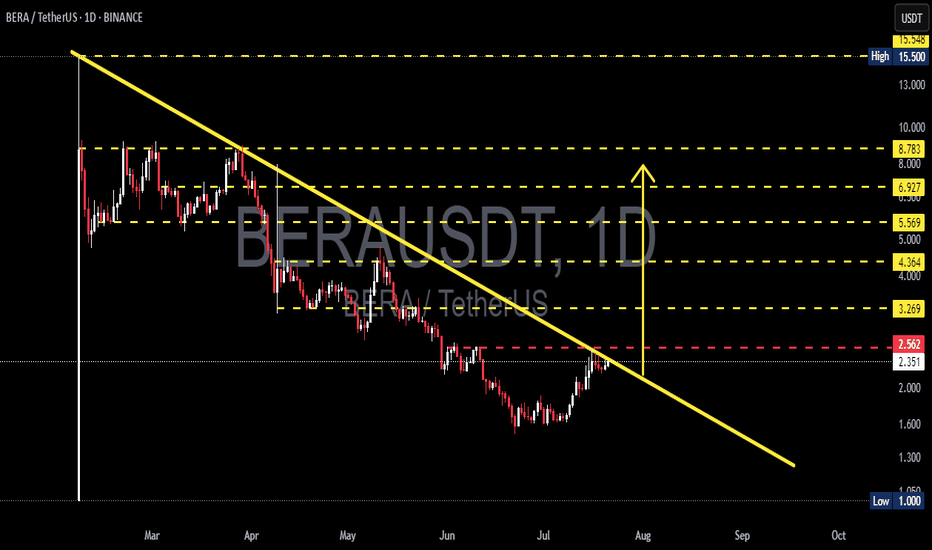

The BERA/USDT pair is displaying a highly compelling structure on the daily time frame, where the price has formed a Falling Wedge / Descending Triangle pattern over the past 4+ months.

This type of pattern often signals a large-scale accumulation phase by smart money, followed by an explosive breakout once selling pressure is exhausted and demand starts to dominate.

🧱 Pattern Structure: Falling Wedge / Descending Triangle

Descending trendline resistance (yellow line): Has suppressed price action since early March 2025

Horizontal support formed around the $1.00 to $2.00 zone (strong accumulation area)

Volume has been contracting — a typical sign of a wedge nearing breakout point

Price is approaching the key breakout zone at ~$2.56, showing early signs of reversal

---

✅ Bullish Scenario (Potential Major Reversal)

If the daily candle closes above $2.56 with strong volume confirmation, the breakout could trigger significant upside, with potential targets as follows:

Target Resistance Levels Notes

$3.269 Minor resistance + breakout confirmation level

$4.364 Previous support turned resistance

$5.569 Key historical distribution zone

$6.927 – $8.783 Mid-term targets / potential profit zones

$15.500 Long-term ATH target if momentum continues

💡 Additional Bullish Catalysts:

Volume compression aligns with classic breakout behavior

Breakouts from such macro patterns can yield 100–300% rallies in crypto markets

❌ Bearish Scenario (Rejection or Fakeout Risk)

If the price gets rejected at the trendline near $2.56 and fails to break above:

A pullback to the $2.00 – $2.35 support zone is likely

Further selling pressure may push price down to $1.00 (major support & psychological level)

A drop below $1.00 would confirm a continuation of the downtrend, forming new lower lows

🚨 Caution: Be wary of false breakouts — especially if the breakout happens with low volume or against bearish divergences.

🧠 Trading Plan & Strategy

Conservative Entry: Wait for a confirmed breakout + retest + volume confirmation

Aggressive Entry: Enter on daily candle close above $2.56

Stop Loss (SL): Below previous support: $2.30 or tighter at $2.00

Take Profit (TP): Scale out at $3.2 – $4.3 – $5.5 – $6.9 – $8.7

🧭 Conclusion: Critical Moment for a Macro Reversal?

> BERA is at a pivotal point that could define its next major trend. A successful breakout from this long-term pattern could mark the beginning of a powerful bullish cycle.

The technical setup is solid, the breakout level is near, and the reward-to-risk ratio is highly attractive — ideal for swing traders, breakout traders, and mid-term investors.

#BERA #BERAUSDT #CryptoBreakout #FallingWedgePattern #AltcoinAnalysis

#BreakoutSetup #TechnicalAnalysis #SwingTrade #CryptoSignals

#BullishReversal

Berachian

Berachain($BERA) Listed on Major Exchanges: Is a Surge Incoming?Berachain ( BIST:BERA ) has officially debuted on major exchanges, marking a pivotal moment for this innovative blockchain. With listings on Binance, Bybit, MEXC, and Bitget, BIST:BERA witnessed a sharp surge to $14 before retracing to $8, where it now holds support. The question remains—will BIST:BERA see further upside, or is another dip incoming?

The Rise of Berachain

Berachain initially started as a meme but has rapidly evolved into a revolutionary blockchain through its novel Proof of Liquidity (PoL) consensus mechanism. Unlike traditional proof-of-stake models, Berachain integrates liquidity provision into its security infrastructure. Validators are required to stake BERA tokens while providing liquidity, creating a self-sustaining ecosystem where network security scales with liquidity demand.

Key Metrics:

- Funding Raised: $142M from top-tier investors.

- Protocols Testing on Berachain: 234 projects actively exploring its ecosystem.

- Market Capitalization: $911.8M.

- Circulating Supply: 107.48M BERA.

- 24-Hour Trading Volume: $2.11M.

- Price Movement: Listed at $8, surged to $14, currently retraced to $8.48.

With these impressive fundamentals, Berachain is positioning itself as a serious contender in the Layer-1 blockchain space.

Technical Analysis:

Despite its recent retracement, BIST:BERA ’s price action remains constructive. The listing catalyzed an initial spike to $14, but profit-taking pushed prices back to key support at $8. Here’s what the technicals suggest:

Key Support and Resistance Levels

- Immediate Support: $8 (psychological and historical level)

- Major Resistance: $14 (listing peak)

- Potential Target: $20-$50 if bullish momentum sustains

2. Moving Averages & RSI

- While the trading history is still limited, a moving average crossover on lower timeframes suggests a potential reversal.

- The Relative Strength Index (RSI) is cooling off from overbought levels, indicating a healthy consolidation before another leg up.

3. Breakout Patterns & Volume Analysis

- Bullish Flag Formation: The recent price action suggests a potential bullish flag, signaling accumulation before the next breakout.

- Volume Confirmation: While overall trading volume has been volatile, sustained liquidity from exchange listings could act as a catalyst for a continued uptrend.

What Sets Berachain Apart?

Berachain’s two-token model further enhances its economic security:

- BIST:BERA (Gas & Staking Token): Used for transactions and securing the network.

- NYSE:BGT (Governance & Rewards Token): Non-transferable, incentivizing validators and network participants.

This unique system ensures that rewards scale with demand rather than being diluted, which could sustain long-term value appreciation.

Market Sentiment & Future Projections

- Short-Term Outlook: With a strong support zone at $8 and growing adoption, BIST:BERA could see a retest of $14 and a breakout toward $20 if volume and sentiment remain positive.

- Mid to Long-Term Potential: Given its robust PoL model, strategic partnerships, and significant backing, a $50 price target isn’t unrealistic in a bullish market cycle.

Conclusion: Dip or Surge?

Berachain’s fundamentals and technical indicators point toward strong upside potential despite its recent pullback. With its innovative PoL consensus, growing developer ecosystem, and major exchange listings, BIST:BERA is poised to capitalize on the current market trend. If bullish momentum builds, a significant rally could be on the horizon. However, traders should monitor support at $8 and volume inflows for confirmation before making a move.

Will BIST:BERA surge past $20 or dip further? The coming weeks will be crucial for its price trajectory.