GBPJPY: Pullback From Resistance 🇬🇧🇯🇵

I think that GBPJPY will pull back from a wide

intraday supply area.

As a confirmation, I see a bearish imbalance candle that

is formed after its test.

Goal - 198.51

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bestforexsignals

GBPUSD: Strong Trend-Following Pattern 🇬🇧🇺🇸

GBPUSD is going to drop lower.

The market has completed a correctional movement within

a bearish flag.

Its support violation provides a strong bearish confirmation.

I expect a drop to 1.3202 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPJPY: Important Demand Zone 🇬🇧🇯🇵

GBPJPY is trading within an important demand zone that

is based on a rising trend line and a horizontal support.

We see a false violation of that and a bear trap, followed

by a bullish imbalance candle.

I think that the pair may go up and reach at least 198.08 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDCAD: Bullish Move From Trend Line 🇦🇺🇨🇦

AUDCAD may bounce from a solid rising trend line on a 4H.

The price started to consolidate on that after its test.

A breakout of a minor horizontal resistance is a strong bullish confirmation.

Goal - 0.8999

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

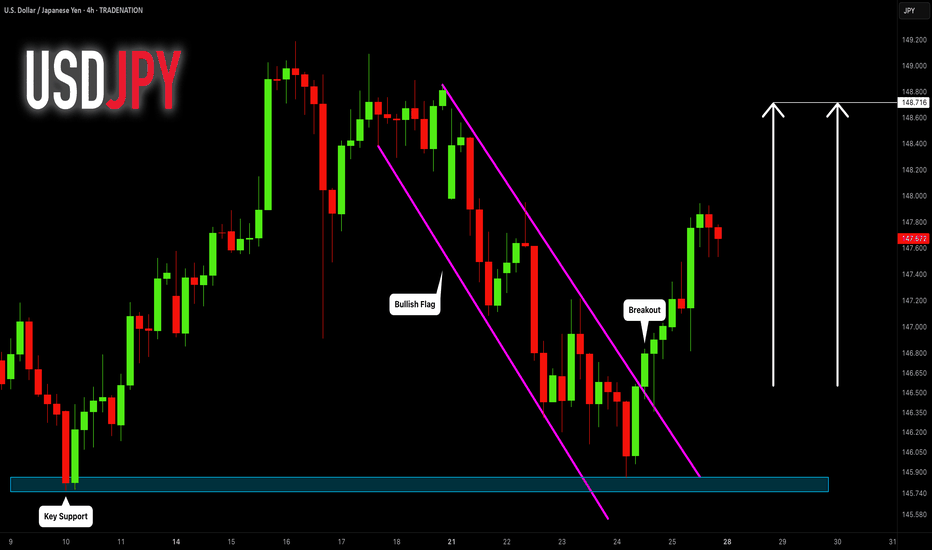

USDJPY: Bullish Move From Support Ahead! 🇺🇸🇯🇵

I think that there is a high chance that USDJPY will continue growing

next week.

A bullish breakout of a resistance line of a flag pattern that occurred

after a test of a key support provides a strong bullish signal.

Goal - 148.7

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

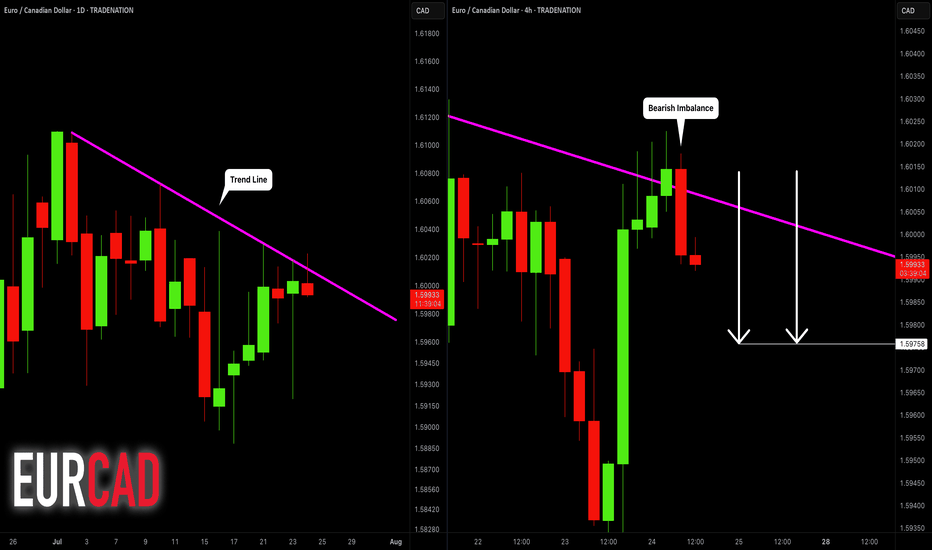

EURCAD: Bearish After the News 🇪🇺🇨🇦

EURCAD may drop from a solid daily resistance.

As a confirmation signal, I spotted a bearish engulfing candle

on a 4H time frame after its test.

The formation of this candle is accompanied by multiple negative

German fundamentals.

Goal - 1.5976

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

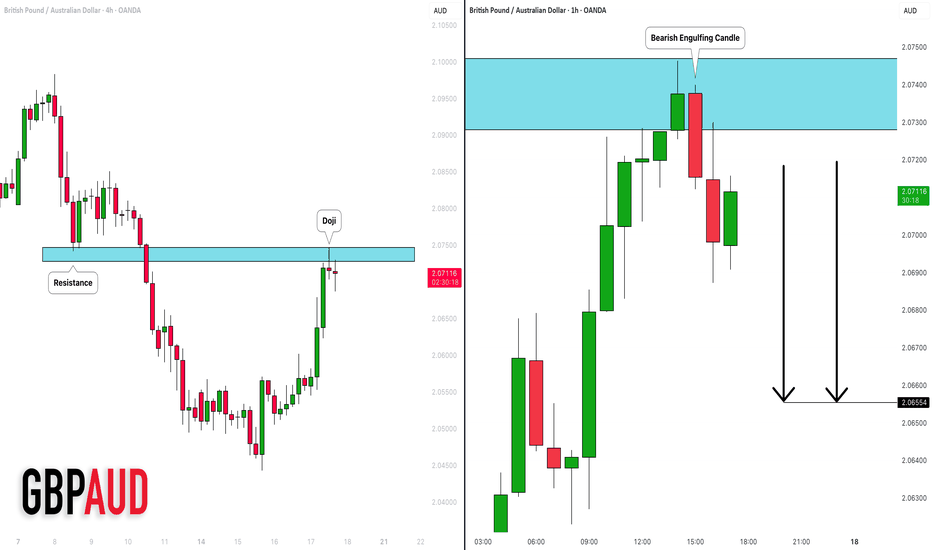

GBPAUD: Pullback From Resistance 🇬🇧🇦🇺

I think that GBPAUD may pull back from a key intraday resistance.

As a confirmation, I see a bearish engulfing candle after its test

on an hourly time frame.

Goal - 2.0655

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

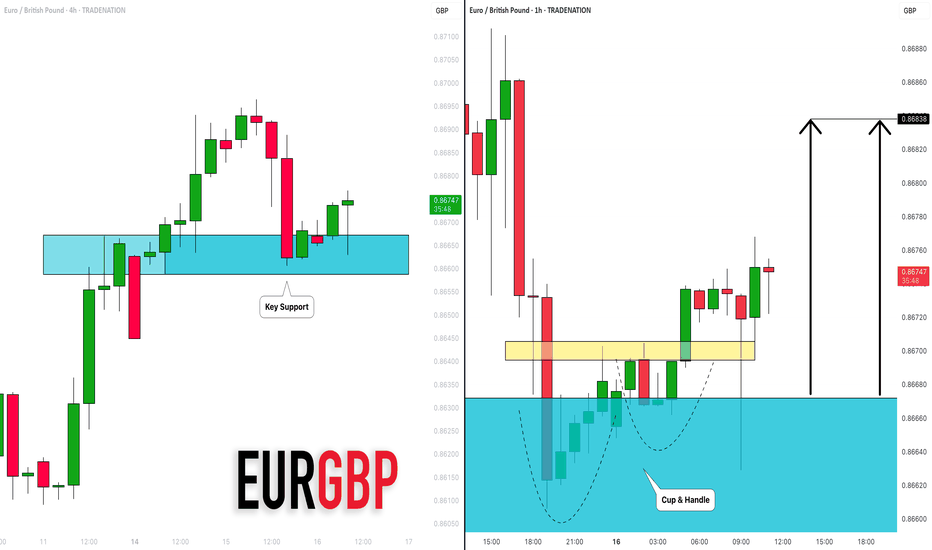

EURGBP: Bullish Move From Support Confirmed?! 🇪🇺🇬🇧

There is a high chance that EURGBP will bounce

from a key intraday horizontal support cluster.

The market looks bullish after UK CPI release this morning.

Goal - 0.8684

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

MarketBreakdown | EURUSD, DOLLAR INDEX, BITCOIN, SILVER

Here are the updates & outlook for multiple instruments in my watch list.

1️⃣ #EURUSD daily time frame 🇪🇺🇺🇸

The price started a correctional movement after it updated

a high the first of July.

The market formed a bullish flag pattern.

Your next trend-following bullish signal will be a breakout and a daily

candle close above its resistance.

2️⃣ Dollar Index #DXY daily time frame 💵

The market corrects in a bearish flag pattern.

I see a test of a significant horizontal resistance cluster now.

Your signal to see will be a bearish violation of a support

of the flag and a daily candle close below.

3️⃣ #BITCOIN #BTCUSD daily time frame

Though the price managed to update the All-Time High

yesterday, the market did not manage to close above

a current major resistance.

I believe that we will see another attempt of the market to breakthrough.

Your bullish confirmation will be a daily candle close above the underlined resistance.

4️⃣ #SILVER #XAGUSD daily time frame 🪙

The price reached an important confluence demand zone

based on a rising trend line and a horizontal key structures support.

Probabilities will be high to see a bullish movement from that.

Do you agree with my market breakdown?

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

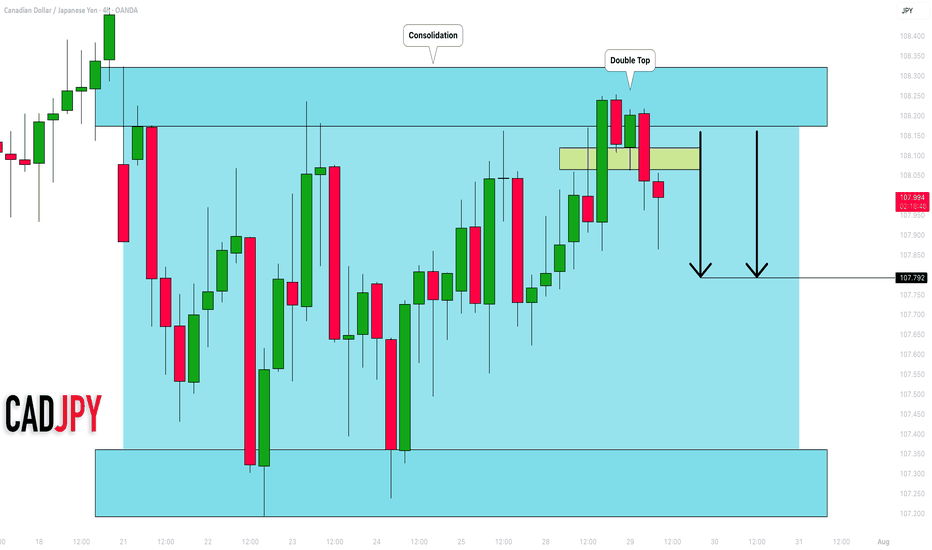

CADJPY: Bullish Move From Support Confirmed?! 🇨🇦🇯🇵

CADJPY may bounce from a key daily horizontal support cluster.

As a confirmation signal, I spotted a bullish imbalance candle

on a 4H time frame after its deep test.

I expect a pullback to 106.65

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURCAD: Pullback Trade From Support 🇪🇺🇨🇦

EURCAD is going to bounce from a recently broken

key daily horizontal resistance that turned into support after a violation.

The price violated a neckline of a double bottom pattern with

a bullish imbalance candle on an hourly time frame as a confirmation.

Goal - 1.5998

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURJPY: Bullish Trend Continues 🇪🇺🇯🇵

EURJPY shows a strength after a test of a significant demand zone.

Bullish breakout of a resistance line of a flag pattern provides

a strong trend-following signal.

Goal - 169.64

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CADCHF: Confirmed Bearish Trap?! 🇨🇦🇨🇭

There is a high chance that CADCHF will bounce from the underlined

blue support.

As a confirmation, I see a cup & handle pattern on an hourly time frame

that compose a bearish trap.

Goal - 0.5926

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPCHF: Pullback From Support 🇬🇧🇨🇭

GBPCHF is going to pull back from a wide daily support cluster.

I see a strong intraday bullish confirmation and a bullish

imbalance candle after the news.

Goal - 1.0986

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDCAD: Confirmed Bearish Trap?! 🇳🇿🇨🇦

There is a high chance that NZDCAD will bounce

after a false violation of a significant daily support cluster.

A formation of a bullish imbalance candle on an hourly time frame

leaves a strong bullish clue.

Goal - 0.818

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURNZD: Bearish Move From Resistance 🇪🇺🇳🇿

EURNZD is going to retrace from a strong daily resistance cluster.

As a confirmation signal, I see a bearish breakout of a support line

of a rising wedge pattern on an hourly time frame.

Goal - 1.9144

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDCAD: Bearish Trend Continues 🇺🇸🇨🇦

Amid the geopolitical tensions and a bullish rally on Crude Oil,

USDCAD is going to drop more.

The closest support that I see is 1.3545.

It will be the next goal for the sellers.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURCHF: Pullback From Resistance Confirmed 🇪🇺🇨🇭

EURCHF may pull back from the underlined resistance today.

As a confirmation, I spotted a double top pattern after a test

of a key intraday resistance and a violation of its neckline with

a high momentum bearish candle on Friday.

Goal - 0.93585

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDJPY: Pullback Confirmed?! 🇦🇺🇯🇵

There is a high chance that AUDJPY will pull back

from the underlined resistance cluster.

Its false violation, a formation of a bearish imbalance candle

and a breakout of a rising trend line provide strong bearish confirmation.

Goal - 93.185

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.