Power of Psychology TradingIn the dynamic world of trading, it is widely acknowledged that strategy and market knowledge are essential for success. However, there is a critical aspect that often goes unnoticed but holds immense power in shaping trading outcomes: the psychological dimension. The psychological aspect of trading encompasses understanding and effectively managing emotions, biases, and mental states that can significantly impact trading decisions. Neglecting this facet can lead to costly mistakes driven by emotional decision-making, such as panic selling during market dips or clinging onto losing trades fueled by hope or fear. Thus, it is crucial to cultivate a clear and disciplined mindset to achieve more profitable and consistent trading outcomes. This tutorial aims to delve into the psychological landscape of trading, offering invaluable insights and practical tips to help you master your mind and, consequently, conquer the market.

Common Psychological Traps in Trading

Traders frequently fall into various psychological traps that can severely undermine their trading performance. One such trap is overconfidence. After experiencing a string of successful trades, it becomes easy to develop an invincible mindset, leading to riskier behaviors and impulsive decisions.

Fear and greed are two emotions that often dictate trading decisions. They serve as key drivers behind market trends but, if not managed properly, can result in significant financial losses. The fear of missing out (FOMO) can drive traders into hasty, poorly thought-out trades, while greed can create a reluctance to sell even when all signs point to a market downturn.

Another common psychological pitfall is anchoring. This occurs when traders become fixated on specific price points or values, distorting their perception of a security's true worth and hindering rational decision-making.

Understanding Your Trading Emotions

To effectively manage your trading emotions, it is essential to first understand them. One practical approach is to maintain a trading journal. In addition to recording your trades and their outcomes, this journal should document your emotions and thoughts at the time of each trade. Over time, patterns may emerge, revealing how your emotions influence your trading decisions.

Another crucial factor is knowing your risk tolerance. Each trader possesses a unique level of comfort when it comes to taking risks, and comprehending this can significantly shape your trading strategy. A risk-averse trader might prefer more stable assets, while a risk-tolerant trader may be comfortable with higher volatility.

Strategies for Managing Trading Emotions

Being in the right mental state before engaging in trading is paramount. Developing a pre-trade routine that helps you calm down and focus can prepare you for the trading day ahead. This routine could include activities such as meditation, exercise, or reviewing the latest market news and your trading plan for the day.

Having a clear trading plan also provides a solid foundation for managing your emotions. This plan should outline your strategy, encompassing risk management tactics, potential entry and exit points, and your objectives for each trade. It serves as a roadmap, grounding you when market volatility triggers emotional responses.

Additionally, learning stress management techniques can be invaluable in the trading arena, often laden with stress. Taking regular breaks, practicing deep breathing exercises, and maintaining a balanced lifestyle outside of trading can help maintain your mental equilibrium.

Conclusion and Further Reading

Trading psychology is a vast and intricate field, but understanding its fundamental principles can profoundly enhance your trading performance. By familiarizing yourself with common psychological traps, comprehending your own emotions and risk tolerance, and employing effective strategies to manage your trading emotions, you can make more informed and profitable trading decisions.

Continuous learning and emotional self-awareness are key to successful trading. There are numerous resources available for those who wish to delve deeper into trading psychology, risk management, and market analysis. While the journey to master your trading psychology may present challenges, the potential rewards - improved trading outcomes and personal growth - far outweigh the effort invested.

Beyondofthetechnicalanalysis

Be prepared!!! A skyrocket on Ethereum it's goes to $800 dollarsWaoh, in this technical analysis, we see that Ethereum it's so prepared to go to the $800 dollars. Because in 3 Daily chart, the recentrly candlestick was closed up with a strong rejection of bears scenario, that mean that it's so bullish toward the $800 USD. The $800 USD it's so invevitable for Ethereum!!!

This it's what I talking about in 3 Daily chart, this it's a kind of candlestick called bullish hammer and that show that boughts it's soon!!! Also, looking with Fibonacci we confirm the 0.618% of Fibonacci and then, that show that investors and holders are prepared to leading Ethereum toward the $800 USD.

i'm so enfocous in Daily chat too because it's so important, the only what I apply it's this important support that I mark

And that it's all, in H8 timeframe Ethereum it's so bullish toward to make a new higher price at $800 USD soon. So, we are in the psycological point of bought more Ethereum in good price. I put a buy order limit at $616 USD with a SL at 584 USD.

Clearify your doubts; Bitcoin still bullish for limited time!!!Ok, looking my technical analysis, the Daily candlestick was closed up with indication bullish. So guys, please you can to get benefit of this trend because maybe we can to see that Bitcoin make any prove to the $19,000 USD level as prove to break up. But still await that in medium term it's bearish. Look. If we see the H4 timeframe. We can to see that Bitcoin it's show any resistance for bulls part that indicate that many bulls want to make resistance of the chart. And I believe that the price it's find up the bearish line that I mark here.

Now, this it's my scenario in Daily, the previosuly candlestick was closed up very positive for bulls. So, yesterday when the candlestck was finished their closed up yesterday, I send you a message to put a buy order limit at $18,000 to $18,100 USD beause we could see any bull movement for limited time. Also, noticed that I know that we are in bearish scenario using the price action of Daily. But, we see that once again Bitcoin want to up for limited time. I could see that when Bitcoin goes to the $19,000 USD again to prove this break up. We can see any double top. And that it's why I expect that.

Now, we see in 3 Daily chart that Bitcoin still bullish and then, we can see a up movement but if you see, this timeframe it's become more bearish and I have a plan to sell Bitcoin in the $19,000 USD resistance.

So guys, in summary in Dail timeframe it's a so key becuas Bitcoin show any resistance weak for part of the bulls and bulls want to leading Bitcoin up toward the $19,000 USD. The $19,000 USD it's a logical key to take profit. My own profit will be $19,100 USD and my SL around of $17,550 USD. Now, I hopea double top in these zone of $19k to then, make a big short toward my targets $16,500 USD and $13,800 USD as possible earnings to targets.

What do you think about the correction of Bitcoin specific in Daily chart?

Australian Dollar/ U.S. Dollar: Bearish BAT FormationSo, we continue buy Australian Dollar into this trend in H1 timeframe and well, I see a long opportunity of 100 pips. So, as the same of Euro/U.S. Dollar, we hope a bought approximately at $0.73 USD.

At the moment, we find up the level of 2.24 and 2.618 of Fibonacci to complete this bearish BAT formation.

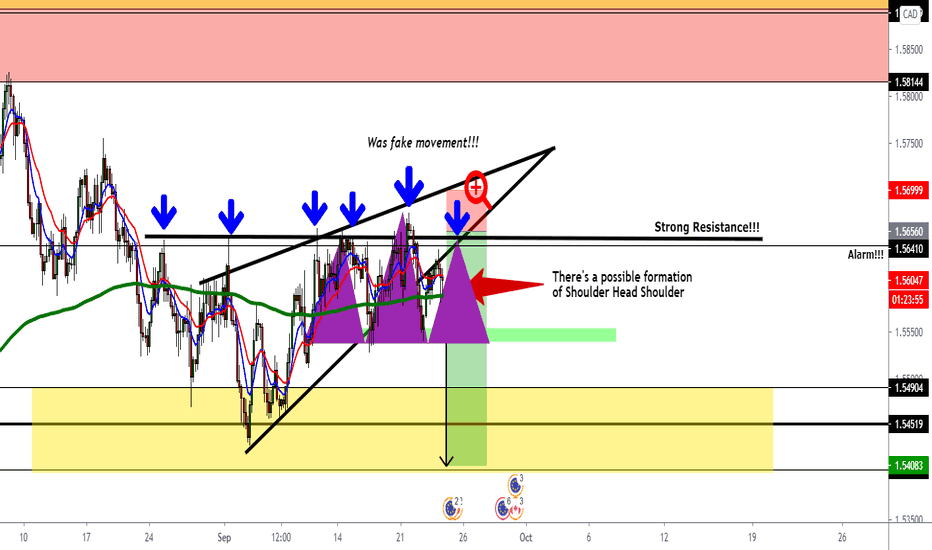

Euro/ Canadian Dollar is turn in bear singal!!!In H4 timeframe, we see a lot chartist in formation, but the most chartist in the bearish rising wedge. Also, we have formed a bullish channel or simetric triangle too both, Now, in Daily is the key:

3 days ago, EUR/CAD show a bearish, and yesterday the green candlestick grew by 50% of the big red candlestick, and then, we could see another short opportunity to find down 247 pips. Because we see a Shoulder Head Shoulder bearish pattern and we could see for the eyes this opportunity to take in notice it.

Now, in H4 timeframe we see a nice shoulde head shoulder. Also as theory, let's me explain these 6 blue arrow. These blue arrow are forming a strog resistance and we could see in H4 timeframe a drop!!!

So, I'm still alert on this par because for the next week, we see a possible nice opportunity in Forex!!!

If you like this, give me a like and share it with your friends or traders.

Not put any short or long position in this par until this par leave in this strong resistance at $1.5656 CAD, it's my psycological point to take my decision, my own decision is short becuase we see a strong resistance, I reccomend for you to put an alart approximately at $1.5638 CAD, and then, when the price leave at this price, I am still pending of possible short position at $1.5656, this is an alert to know it!!!.

U.S. Dollar is crazzy: Sell U.S. Dollar for FED plansHello, in this analysis, it's much interesting what I see. First, in the past analysis, I will going to cancel and closed up all long position, it's not yet to buy U.S. Dollar, we are continue drop, not up

Now, in H4 timeframe we was in this bearish triangle descendent, that make a higher lower and the equal lower equal the previously lower, that is a distribution zone to sell US Dollar.

Guys, its very sad how the US economic is suffer its depression and devaluation of our Federap World currency, now this scenario in H4 is so bearish, I put a short position in the $0.9060 and the SL at 44 pips above of my short entry price and the take profit over +250 pips between this week and the past week its could be the trayectory, also, you can to entry in sell position until we leave at the down side of $0.87. We could to get profit for this awesome par.

In Daily we are so bearish

Are you know this blue zone, we are near to down side to the monthly timeframe and we lead of it, nos this is one of the screenshoot that better I see it to find down the one of the minimun of the year of 2015, that for this year I was studied in my high school and the end to graduated and find up my High School Diploma in this year.

But if you get it, we could to expect a pull back and make another elliot wave analysis to complete it.

Fundamental and Analysis: FED want's to created the plan In this analsysi and updated, we see in the speculate news that Federal Reserve want to created a strategy that yesterday was lays us to boost inflation and make the US economic recovery their employments, other datas as it is important for the next weeks.

So, lookin in H4 we are in formation of bullish rising wedge, this is accomplish of what FED want, that is a correlated positive of the US economic, but for long-term and mid-term is not good, but now we could to appreciate a recovery of the economy.

And remember that in Daily we see a bullish divergence and I follow this timeframe.

Remember: Tomorrow I will going to make an weekly and monthly timeframe about the situation and to know the macrotrend and what we expect in the future in the US economic about the analysis, fundamentals and theory of technical analysis.

The most perfect entry in short: Euro/Sterling PoundI'm happy to identify anohter perfect entry in short for Euro/Sterling Pound. And it's in H1 timeframe, it's a 2nd entry in short wiht objective to find down 130 pips and another 160 pips itssequal near of 300 pips if you operate with 0.01 lots, but in my case as I was earning, I operate with 0.02 lots. This is a huge signal to short position in this par

Now, in H1 timeframe we have a Bullish Butterfly, but not bullish in H1 timeframe, because the price is arrive at 0.50% of Fibonacci to entry in short position in this armonic patterns.

Also, I make a break even in my first operation to 0 pips, I do not loss and not earn, but 0 pips is without earns and without loss, to proteted my position and open up my second position in this par in short

Well, this is a good singal to making a short

But if you see the H4 timeframe, we are making a pull back in this timeframe, and the objective is so bearish, so in the next par I will going with 44 pips in profit in this par in my first operation with near of $10 USD earning in my first operation operate 0.02 lots

As we look in EUR/USD, the par EUR/GBP is bearish too, all pars in EUR we could to found out in sell about the surgement of the US Dollar,

'

Now, I share with you my fundamentals of this par and what we see:

1. GBP/EUR exchange rate forecast: Sobering GDP figures to drive collapse in the pound?

2. GBP/EUR exchange rate muted ahead of key GDP release

3. Grim UK GDP figures to reverse pound in the recent rally soon

4. While te pound has found room to a recent weeks, there is a major risk of Sterling relianishing a good portion of these gains this week on the back of some sobering GDP estimate for the second quarter will report that the UK economy suffered a record contraction, with growth shrinkg over 20% and plumging the country into a deep recession

5. The UK dramatic slump in comparasion with its perer looks to have driven by the government delayed lockdown announcement, which in turn have led to a later lifting of restrictions and reopening economy in UK.

6. While of that, Bank of England recently ravised its growth forecast for 2020 up from -14% to -9.5% analysts believe there is limited chance for a V-shaped recovery, given that coronavirus risks still remain.

7. Garry Yound, deputy director of the National Institute of Economic and Social Research said that: "A rapid V-shaped recovery is a possible outcome still, but all the risks seem to be to the down side. If we get another wave of the virus and have to do more widespread lockdowns, that's going to know the economy off that V-path.

Well, in conclusion, we have bad as good news and we always need to monitored this par becuase the relationship between the United Kingdom and European Union is so go to hand to hand to trade their future of Europe. As this par is sensitive this par the only move is based the fundamentals, for now, the only expectative for short term waht we see is that GBP is cooming to strenghten agains the all par, specially in EUR/GBP.

Sterling Pound it's has been benefited: Sell Euro!!!There are a nice opportunity to put in short position in EUR/GBP in H1 timeframe following the Izzi Money Strategy, the only we need it's to hoped the next candlestick.

In Daily we see this panoramic so bearish for Euro, so in this par you need to sell Euro!!!! But this is another re-entry in short and so beautiful, just we need to wait a candlestick in some minutes to hour.

Fundamentals Keys:

1. Pound Sterling to Euro Exchange Rate Could keep gaining if Brexit outlook improves

2. Pound to Euro Exchange Rate up despiste the Europe Union recovery fund developments

3. The pound has been benefitting from various market optimism

4. Pound Exchange rates get a boost from coronavirus and Brexit hopes

5. Britain's economy and coronavirus outlooks have recently been filled with gloom and concern, the data show as Britain's economy is not weathering the pandemic as well as hoped, and the UK government's approach to hte pandemic continues to confuse analysts.

6. Investors bought the pound back from its lowest levels. It was due partially to profit-taking, but fresh develpments regarding the coronavirus and Brexit situations also helped.

7. Sterling it's has been benefited from specualte news that some british companies were making progress on a coronavirus vaccine.

Analysis and Fundamentals: European Union climbs to Recover FundToday, Euro in H4 timeframe is show a possible drop of the price into the $1.1323 USD, but let's me explain why Euro is continue drop.

First, in weekly Euro is leave at the highest point in the past time at $1.14 USD as we are now, so we could be a possible drop of 200 pips in week if EUR continue because the European Union has today bad news accomplish with this bearish armonic pattern, also to recall in H4 timeframe, we could to be into his bearish rising wedge and the experctative is so bearish that put in Euro in bad situations, all depend what make the market.

So, in I put a short limit order at $1.1435 USD with a SL at $1.1488 USD and take profit at $1.1323 USD. So the only is that I hope that Euro up a little at least 24 pips to actiavate my sell order limit at $1.1435 USD. if in case doesn;t activate, I cancelled my order. Also as reference, if you see the RSI we have a bearish divergence and if you see in Weekly, you can get the higher point as in Daily too in the RSI and price action.

The price action and RSI indicator show the weakness of the bulltrend in EUR, and possible futures to find down sells.

Fundamentals Analysis to take in noticed:

1. The currency remained flat this morning after press reports suggested the latest round on European Union negotiations failed.

2. A commenting of Crhis Weston, head of research at pepperstone brokerage say that she think that expectations were that they weren't meeting anyway, but they muuded that there was one coming in August or September

3. Talks concerning the 750 billion Euros bill were unsuscessful. Although the countries Netherlands, Austria, Denmark and Sweden, they were satisfied with a sifferent avangement.

4. A reports suggest they are happy with allocating around 390 billion Euros as grants and the rest as low-interest rate loans.

5. While European Union leaders were making progress after 3 days of negotiations, discussions could soon fall apart

6. Dutch Prime Minister Mark Rutte has warned this could be a possibility and talks had been close to falling apart. He noted that European Union Chairman, Charles Michel was working on a news compromise proposal.

7. The European Central Banks chief Christine Lagarde noted it would be better for a leaders to agree on an ambitions package than to have a quiet deal at any cost.

8. Euro Climbs as European Union Recovery Fund Optimism

***Guys, this speculate news is the most important because as Euro climbs the market, investor are Sell Euro as there are many problemas of some countries that we need to recovery fund optimism in the European Union and that could be bad for mid-term.

9.The Euro edged higher today as traders anticipate that the European Summit discussions on a proposed 1.68 trillion of Euros to seven-years budget and covonarius recovery fund that will be resolved.

EUR continue drop has UK into economy recuperationUk continue in recoveration about all cases of covid and take control in this country. Now, so important is that UK Governments approved a aid fiancial of 30 billion pounds to stimulated their economies and about a rate undemploymnet that was horrible and lot

England peoples's unemployments. Also, as many investors are give a welcome the Chanceller efforts to limit job losses and help recover the nation's economy from the covid-19 crisis.

And also, as intersting data found up this morning is that EUR/GBP has formed a bearish divergence in Daily in the RSI and MACD and that show a sign of bearish movement in Daily, that mean a strong sell in EUR has GBP is strenghthen agains the EUR, that benefited United Kingdom in their aid financial to stimulus their economies as US do it in the past, and that USD is up, maybe Sterling did it too.

Also, in H4 timeframe we continue so bearish movement, also, you can if you want to make re-entrys in H1 to entry in short movement and take off a nice earns of a lot money. As I am in profit, I prefer to re0entry in the next entry sell off. Also, I represent 3 targets profit if you want to closed down the position, these are my 3 targets profit that you can see in your display on your computer or telephone to reach price's target's. So i believe that is UK is mroe strenghten of the recovery of covid-19 cases, brexit ends to prepared more yet, so Euro could to drop a lot. For more analysis, there are a possibility to from an elliot wave trend change, so that is a new analysis to add and updates as alert. I will go on to making analsyis in the next days to give a following.

EUR/USD has failled with US Dollar in the earlySo, in this technical analysis, EUR/USD is into this ascendent triangle in formation. that mean the expectative is so bullish until the $1.15 USD. For now in H4 timeframe the only we hope is that EUR/USD is goes to this yellow circle that is the following to make a buy at this lower zone that we hope, so investor analyze that US Dollar has a lot fears about the continuilly of US cases of covid-19.

Remember than mid-term we are so nearly to reach and conclude the elliot wave # 5

Updates: Bitcoin make a manipulation to liquidated all longs.Well, in this technical analysis. Today we have a manipulation into the $8,900 USD, that was the key of the price was manipulated and get away all longs position, included me too. But, I'm okay and i'm put a re-entry long, because I say you in the morning that Bitcoin is to starting up, but the price was manipulated. I believe that was my wrong of my technical analysis, but the wrond is give up and don't assume our risks. But nos just Bitcoin, also ETH it's was manipulated and don't touch my SL. but maybe its keep my long position, but in Bitcoin when afternoon I see that go back up, that was a manipulation and doesn't a drop, that is fake and that wick that the past candlestick get us, that is a good information that Bitcoin it's could to reach at $9,700 USD.

That was the manipulation and look how the price is go back up liquidated all longs potion, and include this is a evidence of what comming on in the past hours, but my prediciton it's was good and I entry in good position, just hat the price was manipulated. And to respald my idea, I believe that Bitcoin could to break up this bearish channel and very well prepared for do it. So, guys, that is my all technical analysis.

Also, I reccomendaly for you to large your take profit until the $9,700 USD, and if we see a movement so strange of Bitcoin that could to be a trap of bears in the next days, I will going to inform in the technical analysis.

And finally to finish, we updated our ascendent triangle and we believe that Bitcoin could force to continu up until the $9,700 USD, that is my target profit. Also, if you see there are a double bottom in Daily and look the candlestick Daily today how the bulls are neutralized bears.

Now, I reccomendaly for you to large your position until the $9,800 USD, that is a good point to pick up your earn, if this candlestick group show a demand, the price easily go to these levels.

Updates of Bitcoin/U.S. DollarGOOD Morning guys, today in this technical analyusis I want to make an updates of what comming on in the Bitcoin price!!!

Fistrly, in the Daily timeframe we see that Bitcoin is so bearish for longer, remeber that in the past we analyse using the elliot wave analysis and so, we are now that Bitcoin has a possibility to up until the $9,350 USD, that is my maximum to pick up my targets profits of Bitcoin.

But also, in the H4 timeframe we are in formation one of my favorite pattern of Shoulder Head Shoulder inverted that approximately it's going to leave us the target until the $9,700 USD in the higher zone of the trend line that form the simetric triangle.

And also, let's me see one thing. If Bitcoin doesn't get us a bearish trend that soon, so, the possibility is that Bitcoin is continue up as the contrary hand and if I see a Bitcoin above of $9,700 USD and confirm as pull back that zone and Bitcoin is into the ascendent triangle that we can see so better in Daily there are a highly possibiliy to put in long until the $10,500 USD. That is the contrary hand if Bitcoin goes to up.

But for now, my target is into the $9,350 USD to pick up 10% of my earns. Because I invest in the zone of $9,108 USD put in long position investing 0.04 lots in BTC.

Below of there, you can to see better what I mean for you!!! And a good counsel is to keep prepared if Bitcoin goes to up and invalid my bear sentiment taht we hope in Daily or Weekly that it's see a bearish candlestick pattern.