CVNA EARNINGS TRADE IDEA — July 30 (AMC)

## 🚗 CVNA EARNINGS TRADE IDEA — July 30 (AMC)

**Carvana (CVNA)**

📊 **Bullish Confidence**: 85%

📈 **Earnings Play Setup**

💣 Big Volatility + Strong History = Explosive Potential

---

### ⚙️ FUNDAMENTALS SNAPSHOT

✅ **Revenue Growth**: +38.3% YoY

🔁 **8/8 EPS Beats** (114.5% avg surprise)

🟡 **Profit Margin**: 2.7% (Thin but improving)

⚠️ **Debt-to-Equity**: 344.78 (High leverage risk)

💬 **Sector Rotation**: Growth favors high-beta names

💡 **Beta**: 3.60 → Big post-earnings swings likely

---

### 📊 OPTIONS FLOW HEATMAP

🔥 Heavy Call Volume @ \$360–\$370

🟢 Bullish OI Stack

📉 Put/Call Skew: CALL DOMINANT

💥 IV Elevated = Lotto ticket pricing

---

### 📈 TECHNICALS

💵 Price: \$336.50

🧱 Resistance: \$343.68

📉 RSI: 44.5 (Neutral – Room to Run)

📊 200D MA: \$252.21 → Long-term bullish positioning

---

### 🔥 TRADE IDEA:

**CVNA 08/01 \$360 CALL**

🎯 **Entry**: \$11.25

🚀 **Target**: \$33.75 (200% ROI)

🛑 **Stop**: \$5.60

📊 **Size**: 1 contract

⏰ **Entry Timing**: Pre-Earnings Close (AMC play)

---

### 📉 RISK / REWARD

* 🟥 Max Loss: \$11.25

* 🟩 Profit Target: \$33.75

* ⚖️ RR Ratio: 1:3

* 💼 Portfolio Risk: 2–3%

---

### 🧠 STRATEGY INSIGHTS

✅ Historical beat rate = STRONG

✅ Bullish options skew = CONFIRMED

⚠️ High debt = risk, but momentum > fear

📌 Tip: If IV crushes post-earnings, exit fast. This is a *structured speculative play* — not a hold-and-hope.

---

📢 "Speculation is fine. Structure it."

💬 Tag a trader who *YOLOs with stop losses* 👇

\#CVNA #EarningsPlay #OptionsTrading #TradingView #HighBeta #LottoPlay #RiskManaged #CallOptions #BullishSetup #IVCrushProof #EcommerceStocks #EarningsSeason

Beyond Technical Analysis

EUR/AUD Testing Support - Drop Incoming?EUR/AUD is sitting on an important support level. So far, the price has been holding, but it's starting to show signs of weakness.

If the price breaks below this support, it could drop further, with the next target around 1.7640.

This level could act as the next area where the price might slow down or bounce.

XAUUSD Market Update – July 30 Late NY Recap🔸Macro Context

Markets are still digesting Powell’s ongoing speech with no clear pivot signals. While FOMC tone remained cautious, no dovish surprise emerged. Trump’s upcoming comments keep geopolitical risks elevated. USD remains firm. Gold is reacting within key HTF demand as intraday volatility cools off.

🔸Bias Overview

Weekly Bias:

• Bearish rejection from the major supply wick 3439–3350

• Structure still below 3345, maintaining downside pressure

• Weekly RSI cooling off — no bullish divergence yet

Daily Bias:

• Lower high locked below 3345

• Price reentered the imbalance toward 3272

• Clean structure remains bearish unless we reclaim 3302

H4 Bias:

• Lower high formed at 3314

• Current price testing HTF Extreme Demand Base (3289–3272)

• Still bearish unless we see a confirmed M15 or H1 BOS from demand

🔸Key Structural Zones

🔺Above Price (3272):

• 3289–3294

Decision Block – M30 OB + FVG. First sign of momentum shift if reclaimed.

• 3302–3314

Supply Reversal – H1 OB + previous BOS zone. EMA alignment adds pressure.

• 3345–3350

Major Rejection Zone – H4 origin of last leg down. Strong resistance area.

🔻Below Price (3272):

• 3254–3264

Imbalance + OB – H4 FVG + clean demand zone. Buy setup only on deep flush + reversal PA.

• 3227–3214

HTF Demand Base – Daily OB + historical volume shelf. Final structural floor before deeper downside opens.

🔸Battle Plan

▶ Scenario 1 – Bearish Breakout

If 3272 fails with momentum and no reversal signs, expect continuation into 3254–3264.

No long trades unless BOS confirms.

▶ Scenario 2 – Reactive Long from Demand

If price gives a strong reaction from 3272 with BOS on M15 or H1 and clears 3294, then a recovery into 3302 is possible. Only valid with confirmed PA + EMA shift.

▶ Scenario 3 – Choppy Rejection from 3294

If price tests 3294 but fails, watch for rejections back toward 3272. Scalpers can fade reactions if no bullish structure forms.

🔸Final Thoughts

Price is once again testing our Extreme Demand Base from July 28 (3289–3272). The zone remains valid — but execution depends entirely on confirmation. Bears still in control unless we reclaim 3302 cleanly.

No need to rush. Best RR setups are found at clean structural edges.

Patience = profits.

—💬 Drop your thoughts in the comments.

❤️ Like if you appreciate the precision.

🔔 Follow GoldFxMinds for more sniper-level updates.

With you all the way,

— GoldFxMinds

📊 Analysis based on Trade Nation TradingView charts.

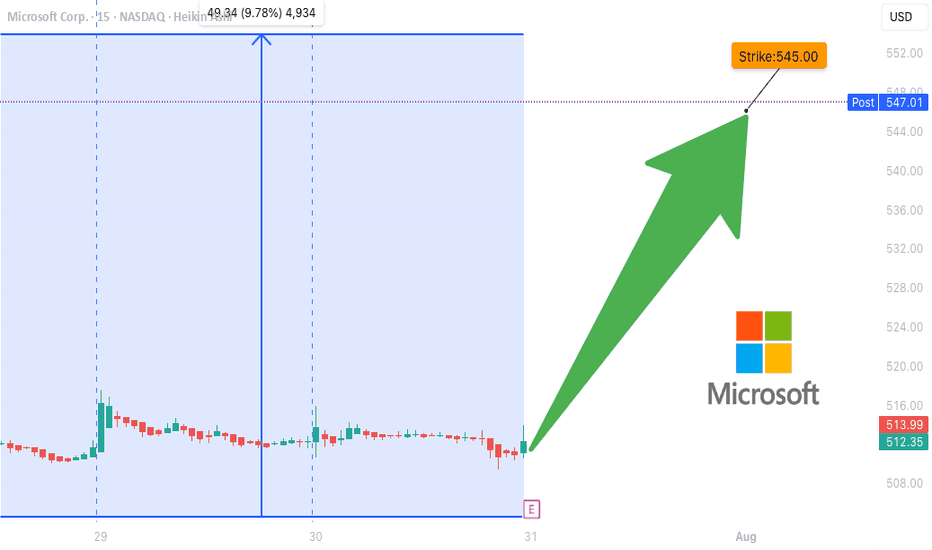

MSFT Earnings Play (2025-07-31) — STRONG BULLISH SETUP

**🚨 MSFT Earnings Play (2025-07-31) — STRONG BULLISH SETUP 🚨**

**Microsoft \ NASDAQ:MSFT Pre-Earnings Trade Idea — 545C (Aug 1)**

---

### 🧠 **Earnings Thesis (🔥 80% Conviction)**

MSFT is set to report **BMO July 31**, and all signs point *bullish*:

📈 **Revenue Growth**: +13.3% YoY, driven by **AI + Cloud** momentum

💰 **Margins**: Profit 35.8%, Op 45.7%, Gross 69.1% — textbook pricing power

📊 **Guidance**: 100% beat history, avg. +5.8% surprise

📌 **Analyst Consensus**: 💪 Strong Buy | Target: \$549.90

📊 **Sector Tailwinds**: Tech favored in current macro with Fed on hold

➡️ **Score: 9/10 Fundamentals | Bullish Momentum Across the Board**

---

### 🔍 **Options Flow & Technicals**

🔥 **Implied Move**: \~6.3% by Aug 1

📉 **IV Rank**: 0.75 (Room to expand post-earnings)

💸 **Call Flow**: Strong OI in 540–550 zone, gamma buildup may fuel squeeze

📊 **RSI**: 70.14 → Bullish, close to overbought

📈 **Support**: \$505 | **Resistance**: \$518.29

➡️ **Score: 8/10 Options | 8/10 Technicals**

---

### 🧨 Trade Setup: 545 CALL (Aug 1 Exp)

🎯 **Entry Price**: \$0.90

📅 **Expiry**: 2025-08-01

📈 **Profit Target**: \$1.80 (⚡️+100%)

🛑 **Stop Loss**: \$0.45

📐 **Size**: 2 contracts (2% portfolio risk)

💡 **Timing**: Enter **EOD July 30 (Pre-earnings)**

⚠️ **IV Crush Alert** → Exit within 2 hours *post-earnings*

---

### ✅ RISK PLAN

* Position: Max 2–3% of portfolio

* IV crush & gap protection: Tight stop and quick post-earnings exit

* Exit Plan: \$1.80 or Stop \$0.45, OR close manually after earnings move

---

📊 **Trade JSON Snapshot**

```json

{

"ticker": "MSFT",

"direction": "CALL",

"strike": 545,

"entry": 0.90,

"target": 1.80,

"stop": 0.45,

"expiry": "2025-08-01",

"entry_time": "EOD Jul 30",

"earnings_date": "2025-07-31 BMO",

"confidence": "80%",

"expected_move": "6.3%",

"iv_rank": "0.75"

}

```

---

🧠 **Summary**

MSFT is poised for a **clean earnings beat** with bullish fundamentals, strong options flow, and upside momentum. This is a **high-conviction, short-dated trade** with defined risk.

🎯 **Watchlist it. Size smart. Exit fast.**

ID: 2025 - 0146.16.2025

Trade #14 of 2025 executed.

Trade entry at 60 DTE (days to expiration).

BULLISH options trade executed on Crude Oil. Once price level of $75.00 gets taken out, this trade will get adjusted to secure a risk-free trade. Targets will be 100% ROI based upon this being a balanced bullish butterfly construct.

Defined risk

Defined reward

Happy Trading!

-kevin

MA Mastercard Incorporated Options Ahead of EarningsIf you haven`t bought MA before the rally:

Now analyzing the options chain and the chart patterns of MA Mastercard Incorporated prior to the earnings report this week,

I would consider purchasing the 545usd strike price Puts with

an expiration date of 2025-8-8,

for a premium of approximately $4.45.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

MSFT Microsoft Corporation Options Ahead of EarningsIf you haven`t bought MSFT when they announced the 49% stake in OpenAI:

Now analyzing the options chain and the chart patterns of MSFT Microsoft Corporation prior to the earnings report this week,

I would consider purchasing the 550usd strike price Calls with

an expiration date of 2025-12-19,

for a premium of approximately $14.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NAS100 - EXPECTING THE DUMPTeam, we got short well today with AUS200 - both target hit

we have set up the NAS entry , this is the entry price 23268 - 23200

STOP LOSS at 23100

Once it break above 23320 - bring stop loss to BE

Target 1 at 23320-60 - take 50%-70& partial

Target 2 at 23380-23400

LETS GO

META Meta Platforms Options Ahead Of EarningsIf you haven`t bought META before the rally:

Now analyzing the options chain and the chart patterns of META Platforms prior to the earnings report this week,

I would consider purchasing the 710usd strike price in the money Calls with

an expiration date of 2026-6-18,

for a premium of approximately $89.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

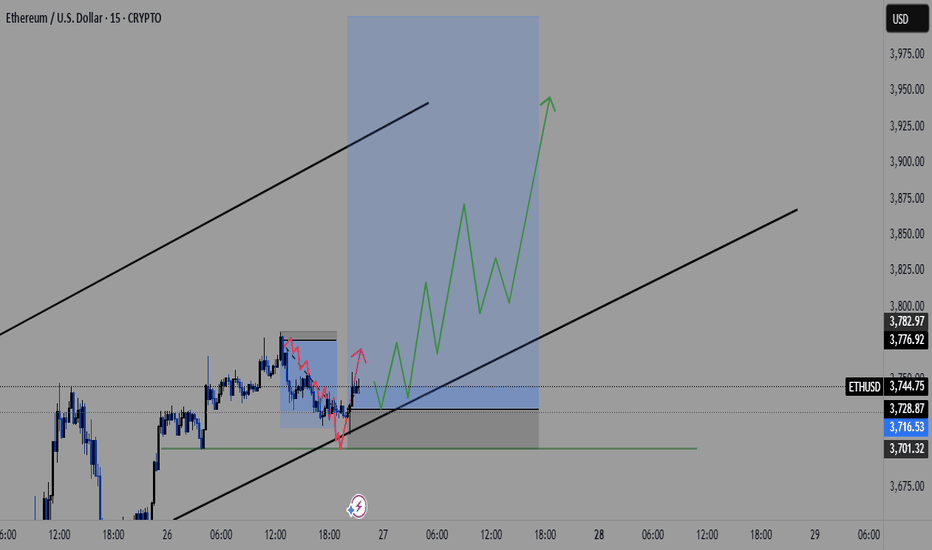

ETHUSD Long Setup: Targeting $4,000 After Bullish Reversal from ETH just swept the previous lows near $3,650–$3,700, clearing liquidity and flipping that zone into fresh support. This classic price action move often precedes expansion, and ETH looks primed for a continuation toward $4,000 in the coming sessions.

🧠 Technical Analysis

Previous Highs Swept: ETH took out the prior highs around $3,650–$3,700, trapping late shorts and grabbing liquidity.

Break of Structure: We've seen a clear bullish market structure form on the 4H and daily TFs, with higher highs and higher lows intact.

Support Zones:

$3,650–$3,700 (former resistance, now flipped support)

$3,550 (consolidation base before breakout)

Resistance Zones:

$3,950–$4,000 (psychological level + previous 2024 highs)

$4,100+ (weekly imbalance and potential extension zone)

Now that ETH has cleared short-term liquidity and confirmed demand on the retest, the path of least resistance appears to be up.

🔍 Fundamental Outlook

ETH ETF Narrative: Market anticipation for spot ETH ETF approval is heating up, boosting demand and institutional interest.

Reduced Sell Pressure: With the Shanghai upgrade long behind us, staking continues to increase, reducing circulating supply.

Macro Tailwinds: Risk-on sentiment in the broader market is aiding crypto momentum, especially for large-cap assets like ETH.

🎯 Target: $4,000

📉 Invalidated Below: $3,550 (if reclaimed by bears, invalidates bullish thesis)

Bearish Gold Outlook — Potential Flash Crash Imminent🔻 Technical Structure – Bearish Breakdown Brewing

Lower highs and lower lows forming on the daily and 4H timeframes — classic downtrend mechanics.

Price has rejected multiple times near $3,400–3,430, forming a strong resistance ceiling.

Support at $3,280–3,300 has been tested too many times— and each bounce is weaker. When support holds with less conviction, it's often about to break.

Volume spikes on red candles show smart money is exiting on down moves — signs of institutional distribution.

The **tightening consolidation range** looks like a **descending triangle** — usually resolves downward.

If $3,280 breaks, expect a **liquidity event**. Stops get swept, leading to a **sudden acceleration — possibly a flash crash** to $3,200 or lower.

🌍 **Fundamental Drivers – Macro Picture Is Turning Hostile for Gold**

1. Real Yields Are Climbing

U.S. real yields are up as inflation fades and the Fed stays hawkish.

Gold, being yieldless, suffers when investors can get positive returns from bonds.

2.The Dollar Is Gaining Strength

DXY is pushing higher, fueled by strong U.S. data and weak peers (euro, yen).

Gold priced in USD becomes more expensive globally — this suppresses demand.

3. **Rate Cuts Are Off the Table — or Delayed**

Market is pricing fewer and later rate cuts from the Fed.

This removes one of gold’s biggest bullish catalysts from earlier in the year.

4. Geopolitical Fear Is Cooling

No major escalation in Ukraine, Middle East, or Taiwan.

Without fear, gold loses its safe-haven premium.

5. Central Bank Buying May Have Peaked

Recent data from WGC shows some slowing in central bank accumulation.

If this institutional bid softens, gold could drop hard — few natural buyers remain above $3,300.

⚠️Conclusion: Gold Is Walking a Tightrope

The chart is a staircase down.

Macro fundamentals are no longer supportive.

A clean breakdown below $3,280 could trigger a **chain reaction** of automated selling and margin calls — **a flash crash is on the table**.

This isn’t just a correction — this feels like the calm before the storm.

Bitcoin - Structural Ascendancy under Silent Momentum.⊣

⟁ BTC/USD - BINANCE - (CHART: 1D) - (Jul 29, 2025).

◇ Analysis Price: $118,996.40.

⊣

⨀ I. Temporal Axis - Strategic Interval - (1D):

▦ EMA9 - (Exponential Moving Average 9) - ($118,352.22):

∴ This short-term exponential blade reflects immediate price sensitivity, showing reactive balance across recent closes;

∴ Price currently floats above this threshold, indicating micro-support for the bulls - a soft floor in the fog of uncertainty;

∴ The EMA9 line curves gently upward, though not sharply - signaling lingering momentum, but without fury.

✴️ Conclusion: EMA9 acts as a dynamic support amid deceleration; a watchful line between calm consolidation and renewed ascent.

⊢

▦ EMA21 - (Exponential Moving Average 21) - ($116,729.10):

∴ This mid-range trend beacon provides clearer directional context - its upward slope holds the spell of continuity;

∴ Price rests safely above this median force, confirming bullish alignment;

∴ However, the arc begins to curve with less conviction, a signal that the current push is softening.

✴️ Conclusion: EMA21 maintains bullish structure but foretells potential slowing; if momentum dims further, this level may serve as magnet for retracement.

⊢

▦ EMA50 - (Exponential Moving Average 50) - ($112,511.79):

∴ The long-arm average projects the memory of the trend - the deep root under the recent canopy;

∴ Price is far above this line, a sign of strong prior conviction from bulls;

∴ Its firm inclination remains intact, yet price distance signals risk of gravitational return should upper momentum fracture.

✴️ Conclusion: EMA50 preserves bullish foundation, but may become a zone of rebalancing if the rally loses vitality.

⊢

▦ BB (21) - (Bollinger Bands + SMA21) - ($117,764.35):

∴ The Bands, ever sensitive to volatility’s breath, expand wide - a sign of elevated tension and price exploration;

∴ Price nears the upper band ($121,401.48), a common altar for speculative saturation and potential rejections;

∴ The median band (SMA) acts as equilibrium, now beneath the price - suggesting deviation from balance.

✴️ Conclusion: BB21 signals a volatile climax zone; price at the upper band often faces a verdict - continuation by force, or descent by default.

⊢

▦ Volume + MA21 - (Last - 148 vs Average - 363):

∴ Volume flows now with diminished voice - the current bar echoes only 148 units against a historical pulse of 363;

∴ Such silence beneath a rising price may betray a hollow rally - or a pause before engagement;

∴ Absence of participation often precedes reversal or sudden liquidity spikes.

✴️ Conclusion: Subdued volume undermines the bullish signal - lack of validation breeds caution in forward projection.

⊢

▦ RSI - (Relative Strength Index 21) - (61.41):

∴ RSI remains in neutral-high territory, not overbought, but clearly tilted toward bullish control;

∴ Momentum persists but shows signs of plateau - recent movement flattens after steady ascent;

∴ Without new strength, RSI may drift toward the median.

✴️ Conclusion: RSI shows bullish favor, but the fire beneath the trend cools; next candles will determine if it's pause or fade.

⊢

▦ MACD - (9, 21) - (Histogram: –455.70):

∴ MACD line at 2,078.82 vs Signal line at 1,623.12 suggests bullish dominance in structure;

∴ Yet the negative histogram tells a story of fading acceleration - as if the charge slows though direction holds;

∴ This divergence signals decay beneath strength, an omen of indecision.

✴️ Conclusion: MACD is structurally bullish, but its weakening impulse demands attention - the momentum candle dims.

⊢

▦ StochRSI - (3, 3, 21, 9) - (%K: 20.46 / %D: 23.93):

∴ The indicator rests near the lower bounds (sub-25) - a territory of emotional exhaustion and tactical reversion;

∴ A cross upward from these levels often ignites short-term rally pulses;

∴ No confirmed crossover yet - but proximity speaks of potential awakening.

✴️ Conclusion: StochRSI breathes in the lowlands, poised to reverse if kinetic force is summoned.

⊢

▦ OBV - (On Balance Volume) - (102.17M):

∴ The OBV remains elevated, suggesting previous bullish runs were volume-supported, not hollow;

∴ However, flatness in recent OBV progression warns that fresh volume is not accompanying the current price hold;

∴ It whispers of consolidation, or worse - divergence.

✴️ Conclusion: OBV confirms the history of strength, but offers no new blood to feed the advance.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ The battlefield holds its shape - the banners of bullish trend still wave, upheld by structural support from EMA's and historical OBV flow. But the wind... it stills.

∴ Volume fades, momentum indicators lose their incline, and oscillators rest on edges. This is a moment of price levitation - elevated without lift. The form remains, but the force hesitates.

∴ The Arcane Pattern whispers:

Should volume return and MACD reignite, $121K may be pierced with clarity;

If silence deepens, however, the bands will contract, and price may descend toward EMA21 or even test EMA50.

∴ The Vortex of Pause has formed. From here, either ignition... or gravity.

⊢

𓂀 Stoic-Structural Interpretation:

▦ Structurally Bullish - Strategically Cautious:

∴ Price remains securely above all major (EMA's 9/21/50) on the daily chart, preserving directional integrity;

∴ Bollinger Bands expanded near upper thresholds, signaling climax zone - yet not rupture;

∴ Momentum indicators (MACD, RSI) maintain bullish structure, but histogram weakness and RSI flattening warn of interior softening;

∴ Stoch RSI in low-band suggests reversal potential, but has yet to trigger.

✴️ Conclusion: Market structure supports continuation, but momentum exhaustion and low volume raise caution flags. Bulls hold the field - but must call the wind.

⊢

▦ Tactical Range Outlook:

∴ Upper Limit: $122,054 - Fibonacci 1.0 and previous cycle top;

∴ Short-Term Support: $118,352 - EMA9 + 0.618 Fib confluence;

∴ Median Guard: $116,729 - EMA21 + 0.382 Fib;

∴ Sacred Support: $112,511 - EMA50 base + structural floor;

∴ Final Bastion: $103,971 - 0.236 Fib retrace (macro turn pivot).

✴️ Conclusion: Bullish path remains sealed while price resides above EMA50 and above $103K. Breach of that zone could awaken deeper volatility structures.

⊢

◩ Codicillus Silentii - Strategic Note:

∴ Price stands at the edge of Fibonacci climax, just below the mythic $122K - a known threshold of reaction;

∴ Volume whispers, not commands - the force of momentum now rests on belief, not confirmation;

∴ The convergence of structure without influx invites caution. This is the realm not of action, but of observation.

✴️ Final Seal: Beware the illusion of calm. A structure may stand in silence, but silence precedes collapse as often as continuation. The Sacred Frame is intact - but shall remain sacred only through vigilance.

⊢

⧉

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

⚜️ ⌬ - Silence precedes the next force. Structure is sacred - ⌬ ⚜️

⧉

⊢

btc buy midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

Interest rates unchanged, sticking to my bearish idea.Look at my other posts and you''ll understand as to why, I was telling everyone to sell. There was a small sellers trap, we pushed up, at that moment I already had closed my positions. Now we go down to the other key levels. I'm done till the end of August. Will still post my setups, but won't take any trades. Stay safe and keep your funds safe. Hella Love!

EURUSD – Post-FOMC Macro Compression in Play📉 EURUSD – Post-FOMC Macro Compression in Play

WaverVanir | VolanX Protocol | July 30, 2025

The recent Fed hold has added pressure to the euro as rate differentials remain in favor of the USD. On the chart, EURUSD failed to sustain above the 0.786 retracement level (~1.1476), with clear signs of exhaustion.

🧠 Thesis:

We may see a macro compression pullback with EURUSD potentially revisiting the baseline support zone at 1.08147, which previously acted as a long-term resistance-turned-support.

🔍 Technical Confluence:

Rejection near 0.786 Fib (1.1476)

No bullish breakout above 2023–2024 ceiling

Downside targets:

1.1070 → short-term support

🟡 1.0815 → baseline zone and decision point

🧠 Macro Overlay:

Fed is in pause-and-watch mode

ECB growth outlook is slowing

US inflation is stickier = USD strength persisting short term

📌 VolanX DSS Summary: Bearish structure developing. We favor tactical shorts on rallies toward 1.1470–1.15 with eyes on the 1.08 handle.

#EURUSD #FOMC #VolanX #WaverVanir #MacroTrading #ForexSignals #USD #ECB #RateDifferential #Fibonacci #SMC #Liquidity #ForexMacro

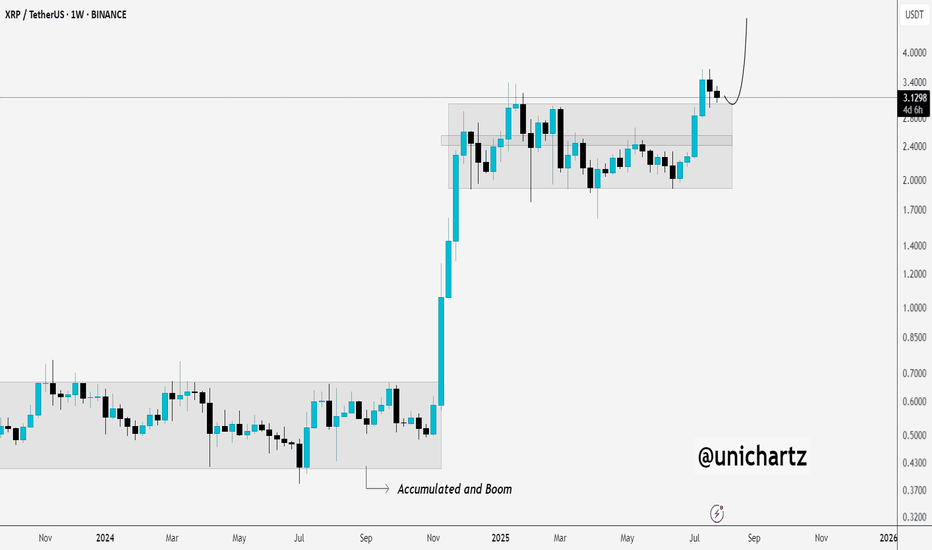

XRP WHERE ARE WE HEADED ? LEVELS TO LOOKOUT FORHey trading fam

So XRP is a fun one but based on BTC correcting and what we are seeing there are a couple thesis's that we currently have for it

Thesis 1: We break south from 2.98 lows: Levels to look out for:

2.80

2.70

2.68

Thesis 2: We break the highs of 3.29: Levels to look out for:

3.65

3.79

3.99

Trade Smarter Live Better

Kris

Final Breakdown from Rising Wedge – Alts About to Run?BTC dominance has been rising steadily inside a rising wedge, but now it looks like the structure is giving up.

Price just broke below the wedge, a move many traders watch as a potential shift in momentum.

If this breakdown holds, it could be the final breakdown before altcoins start gaining serious strength.

Eyes on alts, the rotation might be starting.

Bitcoin Are We Heading to 140K or 80K ??? Here is the Analysis Based on what is happening here is what we currently see with Bitcoin

Idea 1: If we can break 119K then here are the following levels Bitcoin can go to :

122K

126K

135K

140K

Idea 2: If we continue and break further bearish here are the levels BTC can go to

115,600

114,500

112,800

If we go below this level then a larger correction thesis would point us with a deeper bearish level

Happy Trading

Trade Smarter Live Better

Mindbloome Exchange

Kris

USD/ CAD Are We Heading to $1.46 Territory Watch OUT Afternoon Trading Family

Based on what we are seeing is a nice bullish run up to the following levels :

Levels To Watch For:

1) $1.39

2) $1.41

3) $1.43

4) $1.46

However be aware if we for whatever reason we sink back into the 1.35 territory then we could see a drop down to 1.34

Trade Smarter Live Better

Kris

Healthy Retest After Explosive Move – XRP Eyes More UpsideCRYPTOCAP:XRP broke out of a long accumulation range and is now coming back to retest that breakout level, a classic and healthy move.

If this retest holds, we could see the next leg up kick off soon.

Accumulated. Broke out. Now confirming.

DYOR, NFA