2 Steps in Drawing a Downtrend Channel A buying strategy in a downtrend.

How to identify buying opportunity in a downtrend?

Not my preference to buy in a downtrend, but that does not mean we should avoid it when buying opportunity arises.

Recognizing it is a downtrend, we keep our buy position short-term; as we are going against the trend.

Discussion: Rules in constructing a downtrend parallel trendline

Rule 1 – First the downtrend line

Rule 2 – Then, its parallel

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

Beyond Technical Analysis

How to get "lucky" in day tradingHey Traders!

In todays morning video we go over how you can become more lucky in trading by following 3 basic tips!

We hope you enjoy the video, later today we will release a longer video explaining how we use the VWAP and Anchored VWAP indicators here on trading view to spot excellent support/resistance levels and trade with momentum or ranges!

Happy trading to everyone!

How To Trade Double-Top/ Double-Bottom?Hi Traders. In this workshop, I'm going to talk about different angles you could trade when it comes to trading this simple Double-Top/ Double-Bottom reversal pattern, and what are some of the common mistakes made by most traders.

If you enjoy the content, make sure you follow my profile and click the like button.

Take care and trade safe.

All the content I've posted are for educational purposes, please perform your own research and only take it as a reference.

How To Know If You Are Being Stubborn Or Rational?Hi Traders, welcome back to another educational video.

We're all humans, we all have times where we are being denial to the truth being slapped infront of us.

Have you encountered times where you clearly knew the market have high chance of moving into certain direction, but after awhile, you're either not making money from it or not gotten into the move at all?

Have you faced situations where you get stopped out once, twice, thrice.... but still refuse to accept the fact that you could be wrong?

The key point to consistent profitability is flexibility.

Two thumb rules i remind myself every day

1. Do not fight against the market - own eyes

2. Do not fight against my strategies

The best traders out there are not the smartest, but they are those who have strict discipline and processes to maintain themselves at a high level of performance.

Now, review your journal and look back at your losing trades.

Ask yourself, how many of them are due to revenge trading OR trading on tilt?

How much i would've gotten better ONLY IF you removed those bad habits?

Hope this short workshop will help you to improve your overall performance and re-frame your mindset.

If you enjoy the content, make sure you follow my profile and click the like button.

Take care and trade safe.

All the content I've posted are for educational purposes, please perform your own research and only take it as a reference.

GBPJPY Trade Recap - Missed Out 8R Due Tight Stops (Lesson)HI Traders, in this Market Recap I'll be sharing my today's trade where i had my SL slightly too tight, ended up causing myself to miss out a 8R - 10R trade.

This Afternoon right before London open, i noticed that GJ is pulling back to the 0.5fib level, which is where i believe there are potential further selling opportunities as the overall flow is Bearish.

I noticed the first rejection, I then waited for the second trigger candle to confirm that sellers are stepping in.

Got into a short position after I saw a Bearish Pin-Bar on the 3min chart, had my SL set several pips above it.

Got stopped out not long after as price suddenly spike up above the my trigger candle (Pin-Bar), only to watch the market run into 8R profit.

Myself and NEO-Trading, I'm always here to share the maximum transparency, the reality of full-time trading.

There are times where you get into good trades, bad trades, or trades that you mismanaged.

Hope you learn from this lesson, and always make sure to set your SL at a reasonable level where your strategy tells you its nearly impossible to be hit.

NEVER set your SL based on RR as in that way human brain will have the tendency to tighten in to maximize rewards, which might ruin your expectancy as you're not following what your strategy data tells, but rather the P&L.

If you enjoy the content, make sure you follow my profile and click the like button.

Take care and trade safe.

All the content I've posted are for educational purposes, please perform your own research and only take it as a reference.

Just playing with a fractal idea using fibs within fibs initially the setup hadn't developed yet, so I pulled from current resistance down to support, checked overhead and to the left price history for confluence with the idea, and sure enough price action is respecting them on the money. As the chart develops I will reset the fibs to what ever the larger chart pattern begins to form.

Post Trade Analysis (intro video)This is just a quick inditial video of a much more detail video which we will release tomorrow to show why and just how powerful Post Trade Analysis is.

I personally believe it is the express lane to trader development and I highly recommend you guys use it too for every single trade you take!

More on this tomorrow!

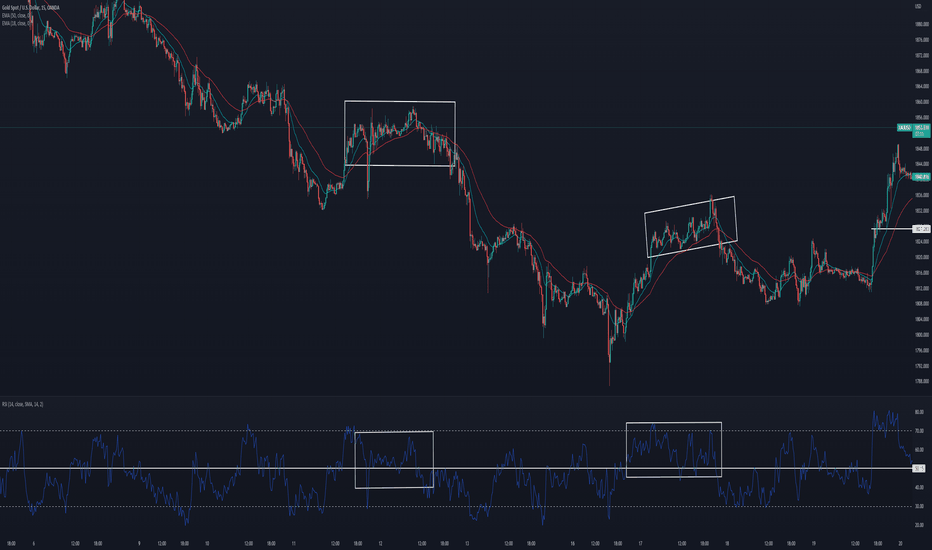

How To Use The RSI To Filter Out High Quality Setups?Hi Traders, welcome back to another workshop. RSI is one of the most common tools amongst short-term to pre-empt 'Overbought' OR 'Oversold' condition. Despite being a momentum indicator, but its commonly used to capture reversal trades.

In this video, I'll be listing out some of the methods i personally use, to make sure I'm in sync with the latest market condition by using RSI, rather than the typical model.

Try it out and let me know!

If you enjoy the content, make sure you follow my profile and give me a thumbs up for daily fx forecast & educational content.

Take care and trade safe.

All the content I've posted are for educational purposes, please perform your own research and only take it as a reference.

Post Trade Analysis: NASDAQ & WTIHey Traders!

In this video we go over a brief post trade analysis of the trades we've taken so far today on NASDAQ and WTI.

As a practice we highly recommend every one of you guys to actually perform a PTA on your own trades as it is literally the best way to improve as a trader as you will find your good and bad habits quickly. For example if you are not following your entry process you'll quickly understand that you should.

Anyway, we will make a longer post about this on Wednesday and explain it in detail, exactly what we do and why we do it!

All the best!

How the higher time frames help you to avoid unnecessary losses Hello everyone:

Today I want to discuss the importance of higher time frame analysis.

Doesn't matter what type of trading strategy, method or style you use,

the higher time frame often will help us to strengthen our bias overall and give us a good perspective of the possible direction for the price to go.

In addition, it helps traders to avoid unnecessary losses and mediocre entries that will eat up your profits.

More often I hear traders will execute trades on the lower time frames, and not factor the overall higher time frame bias and perspective.

Although entering on the smaller time frame can potentially give you more Risk:Reward, it's often more risky and trades can easily reverse, then hit the stop loss.

This often creates stress, negativity, and revenge trading psychology for traders which ended up blowing accounts.

I want to give a few examples of higher time frame analysis, how they can help traders to avoid “traps” on the lower time frames, avoid unnecessary losses, and keep the emotion at bay to trade another day.

When having a bullish bias on the HTFs, its good risk management to not consider any short term, bearish sell setups.

These sell setups may form on the LTFs, but they can easily not continue to your desired target, and reverse up before you have time to react.

In addition, traders hate to see profit come and go.

So if a trader has a short position running in some profit, but decides to hold onto the trade, and once the position reverses, traders don't want to exit, and then end up holding a losing position to its SL.

Examples:

AUDUSD:

HTF: Overall bias and perspective in bullish

LTF: Many LTF bearish setups/development, but due to going against the HTF, they ended up with losses

NZDUSD:

HTF: Overall bias and perspective in bullish

LTF: Many LTF bearish setups/development, but due to going against the HTF, they ended up with losses

AUDCHF:

HTF: Overall bias and perspective in bullish

LTF: LTF bearish setups/development, but due to going against the HTF, ended up with loss

NZDCHF:

HTF: Overall bias and perspective in bullish

LTF: LTF bearish setups/development, but due to going against the HTF, ended up with loss

NZDCAD:

HTF: Overall bias and perspective in bullish

LTF: LTF bearish setups/development, but due to going against the HTF, ended up with loss

SILVER:

HTF: Overall bias and perspective in bullish

LTF: LTF bearish setups/development, but due to going against the HTF, ended up with loss

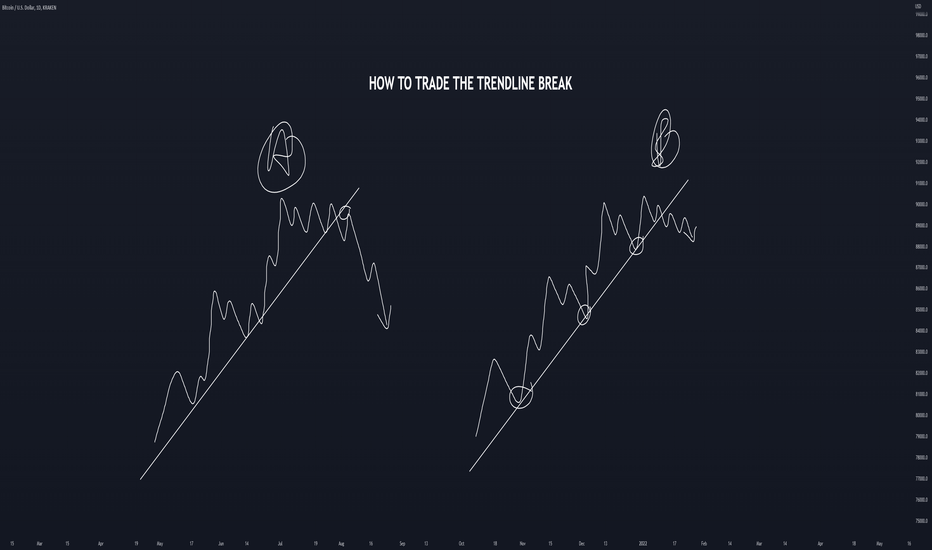

Trendline Break - Is It Really Reliable? How Should You Trade ItHi Traders, here comes another workshop. Today's topic is just something that randomly popped up in my head, just thought of sharing some of my thought process on Trendline Break.

Most beginner traders seem to put way too much attention into trendline break, but from my personal experience, the ONLY information that you could extract from a Trendline Break scenario, is a potential shift in trend direction.

Right after price breaks above OR below a trendline, I want all of you to ask yourself several questions

1. Does the momentum looks strong enough to flip the market direction around?

2. Compare the length/ size of the 'break' to the initial trend - That would usually gives you clue of whether is it a real break or a false break

3. What is the follow through after the break? Is the direction really completely flipped, or goes into some halt?

4. Where is the nearest obstacles (structure) if you were to take the reversal trade?

These are some of the questions that will hold you back if you're always thinking of immediately jumping into those Trendline Break setup, and hope this gives you a completely new perspective on this simple pattern.

If you enjoy the content, make sure you follow my profile and give me a thumbs up for daily fx forecast & educational content.

Let me know your thoughts on Bitcoin in the comments below.

Take care and trade safe.

All the content I've posted are for educational purposes, please perform your own research and only take it as a reference.

Tutorial - Convert an indicator into strategy in pineHello Everyone,

I just made this video because, this question came up many times in Pine QA. In this video we are trying to load default Bollinger Band indicator from Tradingview and convert it into strategy.

Below are the steps

Load the indicator on chart

Click on source code (curly brackets next to indicator title) to load the code into your pine editor.

Make copy of the script. Remove the indicator on chart and load your copy of the script from pine editor

Replace indicator call with strategy call

Define your entry/exit conditions for long and short

Add strategy.entry, strategy.exit, strategy.close calls based on the conditions to generate trades on chart

Useful references

Pine Reference Manual

www.tradingview.com

Strategy template in the linked ideas.

Enjoy :)

Managing Drawdowns - Do This When You're Underperforming!Hello Traders. It's been awhile since I last uploaded a workshop. Myself as a full-time trader, to be frank, the past 6 months have been tough for my personally. I've gone through some really bad drawdowns, mostly due to my external pressure that's causing me to have lower performance.

In today's topic, I am going to talk about "Drawdowns", which is not something people usually talk about. Social media, Youtube, all these platforms are made to make you 'feel bad'! People are constantly showing off their profits, but who'd willing to really open up to their drawdowns and bad trades?

Drawdowns are inevitable in trading, the only you can eliminate drawdown is to not take any trade/ risk. Make sense?

From my humble six years of trading experience, i realize most of the successful traders have one thing they are very good at - which is managing drawdowns and negative emotions. Think about it, we're all human, we're all a normal trader, why would some constantly achieving such a high performance while some constantly losing?

These are the four simple steps to help you in refining your drawdowns and hopefully get you out of it.

1. Understanding probabilities

- While we're in a drawdown (negativity), it's vital for us to take a step back and look at the numbers. Three things to read - trading plan, strategies data, market condition. If you're whatever you do is wrong, that's usually due your forcing trades during uncertain market environment/ condition, try to re-assess everything.

2. 3R Process (Review, Reflect, Revise)

- This is the most important process i've utilized for years to improve my trading consistency. Review your trading plan and all your journaling, then reflect what's the root of the problems, then find solutions around it. Remember to simplify things! By over-complicating your journaling, trading plan, or trading systems, really don't help things to be better.

3. Eliminate negativity

- Us, especially as a full-time trader, is common for us to blame ourself due to our bad decisions. But sometimes understand that no one wants to be in a drawdown, as it is all probability-based. Who want to lose money? But over the years, i found that the most successful traders out there have one very common personality - Confident.

- Be confident on yourself, that's the easiest element that allows you to execute trades consistently and fearlessly. Believe in your system, the drawdown is only temporary, you still got a long way to go. FInd a solution, fix it.

4. Take a step back - Re-evaluate

- When you're in a drawdown, most likely your rational behaviour and emotion have been negatively impact. So stop trying to force things, take the time you need to refresh your mind, re-set your mental state then come back stronger.

- By not giving yourself time to re-set your mental state, you're not just halting your performance, it could be self-sabotaging as well. Because by that means you're not applying the 3R process, certainly not fixing the problems too.

- Most of the losing streaks have one common losing pattern (that is hidden), so it is our accountability to find our the root of the problem, then frame a set of routine and action plan to solve it.

Hope this short workshop helps you a little bit.

Let me know in the comment section below what's your worst drawdown and how do you fix it!

Do not forget to like if you enjoy the content, and share with someone who'd enjoy reading this.

Calculate your 1% risk per Trading Account to identify 3:1 R:RHello traders:

Lately there are more and more newcomers in my community,

and some are not quite familiar with risk management, especially when it comes to calculating R:R based on 1% of your account size.

Risking 1%, simply means risking 1% of your total account size.

For example, $1000 account size, is $10 per risk at 1% of trading account

$100,000 account size, is $1,000 per risk at 1% of trading account

The goal is to forecast and plan out an entry that will potentially give you at least 3:1 RR per trade or more.

Meaning by risking 1%, $1000 of your $100,000 account, you should look to achieve a $3,000 profit or more, hence giving you 3:1 RR, or +3% profit.

There are many websites that help you to calculate your R:R and position size in relation to your account.

Utilise them to calculate exactly your LOT size position in relation to your SL amount so you have a proper risk management in place.

Any questions, comments or feedback welcome to let me know.

Thank you

Risk Management: When/How to move SL to BE and to profit in a running trade ?

Risk Management: How to filter trading opportunities if multiple setups are presenting entries:

Risk Management: 3 different entries on how to enter the impulsive phrase of price action

Risk Management: What Is Capital Partitioning ? How will it help you as a trader ?

Risk Management 101

Risk Management: How to set a Take Profit (TP) for your trades

Risk Management: How to Enter and set SL and TP for an impulse move in the market

Risk Management: How to scale in the impulsive phrase of the market condition?

Risk Management: Combine everything you learn to prevent blowing a trading account

How did Open Interest tell me: Stay long as BTC Dumped!?!BYBIT:BTCUSD

I was in 3 long trades as Bitcoin dumped on the 26th of May 2022.

I had 2 choices. Close my longs because I saw price dumping below my entry

or

look at what Open interest was telling me to determine if this was a fakeout.

I saw price dropping as OI was dropping. This meant that longs were closing out their positions, which means that when this ended, price could reverse quickly.

Longs were closing out their positions and re-entering as shorts. As soon as this selling dried up, Longs started entering and then suddenly shorts were being liquidated, pushing the price up again.

This is known as a stop run. Hit long stops and then hit short stops. Be aware of this kind of fakeout as it happens again and again!

Learn to trade the retest and why it is important not to short at support and inversely why it is NB not to long at resistance, UNLESS you get a retest of that level!

Not financial advice, DYOR. Papertrade before using real money.

If this educational snipped helped you, please consider giving it a thumbs up and follow for more like this!

Trade Safely and Learn something every day!

Shawn

Why Shorting support & Longing resistance gets traders REKT!INDEX:BTCUSD INDEX:ETHUSD FXOPEN:XAUUSD FRED:SP500 NASDAQ:NDX

I see this time and time again - no matter if you are trading, cryptocurrency, commodities, indices or stocks, the principle remains the same:

Shorting at support and longing at resistance is GENERALLY not a good idea.

I show you examples in the video and explain why.

There is however a good time to short at support - i.e. When it has flipped into resistance after the retest, changing the market structure - and the inverse is true for longs.

If this video helped you, please consider leaving a thumbs up and a comment if you have any questions!

Learn, learn and then learn some more!

Not financial advice. DYOR. Papertrade before using real money

Austrailian Dollar Seasonal PatternsHey traders today I wanted to go over the best Seasonal Patterns in the Austrailian Dollar Futures Market. The Austrailian Dollar futures and forex follow an annual seasonal pattern with is also correlated with Gold during the year . Knowing when to find these seasonal patterns on your charts can really benefit us in our trading of the Austrailian Dollar.

Enjoy!

Trade Well,

Clifford

How To Spot Economical Cycles Top Using [DXY- SPX and VIX]

Hi Everyone

In this video I want to share an overview of the importance of economic cycles for traders and investors and how we can use Trading View charts

with no indicators to figure out key economic signals on the following charts:

DXY tops for the end of previous bear markets

VIX normal ranges vs Bear cycles ranges

The Dow Jones Industrial average is another key chart with SPY charts because everyone has a 401K retirement account these days and people are use to the headlines of the Dow Jones Industrial Average new highs and new lows to shift emotionally between despair and exuberance. It's not unusual for people to throw in the towel just as the market begins to rise in the next economic cycle.

As a student of the markets, you need to know when it's time to load up on bargain priced assets and ride the next cycle up and when it is time to slowly sell or fade into the tops of the markets and avoid the downturns.

Are we in a normal healthy correction 10-20% or are we heading toward the Great Depression type 50% correction from the top? These charts will help you answer the question.

Mastering the market and economic cycles is the key to becoming wealthy in all asset classes - Stocks, Real Estate, and Cryptos

Hope it helps...

@Marc

Trading Psychology - Long Term Sustainability in the MarketHello traders:

Today I want to discuss an important topic on long term sustainability.

It is no surprise that trading any financial market has proven to be difficult, and stressful.

Many new traders come and go so fast in the industry, and it's often due to the wrong mindset, trading plan, risk management and expectations.

I want to focus on the psychology part of trading for sustainability,

as I have made many trading plan, risk management related videos already, though I can discuss more on mindset and emotion today.

My vision in trading psychology has always been: Consistency, and Sustainability .

These are a few things I tell myself each and everyday in my trading journey to help me stay sustainable in the market.

-I am NOT here to get rich quick, traders who have that mindset often failed fast and quit

-I am here to make a reasonable % return per month, based on proper risk management and trading plan.

-I understand in order to make a ridiculous return per month, it requires over-risking and over-trading,

but it's unsustainable on a larger account size. I do not wish to lose a larger account or ability to trade for larger prop firms’ accounts.

-I understand the uncertainty in the market, any strategy, method and approach will run into drawdowns and losses.

-To prevent revenge trading, over trading and over leveraged, proper mindset and emotion are needed to survive and sustain in the market

-I believe in long term sustainability, and looking to “win the lottery” by going all in on trades. 1

% per account risk with 5-7% return per month is reasonable, achievable, and sustainable in the long run.

These are just a few pointers and reminders I tell myself each and every day.

This year will mark my 9th year in trading, and I am thankful to have gone through all these trading experiences in the past that made me a better trader today.

I am still continuously learning and growing, very happy with the consistent and sustainable approach that I do.

I am sure there are many other traders with different opinions, methods, approaches in trading, with different mindset, expectations and goals.

I respect all trading strategy, perspective and options. At the end of the day, it's up to each individual trader to identify their journey and what method they wish to implement in trading.

I sincerely hope I can help some of the traders to understand the importance of long term sustainability, and that will enable traders to continue to be a part of the financial market for the years and years to come.

Thank you :)

Jojo

Risk Management Educational Video:

Risk Management: When/How to move SL to BE and to profit in a running trade ?

Risk Management 101

Risk Management: Combine everything you learn to prevent blowing a trading account

Trading Psychology Educational Video:

Trading Psychology: How to deal & manage losses/consecutive losses in trading ?

Trading Psychology: Revenge Trading

Trading Psychology: Fear Of Missing Out

Trading Psychology: Over Leveraged Trading

Trading Psychology: Is there Stop Loss Hunting in Trading ? How to deal with it ?