Price Action Lesson: The Basics of How to Read Price Part 3Hey Guys!

As you guys know I aborted 2 short entries on the NZD/USD pair yesterday to minimize my losses.

In this lesson, I'll explain how I knew to abort the short entries early by reading 1 minute price action and thus minimize the loss.

Enjoy!

Have a great day!

Ken

Beyond Technical Analysis

Message To Leveraged Longs of BitcoinThe "Fear Index" of Bitcoin COINBASE:BTCUSD is rising both statistically and on my social media. I'm fielding a lot of questions today from people that thought THIS was the bounce (from the 36k support) and leveraged up to the ta-ta's. The question they should NOT be asking is, "when will it reverse?" The question they need to be asking is... "how much is this lesson in leverage going to cost?"

Risk Management Basics for new tradersWhat is risk management and why is it important?

Risk management is the identification, evaluation, and prioritization of risks (defined in ISO 31000 as the effect of uncertainty on objectives) followed by coordinated and economical application of resources to minimize, monitor, and control the probability or impact of unfortunate events or to maximize the realization of opportunities.

Here I talk about 5 Basic topics:

1) Stop Loss

2) Risk

3) Size

4) Evolving the trade

5) Drawdown

Please keep in mind these are my personal basic view to give you understanding of the market. I highly recommend getting help from a professional before trading or taking financial advice.

BTC and understanding structure breaks with your tradesin this video im explaining how to read the story price is telling you via structure breaks. i also give a little idea of how i use the rsi in my trading. i hope this video helps you understand that price is not as confusing as you may have been lead to believe.

How to capture chart snapshot in tradingview-telegram alert botHello traders,

In the last video we learnt How to create simple web-hook to send alerts to telegram . In this tutorial, we will try to build a bit more on it and to also include chart snapshots along with plain alert messages.

Webhook code is updated in the replit repository here: replit.com

Once, setup, run the repl and capture base URL

⬜ Webhook API

Webhook post request URL format below:

https:///webhook?jsonRequest=&tblfmt;=&chart;=&loginRequired;=

jsonRequest - true/false. Set it to true only if you are sending alerts in the form of json. If set to true and the alert message is not in json format, it will throw error

tblfmt - Values taken from python library tabulate . Defines how to display the json message in tabular format. Applicable only if jsonRequest is true

chart - Chart URL from tradingview for which snapshot need to be captured

loginRequired - true/false. Use this only if you are using a private non shared chart for snapshot or if your chart contains invite only scripts which needs to be shown in the chart snapshot.

⬜ Capturing Chart URL

Note: Make sure you create different chart for different instruments which you are trying to get alert. Also make sure your chart is saved and all the indicators are in palce.

⬜ Testing on postman

⬜ Creating the alert

A Trader's ReflectionReflection What’s a reflection? Do you love your own reflection? So many questions—with, yet again… different definitions. A reflection is the return of light, heat, energy or sound waves from any surface. “To fix one’s thoughts (particularly from the past) on something”, is also a reflection. When you reflect, you ponder, mull, think—reflecting is synonymous with “past”—In most cases, you can only reflect if it’s something from the past.

However, writing this particular journal entry, I thought of… “what our reflections would be like as traders”. Have you ever had to reflect back to—who you were before trading?, Well, I do sometimes, who am I kidding? I’m even doing it now.

According to our definitions, In the word reflection, we get to pick some words like: “The return of light, heat, energy or soundwaves”, “Fix one’s thoughts”… You know what this means?, The first definition, simply means: your reflection is how you feel at a particular moment, the energy you transmit at that point is reflected. That’s why, if you look in the mirror—sad, you will not expect to see someone happy in there. Whereas, the second is an escape from realty. That is, when you reflect you leave this particular plane, moment and travel back in time.

A Trader’s Reflection

As traders, our reflections are shown to us by the charts (market). Just like your energy is reflected when you look in the mirror, the same thing happens when you trade the market. Therefore, the adage that says, “whatever you sow, you reap”—is a perfect example.

The market serves as a: trader’s mirror, the light, heat, energy and soundwaves are going to be very visible when you take a trade. Similarly, you don’t expect to enter the market sad and expect a happy outcome. I want to re-quote Ernest Holmes. “The market is a mirror and will reflect back to both its observer, spectator or player—that which it thinks into it”. The way the market seemed to you, was actually the way you created it in your own mind. That’s the energy returned I speak on.

Dumb question, Have you ever looked in the mirror? Anyway, who do you see—Yourself or some imagination of yourself? There are times when I’ll imagine what I’d want to be in 5-10 years from now, I’ll look in the mirror and nothing’s changed. It’s like imagining your flying but your feet never left the ground. My aunt said, “it’s good to be ambitious”—but, ambition without action is—damnation.

On twitter, I remembered tweeting—“the market’s not responsible for your decisions—You are”. A trader’s reflection simply means, The subconscious replication of a trader’s non-verbal signals. Similarly, your reality as a trader comes from what you see in the mirror (market). In addition, What you hold in mind manifests—irrespective of your preferences.

The Reality

In reality, we actually trade people’s reflections…

Looking at the mirror, if someone were to tell you, “oh, woah! you look pretty” is that enough? It might not be if you don’t think you look pretty. Even if the person tried to give you reasons. Most traders consider their problems to come from outside conditions whereas, Albert pointed out—“We cannot solve our problems with the same level of thinking that created them”. Therefore, If a trader is feeling fearful, he can try to cover it up all he wants, but, his trading results will readily reflect his true feelings.

As traders, “you can lie to everyone but the one person you can’t lie to is—the market”

Took a break on Ruth Roosevelt’s blog. She made it known that, “Trading is a microcosm of life. What you do in life, you’ll do in trading”—A dirty mirror that’s made clean isn’t usually enough vision if one’s blind. We can fool everyone into thinking we’re professionals but not the market. Dude’s just so good at the detective job. You’ll get caught!

The market feeds off your energy, that’s why you can look at a market and say, “oh! I think the buyers are in control”, because, everything reflects. March 2020, the Covid beginning-era, the Nasdaq index and many other instruments dropped drastically. The market reflected the pain, fear, frustrations, and turmoil—every human was going through. What happened afterwards?, there was a massive decline. Energy is indeed contagious.

Dear Traders

In conclusion, Don’t be fooled, In trading, it’s not the analysis or predictions that matter—it’s your belief, thoughts and emotions. Once you take a trade with a messed up mindset, what do you expect would happen? You probably have a messed up outcome.

The market doesn’t have to read your mind to know what you’re thinking because—whatever you’re thinking reflects in your trading. However, most focus on the outward appearance because they think of social status, online gratification or they’re just good at marketing. Well, you can fool other people; who exactly are you fooling? The market does not create the ways in which you perceive it; it merely reflects what is going on inside of you in any given moment.

The annoying thing about this particular mirror (market) is that, it doesn’t speak or warn you. It just reflects; The great thing about it is: You get to know the truth.

Humans will lie, Your fake gurus will say anything so you can keep purchasing their course. The market, will reveal everything about you both good and bad. A good trader isn’t judged by his analysis or predictions; A good trader is judged by his outcome. Tell your gurus to start showing you “real” account histories and not trading view analysis. Haha!

Make The Market Your Teacher

Finally, the only guru you should be listening to is: The market. The market will quite naturally make you face what is inside of you on a moment-to-moment basis. What is inside of you could be confidence or fear, a perception of opportunity or loss, restraint or uncontrollable greed, objectivity or illusion. The market just reflects these mental conditions, it does not create them. I’ve come to very conclusion that—in trading, having a mind of your own is bliss. You must be a fool thinking your guru can 100% predict the market. Unless he trades billions (can actually move the market). We are all just mere spectators hoping to join the winning animal.

Price Action Lesson: The Basics of How to Read Price Part 2Hey Guys!

As you guys know the current NZD/USD daily bias is short. Or in other words, price is likely to reach 0.6591 before reaching 0.6731.

So on my last post, I mentioned I took a short entry at 0.6722 with a stop loss at 0.6591 with its main target at 0.6591 for the time being.

In this Price action lesson, I just wanted to briefly explain how I read price in order to take the short entry yesterday. Moreover, why I was able to

take the short position "comfortably" even though price pulled back to 3 pips to the stop loss level.

That's it!

Have a great day guys!

Ken

Disclaimer: This is not Personal Financial Advice.

Safe Haven Currency, How are they affected by global eventsHello everyone:

Want to talk a bit more about safe haven currency in the market.

Since the recent tension between Russia and Ukraine,

the safe haven currency could strengthen as a result of such uncertainty in the world.

We will take a look at some past history of these currency pairs,

how they react to the market at the time, and what could we reasonably expect in the current market conditions.

Safe Haven Currency

USD

JPY

CHF

It's in our interest to look for opportunities when a strong currency is paired with a weaker one.

This generally will move the price very impulsively with strong momentum.

Pair such as these below will potentially develop the best price action for good R:R trades.

AUDUSD

NZDUSD

USDCAD

GBPUSD

AUDJPY

NZDJPY

CADJPY

GBPJPY

AUDCHF

NZDCHF

GBPCHF

CADCHF

Always have good risk management when it comes to entering. Don't enter all the pairs, don't open too many positions,

and understand correlation between the currency pairs.

Thank you

DISCLAIMER:

-My forecast and analysis are NOT trading signals nor financial advice, you should not enter trades and invest solely on this information.

Jojo

Some points on managing positionsTake into account market structure when managing trades. There's times when it pays to be aggressive with cutting profits and tightening stops, and times when you need to let something play out. Having an awareness of what the overall market is doing and what the environment is like can help you make small changes that help you protect capital. For example, if you taking breakout/momentum setups, you are expecting to see momentum pretty soon after you enter. If it's not working as expected, you should reduce your risk on the trade as it's then become much less likely to work out. Being stubborn and leaving trades that aren't doing what's expected run for larger than necessary losses will destroy your chances of consistent profitability.

How to guide ? Hide INPUT values of indicators From ScreenHide INPUT values of indicators From Screen

There is a very common cluttering issue that can happen when adding indicators.

All input values are shown on the chart next to the indicator name, which is not really helpful in most of the cases. The values are input settings selected for the indicator, which is of very little use to just see selected values. So if you have long strings as input, or multiple inputs, you will see a long line of text, even hiding the indicator name itself. Further it blocks the chart and looks very bad when taking screenshots.

Fortunately there is an option available from trading view itself, that many people are unaware of. This option enables you to hide all input values, leaving just the indicator name.

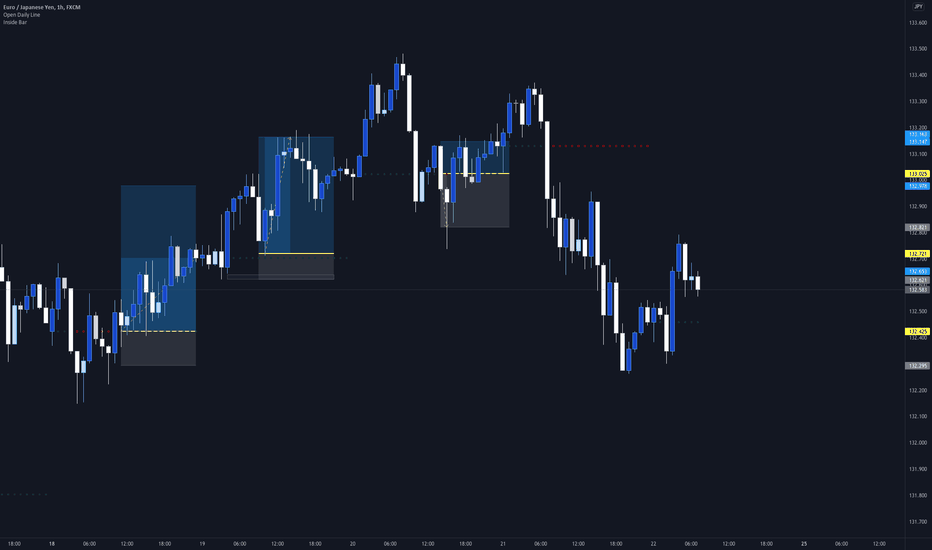

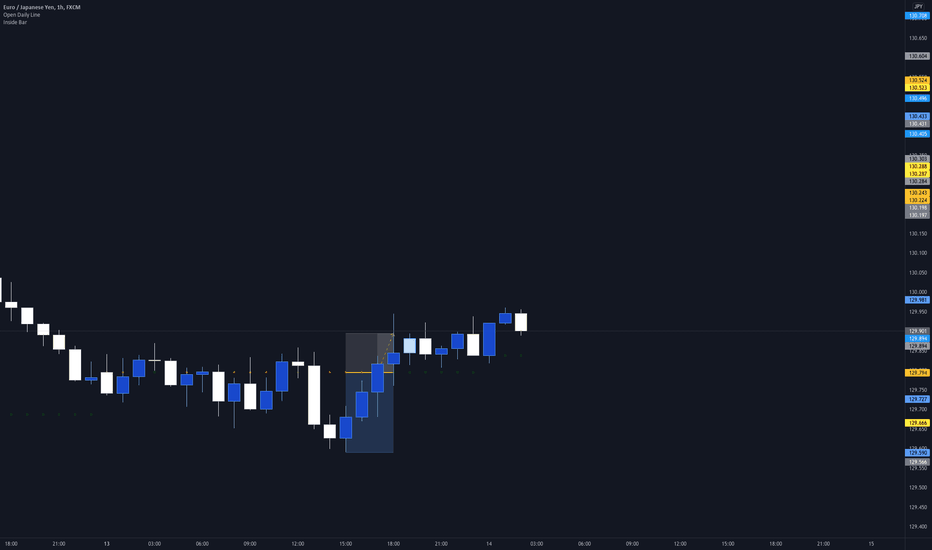

Price Action Lesson: The Basics of How to Read PriceHey Guys!

Just wanted to put up a quick Price Action Lesson on How to Read Price.

I demonstrate this foundational element of reading price with a current eurjpy short trade I'm currently in.

The Key point of the lesson is simply: Directional movement of price is irrelevant when it comes to reading price. What's important is "How Price Gets from Point A to Point B".

So even if price moves up, if there is no signs of strength in the same direction, that move up will be unsustainable.

Moreover, this foundational way of looking at price movement is what allows a trader to always be one step ahead of the market and thus not chase the market.

Ok! I hope this helps guys!

Have a great day!

Ken

Disclaimer: This is not Personal Financial Advice.

A Chat With Traders: Traders And Psychology With JohannaJohanna a 22 years old forex trader—with an enthralling background and compelling story. The Sudanese trader’s story starts from: Cameroon and Norway. Johanna was born in Cameroon but, bred in Norway.

According to her, “emotional intelligence is a crucial part of forex trading”. Albeit, traders don’t really talk about it. However, she prefers to trade in a converse way in relation to other retail traders. “I didn’t know I would be so affected by psychology in this game”, she mutter. In addition, “I’m a risk-taker. I love taking risks”.

Who is Johanna?

Originally from South Sudan, born in Cameroon but raised in Norway. I am currently both: a dental student and an upcoming day trader. Was first introduced back in 2018 through another female trader posting it on Instagram but—because of fear and lack of motivation, I did not take it seriously until late 2019.

Had jobs in different branches: from store employees, elder homes, and customer service. None of them have really fulfilled my perspective of living my life on my own terms.

So when I got introduced to trading, I knew it could give me the freedom I was looking for. What I didn’t first know, was the work, effort, and knowledge that was required. My first initial thought was to give someone else my own money to trade for me whilst learning, just for me to become a victim of scams on my earliest day.

Moving forward, after almost 10 months of trading live, I’m looking to get the right skill needed for me to handle the market in the long term but also educate and inspire more females to join the industry.

Woah, Johanna that’s some kick wass intro. I wouldn’t continue until this question is asked though. How long have you been trading? How did you learn forex and come to know it?

It has already been year on a live account. But, I was 5 months on demo before that.

Johanna’s On Trade And Psychology

The previous chat I had, inspired this particular question. Social media has allowed us as traders to have a wider footprint outside of the forex industry, what do you think your impact is in the industry?

The industry is heavily male-dominated and I really want females to contribute and represent another side. I’m also big on learning the right skills; from the right people so you don’t get scammed easily in this industry.

That’s you speaking from experience there. Right? Do you have a special way you trade this particular pair? If yes, can you share a tip for that pair?

My approach is a bit different: as I look to trade the strongest and the weakest pairs. I will therefore look for these pairs during my market preparation—this will also help me to understand the directional bias for further analysis.

Hey, Johanna—are you a technical or fundamental fan?

Technical and fundamental. I personally feel like both are important to have an overall look of the market and why things happen the way it does.

Without a doubt. Loving the way you’re handling this questions. What is your go-to strategy? I would also love that you explain: why that is your go-to. Do you have a major reason why you chose that strategy and how it has helped in improving your trading.

I like trading the opposite of what retail traders generally do, and as an Intraday/Swing trader, I prefer to look out for major liquidity grabs and trade from those areas.

“The opposite”. How can you tell—Just a curious cat here. By the way, Who/what inspired you to start trading? If you have a mentor, what’s their name and what about that individual inspired you?

Haha. The freedom to be able to trade from wherever and whenever I want is—definitely the inspiration. Those who inspired me are: Melisa Hilma, Cue banks, Forex with ally, and the Gold father

It’s research time for me—I guess. However, still on psychology, What keeps you sane? Because I won’t lie—trading can stress you out and some even get depressed. So how do you overcome this?

Hmm. I trade with an amount that doesn’t affect me, adjust my risk management to a level where I feel comfortable trading, and ready psychology books both for trading and personal development.

Okay, that works. Especially the reading part. I know this particular question may sound weird. The reason asked is: as humans we have the whole “act now, think later” thingy going on even when it’s not the right thing to do. So, do you have a trading “guilty pleasure”? If “yes” what is it and how do you handle it when it happens?

Made this mistake a lot in the beginning. Albeit, I’ve tried to work on being very strict and journal every time—I might do this mistake to then go over it during the weekend. If greediness occurs, I really need to take a step back and look at my plan, checklist, and rules before taking a trade.

Someone’s disciplined. Tell me—what are the three traits you have that keeps you successful? And what three traits do you hope to have in trading that would make you a consistent trader?

A big risk taker, I love taking risks. Being consistent and systematic as a person, also helps me become a better trader and the appetite to always learn something new! As a trader you meet so many challenges, you can never be bored!

Truth to that. It’s amazing the discoveries one can get from just trading. Speaking on bore-dom—When you’re not trading, what are you doing?

I study, read and I like meeting friends. In addition, the Corona virus has also made me start watching some new tv shows. I love to bing watch them on: Netflix and HBO.

Yeah being hooked on some shows as well. Tell me about a time you disagreed with a decision. A time you didn’t follow your trading plan. What did you do?

There was this one time where I did something. Though, I do not recommend it. Took a trade into a news event. That’s personally against my rules. I still did it and it went away for a while before it reversed and hit my stop loss. The worst part was: I was trading Nasdaq100 (indices) that moves very fast and can easily blow up your account with one bad move.

Eish! I can definitely relate. Nasdaq’s my field. How do you handle pressure, impatience, fear, doubt and greed in forex?

You know what, I don’t work well under pressure—so, I can’t be dealing with anything that might pressure me to do something outside my plan. I’m actually a very patient person and I haven’t really rushed in the market. Things take time and I accept it. I might doubt myself sometimes but I keep thinking that others have done the same but they are now in better situations. Same thing with greed. Greed will test you in the market but, taking control of that earlier in the trade will help you a lot. I take what I can from the market and I’m happy with that.

Well said. Johanna. Let’s visualize now. So what would you want your forex dream to be like (in details).

Too many dreams. My forex dream is just one of many things I need to accomplish. Being financially stable from forex is the first step, but investing in other assets and businesses is as important as my drive to learn forex.

Investing, compounding. A great dream. Who is one person/academy you think Neophyte or everyone should follow and why?

Really look up to Melisa Hilmi, the first person who introduced me to forex. She has a genuine drive for the market and has an amazing course from beginner stage to advanced. Also, she has an amazing track record, history and I appreciate people who do their own thing.

Haven’t really heard of her. Another assignment for me. What are you biggest strengths in forex and What’s one thing you think you are very good at in forex?

I’m a big risk-taker. This makes me less emotional when I trade: as I’m not attached to money—the same way as many might be in the beginning.

“Big risk-taker” That means you probably won’t relate to this question—But, Have you ever tried quitting? If yes, what did you do about it?

Yes. I took 2 months break after I got scammed and was really depressed. I got back up knowing that it was just a mistake. Trading is still something I should be able to try out but by myself.

Ouch. So sorry about that. By the way, speaking on losses—What was your greatest loss, how much was it?

My greatest loss so far is: $6000 in 2 days.

That’s crazy. What motivates you?

Being able to change how I and my family live. My younger siblings motivate me—even more. I want to give them much more than what I got when I was younger.

Aww. That’s so sweet. In trading, how do you manage a trade when in it?

While the trade is running, I make sure I have alerts on areas of key levels. I might check it one time every hour and might adjust my stop loss to make the trade risk-free.

I’m curious now. What’s your trading plan? And what is your go-to assess class (what pair(s) would you consider are your favorites) and why do you prefer these pairs?

I start off by looking at major news for the day/week and look out for events that might affect my trades. Most of my market preparation for the week happens during the weekend and I will focus on only executing my trades after that. I look for high probability trades and I have a checklist I mark off before, during, and after the trade. They include: my entry rules, exit rules, risk management strategy, and how I will manage my trade while it’s running. My favorite pairs are: GBP and NZD pairs.

Johanna speak on the Industry and It’s Newbies.

Hope to see your watchlist someday. I always ask this particular question. What’s your take on Neophytes that want to learn forex? Do you prefer they paid for the knowledge or stick with YouTube videos and free materials.

Spent a lot of time on YouTube and it helped me but—you should also take a course: as the information can be overloaded with free materials.

Yeah. Lots of free courses everywhere. Learning everything can be quite exhausting. This may sound “cliché” but why forex? What is your major reason for choosing forex?

Not funny but, I was first scammed in the crypto industry—I backed off from that. Then forex seemed like a reasonable market for me as it involved more than just studying currencies.

Lot of scamming on your part. Moving forward. We all talk about trading psychology, what can you say about that?

Didn’t know I would be so affected by psychology in this game. Pay attention to every move that affects your mindset and work hard on improving it.

Needed to hear that from you. Because, I think psychology is one of the most important—if not the most important part of trading. So, that’s why I’m laying emphasis on it. What are your trading rituals and how has it helped your trading?

When looking for high probability trades, I only take trades that matter hence—why I don’t need to take many trades every week. I stay out of bad markets and back-test my weekly losses.

Back-testing, important. What are your trading aspirations? I know many trade for “financial freedom” but what happens when that’s achieved? What do you plan on doing with trading?

Plan on making an educational space. Not just within trading, but also in finance. There are many opportunities out there: to better yourself financially. However, I see many people don’t take that chance due to: either lack of experience but also fear of losing money. I want to motivate more people to go for what they want.

Good-luck on these aspirations Johanna. It’s a great idea. What would say is your “win-rate” and what really drives results in your trading?

I would say I have a win rate of 68-72%. My results are driven by hours of back-testing different pairs and their movement.

Not bad really. Did you have a job though. If yes, What was your salary in your last job before forex? Was leaving it for forex worth it and why?

$1300-1700 a month. Definitely worth it. Not looking to go back to a corporate job anytime soon.

Haha. Forex stole you away. Tell me how you think other people would describe you. What do you want to be remembered for in the industry?

Very social and outgoing. I want to be known for someone introducing the market in a different way by: showing them both obstacles and good days. There’re too much fake lifestyle on social media.

Well, most are great marketers. Others, for social status. Do you keep a journal? If yes, what does it consist of?

Yes, I do. I have different sections where I journal my market, pips achievements, losses & wins, my risk percentage, and personal processed thoughts I had during the trade.

Nice. I’m really grateful for your time. Although, I won’t be leaving till you tell me about the toughest decision you had to make in the last six months. Was it a trading decision? If yes, tell me how you handled the situation.

No worries. Quitting my last job. It was a hard decision but I knew it was the right thing for me not only to pursue my trading dream but—also be able to focus on things that make me happy. I don’t regret it at all.

That’s tough. How would you describe your ideal work environment?

My ideal work environment is essentially an office filled with other female traders working to help and educate other upcoming traders like myself on their journey.

Yup. You’ve definitely got a great belief system. I’ll be looking forward to this Ma’am. You know we have the Neophytes now in the industry. In fact, more Neophytes are trooping in. What’s your advice to them and what would you recommend they start with?

Simple. Throw away the whole “I’m going to become rich in a few weeks”. Focusing on the money aspect will really turn your motivation off in the beginning as: you don’t even have the skill set. Focus on the skillset, and the money will come along.

Process first, then outcome. You couldn’t have said it better. What would you consider to be your biggest forex achievement? Tell me about a forex accomplishment you are most proud of.

When I was profitable enough to quit my job. It takes time, and I’m nowhere near where I want to be but—I have at least come a long way.

Positivity goes a long way. Do you have weaknesses—What are your forex weaknesses? How do you plan on going about them? Have you succeeded in doing that?

Social media can be a very scary place and as an upcoming trader, you will encounter a lot of different things. Comparing myself to other traders is a weakness of mine, but I keep reminding myself that their journey is different from mine and we all have our own path. I don’t really look at other traders that much anymore and just focus on myself and my own journey.

The media, if used wrongly is a deadly disease. Proprietary firms are in existence now. Do you trade for any proprietary firm? If yes, which one and how is it going?

No, not yet but I’m looking to take the FTMO when I’m ready.

Finally, before I leave you Johanna. How long do you plan on trading forex and Where do you see yourself in five years with forex?

Plan to stick to my written rules and risk management. I also look up everything that I don’t understand and learn from it. Progress is my everyday mission.

MArgin Trading vs Stock tradingEducational purposes ONLY!

I butchered some information. First time doing a video and still learning in the game.

*****PIP = Percentage in Price ******

also back then, to participate in Foreign exchange, you need to have a huge capital to have access.

Now we can leverage from brokers (Banks that give us access to FOREX)

Direct message me for any questions or concern.

I hope you to drop some value and help others.

I appreciate everyone who support my page :)

How to Construct Your Trading Plan 2.0 Hi everyone:

Today let's go over a trading plan in more detail. I have made an educational video on this before, and many have asked me to create a more in depth breakdown on this topic.

So let's take a look at what topics to include in a trading plan.

First, what you should understand is there are no set guidelines of what exactly you should include in your trading plan.

Most traders will have different approaches on this topic, and some will have similar ways of constructing it.

What is important is this is something you will look at on a regular basis.

You will add, remove, edit your plan so it is the most up to date with the information you want to include in.

You should NOT however, just copy someone else’s trading plan, since it won't be applicable to you.

Below I have outlined the 6 main topics that I include in my trading plan, and I will go over each topic in more detail on what can be included in.

Personal Goals, Emotion/Mindset, Changes

Trading Checklist

Trading Quotes to reflect on

Trading Past experiences, mistakes, and lesson

Trade Enter Criteria

Trade Management

If you have any questions, feel free to let me know :)

Thank you

How To Use Bitcoin Futures To Hedge Your CryptoYou are either a trader or a HODL'er. Since I am a trader I don't like to sit in massive swings in my spot Bitcoin positions, I like to use Micro Bitcoin Futures to hedge my spot position to minimize the risk and also maximize my long position in spot. In this video I explain how I am currently hedging my long Spot Bitcoin position using Micro Bitcoin Futures, Symbol MBT.

Past performance is no guarantee of future results. Derivatives trading is not suitable for all investors.

Is Trading “Gambling” or “Risky” ? Explained in business terms.Hi everyone:

The question that most people will ask is whether trading is the same as “gambling”.

Throughout the 9 years of my trading journey, this has always been brought up and asked about many times.

Of course anyone is entitled to think based on their perspective and view, so I am not here to argue or convince them otherwise.

Rather, I am here to share some key aspects of what I learned in trading for the last 9 years,

as well as years in the business world to discuss the difference between “Gambling” and “Risky” in trading and in business.

Most people who have never traded in their lives, but have heard about trading, usually assume trading is some sort of get rich quick scheme.

They often assume it's a type of “gamble”. Since most people around them probably lost money in trading.

It's not surprising as the statistics don't lie, 90-95% retail traders lose money in trading and quit eventually.

But what most people don't know is “why” and “how” they lose money in trading.

It's usually a combination of poor mindset and emotion.

No systematic plan, no risk management, get rich quick thinking, revenge/over trading, fear of missing out, and alot more psychological issues.

They did not put in the time and effort to succeed. Which then resulted in traders losing money and quitting.

Eventually making up excuses of why they fail in trading, and blame the market, the broker, the strategy.

All these no doubt also resulted in what normal people will say trading is a “gamble.”

On the other hand, is trading “risky” ?

Trading is just like any other businesses out there, that will be risky due to unforeseen circumstances.

Businesses face external factors that they can not control, just like in trading. Businesses have internal expenses, overhead costs, labour, loans, C.O.G.S…etc as well as many competitions within their respected industry.

It requires hard work and determination to succeed. Even for larger businesses that are where they are today, they were all risky when they started.

Was Amazon Risky ? Was Tesla Risky ? Was Facebook Risky ? Absolutely. But that did not stop their owners from putting in maximum effort and time to make it work.

Trading is no different, you are the owner, director and the CEO of your trading account.

So, don't confuse and get “gamble” and “risk” mixed up.

It's up to us individually to acknowledge and understand the difference between the two.

The truth is, successful traders understand the difference between “gamble” and “risk”.

To remove the “gambling” aspect from trading, is to have a well written trading plan, proper risk management, right trading psychology, positive mindset and control emotion.

Whatever strategy you decide to implement is not really the cause of your success or failure, but rather those I mentioned above.

This way, you remove almost all the “gambling” aspect away from trading, and it is now “risky” but bearable for you to handle.

Will trading always be “risky” ? Sure, it is a business and anything can happen unexpectedly and out of nowhere.

But successful traders understand the importance of treating trading like a business, so contingency plan, back up plan, trading plan, management plan,

and much more should be carefully thought out so you will know what to do when you are hit with sudden surprises like in a business operation.

The worst thing we can do is to not be part of any “risk”. If we are so relaxed, laid back, and have no stress to motivate us to move forward, then we stay within our “comfort” zone.

We become so glued to our 9-5 job which we then think it's safe. But, we will forever be in a rat race against many others who are better than us in credentials that will land that higher position/salary that we want.

“So to me, without taking a “risk” in life is the biggest “gamble” that you can do in life.”

Welcome to let me know and share with everyone what you think about this topic :)

Thank you

Jojo