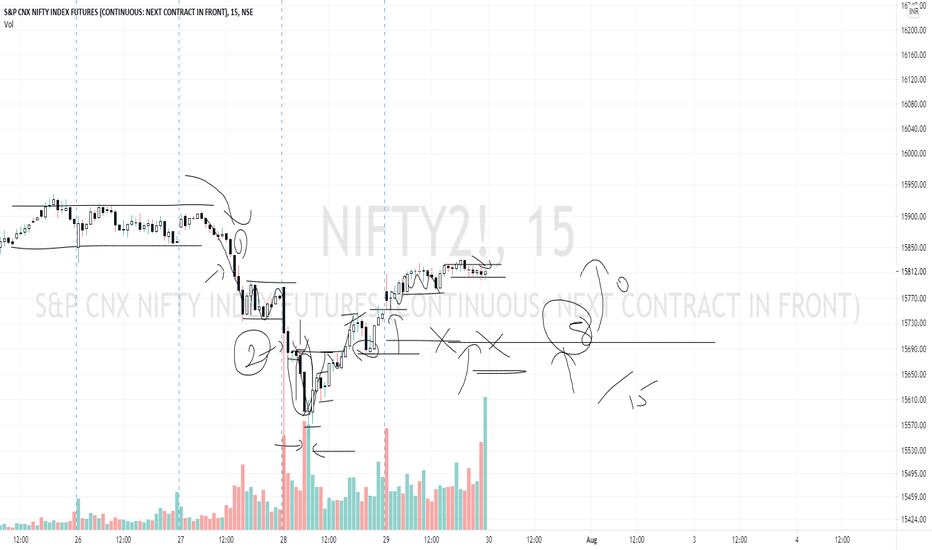

What forms bullish conditions? Here I spoke on how the phases of the market gives you a buying opportunity.

I spoke on what to look for when we get expansion, retracment, and where to

anticipate a buy to take place on a smart money level.

We must trade with the banks not against them.

Buying is primed at discounted prices not premium.

Hopefully you found this video insightful and give it a thumbs up.

Here at Forensic Forex we do it Better.

Beyond Technical Analysis

Tutorial | Lesson 4: Key Levels When Trading 24 Hour MarketsLet's look at some key levels to identify before each trading session, especially when trading around the clock markets like futures.

Before the cash session bell, what are the prices for the following levels?

Prior Session High/Low

Overnight High/Low

Developing Value Area High/Low

And then, at 8:30a ET, is price above or below the prior session high or low? Are we seeing an inside or outside day? Other levels worth consideration are prior sessions POC, High Volume Nodes (HVN) for possible areas of support or resistance, and price relative to our trend filter.

Trade Review: How I Scalped $DKNG, $NIO, $PYPL + Reviewing WatcIn this video I will reviewing trades I took on the first week of August 10, 2021 going full in depth explaining how I traded these tickers with a new strategy I been testing with Inside Candles Credit: TW for his indicator and his strategy! Covered $DKNG, $NIO, $PYPL W/ huge FUMBLES!!! Traded these tickers using my knowledge of technical Analysis , sharing my levels: Support & Resistance , my trendlines , Fibs, Waves, Price Action, Channels , Emma's, and prior experienced , while providing both bullish & bearish scenarios for you to be able to understand my analysis and wait for confirmation as always!

Want to see more content like this? Make sure to Like and Subscribe!

The Safest Way to Short The Stock MarketIn this video we explain Inverse ETFs as a tool to gain short exposure to the stock market. These can be used as a tool to profit directly from market or as a hedge to protect your stock portfolio in times of market volatility.

Let us know your thoughts in the comments below! Have you ever invested using one of these ETFs?

Trade Review: How I Scalped $MARA+ Reviewing Stream Set ups!In this video I will reviewing trades I took on the first week of August 9, 2021 going full in depth explaining how I traded these tickers with a new strategy I been testing with Inside Candles Credit: TW for his indicator and his strategy! Covered $MARA for a nice 10% scalp, then reviewing the set ups from Sundays Stream, then giving out some set ups for this week! Traded these tickers using my knowledge of technical Analysis , sharing my levels: Support & Resistance , my trendlines , Fibs, Waves, Price Action, Channels , Emma's, and prior experienced , while providing both bullish & bearish scenarios for you to be able to understand my analysis and wait for confirmation as always!

Want to see more content like this? Make sure to Like and Subscribe!

How I do my top down analysisHello everyone, I've been asked a few times on how do I do my Top-Down analysis, from HTFs to LTFs, and I've decided to make a video on it, trying to show the things I usually do. I hope you enjoy and take something away from it.

DISCLAIMER:

I am not a Financial Planner, nor a Financial Advicer, I am not FCA approved, I'm not approved by any institution that allows me to give financial nor investment advices, nothing mentioned in the video should be considered Investment Advice/Guidance. Everything showned/talked/explained, is for pure and only educational purposes. The risk is in your own hands.

How to Draw the Fibonacci Extensions based on Previous Day Value1. Load the previous day's data in full. Add volume profile; apply right-sided placement so that it is easier to draw out the fibs based on previous day

2. Draw out the Fibonacci Retracement/Extensions. Your Numbers are 0, 1, x.236 and x.618. In a market trading higher than the Previous Day Value Area, set the Value Area High as 1.00 and Value Area Low as 0.00. In markets trading lower, Value Area High is 0.00 and Value Area Low is 1.00.

3. In markets trading in both directions, draw it in both directions :-)

Trade Review: $RIOT & $SPCE 200%!! WITH 1000% FUMBLES ON $AMZN In this video I will reviewing trades I took on the first week of August 6, 2021 going full in depth explaining how I traded these tickers with a new strategy I been testing with Inside Candles Credit: TW for his indicator and his strategy! Fumbled Huge Shorts but being consistent is KEY!!!!! Traded these tickers using my knowledge of technical Analysis , sharing my levels: Support & Resistance , my trendlines , Fibs, Waves, Price Action, Channels , Emma's, and prior experienced , while providing both bullish & bearish scenarios for you to be able to understand my analysis and wait for confirmation as always!

Want to see more content like this? Make sure to Like and Subscribe!

Learning the TradingView Platform: Exploring the Top Panel Pt.2In this video we will explore:

Indicators and Strategies

Fundamental metrics for stocks

Indicator Templates

If you would like to learn more about these items, check out the great material we have in the help center and on our blog. 📚 🤔 📚

Indicators

www.tradingview.com

Fundamentals

www.tradingview.com

www.tradingview.com

Indicator Templates

www.tradingview.com

Did you learn about anything new that you may use from now on?

Let us know in the comments below 👇 👇

Trade Review: How I been making consistent 80% returns W/ PROOF!In this video I will reviewing trades I took on the first week of August. going full in depth explaining how I traded these tickers with a new strategy i been testing with Inside Candles Credit: TW for his indicator and his strategy! Traded these tickers using my knowledge of technical Analysis , sharing my levels: Support & Resistance , my trendlines , Fibs, Waves, Price Action, Channels , Emma's, and prior experienced , while providing both bullish & bearish scenarios for you to be able to understand my analysis and wait for confirmation as always!

Want to see more content like this? Make sure to Like and Subscribe!

Learning the TradingView Platform: Exploring the Top Panel Pt.1In this video we will explore:

Symbol Search

Time Interval

Bar's Style

Compare or Add Symbol

If you would like to learn more about these items, check out the great material we have in the help center. 📚 🤔 📚

Spread Charts

www.tradingview.com

Time Interval

www.tradingview.com

Compare Tool

www.tradingview.com

Did you learn about anything that you may use from now on?

Let us know in the comments below 👇 👇

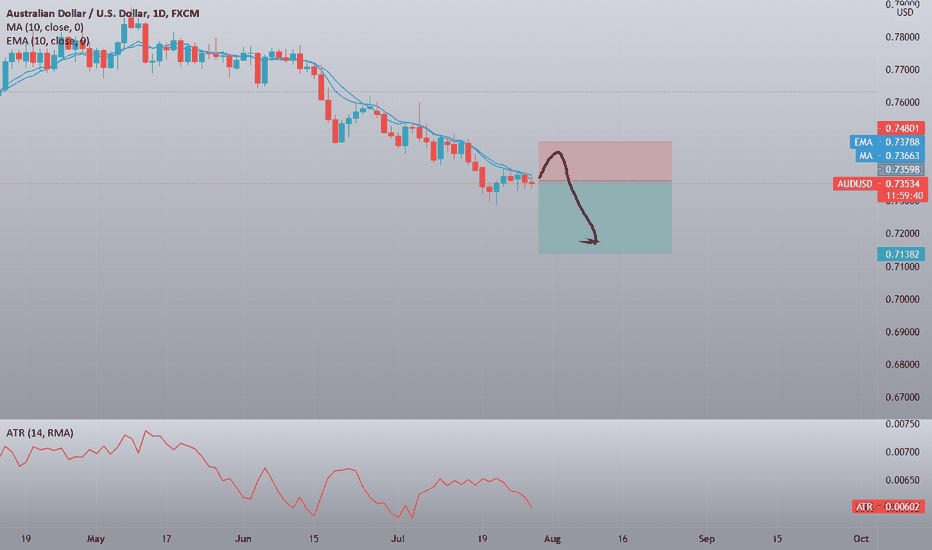

How to Trade NQ when TICK is quiet and not at +1000/-1000I have shown how to fade TICK extremes. Here, I show you how to trade when the TICK is not at extremes.

1) Ascertain where TICK is

2) Define the first 5 minute high and low (NY open high and low)

3) Await for TICK to open and close a whole body above 200, or below -200. This will determine your bias but is not in itself an entry signal! Wait for price action confirmation

4) Price action confirmation - wait for price to close above the NY high if long biased, and close below NY low if short biased. Alternatively, enter when the price has reached a significant Fibonacci level (see previous tutorials for definition based on Value Area). The idea is that price action signals that conflict with TICK signals are either fake or not long lasting

5) When price action confirms, Enter, and set a suitable stop loss (in this example, enter at close of candle below the NY low, setting the stop loss at the 1.618 Fib. If you entered at the 1.618 Fib, consider a stop loss equal to the value of ATR)

6) Take profit at the next significant Fib x.618 or if market is struggling, at next x.236

The MACD explained ! All you need to know about it Hello everyone, as we all know the market action discounts everything :)

_________________________________Make sure to Like and Follow if you like the idea_________________________________

In this video, I am gonna explain what is the MACD and how to use it and how to identify buy and sell signals using this indicator.

So what is the MACD, The MACD is a trend-following momentum indicator (so a momentum indicator is a technical analysis tool that allows us to determine the strength or weakness of a stock's price movement )

There are a lot of people that use the MACD when they analyze charts because it's very simple and it's very good but I always say never just use 1 indicator to analyze a chart, always try to use at least 3 this way u can make sure that the result is more accurate and the market most likely to move as u analyzed.

let's look at the theory behind the MACD before looking at a real-life example and how to identify buy and sell signals using this indicator :

The typical settings for the MACD are 12 26 and 9.

The MACD consist of 4 parts :

1) Zero line

2) MACD line

3) Signal line

4) Histogram

We start off with our zero line and this is where the MACD line and the signal line move around and basically so if the MACD is trading above the 0 line then it's bullish and if it's under then it's bearish.

Then we have the MACD line and it comes from the 12 26 section, and it gets calculated by subtracting the 26 EMA of the price out of the 12 day EMA of the price.

And after that we have a second line that gets plotted from the 9 section so basically, it’s a moving average for the MACD line so it tries to smooth the MACD line and give us some signals and it's called the signal line.(it's called a signal line because that's where we get our buy and sell signals from)

So on top of that, we have another part in this indicator which is called the histogram. So this histogram job is to show how close these lines will crossover, so when the distance between the MACD line and the signal line is far the histogram gets bigger and bigger.

So how do we use this indicator :

1) Crossovers between the MACD line and the Signal line.

* When the MACD line crosses above the Signal line then its a buy signal (Bullish Crossover)

* When the MACD line crosses below the Signal line then its a sell signal (Bearish Crossover)

2) The Histogram .

A lot of people use histograms as a way to predict when a reversal will occur.

We know that the MACD is a momentum indicator so it can show us when sell pressure is low. And that means it might be a good time to buy. And It can tell you when your long position is about to run out of steam and when you should exit.

3) Divergences between the MACD and the Market Price .

A Divergence means that the indicator is not moving in sync with the Market Price and a Reversal could happen (Note that Reversal trading is risky so please calculate your risks before using this Strategy)

always remember that :

Bullish divergence is when the Market price is going down but the MACD is going up.

Bearish divergence is when the Market Price is going up but the MACD is going down.

I hope I’ve made the MACD easy for you to understand and please ask if you have any questions .

Hit that like if you found this helpful and check out my other video about the Moving Average, Stochastic oscillator, The Dow Jones Theory, How To Trade Breakouts and The RSI. links will be bellow

What's the Probability of SPY 500 End of Year?This is not a forecast of AMEX:SPY getting to 500... this video will instead demonstrate how we can answer this question using Options Delta to assess the probability the market expects for an event to happen. I use a backtest of NASDAQ:TSLA Weekly Options to demonstrate.

TUTORIAL - Finding Better Entries Finding Better Entries

Ok, y’all, I’m losing my voice a little bit… but I also just got a new microphone so that is why this video happened. So be nice about my hoarse voice.

Let me know if this is helpful and If I should do more like this

ENTRIES

PYPL - 225.30

DKNG - 43.01

CVS - 81.19

UBER - 42.97

LYFT - 48.27

ETSY - 163.08

I will most definitely be making more videos on entry targets. Leave me a comment if there's a symbol you want me to analyze in the next video. I'll try to do them every couple of days (And definitely on sunday nights)

The Art of Technical Analysis for Beginners 123 Top & BottomsHey Traders so In my last video we discussed what are Fibonacci Retracements and how they can benefit you in your trading. Today I want to go over one of the most powerful chart formations in technical analysis called the 123 top and 123 bottom.

Enjoy!

Trade Well,

Clifford

Dealing with "failure" in your trading 😎Failure in trading is frequent, yet for some it is permanent and for the few it is temporary, the choice is always yours!

In this video we go over our advice on how you should deal with failure so you can keep it as a learning experience and grow and develop as a trader!

If you're having challenges in your trading and cant seem to find solutions to them just send us a DM and we'll do our outmost to help you overcome them and find solutions to your "trading problems' :)

Have a great day!

Learning the TradingView Platform: Introduction to the Top PanelIn this video we will be covering what the Top Panel has to offer and some of its functions.

This will be the first part of a video series where we will be providing video walkthroughs of tools and items on the TradingView platform.

We hope that this helps both the brand new TradingView user as well as the seasoned user.

Feel free to let us know what features you want to learn more about below!

How to analyze any market using breakouts and indicators Hello everyone , as we all know the market action discounts everything :)

_________________________________Make sure to Like and Follow if you like the idea_________________________________

So in this video i show u a general idea on how to understand the market while using a breakout strategy and how to use different indicators to understand the movement of the market.

i haven't said anything about Chart pattern on Candlestick patterns because i will be making a video on these to try to understand how they work and what are the different types of reversal that we look for on a chart and how to plan your trades around them.

In this video you will see how to identify support and resistance lines and come up with different scenarios how the market is most likely to move .

And using different indicators to tell if the market is bearish or bullish to determinate your next move .

If you have any questions please ask

Thank you for reading & watching .

Closer look into Rising/Falling Wedge, Reversal Price Action

Closer look into Rising/Falling Wedge, Reversal Price Action structures/patterns

Hi traders:

Today I will go more in detail on rising/falling wedge correction in price action structures/patterns.

You might have already heard about these types of correctional structures, and many traders who utilize them.

Certainly there are many ways of traders identifying them and taking advantage of these kinds of price action, so it's ideal for you to understand them in your analysis.

We first need to understand that a rising/falling wedge is a REVERSAL price action. Meaning when the correction completes, there's a higher probability of the price to reverse.

You might have already seen multiple price action videos from me that go over all sorts of continuation and reversal price action (I will share links below),

and I always talk about when combining multiples of different price action structures/patterns will give you a better edge at entering positions that work out in your favor.

Same idea here, so let's take a look at how rising/falling wedges are, how to identify them, and how to effectively use them in your analysis.

Rising/falling wedge, just as the name suggests, is an ascending/descending type of correction where the price is getting squeezed into a “wedge”.

As the price gets narrower and narrower, there's a higher probability of the price to “reverse” from the wedge.

Now about entries, certainly many traders have their own method of entering, so I will share my point of view and the way how I like to enter them.

Any questions, comments or feedback welcome to let me know :)

Thank you

Risk Management: 3 different entries on how to enter the impulsive phrase of price action

Multi-time frame analysis

Identify a correction for the next impulse move in price action analysis

Continuation and Reversal Correction

Continuation Bull/Bear Flag

Parallel Channel (Horizontal, Ascending, Descending)

Reversal Ascending/Descending Channel

Reversal Double Top/Bottom

Reversal Head & Shoulder Pattern

Reversal “M” and “W” style pattern

Reversal Impulse Price Action

Continuation/Reversal Expanding Structure/Pattern