Beyond Technical Analysis

AMZN dip buyAMZN was one of the names hit the most after today's/this weekly drop. over 8% fall. no need to check the RSI to see how oversold it is lol. I think the market will see a mag 7 stock drop this large as a buying opportunity which made me look at TA. the 4 hr has a red hammer and has a new higher high on the 15m.

Looks like $ investors switch possible - Crypto rules??Hello fellow traders,

Just looking at the chart of total market cap and based on trend line weekly focus- this is it- a point at which crypto market might start to recover and go for 2 x what it has in total, heading for 5t?? Let me know in your comments what do you think? Also, many investors might start diversifying their portfolio since Fridays 'crash' hence I wouldn't be really surprised if next week brings some $ into crypto !

It's just my idea don't copy think and do your own stuff

CVX Earnings Trade Setup — August 1, 2025

## 🚨 CVX Earnings Trade Setup — August 1, 2025 🚨

🔍 **Chevron (CVX) Earnings Analysis | High Conviction Call Play**

### 🧠 Model Consensus (Multi-LLM Blend)

* 📉 **Revenue Trend:** -1.0% TTM growth, margin pressure from falling oil

* 📈 **Analyst EPS Expectation:** \$11.04 with 26.2% YoY growth est.

* ⚠️ **Miss Rate:** 50% EPS beats w/ average surprise -2.2%

* 💬 **Consensus Sentiment:** ⚖️ *Moderate Bullish (Confidence: 60%)*

---

### 🔥 Options Heatmap

* 🟢 **Most Active Call:** \$152.50 strike, 🔥 ask volume at 152

* 🔺 **IV Rank:** 63% → *Moderate move expected*

* 🧊 **Put/Call Skew:** Defensive bias with light bullish divergence

* 🕵️♂️ **Dark Pool:** Mild accumulation hints by institutions

---

### 📉 Technical Breakdown

* 🔹 Near 50/200 MA — Neutral Pre-Earnings Drift

* 🔸 Support: \$150 | Resistance: \$155

* 🔻 Volume: 0.53x avg → *Weak conviction*

---

## 🎯 TRADE SETUP

🛠️ **Strategy:** Long Call (Pre-Earnings Entry)

💰 **Strike:** \$152.50

📅 **Expiry:** 2025-08-01

💸 **Entry Price:** \$3.70

🧠 **Profit Target:** \$11.10+ (200–300%)

🛑 **Stop Loss:** \$1.85

📊 **Risk/Reward:** \~2.5:1

🕓 **Exit Timing:** 1–2 hrs post-earnings (to avoid IV crush)

---

### 🧪 Earnings Catalyst Trade

Chevron’s setup shows a **classic low-volume/high-upside IV play**. Risk tightly managed with a defined stop, but room for explosive move if earnings surprise to upside.

---

📦 **Trade JSON Snapshot:**

```json

{

"instrument": "CVX",

"direction": "call",

"strike": 152.50,

"expiry": "2025-08-01",

"confidence": 60,

"profit_target": 11.10,

"stop_loss": 1.85,

"size": 1,

"entry_price": 3.70,

"entry_timing": "pre_earnings_close",

"earnings_date": "2025-08-01",

"earnings_time": "AMC",

"expected_move": 5.0,

"iv_rank": 0.63,

"signal_publish_time": "2025-08-01 13:05:25 UTC-04:00"

}

```

---

📈 **#OptionsFlow #CVX #EarningsPlay #TradingViewSetups #LongCall #EnergySector #IVCrushProtection #PreEarningsTrade**

304-PIP Move on USDJPY in One Day - Trading NFP ProfitablyOn August 1st, USDJPY experienced a massive 304-pip drop after a strong impulse into the daily order block. From there, the daily order block was respected, and the retracement was induced by the USD Non-Farm Payrolls news release, leading to a sharp move down to a four-hour liquidity void, hitting the 75% Fibonacci retracement level.

This move highlights the precision of combining institutional levels with news catalysts, capturing a significant move in a short timeframe.

This is Outlier Trading Folks.

APLD 0DTE TRADE IDEA (AUG 1, 2025)

## 🔥 APLD 0DTE TRADE IDEA (AUG 1, 2025)

**💡 Multi-AI Model Consensus | High Risk-Reward | Gamma Alert**

### 🧠 AI Model Summary

✔️ **Bullish Momentum** confirmed across all models

📉 **Volume Weakness** = key caution signal

⚠️ **Gamma Risk HIGH** → Most recommend entry *next session* (Monday)

---

### 🛠 TRADE SETUP (Based on Consensus Call)

| Field | Value |

| -------------- | ------------------------------ |

| 📈 Direction | **CALL (Bullish)** |

| 🎯 Strike | **\$13.50** |

| ⏰ Expiry | **Aug 1 (0DTE)** |

| 💰 Entry Price | **\$0.23** (ask) |

| 🎯 Target | **\$0.35** |

| 🛑 Stop Loss | **\$0.12** |

| 🔁 Size | 1 Contract |

| 📊 Confidence | **75%** |

| 🕒 Entry Time | **Next session OPEN (Monday)** |

---

### 🔍 Key Model Insights

* 📊 **Call/Put Ratio Bullish** across all platforms

* 📉 **Weak Volume** warns of unsustainable moves

* 🧨 **High Gamma Sensitivity** → rapid profit/loss shifts

* 🧠 **Claude / Grok / DeepSeek** all flag for rapid exit if entered today

---

### 📌 TradingView Viral Caption

> ⚠️ \ NASDAQ:APLD 0DTE 🔥

> Models agree: 🚀 bullish trend, 💀 dangerous gamma

> ✅ \$13.50 CALL @ \$0.23 → Target: \$0.35

> ⏱️ Most say: **WAIT ‘til Monday open**

> 🔍 Risk tight. Exit fast. Volume light.

> \#APLD #OptionsTrading #0DTE #FlowTrading #AIModels #GammaSqueeze #FridayTrades #TradingViewIdeas

ID: 2025 - 0158.1.2025

Trade #15 of 2025 executed.

Trade entry at 140 DTE (days to expiration).

Excellent fills this morning, well under mid. Created a GTC working order two days ago and let price come to me. No chasing. There are TONS of external liquidity voids resting below.

Target profit is 5% ROI

Happy Trading!

-kevin

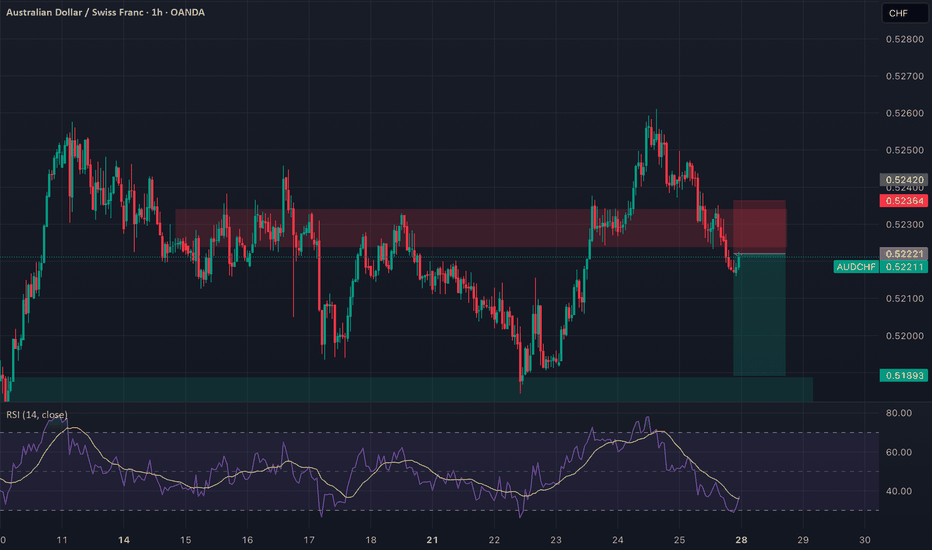

AUDCHF: Broken Support, Bearish Flow In Play Timeframe: 1H

Bias: Bearish

Type: Support Turncoat → Breakdown Play

📊 Technical Setup

AUDCHF previously broke the 4H resistance (0.5236) which flipped to support. However, price has now broken below this support, confirming it as a failed demand zone.

• Entry: Market execution or retest of 0.5236

• SL: Above 0.5245

• TP: 0.5189

• RR: ~1:2

• RSI: Below 50 and heading lower = momentum supports downside

📉 Macro & Fundamental Confluence

• AUD Weakness: RBA dovish, conditional score declining, bearish seasonality

• CHF Slightly Less Weak: Despite SNB dovish stance, CHF is outperforming AUD

• COT + Sentiment: AUD CFTC weakening, CHF holding steady

• Risk Sentiment: RISK ON environment reduces CHF demand but AUD still underperforms

🧭 Gameplan

“Support failed to hold. Bearish pressure intensifies. Target previous swing low zone.”

🔔 Watch for retest of 0.5236 for better RR setup before continuing short.

Figma (FIG) | Short Bias | AI Pressure on Design (Aug 2025)Figma (FIG) | Short Bias | AI Pressure on Design Platforms (Aug 2025)

1️⃣ Short Insight Summary:

Figma just went public with a huge IPO pop, but the company faces serious long-term questions. With AI rapidly changing design workflows and tech giants aggressively cutting costs through automation, the design-collaboration market could look very different in a few years.

2️⃣ Trade Parameters:

Bias: Short

Entry: Watching for re-tests near $110–$115 (post-IPO highs)

Stop Loss: Above $120 to protect against strong breakout continuation

TP1: $95

TP2: $80

(These levels can adjust based on broader market reaction and SPX performance)

3️⃣ Key Notes:

Figma is an incredible platform, but it must keep up with AI-powered design tools that can build full websites and products in minutes. We’re already seeing major tech companies (IBM, Amazon, Apple) laying off staff because AI is streamlining operations. If Figma doesn’t stay ahead, its massive IPO valuation could be hard to justify.

S&P 500 reaction is also key—if the index weakens, high-flying IPO names like Figma could see sharper corrections.

4️⃣ Follow-up:

I’ll revisit this trade idea after we see how price reacts around the $110–$115 zone and how broader market sentiment plays out.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

Ocean Pal, Inc $OP going to .01 centThis one will soon be at .01 cent. Why? Outstanding shares went from 7 million to over 170 million as of a July 31st filing! OceanPal is based is Greece (not known for their financial accountability). There are others posting about an upswing to $3 based on TECHNICAL analysis. However, they are ignoring the fundamentals. Short this one if you can!

Bitcoin Monthly - Structure Intact, Tension Rising?⊣

⟁ BTC/USD - BINANCE - (CHART: 1M) - (Aug 01, 2025).

◇ Analysis Price: $114,994.73.

⊣

⨀ I. Temporal Axis - Strategic Interval - (1M):

▦ EMA9 - ($100,069.29):

∴ Price holds 14.93% above this dynamic threshold, indicating momentum continuation but also positioning within an overheated range;

∴ The EMA9 structure is firmly ascending, representing the spine of the short-term bullish wave;

∴ July’s candle remains fully above the EMA without testing it - no wick beneath the line-marking dominance of buyers without internal correction.

✴️ Conclusion: The EMA9 governs the tempo of the current trend and stands untouched. Elevated, but structurally intact.

⊢

▦ EMA21 - ($81,990.60):

∴ A core support vector in the macrostructure, now 28.73% below price, suggesting strong bullish detachment from equilibrium;

∴ The line maintains a smooth, upward slope, echoing the recovery arc since late 2022’s structural low;

∴ Its alignment with the Bollinger Basis and Realized Cap forms a triad of reinforced technical stability.

✴️ Conclusion: EMA21 anchors the mid-term uptrend and guards the sanctum of continuation. No breach, no threat.

⊢

▦ EMA50 - ($47,983.10):

∴ Deep beneath price, resting at 58.27% below the current level - a relic of past cycles, yet still relevant as ancestral support;

∴ The EMA50 has curved upward subtly, signaling the final stage of long-term bear cycle recovery;

∴ Price has not interacted with this zone since late 2023, preserving its status as last-resort structural bedrock.

✴️ Conclusion: EMA50 serves as the sacred foundation of the macro trend - distant, but silently upholding the higher order.

⊢

▦ BB (21, 2) - ($81,990.60, $124,871.91, $39,109.29):

∴ The Basis of the bands aligns precisely with the EMA21, confirming equilibrium at ($81,990.60) - the mid-guardian of the macro cycle;

∴ The Upper Band is currently intersecting the candle body at ($124,871.91), marking an imminent volatility ceiling that may trigger either breakout or rejection;

∴ The Lower Band rests at ($39,109.29), far beneath the trend structure, now serving as a shadow chamber rather than an active field of probability.

✴️ Conclusion: The BB channels have opened widely, signaling expansion. With price nearing the upper rim, the phase is volatile but directional. The core remains intact through the EMA21 basis.

⊢

▦ Volume + EMA21 - (37.62B, 29.71B):

∴ Monthly volume for July reached $37.62 Billion, standing above the EMA21 of volume at $29.71 Billion, indicating an active expansion phase in market participation;

∴ This is the third consecutive monthly close above the EMA21, forming a sequence of rising activity that mirrors the price climb - suggesting healthy conviction behind the movement;

∴ The volume body also aligns with bullish momentum confirmation, as it occurs within an ascending slope of the EMA21, avoiding false divergence or exhaustion patterns.

✴️ Conclusion: Volume expansion supports the current trend. The flow is consistent, not speculative.

⊢

▦ RSI (21, 9) - (69.79, 64.71):

∴ The RSI main line stands at (69.79), nearing the classical overbought threshold but not breaching it, reflecting a strong yet controlled uptrend;

∴ The signal line (9-period smoothing) trails at (64.71), confirming positive pressure without showing divergence - both curves remain aligned and ascending;

∴ There is no crossover, no rejection, and no curvature breakdown - suggesting momentum still leans bullish, but the zone is tightening.

✴️ Conclusion: RSI reveals active strength under equilibrium control. Nearing the gates of exhaustion, but no conflict yet.

⊢

▦ MACD (9, 21, 9) - (4,172.31 / 3,423.95 / +748.36):

∴ The MACD Line remains well above the Signal Line, holding a spread of (+748.36), confirming an active momentum cycle;

∴ Both lines are above the zero axis, reinforcing a long-standing bullish wave with consistent inertia since late 2023;

∴ The Histogram is positive, though it shrinks slightly from previous months, suggesting a potential slowing of force - not a reversal, but a breath.

✴️ Conclusion: The MACD still flows in favor of the bulls. The pulse continues, yet shows first signs of contraction. Momentum remains, but vigilance awakens.

⊢

▦ OBV (21, BB2) - (10.27M / 9.82M / 11.19M / 8.45M):

∴ The OBV line rests at (10.27M), positioned above the Basis (EMA21 at 9.82M), indicating a net accumulation bias over the mid-term;

∴ It remains within the upper half of the Bollinger channel, but beneath the upper band, currently at (11.19M), suggesting accumulation without climax;

∴ The bands are widening, signaling expanding participation and heightened flow volatility - yet without destabilization.

✴️ Conclusion: OBV confirms active, steady inflow. Accumulation sustains the structure. Flow is present, but not yet euphoric.

⊢

▦ MFI (EMA9) - (79.90 / 74.63):

∴ The MFI registers at (79.90), resting near the upper saturation zone, traditionally viewed as overbought - but no rejection candle has occurred;

∴ The 9-period EMA smoothing line at (74.63) trails cleanly beneath, reinforcing directional alignment without divergence;

∴ This spread between the MFI and its smoothing curve affirms a persistent inflow dominance, though now nearing exhaustion thresholds.

✴️ Conclusion: The MFI reveals an environment of strong capital influx. Though high, it is not yet reversal-bound. Compression may precede contraction.

⊢

▦ TDI + EMA21 - (69.79 / 64.71 / / 62.00):

∴ The RSI Line (TDI core) sits at (69.79), nearing the volatility band’s upper arc, denoting strong upward rhythm but with limited expansion room;

∴ The Signal Line at 64.71 lags slightly, confirming the trend with no divergence or curvature weakness;

∴ The Volatility Bands (±10 around Signal) contain price action cleanly - upper band at (74.60), lower at (58.83) - showing moderate but controlled pressure;

∴ The EMA21 overlay at (62.00) forms the base layer, maintaining upward inclination and reinforcing long-term trend security.

✴️ Conclusion: The TDI remains bullish, harmonized, and stable. Momentum leads, volatility permits. No rejection yet, but expansion space is finite.

⊢

🜎 Strategic Insight - Technical Oracle:

𓂀 The monthly structure reveals a state of controlled elevation within a structurally sound uptrend, yet with rising compression near upper bounds. The convergence of indicators outlines a field that is both fortified and tense;

∴ EMA9, EMA21, and EMA50 remain fully aligned and ascending - the Exponential Trinity forms a resilient foundation, untouched by regression;

∴ Bollinger Bands (21) have widened, and price now hovers near the Upper Band, suggesting that the volatility channel is at maximal stretch; further price advance may trigger short-term exhaust or rejection;

∴ Volume + EMA21 confirms that market participation has expanded meaningfully across three consecutive months - a sign of conviction rather than speculation;

∴ RSI (21, 9) and MFI (EMA9) hover in elevated zones, signaling latent overextension, yet without immediate signs of breakdown - still ruled by strength, not fear;

∴ MACD (9, 21, 9) retains bullish momentum, though its histogram begins to contract slightly, marking a potential early shift in impulse rhythm;

∴ OBV confirms accumulation without climax, and the TDI shows synchrony, yet the volatility band ceiling is near - a gateway, or a wall.

✴️ Synthesis Technical: The structure is strong, but stretched, all trend anchors remain intact, and no macro-reversal signal is present. However, the cluster of elevated oscillators and narrowed volatility envelopes warns:

∴ The next impulse will define the phase - either breakout beyond resistance ($125K+) or pullback to base zones near EMA21 (~$82K).

⊢

∫ II. On-Chain Intelligence - (Source: CryptoQuant):

▦ Realized Cap - UTXO Age Bands - ($437.6B):

∴ Capital density remains clustered in the 3m / 12m range, signifying strong mid-term holders anchoring price memory beneath $90K;

∴ The realized cap has risen steadily, confirming new capital commitment and reinforcing the EMA50 region as the “Arcane Bedrock”;

∴ No abrupt aging shift - holders have not fled, nor distributed heavily.

✴️ Conclusion: The realized cost base is lifting upward; Structure is strong beneath price.

⊢

▦ Whale to Exchange Transactions (Binance) - (Rising):

∴ Transfer spikes occurred in mid and late July, echoing pressure near technical ceilings;

∴ Whale flow to exchanges signals potential supply reloads, though no persistent distribution trend is confirmed;

∴ Activity suggests readiness, not execution - threat held in silence.

✴️ Conclusion: Whales signal tension, not aggression; Movement is tactical.

⊢

▦ MVRV Ratio + EMA9 - (2.257 / 2.039):

∴ The MVRV ratio holds above 2.0, implying price trades at over twice the realized cost basis - historically a zone of caution;

∴ No divergence from the EMA9; both slope upward - valuation expansion continues, but no climax;

∴ Price remains above the line of equilibrium, but not in parabolic distortion.

✴️ Conclusion: MVRV confirms overvaluation, but not detachment; Risk is elevated, but contained.

⊢

▦ Exchange Net Position Change (BTC) - (–35,871 BTC):

∴ Net outflows persist, with 35,871 BTC withdrawn in the last monthly cycle;

∴ This behavior aligns with strategic cold storage accumulation, reducing circulating pressure;

∴ On-chain confirms technical's: price rises on supply contraction, not mere speculation.

✴️ Conclusion: Bitcoin leaves the field; Supply retracts as price ascends; Structure reinforced.

⊢

🜎 Strategic Insight - On-Chain Oracle:

𓂀 The on-chain field reveals a fortified structure of conviction beneath the surface of price. Flow, cost basis, and behavior of dominant agents all signal a phase of controlled strength, though shadowed by rising valuation pressure;

∴ The Realized Cap ascends in harmony with price - an uncommon convergence. It suggests that new capital is not merely speculating, but embedding itself into the very structure of the network. The UTXO Age Bands reveal no panic rotation - holders remain;

∴ Whale Transactions to Exchanges rise in key moments, particularly around technical compression points. They do not yet dominate the flow, but stand ready - guardians or destroyers, in silence;

∴ The MVRV Ratio, though elevated, does not deviate violently. It warns, but does not collapse. It reflects a price above cost, but not a mania;

∴ The Net Exchange Position continues its descent. Bitcoin leaves the field; Supply contracts; This is not exit liquidity; This is strategic withdrawal.

✴️ Synthesis Technical: The network breathes in accumulation, not inflation; The participants anchoring this cycle are deliberate; On-chain structures confirm that value is migrating into dormancy, not into exits. The risk is not in structure collapse, but in overvaluation compression - a tightening halo around price.

⊢

⧉ III. Contextvs Macro-Geopoliticvs - Interflux Economicvs - (Jul 31, 2025 - Post-FOMC Strategic Decoding):

▦ FOMC Decision - (July 31, 2025):

∴ The Federal Reserve held its benchmark interest rate steady at (5.50%), marking the fourth consecutive pause - a clear stance of vigilant hold;

∴ The tone was neutral-hawkish, acknowledging progress on inflation while leaving the door open for future hikes if data demands;

∴ No mention of cuts. The Fed maintains narrative control - a message to both markets and sovereigns: we're not done yet.

▦ Jerome Powell’s Address:

∴ Powell reiterated the “data-dependent” framework, but expressed concern over sticky inflation in services and housing;

∴ He praised the resilience of the labor market, signaling no urgency to ease policy;

∴ His delivery was measured, ambiguous by design, injecting uncertainty - fuel for volatility, not clarity.

▦ Market Response - (Traditional Finance):

∴ The DXY (Dollar Index) swung sharply, but closed neutral, reflecting indecision over the Fed’s path;

∴ The S&P500 and Nasdaq attempted intraday rallies but reversed lower - a reaction to Powell not being “dovish enough”;

∴ Gold and Silver caught bids - hedges moved in, not out.

▦ Bitcoin (BTC/USD) Response:

∴ Bitcoin spiked on initial Fed release, tagging the upper Bollinger Band (1M) before retreating slightly - not a rejection, but a breath;

∴ No capital flight occurred. The response was measured and strategic, not speculative;

∴ On H4, Bitcoin touched the EMA200, reinforcing it as a post-FOMC decision point.

✴️ Macro Synthesis: The Fed sheathed the blade but did not lower the shield; Powell’s message: discipline remains. Markets flinched but did not panic; Bitcoin stood firm. This was not a moment of collapse - this was a moment of calibration.

⊢

⌘ Codicillus Silentii - Strategic Note:

𓂀 Let this note be written in the margin of all oracles, beneath the seals and above the motion: This is a cycle governed not by noise, but by intent restrained; The silence between macro movements, the calm in on-chain flows, and the geometry of structure all speak one truth:

The system is waiting;

There is no breakdown;

There is no climax;

There is only a tightening coil - one that neither confirms euphoria nor accepts rejection.

∴ Bitcoin holds above its sacred averages;

∴ The on-chain breath is slow, but pure;

∴ The macro field is firm, yet not soft.

⟁ The next force will not be a whisper - it will be a break or a roar.

✴️ Let no position be based in hope;

✴️ Let no assumption ignore volatility’s patience;

✴️ Let silence guide the strategy, not emotion.

⊢

𓂀 Stoic-Structural Interpretation:

∴ In the mirror of the arcane chart and the silence of on-chain flow, the Stoic lens reveals not merely price action - but the nature of motion itself;

∴ All movement is governed by tension and release, control and surrender. This cycle is no different;

∴ The trend holds, but does not rise arrogantly. It is disciplined;

∴ Capital flows, but not chaotically - it retreats where needed and commits only in strength;

∴ The macro world tempts chaos, but Bitcoin walks with its own gravity - unmoved unless chosen;

∴ Indicators show power without delusion, and pressure without collapse.

This is not a time for euphoria;

This is not a time for panic;

This is a time to observe structure, act with clarity, and remain unshaken.

✴️ The Stoic sees the signal beneath the storm:

Structure is intact;

Trend is valid;

Valuation is tense;

Strategy must remain cold.

⟁ Therefore, the Stoic does not chase candles; He waits for break of structure, or confirmation of continuation; No action is better than misguided motion.

⊢

✦ Structure: Bullish - (Controlled Phase).

∴ All key exponential moving averages - EMA9, EMA21, and EMA50 - remain aligned and ascending, with no curvature breakdown or crossover threat;

∴ Momentum indicators (MACD, RSI, TDI) are positive and synchronized, with no bearish divergence or rejection confirmed;

∴ Price holds above the EMA9 and remains well above the Bollinger Basis, signaling ongoing trend dominance;

∴ Volume exceeds its 21-month moving average, reflecting conviction, not hollow motion.

⟁ However:

∴ The structure is technically stretched - several oscillators approach saturation thresholds, signaling compression, not collapse;

∴ This is a bullish structure, but under strategic tension, not euphoria.

✴️ Final Judgment: Bullish Structure, currently in a compressed expansion state, preparing for either breakout continuation or technical correction - but showing no signs of structural reversal.

⊢

⧉

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

⚜️ ⌬ - Silence precedes the next force. Structure is sacred - ⌬ ⚜️

⧉

⊢

Gold’s Glitter Fades: Why $3,250 Is the Next Big Drop🧠 Fundamental Analysis

Despite recent bullish momentum, several macroeconomic and policy-driven headwinds could pressure gold prices lower toward the $3,250 mark:

1. **Fed Policy Shifts (Higher for Longer):**

The Fed’s persistent “higher-for-longer” stance on interest rates has kept real yields elevated. With the U.S. economy still showing resilience (strong labor market, consumer spending), markets are pricing out aggressive rate cuts. Higher real yields reduce gold’s appeal as a non-yielding asset.

2. **Strengthening U.S. Dollar (DXY):**

Renewed dollar strength, driven by global risk aversion and higher U.S. yields, is acting as a headwind for gold. Since gold is priced in dollars, a rising DXY typically puts downward pressure on bullion.

3. **China & India Demand Weakness:**

Physical gold demand in key markets like China and India has been softening. High local prices, subdued consumer sentiment, and tighter liquidity conditions in China are dampening jewelry and investment demand.

4. **Geopolitical Easing:**

As geopolitical tensions (e.g., Middle East or Ukraine) show signs of stabilization, the fear premium embedded in gold could start to unwind.

---

## 📉 Technical Analysis – Bearish Setup to $3,250

From a chartist’s view, gold shows early signs of technical exhaustion and potential reversal:

1. **Rising Wedge Breakdown:**

Gold recently broke down from a **rising wedge pattern** on the daily timeframe—a classic bearish continuation setup. Price failed to hold the breakout above \$2,450 and is now forming lower highs.

2. **Bearish Divergence (RSI & MACD):**

Both RSI and MACD are flashing **bearish divergence** on the weekly chart. While price made new highs, momentum indicators did not confirm—suggesting weakening buying pressure.

3. **Fibonacci Retracement Targets:**

A pullback toward the **50% retracement** of the March–July rally aligns closely with the \$3,250 level. This would be a logical technical correction zone.

4. **Volume Profile Gaps:**

The VPVR (Volume Profile Visible Range) shows a low-volume node around $3,250, implying weak support. If price breaches the $3,400 psychological level, a swift drop to $3,250 is plausible.

5. **Elliott Wave Perspective:**

If the recent top was wave 5 of a larger impulsive structure, we may now be entering an **ABC corrective wave**, with Wave C potentially targeting the $3,250 area.

---

## 📍 Key Levels to Watch

* **Resistance:** $3,420 $3,500

* **Support:** $3,400 → $3,250 → $3,000

* **Trigger Point:** Break below $3,400 with volume confirmation

---

## 📊 Strategy Notes

* **Short Bias**: Watching for rallies to short near \$3,400–\$3,450 with tight stops.

* **Risk Management**: Be cautious around key macro events (NFP, CPI, FOMC).

* **Confluence is Key**: Look for alignment between macro headwinds and chart setups.

---

📌 **Conclusion:**

While gold’s long-term bull thesis remains intact, a medium-term correction to $3,250 appears increasingly likely due to weakening fundamentals, overbought technical conditions, and waning momentum. Traders should prepare for volatility and focus on disciplined execution around key support zones.

ENA | Range Low Reclaim — Targeting Midrange and AboveClear reclaim of the range low and a strong daily close confirm a bullish market structure shift.

Printing a higher high signals potential for continuation.

Dips toward the reclaimed range low are healthy, providing buy-the-dip opportunities.

Accumulation at the range low with invalidation below keeps risk tight.

Plan:

Accumulate pullbacks toward the range low.

Hold for midrange ($0.83) and upper range/major resistance.

AVGO - LONG Swing Entry Plan NASDAQ:AVGO - LONG Swing Entry Plan

Entry Zone 1: $280.80 – $277.00

→ Open initial position targeting +8% from entry level.

Entry Zone 2: $265.50 – $261.00

→ If price dips further, average down with a second equal-sized entry.

→ New target becomes +8% from the average of Entry 1 and Entry 2.

AD Zone : $240.00 – $235.00

→ If reached, enter with double the initial size to lower the overall cost basis.

→ Profit target remains +8% from the new average across all three entries.

Risk Management:

Stop Loss:

Risk is capped at 12% below the average entry price (calculated across all executed positions including the Edit Zone).

Position Sizing Approach:

Entry 1: 1x

Entry 2: 1x

AD Zone: 2x

→ Total exposure: 4x

→ Weighted average determines final TP and SL calculations.

______________________________________

Legal Disclaimer

The information provided in this content is intended for educational and informational purposes only and does not constitute financial, investment, or legal advice or recommendations of any kind. The provider of this content assumes no legal or financial responsibility for any investment decisions made based on this information. Users are strongly advised to conduct their own due diligence and consult with licensed financial advisors before making any financial or investment decisions.

Sharia Compliance Disclaimer: The provider makes no guarantees that the stocks or financial instruments mentioned herein comply with Islamic (Sharia) principles. It is the user’s responsibility to verify Sharia compliance, and consultation with a qualified Sharia advisor is strongly recommended before making any investment decisions

AUDNZD still bullish trend expecting

OANDA:AUDNZD last five analysis accurate (attached), here is new view on AUDNZD, still bullish expecting, price is not break strong zone, bouncing - pushing strongly from same, looks like DESCENDING CHANNEL is breaked.

Here still bullish expectations having.

SUP zone: 1.09100

RES zone: 1.10300, 1.10600

Could GBPUSD break the support at 1.3100?The pound extended its decline amid a stronger dollar and softening UK labour market, which fueled BoE rate cut expectations. From a technical perspective, GBPUSD broke out of the ascending channel and closed below the Ichimoku Cloud. If GBPUSD extends its decline and breaks the support at 1.3100, the price could approach the following swing low at 1.2720. Conversely, a rebound from the support at 1.3100 could prompt a retest of the resistance at 1.3380.

By Li Xing Gan, Financial Markets Strategist Consultant to Exness