BGB

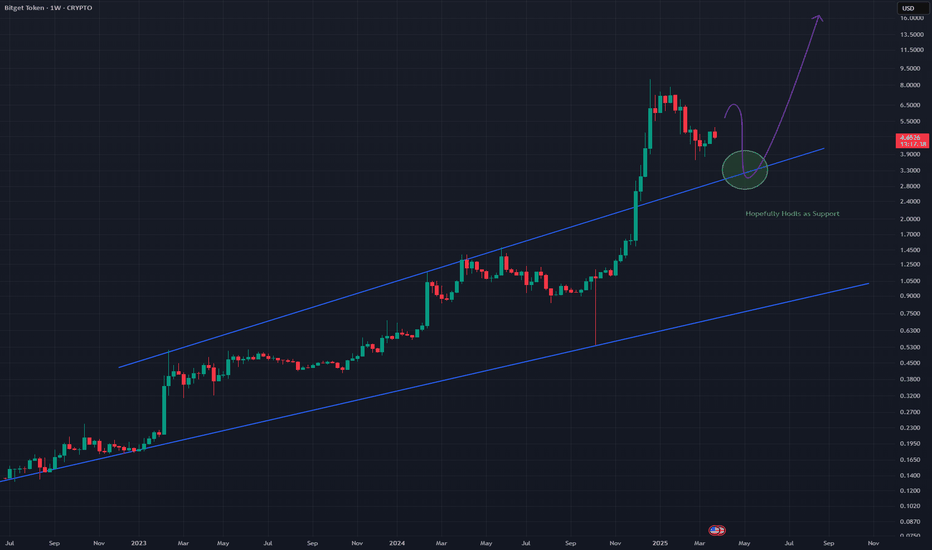

BGBUSD Trend Line as SupportAn upper trend line from a lower point of this bull run has been broken above and will now likely be tested as support

Hopefully this acts as support and the bull continues, if it breaks down below however a bear market could ensue.

Great run from this coin.

Weekly timeframe

Just In: BGB Set for Breakout as Bitget Conclude 800M Token BurnThe cryptocurrency market has been abuzz with excitement following Bitget’s monumental token burn. The event has set the stage for a potential breakout in the price of Bitget’s native token, $BGB. With both technical and fundamental factors aligning, market participants are optimistic about what’s next for the asset.

Tokenomics Boosted by Massive Burn

Bitget’s decision to burn 800 million BGB tokens, equivalent to 40% of its total supply, marks a significant step in strengthening the token’s value proposition. The burn, worth approximately $5.2 billion, was executed through five multi-sig wallet addresses, as confirmed by on-chain tracker @ai_9684xtpa. Key wallets involved in the burn include addresses such as (0x2dd), (0xe36), and (0x255), as reported by Arkham.

This move aligns with Bitget’s updated tokenomics strategy outlined in its latest white paper. By reducing the token’s supply, Bitget is adhering to the fundamental economic principle of supply and demand. With fewer tokens in circulation, the potential for price appreciation increases, especially as demand grows within the platform’s ecosystem.

Adding to the bullish sentiment, Bitget has unified its ecosystem by merging the BWB and BGB tokens. This strategic consolidation is expected to enhance utility and simplify the user experience, further bolstering market confidence.

Technical Analysis

As of the time of writing, NYSE:BGB is trading at $6.23, down 0.86% intraday. Despite this minor decline, the token has shown impressive weekly gains of 56%, reflecting strong bullish momentum.

The current price action places NYSE:BGB within the 38.2% Fibonacci retracement level, which serves as a minor support zone. However, the major support lies at the 61.8% Fibonacci retracement level. This psychological level is crucial, as it has historically acted as a “buy zone,” shaking out weak hands and attracting liquidity. A bounce from this level could trigger significant upward movement.

On the resistance side, the immediate target is the recent high of $7.19. A breakout above this level could pave the way for a retest of higher levels, fueled by renewed market optimism and robust tokenomics.

Market Sentiment and Broader Implications

The broader market’s recent volatility has impacted NYSE:BGB ’s price, yet the token’s fundamentals remain strong. The successful token burn and the unified ecosystem have injected fresh optimism into the community. These developments, combined with NYSE:BGB ’s technical setup, position the token for potential phenomenal gains in the near future.

Looking ahead, market watchers are closely monitoring NYSE:BGB ’s price action as it navigates critical support and resistance levels. With reduced supply and an improved ecosystem, NYSE:BGB is well-poised to capitalize on the next bullish wave in the crypto market.

Conclusion

Bitget’s 800M token burn is a landmark event that underscores the exchange’s commitment to enhancing NYSE:BGB ’s value. While the token’s price currently consolidates, both technical and fundamental indicators point toward a potential breakout. As the market digests these developments, NYSE:BGB remains a token to watch for investors seeking exposure to innovative and fundamentally sound crypto assets.

Bitget token ( BGB)Bgb usdt Daily analysis

Time frame 4hours

BgB is bitget exchange token

OT has unbelievable growth before yesterday

7days 81%

30days 366%

90 days 623%

YTD 1164%

Today, this growth stopped ✋️ and fell down 10%

I think we have two price to enter 7.3$ and 6$

But here is a problem

If you want to buy this token , only bitget , bitfinix and mexc exchanges are seller , not famous exchanges like Binance and kraken and...

This problem when you want to trade bgb will be a big problem.

So you have to be careful.👌👌

BGB Token Rockets 30% Amidst Massive 800M Token Burn PlanBitget’s NYSE:BGB token has captured the spotlight in the crypto world, surging over 20% following the announcement of an 800 million token burn. This development, coupled with the release of a new white paper, has positioned NYSE:BGB as a token to watch in the evolving crypto landscape.

1. The 800M Token Burn Plan

Bitget’s new white paper reveals an ambitious plan to burn 800 million NYSE:BGB tokens held by the core team. This move represents the destruction of nearly 40% of the token’s total supply, reducing the circulating supply from 2 billion to 1.2 billion. Such a drastic reduction in supply is expected to generate a significant bullish impact by adhering to the economic principle of supply and demand. The total value of the tokens set to be burned exceeds $5 billion.

Additionally, Bitget has committed to repurchasing and burning tokens equivalent to 20% of its quarterly profits from its exchange and wallet businesses starting in 2025. This proactive approach is aimed at bolstering BGB’s long-term tokenomics.

2. Strategic Ecosystem Developments

The white paper also introduces a merger of Bitget Wallet Token (BWB) with BGB, aimed at streamlining the ecosystem. This move not only simplifies the platform’s token structure but also fosters a unified community, further enhancing the utility and adoption of BGB.

3. Utility and Use Cases

BGB is Bitget’s native utility token, launched in July 2021. Its use cases include staking, social trading, profit sharing, and discounts on trading fees. BGB holders can also participate in platform initiatives like launchpads and launchpools, adding to its appeal among active traders.

Technical Analysis

At the time of writing, NYSE:BGB is trading at $8.359, up 15.15% on the day, with an intraday high of $8.49. This bullish trajectory aligns with the market’s positive reception to the token burn announcement and other ecosystem updates.

Despite the euphoria, technical indicators suggest caution. The Relative Strength Index (RSI) is at 85, signaling an overbought condition. Traders are advised to wait for a confirmation trend above the one-month high before entering long positions. A pullback could test the 38.2% Fibonacci retracement level, which may act as a clearing field or shake out weaker hands before a potential rebound.

Bullish Continuation Potential

The current candlestick formation indicates a potential bullish continuation, but confirmation through a breakout pattern is crucial. If the breakout materializes, NYSE:BGB could target new resistance levels, making it a promising asset for short-term and long-term gains.

Market Performance

BGB’s 24-hour trading volume stands at $780,650,069, with a live market cap of $11.59 billion, ranking it #16 on CoinMarketCap. The token’s significant liquidity and trading activity highlight its growing adoption and market interest.

Price Comparisons

BGB’s price increase of over 30% in the last 24 hours has defied broader market trends, outperforming other top tokens. This resilience underscores its potential as a standout performer in the current market environment.

Conclusion

Bitget’s BGB token is poised for continued growth, fueled by strategic developments like the 800 million token burn and ecosystem enhancements. While technical indicators advise caution due to overbought conditions, the token’s robust fundamentals and community-driven initiatives provide a strong foundation for long-term value.

Investors should monitor key levels, such as the 38.2% Fibonacci retracement support and the one-month high resistance, for potential trading opportunities. As Bitget continues to innovate and expand its ecosystem, BGB remains a compelling investment in the crypto space.

Bitget Token | BGB ( is the next BNB )BGB is 600% up since our first signal so its time to give it another look🔍

So, what’s this Bitget Token again ?

It’s a centralized exchange for crypto derivatives and spot trading. Bitget wants to make crypto trading so easy even your grandma could moonshot her portfolio! Their ultimate goal? Bridging Web2 and Web3, connecting CeFi and DeFi, and being the go-to portal for all things crypto—basically, the digital glue holding it all together. they got BGB token and wen exchange doing good the token will doing great

What Makes Bitget So Special ?

1. Cool Gadgets

- One click copy trading (copy the pros or MoonMaster, not your buddy who lost his private keys)

- Trade without converting tokens because math is hard.

- USDC margin derivatives.

2. Ironclad Security

- Risk control with hot & cold wallet segregation (because mixing wallets is like mixing tequila and milk never a good idea)

- 12 A+ ratings from SSL Labs, and it's backed by big tech names like Suntwin, Qingsong Cloud Security, HEAP, and Armors.

3. Top-notch Customer Service

- 24/7 multilingual support (crypto doesn’t sleep, so neither do they)

- VIP 1on1 support (you’re a big deal here)

- Reward centers, because everyone loves free stuff

Why Should You Care About BGB ?

1. Save on trading fees 15% discount just for using BGB as margin.

2. Flex those BGB tokens and get a 20% fee discount.

3. Collateral? Yep, BGB’s got you covered.

4. Exclusive perks: access to Bitget rewards, private circles, and all the cool-kid crypto stuff.

BGB successfully broke 1.3 and 1.7$ and thanks to BTC and it just showed to all exchanges who is the king of exchanges tokens

If you’re not already checking our signals these days, you might just miss the rocket while you're still tying your shoes 🚀

IT'S UNSTOPPABLE? BGBThe weekly chart for BGB it's pretty incredible. Since it's creation in 2022, Bitget token has never stopped to grow. The price of BGB is always rising, and i think this trend will continue. I think the price will reach the main resistance of $1.7/1.8 this year. Looking at short term, price must break above the strong resistance at $1.4 before pushing higher, and i see a good accumulation zone at $1.1, where i hope the price to come back to add more. First support zone is $1.28, if this hold we have nothing that can stop the rise

BGB - Standing Strong 💪Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📊 Despite many altcoins experiencing lower lows over the past couple of months, BGB has demonstrated resilience by maintaining support above 0.4.

📉 As BGB nears the lower boundary of the red channel, coinciding with the 0.4 support level, we will be on the lookout for short-term buying opportunities .

📈 To regain medium-term bullish momentum, it is essential for BGB to breach the channel's upper boundary and surpass the previous significant high marked in red, which is approximately at 0.45.

Which of these scenarios is more likely to occur first, and why?

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

$BGB - Bitget's flagship coin. This is Bitget's platform token. I've been looking at this chart for a few days and could clearly see the retrace wasn't over.

The volume started to pick back up again early 2023 to form an impulse. Where this is situated in the grand scheme of things, only time will tell, but this structure most certainly needs a wave 5. Unless this is nothing more than an ABC with higher than average volume. I believe a break below 0.238 would confirm the corrective conclusion.

Please notice the Shallow retrace of (2) on the chart. This is what allowed me to suspect a deeper correction in this wave (4) we are currently in. I'm expecting for us to test the 33 cent mark rather soon.

Safe Trades to all!

BGB - 100%+ Move!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

BGB was stuck inside a range 0.17 and 0.22

As per my last video analysis (attached on the chart) we were looking for short-term buy setups inside the range.

🏹 BGB got even stronger and broke above the 0.22 resistance zone in green and kept moving higher for another 100% bullish movement.

Last week, we have rejected the 0.5 round number and now retesting the blue demand zone.

As per my trading style:

as BGB approaches the demand zone 0.35, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

how knows maybe the next bnb? (BGBUSDT) 💣🚀Hello 🐋

Based on the chart, and Fibonacci indicator and fib supports and many other fundamental sign we expect more gain ✔️

here

the price can shape the parallel channel and see more range market or explosive volume and huge gain 💣🚀

otherwise

we can see more correction to lower support level ❌🧨

if

breakout of the upper resistance zone be completed, we can see more pump to the upside and ATH ✔️🚀

Please, feel free to share your point of view, write it in the comments below, thanks 🐋

BGB - Video Update!Hello TradingView Family / Fellow Traders. This is Richard, as known as theSignalyst.

Here is a detailed update top-down analysis for BGB .

Which scenario do you think is more likely to happen? and Why?

Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

BGB - Video Top-Down Analysis!Hello TradingView Family / Fellow Traders. This is Richard, as known as theSignalyst.

Here is a detailed update top-down analysis for BGB.

Which scenario do you think is more likely to happen? and Why?

Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!.

All Strategies Are Good; If Managed Properly!

~Rich

Bitget - Wait For The Bulls! 📈Hello TradingView Family / Fellow Traders. This is Richard, as known as theSignalyst.

While many altcoins made lower lows the past couple of months, BGB stood strong above support.

on DAILY: Left Chart

BGB is stuck inside a range in the shape of a symmetrical triangle highlighted in red.

📈For the bulls to take over medium-term, we need a break above the upper red trendline, and then above the green resistance 0.225 for the bulls to take over from a long-term perspective.

Meanwhile, as we approach the lower red trendline and blue support, we will be looking for short-term buy setups.

on H1: Right Chart

BGB is bearish short-term trading inside the orange channel.

📈 🏹Trigger => for the bulls to take over, we need a break above the orange trendline and last major high in gray.

Meanwhile, until the buy is activated, BGB can still trade lower till the blue support and form a new major high before the bulls take over.

Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Bitget - Standing Strong 👌Hello TradingView Family / Fellow Traders. This is Richard, as known as theSignalyst.

While many altcoins made lower lows the past couple of months, BGB stood strong above support.

BGB is stuck inside a range in the shape of a symmetrical triangle highlighted in red.

For the bulls to take over medium-term , we need a break above the upper red trendline, and then above the green resistance 0.225 for the bulls to take over from a long-term perspective.

In parallel, for the bears to take over, we need a break below the blue support 0.17, in this case a movement till the next support would be expected.

Meanwhile, inside the symmetrical triangle range, we will be looking for short-term buy and sell setups respectively around the lower bound and upper bound.

Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Exchange Tokens: CEX vs DEX📈This 1-year chart compares tokens from centralized and decentralized exchanges (in the latter considering those that allow derivatives/futures trading, not just swaps).

BTC was placed as a benchmark.

🥇The GMX token appreciated the most, especially after distrust of the ability of centralized exchanges to honor customer withdrawals.

🥈In second place is the Bitget token.

🥉And in third place is the Gains Network token.

👎The negative highlight goes to Binance's BNB.