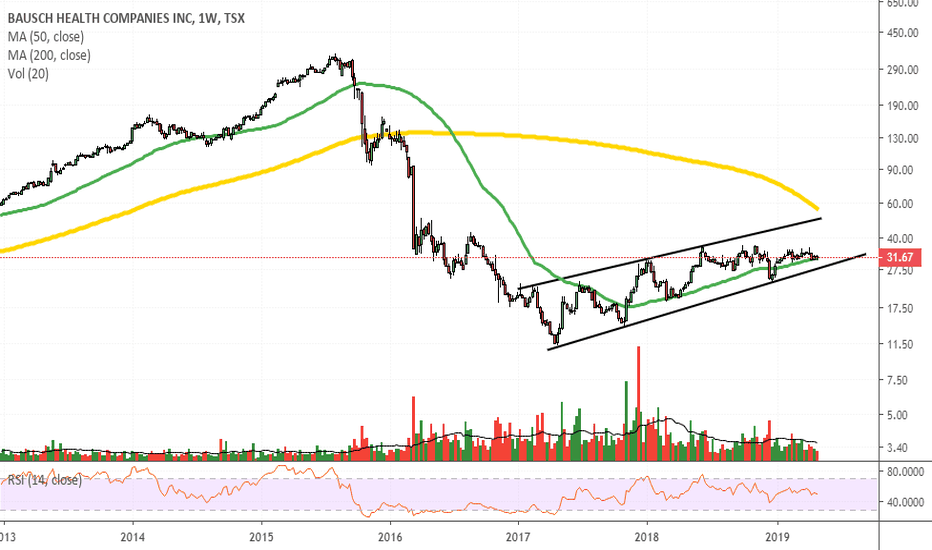

$BHC - LongThis stock has horrifically bad spreads, i usually stay away from trash like this but reviewing trading data from this month i'm seeing extremely big activity behind this stock. I also checked around and apparently Jim Cramer is bearish this stock within the same month as said same extremely trading activity. Due to these nice 2 conflicting things i've gone ahead and went long this stock.

BHC

Bitcoin Cash/Tether US is close to the Support Level...If the price will cross the Support Level it will be a nice opportunity to open the Sell position.

The reason is the global bearish trend, every next high is lower than the previous.

Potential profit will be 3 times bigger than the risk.

Let's watch this together!

Push like if you think this is a useful idea!

Before to trade my ideas make your own analysis.

Write your comments and questions here!

Thanks for your support!

Elliott Wave View: An Impulsive Rally in Bausch Health (BHC)Elliott Wave View in Bausch Health (BHC) suggests the rally from June 4 low (20.28) unfolded as a 5 waves impulse Elliott Wave structure. Up from 20.28, wave (1) ended at 21.9 and wave (2) pullback ended at 20.8. The stock then resumes the rally higher in wave (3) towards 25.85, and wave (4) pullback ended at 24.61. Finally, the stock ended wave (5) of ((1)) at 25.9.

The stock is now correcting cycle from June 4 low within wave ((2)). Wave ((2)) pullback should unfold in the sequence of 3, 7, or 11 swing. The current pullback is proposed to unfold as a double zigzag Elliott Wave structure. Down from 25.9, wave (A) ended at 24.64 as a diagonal structure. Expect a bounce in wave (B) then another leg lower in wave (C) as another 5 waves before wave ((2)) pullback is complete. We don’t like selling the stock and expect dips to continue finding support in 3, 7, or 11 swing as far as pivot at June 4 low (20.28) stays intact.

Bitcoin cash descending or ascending! There is a clear triangle appears in the chart BHC/USD, however it could be both ascending

or descending. One of the traits of triangle is that it continues a trend, in this case it's an upward trend, on the other hand it is a more of the pattern of a descending triangle(the line below goes strait horizontal and line above goes inclined. Wait for the conformation!

A candle has to be closed above or under one of the triangle lines.

BAUSCH Elliott Wave View: Pullbacks Should Remain Supported

Good afternoon Traders,

BHC short-term Elliott wave analysis suggests that the pullback to $20.28 low ended black wave ((2)) pullback.

Up from there, it is in a possible 5 waves Elliott Wave structure higher. The first leg higher in black wave ((i)) ended at 09/13 peak (24.13). The internal structure of that move unfolded as a 5 wave impulse.

It ended blue wave (i) at 09/11 peak (20.98), wave (ii) pullback at 09/11 low (20.67). Above from there, it ended the wave (iii) at 09/12 peak (24.12). Below from there it ended blue wave (iv) pullback at 09/12 low (23.22) and above from there it ended blue wave (v) of black wave ((i)) at 09/13 peak (24.12).

Below from there, it ended black wave ((ii)) pullback at 09/17 low (22.07). The internals of that pullback unfolded as an Elliott Wave double correction in blue wave (w)-(x)-(y). Up from there it ended black wave ((iii)) at 09/21 peak (25.26) and the pullback in black wave ((iv)) at 09/25 low (24.32) after reaching the 100-123.6% extension area from 09/21 peak. And any long trades from that area (blue box) should be risk free by now. As long as it does not break 09/21 peak (black wave (( iii )) ), a double correction lower in black wave ((iv)) can't be ruled out.

As long as the pivot at 20.09 stays intact we expect the stock to extend higher and we don’t like selling it because the right side is to the upside.

BitcoinCash – Final Sell-off?Hello everybody,

I think we will see the final sell-off during the next days or weeks, so we can prepare us to place a long order. BCH is forming the final wave 5 of the last wave 5 of c of 2.

What we have seen is a nice all time high (wave 1), and since then a long-lasting a-b-c correction pattern (wave 2). But now it’s the final mile bevor turn around, I think.

Scenario 1 (10% chance)

BHC is going up directly.

Scenario 2 (5% chance)

BHC is not holding the last support (190$) and is going to hell.

Scenario 3 (85% chance)

BHC is completing wave 2 in my green trading box as described above. The ideal turning point would be between 290$ and 280$.

Be careful: if 190$ fails, there will be tears and blood, because then BHC will go to hell.

On the upside there is much resistance (the key levels are shown in the chart above). It’s not that easy, but it’s possible to make it through aiming for new highs.

Be patient, there are only a few dollars left…

Please leave a comment or a message, if you have any questions.

Take care,

tgo

$BHC almost a buy: under the radarI am waiting for an entry long in $BHC but positive signs are already there especially RSI is giving an insight, MA 200 is almost close and it might be probable a new test. Monthly RSI is down and on a weekly basis price is approcing the pullback of the third bullish wave.

For the time being, given the positive earnings release a bullish trend continuation is highly probable but I would not exclude somewhat time to complete the flag in order to reach the main trendline in red. If it is not like that a bullish signal will be given ....only.... when the price breaks the upper edge of the flag.

For aggressive traders an entry long might be done even today with really tight SL.

BHC Bausch Health: possible opportunity in the next daysAlthough earnings are releasing next week, the today's session for $BHC will be critical: a trend inversion might be possible on a daily basis, yesterday price formed a dragon fly bullish as the arrow shows.

This must be confirmed with a black (green) candle today in order to develop minimum of swing, otherwise there will be no signs for an inversion in the short term.

Ground seems to be ready even because RSI (oscillator) is near the range of 30-40 which means that it is charged enough to support a bullish trend.

Conclusions

For aggressive traders entry long might be done today with tight SL. Price actually flows over a solid support around 21.50 dollars.

For conservative traders: watch and wait at least today.