Sector early indicator? No: Natural Resources, not really.The Natural Resources sector - here represented by BHP (in green) and Rio Tinto (RIO, in orange) - does not generally act as an early indicator against the broader market (here represented by the DJIA in gray, and the NASDAQ in black)... only possibly during the fall in their share prices over Jul and Aug of 2018.

BHP

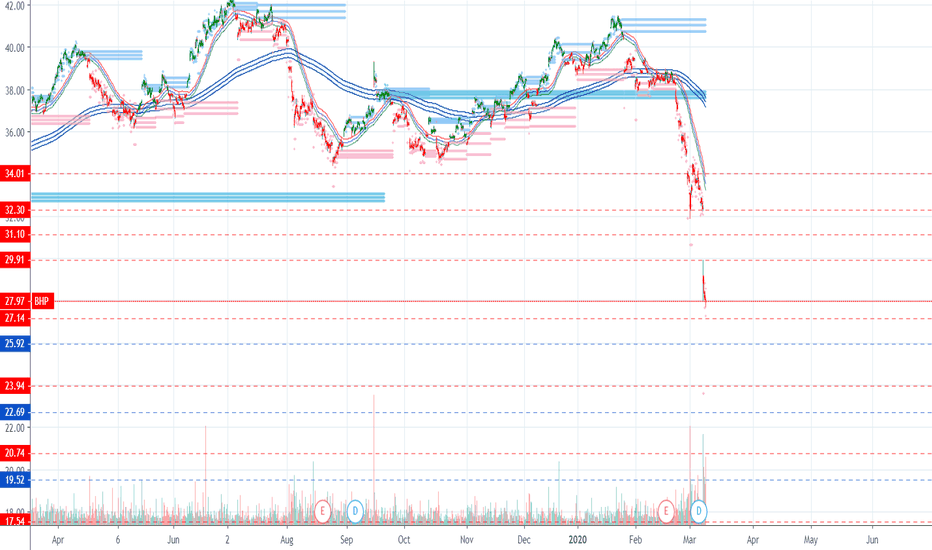

BHP daily close at H&S neckline, bullish vibes zero JSE:BHP close today resting right at the neckline of a textbook H&S. I wish it were not so, as I'm positioned for a bounce, but alas resources are not giving off good vibes at the moment, not good at all :-(

Prime Number Bands 1- Trend analysis:

Higher prime numbers mean we are in an uptrend. When the bands are moving upward direction, the market has a Bullish Direction.

Lower and lower prime numbers mean we are in a downtrend. (If the bands are moving Downward direction)

2- Volatility:

Narrower bands mean stock price is less volatile.

Wider bands indicate share price is volatile.

3- Signals:

In an uptrend look for a spike down in prime band for a long position entry.

in a downtrend look for a spike up in a prime band for a short position entry.(Not my favourite scenario, though!)

BHP - Full Breakdown Using The Main Indicies PatternIn this special idea I apply the AriasWave methodology to a stock by incorporating the main pattern in Global Markets.

See related idea below for the DOW JONES to understand this pattern. I will post an idea shortly for the FTSE 100.

Using the AriasWave framework and the main pattern which a TYPE-2 ZIG ZAG I apply careful and precise wave analysis to this stock.

This will help you with targets and what the rest of the pattern will look like.

Please LIKE and FOLLOW to get notification of updates and future posts.

BHP upward moveThe Head & Shoulders that was alerted a few weeks ago played out quite nicely, but didn't quite reach it's target. At it's bottom, it formed a bullish engulfing candle pattern which is an upward move signal. The stochastic and MACD are confirming an up, so if it breaks today's high, I will enter long.

BHP - Head & ShouldersJSE:BHP has formed a Head and Shoulders pattern and has broken through the neckline on its way downwards. If the pattern plays out, we could see a move down to the target at around the 28900 level

#BHP - 1D Timeframe - US ELECTION OPPORTUNITY - WIN-WIN?POLITICAL AND MARKET CONTEXT

Specialized on silver production that is a basic raw material of photovoltaic solar panels. Renewable energy consumes up to 30% of world silver production.

If Trump wins, price of metal might still rising due to his monetary (inflationary) policies.

If Biden wins, BHP will be a huge player as a raw material supplier of a possible boom of Solar and renewable energy

TECHNICAL ANALYSIS. 1D TIMEFRAME.

Historical support on $46.80 - $47.70 range. 4 clear rebounds on this level over last 15 months (yellow rectangles). March´s COVID-19 meltdown was the only time that this support was broken.

Last week this price range was tested again and showed quite strong even with a high seller volume . This time we've got MA200 assisting as double support just above Fibonacci´s 0.382 level.

Strategy: Monday and Tuesday sessions are crucial to confirm rebound on support pointed out. Specially with the high volatility and bear forces we might expect for this week.

If price resist this level and cross MA200, we´ll be able to open a long position with a target of $58.55 (+21.5%).

Another Country Breaking Out - Australia!When we look around the world, it often feels like the sky is falling if you tune into financial media. Well here, we look at the charts and see if we can find trends. We have a new breakout in an important commodity economy. Australia! Let’s have a look at the chart.

So here we have Australia going nowhere since June. Tons of failed breakouts with the wicks not being able to stay above 6130. We finally get the breakout with follow through as well. Not only do we have the breakout in price, we also have a breakout in RSI terms. This is bullish. Right now we are looking for stuff to buy. We have made that clear. Now we can add Australia to the list of markets that are breaking out.

Happy Trading!

BHP - Resistance at R370BHP find a hard time to breach through R370. Short idea could be in play with a tight stop loss above R375. First target at R360 and second target at R350

$BHP BHP Billiton, too much too soon? $JSEBHP Group in South Africa broke down towards the end of Feb from a rising bullish channel that was in place since early 2016. After breaking down from this channel, the stock dropped a further R100 very rapidly in the space of 2 weeks before bottoming out on high volume. The stock has spent the better part of 4 weeks regaining this massive drop, but i believe this has now presented us with an opportunity to short BHP Billiton in anticipation for a consolidation & correction in price. I find this area between R300 - R306 particularly important for a number of reasons:

(1) we have now retested the underside of the bullish channel that was in play for the last 4 years. Normally when one see's such a big technical break, the channel which acted as support can often turn into resistance. This retest and failure can often also be seen as the "kiss of death" with a bigger drop in price to come in weeks ahead.

(2) this is also the 61.8% fib retracement using the most recent lows and highs over the last year (R195 & R369)

(3) this is also where we find the 50 week moving average (blue moving average) which has been a reliable indicator of support over the last 4 years, it could now become a reliable level for resistance.

(4) the RSI level has reached the midpoint of its range at 50. this level will often coincide with tops when a trend turns negative in a stock

(5) the last 4 weeks has seen price move higher, but each successive move higher has been accompanied by smaller price ranges and less volume (this is not a bullish price action).

(6) the level at R306 was also a level of support back in October 2019, which will now likely turn into resistance on the re-test.

Putting this all together leads me to believe that this area could well be worth an opportunity to take a short, with an initial target to retest the 200 week moving average (green line) at approximately (R270 - R275).

BHP Key 200 WMA| Oversold RSI| Volume Climax Evening Traders,

Today’s analysis will focus on BHP, sellers are in complete control after breaking key technical levels. It has been rejected at a technical point that will dictate the overall trend in the coming weeks and months.

Points to consider,

- Strong bear break

- 200 WMA – Current resistance

- Local support respected - .618 Fibonacci in confluence

- RSI coming of oversold

- Stochastics in lower regions

- Volume climax evident

The trend is bearish for BHP, breaking key technical levels in the recent sell off. The 200 WMA is a vital level for the overall trend, current acting as resistance.

Local support is in confluence with the .618 Fibonacci, breaking this level will target the 2.618 Fibonacci Extension.

The RSI is currently extremely oversold; this is considered to be an oversold bounce if it recovers to neutral territory. Stochastics is in lower regions, can stay trading here for an extended period of time, however lots of stored momentum to the upside.

Volume climax is evident; this suggests that the temporary bottom may be in. If BHP puts in a lower high, it will increase the chances taking local support out.

Overall, in my opinion, BHP has a clear level, 200 WMA, a break will increase the bullish bias as the .618 will hold true. A rejection will increase the bearish outlook, thus the first target being the 2.618 Fibonacci Extension.

What are your thoughts?

Please leave a like and comment,

And remember,

“Trading mastery is a state of complete acceptance of probability, not a state of fight it.”

― Yvan Byeajee

JSE:BHP Accumulation CompleteBHP has consolidated for the best part of 2019. Now we have seen a spring and markup in phase D starting. Looking for the markup to take price above the highs in 2020.