BHP

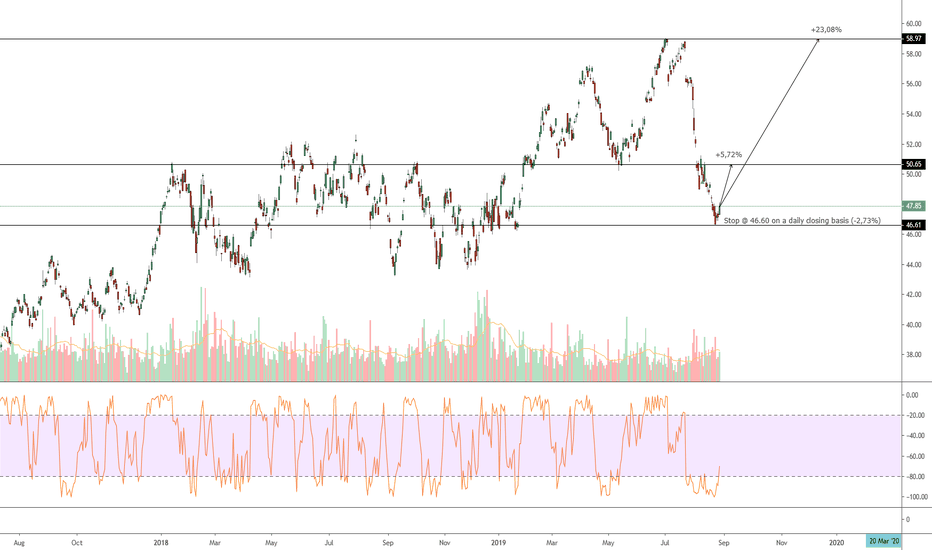

CLF JOINS S&P SMALLCAP 600 - SHORT SQUEEZE! As we've been posting, Cliffs is a turn-a-round play with a new organic HBI plant coming online within the 1st qtr of 2020.

After the market closed, news hit that the company will be added to the S&P SmallCap 600.

S&P would not list CLF before looking at the company and its financials. CLF is a solid play.

We figure fair market value is between $13 and $15 per share at current earnings, market cap, etc...

With over 100 million shares short, this could be the biggest short squeeze in a long time!

ADDING ANOTHER 2,000,000 SHARES IN THE MORNING BEFORE THE STOCK SPIKES

DISCLAIMER

This website and our posts are for general information only. No information, forward looking statements, or estimations presented herein represent any final determination on investment performance. While the information presented in this website and our posts has been researched and is thought to be reasonable and accurate, any investment is speculative in nature. StockKid, and/or our agents cannot and do not guarantee any rate of return or investment timeline based on the information presented herein.

By reading and reviewing the information contained in this website and our posts, the user acknowledges and agrees that StockKid, and/or our agents do not assume and hereby disclaim any liability to any party for any loss or damage caused by the use of the information contained herein, or errors or omissions in the information contained in this website or our posts, to make any investment decision, whether such errors or omissions result from negligence, accident or any other cause.

Investors are required to conduct their own investigations, analysis, due diligence, draw their own conclusions, and make their own decisions. Any areas concerning taxes or specific legal or technical questions should be referred to lawyers, accountants, consultants, brokers, or other professionals licensed, qualified or authorized to render such advice.

In no event shall StockKid, and/or our agents be liable to any party for any direct, indirect, special, incidental, or consequential damages of any kind whatsoever arising out of the use of this website, our posts or any information contained herein. StockKid, and/or our agents specifically disclaim any guarantees, including, but not limited to, stated or implied potential profits, rates of return, or investment timelines discussed or referred to herein.

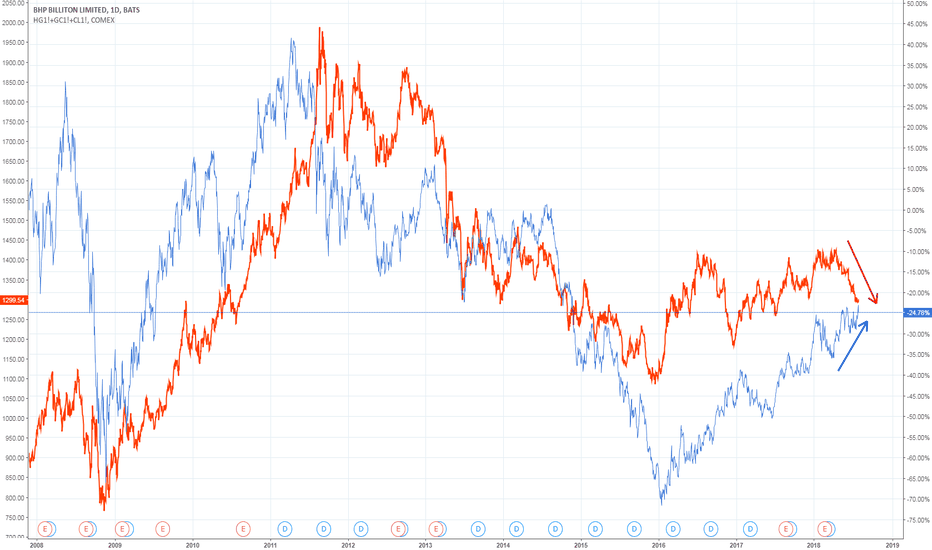

BHP in a channelJSE:BHP has failed to break out of the downward trending channel that it has been trading in and has once again bounced off the top for a downward move. We could see it continue down to the bottom of the channel, but it might also find some resistance around the 31000 level as it has before.

CRAMER IS A FRAUD! SHORT SELLERS ARE PAYING HIM OFF! *** BUY ***ON JANUARY 11, 2019...CRAMER SAID THE FOLLOWING ABOUT CLEVELAND-CLIFFS...

Jim Cramer Gives His Opinion On Cleveland-Cliffs, SINA, Take-Two And More

Craig Jones , Benzinga Staff Writer

January 11, 2019 8:23am

On CNBC's "Mad Money Lightning Round", Jim Cramer said Cleveland-Cliffs Inc

CLF 4.52% is the best company in the show...

NOTHING HAS CHANGED SINCE CRAMER TOLD PEOPLE "CLIFFS IS THE BEST COMPANY IN THE SHOW...ACCEPT..CLIFFS PAID OFF SHORT TERM DEBT AND ISSUED AN OVER $100 MILLION SHARE BUYBACK ALONG WITH RECORD EARNINGS.

INSIDERS HAVE ALSO BEEN BUYING UP THE STOCK

FOLKS, READ CLIFFS LAST EARNINGS CALL / TRANSCRIPT..

CLIFFS RECENTLY PAID OFF SHORT TERM DEBT, THE COMPANY HAS NO DEBT COMING DUE FOR A GOOD 5 YEARS

SINCE JANUARY 11, CLEVELAND-CLIFFS HAS BEATEN EARNINGS EVERY QTR WITH NOTHING BUT POSITIVE CONFERENCE CALLS

THERE IS A HUGE SHORT POSITION IN CLIFFS AND IF THE STOCK SPIKES UP, THE SHORTS WILL LOSE HUNDREDS OF MILLIONS OF DOLLARS.

ON OCTOBER 19, 2018, Cleveland Cliffs CEO Lourenco Goncalves berated analysts and short sellers on his company's conference call.

TODAY, IRON ORE WAS UP OVER $3.50 TO $96.01...THERE IS NO SLOW DOWN OR SURPLUS FOR IRON ORE AND IT CONTINUES TO MAKE RECORD HIGHS

CLIFFS HAS ITS PRODUCT TIED INTO LONG TERM CONTRACTS AT VERY HIGH PRICES

WHEN CLIFFS WAS TRADING AROUND $78 YEARS AGO...IRON ORE WAS NO WHERE NEAR WHAT IT'S TRADING AT TODAY! CLIFFS IS MAKING MONEY HAND OVER FIST AT THESE RECORD HIGH PRICES

THE CEO SAID THERE IS NO SURPLUS AND HE SEES THE ROBUST DEMAND FOR HIS PELLETS CONTINUING INTO THE FUTURE WITH NO SLOW DOWN

SO...THE CEO HAS BEEN VERY OUT SPOKEN AGAINST THE DIRTY WALL STREET BROKERS AND SHORT SELLERS...AS USUAL, IT'S OK FOR DIRTY BROKERS, ANALYST AND SHORT SELLERS TO TALK NEGATIVE ABOUT A COMPANY BUT GOD FORBID THE CEO TALKS NEGATIVE ABOUT THEM. SAME OLD DIRTY GAME, ANOTHER CORRUPT WALL STREET DAY.

CRAMER IS A CROOK...HE PUMPS STOCKS TO BENEFIT HIMSELF AND HIS WALL STREET CRONIES.

ON 08/16/2019...JIM CRAMER WAS ALMOST CRYING AND SAID..."VIACOM CLASS A & B ARE BOTH TRADING LOWER AND IT IS DRIVING HIM CRAZY. HIS CHARITABLE TRUST OWNS VIACOM CLASS A."

WELL CRAMER...HOW DOES IT FEEL TO GET SLAMMED!

VIACOM DAILY CHART LOOKS LIKE THE COMPANY IS GOING BANKRUPT AND IT CONTINUES TO SINK!

YOU KNOW WHAT THEY SAY ABOUT PAYBACK RIGHT CRAMER?

CRAMER'S FRAUDULENT REMARKS ON CLEVELAND-CLIFFS TODAY WILL BRING HIM BAD CARMA INTO THE FUTURE AS YOU CAN ALREADY SEE, VIACOM IS GOING BANKRUPT!

DISCLAIMER

This website and our posts are for general information only. No information, forward looking statements, or estimations presented herein represent any final determination on investment performance. While the information presented in this website and our posts has been researched and is thought to be reasonable and accurate, any investment is speculative in nature. StockKid, and/or our agents cannot and do not guarantee any rate of return or investment timeline based on the information presented herein.

By reading and reviewing the information contained in this website and our posts, the user acknowledges and agrees that StockKid, and/or our agents do not assume and hereby disclaim any liability to any party for any loss or damage caused by the use of the information contained herein, or errors or omissions in the information contained in this website or our posts, to make any investment decision, whether such errors or omissions result from negligence, accident or any other cause.

Investors are required to conduct their own investigations, analysis, due diligence, draw their own conclusions, and make their own decisions. Any areas concerning taxes or specific legal or technical questions should be referred to lawyers, accountants, consultants, brokers, or other professionals licensed, qualified or authorized to render such advice.

In no event shall StockKid, and/or our agents be liable to any party for any direct, indirect, special, incidental, or consequential damages of any kind whatsoever arising out of the use of this website, our posts or any information contained herein. StockKid, and/or our agents specifically disclaim any guarantees, including, but not limited to, stated or implied potential profits, rates of return, or investment timelines discussed or referred to herein.

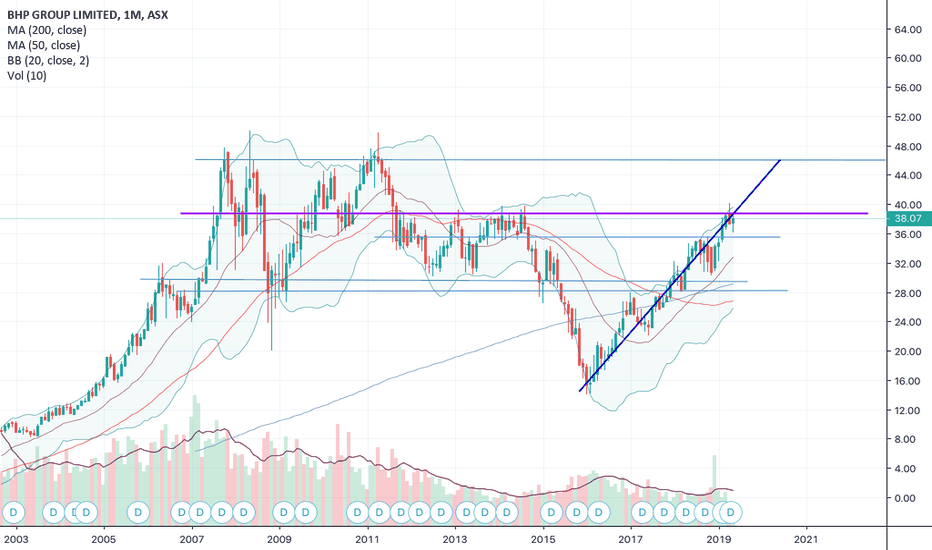

BHP Share prices could reverse the trend if it holds at 34.50BHP - BHP Group Ltd share prices seem to have found support from a support level indicated in my previous post at 34.55. Share prices rose to 34.94 up 0.72% from the time of writing, and we might see a change of direction if it holds above the trend line highlighted on the chart. BHP share prices are still trading above my long term channel indicator, which I consider an excellent win-loss ratio of more than 80% to 20% for a long term trade.

BHP Resistance and Support zonesAs you can see the price is getting very close to the fibonacci zones drawn on the chart. We can expect to see a pullback to the lower box if we do not break above the upper resistance box. That being said If my short does not go to plan and we break above we are targetting higher highs. Check out my youtube channel at aweeboneshTV for more ideas :D

BHP broken through supportJSE:BHP has broken and closed below an 8-bar ascending support level. I will wait for it to confirm, but looks good for a short position.

BHP BILLITON (BHP) DAILY LONG BHP Billiton's share could find support at the 31 150 price level, which is an area of interest from the weekly timeframe. Since this analysis is based on a higher timeframe, it could take several days before this can happen. The weekly timeframe shows a healthy trend, with symmetrical, deep pullbacks. We are currently on one of these pull backs, and am hoping that buyers will come in at the mentioned support zone. Also be aware that prices could tank further to the trendline and possibly find support there. Pulling up a Fibonacci tool, we can see that the 31 186 area represents a 50% retracement, which could be a good entry for traders who use this tool. Personally, i prefer the feeling of jumping into the markets with nothing but price and a stop loss as my parachute in case i "crash" land. (pun intended)

BHP BILLITON | Heading Towards 16.00 ???BHP for the last two years has been quite the bullish pick of the ASX , after it's bear run from late 2014 it was an obvious investment for the long haul trader.

-

Now into late 2018 , we can see that price is currently retesting structure at the range of DEC 201 3 and JUL 2014 . Currently ranging in the structure zone as displayed, accompanied by an RSI divergence, we have a strong reason to believe that price has completed its pullback and is headed on back down to the low of JAN 2016 .

-

A break and close over the trend-line would place us in an ideal position to short the stock.

Bored With Economic Wars: The S&P 500 Meanders Through Minefield"A bored S&P 500 just meanders amid the minefields of an expanding macroeconomic battlefield featuring the U.S. versus the world."

Bored With Economic Wars: The S&P 500 Meanders Through Minefields drduru.com $SPY $QQQ $IWM $TLT $XLF $ITB #VIX #AT40 #T2108 $AA $BHP $RIO $FXY $USDCNY $DXY $USDX #forex $MSFT $RHT $SKX $TSLA

Stock Market Bears Increase the PressureThe trading action over the last 2 days validated my bearish stance as small caps and tech finally sustained a tumble deep enough to matter.

Stock Market Bears Increase the Pressure drduru.com $SPY $QQQ $XLP $XLF $XLI $XLP $AXON #VIX #AT40 #T2108$BHP $USO $SLV $BOTZ $CAT $INTC $KMX $RHT $SPLK $WHR $WIX

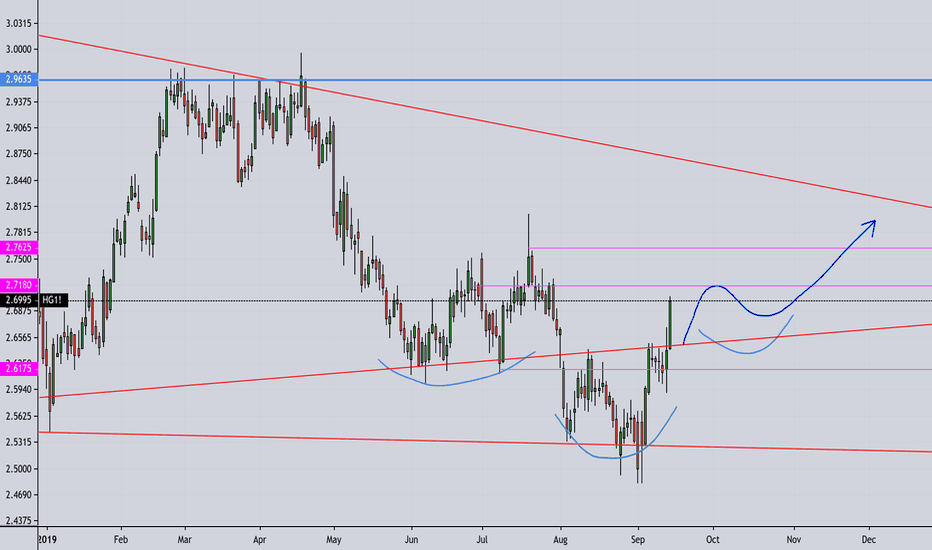

AUDUSD: Resuming the monthly rally next$AUDUSD appears to have comp0leted a correction and is ready to resume the monthly uptrend. We're long and added here at 0.7850 for the last time, after buying at 0.7835 initially.

The trend in EV adoption is driving flows here I suspect, with an increase in the price of copper, iron ore, cobalt, nickel, and other materials required for different battery types. Australia benefits directly from this, as an exporter of these, iron ore and copper in particular. This could drive the long term rally we observe to be active in monthly charts.

See related ideas for more information.

Best of luck,

Ivan Labrie.