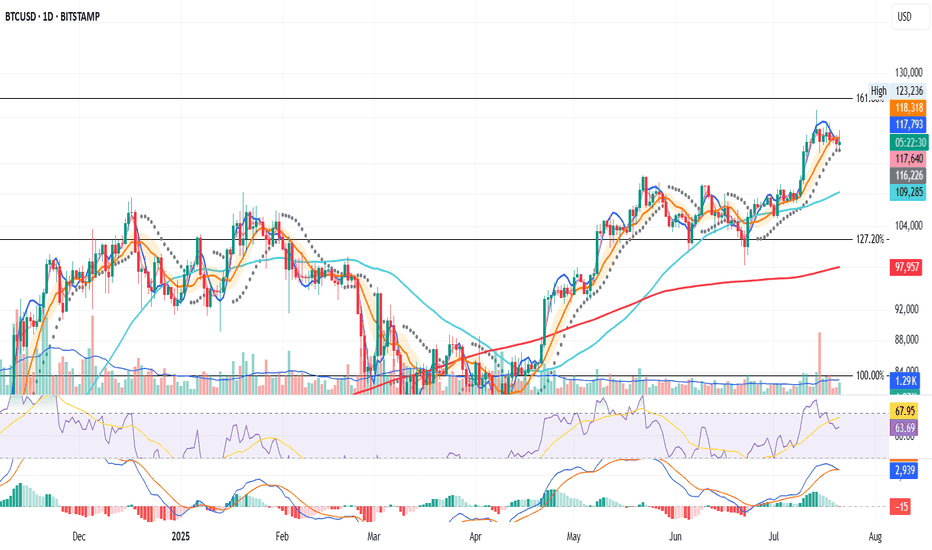

BTC Update – Short-Term Pressure Building

Bitcoin is still being pushed down below the BB center.

RSI is trending lower, and MACD is nearing a bearish crossover.

PSAR is hovering close to price, a warning sign.

This could still be a pause before the next leg up — but don’t ignore the signs.

And just a thought: Trump Media buying $2B in BTC might’ve marked a local top.

Prepare in advance.

Always take profits and manage risk.

Interaction is welcome.

Bicoin

Caution on Crypto, Tech, SPXI know its a mess, this is just for me anyway.

I tend to overcomplicate things so now then, lets over simplify for my monkey brain:

Trend line broken = Warning, thing are likely to change ( even though you didnt get the bull market you wanted)

Watch said trend retest, look for weakness, struggling price action

selling on the retest of the top lows last time would offer you 5% off the peako top, (Thats really good!! stop being a perfectionist)

I am very much frustrated with this market, never got the crazy part I was waiting for. But the lack of euphoria is really not that unreasonable when you think about what has been goin on the past 5 years. Everyone is poorer liquidity has been super tight to curb inflation and we still got NASDAQ:NDX up 150% Coinbase NASDAQ:COIN did a 10x and I still am not happy(likely due to the max pain trade of my life COINBASE:ETHUSD ). I have realized that I have been hoping for another 2018 bull run. It may or may not happen, but I can't expect any market to reflect that in any significant way. Markets are much more dynamic than I give them credit for sometimes. They will rhyme but often in ways you do not expect and will not be made clear until that little bastard hindsight kicks in, showing you how obvious it was.

BTCUSD Bitcoin Long in short-midtermBTC trend is changing,seems temporarily (Until April2nd 2025) it is builidng a support.

Intrady apporaches:

CONSERVATIVE

and aggressive

I cover the stops of others intraday,also profit targets and sell positions of midterm bears,to re-enter long .Simple.

The hiigh volatility guarantees fast moves,but also imbalances,and I take them as my advantage.

Your stop should be individual,because stop means to everybody something different.Some use levels,some use %-risk of account balance or initial balance.

#BICO/USDT#BICO

The price is moving in a descending channel on a 1-day frame and sticking to it well

We have a bounce from the lower limit of the descending channel and we are now touching this support at a price of 0.1676

We have an upward trend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.2170

First target 0.2555

Second target 0.3027

Third target 0.3628

Bitcoin Analysis Base On Eliott Wave Theor and Macro EconomicsBitcoin Projection

Base On Technical Analysis Eliott Wave Theory & Macro Economics

Target Price (Bullish Scenario) :

🔹$108.000 = Fibo Extend 1.272

🔹$134.000 = Fibo Extend 1.414

🔹$182.000 = Fibonacci Extend 1.618

INDEX:BTCUSD

BINANCE:BTCUSDT

Be Careful :

🔹BTC might pullback before breaking out over $100K.

🔹BTC is now in the final Impulse Wave (Wave 5). When Wave 5 finishes, a deeper correction might happen

DISCLAIMER :

🔹BTC might pullback before breaking out over $100K.

🔹 Fibo Extend 1.618 is hard to visit, it'll take a while & need some corrections.

🔹Consider trailing TakeProfit in $108K-$134K (In case BTC successfully breakout from $100K)

🔹Be careful of unexpected bad news.

🔹Watch US inflation rates during The FED's rate cuts, as higher liquidity will boost purchasing power and impact inflation.

🔹ETF's Inflow have entered too much, one day hedge funds will taking profit, be careful !.

🔹Donald Trump's company tax cut policy will impact to inflation. If it happens, The FED might have to stop rate cuts, or even raise interest rates.

BICO Technical Analysis in a Weekly TimeframeHello everyone, I’m Cryptorphic.

I’ve been sharing insightful charts and analysis for the past seven years.

Follow me for:

~ Unbiased analyses on trending altcoins.

~ Identifying altcoins with 10x-50x potential.

~ Futures trade setups.

~ Daily updates on Bitcoin and Ethereum.

~ High time frame (HTF) market bottom and top calls.

~ Short-term market movements.

~ Charts supported by critical fundamentals.

Now, let’s dive into this chart analysis:

BICO recently hit a new all-time low at $0.1631. With the current price at $0.2497, BICO is holding the support trendline, and it's likely to bounce back if it maintains this support.

If a rebound materializes, we could see a 300%-500% rally in BICO in the coming weeks.

Note: BICO needs to maintain the support trendline to stay in the game. A weekly close below the support trendline could have negative consequences for BICO.

Key levels:

- Crucial Support/Accumulation: $0.21.

- Target: $0.97 to $1.3,

- Invalidation: A weekly close below $0.21.

DYOR, NFA.

Please hit the like button to support my content and share your thoughts in the comment section. Feel free to request any chart analysis you’d like to see!

Thank you!

#PEACE

BTC/USD - Massive Move Expected!🚨 A massive move expected on #Bitcoin

Ascending triangle detected. Once the price break this formation we will know where BTC goes next.

High timeframes remain bullish, but on daily the MACD did a bearish cross.

Pull back and then pump? Or we FOMO above 36k?

Like and follow for more!

Crypto is on the Brink of NEW BULL MARKET!🚨 Ladies and gentlemen, we're on the brink of a new bull market.

There is nothing anyone can do to stop this.

#Bitcoin has delivered once again.

Expect a breakout and re-test of the $1.3T level as support, then moon.

A rejection here is unlikely.

Enjoy the ride.

Like and follow for more ideas!

Bitcoin current situation and future ) Guys, and Ladies, my congrats!

We will have the big chance in our future to make millions by crypto )

All information on graph.

The #3 big wave of big grand supercycle approx should take 1-2 million $ price.

Timing the same 10-12 years from 2024.

Also the same i'm checking on stables domination.

Good luck for all of us )

See on Y point in next 6 month )

BTC HALVING APRIL 26Dear Ziilllaatraders,

Why is the halving such a important date?

Reduced Supply and Increased Scarcity:

Halving events significantly reduce the rate at which new Bitcoins are introduced into circulation. This reduction in supply contributes to increased scarcity over time. Historical data suggests that decreased supply often leads to upward price movements for Bitcoin.

Price Volatility and Speculation:

Bitcoin's halving events have been accompanied by increased price volatility. Traders and investors tend to speculate on the impact of reduced supply, causing significant price fluctuations. This volatility presents both opportunities and risks for market participants.

Long-Term Price Appreciation:

While short-term price movements can be unpredictable, the overall trend following previous halvings has been long-term price appreciation. This trend aligns with the fundamental principles of reduced supply and growing scarcity, establishing Bitcoin as a valuable digital asset over time.

Considering past halving events, we can outline potential scenarios for the 2024 halving:

Positive Price Momentum:

Based on historical patterns, there is a reasonable chance that Bitcoin's price will experience positive momentum after the halving. This scenario may attract increased interest from investors and traders, potentially driving the price upward.

Short-Term Volatility:

Previous halvings have demonstrated short-term price volatility. Market sentiment, investor behavior, and external factors can all contribute to price fluctuations. Traders should exercise caution and be prepared for short-term market swings.

Long-Term Growth Potential:

Bitcoin's steady growth and expanding mainstream acceptance suggest a favorable long-term outlook. The 2024 halving could act as a catalyst for continued price appreciation, driven by reduced supply, increasing adoption, and institutional involvement.

Conclusion:

As the 2024 Bitcoin halving approaches, we must stay informed and analyze market dynamics. While past halving events provide valuable insights, they do not guarantee future outcomes. It is essential to remain updated, monitor market developments, and employ sound risk management strategies.

Greetings,

Ziilllaatrades

Bitcoin – Has the Uptrend began?Basic Assumptions:

Before I present my TA for your consideration, I would like to state my basic assumptions:

1. Price is efficient. Any imbalance in Price must be resolved before further continuation.

2. There is liquidity, short stops, Between 27,240 – 27,700.

3. The market is designed to play with our feeling and uncertainties.

4. The current short-term downtrend has not been invalidated.

5. Weekend PA is based on retail activity and low volume. Do not trust weekend pumps.

6. The 25,000 level has not been tested. Logic dictates that there is a lot of liquidity there, waiting to be taken.

Deep Dive:

1. Price is efficient: Price moves in the most efficient manner possible. Meaning that every red candle must be balance by a green candle or a wick. On May 24th Price created an Imbalance, Red candle without an opposing green candle or a wick. This liquidity (red box) has now been taken.

2. Liquidity/Short Stops: 27,650 is the range high. We have been in a range since May 11th. Logic dictates that most short sellers placed their stops at the range high. This buy-side liquidity could be targeted to fuel the move to the downside.

3. Emotions: The market is designed to play with our emotions. You may think that the market is bullish and that if you don’t get in now, you will miss a substantial move. However, the market will always give you a second chance. Patience. Wait for the proof of the move before you risk your hard-earned money.

4. Invalidation Level: As mentioned above, the range high is at the 27,500 level, give or take 200$. As long as the range high is not broken, we have to assume that the current trend is to the downside.

5. Weekend: Lets face the facts: Weekend trading volume is usually low, and the PA is not to be trusted. The heavy hitters are not at the office over the weekend. The only people trading on the weekend are retail traders and algos. Not saying that this move can’t be real, but let’s have patience. If this move is genuine there will be further upside after the weekly close and next week.

6. Sell Side Liquidity: If the Market Makers are truly interested in a big move to the upside, they will gather cheap liquidity first. Where is the cheap liquidity? At the 25K level or below.

My Trade Idea:

Entry:

27,400 (Wait for some bearish divergences and/or a clear rejection.)

SL:

27,700 (Could be a bit higher, depends on the entry)

Targets:

25,800 (Range low).

25,200 (Daily support).

24,650 (0.5 fib).

Invalidation:

Weekly close and Monday open above 27,700$

NFA

Patience – Financial Advice.

Best wishes to all.

Feedback will be appreciated.

Bitcoin Head and Shoulders BreakdownBitcoin is breaking the neckline here for the current Head and Shoulders pattern that's been forming the last few weeks.

My target for Bitcoin is to come down and re-test the important support zone at / around $25,300 - $25,500 which would be a strong support level to bounce from.

Having a reset here and providing a slid launch point would likely push us to the Fib Golden Pocket around FWB:48K -$50k

What do you think?

The direction of movement is visibleThe direction of movement is visible

The direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visibleThe direction of movement is visible

The direction of movement is visible

Bitcoin by end of June - 48k?Bitcoin looks like it would like to reach up and touch 48-50k..maybe even a little higher. People are calling dooms day for all markets..dooms day for everything every day, but what they forget is that Bitcoin is one of the only places to store your wealth in these uncertain times. With a world banking crisis, inflation, war, and economic trouble looming around the globe, people will run to Bitcoin as a safe haven that the globalist banking crime syndicate can't dilute or rig to steal from you. What do you think? Let me know..

Bitcoin : Be Ready for the next moves Good Day Everyone

Bitcoin's Consolidation at 28/28.5k Areas Suggests Possible Retest of 25k Areas

Bitcoin, the world's most popular cryptocurrency, has been consolidating in the 28/28.5k areas for some time now. This consolidation phase suggests that a possible downside move may be in the cards, with the 25k areas being the likely target for a retest.

One of the key indicators that support this bearish scenario is the RSI (Relative Strength Index), which is currently in overbought territory on the daily timeframe, with readings above 60 points. This level of RSI typically suggests that an asset is due for a corrective move.

Furthermore, the wave 5, which was previously discussed, is now completed, and any further extension would require a breakout above the 29k areas. However, the current price movements and volume do not seem to support such an upward move anytime soon.

Given the current market conditions, the best trading strategy, in my opinion, would be to sell around the 28.4/28.5k areas, with a stop-loss set above 29k. For those trading on leverage, it is advisable to use a low leverage of 3-5x maximum to minimize potential losses.

Overall, while there is still some uncertainty in the crypto market, the consolidation phase at the 28/28.5k areas and the overbought RSI suggest that a corrective move may be imminent, with the 25k areas being a likely target for a retest. As always, it is crucial to stay up-to-date with the latest market developments and adjust trading strategies accordingly.

Good Luck And Have A Nice Weekend

Good job! I can't hide my happiness

The perfect week is over. In this week’s trading, the long orders of gold around 1832, the long orders of GBPUSD at 1.930 and the short orders of 1.201, the long orders of EURUSD at 1.589, and the long orders of BTC around 22326 are all TP , so that I get a very good profit from it, Good job!

I am very confident that I will maintain or even surpass this week's success in the next transactions, and I believe that we will all achieve greater profits!

$BTC MAY have lil more pain but look at Alts! Nibble from profitNibbled on #crypto very close to lows

$MKR + $JASMY rebought 1/2 position sold

Volume comes heavy on buys will +

$TRU close to moving avg

Also bought some $FEG - Team was sarcastic when I said change the tokenomics, year later they're doing it

#memecoin #altcoin