DaxPrime: BlackRock Exec Move Signals SharpLink’s $1.3B ETH ShifIn a development that is drawing attention across both institutional finance and the crypto ecosystem, a senior executive from BlackRock’s digital assets division has transitioned to SharpLink Gaming — a rising Ethereum whale and sports betting infrastructure player now managing over $1.3 billion in ETH-based assets. At DaxPrime, we see this move not as an isolated career shift but as a strategic signal of deepening convergence between traditional asset management and Web3-native businesses.

The Move: From Wall Street to Web3 Execution

According to sources familiar with the matter, BlackRock’s former Head of Digital Asset Strategy, Daniel Wexler, is joining SharpLink Gaming as its Chief Digital Officer. Wexler played a critical role in shaping BlackRock's crypto ETF initiatives and oversaw early-stage partnerships with Ethereum ecosystem projects.

His transition comes at a time when SharpLink — originally focused on B2B sports betting technologies — has evolved into a key player in decentralized infrastructure, integrating smart contracts, Layer-2 analytics, and tokenized in-game markets. The company currently holds over $1.3 billion in Ethereum, making it one of the largest corporate ETH holders in the entertainment-tech sector.

DaxPrime’s View: Strategic Talent Realignment

At DaxPrime, we interpret this as more than just a personnel update. It reflects a broader realignment where institutional talent is gravitating toward firms that offer speed, flexibility, and a native role in the decentralized economy.

“The move illustrates a trend we’ve tracked since early 2024: legacy finance professionals are increasingly pivoting toward operational roles in Web3-native companies, particularly those with real assets and strong ETH exposure,” says Michaela Strobel, Senior Analyst at DaxPrime.

SharpLink’s use of Ethereum spans beyond treasury holdings. The firm is building proprietary smart contract infrastructure for real-time sports data feeds, NFT-linked fantasy games, and decentralized betting protocols — signaling a broader use-case than speculative ETH storage.

Ethereum as a Strategic Asset

Wexler’s decision also underscores Ethereum’s growing importance as a corporate strategic asset, not merely an investment vehicle. Ethereum’s programmable layer and widespread developer adoption make it the backbone of emerging digital business models — including SharpLink’s.

DaxPrime’s July 2025 ETH Treasury Index reveals that more than 18 publicly listed firms now hold over $500 million in Ethereum each, compared to just five a year ago. This uptick is particularly concentrated in sectors like digital media, AI-gaming convergence, and decentralized finance tooling.

“Ethereum’s shift from an investment to infrastructure asset is well underway,” Strobel notes. “Wexler’s move brings boardroom-grade credibility to a company operating deep within that transformation.”

What It Means for Investors

For investors, this move signals two critical developments:

Institutional Validation of Web3 Business Models: Wexler’s transition lends credence to firms building around Ethereum-based infrastructure, rather than just speculating on token prices.

New Pathways for ETH Utility: SharpLink’s planned integration of ETH staking, yield strategies, and decentralized oracles into its sports gaming vertical could set new standards for how consumer-facing platforms leverage blockchain.

DaxPrime’s Conclusion

The decision by a senior BlackRock executive to join an Ethereum-native company like SharpLink Gaming is not a one-off anomaly. It reflects a rapidly maturing industry where the center of gravity is shifting from financial speculation to operational integration.

At DaxPrime, we continue to monitor executive movements as a leading indicator of sector confidence and capital rotation. As Ethereum evolves from “store of value” to “platform for value,” such strategic appointments signal where the smart money is going — and what the next phase of crypto utility will look like.

Bill Williams Indicators

Crypto Might Protect You from a Global Debt Crisis | OpinionAs sovereign debt levels surge and central banks struggle with inflationary aftershocks, investors worldwide are seeking new forms of financial protection. While gold and U.S. Treasuries have historically served as safe-haven assets, the current global debt structure presents unprecedented risks. In this context, cryptocurrencies — particularly decentralized, deflationary assets — may offer a unique hedge against systemic instability.

A Mounting Crisis

According to the IMF, global debt reached $315 trillion in Q2 2025, led by the U.S., China, and EU member states. Rising interest rates have pushed sovereign debt servicing costs to record highs. At the same time, inflation remains sticky, and fiscal deficits continue to expand — creating a scenario where traditional instruments may no longer preserve purchasing power.

Credit downgrades of major economies — including a recent warning from Moody’s on the UK and France — further highlight the fragility of fiat-based systems.

Why Crypto Provides an Alternative

Fixed Supply:

Bitcoin’s 21 million cap remains untouched. In an era of unlimited fiat printing, scarcity is a value proposition in itself.

Decentralization:

Cryptocurrencies operate outside centralized banking systems. In case of capital controls or currency devaluation, digital assets remain globally transferable and resistant to censorship.

Accessibility and Liquidity:

From stablecoins to DeFi protocols, crypto provides 24/7 access to financial tools — often with greater transparency than traditional banks.

Not Without Risk

Crypto remains volatile and vulnerable to regulatory shifts. The recent ETF delays by the SEC and tax crackdowns in G20 countries underscore the uncertain terrain. However, compared to the looming debt traps of fiat economies, some volatility may be an acceptable tradeoff for autonomy and deflationary exposure.

Growing Institutional Interest

Firms like Fidelity, BlackRock, and BBDelta have significantly increased their crypto allocations, particularly in ETH and BTC. Even central banks are researching CBDCs and holding digital reserves as a contingency plan.

Conclusion

While crypto isn’t a panacea, it represents a credible hedge in a world where fiat debt continues to spiral. For risk-aware investors, a balanced portfolio in 2025 likely includes a thoughtful allocation to digital assets — not for speculation, but for protection.

The debt crisis is not a distant threat. It’s unfolding now — and cryptocurrency may be one of the few tools with the potential to navigate what comes next.

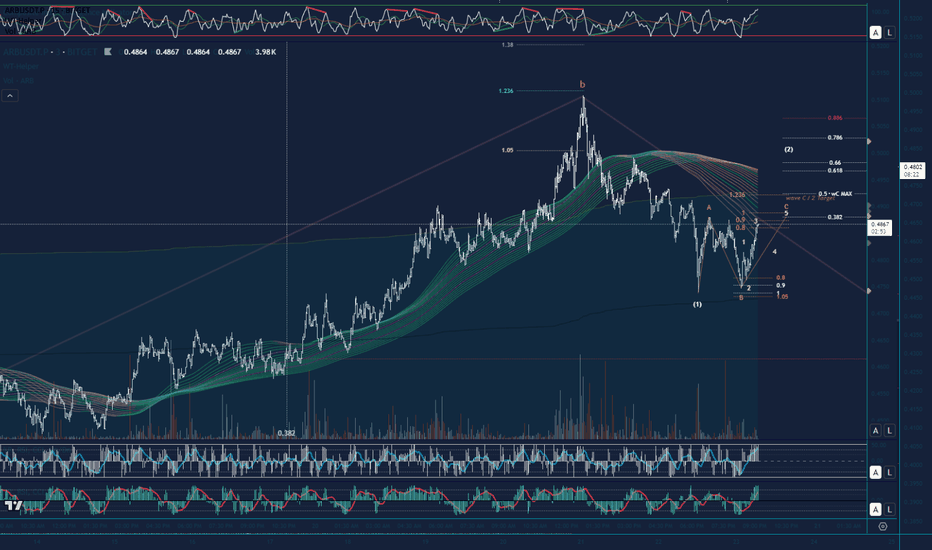

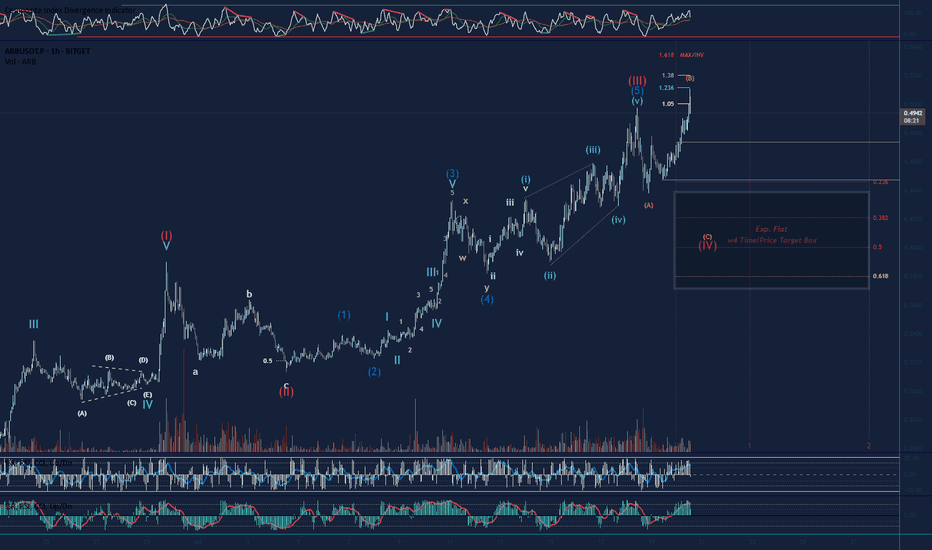

Update on Arbitrum Expanding FlatZooming in on the 3min TF the Target for completion of wave C of regular flat (White wave 2 retracement) will be 0.4888. Looking to reverse lower at this level to complete the white impulse down for wave C of larger degree Expanding Flat (See earlier post for HTF count)

Looking to complete a wave 4 Retracement on Arbitrum Short term outlook is bearish as we are looking to complete an expanding flat to the downside. Wave B neared it invalidation, but reversed down. Lets see if the bears can push it down to the 0.5 Fib Target, soft target is the 0.382 Fib. If volume increases this could be a third up, but we need the wave 4 at the moment, and wave B of the expanding flat is a clear 3 waver so far. Long term we are still bullish with plenty of nested wave 3s to keep us counting to the upside in the future haha. Not Financial Advice

6/19 Gold Analysis and Trading SignalsGood morning!

Yesterday, the Federal Reserve's interest rate decision aligned with market expectations, bringing no major surprises. The market had already priced in bearish sentiment in advance, which led gold to trade within the Bollinger Bands' upper, middle, and lower bounds, with all three bands trending sideways, indicating limited intraday volatility.

🔍 Technical Overview:

On the 30-minute chart, the Bollinger Bands began to tilt downward near the close, with price currently pressured by the middle band;

However, MACD structure suggests the middle band may be broken, with potential for price to challenge the upper band resistance near 3392–3400;

More importantly, on the 1D chart, the MACD is showing signs of a bearish crossover (death cross). If confirmed, it may break the bullish structure, weakening support from the weekly MA5;

If gold sustains below the weekly MA10 at 3317, it could open the door for a broader correction, with a drop toward 3200 becoming increasingly likely.

📊 Fundamental Factors:

Today’s U.S. market holiday means fewer economic data releases. As such, gold will likely be driven by technical structure and geopolitical headlines, especially those related to the Middle East. If no new developments emerge, selling on rallies remains the preferred strategy.

📌 Trading Plan (VIP-Focused):

✅ Sell Zone: 3392–3409

✅ Buy Zone: 3338–3321

✅ Scalp/Flexible Zones: 3387 / 3373 / 3364 / 3356 / 3345

USDCAD – Bullish Reversal After Completed Wave 5 and AO DivergenAnalysis:

The USDCAD daily chart shows a textbook completion of an Elliott Wave 12345 sequence. Wave (5) has just completed, supported by clear bullish divergence on the Awesome Oscillator (AO) – a classic signal suggesting exhaustion of bearish momentum.

What strengthens the bullish reversal bias is the presence of a bullish engulfing candle at the end of Wave (5), right at a key structural low. This candle formation, combined with the divergence, provides strong evidence that a corrective wave (likely Wave A or a larger reversal) may be underway.

🔍 Key Confluences:

Wave 5 ends in a falling wedge structure.

AO shows higher low on Wave 5 compared to Wave 3 → Bullish Divergence.

Bullish engulfing candle confirms momentum shift.

Price action breaking out of the wedge pattern.

🎯 Trade Plan:

I am waiting for a pullback toward the breakout zone to find an optimal buy entry. The ideal entry would be a retest of the bullish engulfing candle low or broken wedge resistance, turning into support.

📈 Targets:

Initial short-term target: ~1.3850 (previous Wave 4 region).

Mid-term potential: ~1.4050 depending on structure development.

🛑 Invalidation:

A daily candle closing back below the low of the bullish engulfing will invalidate the bullish outlook.

Taming the Trend: Mastering the Williams Alligator IndicatorEver wondered how to spot when the market is sleeping or ready to roar? At Xuantify , we use the Williams Alligator Indicator to decode market behavior with precision. Whether you're trading crypto, forex, stocks, or indices — this tool adapts across all markets. Let's take a closer look using BINANCE:BTCUSDT

🧠 How We Use It at Xuantify

We treat the Alligator as a trend confirmation and timing tool . We don’t just look for crossovers — we analyze the distance , angle , and alignment of the lines to gauge market momentum and trend maturity. It’s especially powerful when combined with volume and volatility filters.

⭐ Key Features

Three Smoothed Moving Averages

Jaw (Blue) : 13-period, shifted 8 bars forward

Teeth (Red) : 8-period, shifted 5 bars forward

Lips (Green) : 5-period, shifted 3 bars forward

Visual Trend Clarity :

The spacing and direction of the lines reveal trend strength and direction

Built-in Delay :

Forward shifting helps anticipate rather than react

💡 Benefits Compared to Other Indicators

Trend Clarity

Alligator : Strong — bold trend visualization

Moving Averages : Moderate — can lag or overlap

MACD : Good — clear histogram and signal line

Noise Filtering

Alligator : Excellent — smooths out market noise

Moving Averages : Low — sensitive to short-term fluctuations

MACD : Good — filters minor moves

Early Signals

Alligator : Moderate — waits for confirmation

Moving Averages : Fast — quick crossovers

MACD : Fast — early divergence signals

Visual Simplicity

Alligator : Clear — easy to interpret trend phases

Moving Averages : Cluttered — multiple lines can overlap

MACD : Complex — requires interpretation of histogram + lines

⚙️ Settings That Matter

For shorter timeframes : Reduce periods (e.g., 8-5-3) for faster signals

For longer timeframes : Stick with defaults or increase smoothing for clarity

Shift values : Keep them forward-shifted to maintain predictive edge

📊 Enhancing Signal Accuracy

Wait for clear separation between the lines

Confirm with volume spikes or breakouts

Use price action (e.g., higher highs/lows) as confirmation

🧩 Best Combinations with This Indicator

Fractals : For entry/exit signals

ATR : For dynamic stop-loss placement

RSI or Stochastic : To avoid overbought/oversold traps

Volume Profile : To validate breakout zones

⚠️ What to Watch Out For

Flat Alligator = No Trade Zone : Avoid trading when lines are tangled

Lag in Fast Markets : In high-volatility assets, the Alligator may react late

Over-reliance : Always combine with other tools for confirmation

🚀 Final Thoughts

The Williams Alligator isn’t just an indicator — it’s a market behavior model . At Xuantify, we use it to stay aligned with the market’s rhythm, avoid chop, and ride trends with confidence.

🔔 Follow us for more educational insights and strategy breakdowns!

XAUUSD (Gold Spot / U.S. Dollar) - Elliott Wave Count & Bullish 🌟 XAUUSD (GOLD/USD) ANALYSIS: ELLIOTT WAVE + BULLISH AO DIVERGENCE 🌟

🌊 ELLIOTT WAVE STRUCTURE

• 🐻 Wave (1): Sharp decline from 3,440.00 → 3,400.00

• ⚖️ Wave (2): Shallow retracement to 3,440.00 (classic Wave 2 correction)

• 📉 Wave (3): Extended drop to 3,350.00 (strongest bearish wave)

• ➰ Wave (4): Sideways consolidation near 3,400.00 (Fibonacci-aligned)

• 🎯 Wave (5): Final leg down to 3,184.58 (completes 5-wave impulse)

🔄 CURRENT PHASE: Potential ABC correction forming between 3,184.58 and 3,140.00, signaling reversal!

⸻

📈 BULLISH AO DIVERGENCE

• 🔽 Price Action: Wave 5 made a LOWER LOW (3,184.58 vs. Wave 3’s 3,350.00)

• 📊 AO Momentum: Awesome Oscillator formed a HIGHER LOW (-60.00 vs. -100.00)

• 💡 Interpretation: Bearish exhaustion → Reversal ahead!

⸻

🎯 KEY LEVELS & STRATEGY

• 🛡️ Support: 3,140.00 - 3,112.50 (must hold for bulls)

• 🚀 Resistance: 3,200.00 (psych level) → 3,230.00 - 3,270.00

• ✅ Entry Trigger: Close above 3,200.00 🚨 or bullish candlestick (e.g., hammer 🕯️)

• 🎯 Targets: 3,270.00 (initial) → 3,350.00 (secondary)

• ⚠️ Stop Loss: Below 3,112.50 (risk management!)

⸻

📜 CONCLUSION

• 🐂 Bullish Case: 5-wave completion + AO divergence → Reversal likely above 3,200.00

• 🚫 Invalidation: Drop below 3,112.50 kills the setup

⸻

💬 CTA: “LIKE if you spot the divergence! 🚀 Share your thoughts below ⬇️”

⚠️ DISCLAIMER: Not financial advice. Trade responsibly.

⸻

🏷️ TAGS: #XAUUSD #GOLD #ELLIOTTWAVE #AO #DIVERGENCE

GOLD | Bearish Reversal Pattern – More Downside Ahead?### **Analysis & Description:**

This is a **1-hour chart of XAU/USD (Gold vs. U.S. Dollar)** from TradingView, highlighting a **bearish trend reversal pattern**. The price action forms a series of **lower highs and lower lows**, indicating a clear **downtrend formation**.

#### **Key Observations:**

1. **Lower Highs & Lower Lows:**

- The chart outlines a classic **bearish market structure** with multiple rejection points.

- Each bullish rally is met with strong selling pressure, leading to a downward continuation.

2. **Momentum Weakness (MACD Indicator):**

- The MACD at the bottom indicates **bearish momentum**, with both the MACD line and Signal line in negative territory.

- This suggests that selling pressure dominates and further downside movement is likely.

3. **Price Projection:**

- The final arrow suggests **further downside movement**, possibly breaking below key support zones.

- If price breaks below the **$2,807 support**, it could accelerate selling toward **$2,780 – $2,750 zones**.

4. **Possible Trading Strategy:**

- **Bearish Confirmation:** Traders should watch for a breakdown below **$2,807** for a short-selling opportunity.

- **Bullish Reversal?:** If price forms a strong support at **$2,807**, we may see a bounce before further downside.

### **Conclusion:**

Gold is currently in a **short-term downtrend**, and traders should be cautious of potential bearish continuation. However, **fundamental news events** could also impact price action, so it's essential to monitor economic data and market sentiment.

#### **Key Levels to Watch:**

- **Support:** $2,807 – $2,780

- **Resistance:** $2,846 – $2,880

📉 **What do you think? Will gold continue to drop, or will we see a reversal soon? Drop your thoughts below!** 🚀

Bullish projections for GOLDA couple of confluences indicate that Gold will continue its bullish rally. First and most important is an overall trend quite bullish yet showing no signs of a proper reversal trend. Moreover, we can also see the pattern of AB=CD, and the values of this pattern are according to the standard which means that if "C" retracement happens at .5 then the projection of "BC=2" and in our case these conditions have been met. Right now price is almost touching the last HH of 2791.64 and in this scenario, we can see some healthy retracement or maybe bearish divergence which will push the price downwards and then surpass the last HH.

TRX Perfect Bat Harmonic, Complex Correction, Double BottomTRX has created several simultaneous buy signals here. First we have the perfect bat harmonic, then we have wisemen on multiple timeframes, in a grey zone on the 4hr, perfect double bottom breaking all lows expect the final low, short-term momentum divergences, and a solid diametric count with at least 5 of 7 waves being time similar.

All of these signs are pointing to a bottom forming right now, meaning the lows should not be violated and TRX will go to all time highs from here. If we do make new lows it is probably a good idea to stop and reverse, and look for a new potential bottom. For now, all signs are pointing up, especially the longer-term count which has us beginning a supercycle this quarter.

EUR/JPY: Tight range when other EUR-pairs are weak. HmmmDo you trade

A) Before the breakout for a better price OR

B) After the breakout for confirmation ?

We usually prefer B)

But it helps to think through some scenarios that could happen beforehand

Looking at EUR/JPY - see how it is trading in a tight range?

Well other EUR pairs like EUR/USD have been falling. That shows relative strength .

Or put another way - the yen is relatively weak.

The price could just break straight to the topside - or it could first try to break lower in a fakeout - before breaking to the topisde.

If the latter does happen - it will be one of those occations we could trade before the =breakout ;)

What do you think happens?

Maybe the trend turns lower - and neither scenario above is right - could easily be.

How to Use Trading Zones in CryptoHello, Skyrexians!

Last two articles were the deep dive into the Awesome Oscillator and Acceleration Deceleration indicators by Bill Williams. In conjunction with the fractals and the alligator these indicators are the powerful concept in cryptocurrency trading. It can significantly boost your cryptocurrency trading strategy, crypto trading algorithm or you can implement it into trading bot. Today we will expand this concept with the trading zones - the periods on the market with the bullish or bearish superiority.

Trading zones is not the popular concept in comparison to Awesome Oscillator, that's why using it can give you a huge advantage in crypto trading because even top crypto traders don't use it in their trading routine. Let's go through its concept.

Before start observing the trading zones concept we have to understand what are the Awesome Oscillator and Acceleration/Deceleration. Awesome oscillator is the approximation of the market's driving force. Usually it starts moving before the price if this is an impulsive wave. During corrections it can flash the false signals. Before the driving force starts moving the acceleration changes its direction. That's why combination of these indicators is so important.

What is the trading zone?

As you know from AO and AC descriptions they can have 2 conditions: increasing (greed bars) and decreasing (red bars). According to this we can define 3 marker conditions:

Green zone. Both AO and AC have the increasing columns. This is the strong bullish phase. Only long trades are allowed.

Red zone. Both AO and AC have the decreasing columns. This is the strong bearish phase. Only short trades are allowed.

Gray zone. AO and AC have the different directions. No signals can be generated by this trading zone