USD/PLN 1H Chart: Descending TriangleUSD/PLN 1H Chart: Descending Triangle

The American Dollar is losing value against the Polish Zloty in a pattern that has the features of a descending triangle.

An impulse necessary for its formation was given by an announcement of the US Federal Funds Rate on Wednesday.

In theory, the currency rate should exit the pattern in the southern direction.

On validity of this scenario indicate combination of the 20-, 55-, 100-, 200-period SMAs and the weekly PP that exercise pressure on the pair from the top.

On the other hand, the lower trend-line coincides with the monthly S2 at 3.6160, which has already proved to be a strong support barrier (6 prior rebounds).

Besides, there is a chance that even if the pair breaks downwards, the fall would be stopped near 3.6107, to which point out three William’s fractals.

Bill Williams Indicators

AUDUSD 30 m Channel Break Short "Break-Hook-Go"This is great example of a Break Hook Go entry on price breaking a trend line. SL above the ma's. TP is a resistance level. This is also an entry on our Bill Williams Awesome Oscillator (AO) strategy. There is divergence in price with a higher high but the AO is diverging downward creating two twin peaks. You enter this trade when the first red bar of the AO is below the 0 line.

We have many different strategies to learn on our blog and we are constantly coming out with new strategies for traders to learn every week. Visit us below on the website, Twitter or Facebook.

Watch and try our new “Five Candle Mastery Trading Strategy”. It is available now on our website.

New Short Reversal on AUDNZD 1 H - lower lows lower highsI tried this pair yesterday with the Bill Williams Awesome Indicator Strategy but my rule four (enter when AO crosses 0 line short and paints first red bar) kept me out of the trade. This saved me from getting into a trade when the pair wasn't ready to short and the timing was wrong. Today I see that a new reversal short trade is setting up again. On the 1 H chart I see several lower lows and lower highs. My Macd is overbought. I am entering with a sell limit just below the 50 level @ 1.0547. Early this morning the pair spiked down to 1.0494. So I want to bank my money early, I am closing all my positions at 1.0503. The Day and 4 H charts show TP levels @ 1.0480 and 1.0450 areas (resistance on 1 H shows current resistance around 1.0460 area). Watch 15 m chart when price is around these TP areas for your exits. We have many different strategies to learn on our blog and we are constantly coming out with new strategies for traders to learn every week. Visit us below on the website, Twitter or Facebook.

Bill Williams Awesome Oscillator Trading Strategy on AUDNZD 1 H I am waiting for the Awesome Oscillator to cross below 0 line on my 1 H chart. As soon as the 1st red bar post I will enter. I will exit when two consecutive green bars display on the AO. This has the potential for a big move. On my MT4 I have additional entries at these levels - 1.05449, 1.0527, 1.0507. These entries were based on past Sup/Res levels. My exit for all of these additional entries is 1.0480 based on a past res level.

BABA: Update, Strength Likely To ContinueSince I recommended BABA-on June 7th the stock is up 20 points (17%).

There is likely to be "backing and filling", but I believe the up-trend in-BABA will continue for the rest of 2017.

If you are looking for a target, my preliminary goal would be $165-$170.

From a technical standpoint, Here are the positives for-BABA:

1. Currently multiple buy Fractals.

2. The top upper indicator is a 34 day moving average, and this is positive. Very strong.

3. The alligator is feeding in the uptrend.

4. Prices are trading above the Ichimoku Cloud .

5. The Forward Momentum indicator (lower top) is strong. **

6. The Ichimoku Cloud is rising.

7. The 233 day moving average trend line is rising (this is a Fibonacci number).

8. According to Bill Williams, you can establish an entry point, again and again, with each new valid Fractal.

9. The indicators under the chart (Chop, Chop Zone) have been green (up) for a long time. This is positive if you are long. But (important), when there is a draw-down, you can use this opportunity to establish your entry point, or, accumulate more in your position.

** The lower indicator on top is a forward projection. For an estimation of possible FORWARD TRENDING I use the Ichimoku Cloud Senkou Span A (Leading Span A): (Conversion Line + Base Line)/2)). This is the midpoint between the Conversion Line and the Base Line. The Leading Span A forms one of the two Cloud boundaries. It is referred to as "Leading" because it is plotted 26 periods in the future and forms the faster Cloud boundary. I then make an oscillator out of this and plot the progress up and down around a “zero line”.

BABA-has consistently been strong. Their P/E multiple is around 20. I believe this is cheap for a company that is growing at 40%.

May all of your trades go well.

Don.

BABA: Strong Pattern Suggests Continued GrowthMany compare BABA-to-AMZN.

From a technical standpoint, Here are the positives for-BABA:

1. Currently multiple buy Fractals.

2. The top upper indicator is a 34 day moving average, and this is positive. Very strong.

3. The alligator is feeding in the uptrend.

4. Prices are trading above the Ichimoku Cloud .

5. The Forward Momentum indicator (lower top) is strong. **

6. The Ichimoku Cloud is rising.

7. The 233 day moving average trend line is rising (this is a Fibonacci number).

8. According to Bill Williams, you can establish an entry point, again and again, with each new valid Fractal.

9. The indicators under the chart (Chop, Chop Zone) have been green (up) for a long time. This is positive if you are long. But (important), when there is a draw-down, you can use this opportunity to establish your entry point, or, accumulate more in your position.

** The lower indicator on top is a forward projection. For an estimation of possible FORWARD TRENDING I use the Ichimoku Cloud Senkou Span A (Leading Span A): (Conversion Line + Base Line)/2)). This is the midpoint between the Conversion Line and the Base Line. The Leading Span A forms one of the two Cloud boundaries. It is referred to as "Leading" because it is plotted 26 periods in the future and forms the faster Cloud boundary. I then make an oscillator out of this and plot the progress up and down around a “zero line”.

BABA-has consistently been strong. Their P/E multiple is around 20. I believe this is cheap for a company that is growing at 40%.

May all of your trades go well.

Don.

Profitable New Old StrategyThis was the first strategy that give me first steady profits. It is based on Bill Williams "Profitunity" system. I did remove all oscillators based on Moving averages and introduce RSI – the most powerful indicator on the planet. As you can see on the chart we have Alligator, Fractals and RSI. IN short: Fractal indicates Pivot Points end or beginning of individual Swings, Alligator shows changes to momentum (momentum moves first before price make any changes), and keeps us inform about swing directions (we need to stay in sync with trend and trade with trend, RSI indicates speed of momentum changes, price direction, divergences, trend directions, strong buy/sell signals.

Let’s take a look DAX chart (I trade only Currency Markets but this strategy works on all markets and all TF). Price just touch upper line of Orange Channel (longer term channel), there is Divergence between Price and Alligator Red Balance Line – indication of incoming correction to the last swing (last long four candles). RSI shows support level on 12600.00. last upper move it is not strong an enough to push price higher. We should expect correction to the down side. Last deep move on RSI shows also confirmation of continuation of upper trend. But that could change depend on French election.

cheers,

Jim Poniat

FNTP: USD/JPY Small retrace, then long for several days"From Noob To Pro Trader"-series: another test case and prediction from a complete noob :D. My mission is to become a better trader by making solid predictions. Then, learn form my mistakes and enjoy the times I was right.

I predict that, when the AO gives confirmation of a bearish market on the 4H level, we go down for a few hours, then we'll retrace from there and long for the next few days (bigger timeframe).

Any help & comments from pro's welcome!

If you want to support me, join 1Broker with my referral id: 1broker.com

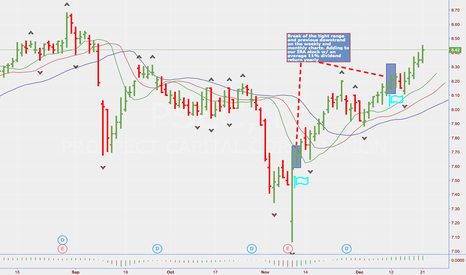

Intelsat SA-Low Priced Issue With Strong Upside PotentialIntelsat-SA-(I)-is a Luxembourg-based company that operates in the satellite services business. It provides communications services to media companies, fixed and wireless telecommunications operators, data networking service providers for enterprise and mobile applications in the air and on the seas, multinational corporations and Internet service providers. The Company is also a provider of commercial satellite communication services to the United States government and other select military organizations and their contractors.

On 2/28/2017, Intelsat-reported 4 quarter 2016 non-GAAP earnings of $5.56 per share. This result beat the $0.19 consensus loss of the 5 analysts covering the company and beat last year's 4 quarter results by $5.14. The next earnings announcement is expected on 04/26/2017. You can see this on the chart above, it was the huge price spike in late February.

The indicators I use remain very bullish (indicating continued strength).

From a technical standpoint, here are the positives for-I:

1. Currently a two buy Fractals (came in late February with the earnings related price upwards spike).

2. The top upper indicator is a 34 day moving average, and this is positive. Very strong.

3. The alligator is awake and is feeding in the uptrend.

4. Prices are trading above the Ichimoku Cloud .

5. The Forward Momentum indicator (lower top) is in an extremely strong position. **

6. The Ichimoku Cloud is green.

7. The 233 day moving average trend line is rising (this is a Fibonacci number).

8. You can establish an entry point, again and again, with each new valid buy Fractal.

9. The indicators under the chart (Chop, Chop Zone) have been green (up) for four weeks. This is positive if you are long. But (important), when there is a draw-down, you can use this opportunity to establish your entry point, or, accumulate more in your position.

10. Prices are trading above the thick red Ichimoku Cloud conversion line.

11. Prices are trading above the Ki jun-Sen baseline of the Ichimoku Cloud and this has been HEADING HIGHER.

** The lower indicator on top is a forward projection. For an estimation of possible FORWARD TRENDING I use the Ichimoku Cloud Senkou Span A (Leading Span A): (Conversion Line + Base Line)/2)). This is the midpoint between the Conversion Line and the Base Line. The Leading Span A forms one of the two Cloud boundaries. It is referred to as "Leading" because it is plotted 26 periods in the future and forms the faster Cloud boundary. I then make an oscillator out of this and plot the progress up and down around a “zero line”.

I HAVE THE RESULTS OF THESE CALCULATIONS FOR-INTELSAT IN THE TOP LOWER INDICATOR. IT IS VERY POSITIVE AND IS SHOWING STRENGTH.

Conclusion: I believe-Intelsat will work its way higher.

Disclosure: I own this stock and bought a position at $4.18.

May all of your trades go well. Don.

AMKR-Positive Technicals Suggest Up-Trend Will ContinueAmkor-Technology-is a provider of outsourced semiconductor packaging and test services. Their packaging and test services are designed to meet application and chip specific requirements, including the type of interconnect technology; size, thickness and electrical, and mechanical and thermal performance. It provides packaging and test services.

The current technical condition for AMKR-is strong and the chart pattern suggests that upward momentum should continue. Over the last 50 trading days, when compared to the-S&P-500, the stock has performed slightly stronger than the market when compared to this index. This relative out-performance is bullish. Over the last 50 trading sessions, there has been more volume on up days than on down days indicating that-AMKR is under accumulation, which is a another bullish condition. The stock is trading above a rising 50-day moving average. This supports the strong technical condition for-AMKR.

I think there is still up-side potential.

From a technical standpoint, Here are the positives:

1. Currently multiple buy Fractals (green up arrows in box on right).

2. The lower indicator under the chart is CHOP - this indicates a strong trend, however, the momentum has slowed.

The green shaded area below CHOP is the CHOP ZONE. This has been strong (up) for quite a while.

3. The top lower indicator is phase energy, and this is positive. It reversed to the up-side at the zero line.

4. The alligator is sleeping (neutral).

5. 34 day moving average (ohlc/4, top indicator) is strong.

6. Prices are trading above the Ichimoku Cloud .

7. Prices are trading above the thick red Ichimoku Cloud conversion line.

8. Prices are trading above the Ki jun-Sen baseline of the Ichimoku Cloud and this has been HEADING HIGHER.

9. The 13 day moving average of phase energy (top middle) is oversold and should reverse to the up-side.

10. The 233 interval trend-line is rising.

In my opinion, AMKR-is in a solid uptrend. I recommend that you also look at the semi-conductor index-SOX.

It has been a leading group this year.

I hope all your trades go well. Don.

NVDA: Breakout Or Fakeout? Most Indicators Say Upside BreakoutNVDA-was recently slammed by short sellers. I took positions in the mid $90 range.

In the past week I sold all of my positions, then bought them back and added more (after it dropped on Tuesday March 21).

I think there is still big up-side potential.

From a technical standpoint, Here are the positives:

1. Currently multiple buy Fractals (green up arrows).

2. The lower indicator under the chart is CHOP; readings below the shaded area (38.2) indicate a strong trend.

The green shaded area below CHOP is the CHOP ZONE. This has been strong (up) for quite a while.

3. The top lower indicator is phase energy, and this is positive. Very strong.

4. The alligator is feeding in the uptrend.

5. 34 day moving average (ohlc/4, top indicator) is strong.

6. Prices are trading above the Ichimoku Cloud .

7. Prices are trading above the thick red Ichimoku Cloud conversion line.

8. Prices are trading above the Ki jun-Sen baseline of the Ichimoku Cloud and this has been HEADING HIGHER.

9. The 13 day moving average of phase energy (top middle) is strong.

10. The 233 interval trend-line is rising.

In my opinion, NVDA-is in a solid uptrend.

Please note: $108.30 is a 50% retracement of the sell-off, and $111.29 is a 61.8 Fibonacci retracement of the same.

If (or when) this stock approaches $120, review structure for possible right shoulder of H&S formation.

Good luck to you on all your trades. Don.

PYPL: Upside Breakout LikelyThis is an update from my last PYPL-posting in late February.

At that time I was bullish for the stock .

The indicators I use remain very bullish (indicating continued strength with an upside breakout very likely).

From a technical standpoint, here are the positives for-PYPL:

1. Currently a THREE buy Fractals (highlighted in green box).

2. The top upper indicator is a 34 day moving average , and this is positive. Very strong.

3. The alligator is awake and is feeding in the uptrend.

4. Prices are trading above the Ichimoku Cloud .

5. The Forward Momentum indicator (lower top) is in a strong position. **

6. The Ichimoku Cloud is green.

7. The 233 day moving average trend line is rising (this is a Fibonacci number).

8. According to Bill Williams, you can establish an entry point, again and again, with each new valid buy Fractal.

9. The indicators under the chart (Chop, Chop Zone) have been green (up) for six weeks. This is positive if you are long. But (important), when there is a draw-down, you can use this opportunity to establish your entry point, or, accumulate more in your position.

10. Prices are trading above the thick red Ichimoku Cloud conversion line.

11. Prices are trading above the Ki jun-Sen baseline of the Ichimoku Cloud and this has been HEADING HIGHER.

** The lower indicator on top is a forward projection. For an estimation of possible FORWARD TRENDING I use the Ichimoku Cloud Senkou Span A (Leading Span A): (Conversion Line + Base Line)/2)). This is the midpoint between the Conversion Line and the Base Line. The Leading Span A forms one of the two Cloud boundaries. It is referred to as "Leading" because it is plotted 26 periods in the future and forms the faster Cloud boundary. I then make an oscillator out of this and plot the progress up and down around a “zero line”.

I HAVE THE RESULTS OF THESE CALCULATIONS FOR-PYPL IN THE TOP LOWER INDICATOR. IT IS VERY POSITIVE AND IS SHOWING STRENGTH.

Conclusion: I believe-PYPL will work its way higher. I FEEL AN UPSIDE BREAKOUT IS LIKELY.

The upside break-out is a move above $43.40, and then a new up-trend.

May all of your trades go well. Don.

PYPL Update: Mostly Bullish PatternsI published a chart for-PYPL two months ago. At that time I was bullish for the stock.

The indicators I use remain mostly bullish (indicating continued strength).

From a technical standpoint, Here are the positives for-PYPL:

1. Currently a buy Fractal (highlighted in green box).

2. The top upper indicator is a 34 day moving average , and this is positive. Very strong.

3. The alligator is awake and is feeding in the uptrend.

4. Prices are trading above the Ichimoku Cloud .

5. The Forward Momentum indicator (lower top) is in a strong position. **

6. The Ichimoku Cloud is green.

7. The 233 day moving average trend line is rising (this is a Fibonacci number).

8. According to Bill Williams, you can establish an entry point, again and again, with each new valid buy Fractal.

9. The indicators under the chart (Chop, Chop Zone) have been green (up) for six weeks. This is positive if you are long. But (important), when there is a draw-down, you can use this opportunity to establish your entry point, or, accumulate more in your position.

10. Prices are trading above the thick red Ichimoku Cloud conversion line.

11. Prices are trading above the Ki jun-Sen baseline of the Ichimoku Cloud and this has been HEADING HIGHER.

** The lower indicator on top is a forward projection. For an estimation of possible FORWARD TRENDING I use the Ichimoku Cloud Senkou Span A (Leading Span A): (Conversion Line + Base Line)/2)). This is the midpoint between the Conversion Line and the Base Line. The Leading Span A forms one of the two Cloud boundaries. It is referred to as "Leading" because it is plotted 26 periods in the future and forms the faster Cloud boundary. I then make an oscillator out of this and plot the progress up and down around a “zero line”.

I HAVE THE RESULTS OF THESE CALCULATIONS FOR-PYPL IN THE TOP LOWER INDICATOR. IT IS VERY POSITIVE AND IS SHOWING STRENGTH.

Conclusion: I believe-PYPL will work its way higher.

May all of your trades go well. Don.

Daily AUD CAD fractal bounce trade. After price hit a resistance and it formed a fractal then it came back down bouncing off on the fractal zone giving us another chance to enter the market. We boxed the price in waiting for outside trading so we got in after indecision candle. First target we are shooting for is 1.03238 but we might get a bit ranging (Kijun is getting flat). On top of that there is volatility in the cloud.