Binance Coin Will Trade At $1,200+, $975 First—New ATH TargetSupport has been confirmed and Binance Coin is now moving in the bullish zone. This is perfect. Now that the bulls have control of the Cryptocurrency market, we no longer have to focus on oscillators, volume, candlestick patterns and the rest, we can simply focus on the targets; things change.

This same approach will be true for all the charts. Instead of reading the signals and sharing "proofs" supporting my bias, we will focus instead on the targets and how far up the pair in question can go. Why? Because the bullish bias has already been confirmed and we are set to grow long-term. The 2025 bull market just as promised.

The first resistance is $730. This is a strong resistance because it rejected growth several times in the past. Many times in December, several times in January and February also. The All-Time High is pretty close as well so here again we will define a range. Between $731 and $794 is the first resistance zone.

BNBUSDT can grapple with this zone for a small while only to win. The win will clear the path for higher prices and open the price discovery phase. After this resistance is broken, the rise will be smooth and nice. Just growth followed by more growth, it will feel great.

The first target will be $975. This is the 1.618 extension in relation to the size of the corrective move. This is a level to watch out for on the way up.

The next target is awesome because the number is so big and because it goes beyond $1,000. The number is $1,269, that's the second—very strong—target.

Depending on how these levels are handled, we can look again and update the chart.

I don't know if this needs to be said, but, just to be certain: Binance Coin is going up .

Namaste.

Binancecoin

BNB/USDT 4H Chart: Rising Channel with Fractal Vibes!Hey traders! Binance Coin is showing some promising action that’s got me on the edge of my seat!

We’ve got a clear rising channel in play, with BNBUSDT moving beautifully in sync with a fractal line pattern shown above the chart — mirroring past price behavior like a roadmap! BNBUSDT is currently trading at $650 , I think price will continue bouncing between the channel’s support at $620-$600 and move upwards to the key resistance target at $700-$720 . A breakout above this resistance could send BNB soaring to new highs, potentially targeting $800 or beyond!

However, if BNB fails to break through, we might see a pullback to the channel support at $620-$600 .

Key Levels to Watch:

Resistance: $700-$720

Support: $620-$600

Breakout Target: $800+

Breakdown Risk: $600

Is BNB about to blast through $720, or will it retreat below support? Let’s hear your thoughts below!

Binance Coin (BNB)The world's largest crypto exchange by volume, Binance continues its push into the embattled crypto mining industry with a plan to begin offering a crypto cloud mining product next month. crypto miners have had a tough year, with the price of bitcoin having hung around $20,000 for months, a far cry from its peak above $68,000 in November 2021. Other cryptos have faced similar or even worse declines. One of the largest mining-related firms in the U.S. filed for Chapter 11 bankruptcy in late September. Other companies, however, are seeing opportunity from this crisis, with CleanSpark going on a buying spree of mining rigs and data centers, and DeFi platform Maple Finance starting a $300 million lending pool

Binance Pool announced its own $500 million lending fund for bitcoin miners last week and said it would enter cloud mining, a service that allows investors – who otherwise might not be able to buy and operate their own equipment – to rent crypto mining machines. The official launch of the cloud mining service will come in November.

BNB can back to 300 in a short time but 195 is a good price for entry and long term investment

BTC/USD: Get Ready for another Bullrun ! (READ THE CAPTION)By analyzing the #Bitcoin chart on the weekly timeframe, we can see that the price is currently trading around $95,000. Soon, we should expect Bitcoin to enter the key supply zone between $99,500 and $109,500, where we’ll closely watch for the market's reaction.

Bitcoin continues to show strong demand, and we may witness another bullish spike in the short term. All previous assumptions from the last analysis remain valid.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

BNB Is Entering Into Final Stage Of Bull RunHello, Skyrexians!

BINANCE:BNBUSDT is the rare asset which showed the bull market with the Bitcoin and set the new ATH. Like Bitcoin BNB is also about to show us the final growth wave.

On the 2 weeks time frame we can see how this bull market has been developing. Awesome Oscillator gives us a hint that wave 3 is likely to be finished because we see the bearish divergence without zero line cross. Only when it crossed under zero line we can say that wave 4 is finished. Another one factor is fibonacci target area which has been reached. The next wave 5 will be started in 1-2 month and reach approximately $900.

Best regards,

Ivan Skyrexio

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Is #BNB About to Break Down or Not? Don't Get Caught Yello, Paradisers! Is #BNB teasing one last move up before the trapdoor opens? Let’s break down what this suspicious structure of #BinanceCoin is really telling us:

💎#BNBUSDT is currently trading around $589, which is right under 200 EMA resistance. The price has been developing inside a clear Leading Diagonal Formation. Here’s the twist: Wave 5 is still in progress, and there’s growing evidence that the move might fail before it even completes.

💎We’re seeing Bearish Divergence flashing on the MACD histogram, which historically signals fading momentum. This divergence could drag #BNBUSD down before Wave 5 finishes, causing an early breakdown of the entire structure. This would completely shift the market bias in favor of the bears.

💎Key resistance levels are stacked around $599, right under the 200 EMA. A confirmed breakout and hold above this zone would invalidate the bearish setup and open the door for a potential bullish extension above $620, but that scenario remains the less probable one for now.

💎Until then, all eyes are on support zones at $533 and the critical swing low at $471. If price closes below the diagonal’s lower boundary and drops beneath $533, it’s likely to trigger a heavy selloff toward the next major demand level at $471, which could form the next Swing Low.

Play it safe, respect the structure, and let the market come to you!

MyCryptoParadise

iFeel the success🌴

BNB AnalysisBinance Coin (BNB) Analysis – March 30, 2025

In today's analysis, we examine Binance Coin's price movements using the 4-hour timeframe to assess its potential future direction.

🔹 Key Support Levels:

BNB remains above a crucial support range of $607–$593, which has held since March 16. If this support breaks, the price may test $546 as the next reaction level. Further downside could see BNB dropping to $530 and $507 as additional support zones.

🔹 Key Resistance Levels:

On the upside, BNB faces resistance at $637–$644. A confirmed breakout above this zone could push the price toward $700, following the same price range projection method used for support breakdowns.

📌 Outlook:

BNB’s trend remains neutral as long as the key support holds. A break below $593 could trigger a bearish move, while a break above $644 may confirm a bullish trend with $700 as the next target.

LTOUSDT – Wave C Correction Ending Soon? Multi-Timeframe ElliottTimeframe: Monthly (Logarithmic View)

Pair: LTOUSDT

Methodology: Elliott Wave Theory + Fibonacci Extension + Divergence Analysis

This analysis suggests that LTOUSDT is currently undergoing a complex corrective structure within the second major wave on the monthly timeframe, interpreted as part of a larger Elliott Wave cycle.

Wave A appears to have formed a double zigzag pattern.

Wave B is identified as an expanded flat, displaying strong internal complexity.

Wave C, which is currently in progress, also shows characteristics of a double zigzag, suggesting we are approaching the final leg of this corrective phase.

Further internal structure mapping indicates:

The market is likely completing Wave 5 of Wave 3 of Wave C of Wave Y of Wave B, based on lower timeframe breakdowns.

Indicators:

Despite clear bullish divergence observed on both the MACD and RSI in the Monthly chart, no confirmation of reversal has occurred yet.

These divergences, in combination with the completed corrective structure, point toward a potential trend shift, pending fundamental confirmation.

External Factors:

The asset has recently received a Monitoring Tag on Binance, which may be influencing investor sentiment and delaying technical reversals.

Broader macroeconomic uncertainty, including potential changes in U.S. interest rate policy and recent tariff-related geopolitical developments, may also be contributing to current price stagnation.

Fibonacci Logarithmic Extension Projection (Wave 3 Potential Targets):

Based on Wave 1 ($0.02 → $0.909) and Wave 2 retracement to $0.0247, the following Fibonacci log-scale targets are calculated:

Extension Ratio Projected Target Price

1.000 $1.21

1.272 $3.1

1.618 $11.8

Note: These are long-term log-scale projections and should be adjusted based on evolving price action and structure validation.

Invalidation Level:

Wave count would be invalidated upon a breach below $0.02 or Fibonacci Extension 100% of Wave 1 → 2 → 4 projection within Wave 3, as previously defined on lower timeframes.

This post is meant to highlight structural observations from a purely technical standpoint and does not constitute financial advice. Further validation across timeframes is advised.

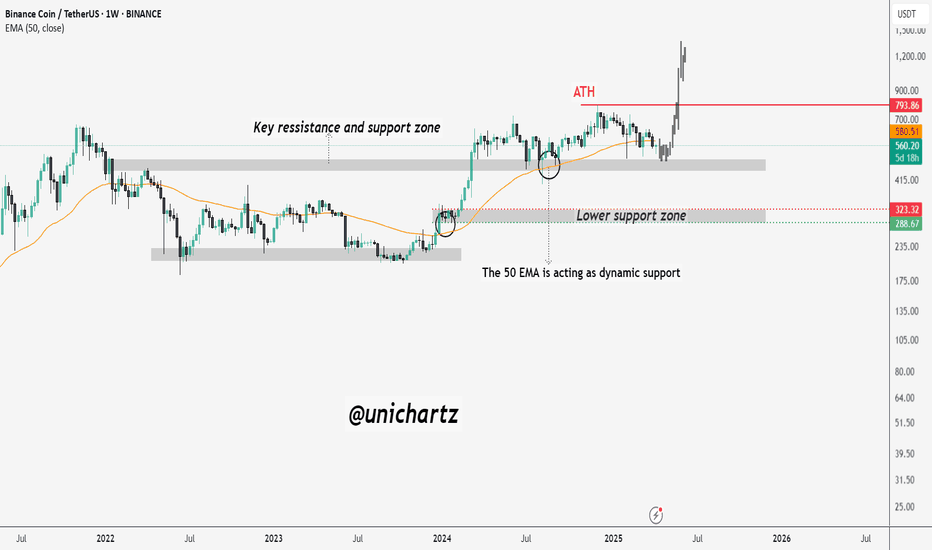

BNB Bulls Must Defend This LevelBNB is currently trading near a key support and resistance zone, a historically significant area that has acted as both supply and demand over the past few years. After reaching its all-time high (ATH) near $793, price has been gradually correcting, and is now approaching a critical point.

The 50-week EMA (Exponential Moving Average) is acting as dynamic support, and so far has played a strong role in providing bounce zones during corrections. This EMA is currently being tested once again, and price action around it will be crucial.

Just below this lies a major horizontal support zone around $415–$430, which previously served as a breakout base in 2023. If this area holds, BNB could see a rebound attempt.

Particle Network Set For Bullish Surge Amidst Bullish Flag Particle Network the Layer-1 blockchain powering chain abstraction, seamlessly unifying users and liquidity across Web3's native token ($PARTI) is set for a bullish breakout amidst a bullish flag pattern depicted on the 15-minute time chart.

The token got listed on major exchanges like Binance, Bybit, OKX, Bitget, GateIo and MEXC. Currently siting on a market cap of $80.89 million $PARTI is well poised for a bullish comeback.

The asset is currently up 8% as of the time of writing with the Relative Strength Index (RSI) at 60, this further validates the bullish thesis on $PARTI coin.

By unifying all chains, Particle will enable billions of users to seamlessly onboard and interact with dApps across every chain, serving as the foundation for mass adoption and playing an indispensable role in unifying the Open Web.

Particle Network Price Live Data

The live Particle Network price today is $0.338798 USD with a 24-hour trading volume of $530,561,230 USD. Particle Network is down 1.99% in the last 24 hours, with a live market cap of $78,939,915 USD. It has a circulating supply of 233,000,000 PARTI coins and a max. supply of 1,000,000,000 PARTI coins.

BNB/USDT:BUY LIMITHello friends

You can see that after the price fell, buyers entered the specified support area and supported the price and created higher ceilings and floors.

Now we can buy at the specified levels with capital and risk management and move to the specified targets.

*Trade safely with us*

BNB looks still in an uptrend while the rest of the market looksBNB is still in an uptrend here while testing the bottom of the demand line. The question is can it hold?

There is a volume gap below to be aware of however horizontal support is being respected while the market shows weakness.

Full TA: Link in the BIO

Breaking: $MUBARAK Set for Trend Reversal Amidst 20% DipCreated on the Binance Smart chain network (BSC) $MUBARAK a coin that recently underwent a "Community Take Over (CTO)"is set for a trend reversal amidst the recent 20% dip that led the token to a falling wedge pattern.

With the RSI at 47 and momentum brewing, $MUBARAK is set for a massive surge if it should break pass the 38.2% Fibonacci retracement point as momentum kicks in.

Similarly, the 78.6% Fibonnaci price point is holding grounds as the support point should $MUBARAK face a moment of reprieve in the long run.

About Mubarak

CZ just subtly acknowledged that he’s Mubarak – a typical cryptic move from the Binance boss! Those who’ve followed CZ long enough know that when he shills like this, the chances of a Binance listing are sky-high. The Arab world, with their deep pockets, is ready to pump Mubarak to a $1 billion MC. This meme coin has now been taken over by the community, with the CTO pushing it hard – get ready for a big boom!

Mubarak Price Live Data

The live Mubarak price today is $0.128175 USD with a 24-hour trading volume of $316,755,028 USD. Mubarak is down 20.97% in the last 24 hours. The current CoinMarketCap ranking is #284, with a live market cap of $128,174,827 USD. It has a circulating supply of 1,000,000,000 MUBARAK coins and a max. supply of 1,000,000,000 MUBARAK coins.

BNBUSD Cup and Handle can now target $1000Binance Coin / BNBUSD is trading inside a Cup and Handle pattern for the entirety of its Cycle.

Right now it is forming the Handle part with the 1week RSI neutral. Technically that is an ideal long term buy opportunity.

Last week could be the bottom and we expect another +98.69% rebound such as on August 5th 2024.

Buy and target $1000.

Follow us, like the idea and leave a comment below!!

Technically, the sell is not over for BNBTechnically, the sell is not over for BNB

$600 is currently acting as a resistance zone. If this force continues resisting the movement towards the north, we might see a drop southward again.

In this instance, $500 will again be the main psychological support level.

The trendline on my chart will be a great point for me to start applying my DCA strategy for another round of longterm holding.

Nothing is 100% sure. But I am convinced that the market has not been corrected fully.

Trade with care

WHY Token Set for Breakout Amidst Symmetrical Triangle PatternBuilt on the Binance Blockchain (BNB) WHY is a bipolar Elephant, RAMPAGE after FOMO (In the dream). Dancing and Happi all the daytime.(In real life) $BNB. The token is set for a bullish surge amidst a Bullish symmetrical triangle with about 50% surge in sight.

Chart patterns like the bullish engulfing pattern has been formed waiting for a breakout above the celling of symmetrical triangle. With the Relative Strength Index (RSI) at 65, TSXV:WHY is more than ready for a breakout with build up momentum.

The Binance smart chain (BSC/BNB) is evolving rapidly as data from DefiLama shows about $5.134 Billion has been locked in Total Value Lock (TVL) by DeFi projects showing a level of immense trust levied on BSC chain.

WHY Price Live Data

The live WHY price today is $0.0000000677 USD with a 24-hour trading volume of $5,579,911 USD. WHY is up 5.95% in the last 24 hours, with a live market cap of $28,417,541 USD. It has a circulating supply of 420,000,000,000,000 WHY coins and a max. supply of 420,000,000,000,000 WHY coins.

BNB Channel and Areas of SupportBNB 3 day chart-

Current PA is still trading within the channel, though not ideally positioned as we approach its lower boundary. I anticipate the wick from February 3 will be filled, which aligns with our initial support zone. Should that support fail, I expect the wick from August 4 to also be filled, indicating the next support level.

These areas can provide short-term bounces or reversals.

Thanks for your time. Chat soon!

Binance Coin (BNB) Market AnalysisRecent Price Action & Breakdown

BNB lost the key $600 support level due to strong selling pressure, dropping 12% over the past week, aligning with the broader market downturn.

The break below $600 signals increased bearish momentum, but BNB has yet to form a lower low, indicating relative strength compared to most altcoins.

Key Support Levels to Watch

If the decline continues, buyers may step in between $550 and $500, with $500 being a historically strong support zone.

Holding above $500 is crucial, as a sustained drop below this level could lead to further downside pressure.

Potential Recovery Scenario

If $500 holds, there remains potential for a recovery, especially if the overall crypto market stabilizes.

A move back above $600 would be a bullish signal, confirming a potential rebound and resumption of BNB’s upward trend.

Conclusion

BNB is at a critical juncture. The $500 support level must hold to avoid a deeper correction.

Despite the drop, BNB shows relative strength compared to most altcoins.

Traders should watch for buying activity around the $500-$550 range, as this could indicate a recovery in the near term.

BNB New Update (1W)If you have been following our BNB analyses, you would know that we previously identified its pattern as a triangle.

The price reacted to the green zones from our previous analysis, but based on the weekly candles, it seems that wave E will be deeper.

We are looking for buy opportunities within the green zone, with a minimum target of $800.

This is our current outlook on BNB.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Long Entry Signal for BNB/USDT - Trading System Confirmation

Welcome!

Long entry signal for BNB/USDT confirmed by the trading system

Based on our custom trading system rules, we had an initial long entry signal for BNB/USDT on February 11th, and since then, the price has remained steady at similar levels. Given that the system's conditions for a long position are still met, we can consider entering a long position today:

MLR Crosses SMA: Even though the SMA is above the MLR, the entry still works because the price is over the BB center line and above the PSAR and 200 MA.

Price Over BB Center Line: The current price is above the Bollinger Bands Center Line (orange), which indicates that despite the MLR/SMA position, the price is in a position that typically favors a bullish trend.

PSAR Flips: The Parabolic SAR (PSAR), indicated by black dots, has flipped to bull, signaling a bullish trend as it is below the price.

Price Above 200-period MA: The price is also above the 200-period Moving Average (red), reinforcing a long-term bullish trend.

Given these conditions, the entry for a long position is supported by the price being over the BB center line, above the PSAR, and the 200-period MA, which are strong indicators for a potential upward movement.

Entry Strategy:

Action: Enter a long position on BNB/USDT today, considering the sustained conditions from the initial signal.

Risk Management:

Trailing Stop: Set your trailing stop at the current PSAR level, which will adjust dynamically with price movements to protect your position.

Standard Exit Strategy:

Exit: Continue to monitor for when the MLR crosses back above the SMA or if the price drops below the BB center line or the PSAR flips to bear. Any of these could signal a potential end to the bullish trend and an opportunity to exit the position.

This signal presents a potential trading opportunity according to our system's parameters, especially since the initial conditions have remained favorable. Remember, always consider additional analysis and risk management practices before making trading decisions.

That is it

BNB’s Correction Could Trigger a Major Move—Are You Ready ?Yello Paradisers! Have you been keeping an eye on #BNBUSDT? If not, now’s the time to focus. BNB is currently in a corrective phase after its recent surge, and this pullback could be setting up a major opportunity for those who know when to strike. But timing is everything, and jumping in too early could be a costly mistake.

💎Right now, we expect BNB to follow a flat zigzag correction pattern of Elliott Wave. The price action shows signs of an imbalance (IMB) and a change of character (CHOCH), suggesting that we might see a further dip before the bulls take over again. You can switch to lower timeframes, like the 15-minute chart, to get a clearer validation of the wave structure. The key here is to wait for a bullish divergence on the RSI and MACD, which will signal that the correction is nearing its end and a rebound is likely.

💎The bullish order block (OB) between $582 -$577 is the crucial demand zone to watch. We anticipate BNB dipping into this zone before finding strong support for a potential upward impulsive wave. However, if BNB closes below this order block, the setup becomes invalid, and we could see further downside toward $560. It’s essential to remain patient and disciplined rushing in without confirmation could lead to unnecessary losses.

💎Once we get the bullish divergence, we expect BNB to target the $643-$646 supply zone in the next move. This could be a sharp and profitable rally for those who wait for the right signals. But remember, if the price closes below the bullish OB, it’s time to step back and reassess. Protecting your capital is just as important as making profits.

Be patient, stay focused, and let the market come to you. That’s how you secure long-term success in this game.

MyCryptoParadise

iFeel the success🌴

BNB’s Explosive Comeback – Next Stop, ATH?CRYPTOCAP:BNB is currently exhibiting strong bullish momentum, making its way toward a key resistance zone near its all-time high (ATH).

The price is recovering from a critical support level and has reclaimed the ascending trendline, signaling renewed buyer confidence.