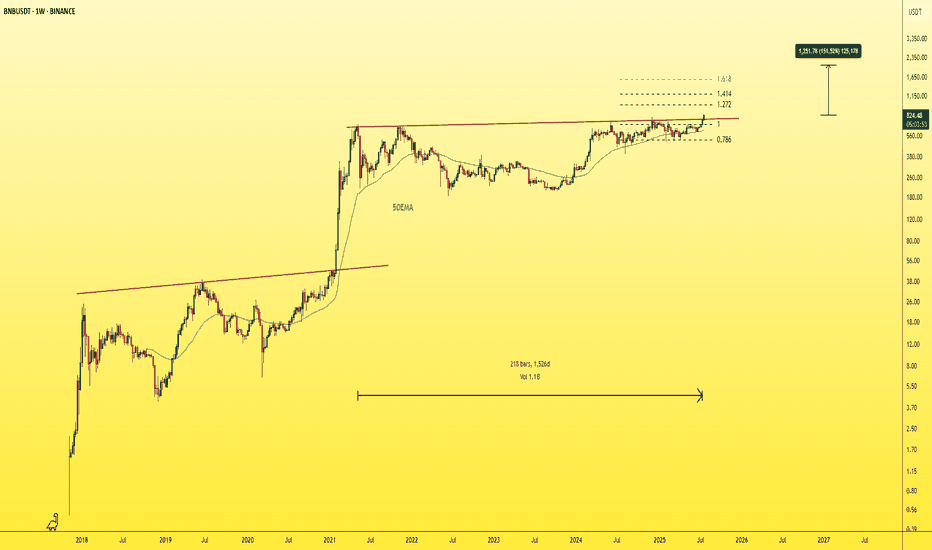

BNBUSDT - New ATH!"The strongest resistance level on the chart has just been broken — which was represented by the previous ATH — after nearly four attempts.

This exact pattern occurred before in 2021, and what followed was a parabolic rally.

The same scenario is unfolding now!

You’ll soon see BNB trading in four digit

When the crowd doubts — the smart money loads up.

Expect a parabolic rally once sentiment flips.

Best Regards:

Ceciliones🎯

Binancefutures

"BNB Primed for a Pump – Thief Trading Mode Activated!"🚨 BNB/USDT HEIST PLAN – SWIPE THE BULLISH LOOT BEFORE COPS ARRIVE! 🚨

🌟 Attention, Money Makers & Market Robbers! 🌟

(Hola! Oi! Bonjour! Hallo! Marhaba!)

The BNB/USDT vault is CRACKED OPEN—time to execute the ultimate heist! 🏦💰 Based on 🔥Thief Trading Style Analysis🔥, here’s your lucrative robbery blueprint for the Binance Coin vs. Tether market.

🔐 MASTER PLAN: LONG ENTRY HEIST (HIGH-RISK, HIGH-REWARD)

🎯 TARGET: 850.00 (or escape before the cops show up!)

🚨 POLICE TRAP ZONE: Overbought + Strong Resistance – Bears & cops are lurking!

💎 TAKE PROFIT EARLY & TREAT YOURSELF! (You’ve earned it, outlaw!)

⚔️ ENTRY STRATEGY: SWIPE FAST OR WAIT FOR THE PULLBACK!

🤑 VAULT IS OPEN! Enter any price if you’re bold (instant long).

🕵️♂️ SMART THIEVES: Use buy limit orders near 15M/30M swing lows/highs for a safer heist.

🛑 STOP-LOSS (ESCAPE ROUTE)

Thief SL: 743.00 (4H candle wick – adjust based on your risk tolerance!)

⚠️ WARNING: If the cops (bears) break in, DON’T HESITATE—RUN!

🎯 TARGETS & ESCAPE PATHS

Scalpers: Trail your SL & escape with quick loot! (Only long-side allowed!)

Swing Bandits: Hold strong but watch for police traps!

📡 MARKET INTEL (WHY THIS HEIST WILL WORK)

Bullish momentum in play! (But stay sharp—consolidation & reversals possible.)

Fundamentals, COT Reports, On-Chain Data, & Sentiment all hint at more upside!

🚨 TRADING ALERTS – DON’T GET CAUGHT!

📰 NEWS = VOLATILITY! Avoid new trades during major releases.

🔒 LOCK PROFITS! Use trailing stops to protect your stolen gains.

💥 BOOST THIS HEIST – STRENGTHEN THE SQUAD! 💥

🔥 Hit the LIKE & FOLLOW to support the robbery team!

🚀 More heists coming soon—STAY TUNED, OUTLAWS! 🚀

🎯 Trade Smart. Steal Big. Escape Faster. 🏴☠️

$BNB Price Travel $888 Price Level Area and see more chart CRYPTOCAP:BNB OVERVIEW

ENTRY AREA IS $613 AND STOPLOSS $500 BELOW, LAST TRAVEL $888 PRICE LEVEL IN 2025

Bubblemaps Launches Token Generation Event on BNB Chain, Sets Fundraising Goal of $800K

According to an announcement from Binance, the event, which is exclusively hosted on the BNB chain via PancakeSwap, will run from 8:00 AM UTC to 10:59 AM UTC.

The TGE offers investors the opportunity to acquire 40 million BMT tokens priced at $0.02 each as the project team tries to raise $800,000 in BNB to fund further developments. This event would distribute 4% of Bubblemaps’ total supply of 1 billion tokens in return to participants.s

The project team noted that each wallet’s contribution would determine its share, which is proportional to the total BNB deposited. There is a participation cap of 3 BNB per wallet to ensure fair distribution.

Binance’s Pascal Hardfork to Enhance BNB Chain – Key Features and Price Impact Table of Contents Announcements / Trading Analysis

Binance’s Pascal Hardfork to Enhance BNB Chain – Key Features and Price Impact BNB.

Binance’s Pascal Hardfork to Enhance BNB Chain – Key Features and Price Impact

What the Pascal Hardfork Brings to BNB Chain

BNB Price Action and Market Predictions

BNB Chain’s Future Upgrades

Conclusion

March 11, 2025 – Binance’s BNB Chain has scheduled the Pascal Hardfork for March 20, bringing significant upgrades, including Ethereum compatibility on the mainnet. This move aligns with BNB Chain’s broader 2025 roadmap to enhance scalability, transaction efficiency, and decentralized governance.

The Ethereum EIP-7702 implementation enables gasless transactions, batch approvals, and multi-signature support, making it easier for users to interact with decentralized applications (dApps) on BNB Chain. The upgrade also activates BEP-439, which improves transaction security through BLS12-381 curve verification.

What the Pascal Hardfork Brings to BNB Chain

BNB Chain developers have emphasized the importance of this upgrade for Ethereum Virtual Machine (EVM) compatibility, helping bridge the gap between Binance and Ethereum ecosystems. Key benefits include:

Enhanced User Experience – dApps can now pay gas fees on behalf of users.

Stronger Security – BLS12-381 verification ensures secure smart contract execution.

Faster Transactions – The Pascal Hardfork sets the stage for future updates that will reduce block time.

Community Governance – The “Vote to List” and “Vote to Delist” mechanisms allow BNB stakers to decide which tokens stay on the BNB Smart Chain.

The upgrade requires node operators, validators, and exchanges to update to v1.5.7, or risk desynchronization from the network.

BNB Price Action and Market Predictions

As of writing, BNB trades at $564.56, fluctuating within the $550–$575 range.

Analysts observe structural shifts, with key resistance and support levels shaping the next price movement:

Bearish scenario – If BNB fails to hold $550, it may decline further to $525 or even $500.

Bullish scenario – Holding above $550 could push BNB to $600, with a potential breakout to $650.

BNB’s previous high at $725 indicates strong resistance, and a rejection from $575 may confirm further downside. However, if momentum shifts, the upgrade could help BNB regain ground amid broader altcoin market movements.

A distinctive feature of this TGE is the immediate tradability of tokens post-subscription, eliminating traditional lock-up periods. Investors can trade BMT tokens immediately after the event on either Binance Wallet’s DEX or directly on PancakeSwap. This real-time liquidity is a bold play, designed to attract traders and investors eager for quick action.

#BTC☀ #BinanceAlphaAlert #BinanceSquareFamily #Write2Earn #SUBROOFFICIAL

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions.

#LITUSD 1DAYLITUSD (1D Timeframe) Analysis

Market Structure:

The price is currently testing a key support level, which acts as a critical decision zone. If the support holds, a bounce may occur, signaling a potential bullish move. However, if the price breaks below the support and retests it as resistance, further downside may follow.

Forecast:

- A buy opportunity may arise if the price shows a strong bounce from the support level.

- A sell opportunity could be considered if the support level breaks down and gets confirmed as resistance after a retest.

Key Levels to Watch:

- Entry Zone: A buy position can be considered if bullish confirmation appears at support, while a sell setup requires a confirmed breakdown and retest.

- Risk Management:

- Stop Loss: Below support for buy trades and above retest resistance for sell trades.

- Take Profit: Targeting key resistance levels for buy setups and lower support zones for sell setups.

Market Sentiment:

The market is at a critical level where price action confirmation is necessary. Traders should wait for a clear reaction at the support level before making a decision.

$BTC Bounce Back Again $100K Price, New Long Setup see on chartBINANCE:BTCUSDT Bounce Back Again $100K Price, New Long Setup see on chart...

News: Bitcoin Leads US Equity Markets Amid Macro Developments, Yet Stays Resilient: Report

Bitcoin (BTC) is becoming increasingly sensitive to macroeconomic factors. In fact, the digital asset is leading equity markets in the United States in response to President Donald Trump’s latest economic and policy changes.

Over the last four days, President Trump’s announcements havetriggeredincreased uncertainty in global markets, leading to a decline in bitcoin’s price. Bitcoin fell below $100,000 and even touched an intraday low of $91,657 on Monday.

Since bitcoin rallied during President Trump’s inauguration, the cryptocurrency has continued to show a downward trend. BTC formed the double top structure at the $108,000 level and has been trading in a 15% range since mid-November.

Bitfinex analysts said such 15-20% ranges often resolve in either an upward or downward direction within 80-90 days. This means BTC will experience a decisive price move in the coming weeks, still under the influence of macroeconomic developments.

As the financial markets process the implications of the tariff hikes, Bitfinex believes BTCfacesfurther downside unless legacy assets recover. Even if legacy markets do not see significant recovery, analysts are confident in bitcoin’s long-term trajectory, which they have described as compelling.

“In conclusion, while Bitcoinʼs short-term volatility may continue in response to macroeconomic influences, its long-term outlook remains positive,” Bitfinex analysts added.

BINANCE:BTCUSDT LONG SETUP HERE

Entry Price: $96,651.98

Stoploss Zone: $91,206.57

Leverage: 11x use 11% of your margin balance.

This Long Setup 4 Target Price Level here

1 Take Profit: $100,443.31

2 Take Profit: $103,772.29

3 Take Profit: $107,087.34

4 Take Profit: $111,059.81

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not available for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment.

$BNB/USDT is trading within an ascending triangle pattern, showi$BNB/USDT is trading within an ascending triangle pattern, showing strong bullish potential as it approaches the resistance zone near 720 - 750 USDT.

The price is holding well above the key support/demand zone around 590 - 620 USDT, which has consistently provided a solid base for the uptrend.

The Stochastic RSI is rebounding from oversold levels, indicating a potential shift in momentum toward the upside.

DYOR, NFA

BinanceUSDT Finds Footing: New ATH on the Horizon?BinanceUSDT is finding strong support at the trendline and the 100 EMA, acting as dynamic support.

The price shows strong potential to break the nearest resistance and aim for a new ATH.

Monitor it closely for upcoming moves, and don’t forget to follow us for more updates.

Bullish on $DOGS1. We have market reacting off the daily fvg high therefore creating a sell program at entry OB-

2. End of sell program ended at the sellside purge therefore leaving the market to spool in a buy program

3. We have strong draws at the Daily FVG high whereby equal highs also reside therefore making the draw stronger

4. H2 OB- Wick has behaved as 'support'

The Patience Game: Waiting for Binance to Drop to $335 demandLook at the significant monthly demand level for Binance’s BNB at $335. The chart below displays where this imbalance is situated. Will Binance decrease to that level? We cannot say for certain, but it is what we anticipate in the upcoming weeks. It is possible that Binance will not drop and instead continue to surpass its all-time high, but we are discussing probabilities here.

BULLISH September !!Hello guys, after 2 months of agressive downtrend we are seeing some bullish signs. In previous TA IDEA I was looking for claiming 54200(BTC broke even this lvl ). Because of high volatility it was impossible to catch the lows. But last 7 days we are seeing successful retesting and holding supports. Next lvl to watch is between 0.618 and 0.786 ( 60k TO 62,5k). I really like to watch at liquidation heat map and there is accumulating a lot of shorts between 59k -67,5k. I believe these levels will be claimed in next couple of weeks ( months)!!Good luck !! Keep it green!!

#INJUSD 1DAYINJUSD (Injective / US Dollar)

Timeframe: Daily (1D)

Pattern: Trendline Breakout

A trendline breakout has occurred on the daily chart of INJUSD, signaling a shift in market momentum. The pair had been following a descending trendline, indicating sustained selling pressure over time. However, the price has now broken above this trendline, suggesting that bearish control is weakening and a bullish reversal may be underway.

Trendline breakouts often indicate a change in trend direction, and in this case, the breakout above resistance points to potential upward movement.

Forecast: Buy

The breakout above the descending trendline signals a buying opportunity. This suggests that the price could continue to rise as bullish momentum gains strength, with the potential for further upward movement in the short to medium term.

Technical Outlook:

Support Level: The previous trendline, which now serves as support, helping to sustain the new bullish momentum.

Resistance Level: Key resistance levels above, which could serve as profit targets or areas to watch for potential price consolidation.

Key Levels to Watch: Traders should monitor price action to ensure the breakout holds, with bullish candlestick formations and volume spikes providing further confirmation.

This pattern often leads to continued upward price movement, but traders should remain aware of broader market conditions that could influence INJ’s performance, such as news related to cryptocurrency regulation or market sentiment.

Keep an eye on the broader cryptocurrency market as well, as shifts in sentiment can quickly affect the performance of altcoins like Injective.

#BTCUSD 1HBTCUSD (Bitcoin / US Dollar)

Timeframe: 1-Hour (1H)

Pattern: Channel

A horizontal channel pattern has been identified on the 1-hour chart of BTCUSD. This pattern is defined by two parallel trendlines, with the price bouncing between the upper resistance and lower support levels. The channel suggests that Bitcoin is trading within a range, with neither buyers nor sellers gaining full control, leading to stable price movement within the channel.

Forecast: Buy Within the Channel

The current forecast suggests a buying opportunity within the channel, particularly as the price approaches the lower boundary (support). Traders can look to enter long positions near the support level, aiming for the upper boundary (resistance) as a target. The pattern indicates potential profits through buying low and selling high while the price remains contained within the channel.

Technical Outlook:

Support Level: The lower boundary of the channel, where buyers are expected to step in and push prices higher.

Resistance Level: The upper boundary of the channel, which may serve as a target for bullish positions.

Key Levels to Watch: Look for bounces off the support line to confirm bullish entries, with resistance levels as the target.

Traders should be cautious of a potential breakout from the channel, which could shift market direction. Confirmation through bullish candlestick patterns or an increase in buying volume near the support zone would be ideal for entry.

As always, be mindful of Bitcoin-related news or regulatory changes that could cause sharp price movements and influence the validity of this channel trading strategy.

#DOGEUSD 1DAYDOGEUSD: Daily Downtrend Breakout - Buy Opportunity

The DOGEUSD pair is showing a significant breakout from its recent downtrend, signaling a potential reversal in momentum. After a sustained period of downward movement, price action has breached key resistance levels, suggesting increased buying interest.

Key Highlights:

Confirmation: The breakout above the resistance line indicates a shift in market sentiment, potentially attracting more buyers.

Volume Spike: A notable increase in trading volume during the breakout supports the validity of this move, suggesting strong momentum behind the price action.

-Technical Indicators: RSI and MACD are turning bullish, further reinforcing the idea of a possible upward trend.

Actionable Insight:

This presents a promising buying opportunity for traders looking to capitalize on the potential recovery in DOGEUSD. Setting a stop-loss just below the breakout level can help manage risk while allowing for upside potential as the market seeks to establish a new support zone.

Stay vigilant for further confirmations and adjust your strategy accordingly!

BNB Bulls Charge Ahead: Uptrend Signals and Price OptimismBinance Coin (BNB), the native token of the Binance ecosystem, is currently displaying bullish signals across technical charts. This positive trend suggests a potential continuation of price growth shortly.

Cruising Above the 100-Day SMA:

One key indicator of BNB's bullish momentum is its position above the 100-day Simple Moving Average (SMA) on the 4-hour timeframe. The SMA represents the average price of an asset over a specific period, and the 100-day SMA acts as a line of support, indicating the overall trend direction. With BNB trading consistently above this level, it suggests a sustained uptrend and buyer dominance in the market.

Breaking Out of Consolidation:

Further bolstering the bullish case is BNB's recent breakout from a consolidation zone. Consolidation periods typically occur after significant price movements, and a breakout from this zone signifies a potential resumption of the previous trend. In BNB's case, the breakout suggests a continuation of the upward trajectory, potentially leading to new highs.

Rising Momentum on the 4-Hour Chart:

The 4-hour chart provides valuable insight into short-term price movements. In BNB's case, the 4-hour chart reveals strong rising momentum, characterized by a series of higher highs and higher lows. This momentum indicates that buyers are actively pushing the price upwards, further strengthening the bullish outlook.

Surpassing the $700 Threshold:

A significant psychological milestone for BNB was its recent climb above the $700 mark. This price point can act as a level of resistance, where sellers may attempt to cap further gains. However, BNB successfully breaching this resistance suggests a robust market recovery and increased investor confidence.

Investor Optimism on the Rise:

The technical indicators and price movements all point towards a growing sense of optimism among investors and traders. The positive momentum surrounding BNB is likely fueled by several factors, including:

• Binance's strong brand reputation: Binance is one of the largest and most respected cryptocurrency exchanges globally. Its success can contribute to increased demand for BNB.

• Expanding utility of BNB: BNB's utility extends beyond simply being a trading token. It can be used for various purposes within the Binance ecosystem, such as paying fees, participating in token sales (IEOs), and obtaining discounts on trading fees. This growing utility can drive demand for BNB.

• Overall market recovery: The broader cryptocurrency market has shown signs of recovery in recent weeks. Positive sentiment in the overall market can have a spillover effect on individual tokens like BNB.

What to Watch Out For:

While the current outlook for BNB is positive, there are always potential risks to consider:

• Market Volatility: The cryptocurrency market remains inherently volatile. Sudden shifts in sentiment or broader economic factors can lead to sharp price corrections.

• Regulatory landscape: Regulatory uncertainty surrounding cryptocurrencies can dampen investor enthusiasm and impact prices.

• Technical corrections: Even within an uptrend, there can be periods of price consolidation or pullbacks. These corrections are healthy for the market but can be misinterpreted by short-term traders.

Conclusion:

BNB's technical indicators and recent price action paint a bullish picture. Trading above the 100-day SMA, breaking out of consolidation, and surpassing the $700 mark all suggest a potential continuation of the uptrend. Investor optimism surrounding BNB and the broader market recovery further reinforce this positive outlook. However, it is crucial to remain aware of potential risks associated with the volatile cryptocurrency market. By carefully analyzing technical indicators, staying informed about market developments, and implementing sound risk management strategies, investors can potentially capitalize on the opportunities presented by BNB's current bullish momentum.

BNB Bulls Charge: Price Attempts Breakout After Clearing Key ResThe Binance Coin (BNB) price is attempting a fresh rally, buoyed by a surge that surpassed the crucial $550 resistance zone. This positive momentum has ignited optimism among investors, with analysts suggesting a potential extension towards $630 and beyond.

Breaking Through Resistance: A Bullish Signal

BNB's recent price action hints at a bullish resurgence. After encountering resistance around $550, the price successfully breached this level, indicating a shift in market sentiment. This breakout signifies increased buying pressure and suggests that investors are regaining confidence in BNB's future prospects.

Technical Indicators Point Towards Further Gains

Several technical indicators support the bullish narrative for BNB. The price is currently trading comfortably above the 100 simple moving average (SMA) on the 4-hour chart. The SMA acts as a line of support, and staying above it indicates a potential uptrend.

Furthermore, a key bullish trend line has emerged on the 4-hour chart, with support established at $592. This trend line reinforces the bullish bias and suggests that dips towards this level might be met with renewed buying pressure.

Crucial Resistance Awaits: $608-$610 Zone

For the bulls to maintain control, BNB must decisively overcome the next hurdle: the resistance zone between $608 and $610. A successful breach of this level would significantly bolster the bullish momentum and pave the way for a potential test of the $630 mark.

Overcoming Hurdles: Factors Influencing BNB's Price

While the technical outlook appears promising, several factors could influence BNB's price trajectory in the coming days. The overall performance of the broader cryptocurrency market, particularly Bitcoin (BTC), will likely play a significant role. If BTC experiences a significant correction, it could trigger a pullback in BNB's price as well.

Additionally, positive news or developments surrounding the Binance ecosystem could provide BNB with an additional boost. Upcoming product launches, partnerships, or regulatory clarity could all contribute to increased investor interest and drive the price upwards.

BNB's Utility: A Long-Term Strength

Beyond the current price action, BNB's inherent utility within the Binance ecosystem remains a significant long-term strength. As Binance continues to expand its offerings and user base, the demand for BNB – which fuels transactions and unlocks various benefits on the platform – is likely to grow as well. This intrinsic utility provides a fundamental layer of support for BNB's price, even amidst broader market fluctuations.

Conclusion: A Cautiously Optimistic Outlook

The current price action suggests that BNB is poised for a potential breakout. The successful clearing of the $550 resistance zone, coupled with favorable technical indicators, paints a bullish picture. However, overcoming the upcoming resistance levels and navigating the external market forces will be crucial for BNB to sustain its upward trajectory.

Investors should remain cautiously optimistic and closely monitor both technical and fundamental developments to make informed decisions. While the short-term outlook appears promising, a long-term investment strategy focused on BNB's utility within the Binance ecosystem might prove more rewarding.

Cryptolean Binancecoin BNB UpdateYesterday Binancecoin failed to reclaim $586.

An inability to break $586 to the upside will push BNB price towards $504-$529 and, if unable to sustain price action above $504, lower to $455-$477.

A daily candle closure above the key daily resistance of $586 is required for Binance coin to have another bullish extension to re-test $635-$660.

Cryptolean Binancecoin BNB UpdateYesterday Binancecoin could not close above $529.

Today, a bullish Bitcoin Dominance put pressure on the Satoshi value of BNB and we saw an intraday pullback to $505.

A daily candle closure above $529 will increase a probability of a continuation of a bullish move up towards $586 and higher towards $600.

An inability to sustain could lead to a re-test of $505 and a dip lower to the key daily support zone at $455-$477.

Intraday Chart

The BNBUSD intraday chart is taking a pause and consolidating.

It is trading in the bullish territory through.

A re-test of the key intraday support at $507 and a bullish rejection will push #Binancecoin price towards $544.

A bullish break-out of $544 will result in a bullish rally towards $588-$620.

A bearish break-out of $507 will lead to a dip towards $472 support and, possibly lower, to $438. .

IMPORTANT: The BNBUSD chart is holding strong and consolidating in a narrow range which is totally normal after last days bullish extension.Once Satoshi price in BNBBTC chart will find a support and reverse, the Dollar price in BNBUSD chart will extend higher.

Like once read.

Thank you!