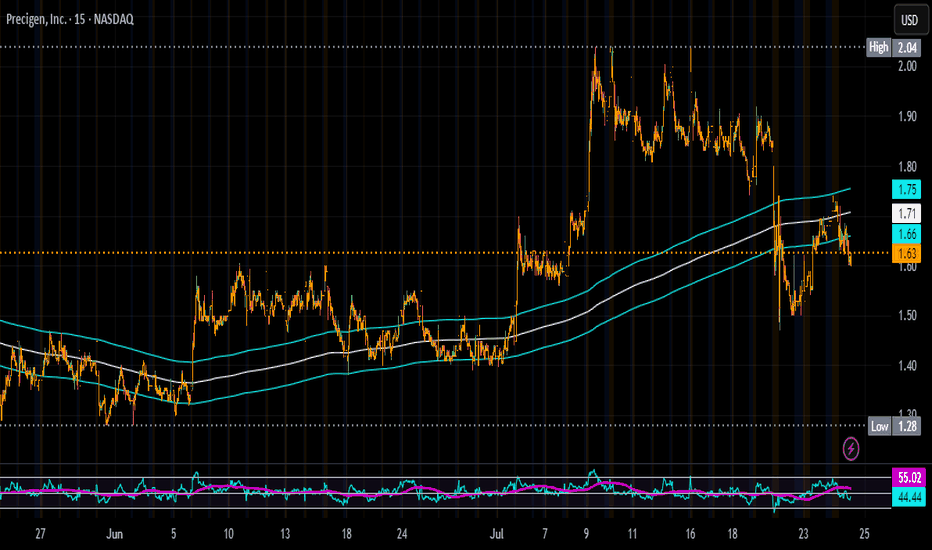

Buying More PGEN on all DipsThe market is overreacting to the NASDAQ:REPL news, and I think it’s a mistake to lump NASDAQ:PGEN in with it. Yes, PRGN-2012 is also a single-arm gene therapy trial, but it’s for an ultra-rare disease—not a broad indication like cancer. The FDA’s tougher stance seems to be focused on common diseases (like NASDAQ:REPL ’s melanoma drug), not niche, high-unmet-need therapies like Precigen’s.

Here’s why I’m loading up on this pullback:

PRGN-2012 has incredible data: 51% complete response rate, 86% reduction in surgeries (from 4 per year to zero). These patients suffer through painful, repeated procedures—this drug could be life-changing.

FDA loves it: Breakthrough Therapy, Orphan Drug, Fast Track, and Priority Review with a PDUFA date of August 27, 2025. If approved, it’ll be the first-ever treatment for RRP.

Commercial upside: Rare disease drugs have high margins, and there’s zero competition.

The sell-off is shortsighted. I’m treating this as a fire sale and buying more before the August 2025 catalyst. NASDAQ:PGEN is a high-conviction play for me.

Biotech

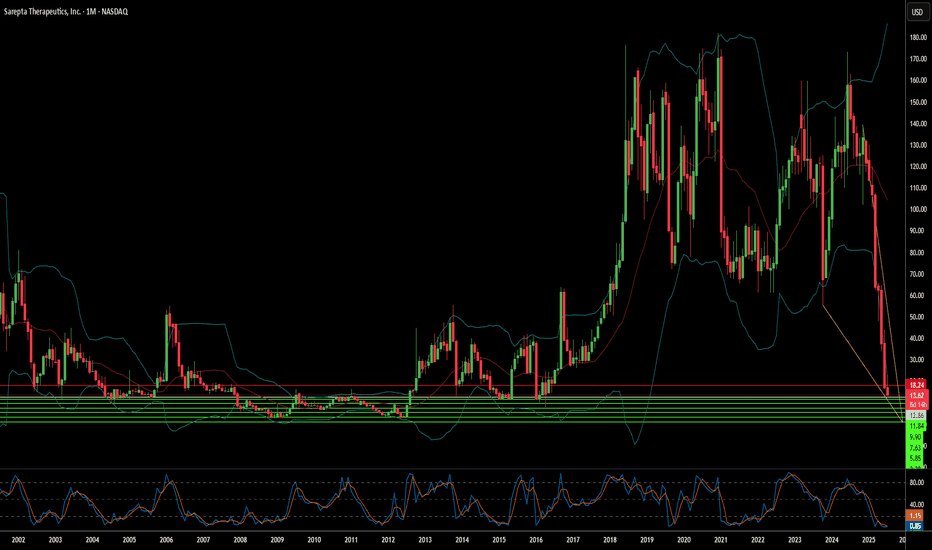

Sarepta's Plunge: A Confluence of Challenges?Sarepta Therapeutics (SRPT) faces significant market headwinds. The company's stock has seen a notable decline. This stems from multiple, interconnected factors. Its flagship gene therapy, ELEVIDYS, is central to these challenges. Recent patient deaths linked to similar gene technology raised safety concerns. The FDA requested a voluntary pause in Elevidys shipments. This followed a "black box warning" for liver injury. The confirmatory EMBARK trial for Elevidys also missed its primary endpoint. These clinical and regulatory setbacks significantly impacted investor confidence.

Beyond specific drug issues, broader industry dynamics affect Sarepta. Macroeconomic pressures, like rising interest rates, reduce biotech valuations. Geopolitical tensions disrupt global supply chains. They also hinder international scientific collaboration. The intellectual property landscape is increasingly complex. Patent challenges and expirations threaten revenue streams. Cybersecurity risks also loom large for pharmaceutical companies. Data breaches could compromise sensitive R&D and patient information.

The regulatory environment is evolving. The FDA demands more robust confirmatory data for gene therapies. This creates prolonged uncertainty for accelerated approvals. Government initiatives, like the Inflation Reduction Act, aim to control drug costs. These policies could reduce future revenue projections. Sarepta's reliance on AAV technology also presents inherent risks. Next-generation gene editing technologies could disrupt its current pipeline. All these factors combine to amplify each negative impact.

Sarepta's recovery depends on strategic navigation. Securing full FDA approval for Elevidys is crucial. Expanding its label and maximizing commercial potential are key. Diversifying its pipeline beyond a single asset could de-risk the company. Disciplined cost management is essential in this challenging economic climate. Collaborations could provide financial support and expertise. Sarepta's journey offers insights into the broader gene therapy sector's maturity.

Walk This Way...This S. Korean company focuses on treatment of cystic fibrosis and chronic kidney disease, et al. Future Medicine, Limited.

Godspeed to this company as they search for cures for primary biliary cirrhosis; colorectal, prostate, and lung cancers and rheumatoid arthritis, et al. They target metabolic cancers, inflammatory and autoimmune diseases, to produce anticancer drugs, anti-fibrotics and antiviral remedies. Not only persistent, but painful diseases, as well. Who on earth wouldn't want this company to succeed ?

Selling Volume has completely Dried-up and the stock is in the process of setting Higher-Lows. MACD, StochasticsRSI, Rate-of-Change, and %r are all additive tenets of confirmation for the astute and intrepid investor.

Go Long.... it's at the 20... the 10... the 5... and Touchdown

GH 3D: breakout forming inside ascending channelThe price of GH continues consolidating within the top of an ascending channel, confirming bullish structure. The rectangular accumulation has lasted for over three months, with price staying above all major EMAs and MAs - a strong trend confirmation. On the last impulse, volume increased, and now the price is compressing again. A breakout with a retest would serve as a valid entry. First target lies near 61.38, second at 73.66, and third at 87.37 - aligned with the upper range of the medium-term Fibonacci extension. Fundamentally, GH remains a promising biotech pick amid sector rotation and potential Fed easing. EMAs and MAs sit below price, and D/A supports the breakout scenario. Waiting for confirmation before entering.

Is Decentralization the Future of Cell Therapy?Orgenesis Inc. (OTCQX: ORGS) champions a revolutionary approach to cell and gene therapy (CGT) manufacturing. The company focuses on decentralizing production, moving away from traditional, centralized facilities. This strategy, centered on their POCare Platform, aims to drastically improve accessibility and affordability of life-saving advanced therapies. Their platform integrates proprietary therapies, advanced processing technology, and a network of clinical partners. By enabling onsite therapy production at the point of care, Orgenesis directly addresses critical industry hurdles like high costs and complex logistics, which currently limit patient access.

Orgenesis's innovative model is already yielding promising results. Their lead CAR-T therapy candidate, ORG-101, targeting B-cell Acute Lymphoblastic Leukemia (ALL), showed compelling real-world data. A study demonstrated an 82% complete response rate in adults and an impressive 93% in pediatric patients. Crucially, ORG-101 also exhibited a low incidence of severe Cytokine Release Syndrome, a common safety concern with CAR-T therapies. These positive clinical outcomes, coupled with a cost-effective, decentralized production method, position ORG-101 as a potentially transformative treatment option.

The broader pharmaceutical industry stands at a pivotal juncture, with cell and gene therapies driving unprecedented innovation. The global CAR T-cell therapy market alone anticipates substantial growth, projected to reach \$128.8 billion by 2035. This expansion is fueled by increasing chronic disease prevalence, significant investment, and advancements in gene-editing technologies. However, the industry grapples with high treatment costs, manufacturing complexities, and logistical challenges. Orgenesis's decentralized GMP-validated platform, along with their recent acquisition of Neurocords LLC assets for spinal cord injury therapies and the MIDA Technology for AI-based stem cell generation, directly confronts these barriers. Their approach promises to accelerate development, enhance production efficiency, and reduce costs, potentially democratizing access to advanced medicine.

ABCL — Bullish Breakout with Upside PotentialAbCellera Biologics Inc. (ABCL) has recently confirmed a breakout above a long-term descending trendline, followed by a successful retest of both the trendline and previous local highs. This technical development increases the probability of a sustained upward move.

The first target stands around $5.70, with a potential medium-term extension toward $13.20, offering attractive risk-to-reward parameters.

The company operates in the biotechnology and healthcare innovation sector — one of the most promising and rapidly advancing industries. While such stocks often face increased volatility due to news-driven events, the potential for high returns makes them compelling for both swing traders and long-term investors.

Top 10 Small-Cap Biotechs with Upcoming Catalysts for 2025Here are 10 small cap biotech stocks with notable upcoming catalysts in 2025—ranging from trial readouts and FDA decisions to pivotal data and corporate milestones:

________________________________________

🔬 Top 10 Small-Cap Biotechs with Upcoming Catalysts for 2025

1. Crinetics Pharmaceuticals (NASDAQ: CRNX)

• Catalyst: FDA PDUFA deadline for paltusotine (oral acromegaly treatment) expected by September 25, 2025.

• Focused on endocrine diseases and advancing pipeline beyond acromegaly (en.wikipedia.org).

Stock market information for Crinetics Pharmaceuticals Inc (CRNX)

• Crinetics Pharmaceuticals Inc is a equity in the USA market.

• The price is 32.33 USD currently with a change of -0.73 USD (-0.02%) from previous close.

• The latest open price was 33.1 USD and the intraday volume is 420639.

• The intraday high is 33.34 USD and the intraday low is 32.32 USD.

• The latest trade time is Wednesday, June 11, 23:45:00 +0300.

________________________________________

2. Viking Therapeutics

• Catalyst: Late-stage trial start for injectable weight-loss drug (GLP 1/GIP); mid-stage data readout for oral candidate due in 2025 (barrons.com).

• Strong analyst sentiment: Jefferies forecasts ~223% upside

________________________________________

3. Insmed (NASDAQ: INSM)

• Catalyst: Phase III/inhalable powder treprostinil palmitil for pulmonary arterial hypertension; recent results exceeded expectations; full Phase III data due in 2025

________________________________________

4. Kymera Therapeutics

• Catalyst: Phase I for KT 621 (oral STAT6 degrader for dermatitis/asthma); next-stage readouts expected late 2025–early 2026

• Shares rose ~50% on initial results; further trials underway

________________________________________

5. Arcutis Biotherapeutics (NASDAQ: ARQT)

• Catalyst: Technical breakout potential near $17.75; continued quarterly readouts with rising sales (33% last quarter)

• Upcoming investor calls/publication strategies may accelerate momentum.

________________________________________

6. Rhythm Pharmaceuticals (NASDAQ: RYTM)

• Catalyst: With FDA-approved Imcivree for genetic obesity, further label expansion or mid-to-late-stage trial results anticipated in 2025

• Institutional buying trends and revenue growth support upcoming readouts .

________________________________________

7. BeOne Medicines (Ticker: ONC)

• Catalyst: Early human data in solid tumor oncology; multiple upcoming trials in 2025 .

• Q1 2025 marked first profit; strong institutional support

________________________________________

8. Mesoblast Ltd & Capricor Therapeutics

• Catalyst: Stem-cell therapies targeting GvHD, heart failure, Duchenne muscular dystrophy—key FDA decisions expected in H2 2025

• Maxim Group flags pivotal year for approvals and stock catalysts (marketwatch.com).

________________________________________

9. Acelyrin (NASDAQ: SLRN)

• Catalyst: Phase III results for lonigutamab in thyroid eye disease; shareholder vote on Alumis merger around May 2025

• Merger closing and clinical readouts may drive volatility .

________________________________________

10. ADC Therapeutics & Foghorn Therapeutics & Pyxis Oncology

• Catalysts: Multiple preclinical/early clinical updates presented at AACR (April 2025)

o ADC Therapeutics (ADCT): Readouts on 6 ADC programs (Claudin 6, NaPi2b, etc.).

o Foghorn (FHTX): Preclinical updates on EP300, FHD609, FHD909.

o Pyxis Oncology (PYXS): Phase I ADC and Siglec 15 antibody data.

________________________________________

🔎 How to Monitor These Catalysts

• FDA PDUFA dates (Crinetics, Mesoblast/Capricor, Viking)

• Trial readouts/ASC presentations (Kymera, Insmed, ADC Therapeutics, Foghorn, Pyxis)

• M&A/news events (BeOne, Acelyrin merger)

________________________________________

📊 Summary Table

Ticker Company Upcoming Catalyst Timeframe

CRNX Crinetics PDUFA paltusotine NDA Sep 25, 2025

Viking Viking Therapeutics Injectable Phase III, oral Phase II data From mid-2025

INSM Insmed PAH inhalable Phase III readout Mid-to-late 2025

Kymera Kymera Therapeutics Dermatitis/asthma Phase I → Phase II Late 2025 – 2026

ARQT Arcutis Biotherapeutics Continued quarterly updates Throughout 2025

RYTM Rhythm Pharmaceuticals Label expansion/trial updates 2025

ONC BeOne Medicines Solid tumor trial data 2025

Mesoblast/Capricor Stem-cell stocks FDA decisions H2 2025

SLRN Acelyrin EMA/merger vote + Phase III readout May–Q3 2025

ADCT/FHTX/PYXS AACR presenters Academic readouts on multiple programs April 2025

________________________________________

⚠️ A Word of Caution

Small-cap biotech involves high volatility—catalyst events often drive sharp price swings, both up and down. Thorough due diligence is essential.

Ending Diagonal Complete? Bounce Toward 1.60 AheadBTAI has likely completed an impulsive 5-wave decline followed by an ABC corrective structure. The final leg (v) of the downtrend appears to have ended near $1.35, where price action shows a reversal signal.

Currently, price is attempting to recover and may retest the descending trendline and previous structure zone near $1.60 — a level that served as strong support previously and now acts as resistance.

If the price breaks this zone with volume confirmation, it could trigger a short-term bullish breakout. Until then, this is considered a corrective rally within the broader downtrend.

Key Levels:

Support: $1.35

Resistance: $1.60

Target: $1.60 (potential +16%)

Conclusion:

A short-term bounce is unfolding. Watch $1.60 for reaction — rejection or breakout will determine the next leg.

ATAI Life Sciences | ATAI | Long at $1.30ATAI Life Sciences NASDAQ:ATAI , a clinical-stage biopharmaceutical company aiming to transform the treatment of mental health disorders, is fast approaching my selected historical simple moving average (SMA). Often, but not always, the closer the price gets to this line, the higher chance there is for a fast upward move. In anticipation of this move, NASDAQ:ATAI is in a personal buy zone at $1.30.

A word of caution: this is a pure technical analysis play and this company is not expected to be profitable for many, many years...

Target #1 = $1.75

Target #2 = $2.50

Target #3 = $2.95

Is Gene Editing's Investment Promise Within Reach?CRISPR Therapeutics stands at the vanguard of the gene editing revolution, transitioning into a commercial-stage biopharmaceutical entity following the landmark approval of CASGEVY. This first-of-its-kind gene editing treatment targets sickle cell disease and beta-thalassemia, validating the transformative potential of CRISPR-Cas9 technology and signaling the dawn of a new medical era. CASGEVY's market entry provides critical proof of concept, paving the way for broader gene editing applications in treating genetic disorders.

Despite this scientific triumph, CASGEVY's commercial launch faces immediate hurdles, primarily its high cost and complex administration, contributing to slow initial sales. While development partner Vertex Pharmaceuticals reports the revenue, CRISPR receives a profit share. The company currently operates at a loss, with operating expenses significantly exceeding revenue, primarily from grants. However, a robust cash reserve provides financial stability as CRISPR pursues an ambitious pipeline targeting widespread diseases like cancer, diabetes, and cardiovascular conditions, alongside its commercial efforts with CASGEVY.

The intellectual property landscape remains dynamic, marked by ongoing patent disputes over the foundational CRISPR-Cas9 technology, which could influence future licensing and competition. Simultaneously, CRISPR Therapeutics contributes to advancements in personalized medicine and delivery systems. A notable achievement includes the rapid development and delivery of a personalized mRNA-based CRISPR therapy for a rare metabolic disorder using lipid nanoparticles, demonstrating a potential model for swift, patient-specific treatments and highlighting the crucial role of advanced delivery technologies in expanding gene editing's therapeutic reach.

For investors, CRISPR Therapeutics presents a high-risk, high-reward opportunity. The stock has experienced volatility, reflecting current unprofitability and market conditions. Yet, strong institutional ownership and optimistic analyst ratings underscore confidence in the long-term potential. The company's deep pipeline and foundational technology position it for significant future growth if clinical programs succeed and commercial adoption of its therapies expands, suggesting that for those with a long-term perspective, the promise of gene editing may indeed be within reach.

AI in Biotech: The Future of Cancer Therapy?Lantern Pharma Inc. is making waves in the biotech sector, leveraging its proprietary RADR® AI platform to accelerate the development of targeted cancer therapies. The company recently achieved significant milestones, including FDA clearance for a Phase 1b/2 trial of LP-184 in a difficult-to-treat non-small cell lung cancer (NSCLC) subset. This patient population, characterized by specific genetic mutations and poor response to existing treatments, represents a substantial unmet medical need and a multi-billion-dollar market opportunity. LP-184's mechanism, which selectively targets cancer cells overexpressing the PTGR1 enzyme, offers a precision approach aimed at improving efficacy while reducing toxicity.

LP-184's potential extends beyond NSCLC, having received multiple FDA Fast Track Designations for aggressive cancers like Triple-Negative Breast Cancer (TNBC) and Glioblastoma. Preclinical data support its activity in these areas, including synergy with other therapies and favorable properties like brain penetrance for CNS cancers. Furthermore, Lantern Pharma has demonstrated a commitment to rare pediatric cancers, securing Rare Pediatric Disease Designations for LP-184 in MRT, RMS, and hepatoblastoma, which could also yield valuable priority review vouchers.

The company's financial position, marked by strong liquidity according to InvestingPro data, supports its ongoing investment in R&D and its AI-driven pipeline. While reporting a net loss reflecting these investments, Lantern Pharma anticipates key data readouts in 2025 and actively seeks further funding. Analysts view the stock as potentially undervalued, with price targets suggesting future growth. Lantern Pharma's strategy of combining advanced AI with a deep understanding of cancer biology positions it to address high-need patient populations and potentially transform oncology drug development.

Can Lilly Redefine Weight Loss Market Leadership?Eli Lilly is rapidly emerging as a dominant force in the burgeoning weight loss drug market, presenting a significant challenge to incumbent leader Novo Nordisk. Lilly has demonstrated remarkable commercial success despite its key therapy, Zepbound (tirzepatide), entering the market well after Novo Nordisk's Wegovy (semaglutide). Zepbound's substantial revenue in 2024 underscores its rapid adoption and strong competitive standing, leading market analysts to project Eli Lilly's obesity drug sales will surpass Novo Nordisk's within the next few years. This swift ascent highlights the impact of a highly effective product in a market with immense unmet demand.

The success of Eli Lilly's tirzepatide, the active ingredient in both Zepbound and the diabetes treatment Mounjaro, stems from its dual mechanism targeting GLP-1 and GIP receptors, offering potentially enhanced clinical benefits. The company's market position was further solidified by a recent U.S. federal court ruling that upheld the FDA's decision to remove tirzepatide from the drug shortage list. This legal victory effectively halts compounding pharmacies from producing unauthorized, cheaper versions of Zepbound and Mounjaro, thereby protecting Lilly's market exclusivity and ensuring the integrity of the supply chain for the approved product.

Looking ahead, Eli Lilly's pipeline includes the promising oral GLP-1 receptor agonist, orforglipron. Positive Phase 3 trial results indicate its potential as a convenient, non-injectable alternative with comparable efficacy to existing therapies. As a small molecule, orforglipron offers potential advantages in manufacturing scalability and cost, which could significantly expand access globally if approved. Eli Lilly is actively increasing its manufacturing capacity to meet anticipated demand for its incretin therapies, positioning itself to capitalize on the vast and growing global market for weight management solutions.

Post-Report Sell-Off Seen as UnwarrantedSupporting Arguments

The market's reaction to the Q1 report was excessively negative

The stock possesses fundamental upside potential driven by a high revenue growth rate

The technical analysis indicates a probable rebound

Investment Thesis

GeneDx (WGS) specializes in delivering precise medical diagnostic results, leveraging exome and genomic testing to accurately diagnose genetic disorders. The company exclusively generates its revenue within the United States.

The recent GeneDx report significantly exceeded market expectations, yet the market's reaction was starkly negative. In our assessment, this presents a promising acquisition opportunity for WGS. Revenue for the first quarter of 2025 surpassed consensus estimates by 9.6%, also resulting in a substantial positive EPS surprise. The company has revised its full-year 2025 revenue guidance upwards by a median of $12.5 million, now projecting between $360 million and $375 million. This adjustment accounts for an anticipated $3 million to $5 million in revenue from the prospective acquisition of Fabric Genomics. The net increase in the guidance aligns closely with the value realized from the first-quarter surprise.

The only potentially contentious aspect of the report is the recorded 0.5% q/q decline in testing volumes within the largest revenue-generating segment, exome and genome sequencing. This trend has not been observed in this segment before. However, a seasonal dip in Q1 testing volumes is typical within the laboratory industry. This decline is primarily driven by a reduced number of working days in the first quarter and heightened diagnostic demand in Q4, as patients seek to maximize their insurance benefits before year-end. Historically, the low base effect coupled with GeneDx's robust sequential growth has counterbalanced unfavorable seasonal trends in Q1. Additionally, in the latest quarter, management cited the California wildfires as a possible negative influence on testing volumes. Consequently, we believe this testing dynamic does not warrant the marked downtrend seen in the price of WGS, especially given the upgraded guidance and the expansion of the product portfolio, both of which are poised to drive revenue growth over the next three years.

WGS stock is fundamentally undervalued. The GeneDx peer group has maintained a trading average of a 6.8 EV/Sales multiple over the past three years. We regard this figure as an appropriate target for GeneDx. Presently, the 2026 EV/Sales multiple stands at 5.6. We believe that sustained robust revenue growth over the next three years provides ample opportunity for valuation appreciation from the existing levels. Utilizing comparative valuation metrics, we project a target price for WGS shares at $87 over the next two months, accompanied by a "Buy" recommendation.

To mitigate risks, we advise establishing a stop-loss at $58. From a technical standpoint, a robust short-term support zone is identified within the range extending from $60 to the 200-day moving average.

Breaking: Vision Marine Technologies (VMAR) Set For 1700% SurgeVision Marine Technologies Inc. (NASDAQ: VMAR) is set poised to capitalied on a patterned from on the 12 hour price chart pattern called the U-shaped cup shape which is a bullish pattern depending on the trend and shape of the cup.

With the Relative Strength Index (RSI) at 29, NASDAQ:VMAR is looking poised to capitalized on this dip that is forming a U-shaped cup pattern looking forward to delivering a 1700% surge.

As of the time of writing, the stock closed Monday's session up by 9.07% showing an increased in the influx of buyers.

About VMAR

Vision Marine Technologies Inc. designs, develops, manufactures, rents, and sells electric boats in Canada, the United States, and internationally. The company offers e-motion electric powertrain technology; e-motion electric outboard powertrain system; electric boats; and maintenance, repair, and customer support services, as well as manufactures customized boats.

Financial Performance

In 2024, VMAR's revenue was 3.79 million, a decrease of -32.86% compared to the previous year's 5.65 million. Losses were -14.06 million, -32.65% less than in 2023.

Analyst Forecast

According to Lucas Ward from Ascendiant Capital, the rating for VMAR stock is "Strong Buy" and the 12-month stock price forecast is $270.0 with a whopping +5,057.10% returns

OKYO Pharma Limited (NASDAQ: OKYO) Set for 70% SurgeNASDAQ:OKYO could be on the cusp of a significant breakout. We believe NASDAQ: NASDAQ:OKYO could be a boomer trade with a potential 70% surge in sight, offering a compelling short-term opportunity while also holding long-term promise as a transformative player in the biotech and ophthalmology space.

Technical Overview

OKYO Pharma Limited (NASDAQ: OKYO) shares are down 7.33% in Monday's market trading. The stock’s Relative Strength Index (RSI) stands at 47, which, despite the recent decline, suggests that bullish momentum is building. The RSI is neither overbought nor oversold, indicating a healthy consolidation phase before a potential upward move.

For OKYO Pharma Limited (NASDAQ: OKYO) shares, the immediate support lies in the $0.926 pivot level not so far from the current price will serve as a springboard towards greater highs with eyes set on 70% gain as confirmed by the chart pattern.

Similarly, a breakout above the $1.55 resistant level could pave the way for the anticipated 70% surge on the horizon without testing the support point aforementioned above.

About OKYO Pharma Limited (NASDAQ: OKYO)

OKYO Pharma Limited (NASDAQ: NASDAQ:OKYO ) is a United Kingdom-based clinical-stage biopharmaceutical company, founded in 2007, that focuses on developing innovative therapeutics for inflammatory eye diseases and ocular pain. The company went public on May 17, 2022, and operates within the healthcare sector, specializing in ocular health advancements. OKYO is led by CEO Gary S. Jacob and a dedicated team, working to address unmet needs in ophthalmology.

The Bull Run 2025 has been triggered! Target $5.00 - $10.00Why I Proposed to NASDAQ:ANNX today? When will we get married?

We all know the golden rule of trading penny stocks keep emotions out of it. Let logic dictate your moves, and don’t overdo the due diligence, because today’s small-cap darling can be tomorrow’s micro-cap disaster. But today, I took a big chunk of my gains from a penny stock account and decided to put a ring on $ANNX.

This stock is like a tiny wildflower in a crowded field easy to overlook until you get up close with a magnifying glass. Let’s skip the poetry and get straight to the facts:

1. ANX005 – The Dark Horse in Neuromuscular Treatment

ANX005 is a strong contender in the treatment of Guillain-Barré Syndrome (GBS) and muscle atrophy. The drug has shown better-than-expected results in Phase 3 trials, which is huge. Institutional investors and major banks seem to have caught the scent of a potential commercial breakthrough, given how far ANX005 has progressed toward FDA approval.

2. ANX007 – A Potential Game-Changer for Vision Loss

The FDA has greenlit Phase 3 trials for ANX007, aimed at treating Geographic Atrophy (GA), a severe form of retinal degeneration. While final results are still pending, ANX007 is one of the few treatments at this advanced stage that protects and enhances vision without needing to shrink lesions. If it clears this hurdle, this could be a massive win in ophthalmology.

3. Cash Reserves > Market Cap – A Financial Fortress

Here’s where things get really interesting ANNX’s total cash reserves exceed its market cap. With only $44M in R&D costs and $9M in operational expenses, ANNX stands out among biotech penny stocks, most of which burn through cash and constantly dilute shares just to survive. Unlike them, ANNX has enough runway to last at least 8 more quarters without raising additional capital. That means no dilution risk for the next two years a rare luxury in this space.

4. Smart Clinical Trials Strategy

ANNX has prioritized international trials outside the U.S., particularly in Southwest and Southeast Asia, where costs are lower and patient enrollment is faster. While some skeptics may question data transparency, the strategy accelerates timelines and saves money. The FDA still approved ANX005 and ANX007 for their final stages, which speaks volumes about the trial results.

5. Commercial Potential – $600M Market Opportunity

The U.S. market alone could support 5,000 patients annually, translating to a potential $600M revenue stream per year. This doesn’t even factor in international markets.

Price Targets and Institutional Sentiment

Despite ANNX’s strong fundamentals, risks remain biotech investing is never smooth sailing. That said, I’m rating NASDAQ:ANNX a Moderate Buy and holding for at least 3 months, expecting a run to $4.00 –$6.00 by Q3 2025 and potentially $7.50 - 10.00 during Christmas 2025. Meanwhile, big players like:

Wells Fargo, JP Morgan, and Bank of America almost have the same consensus target of $14.

Needham says $16, HC Wainwright is going full send with $20.

Total 7 Strong Buy, 0 Hold or Sell.

Bonus Tip: Follow the Options Flow

Take a peek at NASDAQ:ANNX ’s options chain. The big dogs have been scooping up ITM and ATM call options aggressively a classic sign that they’re loading up for a serious move in the next six months.

If you’re worried about macro risks like tariffs, economic slowdowns, or financial crises, hidden gems in biotech might just be a solid "cave".

Beware short sellers, there are always sharks in the Pennystocks forums waiting for posts like this to trigger their greed. But, I bought the share by profit, target to long term, I don't mind the Daily chart, just look at Weekly and Monthly charts. Ready to DCA when ANNX drop to $1.00. Just cut loss whenever the really Bad-news is real and confirmed.

Here’s hoping my wedding day arrives when NASDAQ:ANNX hits $10.00.

(Disclaimer: ChatGPT helped me research and write this article, as Biotech is not my primary field. This is just my personal analysis. Not financial advice at all. Trade responsibly.)

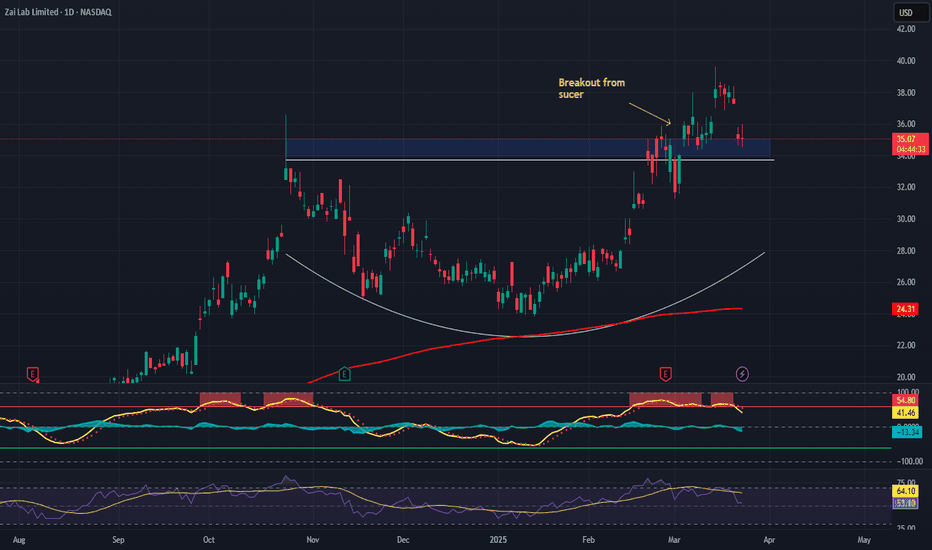

Zai Lab (ZLAB) – Biotech Growth & Profitability PathCompany Overview:

Zai Lab NASDAQ:ZLAB , a leading Chinese biotech firm, is on track for non-GAAP profitability by Q4 2025, driven by strong revenue growth & cost management.

Key Catalysts:

Financial Discipline & Expansion 💰

Operating losses fell 45% in Q4 2024, highlighting cost efficiency while scaling operations.

Analysts project $2 billion in annual revenue by 2028, reinforcing long-term value creation.

Blockbuster Drug Pipeline 💊

VYVGART generated $93.6M in its first full launch year, demonstrating strong adoption.

KarXT & bemarituzumab are key upcoming growth drivers, expanding ZLAB’s market footprint.

Investment Outlook:

Bullish Case: We are bullish on ZLAB above $34.00-$35.00, supported by financial execution & product expansion.

Upside Potential: Our price target is $54.00-$55.00, driven by strong product adoption & long-term growth trajectory.

🔥 Zai Lab – Unlocking the Future of Biotech Innovation. #ZLAB #Biotech #GrowthStocks

TG Therapeutics (TGTX) – Biotech Innovation & Global ExpansionCompany Overview:

TG Therapeutics NASDAQ:TGTX is a biotech leader focused on novel cancer and autoimmune treatments, gaining momentum as an IBD Leaderboard and IBD 50 Top 10 Growth Stock.

Key Catalysts:

Regulatory Approvals & Expansion 🌍

BRIUMVI secured approvals in Europe & the UK, unlocking new revenue streams in key markets.

Strong Profitability & Growth 💰

88.3% gross margin ensures sustainable reinvestment into R&D and future pipeline advancements.

High-Growth Stock Recognition 📊

Technical strength is validated by its inclusion in top-performing stock lists, signaling strong investor confidence.

Investment Outlook:

Bullish Case: We are bullish on TGTX above $34.00-$35.00, driven by global expansion, financial strength, and biotech leadership.

Upside Potential: Our price target is $55.00-$56.00, supported by continued innovation and market penetration.

🔥 TG Therapeutics – Pioneering the Future of Cancer Treatment. #TGTX #Biotech #GrowthStocks

Hoth Therapeutics (NASDAQ: HOTH) Could Be the Next 100% RunnerHoth Therapeutics, Inc. (NASDAQ: HOTH) shares are down slightly by 1.83% in Thursday’s trading session, but the technical outlook suggests a major breakout could be on the horizon. A fully formed falling wedge pattern has developed on the chart, and liquidity has been swept to the downside. The stock attempted to break out of this wedge in early March 2025, but the move was faded due to broader market consolidation, influenced by recent uncertainties surrounding Trump’s tax policy. However, the current setup indicates that a breakout remains imminent, with a potential 100% surge in sight.

The 12-hour chart shows that the Relative Strength Index (RSI) currently sits at 50.66, positioning the stock in a neutral zone. This is a strong indicator that NASDAQ: HOTH could gain traction as buyers begin to accumulate, capitalizing on its stability. The stock’s ability to maintain strength at this level suggests that momentum could shift rapidly if bullish pressure increases.

Key Fibonacci retracement levels are also aligning with this bullish setup. The 65% and 61.8% Fibonacci zones are acting as the primary breakout points, which correspond to the $1.40–$1.50 price range. If NASDAQ: HOTH successfully breaks through these levels, a strong upward move could follow, validating the 100% surge potential. This setup is further reinforced by increasing trading volume and early signs of buyer interest, which could trigger the anticipated breakout.

With volume ticking up and key resistance levels within reach, Hoth Therapeutics, Inc. (NASDAQ: HOTH) shares are shaping up for a move that could catch many off guard. Historically, setups like this don’t stay quiet for long—once momentum kicks in, those on the sidelines may find themselves chasing the action.

About Hoth Therapeutics, Inc. (NASDAQ: HOTH)

Founded in 2017, Hoth Therapeutics, Inc. (NASDAQ: HOTH). is a clinical-stage biopharmaceutical company dedicated to developing innovative therapies for unmet medical needs. Headquartered in New York, the company focuses on advancing treatments across multiple therapeutic areas, including dermatology, oncology, neurology, and immunology.

Important Dates

The next estimated earnings date is Thursday, March 27, 2025, after market close.

Analysts Ratings

Hoth Therapeutics (NASDAQ: HOTH) has garnered strong support from analysts, with a 12-month average price target of $4.75, representing a potential upside of 339.81% from the current price of $1.08. Analysts have given HOTH a "Strong Buy" rating, signaling confidence in the stock's growth potential.

With institutional interest rising and Hoth targeting multi-billion-dollar healthcare markets, this stock offers an opportunity for both immediate momentum and long-term growth.

Don’t overlook Hoth Therapeutics (NASDAQ: HOTH)—a major breakout could be on the horizon.

$TGTX Stock Set For Breakout Amidst Symmetrical Triangle PatternTG Therapeutics, Inc. (NASDAQ: NASDAQ:TGTX ) a biopharmaceutical company, that focuses on the acquisition, development, and commercialization of novel treatments for B-cell mediated diseases in the United States and internationally is set for a breakout amidst a bullish symmetrical triangle pattern.

Analyst Forecast

According to 6 analysts, the average rating for TGTX stock is "Strong Buy." The 12-month stock price forecast is $40.67, which is an increase of 35.16% from the latest price.

Important Dates

The next confirmed earnings date is Monday, March 3, 2025, before market open.

On How the bullish symmetrical plays out is largely incumbent on the earnings report slated for today Monday March 3, 2025 before the bell.

VERTEX ($VRTX) SHINES IN Q4—PAIN & CF FUEL GROWTHVERTEX ( NASDAQ:VRTX ) SHINES IN Q4—PAIN & CF FUEL GROWTH

(1/9)

Good evening, Tradingview! Vertex ( NASDAQ:VRTX ) is buzzing—Q4 revenue up 16%, new drugs hit the scene 📈🔥. $ 2.91B and a bold 2025 forecast—let’s unpack this biotech beast! 🚀

(2/9) – REVENUE RUSH

• Q4 Haul: $ 2.91B—16% jump from last year 💥

• Full ‘24: $ 11.02B, up 12%—Trikafta’s king 📊

• ‘25 Outlook: $11.75-$ 12B—6-9% growth

NYSE:CF keeps humming—newbies add zest!

(3/9) – BIG WINS

• Journavx: Non-opioid painkiller greenlit Jan ‘25 🌍

• Alyftrek: CF drug for 6+—ships now 🚗

• Cash: $11.2B—loaded for action 🌟

NASDAQ:VRTX storms pain—CF stays golden!

(4/9) – SECTOR CHECK

• Valuation: 11x sales—above 9x avg 📈

• Vs. Peers: Gilead’s 4x, Regeneron’s 8x—premium?

• Growth: 12% beats biotech’s 5-7% 🌍

NASDAQ:VRTX flexes—value or stretch?

(5/9) – RISKS ON TAP

• Payers: Journavx needs coverage—hiccups? ⚠️

• Trikafta: 93% of sales—big lean 🏛️

• Comp: Pain rivals, CF safe—for now 📉

Hot streak—can it dodge the bumps?

(6/9) – SWOT: STRENGTHS

• CF King: Trikafta, Alyftrek lock it in 🌟

• Pain Play: Journavx eyes $ 4B peak 🔍

• Cash: $11.2B—war chest ready 🚦

NASDAQ:VRTX ’s got muscle and moolah!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Trikafta reliance—eggs in one basket 💸

• Opportunities: Casgevy rolls, pain grows 🌍

Can NASDAQ:VRTX zap past the risks?

(8/9) – NASDAQ:VRTX ’s Q4 surge—what’s your vibe?

1️⃣ Bullish—Pain pays off big.

2️⃣ Neutral—Solid, but risks linger.

3️⃣ Bearish—Growth hits a wall.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

NASDAQ:VRTX ’s $2.91B Q4 and Journavx/Alyftrek wins spark buzz—$11.2B cash backs it 🌍🪙. Trikafta rules, risks hover—champ or chaser?

SOLID BIOSCIENCES—$SLDB CASHES UP FOR GENE THERAPY PUSHSOLID BIOSCIENCES— NASDAQ:SLDB CASHES UP FOR GENE THERAPY PUSH

(1/9)

Good afternoon, Tradingview! Solid Biosciences is stacking cash—no revenue yet, but a $200M raise has tongues wagging 📈🔥. NASDAQ:SLDB ’s betting big on gene therapy—here’s the scoop! 🚀

(2/9) – CASH, NOT SALES

• Revenue: Zilch—clinical-stage vibes 💥

• Q3 ‘24 Loss: $0.61/share, missed $0.58 est. 📊

• Cash Boost: $200M offering just landed

No sales, but NASDAQ:SLDB ’s war chest is growing!

(3/9) – BIG MOVE

• Feb 18 Raise: $200M via 35.7M shares, warrants 🌍

• Cash Pile: Was $171M, now nearing $350M 🚗

• Goal: Fuel SGT-003 trials into ‘27 🌟

NASDAQ:SLDB ’s loading up for the long haul!

(4/9) – SECTOR CHECK

• Market Cap: $500M post-raise 📈

• Vs. Peers: Sarepta’s 13B dwarfs it—revenue rules

• Edge: Low EV ($150M), big therapy dreams

Undervalued biotech bet or long shot? 🌍

(5/9) – RISKS ON DECK

• Trials: SGT-003 flops could sink it ⚠️

• Sentiment: 30% drop from Jan peak—jitters 🏛️

• Burn: $20-25M/quarter—clock’s ticking 📉

High stakes, high risks—can it deliver?

(6/9) – SWOT: STRENGTHS

• Cash: $200M raise powers trials 🌟

• SGT-003: Early data dazzles, Fast Track nod 🔍

• DMD Focus: Huge need, blockbuster shot 🚦

NASDAQ:SLDB ’s got fuel and firepower!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: No revenue, all-in on one play 💸

• Opportunities: $2-4B cap if trials pop 🌍

Can NASDAQ:SLDB turn cash into a cure?

(8/9) – NASDAQ:SLDB ’s $200M haul—your take?

1️⃣ Bullish—Gene therapy gold ahead.

2️⃣ Neutral—Wait for trial proof.

3️⃣ Bearish—Risks outweigh the buzz.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

NASDAQ:SLDB ’s revenue-free, but $200M keeps SGT-003 alive—stock’s buzzing 🌍🪙. Low EV vs. peers, yet trials and rivals loom. Cure or bust?