BITCOIN Most POWERFUL Signal Activated—Former ATH IS NOW SUPPORTBitcoin (BTCUSD) completed two straight green 1W candles and has started off this week equally impressive, approaching 4-week Highs! This is a direct consequence of the 1W MA50 (blue trend-line) holding as a Support, similar to what happened on the last two Higher Lows of the 3-year Channel Up on August 05 2024 and September 11 2023.

The hidden catalyst perhaps behind this strong move may be the fact that the April 07 2025 Low, besides the 1W MA50, it also rebounded on the former All Time High (ATH) Resistance Zone (red), which now turned into Support (green). This is the Zone that started with the November 08 2021 Cycle High and rejected BT on March 11 2024, April 08 2024, June 03 2024 and July 29 2024.

As long as this critical Support cluster (1W MA50, 2021 ATH Zone) holds, we are expecting the 1W MACD to form a new Bullish Cross, the first since October 14 2024, which technically confirmed the new Bullish Leg of the 3-year Channel Up.

In fact all previous 3 Bullish Legs got confirmed by a 1W MACD Bullish Leg and the minimum the rose by was +105.30%. As a result, after the Bullish Cross is confirmed, we will be expecting to see at least $150000 on this current bull run.

But what do you think? Can this hugely important Support cluster lead Bitcoin to $150k? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bitcoin-btcusd-btc

Bitcoin: Watch For These Break Out Scenarios.Bitcoin is consolidating within a very tight range: between 83 and 86K. Which way it breaks is a matter of catalyst, but recognizing the break can help to better shape expectations on this time horizon. IF 83K breaks, I will be watching for the higher low scenario (see blue square), for confirmations to go long. IF 86K breaks, I will be anticipating a test of the 88 K resistance (see arrow). What happens after that is anyone's guess. This is NOT about forecasting the future, it is about considering multiple scenarios and then adjusting as the market offers new information.

This evaluation can be helpful on multiple time frames if you know how to use it. For example, a break of the 83K support can be a great day trade opportunity on time frames like the 5 minute. A test of the 78K to 80K area followed by a confirmation can offer a long opportunity on the swing trade or day trade time frames. A test of the 88K or 90K resistance levels can offer aggressive short opportunities on smaller time frames as well. You have to be prepared for the possibility of the corresponding pattern to appear (bullish/bearish reversal) and confirmation. From there risk can be effectively quantified and taking action becomes reasonable.

Getting stuck on 1 scenario rather then being prepared for multiple possibilities makes you inflexible because there is NO precision in financial markets (unless you're on the micro structure level MOST retail traders are NOT). The scenarios I explained here can unfold over the week or take longer, AGAIN is it a matter of catalyst or surprise news event.

As far as the bigger picture, nothing has changed. The 76K AREA low is a double bottom, which translates into a broader higher low when you look back over the year. This higher low structure implies Bitcoin is still generally BULLISH which means betting on resistance levels can be considered a lower probability outcome. This also means current prices are still attractive investment levels as long as you are sizing strategically. IF price manages to break below 65K over the next quarter, then I would say investing should be more limited since such a break implies the impulse structure is no longer in play.

Other than that, seasonal volume typically peaks around this time of year in the stock market, which means the next few months are more likely to be less eventful and contain smaller price ranges etc. There are always exceptions and news catalysts will still cause price spikes, but the dramatic nature like we have seen will likely be smaller. So unless there are any surprises in Bitcoin, be prepared for slow grinds or less eventful movements generally speaking.

Thank you for considering my analysis and perspective.

BITCOIN just triggered the ultimate post-Halving BUY SIGNAL!Bitcoin (BTCUSD) hit last week the top of the green Gaussian Channel (GC), a key indicator as last time it did (September 02 2024), kickstarted the massive 2024 rally towards the end of the year.

In fact, it can be argued that when BTC makes contact with the GC during a Bull Cycle, it is the ultimate pull-back Buy Signal after Halving events. More specifically, during the previous Cycle and after the May 2020 Halving, the price touched the GC three times (August 31 2020, July 19 2021 and September 20 2021), all of which were the most optimal pull-back Buy Entries as Bitcoin rebounded instantly.

So far during this Cycle and after the April 2024 Halving, this is the 2nd time the GC is tested. As mentioned the first also initiated an instant rebound. As a result, the current GC test is technically considered a very strong buy opportunity for the remainder of the Cycle, which based on the Time Cycles of the last 2 Cycle Tops, it should peak around October 06 2025.

So what do you think? If buying now towards a potential October 2025 Top, the perfect opportunity? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BITCOIN Sell everything in October!Yep, kind of a clickbait title but it doesn't fail to serve justice to this very important Bitcoin (BTCUSD) chart.

Today's analysis displays in the most illustrative way the extremely tight symmetry between BTC's Cycles and how this can help us time our Sell at the Top of the Cycle and equally have the patience to buy as close to the next Bottom as possible.

As you see, in the past +10 years since the 2014 Bear Cycle, every Cycle has almost identical time ranges/ durations. All three Bear Cycles since then, lasted for approximately 1 year, and both Bull Cycles for almost 3 years (152 weeks, 1064 days to be exact). More specifically, the last two Bear Cycles were exactly 1 year long, the 2018 one started on the week of December 11 2017 and ended on December 10 2018 and the next Bear Cycle started on November 15 2021 and ended on November 07 2022. So it's been December-to-December and November-to-November Bear Cycles respectively.

If this high degree of symmetry continues to hold, counting 1064 days from the last Cycle Bottom o November 07 2022, gives a time estimate for the next Cycle Top on (the week of) October 06 2025. If also that holds for the Bear Cycle, expect an October-to-October duration, with an approximate bottom on October 12 2026.

So Sell everything up to October 2025 and Buy back as we get close to October 2026 is the strategy?

Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bitcoin - This Is Just Wonderful!Bitcoin ( CRYPTO:BTCUSD ) creates textbook market stucture:

Click chart above to see the detailed analysis👆🏻

The entire stock market is selling off significantly but Bitcoin and most cryptocurrencies are still holding their strong levels. This is clearly a sign of bullish strength and even if we see a retest of the previous all time high, the overall uptrend remains perfectly valid over the next months.

Levels to watch: $70.000

Keep your long term vision,

Philip (BasicTrading)

BITCOIN's 1D MA50 Flip = GREEN LIGHT for the NEXT BIG PUMP!Bitcoin (BTCUSD) closed Saturday's 1D candle above the 1D MA50 (blue trend-line) for the first time in more than 2 months (since February 03)! The 1D MA50 got tested and rejected the price 6 times since then. At the same time, the price marginally broke above the Lower Highs trend-line that started on the January 20 All Time High (ATH).

This is the most powerful short-term bullish combination as it was staged on a Bullish Divergence 1D RSI, which is on Higher Lows against the bearish trend's Lower Lows. Technically such break-outs immediate Target is the 2.0 Fibonacci extension, which now happens to be just below the $100k mark at $99500. In not such a coincidental fashion, that is he last Resistance level that run through February 05 - 21 before BTC's strong tariff sell-off.

So do you think the 1D MA50 break is the green light for a $99500 rally? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bitcoin: Anything Goes Inside The Range.Bitcoin has rallied out of my anticipated 76K AREA reversal zone (see my previous week's analysis). I anticipated this move BEFORE all of the news and drama that transpired over the week because I focus on relevant information that came from this chart. As of now, price is fluctuating in the middle of a consolidation. While price is still attractive in terms of the bigger picture for investment, the fact that it is in the middle of a short term consolidation must be strongly considered for day and swing trade strategies. Here's my perspective.

A double bottom (failed low) has been established around the 74 to 76K area. It does NOT matter why, all that matters is the structure is now in place. This is very important for two specific reasons: 1) it is a broader higher low (Wave 4 bottom?) which implies a higher high or at least test of high is more likely to follow. This means test of 109K over the coming months is within reason. 2) Resistance levels have a greater chance of breaking while supports have a greater chance of being maintained. Current prices up into the 90K resistance are attractive for dollar cost averaging while broader risk can be measured by the 76K area low.

As for swing trades, price is fluctuating at a mid point of a consolidation. The range low is around 76K, the high around 88K (see arrow). When it comes to smaller time frame strategies, consolidation mid points are HIGHLY random areas. This is where you either WAIT it out for a support or resistance to be reached before taking a signal OR go with continuation patterns (Trade Scanner Pro great for this). The higher probability scenario would be a minor retrace into the high 70Ks or low 80Ks for a swing trade long. Otherwise WAIT for the 88K to 90K resistance area for short signals which would be EXTREMELY aggressive given the fact Bitcoin is generally bullish.

And day trades strategies have a similar outlook. Being in the middle of the range means smaller time frame supports and resistances within the area 83K to 88K are going to be less reliable or more random until price momentum asserts itself on the bigger picture. Beginners should simply avoid this environment, but if you must participate, the best way to adjust is work on smaller time frames like 5 minute or less and accept the whatever the R:R ratio is for that time frame. Either way do NOT expect BIG moves until price makes its way to one of the outer boundaries of the range. The Trade Scanner Pro quantifies the R:R for your chosen time frame and gives you a much better idea of what to expect.

The illustration on the chart points to a short term rejection of the 88K to 90K area resistance. This can be attractive for those who are willing to accept greater risk and operate on smaller time frames. IF Bitcoin breaks 90K, it can easily squeeze into the 95K area and all it takes is an unexpected news announcement which seems to happen regularly in this environment. NO ONE knows where the market is going, we can only assign probabilities which is why RISK must be assessed and RESPECTED before ANYTHING else.

This game is hard not because traders lack intelligence, it is because MOST participants believe they are consuming information that is relevant, especially if this behavior has been reinforced by random wins. As retail traders we have to operate with a blind fold while a small minority of participants operate with HIGH quality information. Here's a hint: you will not find truly relevant information on public platforms like Twitter, mainstream news, etc., yet people still turn to these sources when they feel the need to be "informed". Everything you NEED is on your chart.

Thank you for considering my analysis and perspective.

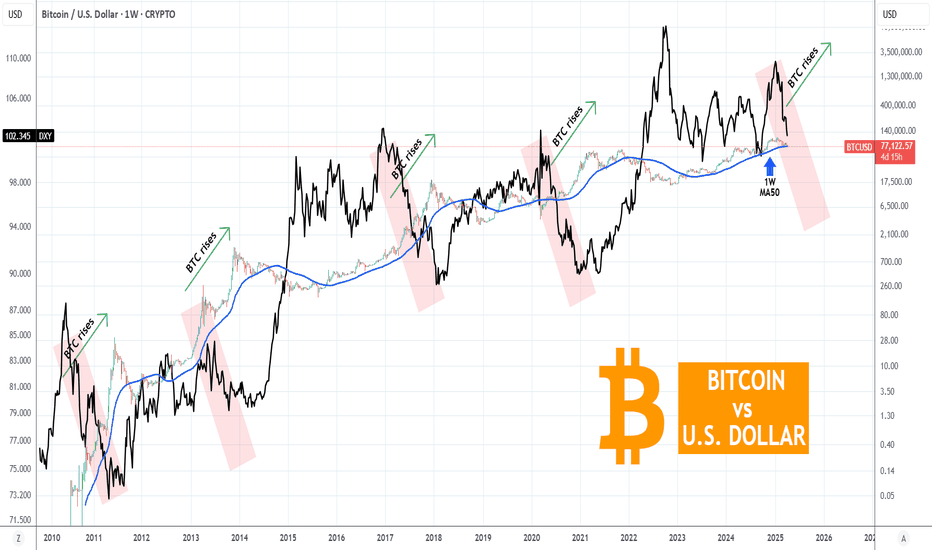

BITCOIN Can a USD sell-off save the Cycle?Bitcoin (BTCUSD) is hanging on its 1W MA50 (blue trend-line) amidst the market chaos and especially following last night's stronger 104% trade tariffs to China from the U.S.

This is a simple yet powerful classic chart, displaying Bitcoin against the U.S. Dollar Index (DXY, black trend-line). This shows the long-term negatively correlated pattern they follow on their Cycles.

Every time DXY entered an aggressive sell-off in the final year of the 4-year Cycle, Bitcoin started its final parabolic rally of its Bull Cycle. This time the DXY peaked exactly at the start of the year (2025) and is on a selling sequence up until today but due to the ongoing Trade War, BTC not only didn't rise but is on a correction too.

Can an even stronger DXY sell-off save the day and complete the 4-year Cycle with a final rally? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BTCUSD: Last chance to prove the Bull Cycle is still intact.Bitcoin remains bearish on its 1W technical outlook (RSI = 40.819, MACD = 1234.500, ADX = 47.185) as it is on the 3rd red 1W candle in a row, which just hit the 1W MA50. First contact since Sep 2nd 2024. The weeky low is also almost at the HL bottom of the Bull Cycle's Channel Up. Needless to say, it has to hold in order for the bullish trend to continue. Practically this is the market's last chance to prove that the Bull Cycle is still intact. So far the -32% decline is no different that all prior inside the Channel Up but an Arc shaped bottom needs to start forming. If it does and that's the new bottom, expect $160,000 by September.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

BITCOIN Is it still on track with past Cycles??Bitcoin (BTCUSD) saw a strong correction last week as well as early trade yesterday on Monday, along with all major stock markets, but had an equally impressive round on Wall Street opening, which keeps it so far above its key 1W MA50 on a potentially weekly closing.

So the critical question now is this: Will it continue the pattern of past Cycles and give one more major rally in 2025?

Well based on the BTC Rainbow Waves, it is still on track and actually in a similar situation as July 2013 when after a 3-month correction/ pull-back sequence, it got back to the Blue Buy Zone and near the Fair Value green trend-line.

As you can see all Cycles peaked on the Red Zone and so far on this Cycle we haven't even reached the 1st orange trend-line. Based on the Time Cycles, the next peak should be around November 2025 and if the price action confirms the Rainbow Wave model again, the closest level to the Red Zone by then would be around $180000.

Do you think that amidst the trade war chaos, that's a realistic expectation? Feel free to let us know in the comments section below!

P.S. I am attaching a snapshot below in case the waves aren't displayed properly on the chart above:

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BTCUSD: Can this M2 supply signal trigger a massive rally?Bitcoin has neutralized the previously oversold levels on its 1D technical outlook (RSI = 35.383, MACD = -1887.100, ADX = 31.814) as it is making a strong technical rebound on the 1W MA50. Today's analysis features the Global M2 supply, which is a leading indicator for Bitcoin. Both in July 2024 and November 2022 (the last two major bottoms for the market) when the M2 started to rise aggressively, Bitcoin declined and consolidated. It followed the bullish trend of the M2 with a rise of its own much later. This is similar to what the market has been experiencing since January 2025, when the M2 started rising but Bitcoin peaked on its ATH and started a decline that continues to this very date. If the pattern gets repeated then by end of April - start of May we are in for a strong Bitcoin recovery (if not earlier).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Will BITCOIN prove to be resilient amidst this market crash??Bitcoin (BTCUSD) just hit its 1W MA50 (red trend-line) for the first time since September 06 2024, while completing the first 1D Death Cross since August 09 2024. This is a critical double combo development as last time those conditions emerged it was a bullish signal.

Despite the theoretically bearish nature of the Death Cross, the last one on 1D was formed just four days after the market's previous major long-term bottom of August 05 2024. That bottom was exactly on the level that the market hit today, the 1W MA50.

The 1W RSI sequences among the 2 fractals are identical and if it wasn't for the abysmal negative market fundamentals regarding the back-and-forth tariffs, that would be an automatic long-term buy entry, the 3rd on of this Bull Cycle.

The only condition we can technically rely on right now, amidst the stock market crash, is for the weekly candle to close above the 1W MA50, as it did on August 05 2024. In that case and of course if and only if the trade war gets under control (and/ or the Fed makes an urgent rate cut), we can expect a new long-term Bullish Leg to begin towards $150k and above.

Failure to address those concerns and a 1W candle close below the 1W MA50, can result into a stronger sell-off towards $50000 and the next long-term technical Support level of the August 05 2024 Low (49150). That would also be a major Support cluster as the 1W MA200 (gray trend-line) is just below that level (and holding since October 16 2023) and by the time of the drop, the market may test that as well.

So what do you think? Will BTC turn out to be resilient amidst this market crash or will it follow suit and decline towards $50k? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bitcoin: 76K Test Watch For Reversal.Bitcoin has broken the 81,500 minor support and is now in the process of testing the recent swing low 78K to 76K AREA. With the lower high structure at the 88K area (see arrow) in place, a lower low is likely to follow in the coming week. The question is how much lower? One reasonable estimate is a test of 73K (the previous all time high before November). The current area between 79 and 76K does present a buying opportunity on multiple time horizons (investment, swing trades, day trades) but the key to timing this WAITING for confirmation.

From the investing perspective, this is an attractive low because this may establish a reversal formation (double bottom) which may be the bottom of Wave 4. IF this turns out to be true, Wave 5 can potentially begin here. Price can probe as far as 64K before overlapping with Wave 1 of this impulse. Stepping into this our placing a limit order at a lower price is reasonable, but managing risk on this time horizon has a lot to do with your sizing strategy (I have explained this on many streams). Keep in mind price can BREAK and test 73K or lower and you must consider that possibility into your sizing strategy.

As far as swing trades, its the same idea except this is where a defined risk (stop) and profit objective has to be assigned (Trade Scanner Pro shines here). While the level is ideal for a double bottom or failed low (see illustration), there is NO confirmation. So it is still highly risky to step into this, especially in light of the stock market situation, etc. Wait for a bullish pin bar, engulfing candle, etc. You can define risk from there and utilize at least a 2:1 or greater profit objective.

For day trades, its the same process just on smaller time frames, (1 min to 15 min). Just on the day trade time frame, at this time, SHORTS can still be attractive on minor retracements because momentum on these time frames is CLEARLY bearish. If 79K breaks, there is a greater chance momentum continues toward the 76K AREA low.

I realize there must be some news catalyst in play to spark such a move. DO NOT react to the news, this is often a mistake. It doesn't matter what it is because this is a game of recognizing herd mentality behavior and identifying potential opportunities in this context. You want to anticipate an inflection point, WAIT for price behavior to confirm. At that point you can identify risk, and profit expectations. THIS is a MORE objective process compared to "thinking" you know how the news will affect a market. Keep decision making as simple as the "IF this, then that" framework which gives you a more accurate view of market intent since it encourages a more passive view rather than asserting your own irrelevant opinions.

Thank you for considering my analysis and perspective.

BITCOIN Do you really want to miss this rally???Bitcoin / BTCUSD remains supported by the 1week MA50 just like it has been through the whole 2020/21 period after the COVID crash.

In spite of the massive bearish pressure of the polical developments (tariffs), the fact that the market is holding the 1week MA50, means that it is respective Bitcoin's Cycles.

In fact this is like the May-June 2021 accumulation on the 1week MA50, following the first Bitcoin Top of April 2021.

Similarly, we've had a peak formation in December 2024- January 2025 and the market corrected.

In addition to that, the 1week RSI is testing the 42.00, which isn't just where the August 2024 and September 2023 bottoms were priced, but more importantly the June 2021 one.

The symmetry between the last two Cycles is uncanny, both trading inside the long term Channel Up, with identical Bear Cycle and (so far) Bull Cycle ranges.

If all ends up repeating themselves, expect a value of at least $160000 by September.

Follow us, like the idea and leave a comment below!!

BITCOIN is exactly where it's supposed to be.Bitcoin (BTCUSD) is under heavy pressure lately due to the trade tariffs but as long-term investors, we shouldn't let this volatility affect us.

The MVRV has been one of the most consistent cyclical Top (sell high) and Bottom (buy low) indicators giving only a maximum of two optimal signals in each Cycle and it shows that the market is nowhere near a Top.

On the contrary the MVRV has spend the first 3 months of the year correcting from the 0.382 Fibonacci level to the 0.236. This is the exact same score it had i March 2017. Even in the other two Cycles that wasn't this low on Fibonacci levels, it still made a correction, flashing a red signal.

As the 1W MA50 (blue trend-line) continues to support, there are far more greater probabilities that the market will recover, turning the recent trade volatility into the best buy opportunity of 2025.

As far as a Cycle Top is concerned, it has always been an excellent exit signal when the MVRV hit the 0.786 Fib.

So do you think that will be the case? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BITCOIN This is where the most aggressive part begins.Bitcoin (BTCUSD) has turned sideways amidst the tariffs implementation today and on the longer picture (1W time-frame) it remains supported just above the 1W MA50 (blue trend-line). On this chart we display our Parabolic Growth Channel (PGC), which is the long-term Zone where BTC is a buy opportunity.

Throughout the market's historic Cycles, the time when BTC was supported above the 1W MA50 but still within its PGC was known as an Accumulation Phase (blue ellipse) before the final parabolic rally of the Cycle and its eventual Top (green Arc).

Based on this model, so far we haven't seen any such rally, despite the undoubtedly strong rallies of October 2023 - March 2024 and October 2024 - December 2024. Only the March 2024 and then the recent Tops can be counted as marginal breaches above the PGC and it's been no surprise that the market corrected back inside the Buy Zone but remained supported by the 1W MA50.

As long as it does, the probabilities of that final, most aggressive Cycle rally get stronger. On the last Cycle the peak was priced just above the 1.618 Fibonacci extension. That is currently a little below $170k and that is why our final Target is just below at $160000. Also right now we are marginally below the 0.618 Cycle top-to-top Fib, which is in line to where all previous final Cycle parabolic rallies started.

So do you think the 1W MA50 will now push BTC to its final Cycle rally? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BITCOIN Will it finally break the 2 month Resistance?Bitcoin / BTCUSD is having an impressive 1day candle,recovering the losses of the last 3 days and with the 1day RSI bouncing on its Rising Support.

Now it faces the most important Resistance of all, the Falling trend line that started on the January 20th ATH.

This is just under the 1day MA50 and this will be the 5th test.

If successful, it will be an early validation that the trend has finally shifted to long term bullish again.

The first technical target will be the 2.0 Fibonacci extension. Aim a little bit lower at the top of February's Resistance Zone at $100000.

Follow us, like the idea and leave a comment below!!

Bitcoin: Watching For Reversal 78K AREA.Bitcoin bear flag has become in play over the previous week as I anticipated in my previous week's analysis. While there is a potential minor support in the 81 to 80K area, the lower high established at 88K implies a lower low is likely to follow which can unfold this week. This scenario could see price retesting the 76K area low. There are a couple of potential opportunities that can present themselves in this situation.

The day trade long off the 81,500 area support (see thin rectangle and arrow). This would be appropriate for the smaller time frames like 30 min or lower. Waiting for price structure confirmations and looking for profit objectives that are proportionally within reason on your selected time frame (Trade Scanner Pro is ideal for this). Price may see smaller time frame reversal patterns between 81,500 and 80K numerous times. It is important to take proportional profits because there is NO guarantee the reversal will follow through especially in the face of a lower probability bounce (thanks to the lower high established at 88K).

The opportunity for larger time frames (like swing trades) is between 78 to 76K. This is the previous low and a broader double bottom formation can develop here. The confirmation patterns are the same as previously explained, except the profit objective can be much greater because of the magnitude of the levels in question. For example, if a long confirms at 78,500, risk would be like 2K points, profit objective would be 4K at minimum. Scaling out of a swing trade can also be considered here like selling half at 83.5K, another quarter at 84.5K and closing what is left at 85.5K. Scaling is a more advanced concept, if you find it confusing, just stick to a simple R:R of 2:1 or more all in all out in high potential situations.

While the broader trend in Bitcoin is still bullish, the short term structure is bearish until proven otherwise by price. Trying to piece together news, economic reports, etc., I find to be nothing but confusing and often counterintuitive to how the market actually reacts. This is why I rely ONLY on price structure and support/resistance levels. They are objective and help me align with the market intent (and why a lot of my anticipated scenarios happen to play out).

The fact that the short term structure is bearish implies support levels have a greater chance of breaking. This helps to shape my expectations, and also why it is so important to wait for confirmation. The reason I prefer longs over shorts in this situation is because I do not lose site of the BIG picture. The 76K to 73K area is VERY relevant location of a broader higher low. This is why you need to have a very deep understanding of the time frames you are using along with the potential and risks presented by reach one. The larger the time frame, the more weight it carries. The short term bearish trend is nothing more than a retrace of a broader BULLISH structure that has been in play since the 15K low a few years ago.

Thank you for considering my analysis and perspective.

BITCOIN BEARISH WEDGE BREAKOUT|SHORT|

✅BITCOIN made a bearish

Breakout of the bearish wedge

Pattern which reinforces our

Bearish bias and we will be

Expecting a further move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BITCOIN Is it owed a parabolic rally based on the GoldBTC ratio?Bitcoin (BTCUSD) has been trading on a highly structured manner within a Channel Up for the entirety of its Bull Cycle since the November 2022 bottom. We've discussed before how this is the smoothest Cycle of all.

What we didn't bring into the mix before was the Gold/BTC ratio (black trend-line), naturally negatively correlated to Bitcoin, which has been trading within a Channel Down since its January 2023 Top. As you can see it posts the same pattern on every Cycle: Channel Down (blue), followed by its bearish break-out and a huge drop (red ellipse) that prices the Bull Cycle Top on BTC.

So far every BTC Cycle had its parabolic rally (green ellipse) when the Gold/BTC ratio broke downwards. Does the market owe one this time also? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BITCOIN Say goodbye to low prices if this level breaks. Bitcoin (BTCUSD) has turned sideways the past couple of days following the strong bullish reaction on the 1W MA50 (red trend-line). The reason it that it is about to face the most common Resistance of this Cycle, the 1D MA50 (blue trend-line).

Within the current (2023 - 2025) Bull Cycle, BTC always started its new rally near or on the 1W MA50 but the most important development to confirm that was a break above the 1D MA50. On both previous correction/ accumulation phases, the 1D MA50 break coincided with a 0.618 Fibonacci retracement break.

The bottom of each phase is formed when the 1W MA50 gets tested on a Double Bottom, which we've had on March 11 2025, September 06 2024 and September 11 2023. Among those fractals, their 1D RSI patterns post identical sequences.

As a result, once the price breaks above the 1D MA50, we can claim that the most optimal buy opportunity of the past 6 months will cease to exist and then you'll have to chase a rally all the way to at least a +97% rise (late 2023 rally, the late 2024 was even stronger at +106%). That gives us a minimum target estimate of $150000.

Do you think that would be the case? Break above the 1D MA50 and off to the races with no looking back? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BITCOIN on a Bull Flag that targets $94000.Bitcoin is trading inside a Channel Up since the March 11th market bottom.

The recent 2day pull back is a Bull Flag that just hit the 0.5 Fibonacci retracement level.

Ahead of an emerging Golden Cross (4h), this is a triple buy signal.

Trading Plan:

1. Buy on the current market price.

Targets:

1. 94000 (the 2.0 Fibonacci extension).

Tips:

1. The RSI (4h) is also rebounding on its 2 week Rising Support. An additional strong buy signal.

Please like, follow and comment!!