Bitcoin - What's Next?We have seen a major 3 Wave (Minor Wave I, II, III) Bullish completion on Bitcoin. What do you think the next move is? For those who understand the BASICS of the Elliott Wave Theory, will easily know what is happening next. I have explained for free plenty of times in this channel, how many waves are in a full bullish or bearish cycle🔥

Bitcoin-btcusd

BITCOIN This is where the most aggressive part begins.Bitcoin (BTCUSD) has turned sideways amidst the tariffs implementation today and on the longer picture (1W time-frame) it remains supported just above the 1W MA50 (blue trend-line). On this chart we display our Parabolic Growth Channel (PGC), which is the long-term Zone where BTC is a buy opportunity.

Throughout the market's historic Cycles, the time when BTC was supported above the 1W MA50 but still within its PGC was known as an Accumulation Phase (blue ellipse) before the final parabolic rally of the Cycle and its eventual Top (green Arc).

Based on this model, so far we haven't seen any such rally, despite the undoubtedly strong rallies of October 2023 - March 2024 and October 2024 - December 2024. Only the March 2024 and then the recent Tops can be counted as marginal breaches above the PGC and it's been no surprise that the market corrected back inside the Buy Zone but remained supported by the 1W MA50.

As long as it does, the probabilities of that final, most aggressive Cycle rally get stronger. On the last Cycle the peak was priced just above the 1.618 Fibonacci extension. That is currently a little below $170k and that is why our final Target is just below at $160000. Also right now we are marginally below the 0.618 Cycle top-to-top Fib, which is in line to where all previous final Cycle parabolic rallies started.

So do you think the 1W MA50 will now push BTC to its final Cycle rally? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BITCOIN Will it finally break the 2 month Resistance?Bitcoin / BTCUSD is having an impressive 1day candle,recovering the losses of the last 3 days and with the 1day RSI bouncing on its Rising Support.

Now it faces the most important Resistance of all, the Falling trend line that started on the January 20th ATH.

This is just under the 1day MA50 and this will be the 5th test.

If successful, it will be an early validation that the trend has finally shifted to long term bullish again.

The first technical target will be the 2.0 Fibonacci extension. Aim a little bit lower at the top of February's Resistance Zone at $100000.

Follow us, like the idea and leave a comment below!!

BITCOIN | 4H | KEY POINTS Hey traders, what's up

I've marked the key levels for Bitcoin on the chart. Right now, it's holding within the 4-hour supply and demand zone. But if this level breaks, I expect Bitcoin to drop all the way down to around $78K.

For spot buyers, there’s no real risk at the moment. But if you're trading on margin and currently in the red, be extra cautious.

The market will liquidate you first, then move on its way.

Big thanks to everyone supporting my analysis with likes

I will provide continuous updates under this analysis.

Bitcoin will reach $180,000 this yearBitcoin’s trajectory is unstoppable—analysts are calling for a climb to $180,000, fueled by institutional adoption, limited supply, and global economic uncertainty. With halving cycles tightening the squeeze and mainstream acceptance soaring, BTC isn’t just a store of value—it’s the financial revolution we’ve been waiting for. Buckle up, the bull run’s coming.

Bitcoin (BTCUSD) Sell Limit Trade IdeaTRADENATION:BTCUSD Bitcoin has formed a double top pattern, confirmed by a breakdown below 89,199, signalling potential for further downside. Additionally, a bearish flag breakdown in recent sessions suggests continuation lower.

This morning’s gap down highlights market weakness, but a fill of this gap at $83,543 may offer an ideal entry for short positions.

Trade Details

Entry (Sell Limit): 83,543

Stop Loss: 87,992

Take Profit: 70,613

Risk/Reward Ratio: 2.9:1

Key Levels

Resistance:

R1: $83,543 (Entry Point)

R2: $85,819

R3: $88,767

Support:

S1 : 76,590

S2: 70,531

S3: 63,411

Technical & Fundamental Factors

✅ Double Top Formation – Breakdown below 89,199 confirms bearish momentum.

✅ Bearish Flag Breakdown – Indicates continuation of the current downtrend.

✅ Gap Lower – Signals further weakness; gap fill at 83,543 offers a selling opportunity.

⚠️ Smart Money Not Buying – Commercial participants are selling Bitcoin, suggesting a lack of institutional support.

Summary

This setup offers a high-probability short opportunity at 83,543, targeting a move down to 70,613, with a stop at 87,992. The combination of technical breakdowns and weak institutional demand supports a bearish outlook.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BTC - Lots of options going into the new week!In this BTCUSDT 4-hour chart analysis on Bybit, we see price action reaching a crucial decision point. Key Fibonacci retracement levels, a Fair Value Gap (FVG), and the Golden Pocket zone indicate potential movements ahead. Will BTC break down, retrace to fill the imbalance, or rally toward the golden pocket? Let’s analyze the key levels.

Key Observations:

🔹 Golden Pocket Resistance: The highlighted yellow zone marks the 0.618 - 0.65 Fibonacci retracement of the greater downtrend, a well-known high-probability reversal area. If BTC reaches this level, we could see strong resistance.

🔹 Fair Value Gap (FVG): The blue zone represents an unfilled imbalance left behind during the recent downward move. If BTC retraces, it could fill this gap before deciding on the next direction.

🔹 0.618 - 0.65 Fib Support: The price is currently hovering near a local golden pocket support area. A strong reaction here could trigger a bullish move. However, failure to hold this level could send BTC lower.

Potential Scenarios:

1️⃣ Bullish Breakout: BTC bounces from the current level, fills the FVG, and continues upward to test the golden pocket resistance. A breakout above this zone could confirm a bullish trend shift.

2️⃣ Short-Term FVG Fill & Rejection: BTC moves up to fill the FVG but faces selling pressure, leading to another bearish move before a larger decision point.

3️⃣ Bearish Breakdown: BTC fails to hold the local support and breaks downward, continuing the broader downtrend toward lower liquidity zones.

What’s Your Prediction?

Which scenario do you think is most likely—1️⃣ Bullish Breakout, 2️⃣ FVG Fill & Rejection, or 3️⃣ Bearish Breakdown? Comment below and let’s discuss! 🚀📉📊

Bitcoin: Watching For Reversal 78K AREA.Bitcoin bear flag has become in play over the previous week as I anticipated in my previous week's analysis. While there is a potential minor support in the 81 to 80K area, the lower high established at 88K implies a lower low is likely to follow which can unfold this week. This scenario could see price retesting the 76K area low. There are a couple of potential opportunities that can present themselves in this situation.

The day trade long off the 81,500 area support (see thin rectangle and arrow). This would be appropriate for the smaller time frames like 30 min or lower. Waiting for price structure confirmations and looking for profit objectives that are proportionally within reason on your selected time frame (Trade Scanner Pro is ideal for this). Price may see smaller time frame reversal patterns between 81,500 and 80K numerous times. It is important to take proportional profits because there is NO guarantee the reversal will follow through especially in the face of a lower probability bounce (thanks to the lower high established at 88K).

The opportunity for larger time frames (like swing trades) is between 78 to 76K. This is the previous low and a broader double bottom formation can develop here. The confirmation patterns are the same as previously explained, except the profit objective can be much greater because of the magnitude of the levels in question. For example, if a long confirms at 78,500, risk would be like 2K points, profit objective would be 4K at minimum. Scaling out of a swing trade can also be considered here like selling half at 83.5K, another quarter at 84.5K and closing what is left at 85.5K. Scaling is a more advanced concept, if you find it confusing, just stick to a simple R:R of 2:1 or more all in all out in high potential situations.

While the broader trend in Bitcoin is still bullish, the short term structure is bearish until proven otherwise by price. Trying to piece together news, economic reports, etc., I find to be nothing but confusing and often counterintuitive to how the market actually reacts. This is why I rely ONLY on price structure and support/resistance levels. They are objective and help me align with the market intent (and why a lot of my anticipated scenarios happen to play out).

The fact that the short term structure is bearish implies support levels have a greater chance of breaking. This helps to shape my expectations, and also why it is so important to wait for confirmation. The reason I prefer longs over shorts in this situation is because I do not lose site of the BIG picture. The 76K to 73K area is VERY relevant location of a broader higher low. This is why you need to have a very deep understanding of the time frames you are using along with the potential and risks presented by reach one. The larger the time frame, the more weight it carries. The short term bearish trend is nothing more than a retrace of a broader BULLISH structure that has been in play since the 15K low a few years ago.

Thank you for considering my analysis and perspective.

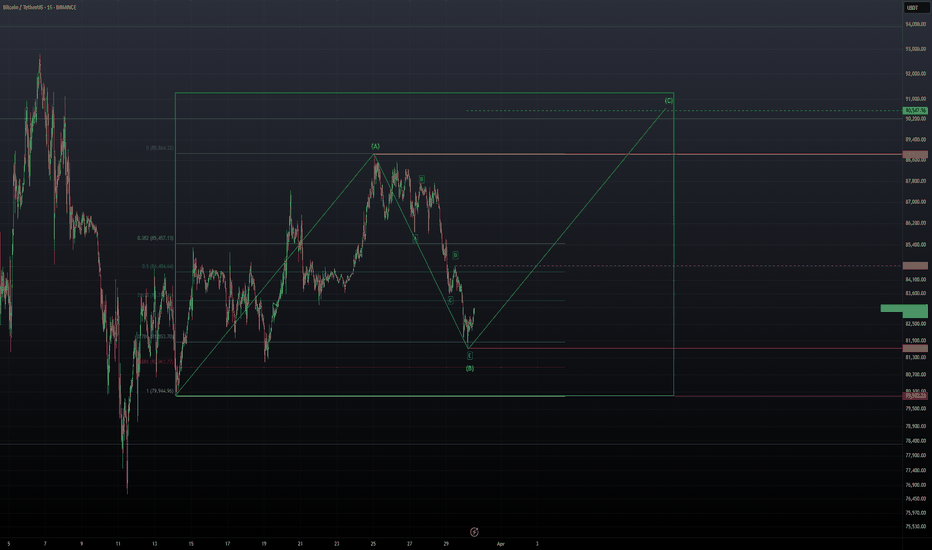

BITCOIN - Long Trade Idea For A Zig-Zag...In corrective patterns, Wave 2 can sometimes include large expanded waves.

Here’s a simplified example of a potential Zig-Zag trade.

The critical support level is at the start of the move at $79,962, while key support lies at the 0.786 retracement level at $81,635 if we break above $84,630.

The target for Wave (C) is $90,547, aligning with the length of Wave (A).

BITCOIN BEARISH WEDGE BREAKOUT|SHORT|

✅BITCOIN made a bearish

Breakout of the bearish wedge

Pattern which reinforces our

Bearish bias and we will be

Expecting a further move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BITCOIN Is it owed a parabolic rally based on the GoldBTC ratio?Bitcoin (BTCUSD) has been trading on a highly structured manner within a Channel Up for the entirety of its Bull Cycle since the November 2022 bottom. We've discussed before how this is the smoothest Cycle of all.

What we didn't bring into the mix before was the Gold/BTC ratio (black trend-line), naturally negatively correlated to Bitcoin, which has been trading within a Channel Down since its January 2023 Top. As you can see it posts the same pattern on every Cycle: Channel Down (blue), followed by its bearish break-out and a huge drop (red ellipse) that prices the Bull Cycle Top on BTC.

So far every BTC Cycle had its parabolic rally (green ellipse) when the Gold/BTC ratio broke downwards. Does the market owe one this time also? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

The Global BTC Shake out is coming before 1 million BTC in 2037I believe it worth stating that we might be in a moment where bitcoin is gonna shake everyone out and make everyone sell or at least all those who think 1 million BTC is coming soon. The great Bitcoin reset cycle will occur eventually before true mass adoption... we could very well retest $15,000 as bottom sometime next year.. if true BUY and hodl and invest consistantly for a whole decade and reap the reward of a 1 million bitcoin probably in 2037-38 and Bitcoin by then will be nearly on par with golds market cap by then or below it. And youll become among the weathiest of the wealth.

Bitcoin - Please Just Listen To The Charts!Bitcoin ( CRYPTO:BTCUSD ) remains in a bullish market:

Click chart above to see the detailed analysis👆🏻

Despite literally everybody freaking out about cryptos lately, big brother Bitcoin is still creating bullish market structure. During every past cycle we witnessed a correction of at least -20% before we then saw a parabolic rally. So far, Bitcoin is just doing its normal "volatility thing".

Levels to watch: 70.000, $300.000

Keep your long term vision,

Philip (BasicTrading)

BITCOIN Say goodbye to low prices if this level breaks. Bitcoin (BTCUSD) has turned sideways the past couple of days following the strong bullish reaction on the 1W MA50 (red trend-line). The reason it that it is about to face the most common Resistance of this Cycle, the 1D MA50 (blue trend-line).

Within the current (2023 - 2025) Bull Cycle, BTC always started its new rally near or on the 1W MA50 but the most important development to confirm that was a break above the 1D MA50. On both previous correction/ accumulation phases, the 1D MA50 break coincided with a 0.618 Fibonacci retracement break.

The bottom of each phase is formed when the 1W MA50 gets tested on a Double Bottom, which we've had on March 11 2025, September 06 2024 and September 11 2023. Among those fractals, their 1D RSI patterns post identical sequences.

As a result, once the price breaks above the 1D MA50, we can claim that the most optimal buy opportunity of the past 6 months will cease to exist and then you'll have to chase a rally all the way to at least a +97% rise (late 2023 rally, the late 2024 was even stronger at +106%). That gives us a minimum target estimate of $150000.

Do you think that would be the case? Break above the 1D MA50 and off to the races with no looking back? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BITCOIN - The Bearish Scenario - Sign's of a Possible Top...In this video, I explore the possibility that Bitcoin may have already hit a temporary peak.

My perspective comes from initially building a bullish case—only to uncover subtle flaws that I chose to set aside.

But as I meticulously documented my observations, those cracks in the bullish argument became impossible to ignore. When I switched to a bearish wave count, some thing began to align, shedding light on areas of the chart that previously seemed uncertain.

These market waves are intricate, requiring patience and a fresh perspective to decipher where we truly stand in the broader pattern.

Only after stepping back and allowing time for meaningful price action does the picture start to come into focus.

I also touch on Ethereum's pattern and the Dow Jones.

Is BTC Bitcoin Overextended? My Bias Is Bullish With Conditions!This 30-minute chart 🌟 shows Bitcoin consolidating within a descending channel after a recent bullish breakout 🚀, with a potential bullish structure forming. The price is currently testing the upper boundary of the channel near $87,500 🛡️. If the price breaks below the channel and retests the equilibrium support, it could present a strong buy opportunity 💰 . Considering the broader analysis 🌍, a break above $87,926 with strong volume 🔥 would confirm bullish momentum toward $90,000 🎯 . Not financial advice. ✨

BTCUSD Trade Idea: is it gonna move?A bullish trade setup on BTC/USD, targeting a move towards the previous day's high or the nearby Order Block . The price recently swept the previous day's low's liquidity (86,407.34), indicating potential support. A long entry is placed after a retracement, with a stop loss below recent lows and a take profit set near 87,654.55.

BITCOIN on a Bull Flag that targets $94000.Bitcoin is trading inside a Channel Up since the March 11th market bottom.

The recent 2day pull back is a Bull Flag that just hit the 0.5 Fibonacci retracement level.

Ahead of an emerging Golden Cross (4h), this is a triple buy signal.

Trading Plan:

1. Buy on the current market price.

Targets:

1. 94000 (the 2.0 Fibonacci extension).

Tips:

1. The RSI (4h) is also rebounding on its 2 week Rising Support. An additional strong buy signal.

Please like, follow and comment!!

BTCUSD: Can $160k be a very 'pessimistic' target estimate?Bitcoin is neutral on its 1W technical outlook (RSI = 50.359, MACD = 2868.500, ADX = 51.194) and having rebounded almost on its 1W MA50, there couldn't be a better buy opportunity for the rest of the year. Basically the price is now ranged inside the 1W MA50 and top trendline of the Pi Cycle, while the 1W CCI hit the -100.00 oversold limit. This has been the most efficient buy entry in August 2024 August 2023 even on the Cycle before in June 2021.

Even if the market doesn't make an 'excessive top' above the Channel Up, like the last two Cycles, hitting $160,000 would still be under the top of the Channel Up and the top of the Pi Cycle. No matter how high this target seems now, it will still be a pessimistic, 'bad case' scenario.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

BITCOIN Wait For Breakout! Sell!

Hello,Traders!

BITCOIN is trading below

The horizontal resistance

Of 92,000$ and has formed

A bearish wedge pattern so

We are bearish biased and

IF we see a bearish breakout

From the wedge we can

Be expecting a further move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

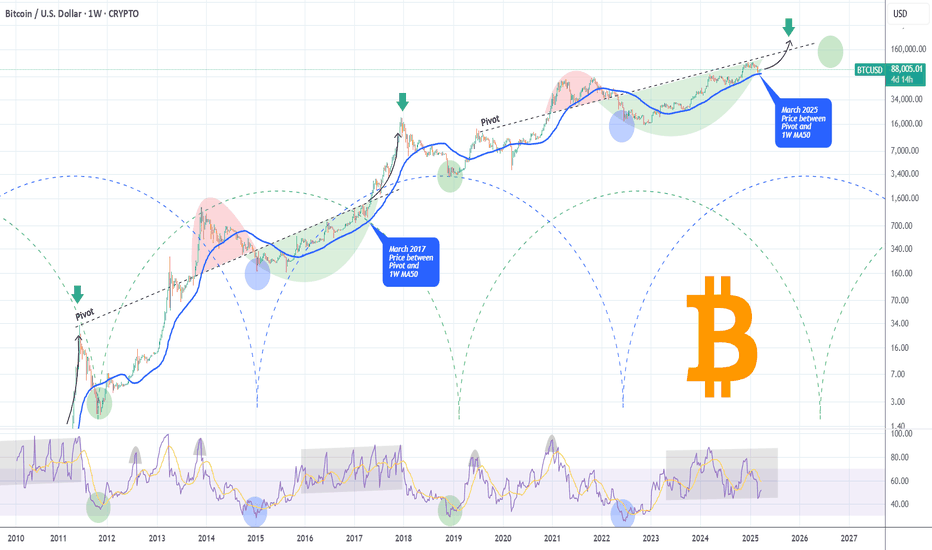

BITCOIN Mega Cycle starting the final Parabolic Rally.This is not the first time we review the Mega Cycle Theory on Bitcoin (BTCUSD). This states that in reality BTC's Cycle's since the beginning aren't 4 as traditional models suggest but 2. And in fact instead of the 4th, we are currently on just the 2nd BTC Mega Cycle.

Well this Theory has for sure a better gel with the stock market trend in the past 15 years but what's more important is that the price is now (March 2025) within the underlying Pivot trend-line and the 1W MA50 (blue trend-line), which is the same level it was coming toward the end of the 1st Mega Cycle. That was when it broke above the Pivot and started the hyper aggressive Parabolic Rally.

This Pivot trend-line is essentially the level that starts after the initial Cycle rally and acts as a Resistance turned Support and then Resistance again until the Cycle's final Parabolic Rally. Practically the Cycle mapping is more effectively viewed on the 1W RSI sequence. We are now at the stage when the 1W RSI ranges for the past 2 years between overbought (80.00) and neutral (45.00) like it was in 2016 - 2017.

In any case, this is yet another study showing that Bitcoin's Top can be at around $150k, which is currently marginally above the Pivot and as we head towards the end of 2025, the bar is raised to as high as $200.

So do you think we are just starting the final year Parabolic Rally to at least $150k? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇