Long Term Resistance.BTC has hit a hard resistance at the .62 Fib level, of the previous all time high in December. And settled right on the .5 level. Based on this resistance and the looks of the basic MA's, RSI and Macd. On a long term scale, it should very likely be correcting and giving us a bearish market for a bit

Bitcoin-longterm

BTCUSD: Gann Box TA Perfectly Predicts Every High And Every Low!I recently took a look at the long term logarithmic Bitcoin chart using the Gann Box as a technical analysis tool. I WAS SHOCKED!

The Gann Box perfectly predicted every single high and every single low amazingly accurately. It pinpointed the exact highs and gave you a beautiful accumulation zone with which to buy the lows. I mean what more could you possibly ask for?!

So now we can predict the price axis and that might be more than enough for most people, but how about the time axis? Where on the Gann Fan will bitcoin peak? Extending this technical analysis out into the future to try and predict where the next high might be meant I had to make some calculated assumptions regarding three factors surrounding time.

1) We will test support for an extended period of time just like the prior two cycles.

2) The price doesn't break new highs until after the halving event.

3) Each bull cycle is longer in duration than the last.

Assumption 1: Support will be tested for roughly 230 days, the same as the previous cycle.

Assumption 2: New highs will be reached 170 days after the halving takes place, the same as in the previous cycle.

Assumption 3: The next bull cycle will last slightly longer than the last, just like the 2017 bull market lasted slightly longer than the 2013 bull market.

With this information we can predict a price range target of between $5 Million and $15 Million within a range of time between September 2021 and June 2022.

This is not financial advice, just a calculated prediction.

Back to 2017! It doesn't mean that this must be true. But I think it's the most likely scenario.

I'm not an expert on the theory of elliott waves . But this all makes sense ... look at the NVT indicator. We will be able to buy at very low prices.

I see the current situation so that the price is rising from the last strength, it is exhausted. The price has grown too fast. We need a great historical correction.

BITCOIN: Two most likely scenariosIn my opinion, there are two most likely scenarios of the incoming bullrun.

Both scenarios reach around $ 140,000. This is calculated from past cycles.

SCENARIO 1

- It takes the same time as the previous cycle.

- Correlation with halving.

- Bitcoin currently looks like the beginning of bullrun.

SCENARIO 2

- It takes more time. This is a calculation based on previous cycles. Each cycle lasts longer than the previous one.

- It doesn't correlate with halving.

- Correlates with NVT indicator

Personally, I would like the scenario number two. However, I want to be objective. I see the situation fifty-fifty. In any case, I think that we will soon look back at 5K, where it will be a great opportunity to invest. Don't be overwhelmed with emotions, set your take profit around $ 130,000 and enjoy your 26x initial investment.

What scenario do you think is likely? ;)

Big Ole Curvy Boi - The Unbreakable Curve -A bet between friends

So a friend of mine alleged that this curve "the green line" is forever unbreakable and that bitcoin will never go below that price at any point along said curve and bet 1 bitcoin it will within the next 2 years.....

I'm just charting this here to keep an eye on it and to remind myself to check it again in a few months... Im coming for your bitcoin John....Im going to make you pay up if this falls below said line.

John do you agree to the terms of this bet... that if it falls below the green line at anytime, for any length of time including quick wicks from now until may 23rd 2021 you will owe me 1 bitcoin... and if it does not go below this line I will owe you 1btc...

Type I agree with initials below:

KEL - 5/23/19

JMC - 5/23/19

Full Rules on Chart

Rules: Can Not go below big green line at any point to win bet. Quick Wicks and authentic Flash crash dumps are included in that.... Flash crashes below line due to a TECHNICAL EXCHANGE ERROR or major HACK on a single exchange does NOT count. Exchange charts that qualify are Bitstamp, Coinbase, Kraken, Gemini, (BITFINEX CHART DOES NOT QUALIFY) Wick/price must breach below the line on 2 of the 4 exchanges listed. This Bitstamp chart being the master chart to reference price points. Payout is to be executed within 24 hours of end date. equal US dollars worth of alt coins is also accepted.

Good luck... The future of Crypto is so bright!

BTC Long-term view BITSTAMP:BTCUSD It looks like price action is very similar to May 2014 when bitcoin rose up to previous resistance only to fall hard. With this outlook, we still have at least another year or two before bitcoin is ready to see new highs and we could see a longer accumulation zone under the lows from this year. I don’t think the accumulation zone will last as long as it did a few years back, but i would love to buy some under $3000. With this outlook, i think we will see that opportunity again, but not before we meet the resistance around $6000. Many alts will see new lows and many will die so whatever you do don’t fomo and stay patient

Implications of this breakout for longterm BTC trendSo yes, BTC is apparently bullisher than I thought, at least short-term, because longterm I'm always a BTC uber bull :)

But short-term, I had several reasons to think that a weekly capitulation bar was very likely:

1. Too much bullishness and optimism (contrarian indicator)

2. Number of daily transactions still below ATH (although now finally approaching ATH level), therefore metcalfe price not high enough

3. Crypto fear and greed index at or above 60 (alternative.me)

4. Weekly and 3d stoch RSI on overbought since ages

5. Drying up volume after a strong impulse move down in an ascending triangle

6. Bearmarkets in BTC like to end with a strong capitulation weekly bar on large volume

And most importantly:

7. Cycles getting longer, meaning that the low we had in 2015 in January, would come a few months later, around April-May.

But apparently, BTC does something else. That's why one has to love BTC. No matter how long you're in the market, BTC always makes you rethink your assumptions.

That's why I was thinking, what implications would it have on the longterm BTC chart, if we'd enter the bullmarket now, the chances of which have increased a lot, especially if the weekly candle closes above 4600.

I've drawn two scenarios: One where BTC slows down, every cycle until now was 574 days longer than the previous one.

Of course, we don't have enough data points yet, but if we are to extrapolate this, we'd get the next ATH in July 2023 at around 200k.

But it seems to me that this theory might be wrong, given that BTC wants to continue the bullmarket prematurely, thus, as fast as the last time, with no signs of slowing down.

This would mean that the cycle duration would from now on stay more or less the same: 4 years, strictly governed by the halvings.

In anticipation of the halvings, the price already starts to rise at least one year before the halvings, as it seems.

Therefore we would get the next ATH at the end of 2021 already, but then not quite as high, "only" around 100k.

So, as BTC appears faster and bullisher than I thought, what do you think, will the cycles get longer or not?

Both could work out, although the faster breakout here would favor a bit the 2021 ATH version.

But then again, the logic dictates that as bigger as something gets, the more "inertia" it should have. Guess we'll need new data points for 2019 :)

Now, when is a good time to enter this market?

I personally never enter a FOMO, especially not when all indicators are overbought. If indeed the weekly candles continue green and get above the 5k range, it will be good to enter when weekly stoch RSI

gets oversold again, after a few strong dumpds, i.e. from 6500 to the 4000 range, provided the logarithmic resistance now acts as strong support.

I've written a lot now, but this move here is fascinating, and therefore needs thinking and re-adjustments for the longterm BTC trend might be necessary. Neutral because I wanna see the weekly candle close first to be sure.

Bitcoin long term bull scenarioAccording to S-curve adoption, tech gets adopted in an S-curve pattern which is exponential at first, linear when it hits the mainstream and then flattens out when full adoption has been achieved.

I follow this reasoning with Bitcoin and while the day to day, week to week, month to month and even year to year movements are too short to see this S-curve pattern, when we look at the full picture of 7 years of Bitcoin price data we can see this S-curve materialising.

What we see in the bitcoin price is a series of declining exponential moves, totally in correspondence with the S-curve adoption. It seems very likely that the bottom for bitcoin is in the neighborhood of today's 3300 USD price. If price holds here, the bottom could be laid for the third multi-year exponential bullrun, less impressive than the former but driving bitcoin price higher than before nonetheless.

It had to be: The INSANE ULTRA LONGTERM BTC chart !!!!This is half fun, half serious. For all of you that plan to live 100+ years like myself (watch Aubrey de Greys theories on life extension and longevity!), this chart is a serious thing to consider, when planning your future home on Mars. Those tickets with SpaceX's spaceship won't be cheap!!!

Also, those life extenstion therapies also won't be cheap. So we carefully have to plan this stuff, hehe. Fortunately, BTC kinda tells us, where this might be going (still half serious).

If we'd extrapolate the current behaviour into the very far future, and look at other Type 1 technologies (in as technologies of an emerging Type 1 civilization such as us, the internet being another example), we can assume that bitcoins growth will take decades until it reaches saturation.

The internet started in 1969 with a network of 4 computers. Yes. 4! It took the internet 7 years to grow to 100 hosts. In 1989, it reached 100k, but still a lot more room to grow. Tim Berners Lee then invented the WWW at CERN. It went public in 1993, reaching 1 million hosts. 2 years later already 10 million.

And now, in 2018 it seems that we finally reach saturation at around 1 billion web hosts.

Here is the chart for internet host growth:

upload.wikimedia.org

So it took the internet almost 50 years from zero to saturation.

If we assume that bitcoin, as a decentralized network, shares many similarities with the internet, it is not crazy to assume that bitcoin will also reach saturation 50 years after its creation, so around 2058.

Thus, translating that to bitcoin price, saturation may lie in the very very far future, at 5-6 million USD, according to the current price trend.

Such longterm charts are of course crazy, because so much can happen between now and the very far future, it is funny and entertaining however nonetheless to speculate about such things.

I for one tend to cash out a few coins around 2050, for my trip to mars. It will be an awesome time there, Elon's also gonna be there, we'll have some insane parties at 1/3 earth gravity.

Don't take this chart too seriously :)

But still, who knows? A lot of crazy stuff happened in the past, from first flight in 1903, to first man on the moon in 1969. That was freaking crazy, wasn't it? So why should this be impossible :)

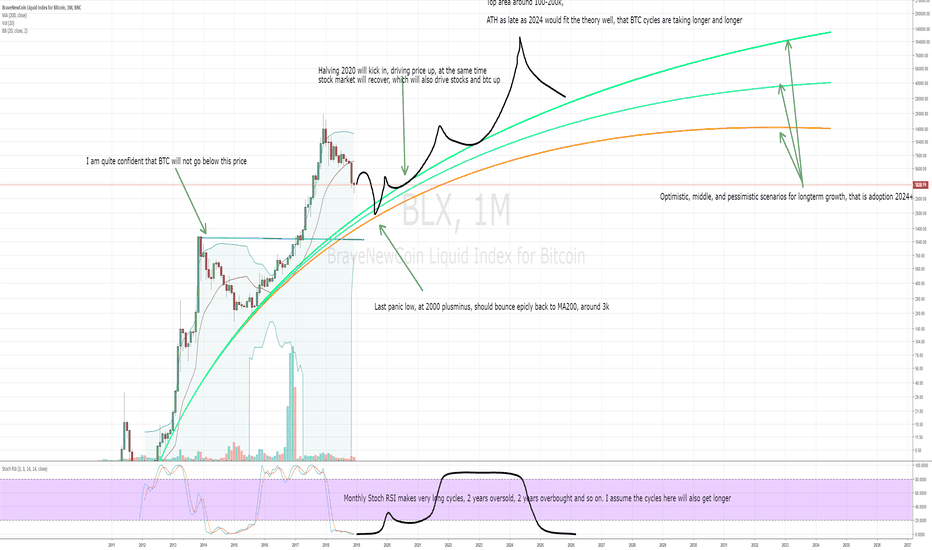

BTC monthly view and possible future scenarioIt's time for another view at the longterm picture, and for that, we must zoom out again to the monthly timeframe.

It is apparent that this structure here is a bit different from the last bearmarkets.

The subsequent bullmarket could therefore also be different.

I think that BTC cycles are getting longer.

One must think of BTC as a physical pendulum. The more mass it acquires, the more people are in it if you will, the more inertia it has, and the slower

it reacts to changes.

Therefore, I think that the next ATH might be as late as 2024 (latest possible date), but I don't see it make new ATHs before 2022, that is for me the earliest possible date

for prices well above 20k.

I still am convinced that another shakeout will occur, this would also fit the theory that BTC is currently coupled to the stock market.

Stocks will probably see a brutal sell-off sometime in 2019, and that could co-incide with the BTC low.

If it goes to the 2k area, it should bounce strongly.

So for me, everything significantly below 3k is a very strong buy and longterm hold.

Halving 2020 WILL come, and WILL drive up the price again, I am absolutely certain of that.

Look at daily transactions, they are rising again, and will make new ATHs too. Rising Tx, rising users, plus halving will drive up price. This is like a law of nature, hehe.

Since I am a physicist, I tend to see BTC as a physical system, with certain laws. And for me, these are laws, which will push BTC up again, no matter what.

Updated longterm chart: BTC always bullishWith all that doomsday feeling going around, I thought I'd update my older longterm chart, with updated, more precise price action.

It still seems that the bottom will be in the low 2000s area, sometime in march/april 2019, then a longer flat period, before the next bullrun.

This time, I looked at the ratio of the previous ATHs to each other, the factors are decreasing apparently each time.

If we'd continue this decreas of x2,25 of new ATH compared to previous ATH, we'd arrive at x7,15 increase over the previous ATH, leaving us at a 143K peak.

Of course this is not super precise, but it indeed is interesting to see, that it would match the resistance connecting the peaks with a curved resistance line, which also points to 100-150K.

So, we'd hopefully go to 3k now, weekly MA200, bounce there, go to 2200-2600 in March/April, then flat, then next bullrun and peak in 2021 with ATH at 100-150K.

I chose long on this one to emphasize that longterm, I am always long :)

So, patience and always think longterm ;) Then you'll have a lot of fun in 3-4 years time, hehe!

Bitcoin testing 3+ years support! What should happen now?Bitcoin has been falling since 20K ATH coming back to this uptrend channel that has been here for more than 3 years. Right now it is testing the bottom of the uptrend channel. If we bounce here we might start another short term uptrend to test at least the top of this channel(7000$-7500$) but if we break down we might see Bitcoin falling hard to 3K-3.6K level.

Long term Bitcoin price development, 50K-200K in 10 years.Not a professional, but based on the chart history, the logarithmic growth of Bitcoin seems to slow down. If everything continues according to the red marked channel, then we will hopefully see Bitcoin at around 80K - 100K by the end of 2021.

Since anything can happen and history not necessarily repeats itself, like there will be no bulls for the next four yearly bull cycle, then Bitcoin might drop to 1K for a longer period. But even in this unfortunate case I believe it would recover over time and come back into 50K - 100K area. Even if it would take close to 10 years from now.

So I am bullish in any case, just thinking at least 10 into the future.

And don't forget, the longer Bitcoin price remains on low levels, the more you can accumulate over time. Of course you need to believe in Bitcoins success in the end.

Have a nice time, enjoy your trading or hodling, depending on what is your preference, stay safe and remember in the long term the chances are really high for you to win.

my first long analysis on BTCUSD (1 day)this is my first analysis on tradingview I have been inspired by the larger analysts I keep working on developing in a few years to understand the market well.

As you can see on the time frame of a day this year starts with a downtrend the first low the second and in the third the support is touched with a double bottem which usually means a reversal pattern. in this way a floor and a strong support were created.

after having gone up again and breaking the resistance on 8943.70 with doubts.

towards the 11538.98 again a strong resistance is made where I have placed a trendline.

back to old level and again towards the trendline know that he is broken but must also be respected again.

waiting to go to its resistance when no breakthrough forms an M-shape which makes a perfect moment for a sell-order by means of the candle stick patterns of hanging man and the inverted hammer which is the result of a bearish reversal pattern.

after the downtrend to go back to the old level to bounce with a double bottem (reversal pattern) and leave the support to the resistance where there is trouble breaking through which eventually succeeds and makes floor.

here you see the famous candle stick pattern the double top or tweezer tops.

at the first double top the support is not broken, which follows to the bounce at the price level which follows another double top to which the support is broken and we can place a new trend line.

At the downtrend, the level of the trend line is respected and continues downwards towards the strong support that has not been breached 2 times before but where it is now in the zone.

what I think is going to happen is when the support level is respected and the trend line is broken, the bitcoin in uptrend will go at what speed unknown.

what I have done is the fibonacci tool used to create the zones.

where the price will go first after the outbreak you could bet on and the number of pips / dollars to the 23.6% fibonacci level

When prize breaks through the support level, the new level of support is created where the prize will bounce and then go up to the certain first fibonacci level.

I'd like to hear your opinion about tips and materials that I could deepen

to eventually become better and together think about the steps strategically.

thanks you see quickly

$STORM TESTING LONG TERM WEDGE RESISTANCE - BUY SIGNALTesting long term wedge resistance wolves, breakout possible.

Entry point: 0.00000400-450

Target 1: 0.00000480

Target 2: 0.00000500

Target 3: 0.00000518

Target 4: 0.00000580

Stop loss: 0.00000370

Breate, Zoom Out, Realise. BTC refuelling at the space station.It's important in times like this, when the bears and bulls fight it out for temporary control, to take a step back from it all and analyse where your long term portfolio is going.

What you see here is what's known as the first sell off of a much greater movement with a strong bullish trend line and bullish divergence on a large time frame (by crypto standards). This drop can also be seen showing a Bullish Flag formation. I believe over the next 3/4 years we'll see this become a fractal to BTC's price moves as trust in banks and governments continues to decline and mass education in tech, finances and security all grow.

Long term BTC is still a fantastic investment at this level and if you get a chance to grab it sub $6k then all the more luck.. With shorts at an all time high people have begun to think they have it all figured out but, as we all know, the only thing we actually know about Bitcoin is that it adheres to 4 key points:

Honey

Badger

Don't

Care