Quick Lesson: How to Identify Trend ReversalKnowing when to enter the market can mean the difference between making a profit and incurring a loss. The chart above clearly compares two similar-looking scenarios with very different outcomes: the one you should aim for and the one you should avoid.

- On the left , we see a textbook example of a bullish reversal. After a significant downtrend, the market prints higher lows and begins forming an ascending support. This signals that selling pressure is fading and buyers are stepping in. Notably, there are usually lots of unfilled bags — latecomers who show strong demand below the current price level but never get their orders filled, and who then just hit the 'market buy' button, which adds fuel to the fire of pump.

- In contrast, the right side shows a very similar pattern — a downtrend followed by consolidation, but with crucial differences. Here, all prior liquidity zones have already been filled, meaning there is less incentive for buyers to support the price. The “same vector” suggests price action hasn’t changed direction, and a common short squeeze traps late buyers before resuming the decline. This is a common bull trap , where a temporary price pump gives false hope before another leg down.

To sum up , a REAL REVERSAL builds on structure, accumulation, and higher lows—whereas a FALSE BOTTOM is often characterized by brief rallies, exhausted liquidity, and no change in vector trend. Experienced traders wait for confirmation and accumulation before entering a position, not just a temporary pause in a downtrend.

Bitcoin-trading

3 Bitcoin Tops, Weak Green Candles, and What’s Next? If you're closely monitoring the Bitcoin (BTC) market, patterns often begin to reveal themselves in surprising ways. In the attached chart, I’ve highlighted three major local tops that Bitcoin has made, each marked by a weak green daily candle. What’s even more striking is what comes next: a dramatic increase in trading volume, followed by steep corrections.

Spotting the Pattern: Weak Green, Heavy Volume

At each pointed top (see red arrows), BTC formed an all-time high (ATH) with a relatively weak green candle, hardly the sign of euphoric buying strength.

Look closely at the volume bars below (blue arrows). Each time, as price struggled to push higher, volume surged after the top, often a signal of major sellers stepping in or longs closing en masse.

What followed? Significant corrections: -13.6%, -29.2%, and, now it might be shaping up for another potential drop (-24.1%) if history rhymes.

Why Does This Matter?

From a technical analysis perspective, volume is the fuel behind price moves. When a new high is reached with limp buying (weak green candles) but is swiftly met with rising volume on the way down, it’s a classic sign of distribution, a strong hand selling into retail euphoria.

Is Another Drop Coming?

Given the consistency in behavior, it’s not unreasonable to ask: are we about to witness another similar correction now that BTC has again hit a top with a weak green candle and volume is ticking up? The historical evidence certainly makes it plausible.

Long-Term Perspective: Still Bullish

Despite these corrections, my long-term outlook remains bullish. Every cycle has corrections, they’re opportunities for healthy consolidation, allowing strong hands to accumulate and the market to reset for its next leg higher.

*not investment advice

#crypto #btc #bitcoin #finance #trading

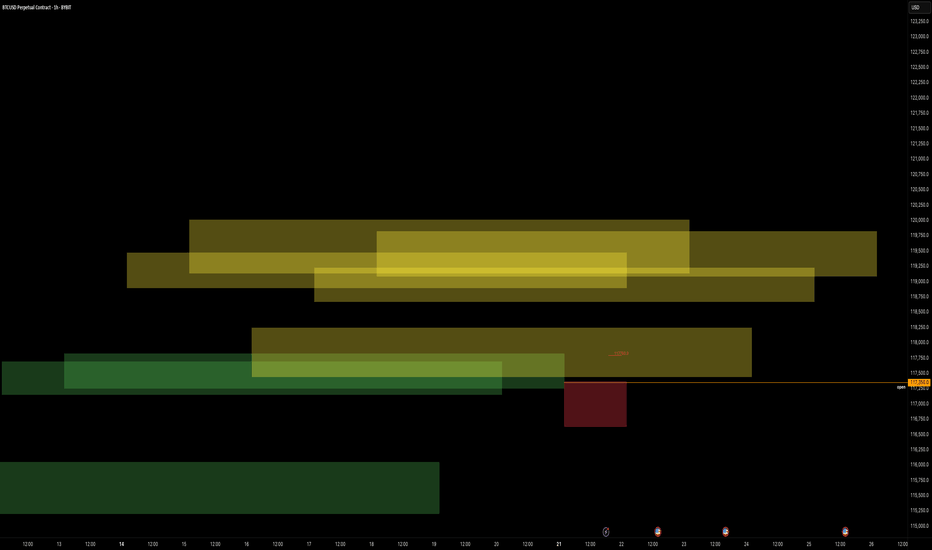

Bitcoin & Altcoins: Technical Analysis and Market OutlookBitcoin (BTC) Analysis

Bitcoin is currently forming a short-term bullish pennant within a larger long-term pattern, projecting a potential target around $135K.

Key Levels: BTC is consolidating between the lower zone at $117.3K and the upper zone at $119.7K.

Breakout Potential: A break above this pattern could propel BTC toward a new all-time high (ATH), surpassing the current ATH at $123K.

Macro Events This Week:

Wednesday: The Federal Reserve will announce its interest rate decision, with no changes expected.

Wednesday: ADP Employment Report, providing insights into potential future rate cuts.

Friday: Non-Farm Payrolls (NFP) data release, which could further influence market sentiment.

Ethereum (ETH) Breakout

Ethereum has decisively broken through its 4-year historical resistance around $3,725, closing the week above this level. This breakout signals a strong bullish outlook for ETH, with potential for further upside.

Altcoin Highlights

BNB: Has shattered its previous all-time highs, showcasing significant bullish momentum.

XRP: Reached approximately $3.64, reflecting strong gains and market interest.

Market Context

The crypto market is showing robust activity, with altcoins following Bitcoin and Ethereum's lead. Key macroeconomic events this week could introduce volatility, so traders should stay vigilant.

Disclaimer: This is not financial advice. Every trader is responsible for their own strategy and risk management.

Happy trading and good profits! 🚀

vision paintingthis is sort of a game, i would like to play with anyone interested in chart riddles. i'm being very specific with my inputs, and coloring, painting a picture of what i need to see and when. painting whats there, guiding to where itll be. wondering if i could actually create art pieces here. hypothetically the 'paintings' would need to be back checked, to artificialy create any worth to it. market involvement is day/week trades. *no advice whatsoever. so, i think ill give it a go. from here onwards, these posts are the only ill post, with updates, within the comments of such post. happy trading

ballino

Premium zone tagged — now we watch how the Smart Money reactsBitcoin just tapped into the 108,151 level — the top of a measured premium range and a likely area where profit-taking begins and fresh distribution footprints form.

This run-up wasn’t random. Price surged from inefficiency, cleanly filled the fair value gap (FVG), and is now flirting with a key liquidity pocket.

Here's what the structure says:

Premium reached: 108,151 (0% fib)

If rejection holds, Smart Money looks to discount entries:

0.236: 106,136

0.382: 104,889

0.5: 103,882

Deep retracement zone: 0.618 at 102,874

Final defense for bulls? The unmitigated FVG block between 101,440 → 99,613

Possible Playbook Scenarios:

Quick retrace → higher high:

Bounce off 104,889 or 103,882 before attacking 108,967+

Deeper sweep:

Into 102,874 (0.618) before Smart Money steps in again

Invalidation:

Break below 99,613 closes this bullish narrative and confirms a structural break

TL;DR Execution Logic:

Wait for retracement into 0.5–0.618 fibs

Look for bullish reaction (engulfing or SFP)

Upside targets:

108,151 (retest)

108,967 (liquidity sweep)

Further upside if momentum sustains

BTC – Stop Hunt at the Edge of ValueThis is what a liquidity raid looks like.

Price just swept the bottom of the range, tapped into the low-volume zone (as seen on the volume profile), and reclaimed — classic sign of a trap sprung.

Key points:

The downtrend line labeled “comp” = compression — bulls forced to capitulate into a thin zone

High probability deviation with stop run and reclaim — this fuels the next move up

The green box shows risk-defined entry off the sweep low

Targeting the prior high: 106,787

Volume imbalance filled = no inefficiency above — price can now move cleanly

Execution mindset:

Trap spring → retrace into structure → expansion

Risk is clear, liquidity is engineered, structure remains

Late shorts just became the fuel.

Watch the reclaim of the box top. If that flips support, we ride momentum.

📈 For more setups like this — including pre-breakout traps — check the description in the profile.

The FVG above isn’t the target. It’s the bait.This is a classic Smart Money sequence. Most are watching the imbalance at 106.5k–108.7k and expecting immediate delivery. But that’s not how this game works.

The setup:

Price broke down violently, then reversed with momentum — stopping right beneath the daily FVG block. That alone tells me it’s not ready. It’s gathering.

Below? Multiple fib levels that haven’t been tested — 104.4k (0.236), 102.6k (0.0), and a volume-backed rejection wick that still holds weight.

The market is likely to dip again — pull into deeper discount, reset the low timeframe narrative — and only then attack the FVG and upper sweep zones.

What I expect:

Sweep of 102.6k (final liquidity run)

Reaction → reclaim 104.4k

Push into the FVG toward 106.5k (0.5) and possibly 107.4k (0.618)

No emotional reaction to the red candles — this is structure playing out, not weakness unfolding.

Plan:

Ideal Entry: 102.8k–103.2k range

SL: Below 102.6k

TP1: 105.6k

TP2: 107.4k

Final: 108.7k clean inefficiency fill

Let it dip. Let it breathe. That’s where conviction is built.

Final thought:

“The real move starts when they convince you it’s done.”

BTC/USDT: Correction to H1 Demand Zone? Multi-Timeframe Strategy🔹 H1 Context (Bullish):

- Demand zone (green) below Fib 0.5: Key support.

- Breakout (BOS) suggests bullish continuation *after possible correction*.

🔹 M5/M15 Situation (Short-Term):

- Price rejecting red zones (immediate resistance).

- Scenario 1 (Bearish):

→ If price respects red zones: Correction toward H1 demand ($103K).

→ Action: Short trades in M5/M15 targeting green zone.

- Scenario 2 (Bullish):

→ If red zones break: Confirmation of strength (new highs target).

🔹 Risk Management:

- Short entries: Rejection at M5/M15 red zones + M1 confirmation.

- TP: M15 lows ($103.5K) or H1 demand zone ($103K).

- SL: Close above red zones.

🔹 Technical Key:

- H2 Order Block as dynamic support: If respected, prevents drop to H1.

- Confluence: H1 demand + Fib 0.5 = High-probability area.

#BTC #Bitcoin #Trading #Crypto #H1 #M15 #TechnicalAnalysis #Fibonacci

btc . recap . w3 . maymon to eager . wait mon to show its hand - cw!

. early LONG compound because of the bullish outlook

- tp2 108462

tue didn't ride momentum - blind bullish

. tp1 HIT

. missed SHORT at 10pm (UTC+2)

- should have traded the momentum of mon looking to form support during the week later . for more compound LONG

wed mid of range . cw

. no trade zone

thu

. waiting for run of aLow during ny

. compound LONG - 101485

. tp1 HIT

fri didnt catch enough upward momentum

. tp1 HIT

. last limit order for bullish continuation . tpo - 102862.5

wknd

. tp1 for weekly LONG idea finally hit

. duration 5d 22h

. +4.33%

conclusion :

trade what you see, go with momentum, but have a narrative.

outlook :

america downgraded from AAA to AA+ . People will turn hardcore bearish, once the price starts falling. this could be the trigger to find the long awaited drop - while having retail call out a bearmarket . massive potential here, to both sides. wOpen and monday full data (while keeping an close eye on tpo and footprint charts), are key .

btc . may . w3 . friyesterdays LONG was beautiful. ny ran aLow, and never looked back pushing higher.

. new aver entry . 102353

i'm right now scalling into new limit LONGs

. aLow . wVWAP . cw0.5 . liquidity grad - in this BULLISH environment

a last limit order is placed at pdTPO

. 102862.5

SL has been lifted to give new trade breathing room

i see us go to cwHigh . 105871, to which tp1 has been changed.

cheers

XAU/USD: Gold Regains Strength After Pullback – New Highs Ahead?By analyzing the gold chart on the 2-hour timeframe, we can see that yesterday, as expected, gold surged above $3400, reaching as high as $3439 before facing strong selling pressure, dropping sharply to $3359.

Currently, gold is trading around $3385, and if the price can hold above $3366, we may expect further bullish momentum. I believe gold is setting up for another move above $3400, potentially aiming to break into new highs once again.

THE LATEST ANALYSIS :

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

btc . wOpen . SHORT weakwOpen with a run down to current range volume profile LOW + minor SFP low (liquidity grab)

- Stop out LONGS

- Catch late retail SHORTS - squeeze them to top range + higher

the friday SHORT was good, but didn't catch momentum

looking to move TP1 to cW 0.5 retrace level @ 93.809

i see this pump higher . though cautios, because these levels are late LONG entries only

looking for LONGS around

93.777 - 92.782

tp1 . 95.843

tp2 . 99.490

if we see a down momentum shift, act accordingly

- i believe this to come towards wednesday

XRP / RIPPLE | 30M | IMPORTANT LEVELSFriends,

I valued your requests and prepared the following Ripple analysis: If Ripple drops below the level of 2.1807 for 30 minutes, the target will be the 2.1424 level. This level holds a very significant support zone.

The most critical support level is located at 2.1085.

If Ripple does not fall below this support zone, my target level for Ripple will be 2.2495.

Please don't forget to like.

Thank you to everyone who supports with likes.

btc . w4 - wknd . SHORT but cautious - yet paytientfriday plan, was to SHORT (see prvs post)

sell zone

starts . friday open

ends . monday open

entry . 95.542

sl . -2.62%

10 sell orders . 1.52% spread

tp1 . 91.642 . +3.99%

funding . +0.01%

we are according to plan + collecting funding

tp1 adjusted to moderate, since bullish outlook coming from april.

tp2 . +10.11%

BTC TO $91,000!!Hello! Today we're going to analyze Bitcoin's price action. It's currently rebounding. The movement doesn't seem to have much strength. However, let's not forget that on a weekly chart, Bitcoin is at the end of wave 4 of Elliott's theory.

We have a very clear scenario: a rebound to $91,000, which is an area with a lot of shorts and liquidity. If buying pressure is greater, it's logical that Bitcoin could break out strongly to the upside, because price action always seeks out areas of less pressure, that is, it will always seek liquidity.

On 4-hour charts, we can see a lot of volatility, however, any purchases below $84,000-$87,000 can be considered conservative because it is a good buying zone. After all, you are buying at the end of wave 4 on a weekly chart, therefore, liquidations below $84,000 are not ruled out, but the short and medium-term trend is bullish.

Disclaimer: This is only an opinion; it should not be used as investment advice or recommendation.

BTC/USDT SELL/SHORTbitcoin can move down

In this analysis, we are observing the potential repetition of market history by comparing the current Bitcoin price action to the previous bearish cycle. By utilizing Fibonacci retracement levels, historical patterns, , we can formulate a hypothesis that the market might follow a similar trajectory if bearish sentiment prevails.

Bitcoin Looks Good: Trading Cryptocurrency Talk TherapyTo me, Bitcoin looks really good. The month closed above $80,000. Soon we will have the weekly close. There can be some bearish action as it happened recently but when prices recover, all ends up being just noise. Truly noise when you consider what was being said in the press. "The correction is just getting started." "Bitcoin will go down for months, until May-June." "The bull-market is over."

Some people are talking about risk management and whatnot when Bitcoin hits 80K. It is bad advice they say to tell people to hold. What is the right choice in this type of scenario?

The basics require a strategy before trading, a plan. The plan is simply defining which actions you would take based on different scenarios. If you bought Bitcoin at $50,000 and failed to sell when Bitcoin was trading at $100,000 for more than two months, it is very unwise to talk about risk management or selling when Bitcoin hits bottom. Sell when the crash is on? Makes no sense to me.

If you didn't sell on the way up, you didn't have a strategy, then the best move is to hold. Normally, we would sell portions at each resistance level until all of our coins are gone. When the correction comes, we buy at support.

If you didn't sell when prices were high up, near resistance, then the opportunity is missed. Nothing happens but the right choice is to wait. This time around, prepare a plan beforehand, when to sell and how much? That's the question you need to answer before the bullish cycle reaches its end.

Since the action is already on-going, Bitcoin traded sideways for more than two months, when the crash is on, the best choice is to hold. FOMO or panic anything won't produce any positive results. Selling at the bottom is a waste of time, energy and money, because whatever you sell will soon start to grow. All the other pairs are in the same situation. To avoid being in this position, plan ahead of time.

There will be a new bullish cycle, a new advance and a new bullish wave. There will also be a new peak and a new correction, so plan now to avoid falling victim to the same mistakes.

It is alright to get it wrong. It is not right to make the same mistakes over and over. Sell when prices are high, buy when prices are low.

We buy when prices are trading at the bottom or near support. The Altcoins already hit bottom and that's our buy zone. Right now is the time to accumulate. If Bitcoin looks hard, there thousands of Altcoins that look ready to grow and strong.

Thanks a lot for your continued support.

Namaste.

Bitcoin (BTC/USD) Technical Analysis & Trading PlanBitcoin (BTC/USD) Technical Analysis & Trading Plan – February 28, 2025

Market Overview

The Bitcoin (BTC/USD) price is currently trading at $79,770, showing a -0.74% decline in the latest 4-hour candlestick. The chart illustrates a falling wedge trading pattern, which is considered a bullish reversal signal. The price is approaching the lower boundary of the wedge, signaling a potential breakout to the upside.

Technical Indicators & Key Observations

Falling Wedge Pattern:

The price has been making lower highs and lower lows within a falling wedge formation (red and green trendlines).

A breakout above the upper boundary of the wedge could trigger a strong bullish rally.

Support and Resistance Levels:

Immediate support: $76,665

Major support: $67,679

Key resistance levels:

$88,671

$91,271

$95,497

$108,329 (Major long-term resistance)

Momentum Indicators:

RSI (Relative Strength Index): 22.26 (oversold), indicating potential upward momentum.

Stochastic Oscillator: 16.14, also in the oversold region, confirming a possible reversal.

Money Flow Index (MFI): Showing weak inflow, but a reversal at these levels could indicate increasing buying pressure.

Cipher_B Divergences: Potential bullish divergence forming, adding confluence to the breakout scenario.

Professional Trading Plan

Entry Strategy

Aggressive Entry: If Bitcoin closes a 4-hour candle above the wedge's upper trendline (~$80,500), an early entry can be considered.

Conservative Entry: Wait for confirmation above the $82,000 level with strong volume before entering a long position.

Profit Targets

First Target: $88,671 (previous local high)

Second Target: $91,271 (psychological level)

Third Target: $95,497 (strong resistance)

Ultimate Target: $108,329 (major long-term resistance)

Stop-Loss Strategy

For aggressive traders: Below $76,500 (recent low)

For conservative traders: Below $74,000 to reduce risk exposure

Risk Management

Risk-to-reward ratio: 1:3 or higher (entry should be calculated to maintain proper risk-reward)

Position Sizing: Allocate 2-5% of capital to this trade, considering volatility.

Conclusion

Bitcoin is currently trading at a critical support level within a falling wedge. The RSI, Stochastic, and MFI indicators suggest oversold conditions, indicating a potential bullish breakout. Traders should watch for a confirmed breakout above the wedge with strong volume before entering a position. Targets remain between $88,000 and $108,000, with well-defined stop-loss levels to minimize risk.

💡 Recommendation: Monitor price action closely, especially in the next few 4-hour candles. If BTC breaks above the wedge, prepare for a bullish move towards resistance levels.

Bitcoin (BTC) – Technical Analysis & Key LevelsCurrent Market Status:

Price: Trading near $97,000, below the $98,000–$100,000 resistance zone.

Weekend Movement: Recovered 10% of losses, but some gains have been retraced.

Directional Bias: Neutral, as BTC consolidates under key resistance.

Key Levels to Watch

Upside Targets (If BTC Reclaims $100K as Support)

$103,000–$108,000 → Next resistance zone, a breakout above this could trigger further upside.

$115,000+ → Potential medium-term target if bullish momentum strengthens.

Downside Support Levels (If BTC Fails to Hold 97K–$100K Zone)

$91,000–$95,000 → Immediate support range, likely to attract buyers.

$85,000–$87,500 → Stronger support in case of deeper correction.

Market Outlook & Trading Strategy

Bullish Scenario:

A confirmed breakout above $100,000 would shift momentum toward $103,000–$108,000.

Sustained price action above $100K would indicate strength, supporting further rally potential.

Bearish Scenario:

If BTC fails to hold current levels, expect a pullback to $91,000–$95,000.

A break below $91K could expose BTC to $85,000–$87,500 support levels.

Final Thoughts

BTC remains at a critical juncture, with $100K acting as a key decision point. Traders should monitor price action closely for confirmation of either a breakout (bullish) or a rejection leading to further downside (bearish) before positioning for the next major move.

NO. 1 IS BITCOIN (STILL) BITCOIN-ALTCOINS-MEMECOINS THIS IS PLANDescending Trading Channel IS IN PROGRESS.

Bitcoin is currently trading within a descending channel, characterized by lower highs and lower lows.

The resistance line at the top of the channel is acting as a barrier to upward momentum.

The support line at the bottom of the channel provides a temporary floor for price movement.

Current Price Action:

The price is near the channel's lower support, indicating a critical decision zone for traders.

The presence of high volume at support suggests potential buying interest.

Indicators:

VMC Cipher B Divergences: Shows momentum divergence, signaling a potential reversal near the current level.

RSI (14): Reading of 27.94 indicates oversold conditions, suggesting a possible bounce.

Stochastic Oscillator (14,3,1): Extremely low (17.32), aligning with the RSI to indicate oversold conditions.

ArTY Money Flow Index (MFI): Neutral, showing neither significant inflow nor outflow of capital.

Key Levels:

Support: $98,282 (current zone within the channel support).

Resistance: $107,153 (aligned with the channel's resistance and previous consolidation).

Breakout Zone: A break above $107,153 could signal bullish momentum toward higher resistance zones ($112,000–$120,000).

Breakdown Risk: A breakdown below $98,000 may trigger bearish continuation to the $90,000 support zone.

Trading Plan

Entry Strategy

Long Position:

Enter near the support zone ($98,000–$99,000) with tight stop-loss at $97,000.

Confirm reversal with bullish candlestick patterns or volume breakout above $100,000.

Short Position:

If the price breaks below $98,000 with strong volume, consider shorting with a target of $92,000.

Take-Profit Levels:

For long trades, scale out profits at:

$105,000 (minor resistance).

$107,150 (channel resistance and key breakout level).

$112,000 (next major resistance).

Stop-Loss Placement:

Place stops 1–2% below the support level ($97,000 for long trades, $99,000 for short trades).

Risk-Reward Ratio:

Aim for a minimum risk-reward ratio of 1:3 (risk $1,000 to make $3,000).

Trade Management:

Monitor volume closely; rising volume during upward movement strengthens bullish conviction.

Use trailing stops to secure profits if the price moves favorably.

Breakout Trading:

If Bitcoin closes above $107,153 with strong momentum, consider entering a breakout trade targeting $112,000 and $120,000.

Contingency Plan:

Stay out if the price consolidates without clear direction near the current levels.

Avoid over-leveraging and stick to predefined risk parameters.

Bitcoin is at a pivotal moment within a descending channel. The oversold indicators and support proximity suggest a high-probability bounce, but traders must remain cautious of breakdown risks. The trading plan emphasizes disciplined risk management and capitalizes on both breakout and breakdown scenarios.