DGB/BTC Digibyte possible breakout..Digibyte possible breakout is happening, 50MA is looking towards target 1 400 Sats and will push towards that area, second target is 440 Sats. MACD has crossed and is signalling buying power and Digibyte moves in a different way towards the rest of the market, many runs that Digibyte have had have been where the market is either falling or sideways movement.

Bitcoin-usd

BTC Existing Trend Possible Outcomes So I think we will see a retrace to the 20 and 50 MA or the 31% fibonacci retracement which support is the strongest even though these 3 levels are very close to each other around the 6560-6630 levels. From there we will go back up to test this resistant point again at 6730. If we have a convincing breakout from there which I am fairly confident that we will, we will then test the 61-62% fibonacci retracement level around the 6900 levels. If we see enough volume pile up at the 6730-6750 levels again whenever we are testing it again then this is a good sign we could breakout from this level and test the 62% retracement. If we enough volume at the 6900 levels(62% retracement from previous rally) then this is also a good sign we could test the falling wedge upper trendline. From there we are most likely to fall back down and test the 62% level as a support. If that holds and we go back up we will probably break that falling wedge upper trend line which is a humongous bullish signal if done in a convincing manner. From there we will test the 200 MA and probably get rejected if volume is not out of this world. From there we will then test the upper trend line again as resistance turned into support.

Save 10% on fees at Bitmex if you use this referral link:

www.bitmex.com

Please like, follow, and comment with your idea below!

Thanks,

Chris

ETH/USD - Short Term Pull UpMMegalodon Package

--------------------------------------------------------------------------------

UltimateMegalodon indicator --> UltimateMegalodon consist of 16 different SetUp combinations. Every single SetUp combinations has more than %66 win rate.

UltimateMegalodon isolator --> UltimateMegalodon isolator consist of trade setups that are designed for catching the longer term time frame trends and setups. It is used as the initial confirmation for a day or swing trade.

Mosasaur isolator --> Mosasaur isolator consists of trade setups that are designed for catching the shorter term time frame trends and setups. It is used as the entry confirmation for a day or swing trade.

--------------------------------------------------------------------------------

Waiting on a confirmation of theMosasaur Isolator with a green tile on 60 min for a day trade.

--------------------------------------------------------------------------------

iPyra

Enlighten others

very Short term idea for btc if this breaks above 6460 , we can see a rally towards 6.7-6.8k levels again , and in breaks below the bearish pennant then we can see a test of 6.2k which gonna be a crucial support level for the bullish case , and if we break that , much more panic gonna enter the market

things to notice we are at a good support level , near 6.2k , shorts again at ATH , we could see a big short squeeze but for now the market would move a bit sideways for consolidation before some big move , keep an eye on 6460 level for quick profit , good luck

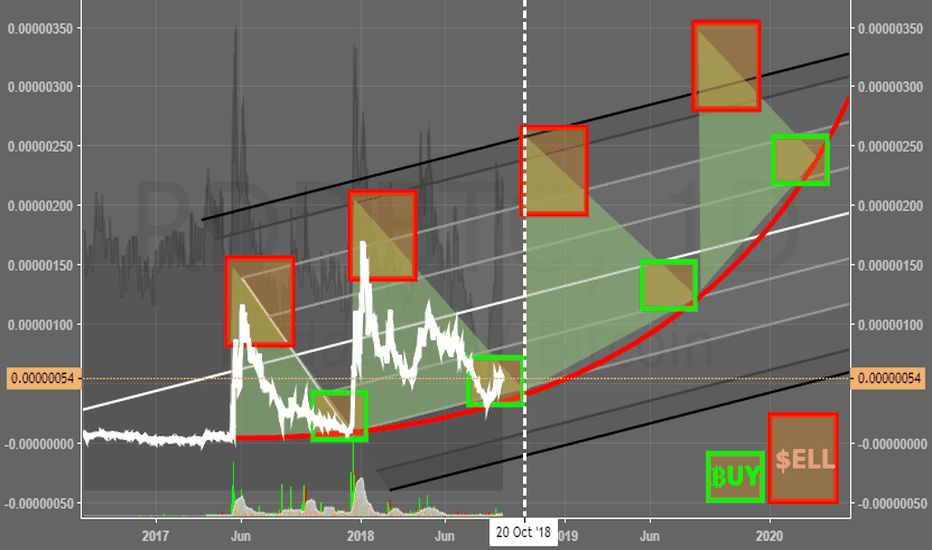

BTC/USD 2018-2020 Accurate Price PredictionThe Rothschilds, JP Morgan, Wells Fargo, tv celebrities and do I even need to mention Goldman Sachs already has put in a trading desk? Very bullish period ahead to cure our tender hearts from this chilly bearish season. Stock up next dip guys. #2018TheLastYearNormalPeopleCanBuyBitcoin

Monero Price Analysis: Could Break in the Future (Neutral Now) We haven’t talked about Monero in a while, but I’m bringing it back up because it had some notable price activity in the last week or so before getting throttled back to its start position.

The chart above is on the H4 timeframe.

The downtrend line that you see in the above picture stems from July 24th, 2018, which was when the price of Monero was at the top of the traded range that you see in the middle of this picture.

As with all traded ranges, once the price breaks out of either the north or the south of the traded range, you can expect either a precipitous decline or increase.

In this case, we saw a precipitous decrease as the price broke down below the south of the traded range.

Above, we can see the four day stretch before the price eventually depreciated back to a baseline (around the $90 mark).

However, even after the consolidation of price, Monero is still up 12% in the last week.

Conclusion

That downtrend resistance is holding strong, so it doesn’t look there’s a whole lot of upside for Monero at the moment.

Since there are no short options for $XMR, this is worth waiting to see if it will break over that downtrend resistance from late July. If it does do so, then it would be a solid investment.

However, at this point, this is something that is only worth being observed.

There is a great trading opportunity to buy in BTCUSD..There is a great trading opportunity to buy in BTCUSD..

Midterm Forecast:

While the price is above the support 4966.90, resumption of the uptrend is expected.

We make sure when the resistance at 8200.00 breaks.

If the support at 4966.90 is broken, the short-term forecast -resumption of the uptrend- will be invalid.

Technical analysis:

The RSI bounced from the support #1 at 26 and it prevented the price from more losses.

Price is below WEMA21, if price rises more, this line can act as a dynamic resistance against more gains.

Relative strength index (RSI) is 44.

New Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (6000.00 to 5460.00). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (6000.00)

Ending of entry zone (5460.00)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

New Trade Setup:

We opened 12 BUY trade(s) @ 6118.08 based on 'Hammer' entry method at 2018.08.14.

Total Profit: 462720 pip

Closed trade(s): 0 pip Profit

Open trade(s): 462720 pip Profit

Open Profit:

Profit for one trade is 6503.68(current price) - 6118.08(open price) = 38560 pip

12 trade(s) still open, therefore total profit for open trade(s) is 38560 x 12 = 462720 pip

New Take Profits:

TP1= @ 6700.00

TP2= @ 7075.00

TP3= @ 7682.60

TP4= @ 8200.00

TP5= @ 8800.00

TP6= @ 9800.00

TP7= @ 11600.00

TP8= @ 12700.00

TP9= @ 14350.00

TP10= @ 17095.65

TP11= @ 19704.20

TP12= Free

Previous Trade Setup:

We opened 11 BUY trade(s) @ 6275.35 based on 'Trough (Valley)' entry method at 2018.07.15.

Total Profit: 224590 pip

Closed trade(s): 224590 pip Profit

Open trade(s): 0 pip Profit

Previous Closed Profit:

TP1 @ 6415.00 touched at 2018.07.16 with 13965 pip Profit.

TP2 @ 6974.35 touched at 2018.07.17 with 69900 pip Profit.

TP3 @ 7682.60 touched at 2018.07.23 with 140725 pip Profit.

13965 + 69900 + 140725 = 224590 pip

8 other break-even trades closed at entry price, therefore no profit no loss.

There is a great trading opportunity to buy in BTCUSD..Midterm Forecast:

While the price is above the support 4966.90, resumption of the uptrend is expected.

We make sure when the resistance at 8200.00 breaks.

If the support at 4966.90 is broken, the short-term forecast -resumption of the uptrend- will be invalid.

Technical analysis:

The RSI bounced from the support #1 at 26 and it prevented the price from more losses.

Price is below WEMA21, if price rises more, this line can act as a dynamic resistance against more gains.

Relative strength index (RSI) is 44.

New Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (6000.00 to 5460.00). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (6000.00)

Ending of entry zone (5460.00)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

New Trade Setup:

We opened 12 BUY trade(s) @ 6118.08 based on 'Hammer' entry method at 2018.08.14.

Total Profit: 462720 pip

Closed trade(s): 0 pip Profit

Open trade(s): 462720 pip Profit

Open Profit:

Profit for one trade is 6503.68(current price) - 6118.08(open price) = 38560 pip

12 trade(s) still open, therefore total profit for open trade(s) is 38560 x 12 = 462720 pip

New Take Profits:

TP1= @ 6700.00

TP2= @ 7075.00

TP3= @ 7682.60

TP4= @ 8200.00

TP5= @ 8800.00

TP6= @ 9800.00

TP7= @ 11600.00

TP8= @ 12700.00

TP9= @ 14350.00

TP10= @ 17095.65

TP11= @ 19704.20

TP12= Free

Previous Trade Setup:

We opened 11 BUY trade(s) @ 6275.35 based on 'Trough (Valley)' entry method at 2018.07.15.

Total Profit: 224590 pip

Closed trade(s): 224590 pip Profit

Open trade(s): 0 pip Profit

Previous Closed Profit:

TP1 @ 6415.00 touched at 2018.07.16 with 13965 pip Profit.

TP2 @ 6974.35 touched at 2018.07.17 with 69900 pip Profit.

TP3 @ 7682.60 touched at 2018.07.23 with 140725 pip Profit.

13965 + 69900 + 140725 = 224590 pip

8 other break-even trades closed at entry price, therefore no profit no loss.

Bitcoin - USD Daily Falling Wedge Still in PlayFALLING WEDGE (FW)... per Bulkowski's textbook "Encyclopedia of Chart Patterns": A Rare Bullish Consolidation, upon upside breakout, prices usually rise to the top of the formation (88% probability), at a minimum, in this instance a target of about 11800. Failure to meet target is only 10% out of 125 formations studied & is even a lower 2% if price closes more than 5% above the upper trend line. A significant resistance is now the 200 MA, since price has turned back from it five times since March 21st. Moreover, the 200 MA is converging closely with the upper trend line, which itself has rebuffed advancing price five times. A simultaneous bullish move through both these resistances would be interesting.

Since the Falling Wedge is well defined now, I also explored the possibility of using Awesome Oscillator for identifying swing trades within the formation. Secondary swing trend lines can also be useful for confirmation.

Approaching the edgeAt the moment, the price has reached an important psychological mark at the level of 6.000. It is the minimum value in the current year. Technical indicators currently point in different directions and we expect a clear signal from the market.

Investors also held their breath and expect to overcome this level. Then the price may move to the marks of 5.600 and 5.200 which were reached before..

We believe that the price will go down, but in the alternative scenario we are considering a return to the mark of 6.400

Bitcoin's inverse cup and handle possibility [BTFD]with some solid buys currently we might be forming a handle here for the inverse cup and handle pattern to form

lower red trend line is target if it breaks the purple neckline after a rebound from fib levels at 6800 supply zone down towards 5800-5600 being the final destination

after the buys/bids at NY open taking bitcoin up over 6400 we need to see good momentum in volume to break 6800 and get above 7k before any bull ideas again

will be shorting at 6800/700 area if it fails to get above 6900/6800

BTCUSD Morning UpdateTechnical Analysis

Hey Guys what up! Sorry i wan't available for long but now i'm back and lets talk about our favorite Bitcoin. Lot's of news we saw ETF got rejected, Starbucks and many more. So let's start with the bull run we saw a week ago we bounce from $5700 To $8500 very good run but we got rejected again at heavy 61.8% Fib levelhttps://www.tradingview.com/x/qR3UhVo3/. SO where we headed to ? its on the chart we still didn't broke important support level which i mentioned on the chart.

Indicators

1. MACD - Bearish On Daily

2. RSI - Bearish(Below 50 Level)

Conclusion

So what is the conclusion, well it depends on this level if it got broke we will continue to bleed but if it took support we may moon soon

Thank You For Your Support

Previous Analysis

Ethereum Classic Dual Chart Bitcoin & USD [BTFD]looking here at longer term targets for ETC

we all know why its pulling weight with a pending coinbase listing and renewed interest in the project

still not out of Coldharbour lane yet tho, so much depending on bitcoin as per usual :P

ETH on the other hand might be looking to go short the down trend and will do a TA on that soon

fanks 4 watchin and plz adhere to proper risk management