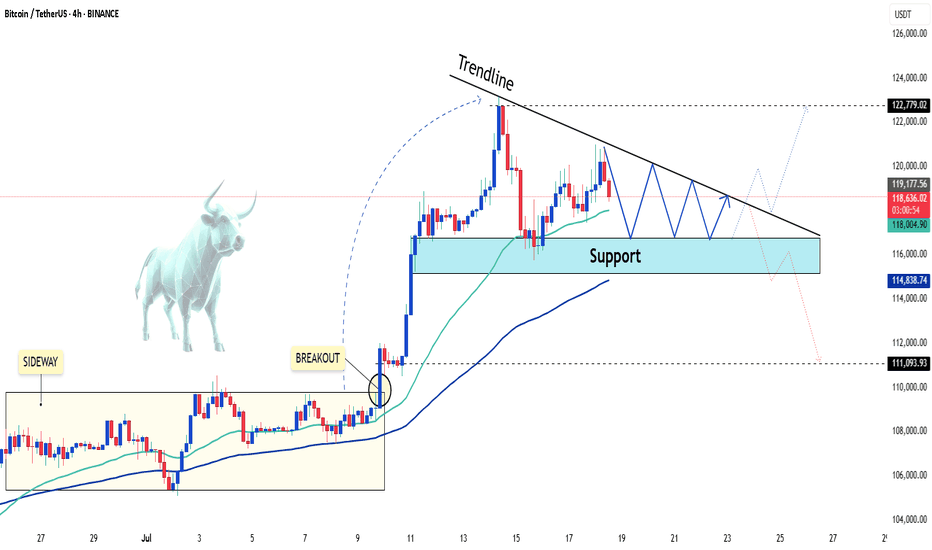

BTCUSDT: A Period of Adjustment and the Next TrendAfter a strong rally to record highs, BTCUSDT is currently entering a period of slight correction. The coin is now trading around 118,500 USD, down more than 0.57% on the day.

From a technical perspective, BTCUSD is moving within a narrowing price wedge, showing a slight downtrend. The support level at 116,500 USD is acting as a springboard for the Bulls. However, as the price approaches the tip of the wedge, a breakout may occur at any time, with two possible scenarios highlighted on the chart.

My personal outlook is that BTCUSDT will continue to decline in the short term before breaking out of the wedge in an upward direction. What do you think about BTCUSDT?

Please share your thoughts in the comments and don’t forget to like this post!

Wishing you all happy and successful trading!

Bitcoin (Cryptocurrency)

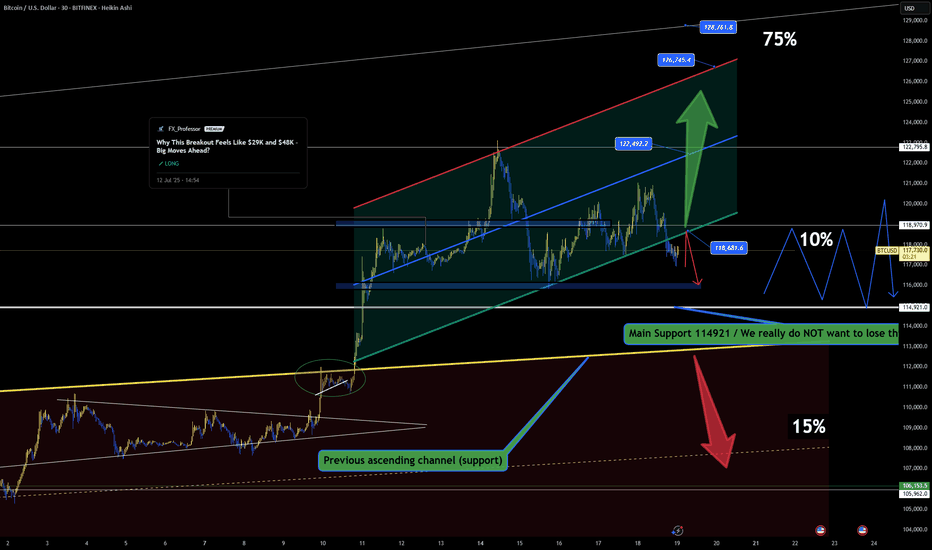

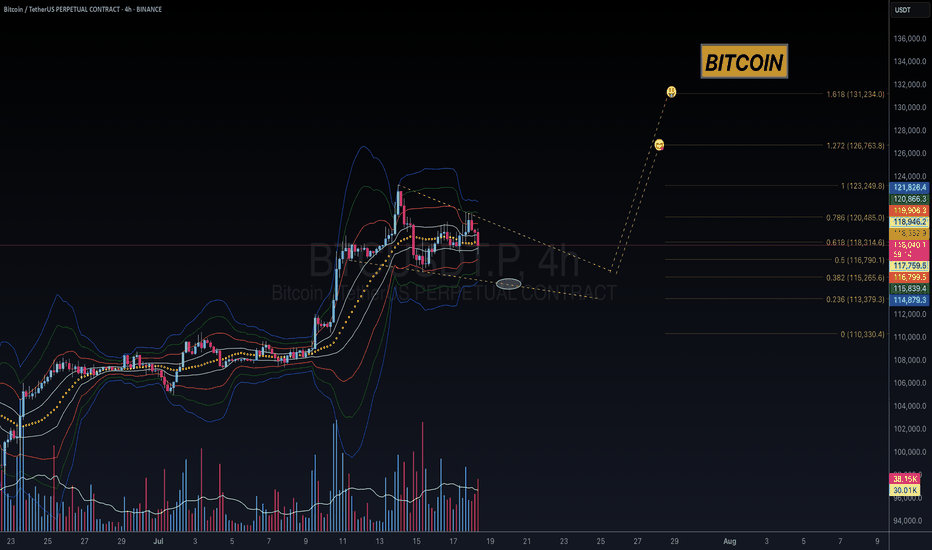

BTC Battles Resistance – Can Bulls Reclaim the Channel?🔥📈 BTC Battles Resistance – Can Bulls Reclaim the Channel? 🧠🚪

Bitcoin is now knocking on the door of the broken channel support — what was once a floor is now acting as resistance. For bulls to regain momentum, price must reclaim and close back inside the channel, ideally above 118.6K.

📍 Key Structural Notes:

We've already broken below the internal channel — this is no longer a confirmed uptrend.

Current resistance is the same trendline that previously acted as support — classic technical flip.

Failing here keeps BTC vulnerable for a deeper move toward the Main Support at 114.9K, where the real test lies.

📊 Order Flow Context:

Funding remains mildly positive, showing no panic from longs.

Premium is near-zero — market isn't chasing.

OI is steady, showing neutral positioning but potential for sudden volatility.

Spot volume picked up during the recent move, but not strong enough to confirm a breakout… yet.

🧩 Scenarios:

✅ Breaks back above 118.6K with volume → Targets: 122.4K, 126.7K, 128.7K (channel continuation).

❌ Rejection at resistance → Eyes on 114.9K. Losing that, and we enter danger territory toward 106K.

We’re at a decision point — and these are the moments that shape the next leg.

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

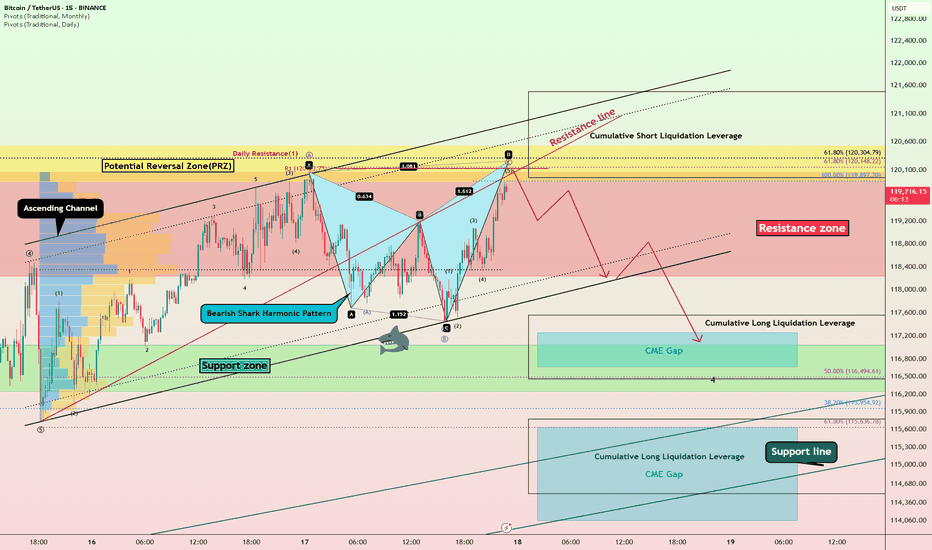

Bitcoin Bearish Shark Detected – CME Gap Below $115K in Sight?Today's analysis is on the 15-minute timeframe , following the previous analysis I shared with you on the 1-hour timeframe .

Bitcoin ( BINANCE:BTCUSDT ) is currently trading in the Resistance zone($120,100-$118,240) near the Potential Reversal Zone(PRZ) and Cumulative Short Liquidation Leverage($121,490-$119,965) .

From a technical perspective , it looks like Bitcoin is completing the Bearish Shark Harmonic Pattern on the 15-minute timeframe .

From an Elliott wave theory perspective, it looks like Bitcoin is completing the microwave 5 of wave C of the Zigzag Correction(ABC/5-3-5) .

I expect Bitcoin to start falling from the top of the ascending channel and at least decline to the lower line of the descending channel, and if the ascending channel breaks this time, we should wait for the CME Gap($117,255-$116,675)/CME Gap($115,060-$114,947) to fill.

Cumulative Long Liquidation Leverage: $117,556-$116,465

Cumulative Long Liquidation Leverage: $115,773-$114,513

Do you think Bitcoin can create a new ATH again?

Note: Stop Loss(SL)= $121,620

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

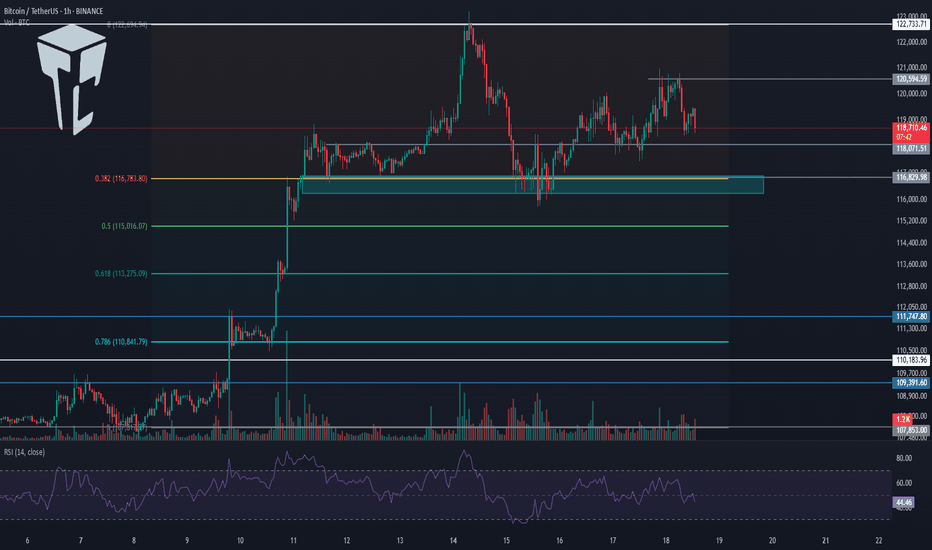

Bitcoin Struggles Below $120K:Will the CME Gap Pull Price Lower?Bitcoin ( BINANCE:BTCUSDT ) has been experiencing a high momentum bullish trend in recent days, which few people expected, especially when it crossed $120,000 . However, in the past 24 hours , Bitcoin has fallen back below $120,000 .

Bitcoin is currently trading in the Resistance zone($119,720-$118,240) and Cumulative Short Liquidation Leverage($118,757-$117,829) on the 1-hour time frame .

In terms of Elliott Wave theory , Bitcoin appears to be completing a main wave 4 . Main wave 4 is likely to have a Zigzag Correction(ABC/5-3-5) .

I expect Bitcoin to attack the Support lines and fill the CME Gap($115,060-$114,947) in the next hour.

Cumulative Short Liquidation Leverage: $123,087-$120,922

Cumulative Long Liquidation Leverage: $116,305-$114,325

Do you think Bitcoin can create a new ATH again?

Note: Stop Loss(SL)= $121,000

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

TON/USDT | Another Bullish Move Ahead? (READ THE CAPTION)By analyzing the Toncoin chart on the 3-day timeframe, we can see that, as per yesterday’s analysis, the price climbed to $3.36 before facing a slight correction — which is perfectly normal since every strong bullish trend needs a healthy pullback. The $3.05–$3.20 zone could serve as a good accumulation area for buyers, and we may soon witness another impressive rally from Toncoin! Based on the previous analysis, the next targets are $3.63, $4.20, and $4.68.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

ADA/USDT | BIG Bullish Move Ahead! (READ THE CAPTION)By analyzing the Cardano chart on the 3-day timeframe, we can see that, as expected, the price continued its rally, reaching $0.89 before collecting liquidity above the $0.86 level and then facing a correction. Currently trading around $0.81, we expect the bullish trend to continue after this minor pullback. Key demand zones are at $0.78, $0.69, and $0.61. Based on the previous analysis, the next short- to mid-term bullish targets are $0.93, $1.05, and $1.33.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

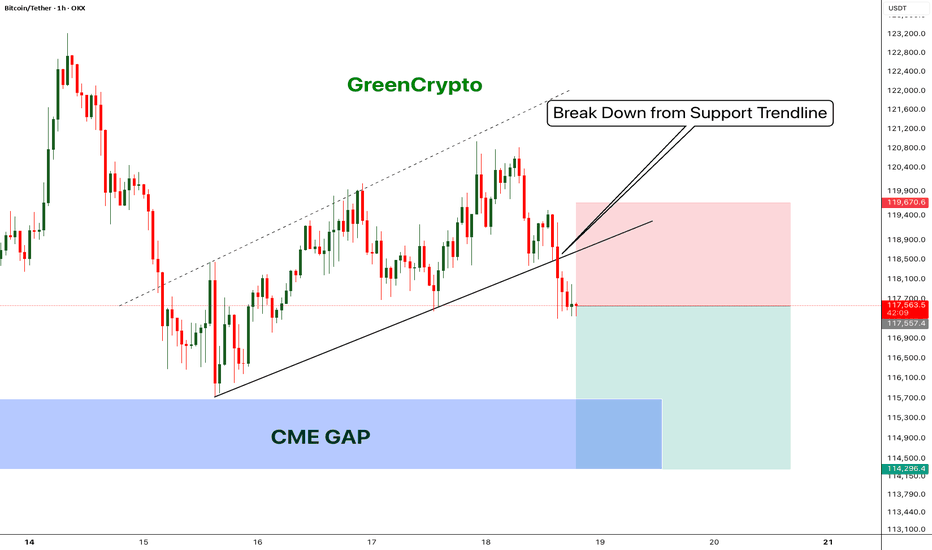

Bitcoin - Bears will push the price fill CME Gap- Bitcoin has broken down from the trending support,

- Price has been going down without any retracement on 1H candle.

- Looks like bitcoin will CME gap before going up further.

- A high risk Short Trade opportunity is here

Entry: 117,431

Stop Loss: 119,670

TP1: 116152.8

TP2: 114403.6

Move SL to Breakeven on TP1 hit

Don't forget to like and follow

Cheers

GreenCrypto

The Critical Blue Line – Will Bitcoin Soar or Sink

🔹 Bitcoin Technical Analysis – Key Blue Line, Bear Trap Possibility & Long-Term Scenario

On the Bitcoin chart, the blue horizontal level has acted multiple times as both support and resistance. The price has broken it several times but failed to sustain above, indicating high-volume decision-making zones by institutions and large players.

📉 Why this pattern keeps repeating:

Strong supply and demand concentration at this level.

Inability to break and hold shows market indecision.

Repeated fakeouts are likely used to shake out weak hands.

🔍 Important hidden scenario: Bear Trap Potential

If the price dips below the blue line but quickly reclaims it, it may form a bear trap, tricking short sellers into entering prematurely. This move could ignite strong bullish momentum from trapped sellers and renewed buyers.

🔮 If price holds above the blue line:

Signals market strength and potential bullish structure shift.

Targets:

109,800

117,200

120,000+ (Long-term)

📛 If support fails again:

Retracement toward the lower channel near 101,000 or lower is possible.

📊 Conclusion:

This zone is one of the most critical decision points in the current market. Traders should combine volume, candlestick behavior, and confirmation signals to avoid getting trapped by fake breaks

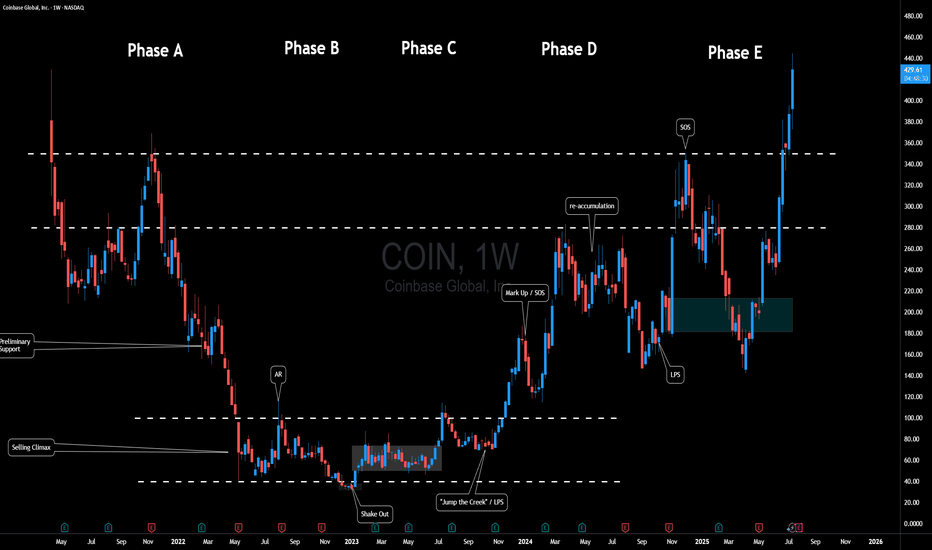

$COIN Fun Wyckoff InterpretationHere's a fun Wyckoff-inspired take on Coinbase Global ( NASDAQ:COIN ) over the past few years, mapping its weekly chart to the classic Accumulation Schematic. Wyckoff's method, envisioning the "Composite Man" quietly scooping up shares during weakness before blasting off... fits COIN perfectly, especially in crypto's wild swings.

We can see a textbook multi-year accumulation from mid 2022, a breakout into markup in 2024, and even a cheeky re-accumulation mid-2024 to fuel the latest highs.

Phase A: Stopping the Downtrend

After the initial IPO Coinbase experienced quite a bit of downside pressure.

Eventually price began to range between $40 and $100.

Phase B: Building Cause

Months of boring sideways chop.

Sellers exhausted because let's think for a moment... If crypto was truly going to stick around - how much lower could this thing go?

Smart money absorbs.

Phase C: The Trap

That shakeout low at ~$32 in early 2023. If you study Wyckoff, this is Schematic #1 vibes.

Phase D: Demand Dominates

Explosive rally (SOS) to ~$280 in early 2024, breaking the range on surging volume.

Mid-2024 pullback to ~$150 acts as a mini Re-Accumulation with its own LPS at the low. Higher lows / mitigation confirm no real distribution yet. Another SOS post-re-accumulation, pushing toward $400+.

Phase E: Markup Phase

Where will the composite man be eyeing for the next target?

Overall, Crypto adoption's heating up (BTC ETF flows, regulatory, etc), and the chart's still in a strong uptrend. But remember, Wyckoff's not crystal ball... it can however be used as a roadmap to navigate the chart.

Fun fact: COIN often mirrors BTC, so keep an eye out for correlation.

What's your opinion - accumulation complete or more shakeouts ahead? 🚀📈

Disclaimer: Not financial advice; DYOR! Chart based on weekly data up to July 2025.

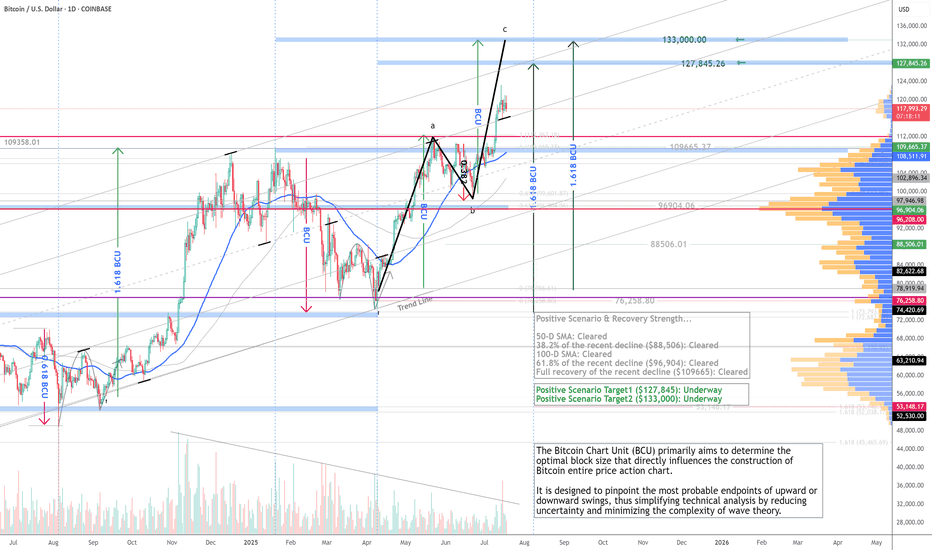

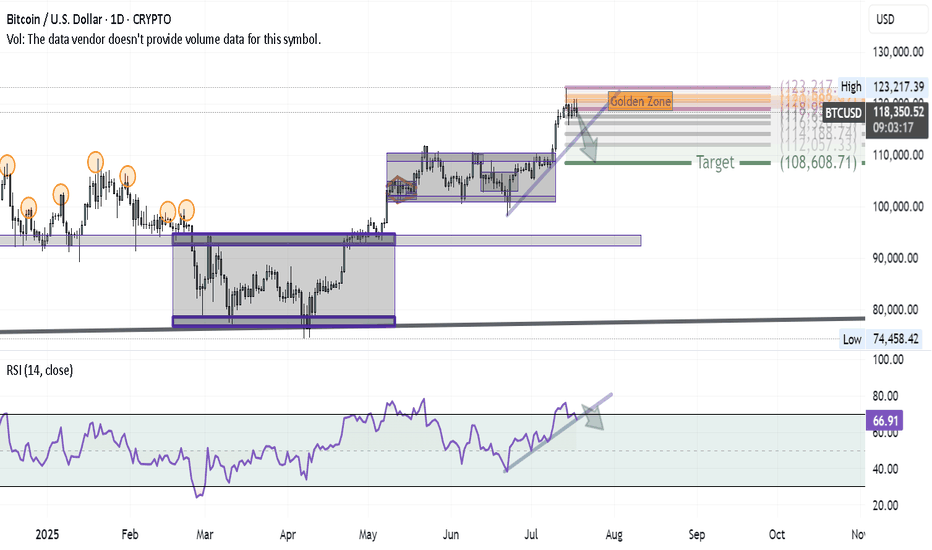

Bitcoin Correction Unfolding — First Wave in MotionAfter successfully hitting the BITCOIN target and anticipating a major correction in my previous ideas, here’s how the first wave of that correction is shaping up on the daily chart:

1- At the recent high, a Shooting Star candle formed — a classic reversal signal.

2- Using Volunacci analysis, the price retraced exactly to the Golden Zone, validating the first leg of the pullback.

3- The next step? A breakdown of the blue trendline would likely send us toward the Volunacci target at $108,600.

4- For confirmation, we're watching the RSI trendline — if it breaks down as well, it would strongly support the bearish continuation.

The setup is clean and developing as expected — it's all about following price and letting the chart guide the story.

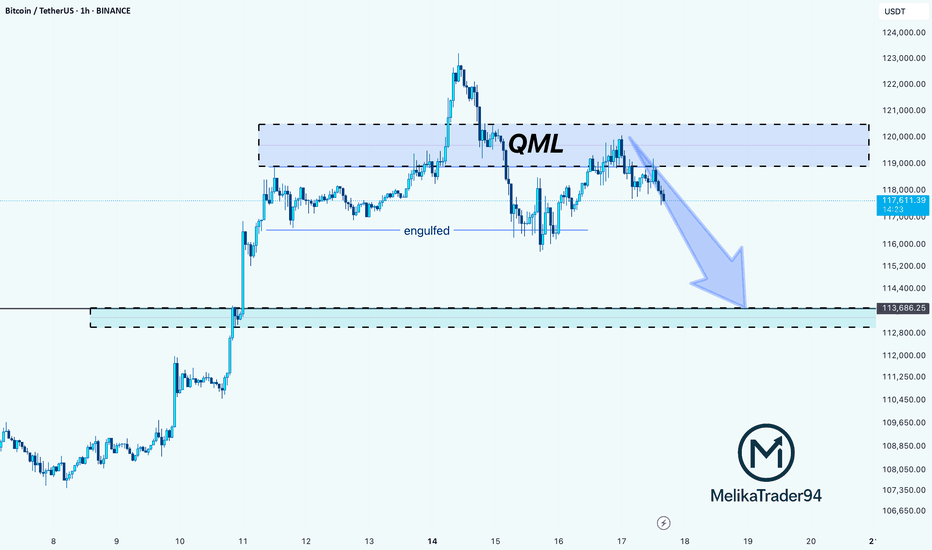

BTC Rejection from QML Zone: Towards on 113,600 SupportHello guys!

This chart shows a QML (Quasimodo Level) setup in play on Bitcoin. After price created a new high and engulfed the previous structure, it returned to the QML zone (around $119K–$121K) and reacted exactly as expected: strong rejection.

The sharp selloff from the QML area confirms a bearish shift in structure, and now the momentum is tilted to the downside.

The next key level to watch is the 113,600 demand zone, where the price may either bounce or consolidate.

As long as the price stays below the QML zone, bears have control.

You should consider that the main trend is bullish, and the stop loss may be hit, so please manage your risk!

TradeCityPro | Bitcoin Daily Analysis #131👋 Welcome to TradeCity Pro!

Let’s dive into the Bitcoin analysis and key crypto indices. As usual, in this analysis, I’ll review the futures session triggers for New York.

⏳ 1-hour timeframe

Over the past few days, the market hasn't been very focused on Bitcoin, and altcoins have been moving more strongly to the upside.

⚡️ Bitcoin is still ranging between 116829 and 122733 and is fluctuating between these two levels.

💥 Currently, a local top has formed at 120594, and if that level breaks, we can open a long position. The main long trigger will be the breakout of 122733.

📈 If the market decides to correct, key support levels are 118071 and 116829. I’m setting the stop-loss for my previously opened positions below the 116000 zone.

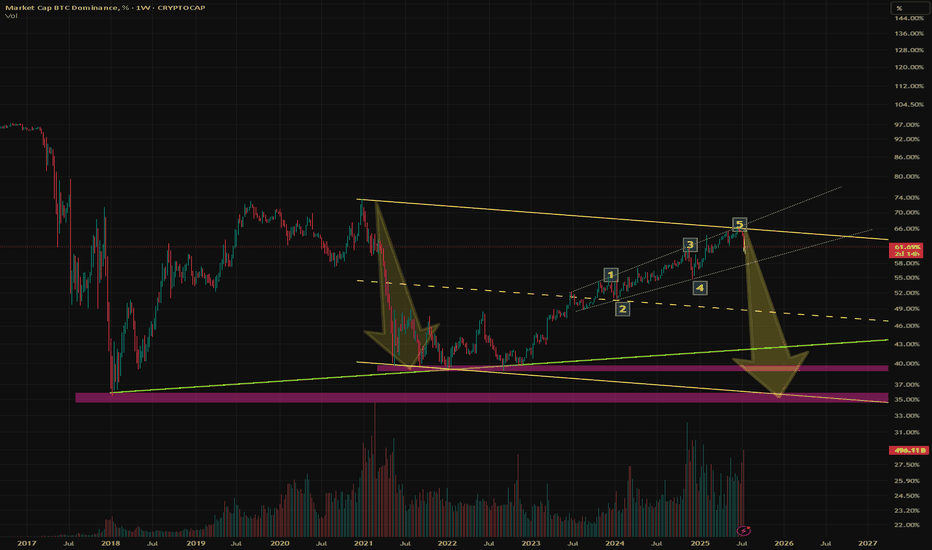

👑 BTC.D Analysis

Let’s look at Bitcoin Dominance. The reason I’m saying Bitcoin isn't currently the center of attention is exactly this dominance chart.

🔔 As you can see, BTC Dominance is in a very sharp downtrend with strong momentum, which means capital is flowing out of Bitcoin and into altcoins—giving us better long setups on alts.

✨ For now, I see the trend as bearish, and the next supports are at 61.34 and 60.49.

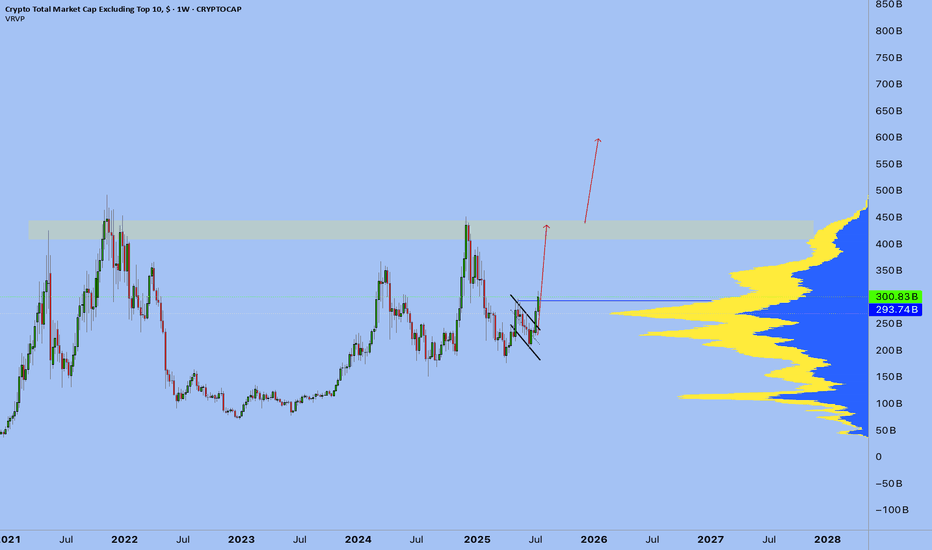

📅 Total2 Analysis

Total2 is still moving upward and has broken above 1.46, continuing its upward momentum.

✔️ The new top is at 1.5, and a breakout above this level can be used as a trigger for long entries.

📅 USDT.D Analysis

Let’s move to Tether Dominance. The 4.22 support was broken yesterday, and the index is now moving downward.

💫 The next support level is 4.08, and breaking that will confirm continuation of the downtrend.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

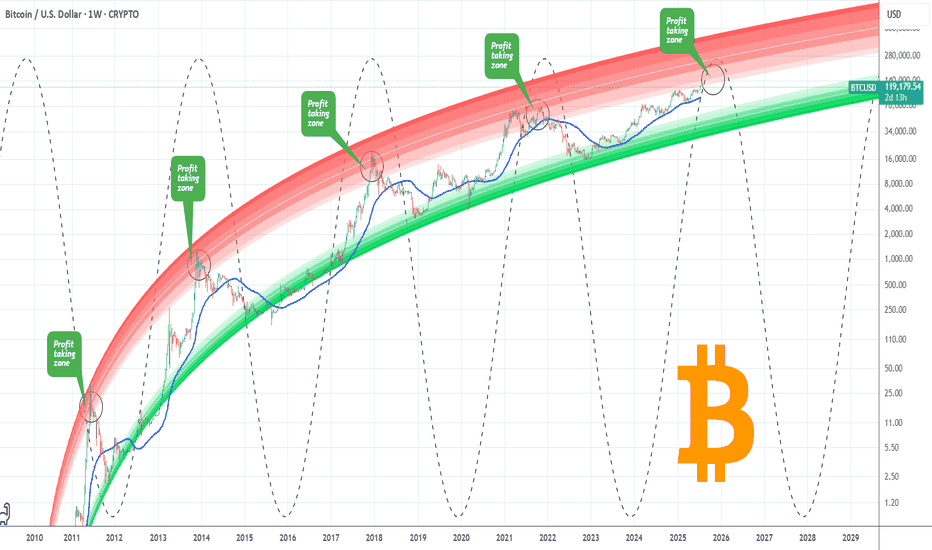

BITCOIN Entering Cyclical Profit Zone. Risk should be limited.Bitcoin (BTCUSD) has just entered the first level of the Logarithmic Growth Curve (LGC) Resistance Zone, which is the light pink band. The Top of the previous Cycle was priced at the top of the band just above this.

In fact every BTC Cycle had this as the 'Profit taking Zone'. The market marginally touched that also within December 2024 - January 2025 but got rejected, almost in similar fashion as January 2021, which was a Double Top approach of the peak formation during the previous Cycle.

This Cycle Top is expected to be within October - November 2025, so we call this the 'Profit Taking Zone' for a reason. Risk exposure from now on should be getting more and more limited. Peak range (depending of the nature of aggression of potential Rate Cuts in September) could be anywhere within $140 - 200k.

Do you think this is the time to start limiting BTC exposure, perhaps moving some of the huge profits to alts? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

is AltSeason Started ????"The altcoin season has likely begun! We're currently witnessing Bitcoin's dominance chart breaking down at a critical juncture, and this cycle may surpass even our most optimistic expectations. The technical signals are remarkably clear and verifiable for most seasoned traders. In these market conditions, the wisest strategy is to hold strong with conviction – maintain your positions and trust in the assets you've carefully accumulated. This could very well be the start of an extended altcoin rally that rewards patience and strategic positioning. #AltSeason #CryptoMarket #BTCDominance #HODLStrategy"

BTCUSD | 1W Time Frame | BITSTAMP ExchangeI have been using curve analysis for Bitcoin on the weekly time frame for a long time, employing two indicators: My BTC Log Curve and Bitcoin Logarithmic Growth Curves, of course, with my own custom settings to achieve maximum harmony with price movements. I recommend that to gain a precise understanding of Bitcoin curve analysis, you search for and study it, and make use of the two free indicators mentioned above.

Bitcoin finally managed to break free from the curve floor in the second week of September 2023, initiating a logical and gradual upward trend. Currently, it is supported by a significant level around $84,000 (keeping in mind that this rate will gradually increase due to the market's floating nature). However, the most critical price ceiling for Bitcoin in the current bullish market trend is approximately $154,000. Given the acceptable momentum of the current upward trend, reaching this price target seems reasonable. Nevertheless, we should anticipate a corrective reaction from the market, considering the historical behavior in this price range.

In summary, it can be stated that for mid-term holders, the price target of $154,000 appears to be a realistic and attainable goal, while the price floor of $84,000 serves as a very suitable level for buying and re-accumulating.

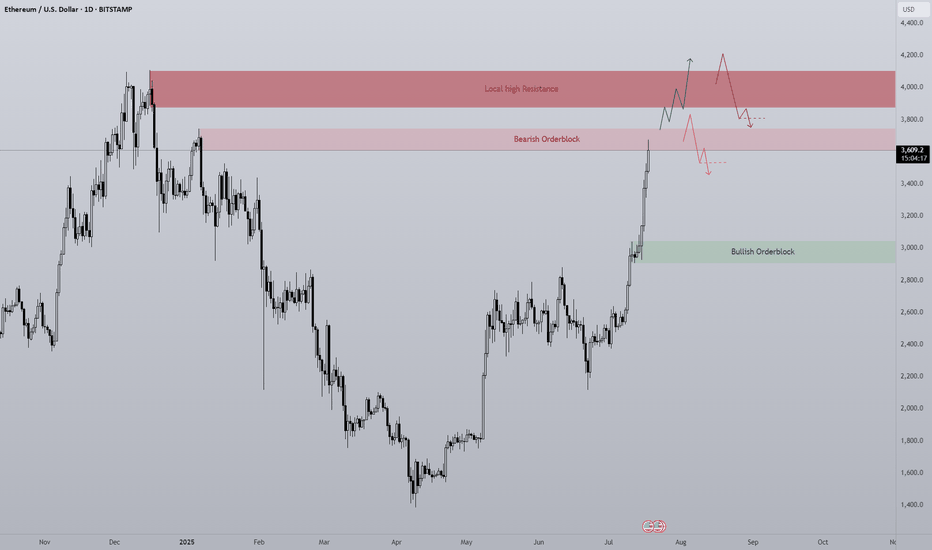

ETH 1D Overview Finally we are seeing altcoins regaining lost ground on Bitcoin and the second largest crypto by market cap is rallying strong.

Since ETH has such strength currently the opportunity to short is quite slim with high risk, however I think it's important to see where ETH may find some resistance or if a pullback was to happen, where would it come from?

The first level is the bearish orderblock level that has just been tapped as of writing. This area previously began the sell-off at the end of 2024 by confirming a new lower high. Naturally this area will present problems for the bulls and so a potential pullback could be initiated from this level. I would like to see a sweep of the stop loss positions just above the area and then a SFP to confirm the pullback is in motion.

Should the bearish orderblock fail the next clear level is the daily local top around $4000. A big even level and the area that started 5 months of downtrend. IMO the most likely level where longs will take profit. I do think if we see any form of consolidation between the bearish orderblock and the local high the bulls will look to carry the rally on, shallow pullbacks maintain momentum

Ten out of the last eleven days have been green candles with the only one day being red just above a key high, I expect if we are to get a pullback that bullish orderblock area ($2900-3000) to be retested as support. Therefor if any of the above areas initiate a pullback this area should provide support and therefor a long entry.

To clarify I am in no way bearish about Ethereum, this is just a plan for different eventualities.

3/ Altseason: Live - My System: Cut Losses, Let Profits RunIntroduction: The Whole Truth About Trading

The "Altseason: Live" experiment is in full swing. Before we continue, I want to show you something important. Not just the wins, but the complete picture.

This is real trading. With big wins and unavoidable losses. And this single screenshot contains my entire philosophy.

My Core Strategy: Cut Your Losses, Let Your Profits Run

My main job as a trader comes down to two simple rules:

Hold my winning positions for as long as possible.

Cut my losing positions as quickly as possible.

Look at the screenshot again. The losing trades on SAGA (-90) and PUMP(−595) were closed fast.

The moment I realized the setup wasn't working, I got out. No hope, no emotions. This is the cost of doing business.

Now, look at MAV (+4,302) and RONIN(+3,254)

I let them run because they were following the plan. These two trades brought in +$7,556 in profit, more than covering all the small losses and securing a great overall result. This is how the system works.

The Winner's Psychology: The Battle with Euphoria

After a series like this, it's easy to get a "winner's high" and believe you're invincible. That's a trap. That's why, after the first wins, I deliberately cut my position size for the next trades by four times. To tame that euphoria and remember that discipline is more important than overconfidence.

My main principle remains : Fear losing more than you fear missing out.

The Hunt Continues: The Current Position

This system isn't a theory from the past. It's working right now. As of this moment, I have one open position in :

GETTEX:WOO , which is already showing over 2121 in unrealized profit.

I plan to manage this trade by the same rules and will likely close it within the next 1-3 days.

What's Next?

I'm not looking for dozens of trades. I'm looking for a few high-quality setups where I can apply my system. I use limit orders to enter on pullbacks, and I always use a stop-loss.

The experiment continues. You can follow it all in real-time on my streams, where I broadcast my trading terminal.

Thank you for your attention. The hunt for Trade #3 has already begun.

Best regards EXCAVO

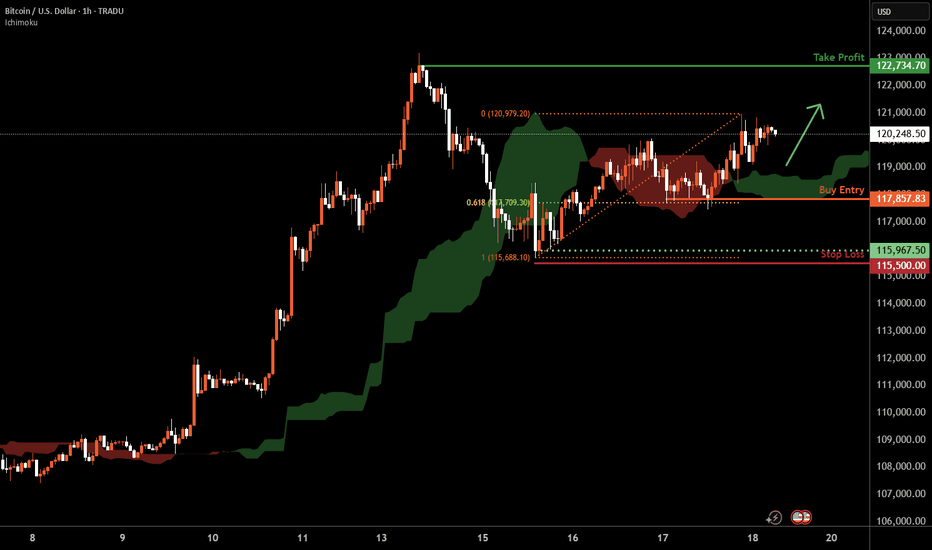

Bitcoin H1 | Falling toward a 61.8% Fibonacci supportBitcoin (BTC/USD) is falling towards a swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 117,857.83 which is a swing-low support that aligns with the 61.8% Fibonacci retracement.

Stop loss is at 115,500.00 which is a level that lies underneath a swing-low support.

Take profit is at 122,734.70 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

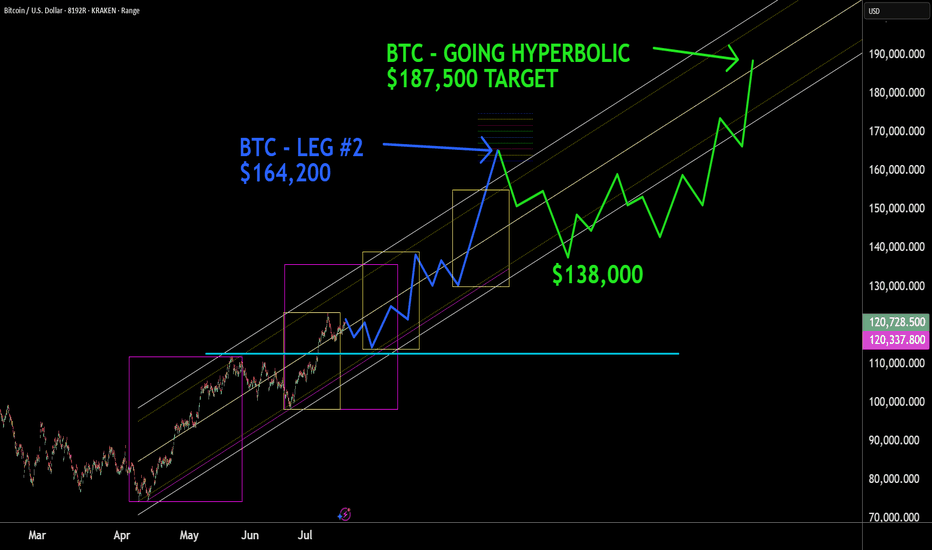

BTC - HYPERBOLIC FINISH This box here where we right shit in, what it really worth? You will never understand technical analysis if you think reading words in a little box mean something. BTC , next top mid frame with a throw over of center to $164,000. Then consolidation around the core to $138,000, then the hyperbolic finish to $187,500+. Nuf said. Good luck. Volatility will be high, but mainly move in one direction. Murrey Math, ( Which trading view wont let me display because its an unpublished indicator , Elliott Wave, Kumar Wave being used for this forecast.

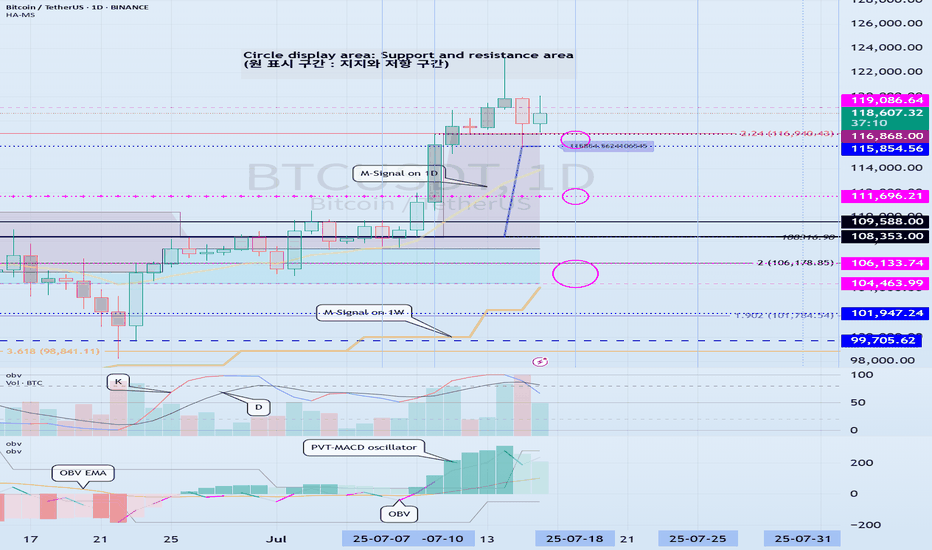

Check support at 115854.56-119086.64

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

(BTCUSDT 1D chart)

On the 1W chart, the DOM(60) indicator was created at the 119086.64 point.

Accordingly, the key is whether it can be supported near 119086.64.

The meaning of the DOM(60) indicator is to show the end of the high point.

In other words, if it rises above HA-High ~ DOM(60), it means that there is a high possibility of a stepwise upward trend.

On the other hand, if it fails to rise above DOM(60), it is likely to turn into a downtrend.

The basic chart for chart analysis is the 1D chart.

Therefore, if possible, check the trend of the 1D chart first.

The DOM(60) indicator of the 1D chart is currently formed at the 111696.21 point.

And, the HA-High indicator was created at the 115854.56 point.

Therefore, since it cannot be said that the DOM(60) indicator of the 1D chart has been created yet, if the price is maintained near the HA-High indicator, it seems likely to rise until the DOM(60) indicator is created.

We need to look at whether the DOM(60) indicator will be created while moving sideways at the current price position or if the DOM(60) indicator will be created when the price rises.

If the price falls and falls below 111696.21, and the HA-High indicator is generated, the HA-High ~ DOM(60) section is formed, so whether there is support in that section is the key.

-

Since the DOM(60) indicator on the 1W chart was generated, if it fails to rise above the DOM(60) indicator, it is highly likely that the HA-High indicator will be newly generated as it eventually falls.

Therefore, you should also look at where the HA-High indicator on the 1W chart is generated when the price falls.

-

The next volatility period is around July 18 (July 17-19).

Therefore, you should look at which direction it deviates from the 115854.56-119086.64 section after this volatility period.

Since the K of the StochRSI indicator fell from the overbought section and changed to a state where K < D, it seems likely that the rise will be limited.

However, since the PVT-MACD oscillator indicator is above 0 and the OBV indicator is OBV > OBV EMA, it is expected that the support around 115845.56 will be important.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain the details again when the bear market starts.

------------------------------------------------------