BTC ANALYSIS🔮 #BTC Analysis 💰💰

🌟🚀As we said #BTC performed same. Now, In daily chart we can see a formation "Rising Wedge Pattern in #BTC. There is a strong resistance zone and we could see a rejection from that level but if the price breaks the resistance zone then we would see a bullish move 💲💲

🔖 Current Price: $1,18,590

⁉️ What to do?

- We have marked some crucial levels in the chart. We can trade according to the chart and make some profits in #BTC. 🚀💸

#BTC #Cryptocurrency #DYOR #PotentialBreakout

Bitcoin (Cryptocurrency)

Want to Know What Happens in Crypto? Check Silver InsteadThe Gold/Silver ratio is one of the key indicators that highlights major turning points in modern economic history. Similarly, the ETH/BTC ratio is widely followed as a gauge of strength in the crypto market and the beginning of altcoin seasons. Interestingly, these two ratios also appear to correlate well with each other.

As adoption of both Ethereum and Bitcoin has grown, the Gold/Silver and BTC/ETH ratios have started to move more closely together. They often follow similar patterns, with tops and bottoms forming one after the other. For clarity, this analysis uses the BTC/ETH ratio rather than ETH/BTC.

Historically, BTC/ETH tends to lead during market tops, followed by a similar move in the Gold/Silver ratio. This pattern has been observed repeatedly since 2020. When it comes to bottoms, the timing between the two ratios is usually tighter, as seen during the 2020, 2021, and 2024 lows.

The latest signal came from a top in the BTC/ETH ratio, and the Gold/Silver ratio now appears to be following that move. Given the cyclical nature of crypto markets, both ETH and silver could be at the early stages of new upward trends. For a potential trend reversal, it may be wise to keep a closer eye on silver in the coming weeks.

BTC/USDT Analysis — Hidden Buyer

Hello everyone! This is the daily analysis from the CryptoRobotics trading analyst.

Yesterday, Bitcoin continued its move toward the local low and formed a false breakout.

Throughout the decline, we observed a positive delta, which may indicate gradual accumulation of long positions. At the same time, the descending trendline has not yet been broken, and there was strong absorption of market buys around ~$118,400 and ~$118,800 — which makes entering long positions very risky at the moment.

Our main expectations are based on further rotation within the range marked in yesterday’s analysis. In the short term, we are watching for a test of two local zones to assess the reaction from sellers. If the reaction is weak, a test of the upper boundary of the new sideways range is quite possible.

Buy zones:

$116,200–$115,000 (volume anomalies)

$110,000–$107,000 (accumulated volume)

Sell zones:

~$118,400 and ~$118,800 (local resistances)

This publication is not financial advice.

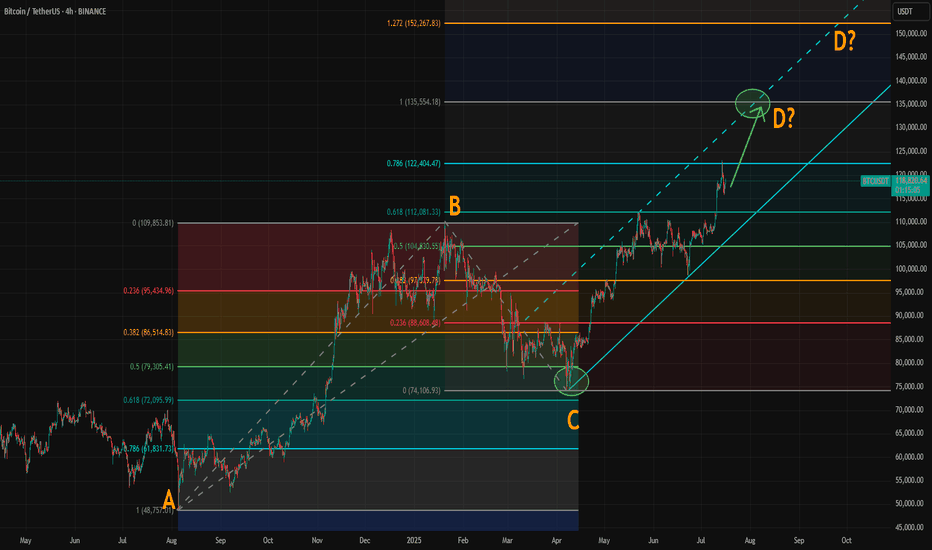

Where Could Bitcoin Make Its Cycle Top? Model and ABCD AlignedWith the breakout above resistance around 110,000, Bitcoin’s rally appears to be back on track. If you've been following our crypto analysis, either here or on our website, you’ll know our target range for this bull cycle is between 135,000 and 150,000, with the top of the range possibly extending further depending on the strength of the final wave.

Now, a possible ABCD pattern is forming, with point D potentially landing at either 135,000 or 150,000. A coincidence? Maybe, maybe not.

How Did We Arrive at the 135K–150K Target?

We based this range on historical halving cycle returns:

Halving Year - Return to Cycle Top

2012 - 9,076%

2016 - 2,122% (↓ 4.27x)

2020 - 541% (↓ 3.92x)

Two things stand out:

Each cycle has shown diminishing returns.

The rate of decline appears roughly consistent, dropping by around 4x each time—but slightly less with each cycle.

So depending on the multiplier used:

If returns fall by 4.27x again → target: 135K

If reduced by 4x → target: 140K

If reduced by 3.92x → target: 142K

If the rate of reduction itself slows (difference of 0.35 between 4.27 and 3.92) → target: 150K

While the sample size is too small, we believe the model holds reasonable logic with fundamental backing from various metrics.

The chart now shows a possible ABCD pattern:

If it becomes a classic AB = CD structure, point D could form near 135K.

If it becomes an extended ABCD (with CD = AB × 1.272), then point D could reach just above 150K.

These technical targets align closely with our halving model projections, increasing our confidence in the 135K–150K range as a likely top zone for this cycle.

Also, please check our earlier post for possible altseason start. A correlation between BTC/ETH and Gold/Silver might give some tips about possible Ether surge.

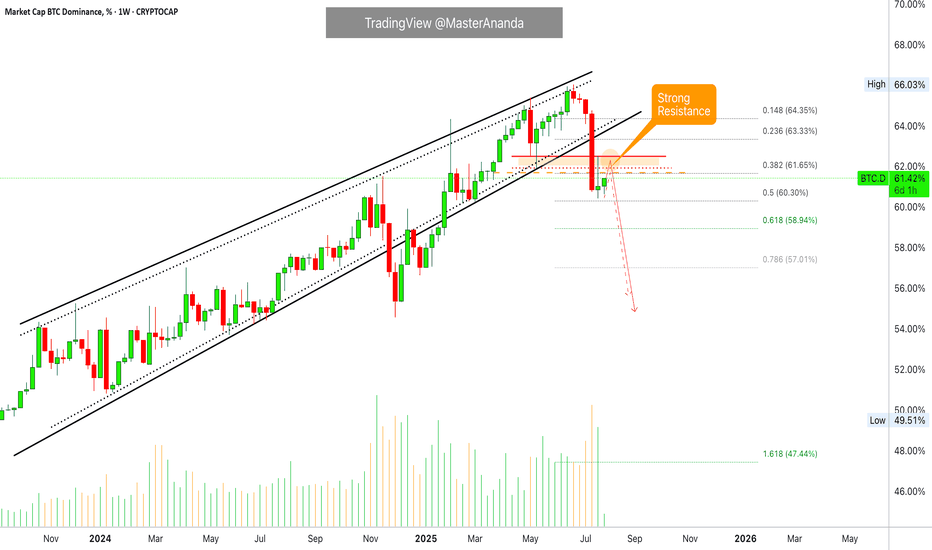

Bitcoin Dominance Still Bearish · Bullish Altcoins ContinuesThe Bitcoin Dominance Index will continue bearish as long as the action happens below resistance as shown on the chart.

An uptrend has been broken with the highest volume in a single session since February 2021. When this same signaled showed up back in Feb. 2021, what follows was a major drop (a marketwide bull-run.).

Seeing Bitcoin Dominance in the same situation as in early 2021 predicts the start of the 2025 bull market phase. This is all to say that the Altcoins market will continue to grow; Bitcoin will continue to consolidate to end up moving higher; the altcoins will resume growing within days.

The chart supports only little time for a break before the next bearish continuation, it should happen within days. At this point, the altcoins will rally up. We are very close and indeed we are already in-the-action. These short retraces should be used as opportunity to rebuy and reload.

Namaste.

Quick Lesson: How to Identify Trend ReversalKnowing when to enter the market can mean the difference between making a profit and incurring a loss. The chart above clearly compares two similar-looking scenarios with very different outcomes: the one you should aim for and the one you should avoid.

- On the left , we see a textbook example of a bullish reversal. After a significant downtrend, the market prints higher lows and begins forming an ascending support. This signals that selling pressure is fading and buyers are stepping in. Notably, there are usually lots of unfilled bags — latecomers who show strong demand below the current price level but never get their orders filled, and who then just hit the 'market buy' button, which adds fuel to the fire of pump.

- In contrast, the right side shows a very similar pattern — a downtrend followed by consolidation, but with crucial differences. Here, all prior liquidity zones have already been filled, meaning there is less incentive for buyers to support the price. The “same vector” suggests price action hasn’t changed direction, and a common short squeeze traps late buyers before resuming the decline. This is a common bull trap , where a temporary price pump gives false hope before another leg down.

To sum up , a REAL REVERSAL builds on structure, accumulation, and higher lows—whereas a FALSE BOTTOM is often characterized by brief rallies, exhausted liquidity, and no change in vector trend. Experienced traders wait for confirmation and accumulation before entering a position, not just a temporary pause in a downtrend.

ETF News Meets the Charts: ETH, BTC, XRP, and SolanaFirst you probably want to watch this video:

📊 ETF News Meets the Charts: ETH, BTC, XRP, and Solana 🔥🚀

The SEC’s new in-kind ETF ruling is a macro-level reset. But as always — we bring it back to the charts 📉🧠

Here's the visual breakdown of what I'm watching and why:

🏛️ ETF Approval = Real BTC/ETH Usage Starts Now

✔️ ETF issuers can now create/redeem with actual Bitcoin & Ethereum

✔️ Real spot demand, better arbitrage, and tighter price tracking

✔️ TradFi goes crypto-native — this changes how ETFs settle

But the market? Shrugged.

That’s why we watch price structure — not headlines alone.

📈 What the Charts Are Telling Us:

🔷 Top Left – Ethereum (ETHUSD)

Breakout triangle forming after the unicorn setup at $2,912.

Momentum building for the third breakout attempt at $4,092

🔥 Fuse lit. Target: $6,036

🔷 Top Right – SOLETH

Solana bleeding against Ethereum — just as forecasted months ago.

Rust tech, but memecoin dilution is hurting its institutional appeal. Solana will keep paying for their mistakes and damage done to Crypto!

🔷 Bottom Left – XRPBTC

Wedge breakdown playing out. XRP continues underperforming.

This chart was paired with a BTC dominance hedge — and dominance rose right after. XRP and dark pools is something I will cover..No, i don't like XRP, sorry.

🔷 Bottom Right – Bitcoin (BTCUSD)

Fib extension points to next possible macro leg:

🚀 0.618 = $131,736,

🟡 Final cycle target zone near $163K (or more? or 130k max?..we will find out)

🇨🇳 China: Rumor or Tumor?

Unconfirmed sources say China may be prepping a Bitcoin move. But let’s stay grounded:

🧠 It’s a rumor. Or a tumor.

There’s a 40% chance we get bad news instead — so keep your expectations realistic.

Still, if true, it could mean:

BTC in reserves

Regulated mining zones

Digital Yuan–BTC integration

🧯 Nothing official yet. But timing near the BRICS summit makes it worth watching.

🧠 Key Altcoin Narratives:

🔹 Ethereum L2s (ARB, OP, BASE) – ETF gas pressure = L2 scalability play

🔹 DeFi (UNI, AAVE, LDO) – TradFi flows into real DeFi utility

🔹 Staking Derivatives (LDO, RPL) – Institutions love yield

🔹 Oracles (LINK) – Real-time price data needed for ETF tracking

🔹 BTC Bridges (ThorChain, tBTC) – Infrastructure plays if BTC moves on ETH rails

🚫 What I’m Not Touching:

❌ Memecoins

❌ GameFi

❌ Ghost Layer 1s

📽️ Full breakdown is in my latest video — check it out from the video ideas tab for full context.

Stay sharp. Stack smart. Structure > noise.

One 💙 Love,

The FX PROFESSOR

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

ETH - BTC ETF News: What It Means for the Market+ China Rumors 🚨 ETH - BTC ETF News: What It Means for the Market + China Rumors 💥🌐

July just ended with a crypto bombshell 💣 — and the market is barely reacting.

Let’s break it down:

🧠 One part hard news.

🌀 One part geopolitical smoke.

🎯 All parts worth watching if you care about macro market shifts.

🏛️ SEC Approves Real BTC & ETH for ETF Flows (July 29)

Say goodbye to the cash-only ETF model.

The SEC now allows direct in-kind creation/redemption of Bitcoin and Ethereum in ETFs.

That means providers like BlackRock, Fidelity, VanEck can now use actual BTC/ETH, not just synthetic tracking.

✅ Bullish Impact:

💰 Real Spot Demand: ETF inflows = real crypto buying

🔄 Efficient Arbitrage: No middle step via cash = faster flows

🧱 TradFi + Crypto Merge: ETFs now settle with crypto — not just track it

🎯 Better Price Accuracy: Spot ETFs reflect true market value more cleanly

📉 The market reaction? Mild.

But don’t get it twisted — this is a structural reset, not a meme pump.

⚠️ But There’s a Bearish Angle:

🏦 Centralized Custody: Crypto now lives in Coinbase, Fireblocks vaults

⚠️ Network Risks: ETF performance now tied to ETH/BTC uptime

🧑⚖️ Regulatory Overreach: More hooks into validator networks, MEV relays

🌊 Volatility Risk: Panic redemptions = real BTC/ETH sold into open markets

Still, this is good news for Ethereum in particular.

Why? Because ETH isn’t just money — it’s infrastructure.

And now Wall Street is finally using it, not just watching it.

🇨🇳 And Then There’s China… Rumor or Tumor?

Crypto Twitter is swirling with unconfirmed whispers from July 29 that China may be prepping a major Bitcoin statement ahead of the BRICS summit.

But let’s be clear:

🚨 It’s a rumor. Or a tumor. 🧠

And like many tumors in crypto — there’s a 40% chance it brings bad news. 🤕

Still, here’s what’s being floated:

🧠 Speculations Include:

🔓 BTC re-legalization in “special finance zones” (HK-style)

🏦 BTC in national reserves (!)

🤖 CBDC integration or smart contract interoperability

⚒️ Return of official state-backed Bitcoin mining

🧯 But no official sources. Just geopolitics + timing.

China’s FUD/FOMO pattern is Bitcoin tradition — don’t get trapped by hopium.

But if even half of it is true... buckle up.

📈 Ethereum Leads the Charge — But Watch These Alts:

If ETFs go fully crypto-native, some sectors light up 🔥

🔹 1. Ethereum Layer 2s (ARB, OP, BASE)

→ ETF gas pressure = L2 scaling demand

🔹 2. DeFi Protocols (UNI, AAVE, LDO)

→ TradFi liquidity meets on-chain utility

🔹 3. ETH Staking Derivatives (LDO, RPL)

→ Institutions want yield = LSD narrative grows

🔹 4. Oracles (LINK)

→ ETFs need trusted on-chain data = Chainlink shines

🔹 5. BTC on ETH Bridges (ThorChain, tBTC)

→ If BTC flows into ETH-based ETFs, bridges light up

🚫 What I will Avoid:

❌ Memecoins – zero relevance to ETF flows

❌ GameFi – not part of TradFi’s roadmap

❌ Ghost Layer 1s – no users, no narrative, no pump

🧠 My Take:

ETH is building momentum toward $4,092 — the third breakout attempt on your 1-2-3 model.

🔥 The fuse is lit. Target? $6,036

Timing? Unknown. But structure is in place.

Meanwhile, Bitcoin Dominance is rising.

ETH is shining.

Solana — while powerful — continues paying the price for memecoin madness 💀

We’re entering a new phase — where ETFs settle with real crypto , China watches the stage, and macro money is warming up behind the curtain.

So stack smart.

Study the flows.

Don’t let silence fool you — the biggest moves come after the news fades.

One Love,

The FX PROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

3 Bitcoin Tops, Weak Green Candles, and What’s Next? If you're closely monitoring the Bitcoin (BTC) market, patterns often begin to reveal themselves in surprising ways. In the attached chart, I’ve highlighted three major local tops that Bitcoin has made, each marked by a weak green daily candle. What’s even more striking is what comes next: a dramatic increase in trading volume, followed by steep corrections.

Spotting the Pattern: Weak Green, Heavy Volume

At each pointed top (see red arrows), BTC formed an all-time high (ATH) with a relatively weak green candle, hardly the sign of euphoric buying strength.

Look closely at the volume bars below (blue arrows). Each time, as price struggled to push higher, volume surged after the top, often a signal of major sellers stepping in or longs closing en masse.

What followed? Significant corrections: -13.6%, -29.2%, and, now it might be shaping up for another potential drop (-24.1%) if history rhymes.

Why Does This Matter?

From a technical analysis perspective, volume is the fuel behind price moves. When a new high is reached with limp buying (weak green candles) but is swiftly met with rising volume on the way down, it’s a classic sign of distribution, a strong hand selling into retail euphoria.

Is Another Drop Coming?

Given the consistency in behavior, it’s not unreasonable to ask: are we about to witness another similar correction now that BTC has again hit a top with a weak green candle and volume is ticking up? The historical evidence certainly makes it plausible.

Long-Term Perspective: Still Bullish

Despite these corrections, my long-term outlook remains bullish. Every cycle has corrections, they’re opportunities for healthy consolidation, allowing strong hands to accumulate and the market to reset for its next leg higher.

*not investment advice

#crypto #btc #bitcoin #finance #trading

Bitcoin: Pennant - Bullish Continuation PatternI spotted a bullish continuation pattern called Pennant in Bitcoin chart

Support and resistance are marked with yellow trendlines

There is also a Flag Pole (white trendline)

The model is clean as we already see a bullish breakup and a textbook pullback

to the broken resistance.

The target is established at the height of the Flag Pole applied to the broken resistance

at $135k.

For final confirmation the price should overcome the top of breakout at $119,800

The invalidation point is located at the bottom of the Pennant at $114,700

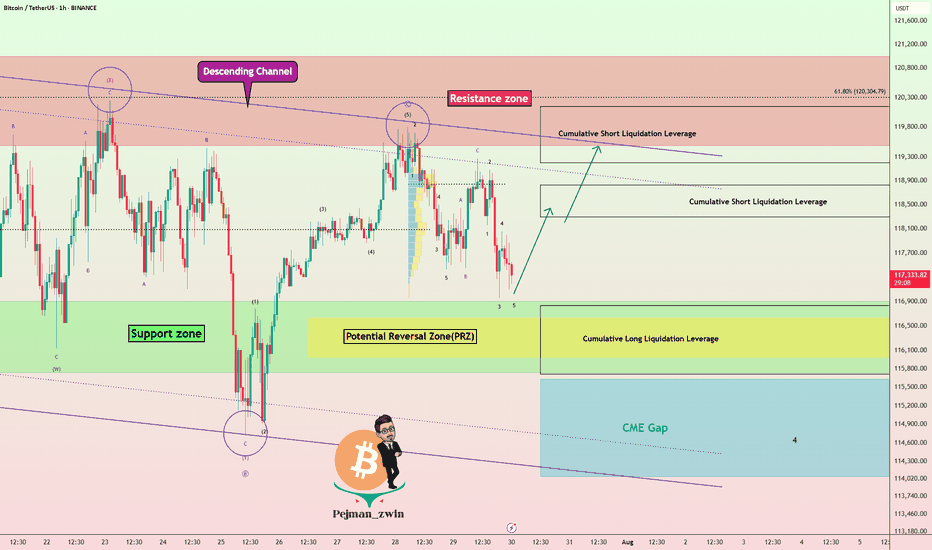

White House Crypto Report Incoming: Will BTC Pump from Support? One of the important news for Bitcoin ( BINANCE:BTCUSDT ) that was released today was that " White House confirms first Bitcoin and crypto report will be released TOMORROW ". Bitcoin is likely to rise with the release of the White House report .

What do you think? At least a temporary pump may be in store for Bitcoin.

Bitcoin fell to the Support zone($116,900-$115,730) and filled the New CME Gap( $119,500-$118,295) as I expected in the previous idea .

Bitcoin is currently moving near the Support zone($116,900-$115,730) , Cumulative Long Liquidation Leverage($116,828-$115,710) and Potential Reversal Zone(PRZ) .

I expect Bitcoin to rise from the Support zone($116,900-$115,730) to at least $118,680(First Taregt) .

Second target: Upper line of the descending channel

Note: Stop Loss: $114,680 = Worst Stop Loss(SL)

CME Gap: $115,060-$114,947

Cumulative Short Liquidation Leverage: $118,827-$118,298

Cumulative Short Liquidation Leverage: $120,144-$119,200

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

What's next for BTC?BTC is potentially forming a textbook bull flag with a measured target of $140k.

A solid break and retest of $120k would signal strength and a push towards the target.

Losing $114k or a strong close below it's current range support around $117k could signal a test of $110k as support - potentially great buy opportunities.

BTC - Bulls vs Bears: who will win?Market Context

Bitcoin is trading in a tight consolidation just below its all-time high after a strong impulsive rally. This phase represents a balance of power between buyers and sellers, with neither side able to take control yet. Such a pause in momentum at this key level often builds pressure for a breakout move as liquidity pools accumulate above and below the range.

Consolidation Phase

The current range is clearly defined by a resistance area at the top and a support area at the bottom. Price has been oscillating within these boundaries without any sustained breakout attempts. This range-bound behavior is an essential part of the market cycle, as it allows larger players to build or distribute positions. The longer price stays in this box, the more significant the breakout that follows tends to be.

Bullish Breakout Scenario

If price breaks out decisively above resistance, it would indicate buyers have absorbed all the supply at these levels. Such a breakout opens the path to a new all-time high and could potentially extend far beyond as trapped shorts are forced to cover. For traders, a retest of the breakout level on lower timeframes could provide a low-risk entry point for continuation to the upside.

Bearish Breakout Scenario

On the flip side, if support fails, the market will likely gravitate toward the unfilled Fair Value Gap left behind during the previous rally. This inefficiency becomes a natural draw for price, offering a logical downside target for a corrective move. A clean break below the range followed by a retest from underneath could present shorting opportunities for those aiming to capture that move into the FVG.

Final Words

Patience and precision are key when dealing with setups like this. Let the market come to your level — and react with intent.

If you found this breakdown helpful, a like is much appreciated! Let me know in the comments what you think or if you’re watching the same zones.

BITCOIN Will Move Higher! Long!

Take a look at our analysis for BITCOIN.

Time Frame: 2h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The price is testing a key support 118,043.14.

Current market trend & oversold RSI makes me think that buyers will push the price. I will anticipate a bullish movement at least to 119,900.74 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Bitcoin Passes Stress TestOn July 25, 2025, Galaxy Digital executed one of the largest Bitcoin sales ever recorded: 80,000 BTC, valued at approximately $9 billion , on behalf of a Satoshi-era investor.

Despite the size, the market absorbed the flow with minimal volatility—Bitcoin dipped from around $119,000 to $115,000, then rebounded above $119,000.

Liquidity Maturity in Motion

Analysts called the trade a significant demonstration of market maturity, noting that 80,000 BTC was absorbed in days with barely a market blip.

Crypto infrastructure has also evolved: algorithmic liquidity providers, institutional desks, and OTC channels handled the load without triggering cascading funding rate hikes or forced liquidations.

Ongoing Risks

Event-Driven Stress: During macro shocks or sharp sell-offs, liquidity may thin, and the same level of absorption might not persist.

OTC vs Exchange: This large sale was managed mostly off-exchange. A similar-sized on-exchange dump could still trigger stop-run cascades.

Retail Complacency Risk: The stability seen now can be deceptive, as retail may misinterpret low volatility as a safe leverage zone, only to be caught off-guard.

Projections:

Watching the 23.6% fib retracement level in line with the $116,600 price level. Anticipate the resistance level of $120,000 to be retested.

If price breaks above $120,000, we could see a significant move toward $130,000

The $9B BTC sale went through without materially impacting price is considered a milestone in crypto market evolution. It reflects institutional-grade liquidity and sentiment maturity.

BTC USDBITFINEX:BTCUSD

This current four hour Ichi cloud will likely fail and we see some decent downside but there is always that chance we respect the cloud and finish heading towards 131k.

Looking at the daily/weekly tf's I'm assuming one more move higher before we sell off relatively soon within the weekly time frames narrative so within some months.

BTC highs in, new lows coming soon?~$122.5k was the top of the range. Now we'll need to go test the lows before we can continue higher.

Alts are clearly not confirming a trend change .

Many still bearish on HTFs (including ETH), I think the reason is because Bitcoin goes lower before we see a continued run and that will drag down alts with it. I think people holding alts here with hopes for new highs (in the near future) are about to have their hopes crushed, that also goes for people long crypto miners.

I don't think the real run starts until end of 2025 or 2026.

Time will tell.

Bitcoin - The cycle is just starting!⚔️Bitcoin ( CRYPTO:BTCUSD ) just created new highs:

🔎Analysis summary:

Bitcoin is currently - especially with the new all time high breakout - just perfectly following previous cycle behavior. Since there is no real resistance above current price, apart from psychological levels, I do expect a substantial rally back to the upper channel resistance trendline.

📝Levels to watch:

$300.000

🙏🏻#LONGTERMVISION

Philip - Swing Trader

Bitcoin Rejected Near $120K – Bears Wake Up!First of all, I have to say that Bitcoin’s movements over the last 12 days have been a bit difficult to trade , generally, the hardest market to make a profit in is the range market with a swing movement .

Bitcoin( BINANCE:BTCUSDT ) is currently trading near the Resistance zone($121,000-$119,500) , Cumulative Short Liquidation Leverage($121,336-$120,000) , and the upper line of the descending channel .

Since Bitcoin has lost support lines , we can consider this increase in Bitcoin over the last two days as a pullback to the support lines(broken) . Do you agree with me!?

In terms of Elliott Wave theory , it appears that Bitcoin is still completing the main wave B. The main wave B is a Regular Flat(ABC/3-3-5) . The structure of the microwave B of the main wave B was a Double Three Correction(WXY) .

Additionally, the SPX 500 index ( SP:SPX ), which Bitcoin is correlated with , is poised for a correction in my opinion, which could also impact Bitcoin .

Also, unlike previous Mondays, MicroStrategy has NOT purchased Bitcoin , and the company currently holds 607,770 BTC .

Old Bitcoin wallets also seem to be waking up to the fact that they can create movements in the crypto market . " In recent days, 471,867.8 BTC worth $56.39 million have been transferred from old wallets from 2012 to 2017 . ".

I expect Bitcoin to decline to at least the Support zone($116,900-$115,730) and fill the CME Gaps in the coming hours .

New CME Gap: $119,500-$118,295

CME Gap: $115,060-$114,947

Cumulative Long Liquidation Leverage: $117,401-$116,615

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

ADA/USDT | Pullback to Key Support – Can It Rebound Toward $1.32By analyzing the Cardano chart on the 3-day timeframe, we can see that after reaching $0.935, the price faced selling pressure and dropped by 18% to the $0.76 area. Now, the key is whether ADA can hold above the $0.75 level by the end of the week. If it succeeds, we could expect further bullish continuation. The next potential targets are $0.86, $0.93, $1.02, and $1.32.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban