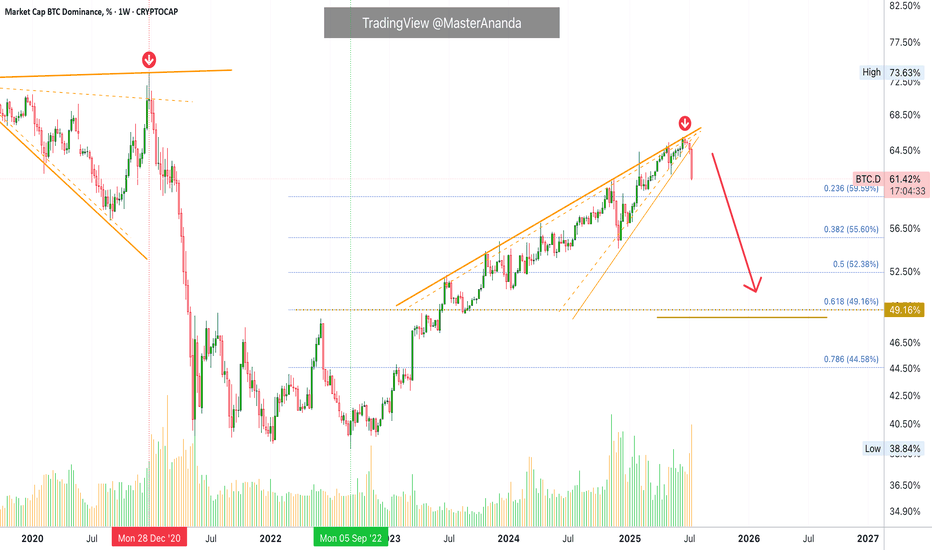

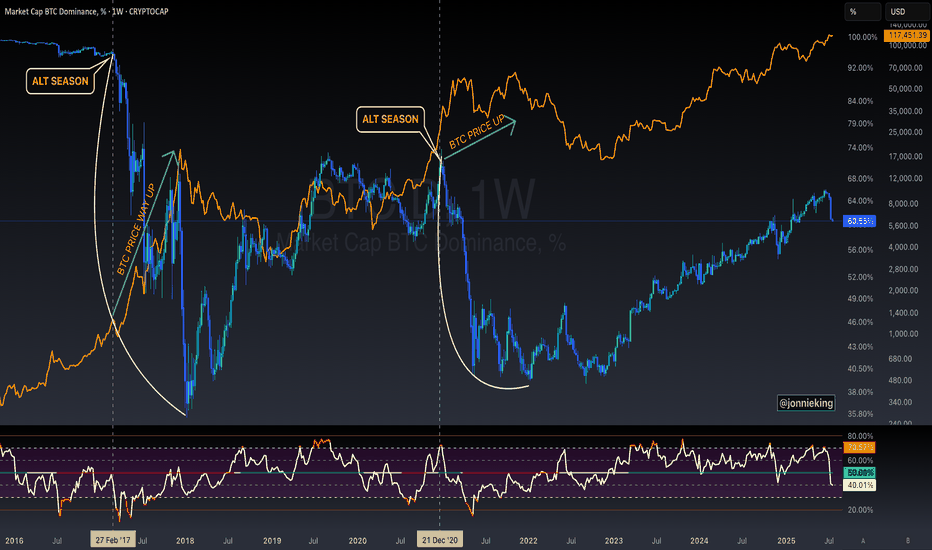

The End of the Altcoins Bull Market? BTC.D Turns Bullish?Bitcoin Dominance produced a bullish trend that was more than 1,000 days long. While this was a major development, the action never happened just straight up. There were always fluctuations.

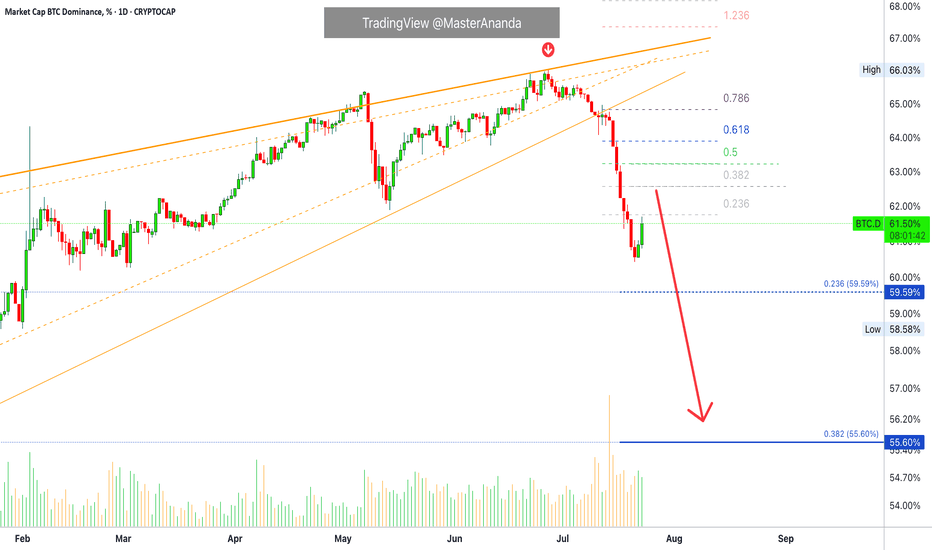

Bitcoin Dominance broke out of a major rising wedge pattern. A pattern that lasted years in the making.

Recently, Bitcoin Dominance produced the highest bearish volume since 2021. A strong chart signal.

The major breakdown following the multiple years long uptrend signals the start of a change of trend. A downtrend. This downtrend is extremely bullish for the altcoins market because BTC.D only goes down when the altcoins are going up and doing so faster than Bitcoin.

What we are seeing now is an inverted correction, a pullback. Simply put, BTC.D already made a strong drop and it needs some relief. This relief is not the end. Bitcoin Dominance can move just a little higher to later resume its newly developing downtrend. Which means that the altcoins market bull market has not reached its end, it is only getting started.

Thank you for reading.

Namaste.

Bitcoindominance

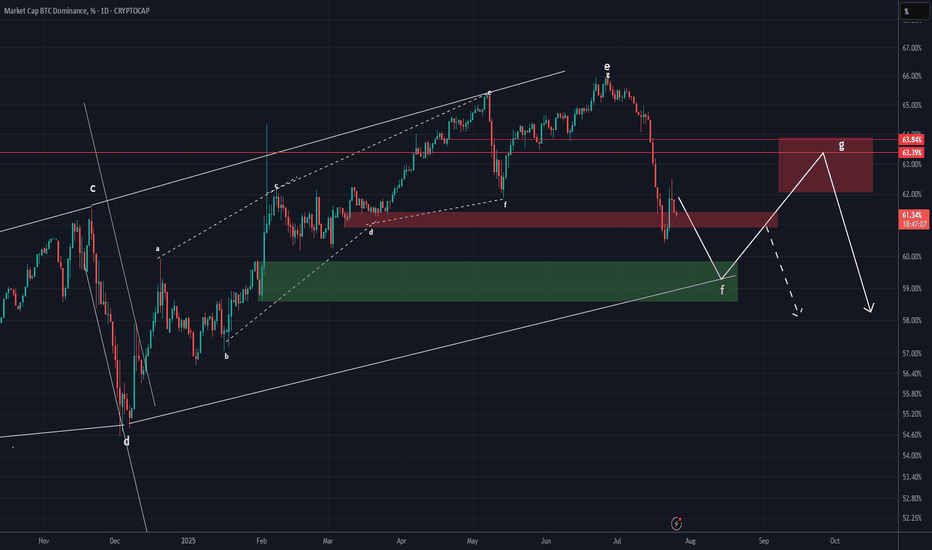

BTC DOMINANCE Update (1D)It seems that Bitcoin dominance may soon experience upward corrections, as it has broken through several support zones to the downside without any reaction and is now close to another support area. Usually, when the market maker pushes the price through multiple supports without a reaction, the price can retrace from a nearby support.

The price may soon move to complete wave G.

We have considered two different scenarios for the fluctuations of this index. However, note that this chart is a derivative chart, and the fluctuations may not follow the schematic exactly, but this analysis gives us a good view of the support and resistance zones and the probable path.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

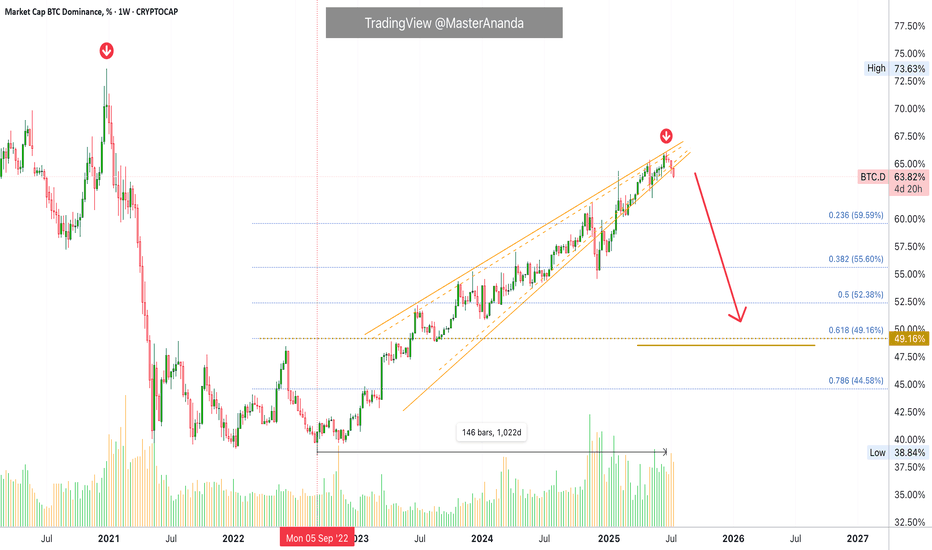

BTC DOMINANCE Looks Bearish (1D)Bitcoin Dominance seems to have completed its bullish structure.

An order block is forming and has been broken to the downside, a trigger line has been lost, and wave g has come to an end.

If Tether dominance also declines, altcoins may remain in the green.

The 62 level is the target drop zone for this index.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

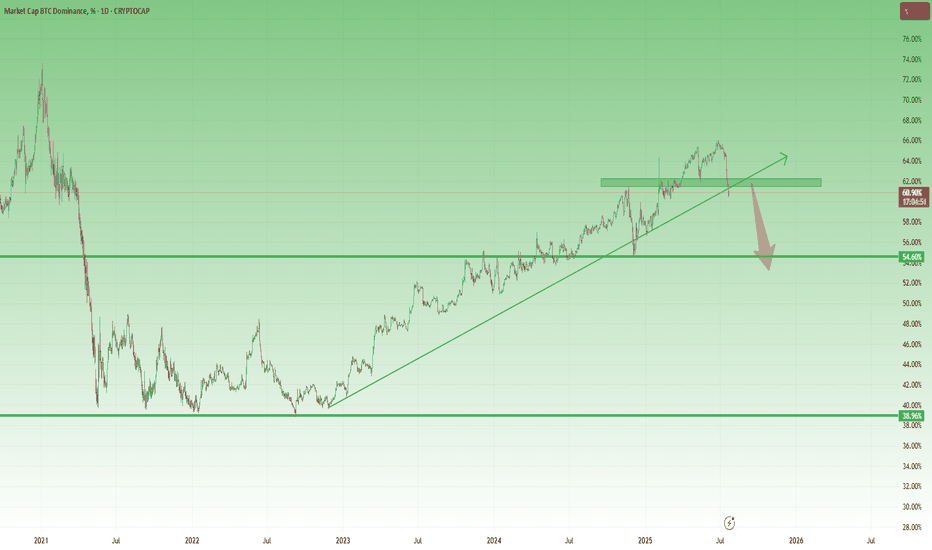

Bitcoin Dominance – Critical Breakdown on the Horizon

Bitcoin dominance is currently testing a major long-term resistance zone formed by the upper boundary of a multi-year wedge. After months of steady climb, the structure is now showing the first signs of exhaustion

If dominance loses the key 60% support zone, that would mark a major structural shift — historically followed by downtrends in dominance and strong capital rotation into altcoins.

Until dominance reclaims the upper trendline or regains bullish momentum, the risk-reward now favors altcoins. Momentum is shifting. Altseason might just be around the corner.

Altcoin Season May Be Real This TimeBitcoin Dominance Finally Breaks – Altcoin Season May Be Real This Time

Since late 2022, Bitcoin Dominance has been on a steady rise — and during this time, the vast majority of altcoins have bled heavily, losing value both in USD and BTC terms.

The long-awaited “altcoin season” became a meme more than a market event.

Every rally was short-lived, and rotation never truly materialized.

Until now...

________________________________________

📉 A Technical Break That Matters

Looking at the BTC.D chart, we finally see something meaningful:

➡️ A clear technical breakdown under confluence support given by the horizontal one and the rising trend line, which held for months and provided the structure for BTC outperformance.

At the same time, Bitcoin is stable around the 120k zone, and the price action suggests strength — not mania, not collapse — just solid consolidation at high levels, and most probably preparing for new ATHs.

This environment historically tends to be favorable for alts.

________________________________________

USDT Dominance (USDT.D) Also Pointing Lower

The USDT.D chart adds even more confluence to the idea:

• It's now pointing towards support

• The structure suggests there’s room for a further drop, which historically means more money flowing into risk assets — particularly altcoins

When stablecoins dominance drops, it usually reflects increased market participation and risk-on behavior — exactly what altcoins need to finally shine.

________________________________________

🔍 What Am I Doing?

I’ve already started buying selected altcoins and I'm looking to add more on dips.

This technical shift is meaningful. It’s not about catching hype, it’s about recognizing a real potential rotation.

In conclusion, I’ll be looking for strong altcoin setups to buy on pullbacks,

as I believe the next weeks and months could offer the kind of upside that can at least double my investment (yeah, yeah, I'm not "to the mooner, hoping for 100x ).

Bitcoin Dominance Weekly · Highest Bearish Volume in YearsThis week Bitcoin Dominance Index is producing the highest bearish volume session since February 2021. More than 4.5 years.

This week we have the strongest bearish action since June 2022. We can say that the altcoins market bull market is not only fully confirmed but already underway. We are already experiencing the best altcoin season since 2021 but it is still early, this is only the start.

Bitcoin Dominance is set to produce the strongest drop in many years and this only happens when the altcoins go ultra-bullish.

Bitcoin is moving sideways right now near resistance. As Bitcoin does this, the altcoins continue to move forward. This is classic bull market dynamics. When Bitcoin consolidates at a high price, the altcoins tend to explode. You can expect this pattern to continue to repeat for months to come. There is more good news though.

The fact that the altcoins are growing, perfect examples right now are Ethereum and Litecoin, is a bullish signal for Bitcoin.

It is not like the altcoins will grow and then Bitcoin will drop, no. Bitcoin consolidates and the altcoins grow, when Bitcoin stops consolidating it will move forward and hit a new major high, that is a price just around $134,000 and $136,000. When Bitcoin hits this price the altcoins continue to grow, back and forth. This is the most bullish the market has been since 2021. We will have to wait and see where this will all lead but new all-time highs are expected across all major projects and then some. Bitcoin is already in new all-time high territory but we need a new all-time high on Solana, Litecoin, Ethereum, Cardano, and so on. XRP is already at a new all-time high but it has much more to give.

If you visit @MasterAnanda, you will find up-to-date analyses for all these altcoins with new updated not conservative but realistic and good optimistic targets.

I will continue to share updates throughout the entire bull market. This is only the start. Get ready because the best is yet to come.

Namaste.

$BTC Will Go Up Alongside Alt SeasonSomeone posted on one of my tweets the following:

" Jonnie my bro, the only problem for me right now is that btc didnt top yet. You also talked how btc shoud top around 200k range. Alt season can only come when btc reach top"

MYTH DEBUNKED ✅

CRYPTOCAP:BTC does NOT need to top in order for Alt Season to commence.

Both can and will occur in tandem 🤝

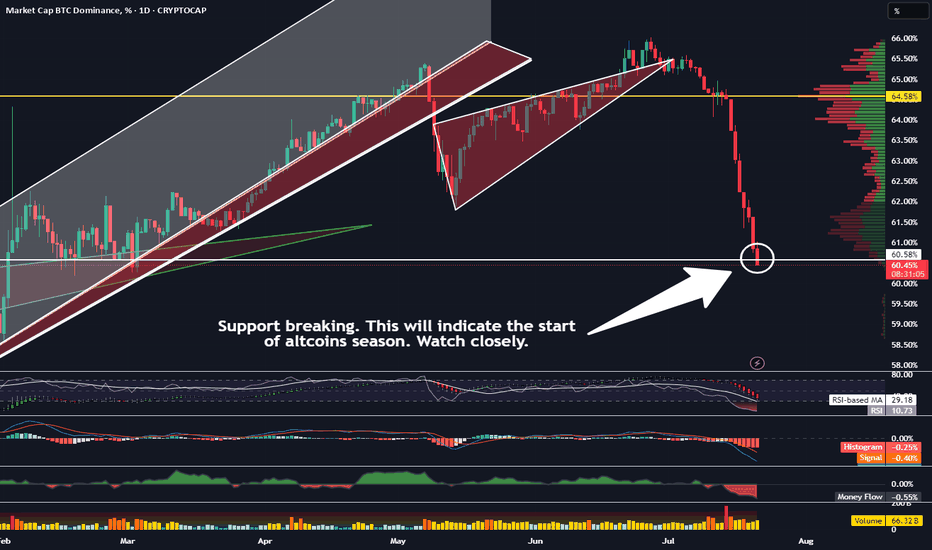

When This Support Breaks, Altcoin Season Becomes Official!Trading Fam,

We have many signs that altcoin season is almost upon us. Solana is breaking important resistance. Eth is nearing its target (both of these posts can be found below). But the most important indicator imo can be found on our BTC.D chart. Dominance has now reached an important support. I was kind of expecting a bounce here. And it still could bounce. But if it doesn't, then I feel like I can officially state that we will be in altcoin season for the rest of the year. Here's what you should be watching. If the body of that daily candle closes below our support today and then a new one opens and also closes below the support, its a wrap.

Let's go!

✌️Stew

Bitcoin Dominance Long-Term · 1,000 Days Long Uptrend BreaksBitcoin Dominance Index (BTC.D) has been on an uptrend since September 2022, an uptrend more than 1,000 days long.

This uptrend produced a rising wedge pattern and this pattern is as bearish as it gets. During the entire time, from September 2022 until June 2025, BTC.D never ever produced more than 3 consecutive weeks red. Now, in July 2025, we are witnessing the fourth consecutive red week, a major bearish signal. The start of a new downtrend.

The last time BTC.D went bearish was December 2020. The index, as Bitcoin grew to new all-time highs, produced a drop from a high of 74% to a low of 39%. Reflecting strong demand for the altcoins and a very strong rising altcoins market. We are about to witness something similar, better or the same.

As Bitcoin Dominance moves down, the entire altcoins market will move up. Bitcoin will grow together with the altcoins. Everything—Crypto—will grow.

Namaste.

Bullish Altcoins · BTC.D Highest Bearish Volume Since Feb 2021The altcoins market is about to have its strongest and biggest bullish cycle since 2021, or possible ever. We are entering the strongest altcoins season in the history of the Cryptocurrency market.

Good morning my fellow Cryptocurrency trader, I hope you are having a wonderful day.

Bitcoin will continue growing, that's old news but let's start by getting this out of the way.

The altcoins are already waking up from major lows and all-time lows and what follows is something hard to comprehend. The hottest bull market ever for the altcoins. Bitcoin is already far ahead.

On the 14th of July BTC.D (Bitcoin Dominance Index) produced the highest volume bar in more than three years, since February 2021. This happened after a double-top and only after a drop was already confirmed. In this way this signal carries extra-strength. The 14th of July session ended up closing red.

We all know that Bitcoin Dominance Index goes down only when the altcoins move up. The fact that we have the highest volume in years on a daily basis signals the start of the altcoins market major bull-run. Sustained growth for months and months and months.

Get ready and be prepared. The confirmation is already in place.

The altcoins market is heating up. Crypto is going up.

The wait is over.

Namaste.

Bitcoin dominance chart ready to dump?Bitcoin dominance aka the btc.d chart has been in these 2 rising channels now for a long long tie, after ust recently being rejected down fro the top trendline of the neon yellow channel, there seems to be an opportunity here for it to potentially head down to retest the bottom trendline of that channel as well. If this occurs this could lead to an altcoin season. Price is right now combating the 50ma(in orange) and trying to maintain it as support. If this moving average flips to solidified resistance that greatly increases the chances of price going down to retest that bottom yellow trendline. Being that both of these channels are rising channels probability favors price action eventually breaking down from them instead of up so I have arbitrarily placed the measure move break down target of the yellow channel in a random spot below roughly where price could break down from the channel were it to be rejected strongly enough here by the 50ma. It’s retested this bottom trendline multiple times in the past and has always found away to avoid the breakdown thus far though so a breakdown there is definitely not guaranteed if it does retest the trendline, but even heading back down to retest the trendline in the first place may provide enough momentum for an alt season *not financial advice*

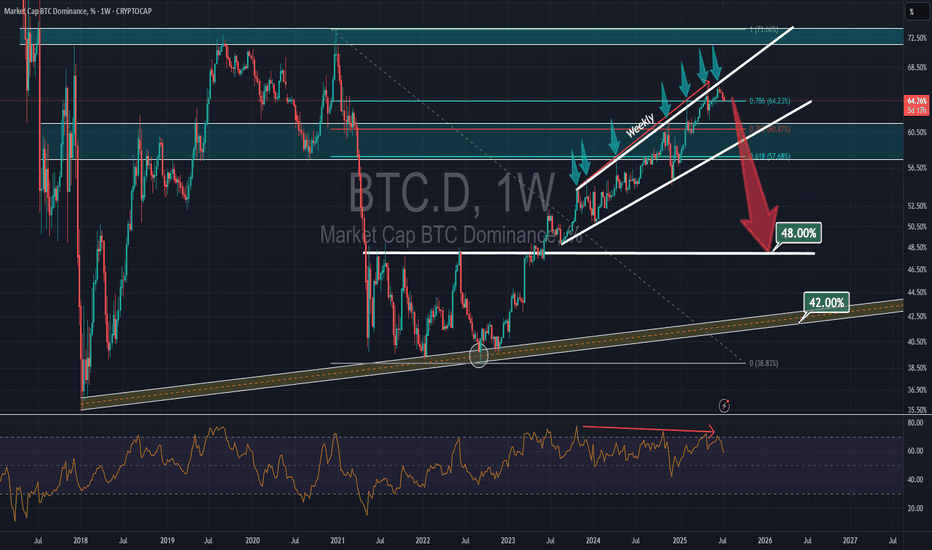

Bitcoin Dominance Rebounds – Bad News for Altcoins??📊⚠️ Bitcoin Dominance Rebounds – Bad News for Altcoins? 🧨💣

Today’s chart says it clearly: Bitcoin Dominance is bouncing off support at the edge of its ascending channel. This rebound zone around 64.58–64.64% has been critical — and the move up confirms it’s holding… for now.

❗ With Bitcoin itself facing heavy resistance, this dominance bounce is not good news for altcoins. In fact, it's a classic setup for capital rotating into BTC and out of alts — not the other way around.

📌 Chart Breakdown:

Biggest alt bull runs have started when BTC.D failed here — not when it rebounded

Breakout above 71.3% = serious risk of altcoin extinction

Breakdown below 62.3% = green light for altseason

🧠 As I’ve written on the chart: the END of alts comes not just from price — but from meme culture, utility decay, and market maker manipulation. That zone? 97% BTC.D. We’re not there, but we’re not heading toward freedom yet either.

🎥 Want to see how this fits into the full market picture? Watch the July 10th macro update:

👉 July 10th Market Outlook – Uncharted Waters, Uncertain Momentum

The market’s pressure is rising.

No good news from BTC.D today.

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

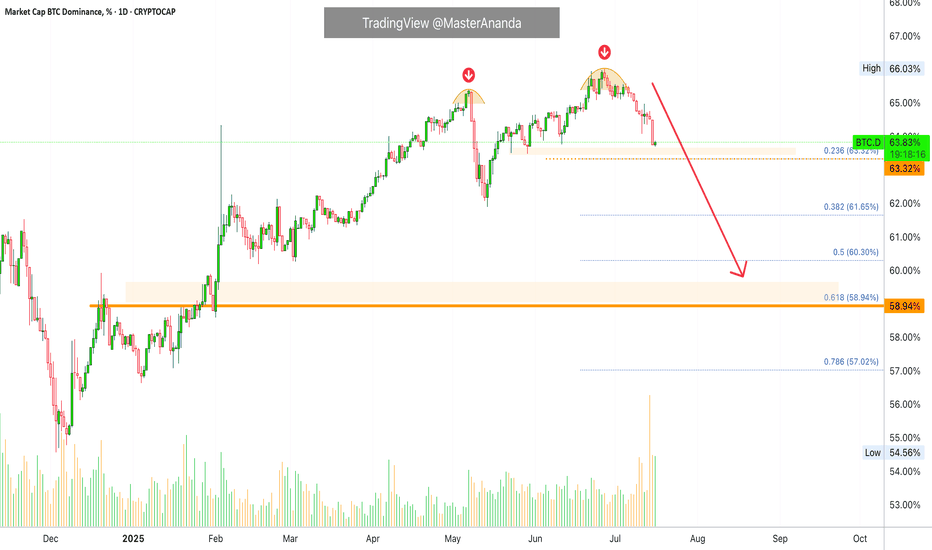

Bitcoin Dominance Daily Bullish Altcoins ConfirmedThere is an interesting signal here on the daily Bitcoin Dominance index chart. Four days red. This signal has not happen since February and it is most certainly bearish.

After 26-June the index went red four days after hitting the highest reading since January 2021. This highest reading ended up producing a rounded top and the action moved back below the 7-May top which was the previous highest reading since 2021.

Now notice the purple line on the chart. This is the 7-May peak price. Yesterday, BTC.D was trading above this level but moved below today. The candle ended as a Doji, lower high and today turning bearish signals growing bearish momentum.

You can check the weekly timeframe for additional signals including the MACD and RSI. You can find it by visiting my profile @MasterAnanda (Make sure to follow.)

In November 2024 BTC.D went extremely bearish and the entire altcoins market produced a major advance; Bitcoin also moved forward, the same can happen today. It is not certain the specific date, can be tomorrow, in a weeks time or within months... What is certain is that the bullish wave won't last as little as in April-May 2025 nor November-December 2024, both instances lasted only one month, this time around the bullish wave can last between 3-6 months.

Some pairs will grow straight up for months. Others will experience strong volatility but with a bullish bias. Marketwide bullish action. Bitcoin and the altcoins.

Thank you for reading.

Namaste.

Bitcoin Dominance Nearing a Top — Altseason Incoming in JULYBitcoin Dominance (BTC.D) is approaching overbought levels on several key oscillators across multiple timeframes. While the 1-Week chart still shows momentum that could push BTC.D slightly higher over the next few weeks, the indicators are signaling an upcoming shift.

📅 Timing the Rotation:

We're eyeing mid to late July as the likely window for a rotation into altcoins. This would mark the beginning of a potential mini altseason, where top-performing altcoins could outpace Bitcoin for a limited but lucrative period.

💼 Strategy Insight:

This could present a strong opportunity to trim or exit older alt positions from earlier in 2024—especially if they rally hard during this period of temporary dominance weakness.

🔍 Watch the oscillators and volume trends closely. The BTC.D reversal could be subtle at first but may lead to outsized moves in select alts.

Bitcoin Dominance Is at the Edge and Fundamentals Are PushingCRYPTOCAP:BTC.D Bitcoin dominance (BTC.D) is pressing right into a massive multi-year trendline that has capped it since 2018. We have seen higher lows building since 2022, tightening this squeeze even more. Now it is decision time.

The fundamentals might just tip the scales.

David Sacks says July could be a huge month for crypto. Bakkt is lining up a 1 billion dollar shelf offering that could directly buy BTC. Meanwhile US regulators are pushing hard to finalize crypto market structure rules by September. On top of that, ETFs and big institutional players keep funneling money primarily into Bitcoin, not altcoins.

All this is fueling the case for a breakout in BTC dominance. If it happens, Bitcoin will likely outperform the rest of the market for a while, pulling more of the crypto share back into its hands.

If the chart rejects, we might see altcoins catch some wind and take the spotlight for a bit. But right now with this macro pressure building, the odds seem to favor Bitcoin leading the next leg.

Keep an eye on this chart. A clean breakout above the trendline could set the stage for a very Bitcoin-heavy next few months.

I'm having illusionsBTC.D is back at 65% (White Line) — same level we saw 5 years ago (5 years is a natural market cycle). In Dec 2020, it spiked to 73% (Green Line) before dipping hard... and that drop kicked off the last real Altseason.

BTC.D dipped to 40% by May 2021 (Orange Line)

ETH pumped +470% 🚀 in that window. A few months later in Nov '21, ETH hit its ATH of $4,878 (Pink Line)

Fast forward to now:

BTC.D is climbing into a historic 70% (Yellow Line) resistance zone (pre-alt era levels). I’ve set an alert for 69%, which is just below that pre-altseason rejection zone (69 is also a natural number, if you know what I mean)… so it’s a critical level to watch.

Despite Ethereum being criticized by some as a “relic,” its market capitalization is still vastly higher than the next-largest alt, XRP, by over $166.9 billion. That’s a huge footprint in the crypto space; it's still very much a market heavyweight IMO. ETH/USD likely to decline near term. Watch for a potential rebound by end of Q3.. #NFA

Not saying history will repeat... But if it rhymes again — I might turn off the charts for a night and go dancing!

Location, Location, Location!!!Knowledge is Power!

But how deeply do most people really understand this?

The average mind thinks power comes from possessing knowledge. But here’s a deeper truth — simply imagining yourself with mastery can trigger powerful feelings. Why? Because as Terence McKenna once described, the human brain is a chemical factory. An inspired thought — a glimpse of future achievement — can activate a cocktail of serotonin and dopamine, giving us a real sensation of power. And yet… did anything really change?

This is where ancient voices — shamans, philosophers, and modern mentors — whisper:

“You are already there…”

But are you really?

The answer is Yes… and No.

You feel the outcome, but you haven’t earned it yet. You’re not truly there until you’ve gone through the effort — the hours and hours of disciplined study, reflection, and ignoring the mental traps like “take a break,” “you have time,” or “scroll a bit.” Power, in this case, is the Knowledge itself — and to approach Power, you must become Power. Or else, it will crush you — like a boot crushes an ant. (Yes, that’s borrowed from the Avengers… we all need a laugh too.)

To actually reach that imagined reality, you must prove yourself to the knowledge itself. You have to earn it — through discipline, sacrifice, and unbroken focus. That means hours of study, observation, application, and repetition — no matter how many distractions your mind throws at you.

Focus on one subject until it bends for you.

Focus like your life depends on it.

Because in a way… it does.

🧠 Opportunity Cost = Power Equation

This focused, intentional work is what economists call Opportunity Cost. It’s the measure of how productively you spend your time. Every marked level, every reaction, every shift in volume is either:

• A step closer to mastery, or

• A missed opportunity, depending on what you choose to focus on.

TradingView becomes your journal.

A sacred workspace in the chaos.

A tool to track your evolution — mentally and technically.

🔍 The SHIBA/USDT 4H Breakdown

On the 4H chart of Shiba Inu, key swing levels are marked — targets that can serve as entry/exit decisions depending on your strategy.

But the magic is not in the lines.

It’s in how volume reacts to those levels.

🔺 Volume — The King

Currently, the 4H Volume shows signs of a bearish continuation. But lower timeframes are beginning to show the initial signs of accumulation — strength where weakness used to live.

This is the beginning of Effort vs Result analysis:

• Are we seeing strong volume but no progress? (Demand absorption?)

• Are we seeing low-effort pushes into supply that fail to break key levels?

That’s how Smart Money behaves. Quietly, strategically, and always one step ahead.

And all this happens near key demand/supply zones — where Location meets Volume.

🔄 Timeframe Psychology: Past–Present–Future

Lower timeframes = The Past (they push).

Higher timeframes = The Future (they pull).

Your active timeframe = The Now — where you make your move.

A shift on the 3M chart might hint, but until it aligns with the 1H or 4H, nothing is confirmed. That’s why true traders are observers first, executors second.

🎯 Alignment: Levels, Volume, Effort

• 📍 Levels: They are not just technical — they are psychological battlegrounds.

• 🔊 Volume: It shows us where energy is being spent and whether it’s paying off.

• 🧱 Effort vs Result: The ultimate measure of Smart Money’s hidden hand.

When everything aligns, you don’t guess — you act.

🧭 Final Thoughts

At the time of this writing — 17:26 IST on June 18, 2025 — the 4H chart remains bearish in tone. But markets shift fast, and for all I know, a power transition could be unfolding on a micro timeframe as I type. That’s the nature of this game.

TA is not rigid. It is an art.

And once mastered, it becomes a part of how you think — not just how you trade.

Use your time wisely.

Let your focus become your fortress, and that fortress will guard you through every storm.

Work Smart. Think Deep. Act with Purpose.

Study the Bitcoin and Bitcoin Dominance cycle to understand altcoin flow.

Explore previous posts — I’ve shared them to help you grow.

The market is a breathing organism, I’ve pointed this in previous ideas. If you’re in sync with it—you’ll feel it.

And for those who believe there’s more to learn—but are struggling to find answers—there’s no shame in asking questions. But remember, nothing in the market is free.

Work Smart, and you’ll earn the right to follow — and even think like — Smart Money.

Till next time, take care—and trade wisely.

Bitcoin Dominance Will Drop To 60% SoonGood Morning Trading Family,

I really don't have much to say on this post. My last post on Ethereum showed us an inverse head and shoulders pattern, which plays out over 85% of the time. This is a clear sign that altcoins may rally within the next week or two. And here, on our Bitcoin dominance chart, you can see that the patterns are clear, BTC dom cannot last at this level much longer before a breakdown to 61% or lower occurs. Be prepared. FOMO will get real.

Best,

Stew