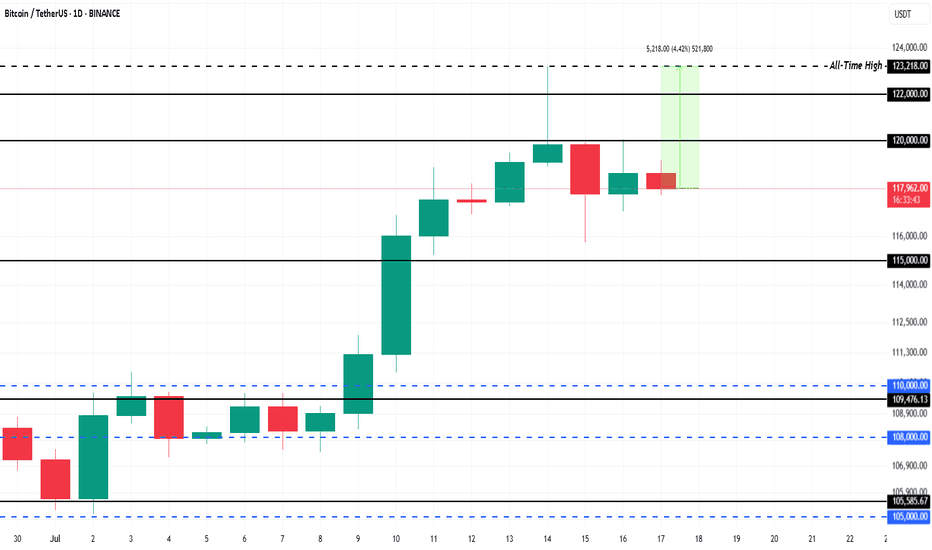

$1.5 Billion ETF Inflows Could Push Bitcoin Price 4% to New ATHBINANCE:BTCUSDT is currently trading at $118,325, facing resistance at the $120,000 level. This resistance is crucial for Bitcoin if it wants to break back to its ATH of $123,218 . The 4.4% gap to reach the ATH indicates potential for growth, but Bitcoin needs to secure support above $120,000 for this to happen.

This week, spot BINANCE:BTCUSDT exchange-traded funds (ETFs) saw over $1.5 billion in inflows , a significant portion of which occurred in the last 48 hours during Bitcoin’s dip.

The influx of institutional money highlights that investors are confident in Bitcoin’s potential despite the market cooling. If this trend persists, it could propel BINANCE:BTCUSDT price upward, as institutional support provides stability.

If BINANCE:BTCUSDT can hold above $120,000 and push past $122,000, it could continue its ascent toward new all-time highs. The current market conditions and ETF inflows support a bullish outlook, with a significant chance of breaking the resistance.

However, the risk of profit-taking remains , which could lead to a price drop. If BINANCE:BTCUSDT faces selling pressure, it could fall back to $115,000 , erasing a portion of recent gains. This would invalidate the bullish thesis, causing Bitcoin to retest lower support levels.

Bitcoinetf

IBIT – Bull Flag + Trend-Based Fib Targets Lined Up🔍 Price Action Setup

IBIT is forming a tight bull flag just beneath key resistance at $64 after a strong impulsive move off the $42.75 base. Structure remains bullish with price holding above the 20 EMA, and volume compression setting the stage for a breakout.

📈 Trend-Based Fibonacci Extensions

If this flag breaks, here's how the upside unfolds based on the trend-based Fib extension:

1.27 – $82.50

1.382 – $85.75 (Measured Move Target)

1.50 – $89.50

1.618 – $93.00 (Full Extension)

These levels align with the prior flagpole projection and market structure above. If bulls step in on volume, $85.75 becomes the logical first destination.

🌊 ETF Inflows Confirm the Narrative

IBIT has pulled in roughly $3.3B in recent inflows, leading the pack during a 12-day net inflow streak across spot Bitcoin ETFs. Institutions are clearly still positioning, and that's reflected in the tape. Tuesday alone brought $436M+ into spot Bitcoin ETFs.

₿ BTC Leading the Way

Bitcoin is holding strong above prior resistance and pushing higher. IBIT looks like it’s just waiting on a breakout confirmation to follow.

📌 Key Trade Levels

Breakout Trigger: Close above $64

Target Zone: $85.75 first, then extended to $93.00

Invalidation: Break below $56 structure

—

🧠 This is not financial advice — just a look at structure and flow through the DC Trading lens.

📲 Follow the journey on IG: @dc_trading_journey

Market Overview (May 7, 2025)📊 Key Metrics

1. Funding Rate: ~0.018% (on Binance)

— positive rate indicates long position dominance and bullish sentiment

2. Open Interest (OI): GETTEX:29B , up ~ SEED_TVCODER77_ETHBTCDATA:7B in recent days

— rising OI suggests new positions are opening, increasing volatility risk

3. ETF Inflows: +$420.9M (May 6)

— strong institutional demand, especially into BlackRock’s IBIT

4. Fear & Greed Index: 67 (Greed)

— rising greed may signal potential for a short-term correction

⸻

📈 Market Movement Probability

• Upward: 60%

(supported by ETF inflows and positive funding)

• Downward: 40%

(high greed and rising OI could trigger a correction)

⸻

Disclaimer: This is not financial advice. Always do your own research.

Market Overview (May 5, 2025)

📊 Key Metrics

1. Funding Rate: -0.0024% (on Binance)

— traders are paying to hold short positions, signaling bearish pressure

2. Open Interest (OI): $27.5B, down –3.13% in 24h

— positions are closing, possibly due to liquidations or profit-taking

3. ETF Inflows: +$674.9M (on May 2)

— strong institutional demand, especially into BlackRock’s IBIT

4. Fear & Greed Index: 52 (Neutral)

— sentiment has stabilized after a period of greed

⸻

📈 Market Movement Probability

• Upward: 55%

(potential short squeeze fueled by ETF inflows)

• Downward: 45%

(OI is dropping, market losing momentum)

⸻

Disclaimer: This information is not financial advice and should not be used as the sole basis for investment decisions.

BTC | NEWS | Abu Dhabi Invests $436.9M in ETFAbu Dhabi's sovereign wealth fund, Mubadala Investment Company, has made a significant investment in Bitcoin by purchasing $436.9 million in shares of the iShares Bitcoin Trust (IBIT).

This MUST be a clear indicator that they are bullish on BTC, at least for the longer term.

Investment firms most commonly invest with the eye on the longer term, and are usually unphased by short term swings like daily or even weekly corrections. This is, if anything, extremely bullish for BTC in the longer term (1 year and possibly beyond).

In similar news; the potential of the SEC approving XRP ETF is causing optimism for XRP.

XRP has recently made great progress in terms of fundamentals, more on that HERE:

________________________

BINANCE:BTCUSDT

BITCOIN UPDATES FOR ENTRIESWere still on a Bullrun, but we might see an clear of LONGS here!. if the premiums clear. wait for pullback.

This idea would manipulates the LONGS. or the price could go back to 78k? before we go higher.

This is only my view for now. I'm still bullish on MARKETSCOM:BITCOIN , this is not a financial advice, do your own research base on the sentiments right now.

The long-term still on 128k? probably yes, but at what timeframe.

follow for more. I will be posting daily updates on other pairs.

Come and check this out.

Daily reminder you need to rest on weekends. the market is just making liquidity.

Lock in boys.

keep stackingsss satttssss.. I believe on this coin. As we can see the US markets especially the ETFS, could drive the price high before our eyes.

Spot Bitcoin ETFs in the US Acquired Nearly 4x the Amount Mined Market Update - January 10, 2025

Takeaways

Spot bitcoin ETFs in the US acquired 51,500 bitcoin in December, nearly quadruple the 13,850 BTC mined: Spot bitcoin ETF-driven demand could create a supply shock that would drive prices higher in the coming months. But the price of bitcoin pulled back below $93,000 this week after reports the US government might sell $6.5 billion worth of bitcoin seized from Silk Road.

Backpack Exchange has reportedly acquired FTX EU after regulatory approval: The exchange, founded by ex-FTX and Alameda staff, would be the managing entity for FTX EU bankruptcy claims. But the FTX bankruptcy estate released a statement claiming Backpack has no control over redistributing the funds, adding that the press release announcing the sale went out without approval.

Terraform Labs founder Do Kwon has pleaded not guilty to fraud charges in US court following extradition: Prosecutors allege he misled investors about terraUSD's stability. Kwon's case is expected to go trial in January 2026.

Metaplanet is aiming to quintuple its bitcoin holdings to 10,000 BTC by leveraging capital markets: The Tokyo-listed firm already holds 1,761.98 bitcoin, currently worth close to $180 million. The move continues a recent trend of corporate and investment entities stockpiling bitcoin as a reserve asset.

Spot Bitcoin ETFs Accumulate nearly four times December’s Mined BTC Amid Supply Squeeze

Spot bitcoin ETFs in the US acquired 51,500 bitcoin in December 2024, dwarfing the 13,850 produced by miners during the same period. This ETF-driven demand reportedly represented 272% of the monthly supply. Bitcoin's price peaked at an all-time high of $108,135 on December 17, driven by surging spot market activity.

A January 6 report also highlighted bitcoin exchange balances hitting record lows, with researchers predicting a potentially imminent supply shock. On Friday last week, spot bitcoin ETFs added over $900 million in inflows. But the price of bitcoin has subsequently pulled back this week, dropping below $93,000 on Thursday as the market weighed the veracity of a report that the US government was poised to sell some $6.5 billion in bitcoin originally seized from Silk Road.

In mining, MARA Holdings led December’s production with 9,457 bitcoin. Riot produced 516 bitcoin and Cleanspark came in third with 668 bitcoin mined. Other contributors included Bitfarms (211 BTC) and Terawulf (158 BTC). With total US bitcoin ETF holdings now nearing $110 billion, some analysts have projected bitcoin to see more significant gains throughout the year.

Dogecoin (DOGE): The Birth of the Original Memecoin

Dogecoin (DOGE) started out as a parody of cryptocurrencies and, in particular, the proliferation of altcoins. Its founders have publicly stated that DOGE was a joke, and the currency hasn’t received a significant technical update since 2015. Despite these facts, market forces have kept the cryptocurrency alive. According to the founders, it was never about the value of DOGE, but rather about giving people an accessible introduction to the world of cryptocurrency through a face many already knew from an internet meme — Doge. The founders sought to overcome Bitcoin’s and other cryptocurrencies’ barriers to entry — for example, news of hacks and scams, as well as technological complexities. To that end, they created a fun and friendly cryptocurrency to welcome newcomers to the crypto space.

Read more!

Onward and Upward,

Team Gemini

IBITUSDT Analysis: Red Box Breakout PotentialIn IBITUSDT, the red box signifies a critical resistance zone. If price breaks and retests this level, it may present a long entry opportunity . That said, my overall expectation is for the correction to deepen further before significant upward movement.

Key Points:

Red Box Resistance: Monitor for a breakout and retest to confirm a potential long setup.

Deeper Correction Likely: Current market conditions suggest the correction could continue before recovery.

Confirmation Indicators: I will utilize CDV, liquidity heatmaps, volume profiles, volume footprints, and upward market structure breaks in lower time frames to validate entries.

Learn With Me: If you want to understand how to leverage CDV, liquidity heatmaps, volume profiles, and volume footprints for accurate market analysis, feel free to DM me.

Reminder: Always manage your risk and look for confirmation before taking any trades.

If this analysis helps you, please don’t forget to boost and comment. Your support inspires me to share more valuable insights!

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you!

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

Orange Breaks, We Fly. Blue Falls, We Dive. The chart highlights two critical regions, each playing a pivotal role in determining the next trend direction for IBIT Bitcoin shares:

Orange Box - Key Resistance Zone

The orange box represents a crucial resistance area. For the rally to sustain momentum and push higher, this region must be decisively broken and secured. A close above this level, coupled with strong volume, would indicate the bulls are in control, signaling a potential continuation of the upward trend.

Blue Box - Key Support Zone

The blue box acts as a significant support level. Should the price fall below this zone, it would suggest weakness in the market. A confirmed breakdown, followed by a retest of the orange box from below, provides an opportunity to take a short position, as this would signal the onset of a downtrend.

Conclusion:

These zones are pivotal for the current market structure. Traders should closely monitor price action around these levels to identify whether the market leans towards bullish continuation or bearish reversal.

Bitcoin Targets $100K with Potential to Reach $120KIt appears that Bitcoin has broken above a strong resistance level, which is now acting as support. Based on the chart, the price has surged significantly without any retest of this new support level. This could indicate strong bullish momentum, as the price hasn't returned to test the previous resistance.

With this upward momentum, Bitcoin may be on a path towards the next major milestone of $100,000. If this psychological level is surpassed, we could see an extended target of $120,000, marking a significant phase of price discovery in this bullish trend. However, traders should remain cautious of potential corrections or consolidation phases along the way

Understanding Bitcoin ETFs: What They Are and Why They Matter?1. What is a Bitcoin ETF?

A Bitcoin Exchange-Traded Fund (ETF) is a financial instrument that tracks the value of Bitcoin and allows investors to gain exposure to the cryptocurrency without directly owning it. Bitcoin ETFs operate similarly to traditional ETFs, which track the value of assets like stocks, commodities, or indices. Managed by financial institutions, Bitcoin ETFs are available on traditional stock exchanges, making it easier for investors to participate in Bitcoin’s price movements through regular brokerage accounts.

There are two main types of Bitcoin ETFs:

Spot Bitcoin ETFs: Track the current market price of Bitcoin, directly reflecting its value.

Futures-based Bitcoin ETFs: Track the value of Bitcoin futures contracts, which are agreements to buy or sell Bitcoin at a predetermined price at a specified time in the future.

In the U.S., Bitcoin futures ETFs have been approved and launched on major exchanges like the New York Stock Exchange (NYSE), while spot Bitcoin ETFs are still under regulatory review by the Securities and Exchange Commission (SEC).

2. How Does a Bitcoin ETF Differ from Buying Bitcoin Directly?

While both Bitcoin ETFs and direct Bitcoin purchases provide exposure to Bitcoin’s value, they differ in several key ways:

Ownership and Custody

Bitcoin ETFs: Investors own shares in the ETF, but not the actual Bitcoin itself. The ETF provider holds the underlying Bitcoin or Bitcoin futures contracts, taking on the responsibility of secure custody.

Direct Bitcoin Purchase: Investors who buy Bitcoin directly through cryptocurrency exchanges or wallets own the Bitcoin and have full control over it, including the responsibility for secure storage.

Access and Regulatory Oversight

Bitcoin ETFs: Are traded on traditional stock exchanges and are regulated by financial authorities. This oversight ensures investor protections that are not typically present in cryptocurrency markets.

Direct Bitcoin Purchase: Involves buying from cryptocurrency exchanges, many of which are less regulated and may lack certain protections offered by traditional financial products.

Trading Hours

Bitcoin ETFs: Trade during standard market hours, typically from 9:30 AM to 4:00 PM EST. Investors can buy or sell shares only within these hours.

Direct Bitcoin Purchase: Bitcoin can be traded 24/7, giving investors the flexibility to enter or exit positions at any time.

Taxation and Fees

Bitcoin ETFs: Investors are subject to capital gains taxes and may also incur management fees for ETF administration.

Direct Bitcoin Purchase: Direct Bitcoin investors are also subject to capital gains taxes. However, they may face lower or no management fees, depending on how they store their Bitcoin.

Use of Leverage and Derivatives

Bitcoin Futures ETFs: These funds allow investors to speculate on Bitcoin’s future price movements without holding actual Bitcoin. However, futures-based ETFs can be more complex, as they rely on futures contracts rather than spot prices, which can introduce tracking errors.

Direct Bitcoin Purchase: Investors buy Bitcoin directly, holding actual units of the asset without derivatives or leverage, providing a more straightforward exposure to its current market price.

3. Why is a Bitcoin ETF Important for the Cryptocurrency Market?

The approval of a Bitcoin ETF is a significant milestone for the cryptocurrency market for several reasons:

1. Broader Accessibility

Traditional Investors: A Bitcoin ETF opens the door to traditional investors, especially those who may not be comfortable using cryptocurrency exchanges. Investors can access Bitcoin exposure through familiar brokerage accounts without needing to learn about wallets or private keys.

Institutional Interest: A Bitcoin ETF creates an easier path for institutional investors to participate in the Bitcoin market, bringing in large amounts of capital. As institutions enter the market, Bitcoin's market liquidity and price stability may improve.

2. Increased Legitimacy

The introduction of a Bitcoin ETF legitimizes Bitcoin as an asset class in the eyes of regulators, investors, and financial institutions. It signals recognition from regulatory bodies and increases trust in Bitcoin among mainstream investors.

3. Boost to Market Liquidity

Bitcoin ETFs can increase liquidity in the market, as they provide a regulated and accessible means for both retail and institutional investors to gain Bitcoin exposure. Greater liquidity can reduce volatility, making the market more stable over time.

4. Potential for Price Appreciation

With increased demand and accessibility, a Bitcoin ETF could lead to upward price pressure on Bitcoin. This is especially relevant for spot ETFs, which would require the fund to hold actual Bitcoin, thus increasing demand for the underlying asset.

5. Step Toward Broader Cryptocurrency ETF Adoption

Approval of a Bitcoin ETF could pave the way for ETFs focused on other cryptocurrencies like Ethereum or Solana, expanding the options for crypto exposure within traditional markets. This could accelerate the overall growth of the cryptocurrency sector.

4. Pros and Cons of Bitcoin ETFs

While Bitcoin ETFs offer numerous benefits, they also come with certain drawbacks.

Advantages of Bitcoin ETFs

Ease of Access: ETFs are easily accessible through traditional brokerage accounts, removing the need for new accounts on cryptocurrency exchanges.

Regulatory Protections: ETFs are regulated by financial authorities, providing investors with protections that may be absent on cryptocurrency exchanges.

Enhanced Liquidity: Increased market liquidity through ETF participation can reduce volatility and provide a more stable trading environment for Bitcoin.

Professional Custody: ETF providers manage Bitcoin custody and security, making it easier for investors who do not want to worry about wallet security or private key management.

Diversification Opportunities: Bitcoin ETFs can be included in retirement accounts or blended into traditional investment portfolios, broadening their appeal as a tool for diversification.

Disadvantages of Bitcoin ETFs

Limited Trading Hours: ETFs can only be traded during standard market hours, unlike Bitcoin, which is available 24/7 on cryptocurrency exchanges.

Management Fees: Most Bitcoin ETFs come with annual management fees, which can reduce overall returns for investors.

Potential for Tracking Errors: In futures-based ETFs, tracking errors may occur, meaning the ETF's performance may not accurately match Bitcoin’s actual price movements.

No Direct Ownership of Bitcoin: ETF investors do not own Bitcoin itself, which means they miss out on the ability to use or transfer the asset directly.

Market Dependency on Regulators: The introduction and ongoing success of Bitcoin ETFs depend on regulators’ willingness to approve and support crypto-based financial products, which may limit the ETF market’s expansion.

5. Outlook and Future of Bitcoin ETFs

The potential approval of a spot Bitcoin ETF in the U.S. could be a game-changer. With increased institutional and retail access, the Bitcoin ETF market could drive greater adoption and legitimacy for cryptocurrencies overall. However, regulatory challenges remain, as the SEC has thus far resisted approving spot Bitcoin ETFs due to concerns about market manipulation and lack of robust investor protections.

As regulatory clarity improves, we may see a broader array of crypto-based ETFs emerge, possibly including multi-asset ETFs that combine Bitcoin with other cryptocurrencies or assets, such as stocks or commodities. Furthermore, as institutional adoption grows, the role of ETFs in the financial ecosystem could increase, potentially influencing Bitcoin’s price dynamics and volatility as well.

Conclusion

Bitcoin ETFs represent a bridge between the traditional financial world and the emerging cryptocurrency market. While they offer unique advantages, such as regulatory protections and ease of access, they also come with limitations like management fees, limited trading hours, and the lack of direct ownership. For those who want exposure to Bitcoin within the security of a regulated investment product, Bitcoin ETFs provide a promising option.

The success and potential of Bitcoin ETFs lie in their ability to draw both individual and institutional investors into the cryptocurrency market, making it a potentially transformative development for the financial world. As more countries consider ETF approval, and as the cryptocurrency industry matures, Bitcoin ETFs could play a pivotal role in the mainstream adoption and integration of digital assets.

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

US Spot Bitcoin ETFs Reverse Inflow StreakMarket Update - October 25, 2024

US spot bitcoin ETFs saw $79 million in net outflows Tuesday, reversing a seven-day inflow streak that had brought in over $2.6 billion: The outflows came mainly from Ark and 21Shares' ARKB fund.

Bitcoin prices inched closer to $70,000 at the start of the week when futures open interest surged to over $40 billion: But prices subsequently pulled back mid-week as investors pared their gains.

Tether’s USDT has hit a record $120 billion market cap, which could set the stage for a bullish October finish in the crypto market: Historical trends suggest that a rise in stablecoin supply can precede rallies in bitcoin and ethereum.

Bitcoin's hashrate has reached a new peak of 703 EH/s, a 6% gain over the past week: This surge coincides with higher mining profitability as transaction fees rise and Bitcoin's price strengthens.

Binance exec leaves prison: Binance’s Tigran Gambaryan was released from Nigerian prison Wednesday so he can receive medical treatment for the numerous ailments he suffered while in captivity.

US Spot Bitcoin ETFs Record $79 Million in Outflows, Ending Seven-Day Inflow Streak

After a week-long run of positive net inflows, US spot bitcoin ETFs reported a shift back to the negative on Tuesday, with net outflows totaling $79.09 million. It was ARKB fund from Ark and 21Shares was responsible for the entirety of these outflows, losing nearly $135 million. Despite the overall outflows, some funds still recorded gains. BlackRock’s IBIT, the largest spot bitcoin ETF by net assets, attracted just under $43 million, while Fidelity’s FBTC saw $8.85 million in inflows.

The recent outflows bring the cumulative net inflows for the 12 spot bitcoin ETFs down to $21.15 billion as of Tuesday. Trading activity also slowed, with the total daily volume for these ETFs declining to $1.4 billion from $1.76 billion the day before. This reversal comes after the ETFs saw more than $2.67 billion in net inflows over the past seven trading days, a figure similar to their peak inflow levels recorded in March this year.

Spot ether ETFs saw more positive activity, with net inflows of $11.94 million on Tuesday – all from BlackRock’s ETHA. Other ether ETFs recorded no change. Trading volume for ether ETFs also noticeably dropped to roughly $118 million on Tuesday, down from around $163 million the previous day.

🕸️ Topic of the Week: Web 3.0: The Next Evolution of the Internet

🫱 Read more here

Phemex Analysis #28: Institutional Inflows Fuel BTC Rally!The recent surge in Bitcoin price, reaching a recent high of $68,400, has been largely fueled by significant inflows into Bitcoin ETFs. In just three days, these ETFs have accumulated over $1 billion, led by industry giants BlackRock and Fidelity. The accumulation of institutional capital often serves as a strong bullish indicator, suggesting a growing confidence in Bitcoin as a viable asset class.

Possible Scenarios in the Next Few Days

Given the substantial inflow into Bitcoin ETFs and the subsequent price increase, several potential scenarios may unfold in the coming days:

1. Continued Upward Momentum: If institutional investors maintain their bullish sentiment and continue to allocate more capital to Bitcoin ETFs, the price could experience further upward pressure. This scenario would likely be supported by positive market sentiment and favorable macroeconomic conditions.

2. Consolidation and Pullback: After a significant price surge, it's not uncommon for markets to experience a period of consolidation or even a minor pullback. This could be driven by profit-taking activities or concerns about potential overvaluation. However, as long as the overall trend remains bullish, a pullback could present a buying opportunity for investors.

3. Increased Volatility: The influx of institutional capital can sometimes lead to increased market volatility. As more participants enter the market, the potential for rapid price movements increases. Traders should be prepared to manage their risk accordingly.

Potential Trading Strategy

Based on the current market dynamics, here are some potential trading strategies:

I. Buy and Hold: For long-term investors who believe in the long-term potential of Bitcoin, a buy-and-hold strategy may be suitable. This involves purchasing Bitcoin and holding it for an extended period, regardless of short-term price fluctuations.

II. Scalping: Short-term traders who aim to profit from small price movements can employ a scalping strategy. This involves entering and exiting trades quickly to capture short-term gains. However, scalping requires a high level of technical analysis and risk management skills.

III. Swing Trading: Swing traders focus on capturing medium-term price swings. They identify potential support and resistance levels to enter and exit trades. Swing trading requires a combination of technical and fundamental analysis.

Conclusion

The recent surge in Bitcoin price, driven by significant inflows into ETFs, is a positive sign for the cryptocurrency market. However, it's important to approach the market with caution and be aware of the potential risks involved. By carefully considering the possible scenarios, developing a sound trading strategy, and managing risk effectively, investors can capitalize on the opportunities presented by the current market conditions.

Tips:

Trade Smarter, Not Harder with Phemex. Benefit from cutting-edge features like multiple watchlists, basket orders, and real-time strategy adjustments. Our unique scaled order system and iceberg order functionality give you a competitive edge.

Disclaimer: This is NOT financial or investment advice. Please conduct your own research (DYOR). Phemex is not responsible, directly or indirectly, for any damage or loss incurred or claimed to be caused by or in association with the use of or reliance on any content, goods, or services mentioned in this article.

Exploring Valkyrie Bitcoin Strategy ETF @BTFExploring the Valkyrie Bitcoin and Ethereum Strategy ETF. Bitcoin ( NASDAQ:BTF ).. strong monthly imbalance in control playing our with BTC cryptocurrency currently attempting to break its all-time high again, with a monthly demand level also in control. Long term investment opportunity. Both Bitcoin and Ethereum are trending upwards and have a significant monthly demand level in control, contributing to the rise of these cryptocurrencies and the

BlackRock: Poised for a Bullish Breakout?

**Current Price Range**: $846 to $822 (Weekly Frame)

**Potential for Bullish Reversal**:

BlackRock, trending between $846 and $822, shows signs of a potential bullish reversal. A strong resistance at $895.20 is key. Breaking and closing above this level on the weekly timeframe could indicate a reversal and the continuation of a bullish trend.

**Double Top Formation and Historical Context**:

The double top pattern from November 15, 2021 , initially suggested bearish momentum due to overvaluation and economic concerns. However, BlackRock's strategic growth initiatives, including climate transition ETFs, acquisitions, and private market expansions, offer strong bullish prospects.

**Probability Indicator**:

Our probability indicator, currently above the middle threshold, hints at a shift towards bullish momentum.

**Key Levels to Watch**:

- **Resistance Level** : $895.20

- A break above this level may signal a bullish continuation.

- **Support Level** : $726.37

- A hold above this zone could further support the bullish outlook.

**Market Factors**:

**Strategic Growth** : BlackRock's innovative initiatives and acquisitions position it well for future growth.

**Resilience Amid Challenges**: Despite facing outflows and ESG-related backlash, BlackRock remains robust.

**Leadership and Vision**: CEO Larry Fink's strategic direction emphasizes long-term growth and adaptation to market changes.

**Expected All-Time High**:

BlackRock is expected to reach its all-time high by end-March 2025, supported by its strategic initiatives and resilience in the market.

**Conclusion**:

BlackRock is on the verge of a potential bullish breakout. Monitoring the $ 895.20 resistance level is crucial for confirmation. The company's strategic initiatives and resilience indicate a strong potential for a bullish trend continuation, possibly mirroring the market recovery patterns seen after the 2008 financial crisis.

COINBASE #COIN priced in #Bitcoin 3X outperfromanceShould u just buy Coinbase stock rather than the go through the hassle of Buying , storing, off-ramping profits back to your bank.

It is far easier for big money who want some crypto exposure to just buy crypto stocks.

All in their familiar regulated platform, hence why the Spot ETF is so important...

But who are the custodians Blackrock is entrusting to hold their #BTC..... Coinbase

This will be a big money maker for Coinbase and hence why it could actually overperform and get back to all time high's in the next two years.

A Bitcoin Compression patternBitcoin appears to be compressing near all-time highs in what looks like an ascending triangle. Previously, Bitcoin would pierce the ascending triangle to the downside and the result would be the liquidation of all of the leverage in the system, then the price of Bitcoin would proceed to chop around more before eventually moving higher. Essentially, the ascending triangle pattern would be extended by double the amount of time, give or take. I have found this example in many uptrends in crypto and specifically in Bitcoin.

While this scenario could certainly play out again, I lean more toward a sooner breakout before this type of scenario happens. Why? Quite simply - ETFs and big money have entered the market. A lot of these players are accumulating bitcoin for the long term in spot. The brokers will have a new fear to face besides waiting to liquidate people, what if they can't? It will force them to cover and the price could start driving higher sooner. This fact alone could lead Bitcoin to not follow its "usual" path of a breakdown first and an extension of its compression pattern and instead break to the upside and continue its journey further north.

For now, we wait and see what happens.

Cheers,

TCD

SEC Approves first Spot ETH ETFs

SEC approves spot ETH ETFs: After months of speculation, the SEC formally approved the first spot ether ETFs on Thursday. The development sets the stage for institutional investors to pour billions into the space.

Grayscale CEO departs: Grayscale CEO Michael Sonnenshein announced Monday he was leaving his role after three years running the crypto investment giant. A Goldman Sachs veteran is expected to take his place in August.

White House opposes crypto legislation: The White House announced Wednesday its opposition to FIT21, a bill that would give the Commodities and Futures Trading Commission (CFTC) power to regulate the crypto market. But the White House doesn't plan to veto.

Gala Games experiences a major issue: It led to the minting of 5 billion tokens worth $206M and caused a nearly 15% drop in the GALA token price.

Major banks reveal significant Bitcoin Trust Holdings in Q1: Morgan Stanley, JPMorgan, Wells Fargo, and UBS have shown a growing interest in digital assets within wealth management.

Venezuelan government will disconnect crypto mining farms from the national grid: They made the move to stabilize the electrical supply after enduring routine blackouts for the past five years.

🧑💻 Topic of the Week: What is a Crypto Exchange

👉 Read more here

Asset Managers are looking at IBIT - Bitcoin thoughts - May 2024Sentiment seems to be that the cycle top is in. I disagree. The bitcoin ETFs are now opening up Bitcoin exposure to hedge funds and asset managers managing trillions of dollars, You have to ask yourself at this point, what is the likely hood that bitcoin has topped before the halving and now ETFs have opened the flood gates. I think very unlikely the bull market ends here.

NASDAQ:IBIT

Market Update - 7/5/24Crypto markets have so far shown resilience after what has been an eventful week to-date. On the 1st of May we witnessed Bitcoin trade below both the March and April lows, where we then saw four consecutive days of buying resulting in a 14% rally back to $64,500 USD.

👉The next few days will be key in understanding if the bulls will continue to show up, we provide some bullish and bearish scenarios to start the week below.

There is little on the economic calendar this week, however we did see a very interesting print at the end of last week for the US labour market.

Fear and Greed Index currently stands at 71.

US Unemployment Rate Ticks Higher

Last week, the US unemployment rate slightly missed expectations, coming in at 3.9% instead of the anticipated 3.8%.

It's important to understand why this matters. An increase in unemployment could hint at a broader economic slowdown. Jerome Powell, the chairman of the Federal Reserve has previously mentioned that a weakening labour market might precipitate a change to interest rates and an overall easing of conditions from the current regime.

Bullish Scenario

Early this week, should the bulls hold their ground at the current ranges, we could see a push to the range midpoint of $66,000 USD.

Bearish Scenario

Failure to see the bulls hold the market here could then see prices retesting the bottom of this channel, which was reclaimed at the start of this month. This may result in Bitcoin moving back towards $61,000 USD.

Spot Bitcoin ETFs Surge – A Bullish Signal for Market Adoption?Welcome to a pivotal moment in the Bitcoin market! As we witness the launch of several spot Bitcoin ETFs, including giants like Fidelity's FBTC, Bitwise's BITB, and Franklin Templeton's EZBC, the landscape of cryptocurrency investing is evolving before our eyes.

First-day volumes paint a promising picture, with funds that 'Buy Bitcoin' directly, such as FBTC (Fidelity), BITB (Bitwise), and EZBC (Franklin Templeton), accounting for a significant 14.06% of the total volume. This direct investment approach is injecting fresh capital into the spot Bitcoin market, hinting at a bullish outlook for Bitcoin adoption and price movement.

Let's not overlook the powerhouses that follow Bitcoin's price through derivatives, such as the ProShares Bitcoin Strategy ETF (BITO) and Grayscale's GBTC, which command an impressive 85.94% of the total volume. While they may not directly purchase Bitcoin, their market presence can't be ignored, as they reflect growing investor interest and add to the overall Bitcoin market depth.

With the potential move to a T+1 settlement cycle, the market could see increased efficiency and a more immediate impact from ETF inflows. This could be particularly beneficial for ETFs purchasing Bitcoin, as it allows for quicker capital deployment, enhancing the responsiveness of the market to new investments.

But let's temper our optimism with a dose of reality. It's crucial to remember that not all ETFs are created equal – some provide direct exposure to Bitcoin's price movements, while others offer a more nuanced approach through futures and other financial instruments. The true impact of these funds will unfold with time, as we closely monitor their influence on market demand and price dynamics.

In essence, the influx of new Bitcoin ETFs could be a harbinger of increased adoption and integration of Bitcoin into the mainstream financial world. This is a bullish sign for those of us optimistic about the future of digital assets.

Stay tuned for more updates as we navigate this exciting phase of market growth. And remember, despite the complexities, the introduction of these ETFs is a step toward broader acceptance and a testament to Bitcoin's enduring allure.

So..still very Bullish news... still very Good news!

One Love,

The FXPROFESSOR 💙