BTC Volatility Play: Compression, Fib Confluence & 48% IV OptionBTCUSD | Volatility Compression Meets Macro Catalyst: Options & Technical Thesis

Chart: BTC/USD 1M (BITSTAMP)

Bitcoin is currently consolidating below all-time highs after touching the $95K level. The monthly candle structure shows the first significant pause in momentum, with price now holding around the $82,000–$84,000 range. This area represents a confluence of prior resistance-turned-support, Fib retracement zones, and the VWAP session level (~$84,910).

Technically, the long-term ascending broadening wedge remains intact. MACD is extended but positive, while RSI has cooled to approximately 62. The structure supports the thesis of short-term rebalancing before a potential continuation or breakdown. Volatility compression is evident.

Options Market Context | BTC1! (May 30, 2025 Expiry)

Implied Volatility (IV): 48.1% across strikes

Underlying Spot Price: $82,978

ATM Strike: $84,500

Theta: ~ -52 per leg (high decay environment)

Delta Cluster: Calls around 0.53–0.59, Puts around -0.41 to -0.47

Despite BTC's recent move and upcoming halving-related volatility potential, the options market is pricing in moderate movement, not extreme. This opens the door for straddles, strangles, and gamma-based strategies if volatility expands or price breaks out of range.

Breakeven Analysis: BTC Straddles (May 30, 2025)

The table below illustrates the breakeven zones and required directional moves for various straddle positions, based on total premium (call + put).

Strike Total Premium ($) Upper Breakeven ($) Lower Breakeven ($) % Move Up % Move Down

82,500 13,468 95,968 69,032 15.65% 16.81%

83,000 13,454 96,454 69,546 16.24% 16.19%

84,000 13,488 97,488 70,512 17.45% 15.04%

84,500 13,546 98,046 70,954 18.16% 14.48%

85,000 13,607 98,607 71,393 18.87% 13.97%

Interpretation:

The FWB:83K –$84.5K strikes offer the most balanced convexity. The average breakeven range requires BTC to move approximately 15%–18% in either direction by expiration to achieve profitability.

Strategy Considerations

1. Long Straddle at ATM ($84,500):

Total cost: ~$13,546

Profit potential if BTC > GETTEX:98K or < $70.9K

Ideal for traders anticipating a significant move in either direction

Vega + gamma rich; best for breakout environments

2. Directional Option Play:

Long Call at $85,000 (~$6,538) for a lower-cost breakout bet

Long Put at $82,500 (~$5,713) to lean bearish

Scaled exposure possible for either side, depending on directional bias

3. Advanced Structures (Neutral Thesis):

Short Straddle or Iron Butterfly at $84,500 to harvest premium

High decay potential, but vulnerable to directional expansion

Only suitable if anticipating range-bound behavior near-term

Final Thoughts

Bitcoin is entering a historically volatile phase post-halving with price compressing below all-time highs and implied volatility sitting at moderate levels. This convergence of technical consolidation and underpriced volatility creates a strong environment for defined-risk, high-reward trades.

Whether you favor directional breakouts or volatility-based strategies, the current setup offers clear levels, manageable risk, and strong reward-to-risk symmetry.

Chart source: BTCUSD Monthly (BITSTAMP)

Options source: CME BTC Options (May 30, 2025)

Bitcoinprediction

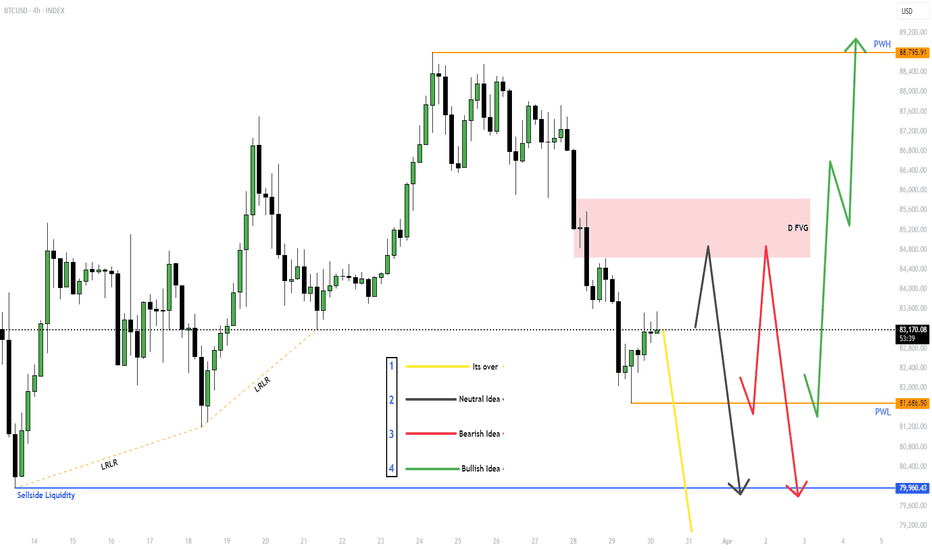

$BTC for Next week (31st March - 4th April)Given out all the ideas, Will react to the market based on which idea presents itself.

If Yellow line - Its better to stay out of the markets.

With the other wait for MSS (Market Structure Shift) and then take the trade and target the other side of the liquidity.

BITSTAMP:BTCUSD , BINANCE:BTCUSDT.P BINANCE:BTCUSDT

Overall I'm neutral on CRYPTOCAP:BTC but SEED_ALEXDRAYM_SHORTINTEREST2:NQ and NYSE:ES look bearish to me, and CRYPTOCAP:BTC could follow.

Bear cycle begins if this happens. Not the time of buy the dipI have been thinking this Bitcoin cycle has already peaked.

I am using a weekly chart here because I can fit in three BTC cycles on the screen, but it is more clear if you look at it in the Daily chart.

I am analysing the chart by using VWAP - Volume weighted moving average.

When you place VWAP (orange line) at the peak of each cycle you can see the pattern as below:

1) The price goes down steadily from the suspected peak price but eventually breaks above the descending trendline. (please check it in daily chart).

2) The price moves and closes above the descending trendine but the upside move is limited and price gets trapped and consolidate in the sideway for a few months (blue rectangular box).

3) VWAP acts as resistance line and eventually resumes the downside move.

4) By then, all momentum indicators are deep in the bear zone, and the bear cycle begins.

When I look at weekly and daily chart, I can see the same scenario is unfolding now.

I don't think the price will go straight down from here. There are good small swing trade opportunities in lower time frame for the next few months. However, if the price struggles to move above VWAP, the end of cycle scenario becomes more and more convincing.

It is just my humble opinion based on one style of analysis.

Final note:

Bitcoin price action has been very similar to NASDAQ100 and US500, and these charts are looking very dire. If US indices go down in the the next few months, Bitcoin will go with them.

Bitcoin Part2: Bullish Trade longBad economy,global inflation,recessive U.S. economy,hypes,uncertainly, the white house policy.

All these facts matter:They put the markets under massive pressure

Where is the chance: To plan different scenarios and models that have benn working in such similar scenarios. 202 is a good example, as the markets suddenly experienced big pressure.

Last not least, the FED transistory inflation, that wasnt real inflation, now indeed is becoming a dangerouse reality: We will have higher inflation, and global risks increasing.This will impact global liquidity inflow into markets.

Additionally we are noticing an outflow of the US stock markest, and increasing inflow of capital in foreign countries stock markets.

This are not good news for Bitcoin nor for crypto at all.

The chane in my opinion is just to think reverse.like 2020

Sell when positive news from the Whitehouse andpositive tone from FED.

Buy when White house talking and announcing threadful tariffs and if FED talks negatively.

Why?Because we have indieed real thread of inflation, and FED is the more competent team, who really now does everything to tame the inflation.Therefor i beleive them more.

Also short term contarian trade is just planned for max 24-48 hours. not longer

As the volatility rises.

Helding positions for more periode of time means increasing the risk.Upwards and downwards.

Bitcoin Part1: bearish Trade Short termBitcoin Macro Index' bear signal puts $110K BTC price return in doubt

Fact is: Bitcoin and ether drop amid grim inflation outlook, tariff uncertainty midterm to long term, as long the white house continues its policy.And PRES: trump cannot prevent it.

A positive change of the white house policy, and improving its relationshipsto other nations,instead putting them with tariffs, will be a boosting positive cataylst also for crypto,specially Bitcoin. Bitcoin has lost in trust of new investors ,specially since 21st of January 2025.

Also participating of Pres. trump in crypto summits had no positive significant signals ,specilly not for Bitcoin.Instead Bitcoin lost now more than 34% since Nov. 2025.

Also many crypto fans are very disappointed about developement of their crypto performances.

Promise gave,Promise ,,NOT,,kept!

It wIll be a very volatile time ahead.

Therefor I prepare for both scenarios:Bullish/Bearish short term.

This is part 1:bEARISH STRATEGY:

Below 78k...bearish momentum will gain more on momentum.

Bitcoin Dump Perfectly Predicted ! What's Next? 76k ?🚨 DID EVERYONE REMEMBER ? 🚨

🔥February 14th – I told everyone loud and clear SHORT or SELL because BTC was about to DUMP. Look at where we are now another perfect prediction, another massive win. 🚀

Hope all my real ones remembered and stayed safe in this move. We are still valid in our analysis, deep in profits, and absolutely killing this trade.

✅ Book partial profits – Lock in those gains.

✅ Move SL to entry – No risk, stress-free ride.

We move smart, calculated, and ahead of the market. Now, let’s analyse

the next move.

🔍BTC Technical Analysis What’s Next ?

Bitcoin followed the bearish rejection from key resistance and is continuing its downtrend. We saw a weak consolidation before another breakdown, and structure still favors further downside.

📊 Key Levels to Watch

🔻 Support: $68,500-$70,000 – If this level breaks, BTC could accelerate lower.

🔺 Resistance: $85,000-$86,000 – A reclaim of this zone would invalidate further downside.

🔮 Potential Scenarios

1️⃣ If BTC holds above $75,000-$76,000, we could see a short-term bounce before another drop.

2️⃣ If BTC loses $70,000, expect further downside targeting $68,500 or lower.

3️⃣ Bulls need a strong reclaim above $85,000 to flip structure bullish again.

📉 We remain bearish until BTC shows clear strength. Manage risk, stay disciplined, and ride the trend.

💬Drop a comment and follow if you caught this move & let’s stay ahead of the game!🚀

Bitcoin 1-Year Pattern- The art of trading lies in analyzing the past to anticipate the future.

On the yearly timeframe, BTC has consistently followed this cycle:

- 1 year of bearish decline.🟥.

- 1 year of consolidation and bottoming out.🟩.

- 1 year of steady growth.🟩.

- 1 year of explosive upward movement.🟩.

based simply on that :

- 2025 is poised to be a breakout year for BTC.

- 2026 should be the next bear market.

- Everything changes, nothing lasts forever, but as a trader, you must stay on course.

- Don't let market noise shake your confidence.

Happy Tr4Ding !

Observing BTC to down for a whileBTC/USD Forming an Inverted Flag and Pole Pattern – Potential Bearish Signal

Current Market Structure:

BTC/USD is currently displaying a classic Inverted Flag and Pole pattern, which is a bearish continuation formation indicating that the market may be preparing for a downside move. This pattern typically forms after a strong downward price movement (the pole), followed by a period of consolidation or a slight upward retracement that forms the inverted flag.

1. Formation Breakdown:

Pole Formation:

The pole was formed after BTC/USD experienced a sharp decline from recent highs, characterized by strong bearish momentum and high volume.

This steep price drop signifies increased selling pressure, often triggered by a combination of profit-taking, liquidation of leveraged positions, and macroeconomic uncertainty.

Flag Formation:

Following the pole, BTC/USD has entered a consolidation phase, creating a slight upward or sideways retracement. This phase forms a channel or wedge-like pattern that slopes slightly upward or horizontally.

The flag reflects a temporary pause where buyers attempt to regain control, but the low volume and weak bullish pressure indicate a lack of conviction in sustaining the upward movement.

2. Key Characteristics to Note:

Volume Behavior:

During the pole formation, volume was significantly high, confirming strong selling interest.

In the flag phase, volume has tapered off, suggesting that the upward movement lacks the strength to reverse the previous bearish trend.

Resistance and Support Levels:

BTC is currently testing the upper boundary of the flag, near the $ resistance.

If this level holds and BTC fails to break out, a reversal towards the lower end of the flag is likely, followed by a potential breakdown.

Support to watch lies around the $ zone, which aligns with the pole’s base and a potential target for the next bearish leg.

3. Expected Market Behavior:

Bearish Continuation Likely:

If BTC breaks below the lower boundary of the flag, it is likely to resume its prior bearish trend. The next downside target is typically measured by projecting the length of the pole downward from the breakdown point, potentially bringing BTC to levels around $ .

A breakdown with strong volume confirmation would further validate this bearish move.

Invalidation Scenario:

If BTC breaks above the flag’s resistance zone with convincing volume, the bearish pattern may be invalidated, potentially leading to a retest of higher resistance levels around $ .

4. Market Sentiment and External Factors:

Macro Influences: Ongoing concerns regarding regulatory changes, interest rate hikes, and broader economic uncertainty may further weigh on BTC’s price.

Trader Behavior: Institutional selling and retail panic could accelerate the downward momentum once the pattern confirms the breakdown.

Conclusion:

BTC/USD’s current pattern suggests that a period of downside correction is likely. Traders should monitor key support and resistance levels closely, along with volume confirmation to assess the next leg of price action. A confirmed breakdown from the flag structure may signal a continuation of the bearish trend, while a breakout above resistance would invalidate the bearish setup.

BTC/USDT Analysis: Buyers Have LostContrary to expectations and the defense of the local low, buying pressure failed to resume fully, leading to a decline.

Currently, we are approaching the buyer's zone at $84,400-$82,900 (accumulated volumes)—monitoring the reaction at this level is crucial.

From a wave analysis perspective, the local uptrend has been broken, and short positions are now the priority. A sell zone has formed above the current price at $86,000-$87,200, where we anticipate a continuation of the downward movement. Another short entry point would be a false breakout of the local high at $88,800.

Sell Zones:

$86,000-$87,200 (absorption of buyer's market aggression)

$95,000-$96,700 (accumulated volumes)

$97,500-$98,400 (pushing volumes)

$107,000–$109,000 (volume anomalies)

Buy Zones:

$84,400-$82,900 (accumulated volumes)

$77,000-$73,000 (volume anomalies, pushing volumes)

BTCUSDTo the bitcoin lovers, investors and traders, this is my forecast on BTCUSD.

With all the news that are circulating about the crypto world, bad or good. Currently BTC is looking bearish. I will be looking for buy at the 71,671 level if BTC will find support.

Please tell us what you think. Is BTCUSD going down or up ?

BTC/USDT Analysis: Local Buyer AggressionYesterday, Bitcoin continued its downward movement. At one point, after breaking the local level of $86,300, buyers defended the price, pushing it back into a narrow range.

Currently, it's worth noting the repeated defense at around $86,700, where a significant buyer volume has accumulated (as indicated by the positive delta in that bar). Given this, we may see a retest of the local high from the current levels.

Despite this, the primary scenario remains a correction toward the sell zones. This is supported by the nature of the current uptrend, characterized by weak new highs, as well as selling pressure reflected in the delta.

An alternative scenario would be a full breakout of the current high on strong volume, which could indicate a continuation of the trend.

Sell Zones:

$95,000-$96,700 (accumulated volumes)

$97,500-$98,400 (pushing volumes)

$107,000–$109,000 (volume anomalies)

Buy Zones:

$84,400-$82,900 (accumulated volumes)

$77,000-$73,000 (volume anomalies, pushing volumes)

Bitcoin in Ascending Wedge?Looks like a rising wedge guys - I'm not a charting TA expert but would love to here your thoughts. Many bears keep posting a drop to $70K level.. I guess that drop is written in some prophecy somewhere, and they believe (or hope) it MUST happen, before we go for new ATH. Maybe so... however can anyone explain WHY that must play out like that? A couple of weeks back i was in that camp but after I see the slow and steady Bitcoin recovery, I have changed my mind.

BTC/USDT Analysis: Moving Within Our ScenarioYesterday, after testing the $88,000-$88,600 sales zone (local volume zone), Bitcoin began to follow the scenario we outlined.

At the moment, we still expect a decline in the first cryptocurrency. Several factors indicate this: a trend with weak updates of each new high and a downward cumulative delta.

Reviewing the chart on a higher timeframe, we have identified a potential support level in the form of the POC of the current uptrend. However, our primary scenario remains a decline toward the $76,700 low.

Sell Zones:

$95,000-$96,700 (accumulated volumes)

$97,500-$98,400 (pushing volumes)

$107,000–$109,000 (volume anomalies)

Buy Zones:

$84,400-$82,900 (accumulated volumes)

$77,000-$73,000 (volume anomalies, pushing volumes)

GameStop Corp. (NYSE:GME) to add BTC as a Treasury Reserve AssetThe price of GameStop Corp. (NYSE: NYSE:GME ) shares saw a noteworthy uptick of 7% in Tuesday's after hours trading, primarily based on the news that the firm is set to add Bitcoin as its Treasury Reserve asset.

The asset bounced from it's psychological support zone aiming for a move to the $35- $40 price point. This move would be feasible if GameStop Corp. (NYSE: NYSE:GME ) shares break pass the $30 resistant point.

In light of that manner, GameStop Corp. (NYSE: NYSE:GME ) also is set to announced earnings report Tuesday, March 25, 2025, after market close.

About GameStop Corp. (NYSE: NYSE:GME )

GameStop Corp., a specialty retailer, provides games and entertainment products through its stores and ecommerce platforms in the United States, Canada, Australia, and Europe. The company sells new and pre-owned gaming platforms; accessories, such as controllers, gaming headsets, and virtual reality products; new and pre-owned gaming software; and in-game digital currency, digital downloadable content, and full-game downloads.

Crypto liquidations drop 76% as Bitcoin $BTC stabilizes aboveCrypto liquidations plummeted by 76% in the second half of March as Bitcoin BTC CRYPTOCAP:BTC consolidated around $87,000 after earlier volatility. From March 12 to March 25, Bitcoin's price moved within a narrower range, starting at $82,857 and closing at $87,330.

Earlier in March, Bitcoin BTC CRYPTOCAP:BTC saw sharp price movements, dropping below $79,000 before rebounding, coinciding with a spike in long liquidations. The recent decline in liquidations signals more stable market participation and reduced leverage risk.

Between March 12 and March 25, long liquidations totaled $1.26 billion, while short liquidations reached $1.14 billion, down from 7$7.2 billion in long and $2.8 billion in short liquidations from February 24 to March 12.

BTC/USDT Analysis: Buyers Have Lost Initiative AgainYesterday, Bitcoin attempted to break the $87,500 level but encountered strong selling pressure, as indicated by the cumulative delta. Each new high appears weak, suggesting that buyers need more strength to develop a full-fledged trend. To achieve this, liquidity below must be tested. If this scenario unfolds, we expect a move toward the local low since only technical levels remain as support, with all major volume zones already tested.

We are looking for short positions upon a reaction in the local sell zone of $88,000-$88,600.

Sell Zones:

$88,000-$88,600 (local volume zone)

$95,000-$96,700 (accumulated volumes)

$97,500-$98,400 (pushing volumes)

$107,000–$109,000 (volume anomalies)

Buy Zones:

$77,000-$73,000 (volume anomalies, pushing volumes)

BTC IMF Tracking, Liquidation Frenzy, and Market PredictionsBitcoin's recent price action has been a rollercoaster, marked by significant gains, dramatic liquidations, and a confluence of macroeconomic factors that are shaping its trajectory. From the International Monetary Fund (IMF) officially tracking Bitcoin in cross-border finance to speculative predictions of a potential $87,000 surge, the cryptocurrency remains a focal point of intense market scrutiny.

One of the most noteworthy developments is the IMF's increasing recognition of Bitcoin's role in global finance. While the IMF previously issued warnings to El Salvador regarding its Bitcoin adoption, its decision to now track Bitcoin in cross-border financial flows signals a tacit acknowledgment of the cryptocurrency's growing significance. This shift reflects a broader trend of institutions grappling with the reality of digital assets, forcing them to incorporate these assets into their analytical frameworks.

Simultaneously, the Bitcoin market has witnessed a surge towards the $87,000 mark, triggering a wave of short liquidations. This phenomenon occurs when traders who have bet against Bitcoin's price are forced to close their positions at a loss as the price rises. The sheer magnitude of these liquidations, exceeding $110 million in a short period, underscores the volatility and the inherent risks associated with leveraged trading in the cryptocurrency market. The total market liquidations surpassing $200,000 in 24 hours only highlights the dramatic price swings and the vulnerability of short positions.

Adding to the complexity of the market dynamics is the emergence of another CME gap in the $84,000–$85,000 range. Historically, these gaps, which represent discrepancies between trading prices on the Chicago Mercantile Exchange (CME) and other exchanges, tend to be filled, suggesting a potential pullback in Bitcoin's price. This pattern creates a sense of uncertainty, with traders weighing the potential for further gains against the possibility of a corrective downturn.

Furthermore, the surge in Bitcoin open future bets on Binance, with an increase of $600 million, indicates heightened price volatility. Open interest, which measures the total number of outstanding futures contracts, often correlates with price movements. A rise in open interest alongside a price increase typically confirms an uptrend, but it also signals the potential for sharp price swings as more capital enters the market.

Market analysts are divided on Bitcoin's future trajectory. Some predict a "brutal bleed lower," while others foresee a break towards new all-time highs in the second quarter. The critical level to watch is $93,000. If Bitcoin can reclaim this level as support, it would significantly reduce the risk of a fresh collapse. However, until this threshold is breached, the market remains vulnerable to downward pressure.

On a more positive note, the S&P 500's reclamation of its 200-day moving average provides a potential tailwind for Bitcoin. This technical breakout in equities, coupled with similar signals in the cryptocurrency market, could indicate renewed bullish momentum. The correlation between traditional financial markets and Bitcoin has become increasingly apparent, with positive developments in equities often translating to positive sentiment in the crypto space.

Adding another layer to the narrative is the potential softening of the stance on reciprocal tariffs by Donald Trump. Some analysts see this development as a potential catalyst for a Bitcoin bottom. Any relaxation of trade tensions could boost investor confidence and create a more favorable environment for risk assets, including cryptocurrencies.

Finally, the concept of tokenized US gold reserves, as proposed by NYDIG, presents an intriguing long-term prospect for Bitcoin. While gold and Bitcoin are fundamentally different assets, the tokenization of gold on a blockchain could enhance the overall legitimacy and infrastructure of digital assets. This increased institutional acceptance could indirectly benefit Bitcoin by further integrating blockchain technology into mainstream finance.

In conclusion, Bitcoin's current market landscape is characterized by a blend of institutional recognition, intense trading activity, and speculative predictions. The IMF's tracking of Bitcoin in cross-border finance underscores its growing relevance, while the liquidation frenzy and CME gap highlight the inherent volatility of the cryptocurrency market. The interplay of macroeconomic factors, technical indicators, and speculative sentiment will continue to shape Bitcoin's trajectory, making it a fascinating asset to watch in the coming months.

Bitcoin Price Analysis – Bullish Setup with Caution AheadThe short-term trend is bullish, as we observe:

- Price movement is above the short- and medium-term moving averages.

- The price is forming higher highs and higher lows.

- Support levels are steadily rising along the moving averages.

However, there is a noticeable loss of momentum in recent hours, which could signal a potential short-term correction or profit-taking phase.

Bullish Indicators

Moving Averages:

- The 10 EMA, 20 EMA, and 30 EMA are all indicating a Buy signal.

- The 200 EMA also reflects a Buy signal.

- This indicates that the price is trading above key averages, supporting the continuation of the bullish trend.

ADX = 29.49 (Buy): The strength of the current trend is still significant (above 25), which reinforces the continuation of the bullish movement.

MACD (Buy): The MACD has shown a positive crossover, which supports the bullish signal and continued upward momentum.

Bearish Indicators

Momentum = Sell (Value: 4,249.13): There is a noticeable slowdown in momentum, which may indicate the early stages of a correction or temporary weakness.

Some Long-Term Averages = Sell: The 50, 100, and 200 Simple Moving Averages are showing sell signals, suggesting the longer-term trend has not yet fully transitioned into a bullish phase. These may also act as resistance if the price continues to rise.

Stochastic RSI Fast = 90.56 (Overbought): This indicator is in the overbought zone, pointing to a potential near-term pullback.

RSI = 53.34 (Neutral to Overbought): Not yet in the overbought territory, but gradually approaching it, which should be watched closely.

2025 Performance Lagging: The latest chart shows that 2025 performance is currently at -6.46%, compared to a strong +111% in 2024. This discrepancy suggests a phase of ongoing profit-taking or broader consolidation.

Outlook

Short-Term (Hours to Days): There is a potential for further upside with key resistance levels at 88,500, 89,000, and 90,000.

The nearest support levels are at 87,500 and 86,800.

However, caution is advised due to signs of short-term exhaustion in indicators like Stochastic RSI and Momentum.

Medium-Term (Weeks): As long as the price holds above the 86,000–86,500 range, the uptrend is likely to continue. A breakout above 90,000 would be a strong bullish signal that could drive the market to new highs.

Recommendation

- For Short-Term Traders: Take advantage of the current move but remain cautious of sudden corrections.

Watch for potential buy zones near 87,000 and 86,500. Use a tight stop-loss strategy if these support levels are broken.

- For Medium/Long-Term Investors: Indicators show that the uptrend is starting to stabilize.

Consider partial entry now while closely monitoring the 90,000 level.

Avoid going all-in at current levels and keep capital aside to buy dips if the market corrects.

Bitcoin - Uptrend Continues: Can Bulls Push to $91K?Market Structure & Trend Overview

Bitcoin (BTC) has been maintaining a strong bullish structure on the 4-hour timeframe, forming a series of higher lows while staying inside an ascending channel. This indicates that buyers continue to step in on dips, keeping momentum in favor of the bulls.

Recently, Bitcoin bounced off the golden pocket level, a key Fibonacci retracement zone that often acts as a strong support area for reversals. This successful retest suggests that buyers are defending this level aggressively, reinforcing the bullish outlook for the coming days.

While BTC remains within the ascending channel, it is gradually pushing towards the next major price target, which aligns with the -0.618 Fibonacci extension level near $91,000.

Key Zone: Fibonacci Support & Higher Low Formation

Currently, Bitcoin is holding above a critical Fibonacci level, confirming that buyers are actively defending the trend. The higher low formation further strengthens the bullish sentiment, as it suggests a continuation of the trend towards new highs.

A key aspect of this setup is that Bitcoin is maintaining its position inside the ascending channel, meaning that the uptrend structure remains valid. If the price continues to respect this channel, BTC could see a steady climb towards higher levels without major pullbacks.

Bullish Scenario: Break & Hold Above $91K

For Bitcoin to confirm further upside movement, it needs to break above the -0.618 Fibonacci extension level ($91,000) with strong bullish momentum. This breakout would signal that buyers are fully in control and could lead to an extended rally towards even higher price targets.

Signs to watch for a bullish breakout:

✅ A strong 4-hour close above $91K with increasing volume.

✅ Retesting the broken resistance as new support (confirmation of trend continuation).

✅ Maintaining higher highs and higher lows, reinforcing bullish momentum.

If these conditions are met, Bitcoin could continue its climb towards new highs, potentially targeting levels beyond $95,000 in the short term.

Bearish Scenario: Failure to Hold the Channel

While the overall trend remains bullish, Bitcoin could see a rejection if it struggles to break above the $91K resistance level. If sellers step in and push BTC below the ascending channel, it could lead to a deeper pullback towards lower Fibonacci support zones.

Signs to watch for a bearish breakdown:

❌ A clear rejection from $91K, showing that selling pressure is increasing.

❌ A break below the ascending channel, signaling a potential trend shift.

❌ Increased selling volume and bearish momentum, leading to lower price levels.

If this happens, Bitcoin could drop towards the $ 83K - $81K range, where the next strong support zones are located. This area could provide a buying opportunity for traders looking to enter at lower levels. If we fail to break out on the upside and see drop first, we could test the $78k range.

Final Thoughts: Bullish Outlook, but Watch Key Levels

Bitcoin is currently in a strong uptrend, staying within its ascending channel and aiming for the next resistance at $91K. The golden pocket bounce has reinforced bullish momentum, and as long as BTC continues making higher lows, the bullish outlook remains intact.

However, traders should monitor price action closely, especially around the $91K resistance level and the lower boundary of the ascending channel. A successful breakout could lead to higher highs, while a failed attempt may result in a pullback towards key support zones.

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

JUST IN: Bitcoin Reclaims $88K, Eyes $100K Breakout!The Price of Bitcoin shocked sceptics surging nearly 4% today, reclaiming the FWB:88K pivot- now setting its coast for $100k breakout amidst a bullish symmetrical triangle Pattern.

On the daily time frame, CRYPTOCAP:BTC has formed 2 bullish candlesticks, should a third identical candlestick evolve, it will lead to a breakout of the ceiling of the symmetrical triangle formed- placing CRYPTOCAP:BTC in the $90,000 - $96,000 range. A break above this pivots would cement the the move to $100k and beyond.

Similarly, should the asset faced selling pressure into making it dip below the $81k range, a selling spree could emerged.

Bitcoin Price Live Data

The live Bitcoin price today is $88,452.78 USD with a 24-hour trading volume of $29,835,452,540 USD. Bitcoin is up 3.95% in the last 24 hours, with a live market cap of $1,755,025,651,822 USD. It has a circulating supply of 19,841,384 BTC coins and a max. supply of 21,000,000 BTC coins.