BTC Making a Comeback?Bitcoin www.tradingview.com is making a strong recovery, pushing higher with steady momentum. Despite the rally, the FOMO-O-Meter 2 shows no extreme greed—meaning the market isn’t overheating just yet.

With no signs of irrational exuberance, BTC could have room to run. Technicals point to a GETTEX:92K target, and as long as sentiment remains measured, this move might have legs.

Are we in for a grind higher, or is this the calm before the real FOMO storm? Let me know your thoughts!

Bitcoinprediction

Bitcoin’s Next Move – Another Attack on Resistance zone?Bitcoin ( BINANCE:BTCUSDT ) fell to $83,400 as I expected in the previous analysis , the question is whether Bitcoin will continue to decline or not.

Please stay with me.

Bitcoin is moving in the Support zone($84,120_$81,500) and near the Support lines . The way Bitcoin has moved and decreased since yesterday until now has been such that it seems that Bitcoin can attack the Resistance zone($87,100_$85,800) at least once more.

In terms of Elliott Wave theory , given Bitcoin’s movements over the past few hours, it appears that Bitcoin is completing a microwave B of the main wave Y .

I expect Bitcoin to be able to attack the Resistance zone($87,100_$85,800) once again and if it breaks, I have marked the next targets on the chart .

Do you think Bitcoin can touch $90,000 again?

Note: If Bitcoin goes below $81,800, we can expect more dumps.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 2-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

The Current State of Bitcoin on the CME Futures ChartAs we analyze the current state of Bitcoin on the CME Futures chart, it's clear that a mixture of market forces and investor sentiment is playing out in an intriguing way. Looking at the Commitment of Traders (COT) index, we can observe a distinct divergence in the positioning of different market participants: commercials, retail traders, and fund managers.

Commercials: Bearish but Accumulating Over-the-Counter

Commercials, who are typically large institutions and market makers, continue to hold a bearish stance on Bitcoin in the futures market. This suggests that they are still not convinced of Bitcoin’s long-term price sustainability, likely reflecting a cautious outlook amid broader macroeconomic uncertainty. However, what stands out is their behavior in the over-the-counter (OTC) market. Despite their bearish position in the futures market, these same entities are accumulating Bitcoin in the OTC market. This suggests that while they might be hedging against short-term volatility, they still recognize Bitcoin's potential value or see it as a long-term store of value, allowing them to position themselves for future upside.

Retail Traders: Fearful and Bearish

Retail traders, on the other hand, have a far more pessimistic view of Bitcoin at the moment. With a lot of fear circulating in the market, many smaller traders are hesitant and have adopted bearish positions. This fear is compounded by the volatility that has become characteristic of the cryptocurrency market, alongside the macroeconomic challenges in traditional markets. Retail traders’ bearishness is a sign of market uncertainty and can often present opportunities for those who can see past short-term price movements. It is also indicative of the emotional influence that sentiment, such as fear, can have on the broader market.

Fund Managers: Extremely Bullish

In stark contrast to both the commercials and retail traders, fund managers are incredibly bullish on Bitcoin. They see the cryptocurrency as a valuable asset, particularly in the context of diversification and inflation hedging. The strong bullish positioning of fund managers indicates that institutional interest in Bitcoin is growing. These larger investors, likely driven by long-term growth prospects and the increasing recognition of Bitcoin as digital gold, remain optimistic about its potential. Their strong positions also suggest a belief in the fundamental value of Bitcoin and its resilience in the face of market turbulence.

Conclusion: A Complex Market Sentiment

The current state of Bitcoin futures on the CME reveals a market characterized by stark contrasts. Commercials are hedging their bets with a bearish outlook in the futures market while accumulating Bitcoin over-the-counter. Retail traders are fearful and bearish, showing caution amid uncertain market conditions. Meanwhile, fund managers stand in stark contrast, displaying strong bullishness, likely driven by the long-term potential of Bitcoin. This divergence of sentiment suggests that the market is at a crossroads, with various players taking different approaches based on their time horizon, risk appetite, and views on Bitcoin's role in the financial system.

In the short term, volatility and fear could dominate, but the long-term bullish positioning of institutional players may point toward a stronger future for Bitcoin as the market matures.

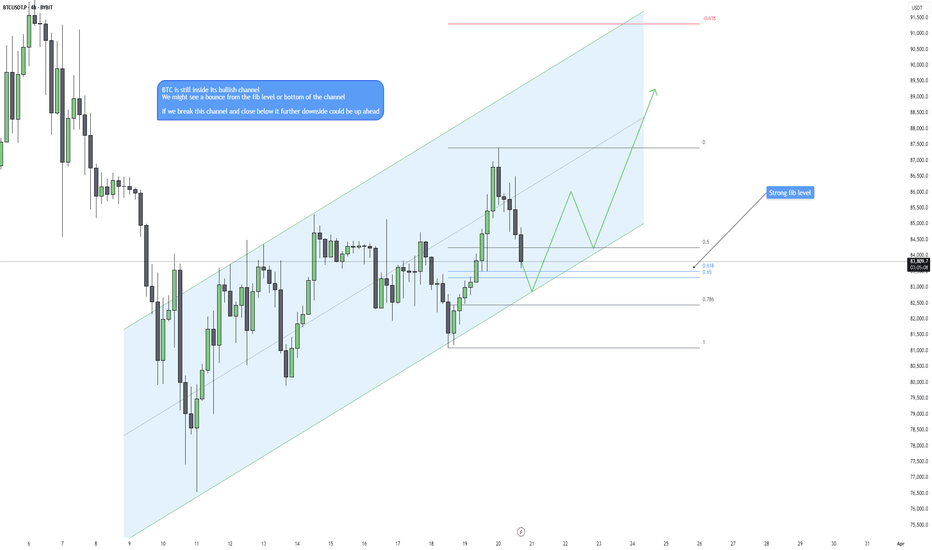

Bitcoin at a Turning Point: Rally or Reversal?Bitcoin (BTC) is currently trading within a upward channel, consistently making higher lows, a strong indication of bullish market structure. This suggests that buyers are still in control, and as long as BTC respects this pattern, the bias remains bullish, favoring a continuation to the upside.

At the moment, BTC is experiencing a pullback from recent highs and is now approaching a critical support zone. This level aligns with several important technical factors, making it a potential turning point in the current trend.

Key Factors Supporting a Potential Bounce:

Upward Channel Structure

BTC has remained inside a clearly defined ascending channel, where price action has respected both the lower and upper trendlines multiple times. As long as BTC stays within this structure and continues to form higher lows, the trend remains bullish.

Golden Pocket Fibonacci Retracement (0.618 - 0.65 Level)

The golden pocket is one of the most significant Fibonacci retracement levels, often acting as strong dynamic support. Historically, this zone has been a high-probability area for reversals in trending markets. With BTC now approaching this area, there is a strong possibility that buyers could step in, leading to a bounce back toward higher levels.

Confluence of Key Support Levels

The Fibonacci golden pocket aligns closely with the lower boundary of the ascending channel, reinforcing this zone as an area of potential support.

There are also previous horizontal support levels in this region, adding further confluence to the idea that BTC could hold this level and bounce.

Potential for Bullish Continuation

If BTC finds support at the golden pocket and reacts positively, we could see another leg to the upside within the channel. In this scenario:

Price could bounce off the lower trendline and move toward the midline of the channel.

If momentum continues, BTC could ultimately target the upper boundary of the channel, potentially leading to new highs.

Bearish Breakdown Scenario – When to Be Cautious

While the bullish structure is still intact, it is essential to consider the potential risks if BTC fails to hold the support zone.

If BTC breaks below the lower boundary of the channel and closes a bearish candle below support, this could be an early signal of a trend reversal. A breakdown of this structure would indicate that bullish momentum is weakening, and further downside could follow.

In this scenario:

BTC could start making lower lows, shifting the trend from bullish to bearish.

The next logical downside targets would be deeper Fibonacci retracement levels or previous swing lows, where buyers may attempt to step in again.

A confirmed breakdown would invalidate the current bullish thesis and could lead to increased selling pressure.

How to Approach This Trade Idea

Bullish Case: If BTC finds support at the golden pocket and forms a strong bullish reaction (such as a clear rejection wick, bullish engulfing candle, or higher low), this would signal a potential bounce. This could present a good long opportunity, targeting the midline or upper boundary of the channel.

Bearish Case: If BTC closes a strong bearish candle below the channel, it would indicate a potential trend shift. In this case, traders should exercise caution, as further downside could be expected.

Final Thoughts

This is a critical area for BTC, as it decides whether the bullish trend continues or a reversal is imminent. The market’s reaction at the golden pocket level will be key. Traders should wait for confirmation before making any moves watching for strong rejection signals for a bullish bounce or a clear breakdown below the channel for a bearish shift.

For now, BTC is still respecting its bullish structure, but this key level will determine whether that trend holds or breaks.

Global Tensions, Market Manipulation, and BTC Uncertainty The cryptocurrency market, a realm notorious for its volatility, is currently grappling with a confluence of factors that are forcing investors to reassess their strategies. Global trade tensions, macroeconomic uncertainties, and the intricate dance of market manipulation are all contributing to a complex and unpredictable landscape. Specifically, Bitcoin, the flagship cryptocurrency, is experiencing a period of intense scrutiny, with analysts offering a range of perspectives on its potential future.

A recurring theme in recent analyses is the notion of "whale manipulation." Reports suggest that large holders, or "whales," are engaging in strategic trades on exchanges like Binance to influence Bitcoin's price. This "liquidity massaging" is seen as a deliberate attempt to create artificial price ceilings, with some analysts predicting that Bitcoin's upward momentum could be capped below $90,000, and more conservatively, $87.5K. Such manipulations introduce uncertainty, making it difficult to discern genuine market sentiment from artificially inflated or deflated prices.

Adding to the complexity is the debate surrounding retail investor participation. Contrary to the prevailing narrative of retail investors being absent, some crypto executives argue that they are already actively involved. This perspective challenges the notion that a surge in retail interest is needed to propel Bitcoin to new heights. If retail participation is already significant, the anticipated catalyst for a bull run may have already materialized, leaving investors to wonder what new catalyst is needed for further price appreciation.

Data from Bitcoin's Realized Cap and UTXO (Unspent Transaction Output) analysis is also signaling a "major shift." These metrics, which offer insights into the actual value stored within the Bitcoin network and the movement of coins, are crucial for understanding the underlying health of the market. Changes in these indicators can foreshadow significant price movements and shifts in investor behavior. Traders are closely monitoring these metrics for clues about Bitcoin's future direction.

However, despite recent attempts to pare losses, Bitcoin is struggling to maintain a consistent uptrend. This instability has led some traders to adopt a bearish stance, with predictions of a potential drop to as low as $65,000. These bearish sentiments are fueled by the inability of Bitcoin to decisively break through resistance levels and the persistent volatility that characterizes the current market.

Conversely, some analysts are finding bullish signals by examining indicators that also correlate with the Nasdaq. The correlation between traditional financial markets and the cryptocurrency space has become increasingly evident, and analyzing these relationships can provide valuable insights. If the Nasdaq shows signs of strength, it could potentially buoy Bitcoin's price. However, this correlation is not always consistent, and the inherent volatility of both markets can lead to unpredictable outcomes.

The performance of U.S. spot Bitcoin ETFs is another critical factor influencing market dynamics. The collapse of the "cash-and-carry" trade, a popular arbitrage strategy, has had significant implications for investors. The stagnation of inflows into these ETFs, compared to the initial surge earlier in 2024, has raised concerns about the sustainability of institutional interest. While there have been recent reports of net inflows returning, questions remain if this is a temporary blip, or a sustained uptrend. This fluctuation in ETF inflow signals a wavering confidence from institutional players.

The combination of these factors creates a challenging environment for investors. Global trade tensions, which can disrupt economic stability and investor sentiment, add another layer of uncertainty. Fluctuations in traditional markets, geopolitical events, and regulatory developments can all have a ripple effect on the cryptocurrency market.

In this tumultuous landscape, investors are advised to exercise caution and adopt a diversified approach. Relying solely on technical analysis or market sentiment can be risky. Instead, a comprehensive strategy that incorporates fundamental analysis, risk management, and a deep understanding of market dynamics is essential.

The current situation highlights the inherent volatility and complexity of the cryptocurrency market. While Bitcoin remains a dominant force, its future trajectory is far from certain. The interplay of whale manipulation, retail participation, technical indicators, and macroeconomic factors creates a dynamic and unpredictable environment. Investors must remain vigilant, adapt to changing conditions, and prioritize risk management to navigate this challenging terrain successfully.

BTC/USDT Analysis. Yesterday’s scenario remains validBitcoin eventually tested the local buyer zone at $84,800–$83,500 (pushing volumes). Throughout the day, price has been consolidating within this range with reduced volatility. Meanwhile, the cumulative delta continues to break its lows, indicating an imbalance and absorption of market sell orders.

The primary scenario suggests a continuation of the upward movement toward $90,000–$93,000. This scenario will be invalidated if price secures a foothold below the current buyer zone, in which case a full retest of last week’s low is likely.

Sell Zones:

$95,000–$96,700 (accumulated volumes)

$97,500–$98,400 (pushing volumes)

$107,000–$109,000 (volume anomalies)

Buy Zones:

$84,800–$83,500 (pushing volumes)

$77,000–$73,000 (volume anomalies, pushing volumes)

Bitcoin at Key Resistance – Will Bears Take Control?Bitcoin ( BINANCE:BTCUSDT ) started to rise as I expected in the previous posts .

Bitcoin is moving near the Resistance zone($87,100_$85,800) , the upper line of the Ascending Channel , and the Time Reversal Zone(TRZ) .

In terms of Elliott Wave theory , Bitcoin appears to be completing microwave C of the main wave Y .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks .

I expect Bitcoin to start declining from the Resistance zone($87,100_$85,800) again, the first target could be $83,400 and the second target can be the CME Gap($80,760_$80,380) filling.

Note: If Bitcoin breaks the Resistance zone($87,100_$85,800) we can expect more pumps.

This analysis is in line with the following analysis that I shared with you on the weekly timeframe. 👇

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

BTC Whales Stir, Trump's Crypto Push, and the Path to $85,000

Bitcoin's recent price action has ignited a renewed sense of optimism within the crypto community. A confluence of factors, ranging from whale activity and political pronouncements to macroeconomic indicators and regulatory developments, is shaping the current market narrative.

Whale Activity: A Harbinger of Bullish Momentum?

The resurgence of Bitcoin whale activity is a significant indicator that has captured the attention of traders and analysts. Large-scale Bitcoin holders, often referred to as "whales," possess the capacity to significantly influence market dynamics.1 Their accumulation of Bitcoin can signal strong conviction and potentially trigger broader market rallies. The recent uptick in whale activity suggests a renewed interest in Bitcoin among these major players, potentially laying the foundation for a sustained upward trend. This can be viewed as the building of a strong base of long positions.

Political Winds: Trump's Crypto Pronouncements and Market Sentiment

Political discourse has increasingly intersected with the cryptocurrency market, with recent statements from a prominent political figure influencing market sentiment. Rhetoric emphasizing the United States as a "Bitcoin superpower" has undeniably contributed to bullish momentum. This political articulation of a crypto-friendly approach signals potential policy shifts and improved regulatory clarity, both crucial factors in attracting institutional investment. Market participants are interpreting this as a sign of acceptance, if not outright endorsement, of digital assets at the highest levels.

It is worth noting that consistent pronouncements regarding the US becoming the "crypto capital of the world," while driving short term volatility, need to be followed with legislative action for long term impact.

Macroeconomic Factors: Fed Policies and Inflationary Concerns

The Federal Reserve's monetary policy and the evolving narrative surrounding inflation play a pivotal role in shaping Bitcoin's trajectory. Recent indications from the Fed regarding continued rate cuts, despite persistent inflationary pressures, have boosted investor confidence. This stance, coupled with Powell's assessment of certain inflationary factors, such as tariffs, as "transitory," has provided much-needed relief to risk assets, including Bitcoin. This monetary policy creates a favorable environment for investment. The combination of Fed policy confirmation and rumors of "significant updates" to US crypto plans have driven Bitcoin to new two-week highs.

Technical Analysis: The $85,000 Threshold and Beyond

From a technical perspective, Bitcoin's ability to reclaim the $85,000 level is considered a crucial milestone. Surpassing this threshold would validate the current bullish momentum and potentially pave the way for further gains. Analysts are closely monitoring key support and resistance levels to gauge the strength of the ongoing rally. The return of significant volume combined with the price retaking old highs lends to an increasingly bullish sentiment.

BlackRock's prediction of a price shift ahead indicates a growing acceptance of Bitcoin as a mainstream asset, potentially aligning it with traditional Wall Street investments.2 These kinds of comments indicate an institutional bullish long-term perspective.

Regulatory Clarity: Ripple's Resolution and Its Impact on Bitcoin

The resolution of Ripple's legal battle with the SEC has sent ripples (pun intended) throughout the cryptocurrency market. This development has provided much-needed regulatory clarity, bolstering investor confidence and fostering a more favorable environment for digital assets. The jump in XRP's price after confirmation of the case coming to an end further exemplifies the markets sensitivity to regulatory action. This resolution will influence Bitcoin’s adoption rates, as investors now know the US regulatory stance may be moderating.

Options Market Sentiment: A Shift Towards Bullishness

The Bitcoin options market has exhibited a noticeable shift towards bullishness, particularly after Powell's "transitory inflation" remarks. This sentiment reflects increased optimism among traders and investors, potentially signaling a sustained uptrend. An increased amount of bullish options being written displays further faith in the rise of Bitcoin’s price.

Bitcoin's Volatility: Navigating the Uncertainty

Despite the positive developments, Bitcoin remains inherently volatile. Price swings, driven by a combination of market sentiment, news events, and technical factors, are to be expected. Investors should remain vigilant and exercise prudent risk management strategies. While large volume and long term political promises are strong positive indicators, there are still volatile short term swings to consider.

Looking Ahead: The Potential for a Sustained Rally

The convergence of positive catalysts, including whale activity, political support, macroeconomic factors, and regulatory clarity, paints a potentially bullish picture for Bitcoin. However, the cryptocurrency market is subject to rapid shifts, and unforeseen events can significantly impact price movements.

To conclude, the present environment is ripe for sustained Bitcoin price discovery. The political and macroeconomic climates are aligning, coupled with increased whale activity and regulatory clarity. While markets will remain volatile, the trend is looking increasingly bullish.

BTC Update 4 Hour/ FOMC Day March 19, 2025, GAME PLAN!🚨 FOMC Day Update – March 19, 2025 🚨

BTC at ~$83,244 (+0.28%–1%) as markets stay cautious. Fear & Greed at 23, RSI at 44.05 = neutral momentum.

While BTC is trading below all significant EMs, 50 100 and 200, It has broken above the 21EMA which is bullish for the short term.

Fed likely to hold rates at 4.25%–4.50% (99% odds) – a surprise cut could ignite a BTC rally. Whale accumulation signals potential upside.

Sentiment data and whale accumulation hint towards a possible upside but only if FED surprises with a rate cut.

The current pump in the market will be short-lived if there's no change in the rates which is very likely.

So be careful with your longs and shorts.

Volatility will kill both bears and bulls.

You need to keep an eye on Powell’s 2:30 PM EST speech.

Inflation & liquidity outlook will shape BTC’s next move. Stay sharp!

I'll keep you updated.

Let me know what you think in the comments and do hit that like button if you like this post.

Thank you

#PEACE

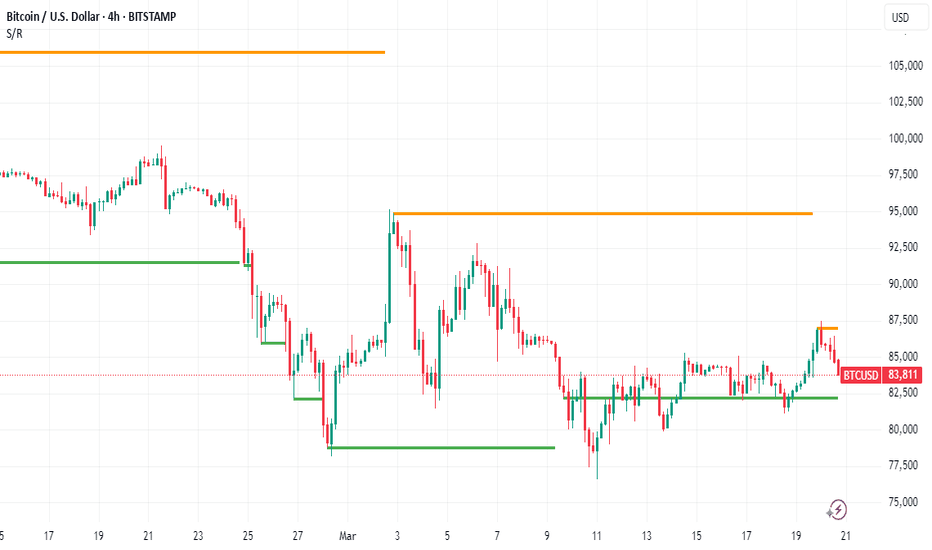

BTC/USDT Analysis: Climactic Moment on the Bitcoin ChartBitcoin managed to hold above the local range despite seller pressure, tested the key volume zone of $85,000–$88,000, and has already shown an initial selling reaction.

Currently, a local support zone has formed at $84,800–$83,500, casting doubt on the scenario of a decline to the lower boundary. If this zone is tested and buyers react to it, the current uptrend will continue. If there is no reaction, the trend will shift to a bearish direction.

Selling Zones:

$85,000–$88,000 (volume zone)

$95,000–$96,700 (accumulated volumes)

$97,500–$98,400 (pushing volumes)

$107,000–$109,000 (volume anomalies)

Buying Zones:

$84,800–$83,500 (pushing volumes)

$77,000–$73,000 (volume anomalies, pushing volumes)

Bitcoin - Price Action Heating Up, Will Bulls Take Over?Bitcoin is at a pivotal moment on the 4-hour timeframe, and the next few moves could dictate whether we see a strong breakout or a potential reversal. Let’s break down what’s happening in the market right now.

📌 Rejections at the 4H Imbalance Zone

BTC has tested the 4-hour imbalance zone twice already but hasn’t managed to break through. This area, highlighted in blue on the chart, represents a key resistance level where sellers have stepped in to push the price down.

Every time price approaches this zone, we see wicks and rejections, indicating that there is still supply here. However, the more times a resistance level is tested, the weaker it tends to become. If bulls gain enough momentum, we could see a breakout.

📈 Higher Lows Suggest Bullish Potential

One of the most notable signs in Bitcoin’s price action is the formation of higher lows. This suggests that buyers are stepping in at higher price points, absorbing sell pressure and pushing the price upwards.

This pattern is generally a bullish signal, as it shows that demand is increasing, and sellers are losing control. As long as BTC continues to make higher lows and hold structure, the probability of a breakout to the upside increases.

🔥 Bullish Breakout Scenario – Target $91K

If Bitcoin can break through the imbalance zone with strong volume, this would likely signal the start of another leg up. A confirmed breakout and retest of this zone as support would give additional confidence in the move.

In this case, BTC could rally toward $91,000, which is the next significant resistance level based on previous price action.

⚠️ Bearish Rejection Scenario – Drop to $75K

However, if BTC fails once again to break through this imbalance zone and gets rejected, it could lead to a shift in market structure. The key level to watch will be the higher low trendline.

If price breaks below the most recent higher low, it would indicate that bullish momentum is fading and that sellers are taking over. This breakdown could send Bitcoin toward $75,000, which is a key demand zone where buyers may look to step in.

🔎 Final Thoughts – Key Levels to Watch

A break above the imbalance zone and confirmation of support could lead to $91K.

A rejection followed by a lower low could lead to a decline toward $75K.

Pay attention to volume on the breakout or breakdown—strong volume will confirm the move.

Bitcoin is at a critical point, and the next few days will determine the trend!

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

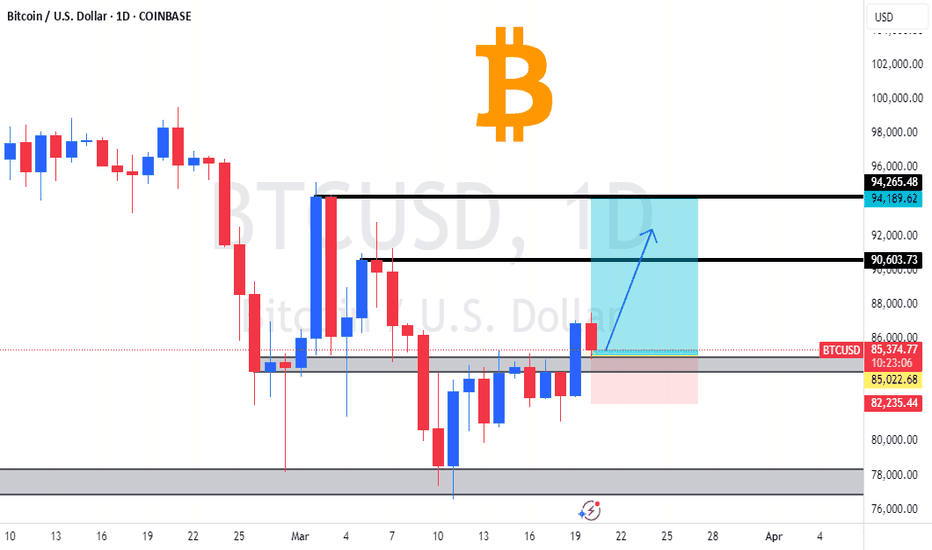

Bitcoin BTC price analysis, FOMC 19/03 - FED rateOur previous idea for OKX:BTCUSDT worked out 10 out of 10

Well, let's try to hit it again !)

Yesterday, CRYPTOCAP:BTC price showed growth despite the fact that the Fed left the rate unchanged yesterday #FOMC

In short, Powell said that he was "hesitant" to cut the rate now because it is not known how the economy will be affected by the new "economic tariffs and economic wars" that come into effect in early April. In the US, one "grandfather" does not know what to expect from the other "grandfather" ))

Nevertheless, #BTCUSD price has every chance of reaching $94k in the coming days.

And then, I would like to see a decline in BTC.D and USDT.D, which in turn will allow altcoins to "stop collapsing", and some low-liquid ones, which are easier to pump, will show good growth, such as X Empire.

👀 In general, the last 2 months have been: "not about making money, but about surviving and keeping the deposit, even with a drawdown", but the next 3 months may be very much about making money.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

BTC/USDT Analysis. Massive Bitcoin Short! What’s Next? On March 16, a whale opened a short position on Bitcoin with a volume of 4,442 BTC using 40x leverage. Naturally, this short attracted the attention of the community, and some traders attempted to trigger the whale's stop-loss. However, their efforts were unsuccessful, and the whale managed to close the position on March 18 with a significant profit.

What’s the takeaway?

Perhaps it's best not to bet against major capital.

Market Analysis

Looking at the chart, it’s clear that this short was closed precisely during Bitcoin’s attempt to break out of its local range, after which a rebound followed, bringing the price back within the same range.

The main scenario for Bitcoin remains largely unchanged. Both wave and cluster analysis suggest a potential decline to the lower boundary from current prices or after a false breakout of the local high and a test of the $85,000–$88,000 sell zone (high-volume area).

However, an alternative scenario is also possible: a strong, high-volume breakout of this zone. If that happens, we will reassess the scenario in favor of long positions.

Sell Zones:

$85,000–$88,000 (high-volume area)

$95,000–$96,700 (accumulated volume)

$97,500–$98,400 (pushing volume)

$107,000–$109,000 (volume anomalies)

Buy Zones:

$77,000–$73,000 (volume anomalies, pushing volume)

Inverse Head & Shoulders in Play – Bitcoin’s Bullish Setup!!!Bitcoin ( BINANCE:BTCUSDT ) touched $84,500 as I expected in my previous post (even higher).

Right now it seems like Bitcoin has managed to break the Resistance zone($84,130_$81,500) and the 200_SMA(Daily) . The formation of the classic pattern , the Inverse Head and Shoulders Pattern , could be a sign that Bitcoin is preparing to break the Resistance zone($84,130_$81,500) .

Another Classic Pattern that we can see on the one-hour Bitcoin chart and hope for an increase in Bitcoin is the Fan Principle at the Bottom Pattern .

Educational tip : The Fan Principle at the Bottom is a bullish reversal pattern where the price forms a series of downward trendline breaks, signaling weakening bearish momentum. As each trendline is broken, buying pressure increases, leading to a potential uptrend.

According to Elliott Wave theory , with the resistance zone broken, we can expect Bitcoin to enter the next impulsive wave , which will likely continue to at least $86,300 .

Also, Today's U.S. economic data release could significantly impact financial markets, including Bitcoin :

UoM Consumer Sentiment : 57.9 (Forecast: 63.1 | Previous: 64.7) – A sharp decline, indicating consumer pessimism about the economy.

UoM Inflation Expectations : 4.9% (Previous: 4.3%) – A worrying increase, which could push the Fed toward a more hawkish stance.

Declining consumer sentiment may pressure the Fed to adopt a more accommodative stance, which is positive for risk assets like Bitcoin.

Rising inflation expectations could increase demand for inflation-hedge assets like Bitcoin.

However, if the Fed sees inflation rising as a concern, they may maintain a tighter policy, which could weigh on markets.

Today's data presents mixed signals, but falling consumer confidence and rising inflation expectations could ultimately fuel Bitcoin's next leg up.

Based on the above explanation , I expect Bitcoin to rise to at least the upper resistance zone($87,000_$85,820) after completing its pullback and complete the mission of filling the CME Gap($86,400_$85,595) . Of course, a CME Gap($80,760_$80,380) has also formed.

In your opinion, has Bitcoin finished its correction or created an opportunity for us to escape again?

Note: If Bitcoin falls below $81,300, we should expect further declines.

Note: If Bitcoin goes above $87,800, we should expect further increases.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Bitcoin (BTC/USD) Technical Analysis & Trade Setup Market Structure & Key Levels:

The Bitcoin (BTC/USD) 4-hour chart displays a descending channel breakout, followed by a range-bound consolidation phase.

Key Support Levels:

$78,000 - $77,320: A strong demand zone where buyers have previously stepped in.

$80,000: Psychological support level.

Key Resistance Levels:

$84,340: Short-term resistance currently being tested.

$85,996: Next major resistance level.

$89,363: Target resistance level if a breakout occurs.

$92,331: A higher timeframe resistance level.

Chart Pattern & Price Action:

Descending Channel (Early March)

Price was in a downtrend, forming a descending channel pattern.

The breakout from this channel led to a shift in momentum.

Range Consolidation (Current Pattern)

After the breakout, BTC entered a sideways accumulation phase (marked by the red box).

Price is bouncing between $82,000 - $84,500, showing low volatility and indecision.

Breakout Possibility (Bullish Bias)

A break above $84,500 could confirm a bullish move towards $85,996 and beyond.

The next major target is $89,363, which aligns with previous resistance.

Support Retest (Bearish Risk)

If BTC fails to break resistance, we might see a retest of $80,000 or even $78,000.

A break below $77,320 would invalidate the bullish scenario.

$BTC Bitcoin at critical point... Head and shoulder Pattern!CRYPTOCAP:BTC Bitcoin is at a critical point

Current price: 91000

Bitcoin has retraced over 16% from an all time high of 108k, Price action is currently forming a head and shoulder pattern which is usually a bearish pattern!

#btc needs to remain supported around 90.5k to continue its uptrend to all time highs at 119k

If MARKETSCOM:BITCOIN price action loses support at 90.5k then expect prices to retest supports at 85k and then 80k.

Definitely a critical point to watch! What do you think?

A possible scenario for Bitcoin over next 2 monthsI do think this has a Strong possibility of happening

MARCH will close as a RED Candle and the statisical expectation is that April will close GREEN and yet there are many reasons why Bitcoin Cannot rise a lot in April to make that Green

SO, We may see March drop down to the 74K area to end the month

This Gives PA the ability to Rise, hit that trend line and still Close the month GREEN and then take off in May.

Why May ?

Because that descending trend line perfectly matches the Weekly MACD decent and the date is when MACD reaches Neutral. Begining of May.

This is also why PA will likely be rejected from the Trend line before MAY

Should PA remain where it is now, it doesn't give a lot of room for April to close Green.

This really is just an Idea so we just need to see if it happens.

I do have a SPOt buy order sitting at 74779 just in case lol