Bitcoin - Bulls vs Bears: Who Will Win This Battle?Market overview:

Daily Timeframe

The daily chart is the foundation of this analysis, providing a macro perspective on Bitcoin’s current market structure. Price is trading between two critical zones, one acting as support and the other as resistance. These levels have historically played a significant role in Bitcoin’s price action, making them key areas to watch for potential breakouts or breakdowns.

Currently, Bitcoin has tested the lower support zone multiple times, showing that buyers are actively defending this level. However, each bounce has been met with selling pressure near the previous support-turned-resistance zone, which indicates indecision in the market. This price action suggests that Bitcoin is in a consolidation phase, where liquidity is building before a larger directional move.

There are two potential scenarios that will determine the next major trend:

Bullish Breakout:

If Bitcoin breaks above the resistance zone (the green-marked area on the chart), it would indicate a shift in market sentiment, with buyers taking control. This move would confirm that the recent downside movement was a temporary correction rather than a trend reversal. A clean breakout, followed by a successful retest of the level as support, would provide an ideal confirmation for a long position, targeting higher resistance levels.

Bearish Breakdown:

If Bitcoin loses the current support zone, it would confirm that sellers remain in control. A daily close below this level would likely trigger increased selling pressure, leading to a move towards lower support zones. In this case, a short position would be favored, with potential downside targets in mind.

Since price is still within this range, waiting for a confirmed breakout or breakdown is crucial before committing to a directional trade. Acting too soon, without confirmation, could lead to getting trapped in false breakouts or liquidity grabs.

4-Hour Timeframe – Liquidity Sweep & Bullish Reversal Signs

Looking at the 4-hour chart, Bitcoin has recently swept a major low, a move often associated with liquidity grabs. However, price did not close below this level, suggesting that the move was intended to trap sellers rather than initiate a true breakdown.

Liquidity sweeps occur when market makers push price below a previous low to trigger stop-losses and induce panic selling before reversing the price direction. This failure to break lower could be a sign that Bitcoin is gearing up for an upside move, but further confirmation is required.

1-Hour Timeframe – Key Level for a Bullish Breakout

The 1-hour chart further supports the bullish case, as it also shows a liquidity sweep of recent lows, similar to what was observed on the 4-hour timeframe. This confluence strengthens the idea that Bitcoin may be preparing for a move higher.

A key resistance level has been marked with a black line on the chart. This level represents the most recent structural high that must be broken and flipped into support to confirm bullish momentum.

Trading plan for a long position:

Break Above the Key High – Price must first move above the marked resistance level to signal strength.

Retest & Hold as Support – A successful retest of this level as new support would indicate that buyers are in control.

Entry for a Long Position – Once support is confirmed, a long position can be considered, targeting higher resistance levels.

If Bitcoin fails to break this level, the bullish thesis weakens, and attention should shift back to the daily support zone for potential bearish continuation.

Upcoming Bitcoin-Related News & Events to Watch

While technical analysis provides clear trade setups, macroeconomic events can heavily influence Bitcoin’s movement. Some key fundamental catalysts to watch in the coming days include:

CPI & Inflation Data (March 12, 2025) – Higher-than-expected inflation could negatively impact risk assets like Bitcoin, while lower inflation numbers could support a bullish breakout.

FOMC Meeting & Interest Rate Decision (March 20, 2025) – The Federal Reserve’s stance on interest rates will be crucial. A more dovish tone could provide a bullish tailwind for Bitcoin, while hawkish policy could lead to downside movement.

Final Thoughts

The daily range is the most critical structure to watch, whichever level breaks first will determine the trade setup.

The 4-hour liquidity sweep suggests potential bullish momentum but still needs confirmation.

The 1-hour key high must be broken and flipped into support before looking for long positions.

Macro events like CPI and Fed decisions could heavily impact Bitcoin’s movement.

__________________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

Bitcoinprediction

BTC 3 MONTHS LONG Starts, this week?Waiting for a last impulse 140 ds/3 months on INDEX:BTCUSD BITCOIN, this week could the 3 months BTC LONG START . Why? Let´s see:

- Channel with 4 elliot waves done. Looking for Wave 5.

- RSI 3D breaking out, like 1 year ago.

- RSI W Just about to Break out, like 1 year ago. Looking for confirmation.

- Rate Cuts this week, lets see.

www.tradingview.com INDEX:BTCUSD

Ethereum Downside to 1000!!!Ethereum has already broken the upward support trendline within the double top formation.

A break of that support line is bearish for Ethereum, especially now that it looks to complete its double top formation.

Ethereum may have a short interim bounce back to 2200 from todays levels of 1800. But will most likely fail to 1000, where that is the next support zone nearby.

Bitcoin looks like its on its way to retest its prior breakout zone of 65-70k, which would mean a 20% decline in bitcoin. If BTC were to decline 20%, this would bring a 40%+ decline in other coins including ETH. Which would indicate if BTC fell to 65k, it would solidify ETH drop to 1000.

Bitcoin’s Fair Value Gap Filling – Will Trendline Hold?Bitcoin is currently trading at its rising trendline support, which has been a key level for price action. On the 5D timeframe, BTC is respecting this strong upward trendline, indicating that buyers are stepping in to defend it. The previous resistance has now turned into support, adding confluence to this critical level. If BTC holds here, it could signal a bullish continuation, while a breakdown may trigger further downside.

On the 1D timeframe, BTC is filling the Fair Value Gap (FVG), a liquidity zone where price typically seeks balance before making the next move. The Stoch RSI is in the oversold region, suggesting that a bounce could be on the horizon if demand picks up.

Bullish Scenario : Holding above the trendline and reclaiming $81,500+ could trigger another leg up.

Bearish Scenario : Losing the trendline support and breaking below $76,000 could lead to deeper correction.

Key Levels to Watch:

✅ Bounce from $76,000-$78,000 → Potential bullish reversal

⚠️ Break below $76,000 → Risk of further downside

ETH at a Critical Support Level! Market Poised for a Big Move?Ethereum ( CRYPTOCAP:ETH ) is currently trading at a 261-week-old support level, making this a crucial zone for the market.

Earlier, ETH dipped to $1,754, a price level that has historically been significant. This could very well mark the bottom for ETH and potentially for altcoins. However, it's still too early to confirm.

The next two weekly candles will be key, if this support holds, we could see a strong altcoin recovery in the coming months.

Macro Factors at Play:

The broader geopolitical and macroeconomic landscape isn't great, despite this potential setup. Markets in the US, China, and India are facing turbulence, and the crypto market is experiencing low volume and liquidity. These factors could impact price action in the short term.

That said, as the chart develops over the next few weeks, we might witness significant shifts in market sentiment.

Sooner or later, BTC will make its move—either consolidating or attempting to reclaim $90K—while altcoins could start rebounding rapidly. When this happens, the market could turn bullish in a matter of weeks.

Stay Alert, The Opportunity Is Coming:

Now is the time to pay close attention to the charts and fundamentals. Stay sharp, monitor key levels, and prepare for potential opportunities.

I'll be sharing a handpicked list of altcoins that could perform well in the coming days.

DYOR , Not Financial Advice.

Stay tuned.

Do show your support buy hitting that like button.

Thank you

#PEACE

BTCUSDT Price Action | March 12, 2025BINANCE:BTCUSDT.P is now trying to recover from its 50% daily time frame correction. As per my analysis 79444 is now Buyers interest level to go long with stop loss of 76560 for targets of 83593, 85765 (50% Pullback level in 4 hour time frame).

Note. This is my personal analysis, please do your analysis and take decision for buy or sell with strict risk management. Thanks.

Breaking: Bitcoin Made a Comeback Surging 8%The world's first digital asset Bitcoin ( CRYPTOCAP:BTC ) shocked traders and investors alike as it surge 6% striking a comeback amidst the recent crypto bloodbath placing CRYPTOCAP:BTC in the FWB:83K zone with eyes set on the reclamation of the $100k Resistance.

Earlier on, we see Bitcoin retraced testing the $70k support point with many altcoins following suit. Should CRYPTOCAP:BTC break pass the $90k pivot point which is in lieu with the 38.2% Fibonacci point, a bullish campaign might evolved for CRYPTOCAP:BTC with odds set on the $120k zone.

Data from DefiLama shows industries and crypto projects are migrating to the Bitcoin blockchain network for scalability with about $5.414 Billion locked in Total Value Locked (TVL).

Bitcoin Price Live Data

The live Bitcoin price today is $83,341.47 USD with a 24-hour trading volume of $58,734,237,674 USD. Bitcoin is up 7.17% in the last 24 hours, with a live market cap of $1,653,114,998,100 USD. It has a circulating supply of 19,835,443 BTC coins and a max. supply of 21,000,000 BTC coins.

Heikin Ashi Trade IdeaCOINBASE:BTCUSD

In this video, I’ll be sharing my analysis of BTCUSD, using my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

Bearish on BITCOINThe bears seem to be in control and the bulls out of control, as long as the trend is negative, bears will keep pulling the price down to lower lows.

My target levels for todays trades are on the charts.

I prefer trading in the new york session, because that is when the volumes are high.

Any close(in 5 min time frame) below the levels and if the low of breakdown candle is broken , we can short for below target levels, with stop loss above high of breakdown candle.

Bitcoin BTC - Bottom Or The Bear Market? [READ CAREFULLY!]Hello, Skyrexians!

Let's update our BINANCE:BTCUSDT idea. Last time we told you that this is the bottom when price was at $80k previous time. Yesterday we posted a mind at $78k that "Don't panic, this is the bottom". Today we have the update on this crypto to give you the thoughts what can really happen next.

Let's take a look at the daily timeframe. We have shown you already the 5 Elliott wave cycle with two red dots on our Bullish/Bearish Reversal Bar Indicator . After that correction has been started. Now it looks like that price has finished the ABC zigzag and ready for the reversal. VERY IMPORTANT: price shall form the bullish bar and green dot on indicator on the daily close. We are still in danger, but if it will happen, it's going to be the strong long signal inside the Fibonacci 0.5-0.61 zone. After that the next impulse is going to happen.

P.S. On 4h and lower time frames picture is beautiful!

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Dollar Decline Fuels Bitcoin Bull Case, Macro Signal CautionThe intricate relationship between the U.S. dollar and Bitcoin continues to be a focal point of analysis within the cryptocurrency market. While a weakening dollar can indeed bolster Bitcoin's bull case, a confluence of other metrics necessitates a cautious outlook. The dynamic interplay between these factors creates a complex and volatile environment for Bitcoin.

The Dollar's Decline and Bitcoin's Ascent:

• A weakening U.S. dollar often strengthens the appeal of alternative assets, including Bitcoin. This is because Bitcoin, perceived by some as a hedge against inflation and the devaluation of fiat currencies, becomes relatively more attractive when the dollar's purchasing power diminishes.

• This inverse correlation stems from Bitcoin's nature as a decentralized, limited-supply asset, contrasting with the potentially inflationary nature of fiat currencies.1 When investors lose confidence in the dollar, they may turn to Bitcoin as a store of value.

"High-Stakes Game of Chicken" with Central Banks:

• The phrase "Bitcoin playing a high-stakes game of chicken" with central banks aptly captures the ongoing tension between decentralized cryptocurrencies and traditional financial institutions.

• Central banks wield significant influence over monetary policy, and their decisions can have a profound impact on the value of fiat currencies and, consequently, on the cryptocurrency market.2

• The potential for regulatory crackdowns or the introduction of central bank digital currencies (CBDCs) poses a considerable risk to Bitcoin's long-term prospects.

• Conversely, if central banks where to greatly devalue their currencies, it would greatly boost the Bitcoin bull case.

Concerning Metrics and Cautious Outlook:

• Despite the potential benefits of a weakening dollar, other metrics warrant a cautious outlook.

• Market volatility remains a significant concern. Bitcoin's price fluctuations can be extreme, making it a risky investment for those with low risk tolerance.

• Regulatory uncertainty continues to cast a shadow over the cryptocurrency market. Governments worldwide are grappling with the challenge of regulating cryptocurrencies, and any adverse regulatory developments could trigger a sharp sell-off.

• Also, the overall global economic climate, with the potential for recessions, and geopolitical instability, add layers of uncertainty to the market.

• Investor sentiment is also a huge factor. While there are times of great excitement, and "Fear of missing out"(FOMO), there are also times of great fear, that can cause large sell offs.

Key Considerations:

• Macroeconomic Factors: The broader economic environment, including inflation, interest rates, and economic growth, plays a crucial role in shaping Bitcoin's price trajectory.

• Regulatory Landscape: The evolving regulatory landscape remains a key factor that could greatly effect Bitcoin's price.

• Investor Sentiment: The psychological factors that drive investor behavior, such as fear and greed, can have a significant impact on Bitcoin's price.

• Technological Developments: Advancements in blockchain technology and the adoption of cryptocurrencies by mainstream institutions could provide a boost to Bitcoin's long-term prospects.

In essence, while the weakening U.S. dollar may provide a favorable tailwind for Bitcoin, investors must remain vigilant and consider the multitude of other factors that could influence its price. The "high-stakes game of chicken" with central banks underscores the inherent uncertainty of the cryptocurrency market, and a cautious outlook is warranted.

Bitcoin's November Low: Recession Fears, and Volatility

Bitcoin's recent slump, dipping below $80,000 to levels not seen since November, has sent ripples through the cryptocurrency market. This downturn, fueled by heightened recession fears and a complex interplay of macroeconomic factors, has triggered a wave of analysis and speculation. While some experts predict further corrections, others point to potential catalysts for a resurgence. Amidst this uncertainty, South Korea's ambitious push for a Bitcoin reserve and the burgeoning $BTCBULL presale add intriguing layers to the narrative.

The primary driver behind Bitcoin's decline is the growing apprehension of a global economic recession. Persistent inflation, rising interest rates, and geopolitical tensions have created a climate of uncertainty, prompting investors to seek refuge in traditional safe-haven assets. This risk-off sentiment has weighed heavily on Bitcoin, a notoriously volatile asset class.

Adding to the complexity of the situation is the ongoing tension between Bitcoin and central banks. As one expert noted, Bitcoin is "playing chicken with central banks" as the dollar experiences fluctuations. This dynamic underscores the fundamental debate surrounding Bitcoin's role as a potential hedge against traditional financial systems. The recent volatility surge following Donald Trump's comments on a Bitcoin reserve and the options expiry further exemplifies this tense relationship.

Despite the bearish sentiment, there are glimmers of optimism. South Korea's ambitious plan to establish a Bitcoin reserve has captured the attention of the crypto community. This move, if realized, could signal a significant shift in the adoption of Bitcoin by institutional players and governments. The implications are far-reaching, potentially bolstering Bitcoin's legitimacy as a store of value and a strategic asset.

The $BTCBULL presale, emerging amidst this volatile landscape, presents an interesting case study. In a market characterized by uncertainty, presales offer investors the opportunity to gain early access to potentially high-growth projects. However, they also carry inherent risks, and their success depends on a multitude of factors, including market conditions, project fundamentals, and community support. The $BTCBULL presale’s ability to attract investors during this period of market downturn will be a good indicator of overall market sentiment. Should it succeed, it may indicate that despite the general bearishness, there is still strong interest in projects that are perceived to be innovative, or to offer a unique value proposition.

The current trading range of $78,000 to $82,000 reflects the market's indecision. Bullish momentum has clearly faded, leaving traders grappling with the implications of shifting macroeconomic conditions. The volatility witnessed in recent days underscores the need for caution and strategic decision-making.

Furthermore, the impact of regulatory developments cannot be ignored. Governments worldwide are grappling with the challenge of regulating cryptocurrencies, and any significant regulatory changes could have a profound impact on Bitcoin's price and adoption. The ongoing debate surrounding stablecoins, DeFi, and central bank digital currencies (CBDCs) adds another layer of complexity to the market.

In conclusion, Bitcoin's recent fall to November lows is a reflection of the broader economic uncertainties and the inherent volatility of the cryptocurrency market. While recession fears and bearish predictions dominate the headlines, South Korea's ambitious Bitcoin reserve plan and the $BTCBULL presale offer glimpses of potential future growth. Investors must navigate this complex landscape with caution, carefully considering the interplay of macroeconomic factors, regulatory developments, and market sentiment. The current volatility serves as a reminder of the need for thorough research and a long-term perspective. Whether Bitcoin retests lower support levels or stages a comeback remains to be seen, but one thing is certain: the cryptocurrency market will continue to be a dynamic and unpredictable space.

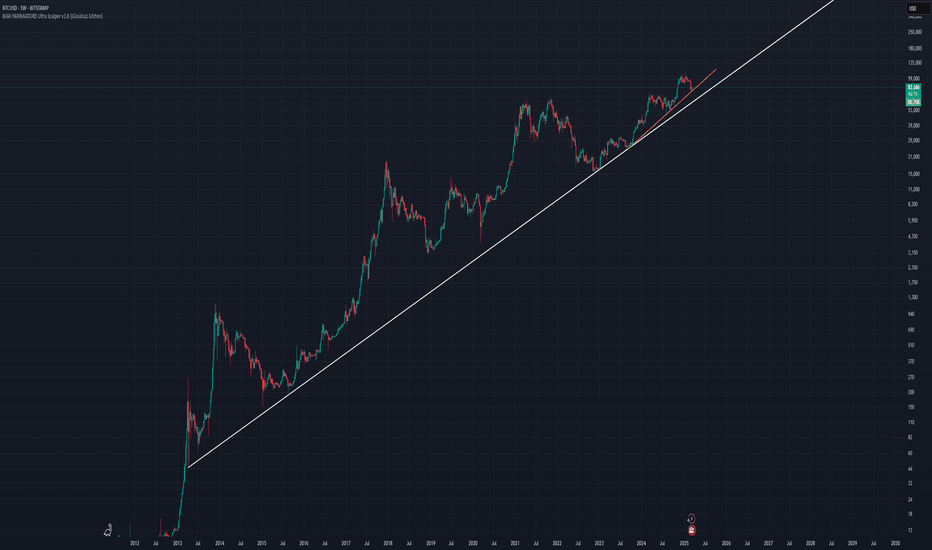

BTC - are we about to bounce?Hi All,

So just a thought and observation - let me know what you guys think. We have had 4 bounces

off this bottom green support trend line since 2023. Each time BTC shoots back up for a solid run.

Is the end near?

Am I hoping for an end to this blood bath correction which just dipped into the $79K range. Is there more to come, the chart says we should be done - or damn near the end.

Let me know your thoughts!!

Bitcoin - Will history repeat itself?In this analysis, we are observing the potential repetition of market history by comparing the current Bitcoin price action to the previous bullrun cycle. By utilizing Fibonacci retracement levels, historical patterns, and the current macroeconomic landscape, we can formulate a hypothesis that the market might follow a similar trajectory if bearish sentiment prevails.

Historical Comparison

During the last bullrun, Bitcoin experienced significant price appreciation before eventually reaching a new all-time high (ATH). However, one key observation from the previous cycle is that before Bitcoin reached its ATH, the price retraced to the 0.618 Fibonacci retracement level multiple times. This level acted as a critical support zone, where the price found demand before making the next leg upward.

Currently, we are seeing a similar pattern unfolding. Bitcoin has recently experienced a parabolic rise, reminiscent of the previous bull cycle. As the market is showing early signs of exhaustion, the possibility of a deeper retracement towards the 0.618 Fibonacci level (around $50,000) is becoming increasingly plausible. If history repeats itself, this level could act as a springboard for the next significant price increase.

Last bullrun we had a 77% drop, and from the current ATH its only a 55% drop to the fib level:

Bearish Sentiment and Market Dynamics

Despite positive news emerging globally, such as the USA announcing its Bitcoin reserves and other adoption-related headlines, the market has reacted negatively, which is a characteristic of bearish sentiment. This kind of price action aligns with what we saw in previous cycles, where good news failed to provide upward momentum as the market was already in a distribution phase.

The fact that Bitcoin has failed to sustain gains even amid positive news further reinforces the likelihood of a deeper retracement. The market is driven by liquidity cycles, and the large players may still be in the process of shaking out retail investors before the next parabolic move.

Key Fibonacci Levels to Watch

0.618 Level (~$51,500): Historically tested in the last cycle before the final leg up.

0.65 Level (~$48,500): Another confluence zone that could provide significant support.

0.786 Level (~$36,000 - $40,000): If the market becomes extremely bearish, this level could act as the final capitulation zone before the next macro bullrun.

Psychological and Macro Factors

Additionally, the broader macroeconomic environment plays a crucial role in this scenario. With ongoing geopolitical tensions, inflation concerns, and central banks' monetary policies, investors are more risk-averse, which could further contribute to the bearish price action.

Historically, Bitcoin has shown strong correlation to traditional markets, especially during uncertain times. If the macroeconomic environment remains unstable, Bitcoin could follow traditional markets into a corrective phase before making a recovery.

Daily Chart Imbalance Zones

On the daily chart, Bitcoin is currently trading between two key imbalance zones. These zones represent areas of liquidity where the market could either find support or break down further. The current price action suggests that if Bitcoin holds the imbalance zones as support, the market structure will still be intact, leaving the possibility for a continuation of the upward trend.

However, if these imbalance zones fail to hold, it would signal a bearish continuation pattern. In this case, the probability of Bitcoin testing the $50,000 level as the next major support becomes highly likely. Traders should closely monitor these zones, as they will play a pivotal role in determining the market’s next major move.

Conclusion

While no analysis can predict the future with certainty, the confluence of technical, historical, and macroeconomic factors suggests that Bitcoin might follow a similar pattern as the previous bullrun. A retracement to the 0.618 Fibonacci level around $50,000 is highly plausible before a new ATH is achieved. However, if bearish sentiment continues to dominate, we could see lower levels before the market finds its true bottom.

The current price action, coupled with negative market reactions to positive news, is an indication that larger players might still be accumulating before the next leg up. Traders and investors should remain cautious, monitor key Fibonacci levels, and be prepared for heightened volatility in the coming months.

Only time will tell if history will indeed repeat itself, but the current evidence suggests that the market might be following a familiar path once again.

Powell’s Speech & Bitcoin’s Decline: Is More Downside Ahead? Today, Fed Chair Jerome Powell is set to speak, and traders should brace for potential market volatility! Given the recent economic data , his tone is likely to be balanced but leaning hawkish .

Why a More Hawkish Powell?

1- Strong Job Market :

Unemployment Rate : 4.1% (Still low)

Non-Farm Payrolls (NFP) : 151K (Decent, but lower than before)

Average Hourly Earnings : 0.3% (Steady wage growth)

This suggests that the labor market remains resilient, which might discourage the Fed from cutting rates too soon.

2- Inflation Still a Concern :

Wage growth and inflationary pressures persist, which means Powell may emphasize keeping rates steady longer to combat inflation.

3- Markets Are Too Optimistic on Rate Cuts :

Investors are heavily betting on rate cuts in 2024, but Powell may push back against these expectations to prevent excessive risk-taking.

Powell will likely maintain a cautious yet hawkish stance to manage expectations. Big price swings are expected across forex, crypto, and commodities—so stay alert! (Of course, this is just a personal analysis).

In addition to Donald Trump , Signs Executive Order to Create Bitcoin Strategic Reserve

Of course, today, we didn't see any strange movement in Bitcoin, and probably, the proverb " buy the rumor, sell the news " was fulfilled.

----------------------------------------------------------

Now let's take a look at the Bitcoin chart on the 1-hour time frame and also take help from technical analysis tools .

Bitcoin ( BINANCE:BTCUSDT ) is in a Heavy Resistance zone($93,300_$89,250) and has started to decline from Potential Reversal Zone(PRZ) .

From a Classic Technical Analysis , Bitcoin appears to move in a Symmetrical Triangle .

According to Elliott Wave theory , Bitcoin has completed the Double Three Correction(WXY) , and we should wait for the next bearish wave .

I expect Bitcoin to attack 200_SMA(Daily) again after breaking the lower line of the Symmetrical Triangle .

Note: Bitcoin is likely to pump more if the symmetrical triangle's upper line breaks.

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

BTCUSDT Analysis – From Simple to Complex!BTCUSDT Analysis – From Simple to Complex! 🚀

“Let’s break it down step by step. At first glance, the first red line looks like an obvious resistance point. But here’s the deal—it’s too obvious. And in trading, when something is too obvious, it often doesn’t work as expected.”

Basic Structure:

📌 Red Line = Clear Resistance – Everyone sees it, but that also means it could be a trap.

Now, Let’s Get Deeper...

🔍 Volume Analysis Changes the Game:

Weekend Moves with Low Volume = High Manipulation Risk – Crypto loves to fake out retail traders in these conditions.

Look at the Black Line Inside the Blue Area – This is where things get interesting. This level could be the true battleground between buyers and sellers.

CDV & Volume Profile Will Guide Us – We need confirmation from buying and selling volumes before making any major moves.

Final Thoughts:

“At first, the chart looks simple, but once you add volume analysis, things get more complex. Don’t trade based on what looks obvious—trade based on what’s actually happening in the order flow. I’ll explain the next step in my following post!”

📉 Stay smart, stay ahead! 🔥

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

I have a long list of my proven technique below:

AVAXUSDT Perfect Short Entry!

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total