Bitcoinprice

Bitcoin(BTC/USD) Daily Chart Analysis For Week of March 28, 2025Technical Analysis and Outlook:

Bitcoin underwent several significant peaks as it completed the Interim Coin Rally 88400. Subsequently, it experienced a decline, moving towards the Mean Support 82500, with the possibility of extending its trajectory to retest the previously completed Outer Coin Rally 78700. An upward momentum may be initiated from the Mean Support of 82500 or the Key Support of 79000/completed Outer Coin Dip of 78700.

Ethereum Major Breakout Confirmed, Targeting $7800Ethereum has just confirmed a major breakout above a critical resistance zone, signaling a strong bullish continuation. Here's the detailed breakdown:

1.Ascending Triangle Breakout:

ETHUSD had been consolidating within an ascending triangle pattern since late 2024, with the upper resistance around $4000 and a rising support trendline (highlighted in yellow).

The breakout above $4000 on high volume confirms the bullish pattern, often a precursor to significant upward moves.

2. Accumulation Zone:

Prior to the breakout, ETH spent several months in an accumulation zone between $2000 and $4000. This phase allowed buyers to build positions, setting the stage for the current rally.

3. Price Targets:

The measured move of the ascending triangle (height of the pattern) projects a target around $7800. This is calculated by taking the height of the triangle (from the base at $2000 to the resistance at $4000, which is $2000) and adding it to the breakout point ($4000 + $2000 = $6000). However, considering the momentum and historical price action, the next psychological level at $7800 seems achievable.

4. Support Levels:

The previous resistance at $4000 now acts as strong support. If ETH pulls back, this level should hold to maintain the bullish structure.

Additional support lies around $3000, aligning with the 50-day moving average (not shown but inferred from typical setups).

5. Momentum Indicators:

While the chart doesn’t display specific indicators like RSI or MACD, the sharp upward move suggests strong momentum. Traders should watch for overbought conditions on RSI (above 70) as ETH approaches higher levels, which could signal a potential pullback.

BTC/USDT: Strategic Entry Points for a Potential Bullish ReversaAnalysis of Key Positions in the BTC/USDT Chart

The chart provided shows a 30-minute timeframe for Bitcoin (BTC) against Tether (USDT) on Binance. The chart includes two labeled positions ("Position 1" and "Position 2") that highlight key areas of interest for traders. Below is a detailed breakdown of these positions:

---

1. Position 1

- Location: Near the horizontal green support line, around the $83,600 level.

- Significance:

- Support Zone: This area acts as a strong support level, where the price has previously bounced back after testing it. The horizontal green line indicates that this level has held firm multiple times, suggesting it is a critical zone for buyers.

- Potential Entry Point: Traders can consider entering long positions near this support level if they believe the price will reverse higher. This is a classic "buy the dip" strategy.

- Stop-Loss Placement: To manage risk, traders should place stop-loss orders slightly below this support level (e.g., $83,200–$83,400). If the price breaks below this level, it could signal a continuation of the downtrend.

2. Position 2

- Location: Near the descending blue trendline, around the $85,000–$86,000 range.

- Significance:

- Resistance Zone: The blue trendline acts as dynamic resistance, and the price has been bouncing off this level multiple times. A breakout above this trendline would be a strong bullish signal, indicating that buyers have overcome short-term selling pressure.

- Potential Entry Point: Traders can consider entering long positions after a confirmed breakout above the trendline. A breakout is typically confirmed when the price closes above the trendline on a candlestick.

- Stop-Loss Placement: For safety, traders should place stop-loss orders just below the trendline (e.g., $84,800–$85,000). This ensures that the trade is exited if the breakout fails and the price reverses lower.

---

Comparison Between Position 1 and Position 2

- Position 1 (Near Support):

- Risk Profile: Lower risk, as it is closer to a well-defined support level.

- Reward Potential: Moderate, as the upside target would likely be the next resistance level (e.g., the trendline or Fibonacci retracement levels).

- Strategy: Suitable for traders who want to enter at a cheaper price but are willing to take on some downside risk.

- Position 2 (Near Trendline Breakout):

- Risk Profile: Higher risk, as it requires waiting for a confirmed breakout.

- Reward Potential: Higher, as a successful breakout could lead to a stronger upward move.

- Strategy: Suitable for traders who prefer confirmation before entering long positions.

---

Actionable Insights

1. For Short-Term Traders:

- Entry Strategy: Look for pullbacks to the $83,600 support level to enter long positions. Use tight stop-loss orders below the support to manage risk.

- Exit Strategy: Set profit targets based on Fibonacci retracement levels or previous highs (e.g., $85,000–$86,000).

2. For Long-Term Traders:

- Entry Strategy: Wait for a confirmed breakout above the blue trendline ($85,000–$86,000) before entering long positions. This ensures that the bullish trend is sustainable.

- Exit Strategy: Use trailing stops or take profits at key resistance levels (e.g., $87,000–$88,000).

---

Risk Management

- Always use stop-loss orders to protect against unexpected price movements.

- Consider using position sizing to limit exposure to market volatility.

- Monitor volume and momentum indicators to confirm the strength of any breakout or reversal.

---

Conclusion

The two positions highlighted in the chart provide distinct trading opportunities:

1. Position 1 (Near Support): A potential entry point for aggressive traders looking to buy the dip near $83,600.

2. Position 2 (Near Trendline Breakout): A safer entry point for traders who prefer confirmation before entering long positions near $85,000–$86,000.

By combining these positions with proper risk management and technical analysis, traders can increase their chances of success in the BTC/USDT market.

---

Final Answer: The two positions indicate key trading opportunities:

- Position 1: Near the $83,600 support level, suitable for traders willing to buy the dip.

- Position 2: Near the $85,000–$86,000 trendline breakout, ideal for traders seeking confirmation before entering long positions.

Bitcoin Daily UPDATE - something for the weekend sir ?Chances are we will see PA Drop over the weekend if what has happened today is anything to go by

As mentioned in apost this morning, Pa fgot rejected off the upper trend line of the descending channel and currently Sits on the POC ( point of control ) on the VRVP ( Vivible Range Volume Profile )

The Drop if we loose this support could be swift but we do have support lines below to try and hold up the fall

But again, as mentioned, a drop is NOT such a bad thing....unless we loose 73K, in which case I will seriously think again about what I Hold.

The 4 hour chart shows the current situation more clearly

If we do bounce of this, remain cautious....we need to get over and Hold 91K before we start screaming "ATH"

For me, I have opened anotehr Spot order at 74K

I go higher than the expected Low incase the visit to the low is a Very quick wick down and the order does not have time to fill.

DO NOT PANIC

Have a good Weekend

Alternatively, Bitcoin just Drops to 73K in the near future In a slight contradiction to my previous post - as I like to consider ALL options and present them to you, so YOU can make up your own mind.

I saya SLight contradiction, as 73K is Still the target here.

See this channel AP is in? The descending channel we been in for a while.

We seem to be getting rejected off the upper trend line.

The lower line crosses the 1 Fib extension and Hits the rising Long term support around 73K

We do have Support just below the Current PA position on the POC ( Point of control) of the VRVP

So, Hang on and we wait to see what happens.

If PA returns to 78K and then 73K - DO NOT PANIC

This would be SUPERB buying opportunities

So, Consider all the possibilities I have sugested today, Make up your own minds and, if you want to, please do leave a comment

Bitcoin -potential to 91K, back to 78K wick to 73K and THEN -->>In this cycle, since the push up from the Low in Jan 2023, we have had 2 other Major pushes.

Each of these came off the Rising line of support that we are currently heading towards again, with the date of "Touch" currently in Mid June.

If we rise and stay back in the higher Range Box, that date is even later in the year ( around Mid Q4 )

As I have talked about many times, I am watching the MACD as the "trigger".

The chart below is the Weekly MACD

We reach Neutral , if we continue current rate of descent, around end of April

This is obviously before we would hit the line of support being talked about above.

That leaves 2 possibilities.

1) - MACD may drop below Neutral

2) - We may see a bounce from PA but NOT to a New ATH

If you look back at previous range we had in 2024, there was a bounce there.

See how the Histogram went White as we had that bounce

We Just had a white bar on the histogram .

Will we see another White bar next week and a further rise in PA

Top of current Range box in 91K - We could head to that again, Drop back to the Low around 78K and then we would be ready. This would be over the next 3 - 6 weeks

78K is the Price that touches that line of support the soonest, in early June

Why could we go back down?

For the reasons above regarding the MACD BUT ALSO ;-

There are things called FAIR VALUE GAPS (FVG)

. These gaps highlight market inefficiencies and potential trading opportunities, allowing traders to anticipate price movements and confirm trends.

That area just below Current PA on this weekly chart is the FVG that goes down to 73K

It is NOT guaranteed that PA will revisit that area but while we sit so close, the potential exists

But something to note, that could be benifical is that Should PA Drop to Fill that Gap, PA could hit that line of support earlier than Mid June..infact, it would be a month earlier and be in Mid May.

So, I can see the potential for a push higher in the near future, to extend MACD, then a drop back to the range Lows, a Sharp wick down to around 73K and THEN a sustained push higher...

This is just an idea.....No guarantees...But it does have Potential

We will see - Time will tell...........

BTC/USDT - The moment of truthThe BTC/USDT chart highlights a crucial moment as the price breaks out of a bearish trendline and tests a Fair Value Gap (FVG) zone. Key scenarios include:

- A potential continuation of the bullish trend if the price successfully holds above the FVG zone and confirms support.

- Alternatively, a rejection at this level could signal a return to bearish momentum.

Keep an eye on price action within the FVG zone for confirmation of the next move. Which way do you see BTC heading?

Is Bitcoin slowly forming a top? What to expect from the market About a week ago, I posted that the recent uptick in BTC (and the broader crypto market) was as a result of Bears taking profits and that the market will dip lower once this correction runs its duration. Well, so far, my prediction is still on track and we can expect prices to climb higher over the next few days (maybe even a week from when this is published).

I believe that that mini rally (black path) within the larger uptrend (green path) has enough juice for one more leg before it pulls back. Once that happens, price might stall around that area and then push higher, setting the stage for the final leg of the larger upswing.

I personally don't like trading matket correction unless they're on the weekly or monthly chart. However, I will keep monitoring price until my prediction plays out.

What are your predictions for Bitcoin's short term price? Let me know in the comments section below.

Make sure you follow me to get future updates as they unfold.

Bitcoin Stalls Below $90,000 as Buying Pressure WeakensThe last four trading sessions for Bitcoin (BTC) have been fairly neutral, with the cryptocurrency fluctuating by around 2% , staying just below the critical $90,000 resistance level. The current uncertainty in the market is mainly driven by the renewed trade war narrative, following Trump’s recent comments about imposing tariffs on cars and auto parts. These statements have once again elevated global economic concerns, prompting investors to avoid risk assets in the short term — a category that includes Bitcoin. As long as this uncertainty persists, this neutral behavior could remain a defining feature of BTC in upcoming sessions.

Key Bearish Channel in Play

Since January 20, a notable bearish channel has taken shape, favoring selling pressure and driving BTC down to $77,000 in recent weeks. At present, the price is testing the upper boundary of the channel, but recent buying attempts have not been strong enough to trigger a breakout.

RSI Indicator

The RSI line initially showed a strong upward slope, but this momentum has faded as the indicator approaches the neutral 50 line, suggesting a balance between buyers and sellers. This reinforces the resistance posed by the upper edge of the bearish channel.

MACD Indicator

A similar situation is developing in the MACD, where the histogram has begun to decline steadily, nearing the zero line. This behavior points to a lack of strength in the moving average trends and may indicate that neutrality could continue to dominate BTC price action in the near term.

Key Levels:

$98,900 – Distant resistance: This level sits near the mid-range zone of a large sideways range observed in previous weeks. A bullish move toward this area could revive the forgotten bullish bias and reestablish the importance of the broader lateral structure.

$90,000 – Major resistance: Arguably the most relevant resistance zone at the moment. It aligns with the Ichimoku cloud and the upper limit of the current bearish channel. A breakout above this level could jeopardize the prevailing downtrend and introduce a strong bullish momentum.

$78,600 – Key support: This level marks the recent low for BTC. If the price drops back to this zone, it could provide confirmation for the continuation of the bearish channel.

By Julian Pineda, CFA – Market Analyst

Bitcoin - Please Just Listen To The Charts!Bitcoin ( CRYPTO:BTCUSD ) remains in a bullish market:

Click chart above to see the detailed analysis👆🏻

Despite literally everybody freaking out about cryptos lately, big brother Bitcoin is still creating bullish market structure. During every past cycle we witnessed a correction of at least -20% before we then saw a parabolic rally. So far, Bitcoin is just doing its normal "volatility thing".

Levels to watch: 70.000, $300.000

Keep your long term vision,

Philip (BasicTrading)

BTCUSDT - Low Time Frame Support Level I believe that BTCUSDT is at a critical level right now, and this blue box combined with the blue line is where we could see some price reaction. However, don't expect a major move, this is a low timeframe zone that might only give us smaller, more precise opportunities.

🔹 What To Watch For:

Reaction Potential: If the price touches this blue box and blue line, there may be a short-term reaction, but don't overestimate it.

Low Timeframe Focus: Keep an eye on the lower timeframes for breakouts or rejections around these areas.

Patience Is Key: This isn't a large move zone, so we will wait for confirmation before acting.

💡 Stay Smart: Always trade with confirmation. If the price moves fast and unexpectedly, we won't chase it. Stay in control, and wait for the right signals!

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

BTC/USDT Analysis: Local Buyer AggressionYesterday, Bitcoin continued its downward movement. At one point, after breaking the local level of $86,300, buyers defended the price, pushing it back into a narrow range.

Currently, it's worth noting the repeated defense at around $86,700, where a significant buyer volume has accumulated (as indicated by the positive delta in that bar). Given this, we may see a retest of the local high from the current levels.

Despite this, the primary scenario remains a correction toward the sell zones. This is supported by the nature of the current uptrend, characterized by weak new highs, as well as selling pressure reflected in the delta.

An alternative scenario would be a full breakout of the current high on strong volume, which could indicate a continuation of the trend.

Sell Zones:

$95,000-$96,700 (accumulated volumes)

$97,500-$98,400 (pushing volumes)

$107,000–$109,000 (volume anomalies)

Buy Zones:

$84,400-$82,900 (accumulated volumes)

$77,000-$73,000 (volume anomalies, pushing volumes)

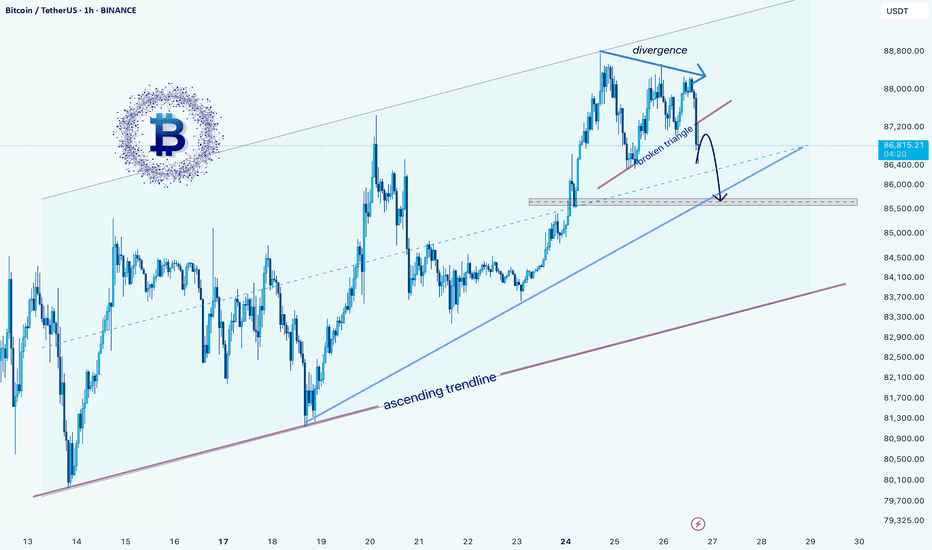

Bitcoin Price Analysis: Potential Correction Ahead?hello guys

The Bitcoin/USDT chart shows an ascending channel with recent price action forming a divergence at the top, indicating potential weakening momentum. A bearish breakout from a smaller triangle suggests a short-term correction. The price may test the ascending trendline around $85,400, where a key support zone exists. If this level fails, a deeper correction toward the major support area around $76,800 could follow. However, if Bitcoin holds above the trendline, the uptrend could resume.

Traders should watch price action around the $85,400 level for confirmation of further downside or a potential bounce.

Bitcoin Looking Bullish on 4 hour - printing a bull FlagBitcoin is certainly looking Bullish on the lower time frames and, in my opinion, continur to fall in the Flag till we get near that lower Trend line of Ascending channel we been making since the Low around 76K

The 4 hour MACD is falling Bearish and support the idea of a continues Drop to lower Trend line

I think the Margins are too tight to do any day trading

Just Sitting, waiting.

Longer term, I am still prepared to see another Drop Lower but maybe not to the 76K range again.

The Monthly candle for March is currently Green off an expected RED.

It has Long wicks above and Below, showing a good fight between Bulls and Bears.

The Body of this candle is not Big but it would take a serious drop out of range to turn it red

So, RELAX

We should be OK

BTC/USDT Analysis: Moving Within Our ScenarioYesterday, after testing the $88,000-$88,600 sales zone (local volume zone), Bitcoin began to follow the scenario we outlined.

At the moment, we still expect a decline in the first cryptocurrency. Several factors indicate this: a trend with weak updates of each new high and a downward cumulative delta.

Reviewing the chart on a higher timeframe, we have identified a potential support level in the form of the POC of the current uptrend. However, our primary scenario remains a decline toward the $76,700 low.

Sell Zones:

$95,000-$96,700 (accumulated volumes)

$97,500-$98,400 (pushing volumes)

$107,000–$109,000 (volume anomalies)

Buy Zones:

$84,400-$82,900 (accumulated volumes)

$77,000-$73,000 (volume anomalies, pushing volumes)

Stablecoin liquidity = Bitcoin bullish thesis --> $109k?Can BTC soon climb to the $109,000 level thanks to stablecoin liquidity? Maybe yes!

An increase in stablecoin market cap often signals more money entering the crypto space, indicating bullish sentiment as investors prepare to deploy capital. This increased liquidity can lead to smoother trading and attract more participants, potentially driving up Bitcoin's price.

The chart clearly illustrates this relationship:

Purple line ( CRYPTOCAP:USDT + CRYPTOCAP:USDC + CRYPTOCAP:DAI + CRYPTOCAP:USDEE market cap) shows steady growth

Bitcoin candle chart ( COINBASE:BTCUSD price) follows with more volatile increases

Blue line at the bottom: BTC and stablecoin correlation coefficient of 0.9 😊

This correlation can serve as a leading indicator for Bitcoin price movements. During downturns, investors might sell Bitcoin for stablecoins, but as sentiment shifts, this "dry powder" can quickly flow back, driving Bitcoin's price up.

Adding to that, the long-term correlation coefficient between stablecoin liquidity market cap (USDT+USDC+DAI+USDE) and Bitcoin is 90%. So, yes, there's a strong long term correlation and usually BTC and stablecoin liquidity converge.

According to my views on the stablecoin liquidity, the Bitcoin price should target the $109k level.

Last time I made this analysis, Bitcoin jumped from $58k to my price target of FWB:73K in the span of 2 months.

Let me know your thoughts.

Where are we with BITCOIN ? 4hour, Daily and Weekly charts tell I am hearing so many people shouting about "This is it, we are on the way"

It may turn out to be right BUT for me, It seems people are looking at the smaller Time Frames only.

Sure, the main chart here is a 4 hour chart, has been climbing from around 76K ( Told you we would go there )

Looks Lovely and Bullish, though a return to 80K is very possible on the lower trend line

Lets Look at the Daily.

And there it is, Even though on a shorter Time Frame, we seem to be climbing, and we are, it is in fact, all with in a DESCENDING channel

But do not worry, a Bullish sign is that PA does appear to have broken over that Upper trend line of resistance.

We need to wait , probably till next week, to see if this remains Bullish or not.

It is Wise to take note of that Fib Circle that we are coming to in the next couple of weeks. If we get trough, we will hit resistance increasingly from 91K

And so now the weekly - this is a different chart to the Daily

The Bigger picture ALWAYS tells us the reality of the situation. and that is simply that PA is currently on a line of strong Local support (dashed line )

Should this fail, we have strong support below, all the way to 70K.

Be fully aware, this COULD FAIL. We are Mid channel, MACD is still falling Bearish and at current rate of descent, will arrive at Neutral near end of April

The Bullish note is we are still above the 2.272 Fib extension. Sentiment is rising, Selling is Slowing

So in conclusion, we are in a Good place.

PA is becoming stronger and we have support below and PA has remained in "channel" for 3 weeks.

That is NOT Bearish

But we are also NOT in a Bull Run yet.

But, for me, I think we are certainly getting ready/.

As I have said, April may see Volatility, March looks like it may Close GREEN but htis has a week to go yet...

Bullish Caution is what I say - And so expect anther Drop out of this rising channel.

It would present excellent Buying opportunity and reset MACD quicker.

Aere we en-route to the New ATH ? We are getting Near but I still say the stronger probability for The CYCLE TOP ATH that is Early Q4