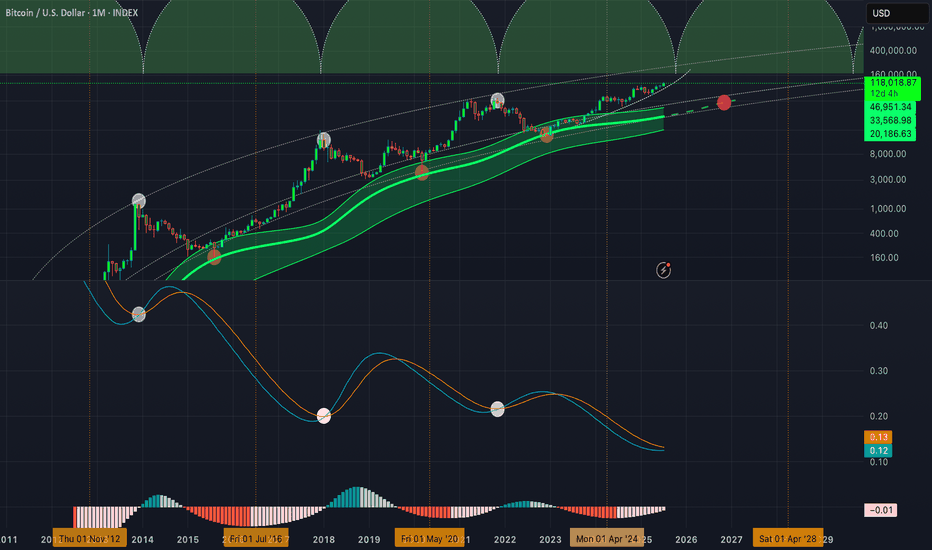

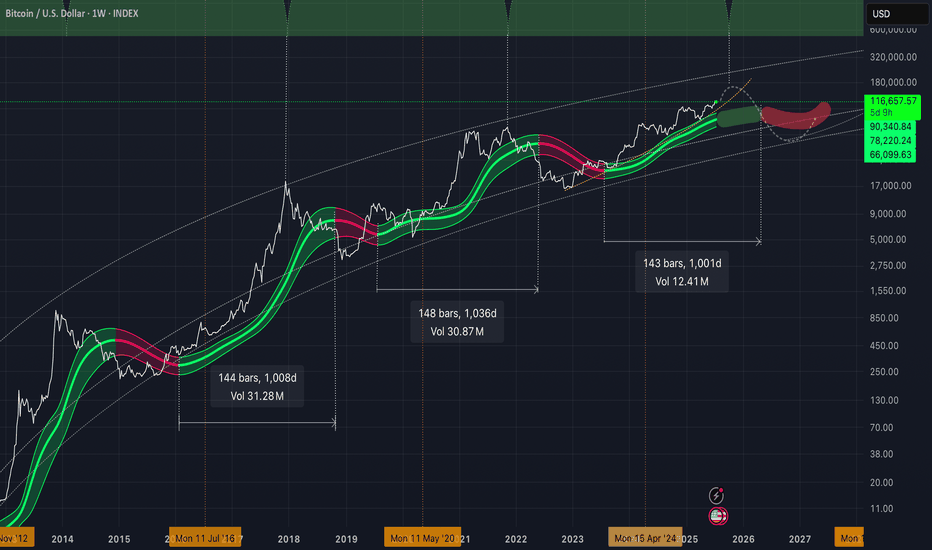

Gaussian will tell the exit signal!Please do not fomo at the current prices , instead be prepared to sell some once Gaussian LMACD signal line and lmacd line come together before crossing to the upside. Might be happening soon in the coming months Unfortunately this signals lags a little bit so you won't be catching the actual peak but we will be in a really good spot to get out before coming back down to the Gaussian Core in late 2026 around 40-50k.

Bitcoinprice

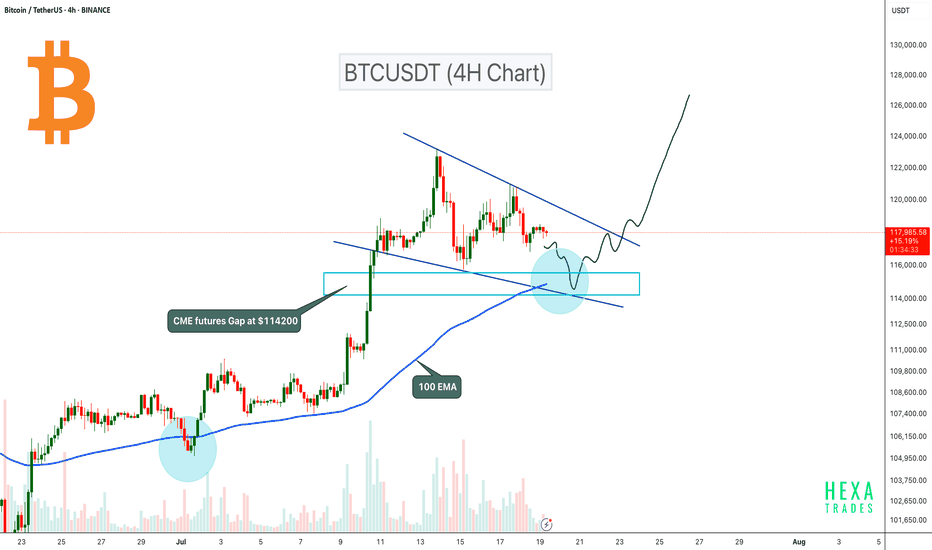

BTC Pullback Expected to $114K Before Next Leg Up!Bitcoin is currently consolidating inside a bullish flag pattern on the 4H timeframe. The price could retest the flag support, where the 100 EMA will act as dynamic support. Additionally, there is a CME futures gap at the $114,200 level, which also aligns with the 0.5 Fibonacci retracement level. Therefore, a retest to the $114,200 zone is likely before the next potential upward move.

A potential bullish reversal could occur if BTC retests this zone and confirms a bounce. A breakout from the bullish flag pattern could signal the next leg up.

Cheers

Hexa🧘♀️

BITSTAMP:BTCUSD CRYPTOCAP:BTC

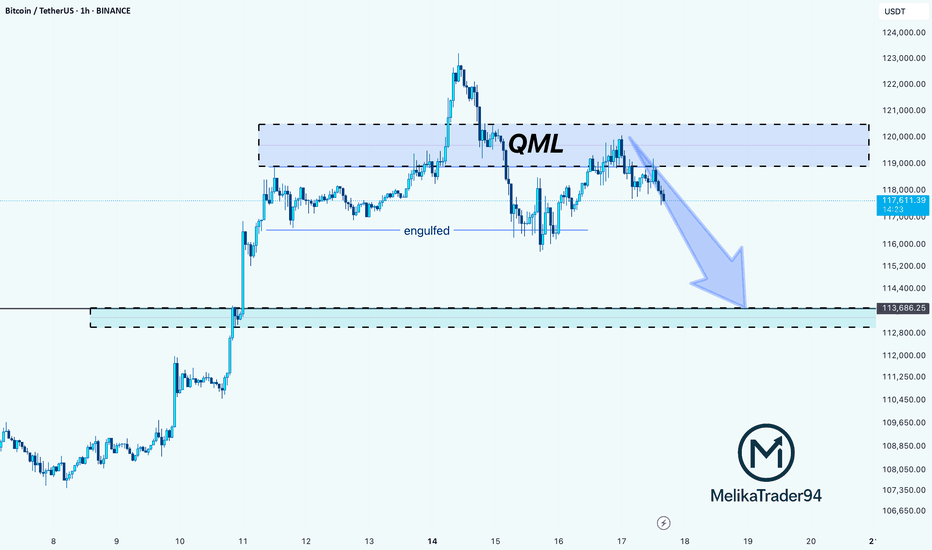

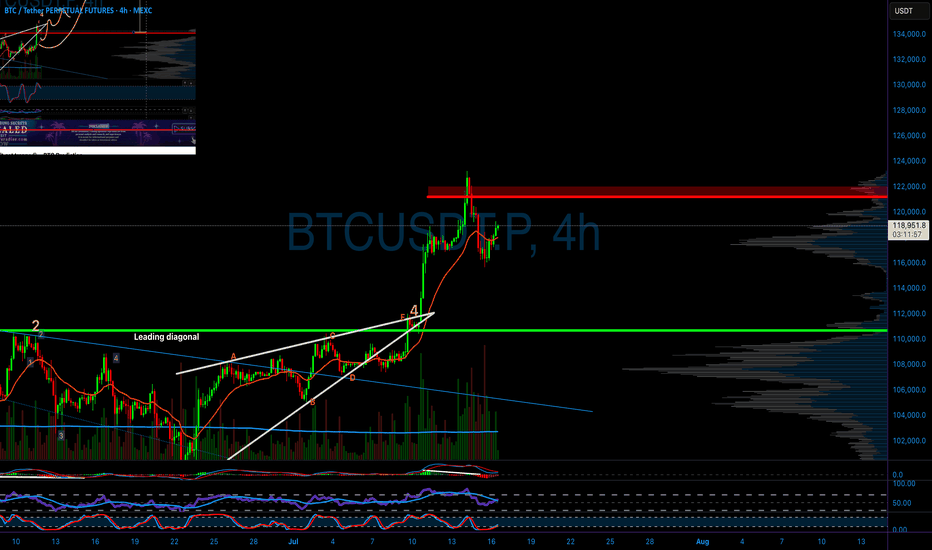

BTC Rejection from QML Zone: Towards on 113,600 SupportHello guys!

This chart shows a QML (Quasimodo Level) setup in play on Bitcoin. After price created a new high and engulfed the previous structure, it returned to the QML zone (around $119K–$121K) and reacted exactly as expected: strong rejection.

The sharp selloff from the QML area confirms a bearish shift in structure, and now the momentum is tilted to the downside.

The next key level to watch is the 113,600 demand zone, where the price may either bounce or consolidate.

As long as the price stays below the QML zone, bears have control.

You should consider that the main trend is bullish, and the stop loss may be hit, so please manage your risk!

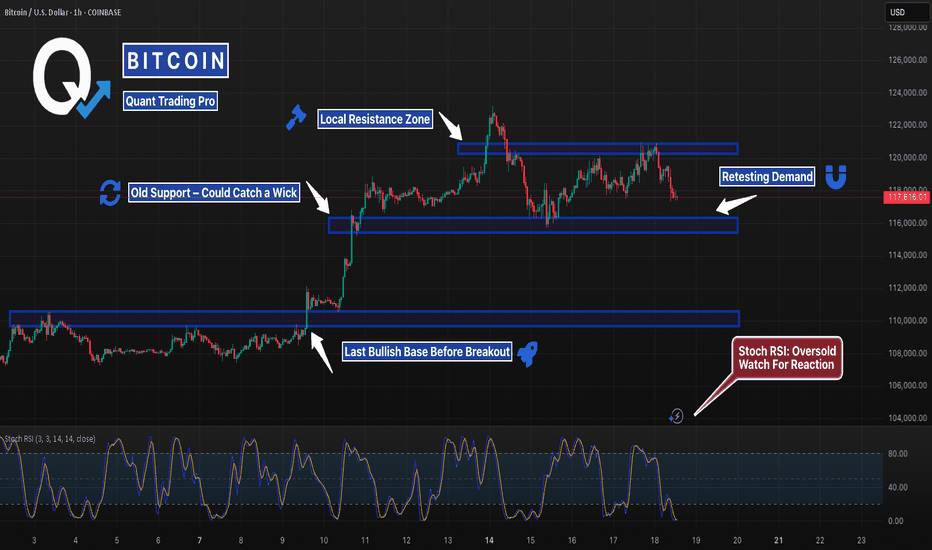

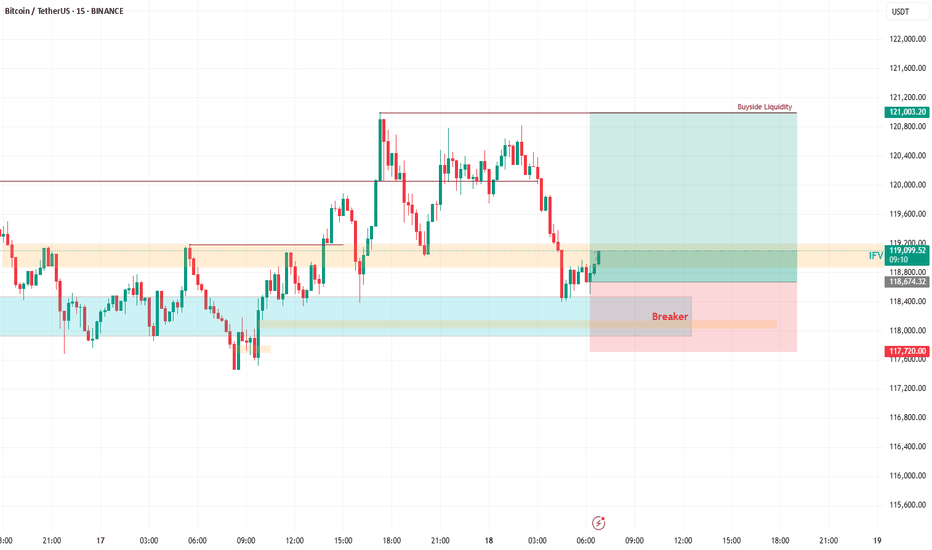

The Setup: Bullish Breaker in Play!Yesterday, BTC smashed into a strong bullish breaker and bounced like a champ. Today, it’s retracing back to this key level, setting up for what I expect to be another explosive buy reaction. Why? Because this breaker is rock-solid, and the price action is giving us all the right signals! Plus, it’s Friday—the last trading day of the week—and I’m betting BTC will stretch its legs to cover the weekly range. 🏃♂️

🎯 Trade Details: Where to Jump In

Buy Area: Right now, the price is teasing the breaker zone.

Stop Loss: Protect your capital with a stop loss at around ~117,700.

Target: We’re aiming for the Buyside Liquidity sitting pretty around 121,000. That’s a juicy move with solid risk-reward potential! 💪

🧠 Why This Trade Makes Sense

Bullish Breaker Strength: This level has proven itself as a springboard for price action.

Weekly Range Play: Fridays often see BTC push to cover its weekly range, and we’re in prime position to catch it.

Liquidity Grab: The Buyside Liquidity at 121,000 is like a magnet for price—let’s ride it there!

⚠️ Risk Management Reminder

Always trade smart! Use proper position sizing, stick to your risk management rules, and don’t go all-in like it’s a casino. Keep those stops tight to avoid getting wrecked by any sudden volatility. 😎

💬 Join the Conversation!

What do you think of this setup? Are you jumping on this BTC train or waiting for more confirmation? Drop your thoughts in the comments below! 👇 Also, if you like this idea, smash that LIKE button ❤️ and follow for more trade ideas to keep your portfolio poppin’! 🚀

Happy trading, and let’s stack those pips! 💰

#BTC #CryptoTrading #BuyTrade #Bullish #TradingView

BTCUSD | 1W Time Frame | BITSTAMP ExchangeI have been using curve analysis for Bitcoin on the weekly time frame for a long time, employing two indicators: My BTC Log Curve and Bitcoin Logarithmic Growth Curves, of course, with my own custom settings to achieve maximum harmony with price movements. I recommend that to gain a precise understanding of Bitcoin curve analysis, you search for and study it, and make use of the two free indicators mentioned above.

Bitcoin finally managed to break free from the curve floor in the second week of September 2023, initiating a logical and gradual upward trend. Currently, it is supported by a significant level around $84,000 (keeping in mind that this rate will gradually increase due to the market's floating nature). However, the most critical price ceiling for Bitcoin in the current bullish market trend is approximately $154,000. Given the acceptable momentum of the current upward trend, reaching this price target seems reasonable. Nevertheless, we should anticipate a corrective reaction from the market, considering the historical behavior in this price range.

In summary, it can be stated that for mid-term holders, the price target of $154,000 appears to be a realistic and attainable goal, while the price floor of $84,000 serves as a very suitable level for buying and re-accumulating.

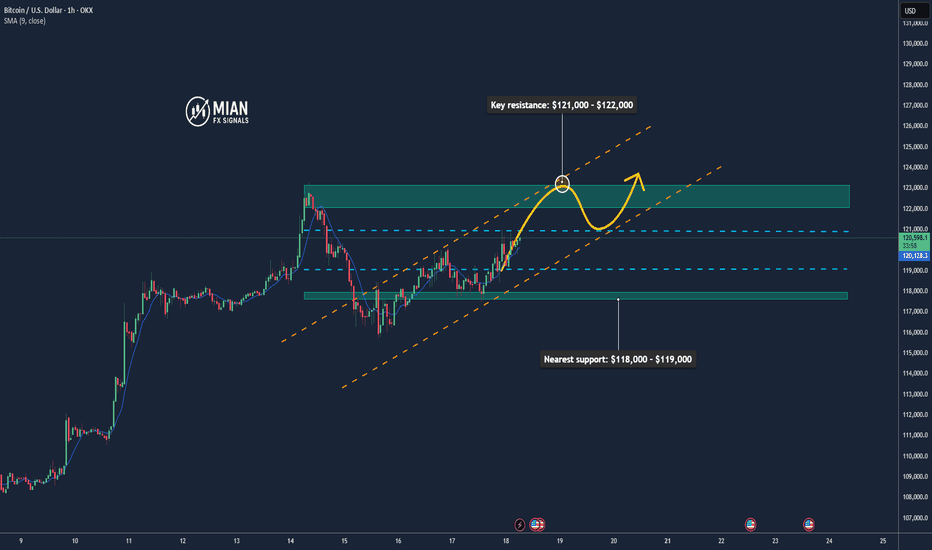

Bitcoin Extends Rally – Eyeing $121K+📊 Market Overview:

•Bitcoin is trading around $120,013, up +0.0149% on the day, with a daily range of $117,715 – $120,691 — continuing momentum after a historic rally.

•The rally is supported by strong inflows into BTC ETFs, institutional demand, and pro-crypto legislation recently passed in the U.S. House of Representatives.

📉 Technical Analysis:

• Key resistance: $121,000 – $122,000 (next technical target post breakout)

• Nearest support: $118,000 – $119,000 (aligns with 50 MA and previous consolidation zone)

• EMA 09: Price is above the EMA 09, confirming strong short-term bullish momentum

• Candlesticks / Volume / Momentum: RSI and MACD remain bullish; rising volume in ETFs and institutional flows confirm upward momentum.

📌 Outlook:

Bitcoin is likely to extend its gains in the short term if it holds above $119,000–$120,000 and institutional buying continues.

• Holding above $120,000 → potential to test $121,000 – $122,000

• Falling below $119,000 → risk of correction to $118,000

💡 Suggested Trading Strategy:

BUY BTC/USD at: 119,500 – 120,000

🎯 TP: 121,500

❌ SL: 118,500

SELL BTC/USD at: 121,000 – 122,000 (if bearish reversal signals appear)

🎯 TP: 120,000

❌ SL: 122,500

The Final Turn Before the Altcoin RotationAs Bitcoin continued its rise, altcoins couldn't keep up. This isn't the first time; the market has experienced this many times. The general pattern is as follows:

1. Global liquidity increases, providing a kind of spark to the market.

2. Bitcoin catches fire, and a bull market begins. If global liquidity increases during this time, great.

3. For various reasons, altcoins don't rise at the same pace as Bitcoin, and therefore Bitcoin's dominance begins to gradually increase.

4. When the market reaches saturation, dominance declines, leading to a rotation into altcoins.

5. The altcoin market capitalization equals Bitcoin's, and the bull market begins.

We're currently at a stage where Bitcoin's dominance has peaked and liquidity is still rising. The beginning of a decline in dominance will trigger a market rotation. This will trigger a capital flow into altcoins, bringing their market value equal to Bitcoin's.

Therefore, we're at the final plateau before entering a bull market. A further rise or hold in Bitcoin is expected. I'm currently buying altcoins, but I'm holding Bitcoin. I don't have a sell mindset at the moment.

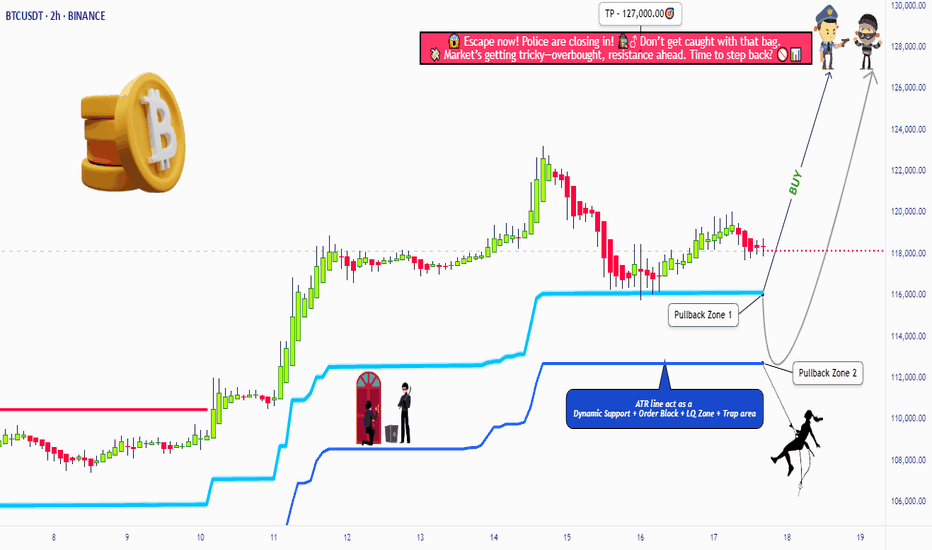

BTC/USDT Heist Mode: Buy Low, Escape Rich🏴☠️"Bitcoin vs Tether" Crypto Market Robbery Blueprint 🔥 | Thief Trading Style (Swing/Day Plan)

🌍 Hey Money Makers, Chart Hackers, and Global Robbers! 💰🤑💸

Welcome to the new Heist Plan by your favorite thief in the game — this time targeting the "Bitcoin vs Tether" Crypto Market like a smooth criminal on the charts. 🎯📊

This is not your average technical analysis — it's a strategic robbery based on Thief Trading Style™, blending deep technical + fundamental analysis, market psychology, and raw trader instincts.

💼 THE SETUP — PREPARE FOR THE ROBBERY 🎯

We're looking at a bullish operation, setting up to break into the high-value vaults near a high-risk, high-reward resistance zone — beware, it's a high-voltage trap area where pro sellers and bearish robbers set their ambush. ⚡🔌

This plan includes a layered DCA-style entry, aiming for max profit with controlled risk. Chart alarms on, mindset ready. 🧠📈🔔

🟢 ENTRY: "The Robbery Begins"

📍 Zone-1 Buy: Near 116200.00 after MA pullback

📍 Zone-2 Buy: Near 112600.00 deeper pullback

🛠️ Entry Style: Limit Orders + DCA Layering

🎯 Wait for MA crossover confirmations and price reaction zones — don’t chase, trap the market.

🔻 STOP LOSS: "Plan the Escape Route"

⛔ SL for Pullback-1: 113000.00 (2H swing low)

⛔ SL for Pullback-2: 110000.00

📌 SL placement depends on your position sizing & risk management. Control the loss; live to rob another day. 🎭💼

🎯 TARGET ZONE: “Cash Out Point”

💸 First TP: 127000.00

🏁 Let the profit ride if momentum allows. Use a trailing SL once it moves in your favor to lock in gains.

👀 Scalpers Note:

Only play the long side. If your capital is heavy, take early moves. If you’re light, swing it with the gang. Stay on the bullish train and avoid shorting traps. Use tight trailing SL.

🔎 THE STORY BEHIND THE HEIST – WHY BULLISH?

"Bitcoin vs Tether" shows bullish momentum driven by:

💹 Technical bounce off major support

🌏 Macroeconomic & geopolitical sentiment

📰 Volume + sentiment shift (risk-on)

📈 Cross-market index confirmation

🧠 Smart traders are preparing, not reacting. Stay ahead of the herd.

👉 For deeper insight, refer to:

✅ Macro Reports

✅ COT Data

✅ Intermarket Correlations

✅ CHINA-specific index outlooks

⚠️ RISK WARNING – TRADING EVENTS & VOLATILITY

🗓️ News releases can flip sentiment fast — we advise:

❌ Avoid new positions during high-impact events

🔁 Use trailing SLs to protect profit

🔔 Always manage position sizing and alerts wisely

❤️ SUPPORT THE CREW | BOOST THE PLAN

Love this analysis? Smash that Boost Button to power the team.

Join the Thief Squad and trade like legends — Steal Smart, Trade Sharp. 💥💪💰

Every day in the market is a new heist opportunity — if you have a plan. Stay tuned for more wild robbery blueprints.

📌 This is not financial advice. Trade at your own risk. Adjust based on your personal strategy and capital. Market conditions evolve fast — stay updated, stay alert.

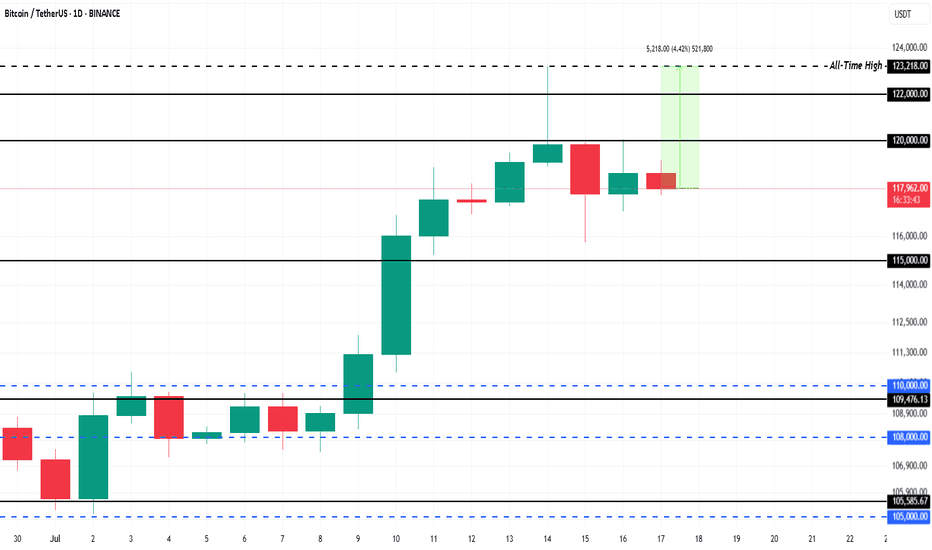

$1.5 Billion ETF Inflows Could Push Bitcoin Price 4% to New ATHBINANCE:BTCUSDT is currently trading at $118,325, facing resistance at the $120,000 level. This resistance is crucial for Bitcoin if it wants to break back to its ATH of $123,218 . The 4.4% gap to reach the ATH indicates potential for growth, but Bitcoin needs to secure support above $120,000 for this to happen.

This week, spot BINANCE:BTCUSDT exchange-traded funds (ETFs) saw over $1.5 billion in inflows , a significant portion of which occurred in the last 48 hours during Bitcoin’s dip.

The influx of institutional money highlights that investors are confident in Bitcoin’s potential despite the market cooling. If this trend persists, it could propel BINANCE:BTCUSDT price upward, as institutional support provides stability.

If BINANCE:BTCUSDT can hold above $120,000 and push past $122,000, it could continue its ascent toward new all-time highs. The current market conditions and ETF inflows support a bullish outlook, with a significant chance of breaking the resistance.

However, the risk of profit-taking remains , which could lead to a price drop. If BINANCE:BTCUSDT faces selling pressure, it could fall back to $115,000 , erasing a portion of recent gains. This would invalidate the bullish thesis, causing Bitcoin to retest lower support levels.

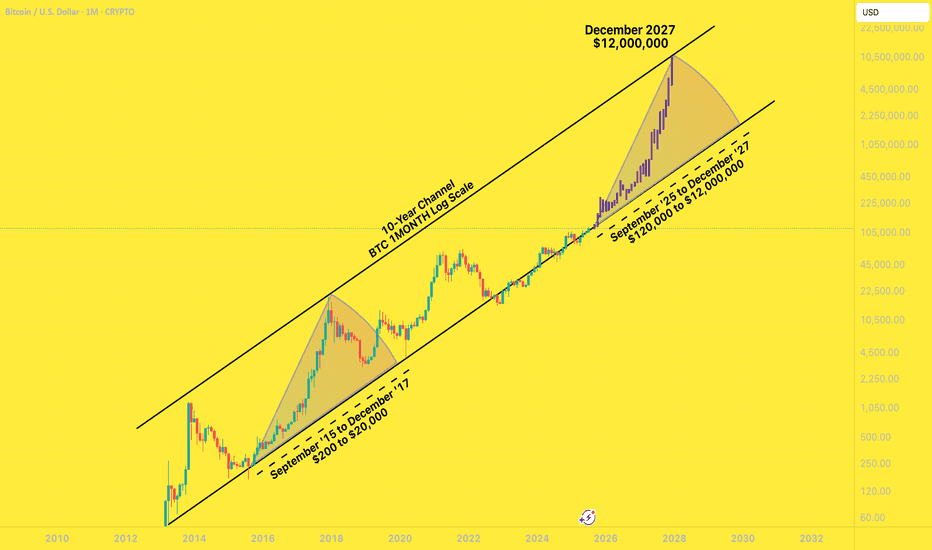

BTC to $12,000,000 December '27I had a years-old bookmarked chart from @MillionaireEconomics that I wanted to update and pick a random, extremely bullish candle pattern from the last time BTC came off the bottom channel to slap on it.

Riddle me this:

Why shouldn't Bitcoin go to $12,000,000 by December 2027?

Saylor continues to lead the way for global companies to scramble to build their own BTC warchests. These early adopters are having investor money dumped into them by the truckload.

Countries are stacking BTC

The BTC ETFs are a smash hit

Trump is all for making his own multi-billy family bitty stack

Mid-curvers will sell far too early, for far too little.

In the next two years, you'll be bombarded with countless, seemingly good reasons to sell your Bitcoins for hundreds of thousands of dollars - and then millions of dollars.

A shocking number of people will be far too early to sell. They will wake up in a cold sweat, night after night, haunted by their "could-have-been" stack, the number that updates in their head ten times a day, going up by six or seven figures a day .

... until they FOMO right back in at $11,999,999.

Bitcoin -> The bullrun is not over!📣Bitcoin ( CRYPTO:BTCUSD ) is still totally bullish:

🔎Analysis summary:

A couple of months ago Bitcoin broke above the previous all time high. This was basically just the expected creation of new highs, perfectly following the underlying cycles. With respect to the long term rising channel formation, this bullrun on Bitcoin is just starting.

📝Levels to watch:

$100.000

🙏🏻#LONGTERMVISION

Philip - Swing Trader

Bitcoin May Face Short-Term Pullback📊 Market Summary

– Bitcoin trades around $118,009, retreating from its intraday high of $118,330 .

– The recent rally was primarily fueled by $14.8 billion inflows into spot BTC ETFs, lifting BTC to an ATH of $123,000 on July 14

– Profit-taking has triggered a ~3% correction

– Market awaits key CPI/PPI inflation data and regulatory clarity in the US to guide next moves.

📉 Technical Analysis

• Resistance: $123,000 – $123,100 (all-time high zone, weekly candle top).

• Support: $114,000 – $115,000 (potential retest zone, IH&S neckline, CME gap)

• EMA 9: Price remains above all major EMAs (10/20/50/100/200 day) – bullish short-term trend

• Candles / Volume / Momentum:

• Confirmed inverted head and shoulders breakout above ~$113,000 neckline

• RSI ~74 suggests overbought; short term pullback possible

• MACD bullish but on chain volumes are cooling, reflecting profit taking

📌 Outlook

– Expect a short-term cooldown/pullback toward $114,000–$115,000 for support testing.

– If support holds and ETF inflows continue, BTC could resume rally toward $130,000–$140,000

💡 Trade Strategy

🟣 SELL BTC/USD upon break below $117,000–$118,000 during retrace

🎯 TP: $115,000

❌ SL: $118,500

🟢 BUY BTC/USD at support $114,000–$115,000

🎯 TP: $120,000 – $123,000

❌ SL: $113,000

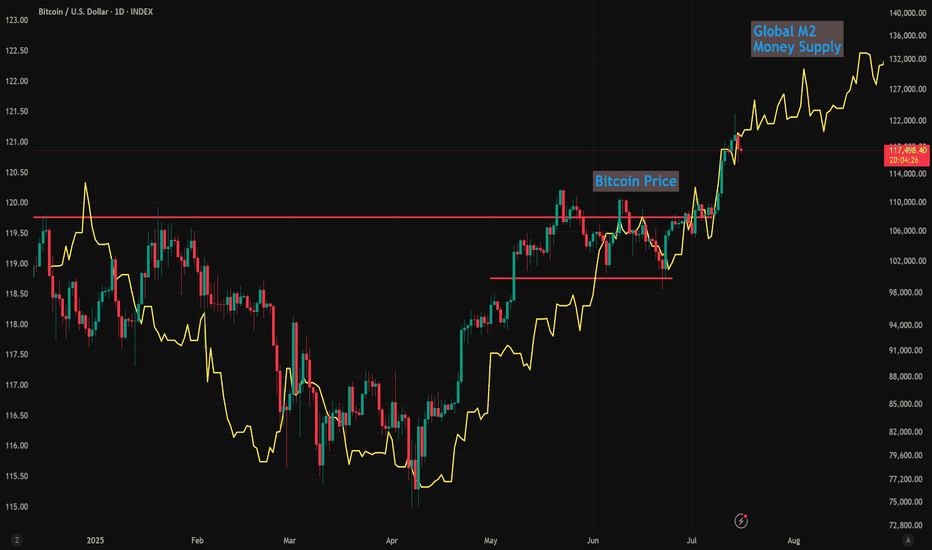

Global M2 Money Supply (70/84/90 Day offset) and $150k BTCI'm using Global M2 slightlty different than most here, and showing it behaves differently during different periods of the cycle.

Many people say M2 leads Bitcoin by 10-12 weeks (70 - 84 Days) and I've seen periods where it does... But in this phase of the bull-run 90 days is working best.

We can see the dip in M2 around now coinciding with the drop in Bitcoin prices.

Of course, these are not directly correlated and can't be relied upon as predictive.

But it's following pretty close, and overall looks great for further upside!

I'll follow up with a video on this if anybody is interested.

BITCOIN PULLBACK 110.000🔹 The uptrend remains intact

After setting a new high, the price may enter a mild correction toward the $110K zone.

Key support levels in this uptrend are:

✅ $115K

✅ $110K

✅ $105K

As long as the price holds above $105K, any pullback is considered healthy and the uptrend is likely to continue.

📊 A shallow correction is part of a healthy market structure.

Gaussian suggesting the last leg to the upside!As we approach close to the ~1000 days of bull market conditions above the green GC. Volatility to the upside should be coming before peaking at some point probably in October. Make sure to sell some coins before we get back to the core of the Gaussian. We could be seeing the price tank from 40k-50k later next year. Cheers!

BITCOIN UPDATEHello friends🙌

📈Given the upward trend we had, you can see that the price is in an upward channel and has also formed a bullish pattern, which, given the strength behind the trend, seems to have higher targets.

🔊Be careful, the basic principle of trading is capital management, so be sure to follow capital management.

🔥Join us for more signals🔥

*Trade safely with us*

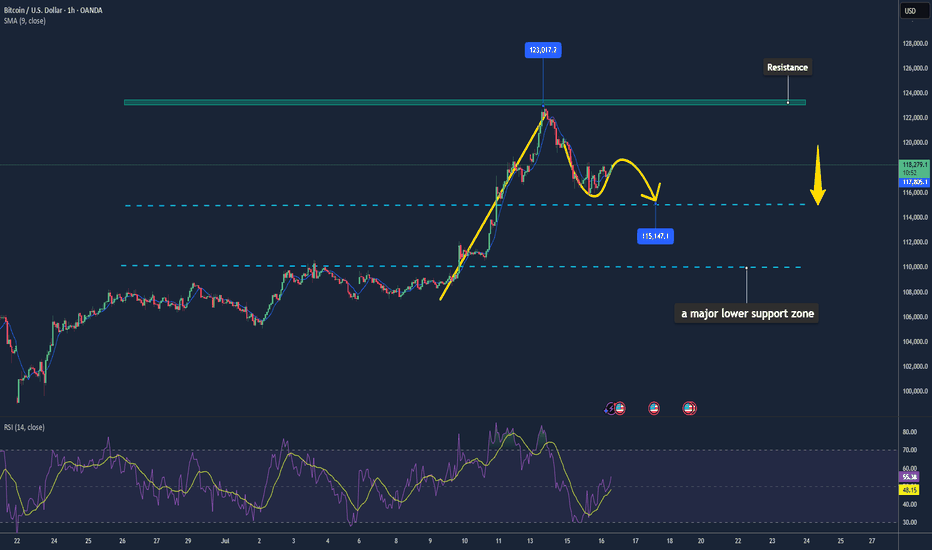

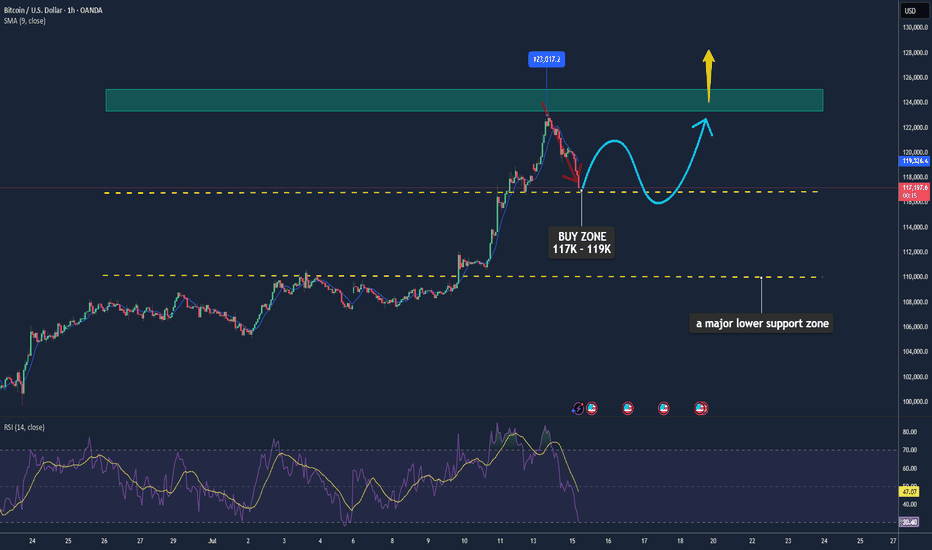

Bitcoin May Pause After Recent Highs📊 Market Move:

Bitcoin (BTC) recently touched an intraday high of ~$122.8K after hitting new all-time highs, supported by a weaker USD, strong institutional inflows, and favorable U.S. regulatory developments (e.g., GENIUS Stablecoin Act, CLARITY Act, and Trump’s executive orders). However, rising volatility (DVOL) and a rebounding USD are signaling a possible short-term correction.

📉 Technical Analysis:

• Key Resistance: ~$123K–$125K

• Nearest Support: ~$117K (with $110K as a major lower support zone)

• EMA: Price is currently above the 9-day EMA → short-term trend remains bullish.

• Candlestick / Volume / Momentum:

• A cup-and-handle formation has emerged, typically a bullish continuation pattern, suggesting a possible 14% rally to ~$134.5K.

• Momentum is still strong; RSI is elevated but not yet overbought (14-day stochastic RSI at ~79.4%).

📌 Outlook:

Bitcoin may consolidate or experience a mild pullback in the short term around the $123K level, especially if the USD continues to strengthen or volatility spikes. However, a clean breakout above $125K could trigger a further rally toward the $134K–$146K range.

💡 Suggested Trading Strategy: (Spot only – no leverage)

🔻 SELL Bitcoin/USD at: $123K–125K

🎯 TP: $117K

❌ SL: $126.5K

🔺 BUY Bitcoin/USD at: $117K–119K

🎯 TP: $123K–125K

❌ SL: $115K

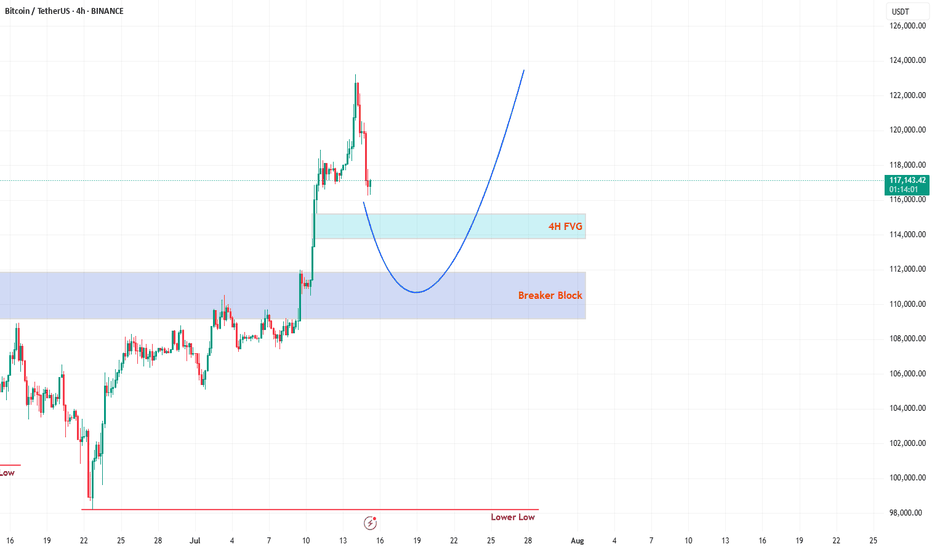

Bitcoin’s Wild Ride to New ATHs: What’s Next for Traders?Hello, TradingView warriors! 👋

Have you caught Bitcoin (BTC) smashing through a new all-time high (ATH) this Monday? 🎉 If you blinked, you might’ve missed it! But don’t worry, the crypto king isn’t done with its rollercoaster ride just yet. After soaring to new heights, BTC has pulled back for a retracement—not a full-on reversal, so hold your horses! 🐎 Whales are playing their usual games, setting traps for unsuspecting traders. Don’t fall prey to their tricks! 🦈 Let’s break down the key levels to watch and stay one step ahead. 💡

🔍 Key Levels to Watch on the Chart

1️⃣ 4H Fair Value Gap (FVG)

This 4H FVG is a thing of beauty—my personal favorite! 😍 But let’s be real, Bitcoin doesn’t care about aesthetics. This FVG is likely to act as the first resistance level. Here’s the plan:

If respected, expect BTC to use this level as a springboard to catapult back toward the ATH. 🚀

If broken, BTC might slide toward the stronger resistance below. Keep your eyes peeled for how price reacts here! 👀

2️⃣ Daily Breaker Block (PD Array)

This is the big one—a rock-solid resistance zone on the daily timeframe. I’m leaning toward BTC dipping into this Breaker Block to clear out liquidity before making its next big move to retest the ATH. 🏦 This level is a magnet for price action, so don’t sleep on it! 😴

🛠️ Trading Strategy: Stay Sharp!

Patience is your best friend right now, traders. 🙏 Don’t rush into trades without confirmation. Watch how BTC interacts with these two levels:

4H FVG: Look for rejection or a breakout to gauge short-term direction.

Daily Breaker Block: If price dips here, it’s likely hunting liquidity before the next leg up.

Wait for clear price action before jumping in—let the market show its hand! 🃏 Stay disciplined, avoid the whale traps, and let’s ride this BTC wave together. 🌊

📚 Want More? Follow Me!

If you’re hungry for more technical analysis insights and market updates, hit that follow button! 📈 I share tips, tricks, and breakdowns to help you navigate the markets like a pro. Let’s level up your trading game together! 💪

What’s your take on BTC’s next move? Drop your thoughts below, and let’s discuss! 💬 Happy trading, and may the profits be with you! 📈

Bitcoin Hits New Highs: Is The Institutional Money Here To Stay?Bitcoin Hits New Highs, Gains Stability and Scale in Its Institutional Era: Will It Last?

From a volatile and often misunderstood outsider, Bitcoin has embarked on a remarkable transformation, evolving into what many now see as a foundational financial layer. This new era is not fueled by the fleeting whims of retail hype, but by the calculated, long-term strategies of professional capital. The steady influx of institutional investors is profoundly reshaping Bitcoin's character, taming its notorious volatility and broadening its accessibility to everyday individuals. This seismic shift begs the question: is this newfound stability and scale a permanent feature of the financial landscape, or a transient phase in Bitcoin's tumultuous history?

The Dawn of a New Epoch: The Institutional Stampede

For years, the narrative surrounding Bitcoin was one of a grassroots monetary experiment, a digital curiosity championed by cypherpunks and early internet adopters. Wall Street remained a skeptical spectator, wary of the asset's wild price swings, its lack of regulatory clarity, and its disruptive potential. However, Bitcoin's unyielding resilience and its core value proposition of a decentralized, finite digital asset gradually wore down this institutional resistance. The floodgates did not just creak open; they were blown apart with the regulatory approval of spot Bitcoin Exchange-Traded Funds (ETFs). This landmark decision marked a clear and decisive tipping point, a formal invitation for mainstream finance to embrace the world's first cryptocurrency.

This regulatory green light has had a profound and cascading impact. It has, in a single stroke, legitimized Bitcoin in the eyes of the most conservative financial establishments. More importantly, it has provided a familiar, regulated, and highly accessible entry point for a vast and previously untapped ocean of capital. Exposure to Bitcoin is no longer confined to specialized crypto-native platforms, which often carried a steep learning curve and perceived security risks. Now, it can be seamlessly integrated into the traditional investment portfolios that millions of people rely on, managed through their existing brokerages, pension funds, and even insurance products. This growing wave of institutional adoption is not merely inflating Bitcoin's price; it is fundamentally anchoring it more firmly within the global economy, weaving it into the very fabric of the system it was once designed to challenge.

The numbers illustrating this shift are staggering. In a remarkably short period, spot Bitcoin ETFs have amassed well over $138 billion in assets. This figure is not static; it represents a dynamic and growing pool of capital, reflecting sustained institutional interest. Registered Investment Advisors (RIAs), who manage the wealth of millions of Americans, along with sophisticated hedge funds and forward-thinking pension funds, represent a growing share of this investment. These are not speculative day traders but entities with long-term horizons and rigorous due diligence processes. Their participation signals a deep conviction in Bitcoin's future.

This institutional embrace extends far beyond the realm of ETFs. Major corporations have continued their aggressive accumulation of Bitcoin, viewing it as a treasury reserve asset superior to cash. This trend of corporate and institutional adoption is a key driver of Bitcoin's maturation, lending it a newfound sense of legitimacy and stability that was unimaginable just a few years ago. The current market cycle is thus being defined not by the frenetic energy of individual retail investors, but by the methodical and powerful currents of professional capital.

Taming the Beast: Volatility in the Institutional Age

One of the most significant and welcome consequences of this institutional influx has been the taming of Bitcoin's infamous volatility. For most of its history, Bitcoin's price chart resembled a dramatic mountain range, with breathtaking peaks and terrifying valleys. This volatility was its defining characteristic and its biggest barrier to mainstream acceptance. Institutional capital, however, operates on a different wavelength. With its longer time horizons and more systematic, data-driven approach, it behaves differently from the often emotionally-driven retail market.

While individual investors are more prone to panic-selling during sharp price dips or piling in during euphoric rallies, large institutions are more likely to employ disciplined strategies like dollar-cost averaging. They see price corrections not as a reason to panic, but as a buying opportunity. This behavior provides a stabilizing force, creating a floor during downturns and tempering the irrational exuberance of market tops.

This shift in market dynamics is evident in the flow of funds into the new financial products. These investment vehicles have frequently seen strong net inflows during price corrections, with major asset managers absorbing billions in capital even as retail sentiment soured. This institutional buying pressure acts as a powerful buffer, moderating the extreme price swings that have historically characterized the Bitcoin market.

While Bitcoin's volatility remains higher than that of traditional assets like gold or global equities, its trajectory is one of marked and consistent decline. This decline is a natural consequence of its growing market capitalization. As the total value of the network expands, the relative impact of new capital inflows or outflows is diminished, leading to smoother price action.

Interestingly, Bitcoin's volatility has at times converged with, and even fallen below, that of some mega-cap technology stocks, which themselves can exhibit significant price swings. This convergence is making traditional investors take a closer look, as the risk-reward profile of Bitcoin becomes more palatable and understandable. Historically, investors have been well-compensated for taking on Bitcoin's volatility, with its risk-adjusted returns often outperforming major stock indices over multi-year periods.

From Digital Gold to a Financial Base Layer: An Evolving Narrative

For much of its existence, Bitcoin has been championed as "digital gold." This narrative is powerful and intuitive. Like gold, it has a finite, predictable supply. It is decentralized, meaning no single entity can control it or create more of it at will. And it is censorship-resistant, offering a store of value outside the traditional financial system. This narrative has been a potent driver of adoption, particularly among those seeking a hedge against inflation, currency debasement, and geopolitical uncertainty.

However, the increasing stability brought about by institutional investment is fostering a new and complementary narrative: Bitcoin as a potential medium of exchange and, more broadly, as a foundational settlement layer for the global financial system. Lower volatility is a crucial prerequisite for any asset to function effectively as a currency. When prices are relatively stable, merchants and consumers can transact with confidence, knowing the value of their money will not drastically change overnight.

The development of Layer 2 solutions, most notably the Lightning Network, is a critical piece of this puzzle. These protocols are built on top of the Bitcoin blockchain and are designed to enable faster, cheaper, and more scalable transactions. They address the primary technical hurdles that have hindered Bitcoin's use for everyday payments, such as coffee or groceries. As this technological infrastructure continues to mature and gain adoption, Bitcoin's utility beyond a simple store of value is poised to expand significantly.

Furthermore, Bitcoin's historically low correlation with traditional assets like stocks and bonds makes it an exceptionally valuable tool for portfolio diversification. In a world where asset classes are becoming increasingly interconnected, Bitcoin offers a unique return stream. Adding even a small allocation of Bitcoin to a traditional 60/40 portfolio can potentially enhance returns over the long term without a commensurate increase in overall risk. This diversification benefit is a key part of the thesis for many institutional investors.

Navigating the Market's Pulse: Price, Psychology, and Predictions

As Bitcoin navigates this new institutional era, the question on every investor's mind is: where does the price go from here? The recent surge to new all-time highs above the $123,000 mark has been met with a mix of bullish enthusiasm and cautious optimism. After reaching this peak, the market saw a natural retreat, with bulls pausing for a breath and prices consolidating. The price action has been dynamic, with a fresh increase starting above the $120,000 zone before finding temporary resistance and trading near the $118,500 level. This kind of price discovery, including breaks below short-term bullish trend lines, is characteristic of a market absorbing new information and establishing a new support base.

Technical analysis suggests that the current rally may have further to run. Having decisively broken through key psychological and technical resistance zones, some analysts see a clear path toward $135,000 or even $140,000 in the medium term. The price trading well above key long-term moving averages confirms that the underlying momentum remains strongly bullish.

However, a closer look at market sentiment and on-chain data reveals a more nuanced and perhaps even more bullish picture. Despite the record-breaking prices, the market has yet to enter the state of "extreme greed or euphoria" that has characterized the absolute peaks of previous bull cycles. Key metrics that track the profitability of long-term holders remain below the "euphoria" zone, suggesting that the smart money is not yet rushing to take profits. This could indicate that the current rally, while impressive, is still in its early or middle phases, with more room to grow before reaching a cyclical top. A delay in the full-blown bull market euphoria could ultimately push Bitcoin higher than many expect.

Of course, the market is not a one-way street. The spike to $123,000 was followed by an increase in Bitcoin flowing into exchanges, a potential sign of short-term profit-taking and a cooling-off period. Even large, strategic players may take profits during rallies. The news of Bhutan's sovereign wealth fund strategically unloading a portion of its holdings is a prime example. While these sales can introduce short-term selling pressure, they are also a healthy part of a functioning market. The fact that inflows, even at the peak, were just a fraction of those seen in earlier parts of the year suggests that the selling pressure is not yet overwhelming.

The Sustainability of the Institutional Era: A Critical Analysis

The institutionalization of Bitcoin is undoubtedly a paradigm shift, but its long-term sustainability is not a foregone conclusion. While the current trend is one of increasing adoption and stability, there are several factors that could challenge this new status quo and must be considered by any serious investor.

One potential risk is the concentration of Bitcoin in the hands of a few large institutions. While this brings stability in the short term, it also introduces a potential point of centralization in a decentralized system. If a handful of major asset managers were to simultaneously decide to sell their holdings—perhaps due to a change in their own internal risk models or a major macroeconomic shock—it could trigger a significant market downturn. Such a move would likely be exacerbated by retail investors following the lead of these financial giants.

Regulatory risk also remains a significant and unpredictable concern. While the approval of spot Bitcoin ETFs in the United States was a major step forward, the global regulatory landscape is a complex and evolving patchwork. Any future crackdowns, unfavorable tax treatments, or restrictive regulations in major jurisdictions could dampen institutional enthusiasm and hinder further adoption. The path to full regulatory clarity is likely to be long and fraught with challenges.

Furthermore, the narrative of Bitcoin as an inflation hedge has yet to be definitively proven across all possible economic conditions. While it has performed well during recent periods of high inflation and monetary expansion, its correlation with risk assets means it can also be sensitive to economic downturns and tightening financial conditions. A prolonged period of global recession or stagflation could test its resilience as a store of value in new and unexpected ways.

Conclusion: A Maturing Asset in an Evolving World

Bitcoin has come an immeasurably long way from its obscure beginnings as a niche digital currency for a small community of technologists. The influx of institutional capital has ushered in a new era of stability, accessibility, and legitimacy. The launch and wild success of spot Bitcoin ETFs has been the primary catalyst, providing a regulated and familiar on-ramp for a vast pool of professional money that is reshaping the asset's very DNA.

This institutional embrace is about far more than just price appreciation; it is fundamentally changing the character of Bitcoin. Its volatility, while still present, is on a clear downward trend, making it a more viable contender as both a global store of value and a neutral settlement network. The long-held dream of Bitcoin as a foundational layer of a new, more transparent financial system is slowly but surely taking shape.

However, the road ahead is not without its challenges. The risks of institutional concentration, regulatory uncertainty, and macroeconomic headwinds are real and should not be underestimated. The sustainability of this new era will depend on a delicate interplay of market forces, regulatory developments, and continued technological innovation on its network.

What is clear is that Bitcoin has earned its place on the world's financial stage. It is no longer an outsider looking in, but a maturing asset that is being progressively integrated into the global economic fabric. Whether this institutional era will be a lasting one remains the defining question of our time. But one thing is certain: Bitcoin's journey is far from over, and its evolution will continue to be one of the most compelling and consequential stories in the world of finance for years to come.