Shit coins and Solana, beware there is a huge difference Rarely do I ever see a weekly chart as bullish as Solana's.

Amidst the new crypto Spring of 2023/2024 I firmly believe that Solana will be the Phoenix that rises from the ashes of the FTX debacle and 2022 Crypto Winter. One year ago, in November one of the largest crypto exchanges at the time FTX, filed for bankruptcy on November 11th 2022, exactly 363 days later Gary Gensler made a statement that FTX “could” be revived since then the coin which played a big role in the downfall of FTX, ‘FTT’ surged past the $5 mark, which equates to a 5x increase in less than a week. The coin which has absolutely no function or roadmap to anything is likely to crash back down to earth in my opinion. At least the people that lost their investments when the company went bankrupt will get back a little more of their losses. This event should not take center stage, however, for the real winner today was Solana.

Only possible on Solana part: 2

Solana’s native token ‘SOL’ was also greatly damaged by the FTX collapse. This was because FTX was one of the largest holders of the token and when FTX went down it took SOL which had already been devastated along with the entire crypto sector down with it. The result was that Solana remained the most oversold crypto out of all the major coins. In December 2022 SOL hit a low of $8, after trading down approximately 97% from its all-time high reached the same time as Bitcoin’s, November 2021.

Although all major coins hit a low around December 2022, Bitcoin and many others started to pump back at the start of 2023. This can be seen on monthly chart containing both BTC and SOL. As evident on the chart Solana’s late start to this crypto bull season did not last as the coin has gained roughly 4 times that of Bitcoin since the December 2022 lows.

After today’s tremendous rise of around 25%, Solana has risen 446% from those lows. The difference between the two tokens FTT and SOL is key and critical for any investor to know before risking any capital. FTT is most likely a pump and dump scheme, for instance the LUNA token which was responsible for kicking off the Crypto Winter, was also exhibiting huge gains on the day both Luna classic and Luna both exhibited gains exceeding Solana’s today. However, it is important for traders to know the difference between these ‘hype’ coins and Solana which has a bright future ahead of it.

A lot of these differences were highlighted in this year's ‘Breakthrough 2023’ the annual convention which highlights the achievements both recent and ongoing on the coin that I believe will become the ‘Ethereum’ of 2023 – 2024. The event spoke of so many developments in the Solana ecosystem that I cannot cover them all in this brief editorial but include new and active partnerships with Google Cloud, Circle (USDC), and Star Atlas. These partnerships are possibly overshadowed by the fundamentals, which include Solana processing more transactions than all other layer 1 blockchains combined and that Solana has surpassed Ethereum in daily active wallets.

This pump in altcoins such as Solana’s meteoric rise and Ethereum’s double-digit gains yesterday is typical of Alt. Season, a term used to describe a period when alternative coins, i.e., other cryptocurrencies besides Bitcoin gain much more than Bitcoin itself. This rotation into riskier alt. coins usually precedes a period in which the most dominant crypto (Bitcoin) exhibits tremendous gains. This cycle is playing right into the historical and future timeline of Bitcoin’s expected rise around its next halving set for Spring of 2024.

My own equation for forecasting Bitcoin’s price at the next halving event (created in May 2020) can be seen here. medium.com

Bitcoinpriceprediction

Bitcoin's next impulse They say there are two pairs of everything in the universe just like two possible scenarios seen on this chart (White & Yellow arrows)

Bitcoin's Overlapping .5 fib and top of the weekly cloud is the target as price could and should respect the 4hr cloud

In theory...

Prevailingnine 11.7.23

Current structure looks bullish lets see how it develops

BTC Bitcoin and the Altcoin Season ThesisThe recent developments in the cryptocurrency market, particularly the favorable court ruling for Ripple Labs, signal an optimistic start to a new altcoin season.

With the federal judge ruling that some of Ripple's sales of the XRP token do not fully meet the definition of a securities offering, it instills confidence in the altcoin space.

This ruling brings clarity to the regulatory landscape and alleviates concerns surrounding XRP, leading to major cryptocurrency exchanges, including Coinbase, relisting the token. The reintroduction of XRP to these platforms demonstrates growing acceptance and renewed interest in this altcoin.

The anticipation surrounding the approval of a spot bitcoin ETF in the United States adds to the positive sentiment in the market.

The successful launch of a previously approved ETF in Europe further reinforces the upward trend for altcoins.

The recent court ruling that declared XRP as not a security sets a precedent that could potentially benefit other cryptocurrencies currently classified as securities by the SEC. In the SEC's case against Binance, they designated 10 cryptocurrencies, including BNB, BUSD, SOL, ADA, MATIC, ATOM, SAND, MANA, AXS, and COTI, as securities.

Additionally, in the SEC's lawsuit against Coinbase, they named 13 cryptocurrencies, reinforcing their stance on SOL, ADA, MATIC, SAND, and AXS, and adding CHZ, FLOW, ICP, NEAR, VGX, and NEXO to the list.

This development showcases the increasing institutional acceptance of cryptocurrencies and creates a ripple effect across the market, providing a boost for various cryptos, including BTC Bitcoin, for which my price target is $37360.

Looking forward to read your opinion about it!

Bitcoin bull run to $170,000 or to $1,000,000 imminent?Highlights:

Two paths, the least bullish path to $170k and a more bullish path to $1M

Next major pivot is still on June-Aug 2025.

Next #BTC targets are $170,000 and $1,000,000

1. path to $170k

- A flat with a corrective wave going up to $170,000 and a sharp correction afterwards before another major bull run in 2025.

2. path to $1M

- A 5-wave up to $1M

3. TIME ANALYSIS:

The next major time zones are still on 2025, which means the ongoing upward movement may lust until then. I used fib time zone from the base of Dec 2018 to the highs of June 2019 as the first major fib time zone. The next fib time zone is from the base of March 2020 to the highs of April 2021. Just see the accuracy of the time zone below.

4. The fibonacci levels used are created by a fib retracement on the very first wave 1 to wave 2

BTC BITCOIN Technical Analysis And Trade IdeaIn this video, we dive into an extensive analysis of the BTCUSD pair, examining the prevailing bullish momentum observed in both the daily (1D) and weekly (1W) timeframes. Notably, Bitcoin (BTC) is nearing a critical resistance level, indicating the potential for an impending retracement. Throughout this discussion, we will explore the intricate aspects of technical analysis, including trading education on how to trade BTCUSDT effectively.

As we progress through this video, we will not only provide a BTC price prediction but also deliver a Bitcoin today analysis with the aim to empower you with the insights required for trading crypto effectively.

It is essential to underscore that the information presented here is intended solely for educational purposes and should not be regarded as financial advice. Engaging in the crypto market, such as trading BTC/USD, carries inherent risks, making it crucial to incorporate robust risk management strategies into your trading plan.

Bitcoin (BTC) / Daily Insight for next 6 Month / 28-10-23Bitcoin (BTC)

*In this analysis I used the Binance Perpetual Future Chart

In Forecast data at the 1 hour TF closing at 10.00 WIB Price BTC closed in a Strong Bullish condition.

I assume BTC still has the potential to retest the $42,000 range with an increase of around 20-23%. This reflects the positive sentiment in the media and also fear and greed market data, where currently BTC is at level 71 (Greed). In terms of indicators and also BTC dex price data there has been a very significant increase in the last 7 days.

For spot holders, I think this is the right time to start considering starting accumulation marking, but make sure to be careful by paying attention to previous price history.

And for personal opinion, look at the data displayed on the chart. There is still a big possibility for BTC price to move higher to retest the major resistance area before the halving.

Important points to monitor:

pivot point : $34,449

Support Levels:

$33,801

$33,139

$32,491 (Strong support)

Resistance Levels:

$35,112

$35,759

$36,422

#Bitcoin - thoughts out loud #9Good evening from Ukraine!

Dear colleagues, I am glad to welcome you!

Work plan.

Because no one expects.

Thank you all for your attention, I wish you success.

Sometimes you win/sometimes you learn.

- thoughts out loud

- thoughts out loud

- thoughts out loud

P.S.

...Think positive)

Bitcoin's Projected PathTraders,

Bought more BTC here. TBH, this just looks like another bull flag. I can see us hitting our heads on the 30k again where I may sell some but eventually that resistance will break. And I think sooner than later. Then we'll have to tackle that 31.6k level. If we can break above that, my prediction from Jan-Feb still stands - 37k by then end of the year.

Best,

Stew

Bitcoin Daily TF Bitcoin experienced a sudden surge in value today due to erroneous reports of Blackrock's spot ETF approval. However, I anticipate a bearish trend for Bitcoin going forward. If Bitcoin's closing price falls below 28,100.79, it is likely to continue its downward trajectory. My focus is on identifying a selling opportunity in this scenario. I believe Bitcoin could reach 25,000 in the coming weeks.

Bitcoin -> Watch The BreakoutMy name is Philip, I am a German swing-trader with 4+ years of trading experience and I only focus on price action and market structur e🖥️

I am trading the higher timeframe s because this allows me to massively capitalize on the major market swings and cycles without getting caught up in the short term noise.

This is how you build real long term wealth!

In today's anaylsis I want to take a look at the bigger picture on Bitcoin.

After Bitcoin perfectly created the double top formation during 2021 and 2022 the bear market was quite expected. However it seems like Bitcoin is once again rejecting the bullish trendline and after a break above the neckline of the previous double top, I do expect a juicy rally.

- - - - - - - - - - - - - - - - - - - -

When the market moves where, and how, and if - these are all unknown.

The only thing which you can control is your risk. Focus on risk management!

Keep the long term vision🫡

#Bitcoin - thoughts out loud #6Good evening from Ukraine!

Dear colleagues, I am glad to welcome you!

Because this is my vision of the situation, because these are my thoughts out loud. Thank you.

Thank you all for your attention, I wish you success.

Sometimes you win/sometimes you learn.

P.S.

...Think positive)

A very nice Bull Trap #bitcoinMany short position liquidations were on 28000 - 28500 area and market makers hit #btc to take that liqs. Now, i turned my eyes to 23500 zone, where the greatest LONG Liquidations waits the butcher to take!..

NOT FINANCIAL ADVICE.

Enjoy my Bitcoin Chart & its Bearish ForecastThose who know my work will recognize that my chart has taken this essential form for over 18 months, with only minor refinements. Hopefully you will challenge my forecast with your tough questions and counter-arguments. After all, this venue exists to arouse the reverse-engineers and to provoke the thinkers to do what we do best, right?

As always, I strive to render these ideas of mine so obviously that their explanation will require no words, and this forecast is no exception.

My trading tactics - including the beauty of Tradingview and how it makes me look good - are based on identifying the opportunities within VOLUME, VOLATILITY and TREND EXHAUSTION.

There are too many details here to discuss, which I will save for future, more detailed posts. For now, you may concentrate on the downside targets and how the price action interacts with the implied forecast as we move forward through time.

On a practical level, this chart is meant to be traded on the 15 minute chart and below, all the way down to 1 second. Whereas the big picture imparts a sense of directional bias, the hyper-granularity of the many intersecting color-coded diagonals reveals precise targets on the lowest time frames suitable for daily scalping in the futures markets.

Speaking of the future, until then, be liquid !!!

BTC 24800 Price Target 32k? Stay Tuned for Trade Regular UpdatesBTC price dumped to 24800 and is currently bouncing, which was our last buy opportunity based on the previous signal in our last BTC post here .

Notice: This post will be regularly updated as the price progresses toward the target or in the event of potential failures due to rejections. We encourage readers to like, comment, and follow this page to stay updated with the latest developments and adjustments. Your engagement and support are greatly appreciated.

It may seem contradictory to our previous short target of 12k, but in our last analysis, we mentioned that we would be longing from 26k down to 24800 after shorting at 30400. this is because we foresee a better short entry with a much better stop loss and profit target as the bears are heavy around $32k to $34800 which will give bears the needed backup to push the price down to 12k come 2024.

According to MT pandora's Box, The current market buyers are not exhausted yet, and the breakdown of the range is likely to be a trap for sellers. This is evident from the price breaking the 25200 support and hitting 24800, triggering a buying frenzy that backfired on the bears. As a result, we see the price racing back to 26800, clearing all the previous last shorters.

We will continue to hold our current Long position, and I will leave a free long trade signal at the end of this post if you wish to catch the bullish momentum that is about to take off. Now, we should stay patient as we anticipate hitting levels of 27200, then 27700, and eventually reaching 28k. Although there might be some minor pullbacks, this Long position is heading toward 32k.

Regarding the question of why we are shorting at 34k, while the price of BTC might extend even to 34800, we are likely to start adding to shorts from the 32k range. However, we won't jump in with our full position size; instead, we will incrementally add to shorts in small percentages. This strategy will give us the opportunity to reach our 12k target by 2024. Expect some reactions from sellers as BTC moves from the bottom to the top of the current range.

Please Note: Due to the length of our previous BTC post, I will only update it again when we reach the current long target of 32k to 34k range. At that point, we will take another BIG SHORT to achieve our 12k target by 2024. this post will provide updates on the current long trade before the BIG SHORT.

(To enter this LONG, wait for a pullback to take the trade as the price will return to one of the supports listed below, multiple entries with one stop to allow you to buy in pieces and that way accumulate as price goes our way.

Free BTC Long Trade Signal:

To enter, wait for a pullback to take the trade.

ASSET: $BTC/USDT

ACTION: LONG

1st ENTRY PRICE: $24800, 2nd $25600, 3rd $25800 (Worst or late entry $26k)

STOP LOSS: $23700

1st TAKE PROFIT: $29700, 2nd TP: $31200, 3rd TP: $32k (Extended TP: $34k)

Disclaimer: This signal is for informational purposes only and does not constitute financial advice. Cryptocurrency trading carries risks, and past performance is not a guarantee of future results. The user assumes full responsibility for any profits or losses incurred, and the signal provider is not liable for any investment decisions made based on this signal.

Notice: This post will be regularly updated as the price progresses toward the target or in the event of potential failures due to rejections. We encourage readers to like, comment, and follow this page to stay updated with the latest developments and adjustments. Your engagement and support are greatly appreciated.

BTC Bitcoin Price Target | Binance vs SEC Lawsuit Binance disputes the SEC's allegations of mishandling customer funds, deceiving investors, and violating securities laws.

The legal battle between Binance and the SEC has sent shockwaves through the cryptocurrency community.

Binance and its affiliates assert that the SEC is overreaching its jurisdiction on digital assets, especially without any clear legislative guidance from Congress. The original lawsuit, filed in June, accused Binance of unlawfully listing unregistered securities.

Historically, the actions of whales have been instrumental in shaping the price movements of Bitcoin and the broader cryptocurrency market.

Non-whale addresses, those holding less than 100 BTC, now account for over 41% of the total Bitcoin supply. Meanwhile, whales, entities holding between 100 and 100,000 BTC, have witnessed a decline in their collective holdings to 55.5%, marking their lowest ownership level since May.

The decrease in whale holdings could signal a potential change in the market's dynamics, potentially leading to increased volatility and uncertainty.

These developments collectively cast a shadow over the cryptocurrency market's near-term prospects.

In this context, my price target for BTC Bitcoin is $23700.

Looking forward to read your opinion about it!

Bollinger Bands Tightly Consolidated as BTC Remains Range Bound At present, Bitcoin has been trading within a narrow range of around $27,000, and this prolonged consolidation phase is a cause for caution. The Bollinger Bands, a widely used technical analysis tool, suggest that volatility is diminishing, and a significant price movement could be imminent.

In light of this information, we strongly urge you to pause your Bitcoin trading activities temporarily. It is crucial to exercise patience and avoid making hasty decisions during such periods of consolidation. While it may be tempting to seize potential opportunities, the current market conditions warrant a more cautious approach.

Here are a few reasons why we believe it is prudent to exercise restraint and pause BTC trading for now:

1. Reduced Volatility: The narrowing Bollinger Bands indicate a decrease in price volatility. During such times, market movements tend to be limited, making it challenging to predict short-term price trends accurately.

2. Potential Breakout: The tightly consolidated Bollinger Bands often precede a significant price breakout. By pausing trading, you can avoid potential losses resulting from sudden and unpredictable price swings.

3. Risk Management: Taking a step back from trading allows you to reassess your risk management strategies and ensure you are well-prepared for any potential market shifts. It is crucial to protect your capital and make informed decisions when the market provides clearer signals.

While the decision to pause trading ultimately rests with you, we strongly advise against making impulsive moves during this consolidation phase. Consider this as an opportunity to reevaluate your trading strategies, conduct thorough research, and seek expert advice if needed.

We will continue to closely monitor the market and keep you updated on any significant developments. Remember, patience and discipline are key virtues in the world of trading, and it is during these uncertain times that they become even more crucial.

If you have any questions or require further guidance, please do not hesitate to comment below. We are here to assist you throughout this period of consolidation.

Thank you for your attention, and we wish you all the best in your trading endeavors.

#Bitcoin - thoughts out loud #8Good evening from Ukraine!

Dear colleagues, I am glad to welcome you!

If it's longs, then maybe so, because the demand test can be considered complete, and a supply test is needed before moving up.

Thank you all for your attention, I wish you success.

Sometimes you win/sometimes you learn.

P.S.

...Think positive)

BTC Bitcoin Price ahead of the FOMC decision next weekWhile Bitcoin has experienced a recent surge in price, there are notable indicators suggesting caution. Investors have begun to take profits, signifying a potential shift in sentiment. This could be indicative of a more cautious market stance, especially considering the prevailing uncertainties.

A critical concern arises from Bitcoin's current position below its 200-week moving average. Historical data shows that this zone has often acted as a formidable barrier for Bitcoin's price movement. This pattern suggests that a sustained breakout above this level might prove challenging in the near term.

The recent inflation figures from the Consumer Price Index (CPI) have sent shockwaves through financial markets, with a year-over-year increase of 3.7%, surpassing earlier estimates. This level of inflation, combined with the Federal Reserve's current interest rate range of 5.25% to 5.5%, is a cause for concern. The surprising stability of Bitcoin amidst such economic turbulence may not be sustainable in the long run.

Adding to the apprehension is the concept of 'sticky' inflation, where prices continue to rise even in the face of elevated interest rates. The core CPI data, excluding energy price fluctuations, still reported a yearly increase of 4.3%, albeit lower than the previous month. This persistent upward trend in core CPI since September 2022 raises valid questions about the Federal Reserve's strategies moving forward.

In light of these factors, it would be prudent to approach the current Bitcoin market with a degree of caution. While the cryptocurrency has shown resilience in the face of economic headwinds, the potential for increased volatility and the presence of significant barriers in its price movement could pose challenges for sustained bullish momentum.

My Price Target for BTC Bitcoin is $23700.

Looking forward to read your opinion about it!

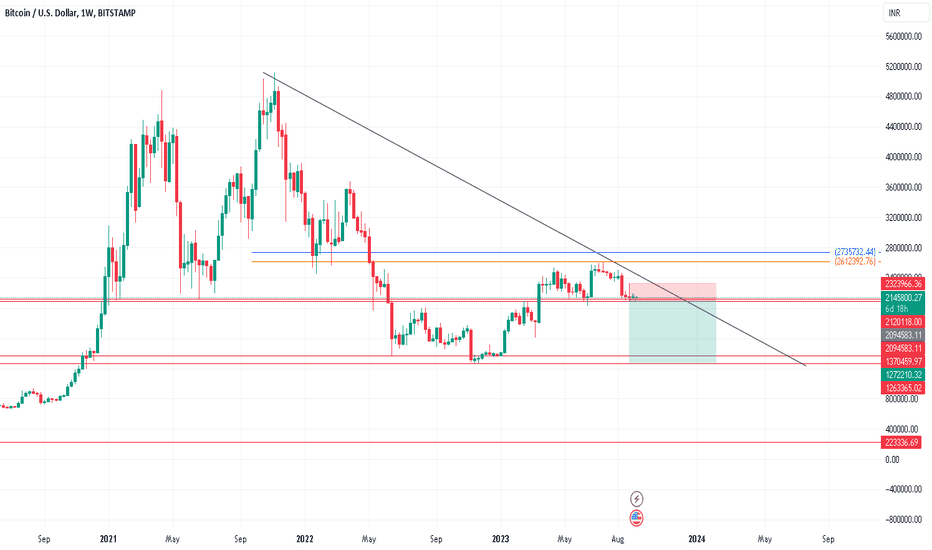

BitcoinWe may see 1270000 again if breaks the support.

Careful upside is very limit as resistance is strong and retested to further fall from here.

Best buying may come next year Jan/Feb 2024..

Stay away from the bitcoin as per technical analysis.

Upside break should be very fast as of now or it will reject and fall in coming weeks or months.