#BTCUSDT: Will Bitcoin Make Any Correction To $90,000?Hey Everyone,

Happy Sunday

Currently, Bitcoin’s price is consolidating within a shorter timeframe, which has heightened the likelihood of it reaching the $90,000 ‘FVG’ region. However, this could be attributed to the hectic week we experienced, with numerous significant market announcements that have heightened uncertainty in the cryptocurrency market. At present, there are two opportunities for Bitcoin: one is riskier, while the other is considerably safer. You can utilise this analysis as a secondary bias.

We extend our best wishes and good luck in your trading endeavours. Your unwavering support is greatly appreciated.

If you wish to contribute, here are several ways you can assist us:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_🚀❤️

Bitcoinpricetrendanalysis

Bitcoin Testing 95k as Resistance TRENDLINE #Bitcoin at a CRITICAL juncture! Testing the downward trendline (double yellow) at 95K as resistance, originating from 107K in Dec.

This trendline has repeatedly rejected BTC, with multiple tests at 95K this week. Historically, rejections have led to drops to 82K support (tested 4x) or even the uptrend line at 77K (Mar/early Apr).

If BTC fails to break & hold above 95K by week's close, we may retest 82K on the 2023 uptrend (red line). BUT, if we break 95K and hold, we could target 109K, with a potential range of 125K-140K for new highs!

#Crypto #BTC #TechnicalAnalysis

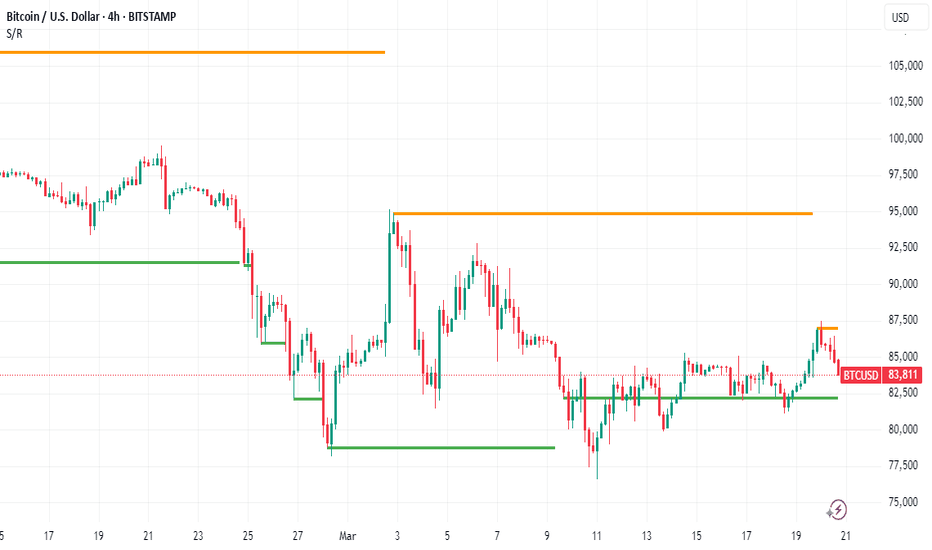

BTC Bitcoin Trade plan 24/4/2025BTC/USD Trading Outlook:

Key Resistance Levels: $95,000 and $97,000

Channel Support Level: $92,000

Support Zone: $86,000

Market Scenarios:

Bearish Scenario:

If BTC fails to break above the resistance at $95,000–$97,000 and drops below the $92,000 channel support, it could trigger a sell-off.

Sell Targets:

Target 1: $90,000

Target 2: $88,000

Watch for further support around $86,000.

Bullish Scenario:

If BTC holds above $92,000 and breaks through the $95,000–$97,000 resistance zone, it may resume its upward trend.

Buy Target: $97,000 (with potential to extend higher if momentum continues)

Bitcoin Is Following Our Trading Plan Hello, Skyrexians!

As we told you new impulsive wave to the new ATH has been started below 80k for BINANCE:BTCUSDT and now price found some resistance. Next 2-4 weeks will be very difficult for traders and holders and we will explain you why.

On the 4h time frame we can see the new impulse which shall consists of 5 waves. Awesome oscillator tells us that this is the wave 3 inside this impulse and it can be over because of target area according to Fibonacci. The wave 4 can retrace to FWB:88K and it can happen very soon, but this time altcoins promised to remain strong. The next growth will happen to $94-95k in the wave 5. Dominance can reach our final target at 66%. The further correction to 0.61 Fibonacci below $85k will cause the atlseason and after that altcoins will grow in the very short period of time with the growing Bitcoin.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

"Bitcoin vs Tether" Crypto Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "Bitcoin vs Tether" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level for Pullback Entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (81000) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 70000 (or) Escape Before the Target

"Bitcoin vs Tether" Crypto Market Heist Plan (Scalping/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

Detailed Point Recap 📋

Fundamentals 📊: Strong network + adoption ✅ offset regulatory risks ⚠️—moderately bullish 📈.

Macro 🌍: Inflation aids BTC 🥇, but tight policy/USD weigh ⚖️—mixed 🤔.

COT 📈: Institutional longs 📈 vs. leverage risks ⚡—cautiously bullish ✅.

On-Chain 🔗: LTH bullishness 📈 vs. STH selling 📉—leans positive but capped ⚖️.

Intermarket 🔄: Short-term bearish (equity/USD) 📉, long-term hedging 📈—mixed ⚖️.

Sentiment 😊: Neutral across cohorts ⚖️—lacking conviction 🤷.

Trends 🎯: Short-term downside ($70K) 📉 vs. long-term upside ($129K) 📈—context-driven 🔮.

Outlook 🌟: Neutral now ⚖️, tilting bearish short-term 📉, bullish long-term 📈.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

BTC Update... What To Expect Now??Currently BTC is facing resistance of major trendline (Blue line)+ wedge resistance+ bearish OB resistance...

For bullish trend, currently Bitcoin have to break above all these resistances along with 89k level for confirmation of bullish trend....

If it fails and retraces back inside Monday high range, then we can expect price dropping below Monday lows where major support level is present+ Bat Harmonic Potential Reversal Zone+ 61.8 Golden Fib Level around 72000-70500 levels.

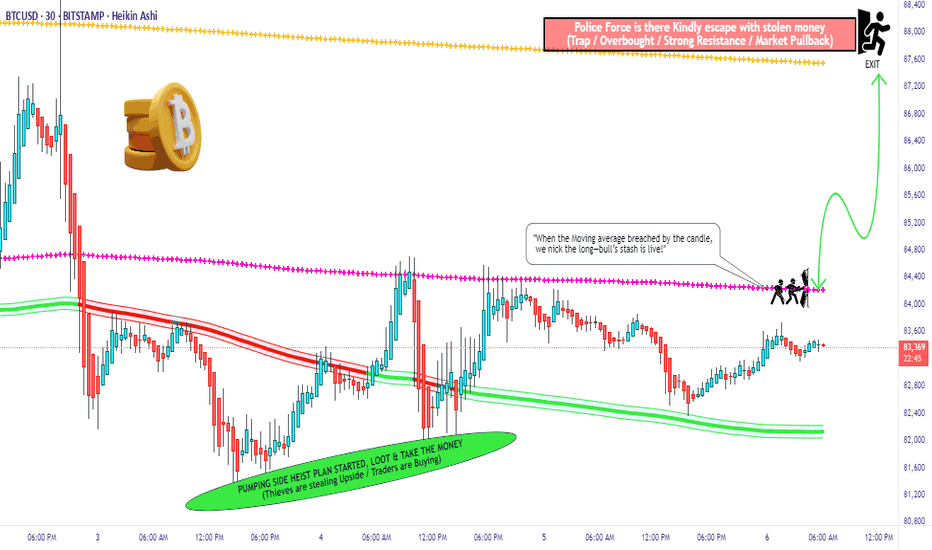

"Bitcoin vs U.S Dollar" Crypto Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BTC/USD "Bitcoin vs U.S Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (84.400) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

Thief SL placed at the recent/swing low level Using the 30mins timeframe (82.000) Day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 87.500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

BTC/USD "Bitcoin vs U.S Dollar" Crypto Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. 👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Bitcoin Weekly For The Value Hunters & Range Enjoers. With lack of significant bid in the books until 70k. Ideally we drop to value sooner than later & gather demand with a range through summer. Supply has been chasing price down, with perps traders off loading latest positions yesterday in the US session.

This will be painful to most crypto traders but good for range trade enjoyers & spot value hunters.

Key levels: 70/71k Weekly & this is both spot & perps largest resting order blocks in the order books.

Time Has Came For Bitcoin NOW!!!As Updated previously on Macro, We have reached at crucial zone. According to Elliott wave count on big picture, BTC formed ending diagonal and now approaching at it's reversal points. From this area of 75-69k region, there's high probability of trend reversal and we will soon see shorters getting rekt

BITCOIN Update: What We Can Expect Next???According to current price action we can expect 3 scenarios:

Scenario 1: BTC is currently at it mid range resistance. If it breaks above this resistance then we may probably see price approaching range high and even beyond.

Scenario 2: If it fails to break and rejects, then most probably we can expect reversal from range low demand zone, which aligns with cypher harmonic pattern's PRZ.

Scenario 3: In worst case, we may see BTC dumping upto 74-70K region, and from there we will most probably see trend reversal.

Most crucial level to watch in all scenarios is 95k region, if it breaks successfully above it, then we will see BTC slamming new ATH.

BTC Whales Stir, Trump's Crypto Push, and the Path to $85,000

Bitcoin's recent price action has ignited a renewed sense of optimism within the crypto community. A confluence of factors, ranging from whale activity and political pronouncements to macroeconomic indicators and regulatory developments, is shaping the current market narrative.

Whale Activity: A Harbinger of Bullish Momentum?

The resurgence of Bitcoin whale activity is a significant indicator that has captured the attention of traders and analysts. Large-scale Bitcoin holders, often referred to as "whales," possess the capacity to significantly influence market dynamics.1 Their accumulation of Bitcoin can signal strong conviction and potentially trigger broader market rallies. The recent uptick in whale activity suggests a renewed interest in Bitcoin among these major players, potentially laying the foundation for a sustained upward trend. This can be viewed as the building of a strong base of long positions.

Political Winds: Trump's Crypto Pronouncements and Market Sentiment

Political discourse has increasingly intersected with the cryptocurrency market, with recent statements from a prominent political figure influencing market sentiment. Rhetoric emphasizing the United States as a "Bitcoin superpower" has undeniably contributed to bullish momentum. This political articulation of a crypto-friendly approach signals potential policy shifts and improved regulatory clarity, both crucial factors in attracting institutional investment. Market participants are interpreting this as a sign of acceptance, if not outright endorsement, of digital assets at the highest levels.

It is worth noting that consistent pronouncements regarding the US becoming the "crypto capital of the world," while driving short term volatility, need to be followed with legislative action for long term impact.

Macroeconomic Factors: Fed Policies and Inflationary Concerns

The Federal Reserve's monetary policy and the evolving narrative surrounding inflation play a pivotal role in shaping Bitcoin's trajectory. Recent indications from the Fed regarding continued rate cuts, despite persistent inflationary pressures, have boosted investor confidence. This stance, coupled with Powell's assessment of certain inflationary factors, such as tariffs, as "transitory," has provided much-needed relief to risk assets, including Bitcoin. This monetary policy creates a favorable environment for investment. The combination of Fed policy confirmation and rumors of "significant updates" to US crypto plans have driven Bitcoin to new two-week highs.

Technical Analysis: The $85,000 Threshold and Beyond

From a technical perspective, Bitcoin's ability to reclaim the $85,000 level is considered a crucial milestone. Surpassing this threshold would validate the current bullish momentum and potentially pave the way for further gains. Analysts are closely monitoring key support and resistance levels to gauge the strength of the ongoing rally. The return of significant volume combined with the price retaking old highs lends to an increasingly bullish sentiment.

BlackRock's prediction of a price shift ahead indicates a growing acceptance of Bitcoin as a mainstream asset, potentially aligning it with traditional Wall Street investments.2 These kinds of comments indicate an institutional bullish long-term perspective.

Regulatory Clarity: Ripple's Resolution and Its Impact on Bitcoin

The resolution of Ripple's legal battle with the SEC has sent ripples (pun intended) throughout the cryptocurrency market. This development has provided much-needed regulatory clarity, bolstering investor confidence and fostering a more favorable environment for digital assets. The jump in XRP's price after confirmation of the case coming to an end further exemplifies the markets sensitivity to regulatory action. This resolution will influence Bitcoin’s adoption rates, as investors now know the US regulatory stance may be moderating.

Options Market Sentiment: A Shift Towards Bullishness

The Bitcoin options market has exhibited a noticeable shift towards bullishness, particularly after Powell's "transitory inflation" remarks. This sentiment reflects increased optimism among traders and investors, potentially signaling a sustained uptrend. An increased amount of bullish options being written displays further faith in the rise of Bitcoin’s price.

Bitcoin's Volatility: Navigating the Uncertainty

Despite the positive developments, Bitcoin remains inherently volatile. Price swings, driven by a combination of market sentiment, news events, and technical factors, are to be expected. Investors should remain vigilant and exercise prudent risk management strategies. While large volume and long term political promises are strong positive indicators, there are still volatile short term swings to consider.

Looking Ahead: The Potential for a Sustained Rally

The convergence of positive catalysts, including whale activity, political support, macroeconomic factors, and regulatory clarity, paints a potentially bullish picture for Bitcoin. However, the cryptocurrency market is subject to rapid shifts, and unforeseen events can significantly impact price movements.

To conclude, the present environment is ripe for sustained Bitcoin price discovery. The political and macroeconomic climates are aligning, coupled with increased whale activity and regulatory clarity. While markets will remain volatile, the trend is looking increasingly bullish.

Bitcoin in Bearish Flag Pattern, Breakout Could Be Near...🚨 Bitcoin Update 🚨

Bitcoin is currently forming a bearish flag pattern on the hourly timeframe, following a strong rejection at the $92,000 level. This consolidation suggests a potential continuation to the downside, but we're closely monitoring for a breakout either way. ⬇️

If the price breaks down from the flag, we could see further downside, while a breakout to the upside could challenge previous resistance levels. 📊

Stay alert and keep an eye on the key levels! Let’s see how this plays out. 🔍

BTC - are we about to bounce?Hi All,

So just a thought and observation - let me know what you guys think. We have had 4 bounces

off this bottom green support trend line since 2023. Each time BTC shoots back up for a solid run.

Is the end near?

Am I hoping for an end to this blood bath correction which just dipped into the $79K range. Is there more to come, the chart says we should be done - or damn near the end.

Let me know your thoughts!!

BTCUSDT Analysis – From Simple to Complex!BTCUSDT Analysis – From Simple to Complex! 🚀

“Let’s break it down step by step. At first glance, the first red line looks like an obvious resistance point. But here’s the deal—it’s too obvious. And in trading, when something is too obvious, it often doesn’t work as expected.”

Basic Structure:

📌 Red Line = Clear Resistance – Everyone sees it, but that also means it could be a trap.

Now, Let’s Get Deeper...

🔍 Volume Analysis Changes the Game:

Weekend Moves with Low Volume = High Manipulation Risk – Crypto loves to fake out retail traders in these conditions.

Look at the Black Line Inside the Blue Area – This is where things get interesting. This level could be the true battleground between buyers and sellers.

CDV & Volume Profile Will Guide Us – We need confirmation from buying and selling volumes before making any major moves.

Final Thoughts:

“At first, the chart looks simple, but once you add volume analysis, things get more complex. Don’t trade based on what looks obvious—trade based on what’s actually happening in the order flow. I’ll explain the next step in my following post!”

📉 Stay smart, stay ahead! 🔥

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

I have a long list of my proven technique below:

AVAXUSDT Perfect Short Entry!

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

Bitcoin Goes "Red Days Again" since "Relief Rally" Has Been NullBitcoin's price has experienced significant fluctuations over last "Intl Women's Day" weekend, reflecting the volatile nature of the cryptocurrency market. To understand these movements, it's essential to consider both the broader economic context and specific events that have influenced investor sentiment.

Background: Economic and Political Factors

In recent weeks, Bitcoin's price has been heavily influenced by economic indicators and political announcements. The U.S. Federal Reserve's stance on interest rates, particularly comments from Jerome Powell, has been closely watched by investors.

Political factors have also played a crucial role. For instance, Donald Trump's re-election and his proposals related to cryptocurrency, including the creation of a "Strategic Bitcoin Reserve," have contributed to market optimism and price increases. However, these developments also introduce uncertainty, as regulatory environments and geopolitical tensions can quickly shift investor confidence.

Recent Price Movements

As of the last weekend, Bitcoin's price has shown a decline of nearly 5%. This decrease is part of a larger trend where Bitcoin's price has struggled to maintain consistent gains, often experiencing sharp drops followed by rebounds. For example, on March 9, 2025, Bitcoin's price was noted to be choppy, trading around $81,500.

Bitcoin's price initially dropped but then rebounded slightly. This rebound was likely driven by renewed optimism in the altcoin market and strategic purchases by entities like Metaplanet, which has been actively buying Bitcoin. However, the overall sentiment remains cautious due to ongoing economic uncertainties and the potential for further interest rate hikes.

Key Events Influencing Price

Mt. Gox Bitcoin Movement: The recent transfer of over $1 billion worth of Bitcoin from Mt. Gox to an unmarked address has raised concerns about potential market impact. Such large movements can lead to increased volatility as investors speculate about the intentions behind these transactions.

Regulatory and ETF Developments: The ongoing efforts to establish a U.S. spot Bitcoin ETF have seen mixed results, with periods of significant outflows followed by brief moments of positive inflows. These developments can influence investor confidence and, consequently, Bitcoin's price.

Global Economic Conditions: Trade tensions and economic stimulus measures, particularly those involving China, have also played a role in shaping Bitcoin's price. As investors seek safe-haven assets, Bitcoin's performance relative to traditional assets like gold can impact its value.

Technical challenge

The fluctuations in Bitcoin's price over the last weekend reflect the complex interplay of economic, political, and market-specific factors. As investors continue to navigate these uncertainties, Bitcoin's price is likely to remain volatile. The influence of major economic data releases, political announcements, and strategic investments will continue to shape the cryptocurrency's trajectory in the coming days and weeks.

The main technical 1-day resolution graph indicates that Bitcoin Goes "Red Days Again" since recent "relief rally" has been Null.

Ahead of upcoing week our "super-duper" @PandorraResearch Team is Bearishly calling to numbers between $30 000 to $50 000 per Bitcoin, that is correspond to major current support of 200-week SMA.

Conclusion

In summary, Bitcoin's price movements are a testament to the dynamic and speculative nature of the cryptocurrency market, where sentiment can shift rapidly based on a wide array of factors. As the market continues to evolve, understanding these influences will be crucial for investors seeking to navigate the volatile landscape of Bitcoin and other cryptocurrencies.

--

Best 'Jojoba oil' wishes,

@PandorraResearch Team 😎

My FINAL Bitcoin chart and Idea (forever)Everyone is too busy focusing on the wrong Technicals. Fear and Greed, RSI, MACD, Stock Markets, etc. All of these are good tools but we have to remember a few things:

1. Zoom out (Bitcoin follows the same 4-year cycle every time... this time is NOT different)

2. Keep it Simple (I'm tired of messy charts, only put what you need for the current timeframe)

3. Avoid Leverage (These areas are too risky and much too volatile... liquidity is getting grabbed at almost every level) Stay safe.

I expect Bitcoin to retrace to $57k and then bounce back up... clear skies ahead if we can break out of this pattern I have drawn up. (If not we keep ranging as follows until we break significantly above the previous ATH)

Peace out! It's been fun... I may return to crypto one day (if ykyk)

Insane Growth Is Just Beginning For Bitcoin BTCHello, Skyrexians!

Recently we made two analysis on BINANCE:BTCUSDT . In the first one we pointed out that $80k is going to be the reversal point, in the second that bullish reversal bar has been confirmed at $85k. Now we are seeing how it is playing out. This is just the beginning of a pump. Here is why.

On the daily time frame we can see the green dot on the Bullish/Bearish Reversal Bar Indicator which has appeared when price bounced form. 0.5 Fibonacci. For us this is the clear sign that wave 2 has been finished and now Bitcoin is printing wave 3. This wave has the most realistic target next to $180k at 1.61 Fibonacci extension, but the strong resistance can be met at $140k.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Long in BTCI. Long entry reason:

1. Breakout from Key Resistance

BTC had closed above the previous resistance zone (~84,500-84,800), signaling strength.

The breakout candle had a good body-to-wick ratio, meaning strong buying momentum.

2. Higher Lows Formation

Before the entry candle, BTC made a higher low (~83,759), confirming bullish structure.

This showed that buyers were stepping in at higher prices, reducing downside pressure.

3. Momentum Shift

The breakout candle closed above the previous 6-8 candles, showing a shift in sentiment.

This price action validated a trend reversal from the dip that happened earlier.

4. Retest & Hold of Support Before Entry

BTC briefly retested the breakout zone (~84,500) before moving up.

This confirmed that sellers were exhausted and buyers were taking control.

II. Risk Management & Stop-Loss Placement

1. Stop Loss (SL) Placement: Below the previous higher low (~83,759)

2. Target Levels:

First target: 87,014 (first resistance)

Extended target: 89,100-89,318 (next supply zone)

Bitcoin Breaks Major Support: Time to Enter Short Positions...?Bitcoin has recently broken through a crucial support level of $92000 on the daily timeframe, following almost three months of consolidation. It may be prudent to hold off on entering a short position until a retest of the $92000 level occurs. The next significant support area to consider is approximately $73000, which could serve as a target for any potential short positions.