Bitcoin Bullish Fractal Bars Pattern To $100k, $155k, and $250kHere's a slightly different chart showing how Bitcoin will likelyt proceed quickly to $100k once we break the $70K triple-top resistance, which I see happening quickly.

With Fresh NASDAQ:IBIT money continuing to flow into Bitcoin and the markets, this market has plenty of rocket fuel on the sidelines to send this rocket into the stratosphere.

Not only does the previous cycle fractal pattern show how Bitcoin can hit these levels this cycle, it also overlays perfect (with minor adjusting) with the Fibonacci projections that correctly forecasted the prior cycle high at the Fib 3.618 level.

The 3.168 number for this cycle would be $210k but I think it's reasonable to overshoot that this time with all the money on the sidelines waiting to come in. We're already starting to see and hear rumors of Tesla buying, Qatar and potentially other sovereign wealth funds, even China.

How high will Bitcoin go this cycle? Here's a good roadmap for now.

But new information = new dedision.

I'll keep you updated.

What do you think?

Bitcoinscenarios

BTC 4H timeframe, Bitcoin Price Prediction As we said before first move isn’t for you but the 2ed is yours.

Also we put 2 entries to minimize the risk..

1- At 66000$ levels

2- In the demanding zone (box below) around 62000$

So what is next now?

We may face some resistance to keep up price around previous all time high level (P-ATH) But in the end we will achieve this and we will move towards ATH as a first goal.

I hope everyone success.

Limited upside but more potential downside in store for Bitcoin?Bitcoin has been trapped in a downward descending channel since March 14th 2024. It is continuously struggling to hold ground and important supports. Right now it is struggling to climb above 50 hours EMA (64612) indicating weakness. Even if 50 hours EMA is crossed there is channel top and 200 days resistance near 66072. In case Bitcoin is not able to cross and close above 50 hours EMA next week, the next support levels will be only near 63551, 62413. After 62413 there is a strong support zone for Bitcoin between 60763 and 62015. 62015 will be a strong support as it is also the mid channel support for Bitcoin.

BTC Drop loadingI wasn't expecting the price to rise so much, but doesn't matter. As we has seen lot of times, it's squeezing some shorts. And as always, the higher the squeeze, the deeper the drop. I don't think it will broke above previous high (but i can be wrong), but what is sure is that is going to drop soon. It's clearly a bull trap, and it can go up a bit more before dropping. 41k is my main target, and invalidation will be clean break above 49k. Most important, don't long now.

Can Bitcoin Hedge Against a Falling Dollar?Global inflation often signifies a weakening of global currencies. The question of whether Bitcoin can serve as a hedge against a depreciating dollar has gained significant interest among investors.

Or should it still be the Gold?

In this study, we will analyse the top 8 cryptocurrencies to determine which one is a more reliable currency hedge.

Bitcoin & Its Minimum Fluctuation

$5.00 per bitcoin = $25.00

BTIC: $1.00 per bitcoin = $5.00

Code: BTC

Micro Bitcoin & Its Minimum Fluctuation

$5.00 per bitcoin = $0.50

BTIC: $1.00 per bitcoin = $0.10

Code: MBT

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Bitcoin's Projected PathTraders,

Bought more BTC here. TBH, this just looks like another bull flag. I can see us hitting our heads on the 30k again where I may sell some but eventually that resistance will break. And I think sooner than later. Then we'll have to tackle that 31.6k level. If we can break above that, my prediction from Jan-Feb still stands - 37k by then end of the year.

Best,

Stew

Macro, multi year view of BTC. Update 1Notes on the chart:

• Month counting starts from where a new bull run begins and on the chart it marks how many months it took for the full cycle to complete (roughly 49mo).

• Blue horizontal lines are BTC halvings.

• Green zones are accumulation zones

Overall update of the 4-year journey

Back from our previous post we were looking at when the lows would be printed. After the rally in H1 of 2023, we are now looking at the expectations in the year looking forward and up to 2025.

In trend with previous years when a new cycle starts an initial top is usually printed within 6 months and this time was no different. Based on history, from month 6 (July 23) onwards, up until the halving which is expected in March 2024, BTC has seen significant drops.

However, I would strongly argue this is the true accumulation zone:

1) Confirmation of the 4-year cycle low has been set. Of course, this can be invalidated, but I would say that a significant catastrophic event would be needed to reach such levels.

2) Before every bull run, a shake-out is needed as it achieves the transfer of bitcoin from retail back to investors AND

3) Large institutions are finally eyeing to tap into the market and be exposed to this.

I think it would be impossible for anyone in this space to miss the idea of a BTC spot ETF being delayed over and over but the narratives just seem to be perfectly aligning for the upcoming years 24,25. Those would be: US elections, returning to QE as recession fears grow (consumer spending is dwindling), possibly the Ukraine war will be over, and BTC halving.

Takeaway

The period up until the halving will be volatile. However, based on history DCA up until the halving should allow you to have a fairly comfortable position for the following years.

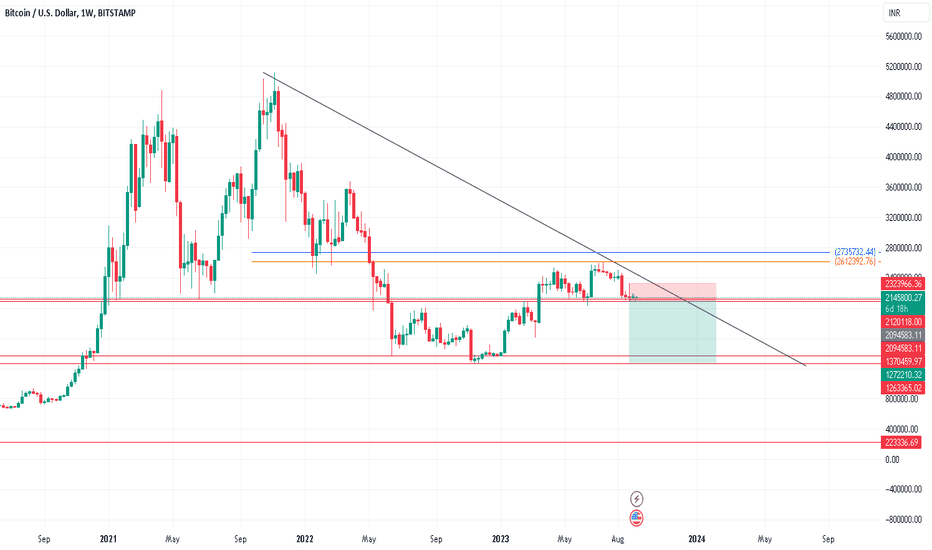

BitcoinWe may see 1270000 again if breaks the support.

Careful upside is very limit as resistance is strong and retested to further fall from here.

Best buying may come next year Jan/Feb 2024..

Stay away from the bitcoin as per technical analysis.

Upside break should be very fast as of now or it will reject and fall in coming weeks or months.

BTC trade, BTC&USDT dominance analysis. When will the altseason?Do you think such a medium-term trade will work for BTCUSDT?

Entry $29170

Stop $27999 (-4%)

Take profit $32450-32750 (+18%)

Potential profit/loss ratio = 4.5/1

The purple trend line since the beginning of the year is at $28350, stop at -1% below it in case of a squeeze.

USDT dominance is in the middle of a multi-month consolidation.

* USDT.D's upward movement to 8.20% will signal an exit from the cryptos to the stablecoin and, accordingly, altcoins will have a chance to lose another -20-40%

* USDT.D's downward movement to 6.90% will give a "fresh breath of oxygen" to altcoins and allow them to organize a mini growth.

Only below 6.90% can the alt-season begin.

BTC dominance is now above the important 49% level.

A signal that capital from BTC has begun to flow into altcoins will be consolidation of this indicator below 49%. And a drop to 44%-42% will only "heat up" the possible and long-awaited altcoin season.

This is all theory) But in practice, everything changes hourly, and our/yours assumptions should be insured by stop orders.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

BTC/USD and its crucial support and resistance areaLooking at this Daily BTC/USD Bitstamp chart from around Oct 2020 to 29th July 2023 (today) we can see a few obvious chart patterns that BTC is still in on this daily chart.

1) Ichimoku Y-Wave Pattern AKA a Broadening Wedge Pattern/Megaphone Pattern

2) Ascending Channel Pattern

3) Descending Channel Pattern

4) Rising Wedge Pattern

We can clearly see the crucial range that BTC must break ABOVE and turn into strong support, which is around $28,709 to $32,360 as highlighted by the channel with horizontal dotted lines with yellow shading.

This area has been both strong support and resistance quite a few times over the years.

As a Strong Support range:

Sat 2nd Jan 2021 to Mon 1st Feb 2021

Wed 19th May 2021 to Fri 23rd Jul 2021

As a Strong Resistance range:

Mon 9th May 2022 to Sun 12th Jun 2022

Monday 20th Mar 2023 to Monday 8th May 2023

Mon 29th May 2023 (1day)

Wednesday 21st Jun 2023 to 29th Just 2023 (as of typing this)

Using @LuxAlgo Buyside & Sellside Liquidity indicator, we can see that BTC is slowly filling up its Liquidity Void from around $29,611 to its bottom at $27,051. As we can see from the history of the chart, quite a few of Liquidity Voids do end up getting filled back up even after a long period of year and a half. We can also see that a Buyside Liquidity line is located almost exactly on the top of our important support/resistance area.

Using the Visible Range Volume Profile (VRVP) in its Delta mode, we can see what the Traded Volume difference was on each of the Volume Profile Bars for this entire charts visible range. Note that the Volume Area Up is Blue and Volume Area Down is Yellow.

Here is a closer look at this 1 day chart.

Note that BTC is still below its Bollinger Bands Middle Band Basis, the Lower Band is still pointing downwards and the Upper Band looks like it may curve downwards.

I have added a Fixed Range Volume Profile (FRVP) indicator from Thur 15th Jun 2023 to Sat 29th July 2023 (as of typing this). The FRVP is also in its Delta mode and you can clearly see the Traded Volume differences for each Bar. Note that again the Volume Area Up is Blue and Volume Area Down is Yellow.

Looking at the Chaikin Money Flow Indicator (CMF) we can see that the CMF Line is still in the Distribution Zone under its 0.00 Base Line and note that it is still Below its Least Squares Moving Average (LSMA) indicator. Note that the LSMA has curved upwards at the moment.

Looking at the Relative Strength Index (RSI) we can see that momentum has dropped and the RSI Line is still below its 9 Period EMA line. Using the Bollinger Bands on the RSI we can see that the RSI now has little bit of room to move downwards and a lot of room to move upwards before becoming over extended/overbought/oversold. It really is good practice to be on the lookout for any Convergence and Divergence with the RSI and the Price.

The key takeaway from this post, the Resistance Area from around $28,709 to $32,360 is very, very important! Note we also have a Buyside Liquidity Line located almost directly on $32,360.

For the Upside:

A successful Daily Candle CLOSE above the $32,360 level and any successful re-test as strong support will be a good sign of continued positive momentum to come.

For the Downside:

Failure to CLOSE a Daily Candle above the $32,360 level will be a good sign of continued sideways to eventual negative momentum.

Anyway, i hope this post is helpful.

Bitcoin BTC price is at a crossroads Vote on where price will goThe BTCUSDT price has been consolidating in a narrow range of $30-31 thousand for 21 days.

MM, which keeps the price in this range, has its own goals, which we can only guess at.

We expected that yesterday's announcement of the "fresh" US CPI, which came in better than forecast (3.0%), would push the price of BTC up (SP500 +1% after yesterday's US CPI announcement), but no.

The BTCUSDT price was smoothly falling to the lower boundary of consolidation yesterday.

This only proves once again that in the cryptocurrency market, it is still quite easy for the big money to fulfill their "tasks" and direct the price in the direction they want.

On the chart, we have presented two fractals of Bitcoin price movements that have occurred in the past.

It turns out that the price of BTCUSDT is now at a crossroads and the next few days may be "hot".

Of course, the activation of both the white and blue fractals will occur after the price consolidates above FWB:31K , or below $30k, respectively.

But still, which movement of the BTCUSDT price do you prefer in the coming days? Up or down? Please vote in the comments below the idea

We think that "the mood" of active participants in the crypto market will be interesting for many to see

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

BITCOIN breakdown IMPORTANT levelsAs you can see, Bitcoin price has been traded in consolidation for quite some time.

Im using fib channel to ilustrate that picture, im not usualy using it to trade.

The price has been reacted on almost every level in channel, having in mind that upper middle is slightly bullish, lower middle is slightly bearish.

But as long as we are in that channel the long swing or short swing positions will be liquidated due to a price fluctuation, and thats why im taking short term trades as long as we are in this consolidation.

Now adding Volume profile to this picture, we can see that there is not much strenght for the bulls to turn things around.

They where defended the Value area twice, the big yellow pocket on the chart where there is a low volume to none, suggesting that if price breakdown to that level it will soar to 25k.

The next defence was now, bouncing of the middle fib channel, liqudating the short positions who where aiming for the 25k. Thats why only the short term trades are in place.

Next for the bull enthusiast, every time the price goes up, the sellers driving the price down even more to collect their stops and liquidity.

As you can see the price tested 3 times the top upper channel, failing to breakthrough, making lower highs for days. As long as we are in the channel and having lower lows for me that is a bearish sentiment.

Logically speaking, the price will aim to touch the lower channel for the third time, where is a big point of control sitting with big volume on that level which is 25k.

Now that wont happen, until price closes below middle level in the channel, suggesting the bearish sentiment. Now this level is a dangerous because this level is with low volume, and very close to that breaking point on yellow pocket with basicaly no volume at all.

This is a psychological level, where bulls are aware that if they lose that level the price will tank down, thats why we have those two big wicks on that level.

Now if the price happen to close bellow the middle fib channel, and start to consolidate a little, gathering strenght for some continuation pattern, we will see the big move on 25k.

25k is the very strong buy zone, even if it breaks down a little, everyone will be jumping in, to buy for even lower price, where we could see a potential reversal for maybe a little longer uptrend, but even then we are far away from the bullrun.

BITCOIN TO $25,000 THEN $35,000 Or Bearish??Bitcoin has 2 main scenarios in play...

Looking at the bigger picture there is still no reason to be bearish, price could easily go higher..

Bitcoin may pump to $35k, if it rejects I see $25.3k possible before a move up. .

Or we could go lower to around 23k

BTC 1D Rising Wedge Pattern & Friday Candles High and Low LevelsBTC try to hold 50MA line. You also can monitor purple lines which based on friday candle high and low values. These are the areas that BTC might bounce.

Disclaimer: The information and analysis provided in this publication are for educational purposes only and should not be construed as financial advice or recommendations to buy, sell, or hold any securities. The author and TradingView are not responsible for any investment decisions made based on the content presented herein. Always consult a financial professional before making any investment decisions.