Bitcoinsell

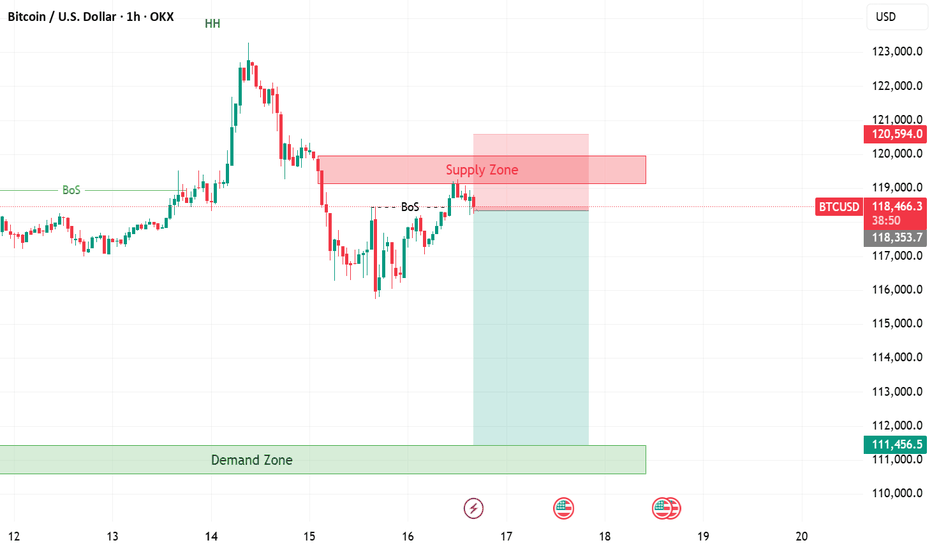

Bitcoin - Looking To Sell Pullbacks In The Short TermM15 - Strong bearish move.

Lower lows on the moving averages of the MACD.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Thu 15th May 2025 BTC/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning, and this is a BTC/USD Sell trade. As usual, you can see the details of the trade/s on the chart. Keep in mind that I am generally looking to buy when the MACD is below the zero level & sell when it is above the zero level. The red/blue QMP Filter dots on the price chart produce the actual trade signal. I am also considering things like divergence, support/resistance, round numbers etc, and these will be marked up on the chart. Enjoy the day all. Cheers. Jim

Tue 6th May 2025 BTC/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a BTC/USD Sell. Enjoy the day all. Cheers. Jim

Sat 29th Mar 2025 BTC/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a BTC/USD Sell. Enjoy the day all. Cheers. Jim

We warned you in the previous post about the crash, BitcoinDo you remember the last post where we warned you about the upcoming crash?

Today, reality has become even harsher.. Bitcoin has crashed below $100, and Tram Coin has plummeted into oblivion!

🔥 Unfortunately.. for those who didn’t read the previous post:

It was the golden opportunity to exit before the disaster..

Now.. regret and loss for those who ignored the warnings!

💡 If you want to know how low Bitcoin will go.. read the previous post!

And if you don’t want the market to crash on you.. hit follow so you don’t miss any important warnings or analysis!

💔 The fear of loss is worse than the loss itself..

Don’t let procrastination or neglect make you a victim..

Follow the analysis and always be prepared for any scenario!

📉 The market shows no mercy..

So, are you ready for the next move?

This is the post I warned you from.. If you were following me and read it, you wouldn’t have lost!

Short Bitcoin (BTC) (For Study Purpose Only)Short Recommendation

Entry Level: Below $94,000

Stop Loss (SL): $111,111

This surge has been largely attributed to President-elect Donald Trump's pro-cryptocurrency stance, including promises of deregulation and the establishment of a national strategic Bitcoin reserve.

However, concerns are emerging regarding Bitcoin's current valuation. Analysts warn that the market may be overheating, with some predicting a potential correction of up to 35%.

COINTELEGRAPH

Additionally, Federal Reserve Chair Jerome Powell has stated that the U.S. central bank cannot hold Bitcoin, which has introduced uncertainty into the market.

This analysis is for educational purposes only. Always consult your financial advisor before making any investment decisions. Cryptocurrency trading involves significant risk, including the potential loss of capital. Ensure to evaluate your risk tolerance and conduct thorough research.

"In markets, gravity always wins."📉 Bitcoin Analysis (BTC/USD) 📉

Bitcoin's meteoric 100% rise since September screams overextension. The euphoria may be fading, and a correction looks imminent.

🔻 Key Levels to Watch:

$73,800: The first major support—breaking this could accelerate the drop.

$65,600: A likely target if bears take full control.

The chart suggests BTC is overdue for a pullback. Corrections after such rallies aren’t just likely—they’re inevitable. Bulls, buckle up. Bears, this might be your moment.

"In markets, gravity always wins."

Tue 26th Nov 2024 BTC/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a BTC/USD Sell. Enjoy the day all. Cheers. Jim

Bitcoin: Step-by-Step Action Plan for 2025

Bitcoin has just reached its 60-day cycle low, coinciding with the conclusion of the U.S. election—a critical moment in both markets. If this cycle follows a "right-translated" pattern, we could see BTC maintaining bullish momentum for the next four weeks.

In trading, two types of participants tend to profit: those who spot and act on trends using indicators, market structures, or other strategies, and those who rely on luck by buying at the right time. While luck might bring gains in a market with Bitcoin’s history of strong growth, relying on it is often short-lived. Without the skill to analyze the market, "lucky" traders often lose out in the long run, especially when conditions turn.

For sustainable success, understanding the 60-day cycle and recognizing right-translation as a bullish sign can make all the difference. Watch for potential upward movement in Bitcoin over the coming weeks, but remember to keep an eye on key indicators and manage risk carefully!

What Are the Cycles Telling Us About Bitcoin and Altcoins Right Now?

Bitcoin Confirmed 60-Day Cycle Low: Bullish Setup for the Next 40 Days

Bitcoin's price is showing signs of upward momentum. Our 3-day indicator, which we aimed to see below 20, has started turning upward, suggesting a bullish short-term pattern. Currently, the daily indicator sits around 46—potentially a good entry signal. Over the next 3-4 days, we could see a strong price push, potentially followed by a brief consolidation.

The ideal buying opportunity came at the last cycle bottom of $56,000, with the next best entry at the recent low around $70,000. Now, with Bitcoin confirming its 60-day cycle low at $68,000 and beginning its ascent, a right-translated cycle could mean a climb over the next 40 days, providing ample time for gains.

While the 1-week indicator (red line) is above 80, it’s holding steady, indicating a continued bullish phase. Although this weekly indicator may dip to 20 within the next month or two, bringing another buying opportunity, strong uptrends can mean that waiting could result in missed profits. Stay alert for potential pullbacks, but the momentum is favoring the bulls!

Don't sleep on open profits - always take profits on the cycle tops!

Sat 2nd Nov 2024 BTC/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a BTC/USD Sell. Enjoy the day all. Cheers. Jim

BTCUSD Reverses from Major Resistance, Downtrend ExpectedBTCUSD has been trading in a well-established downtrend channel over the past few weeks. Recently, it hit a major resistance level and is now showing signs of a reversal to the downside.

Key Resistance Break:

The price action indicates that BTCUSD is failing to break through the resistance level, signaling a potential continuation of the downtrend in the upcoming sessions.

Potential Target:

Looking ahead to next week, we anticipate that BTCUSD may resume its downward trajectory and could potentially touch the 55,000 mark if the bearish momentum continues.

RSI Momentum Shift:

Multiple RSI lines have shifted downward, confirming the weakening momentum and supporting the likelihood of further downside movement.

Conclusion:

Traders should watch for confirmation of the downtrend as BTCUSD moves further from resistance. The technical indicators, particularly RSI, suggest that the market remains bearish in the near term.

Disclaimer:

This analysis is for informational purposes only and should not be considered financial advice. Trading cryptocurrencies involves significant risk, and you should conduct your own research or consult with a licensed financial advisor before making any investment decisions.

BTC → Bitcoin Blasts Through Resistance Then Falls Down. Short?Bitcoin completed its measured move on January 7th and gave us some extra price action up to the $49,000 area. With a strong sell signal and now a follow-through bar reaching the Daily 30EMA, is it time to short?

How do we trade this? 🤔

To justify a short trade, we need a Daily candle close below the 30EMA. The other data points all support a counter-trend trade: Measured Move Complete, Strong sell signal above key resistance area, RSI below the moving average around 50.00 with room to fall.

I frequently reference the 4HR chart when trading the Daily timeframe. As you can see in the chart below, the 200EMA on the 4HR chart overlaps with the 30EMA on the Daily chart. Using that same point of reference as a key support level, we can look for a close below the 4HR 200EMA to justify our short. That also allows us to get an earlier entry into the position:

Once we get that candle, we can justify a short scalp to the previous trading range/measured move mid-support at a 1:1 Risk/Reward Ratio.

💡 Trade Idea 💡

Short Entry: $42,650

🟥 Stop Loss: $46,950

✅ Take Profit: $38,350

⚖️ Risk/Reward Ratio: 1:1

🔑 Key Takeaways 🔑

1. Measured Move Completed Into Key Resistance Area.

2. Strong Sell Signal Above Measured Move Resistance.

3. Strong Sell bar falling to 30EMA

4. Wait for Daily Candle to Close below 30EMA.

5. RSI at 50.00 and below Moving Average.

💰 Trading Tip 💰

There is over a 60% chance of a measured move after the breakout of major resistance, normally, a trading range. That means the distance from the trading range resistance to the top of the breakout will happen again above the top of the breakout.

⚠️ Risk Warning! ⚠️

Past performance is not necessarily indicative of future results. You are solely responsible for your trades. Trade at your own risk!

Like 👍 and comment if you found this analysis useful!

BTC 4HR Analysis - Bears Are Taking Control to 200EMA!Bitcoin has had three pushes up from its previous trading range ending with a failed break of the $37,500 resistance level three times, leading the price below the 30EMA. Per my Weekly Analysis, the $37,500 price area is Bitcoin's Weekly Bull Channel resistance. These data points mean a short is reasonable from the $37,000 price area with a stop just above the pin bar at $38,000. It's also reasonable to take some profits at the bull channel bottom (about 1:1 Risk/Reward) and the remainder just before the 200EMA around the $34,000 area.

Key Points

1. Bitcoin is still in a Bull Channel

2. We have three pushes up ending with a strong bear pin bar

3. Three failed attempts to break and hold $37,500.

4. Gap from Current Price to 4HR 200EMA

5. RSI is just above 40.00 with Room to Fall

You are solely responsible for your trades, trade at your own risk!

Let us know what you think in the comment section below!

Bitcoin Possible Sell-Off to Low 33.9 Or LowerBitcoin performed a sweep yesterday then went up and grabbed the liquidity at 34.6 ( EXACTLY where we mentioned) then got rejected and moved down.we could see one last liquidity grab to the upside before the move to 33.9 starts.

Thanks for watching and your support <3