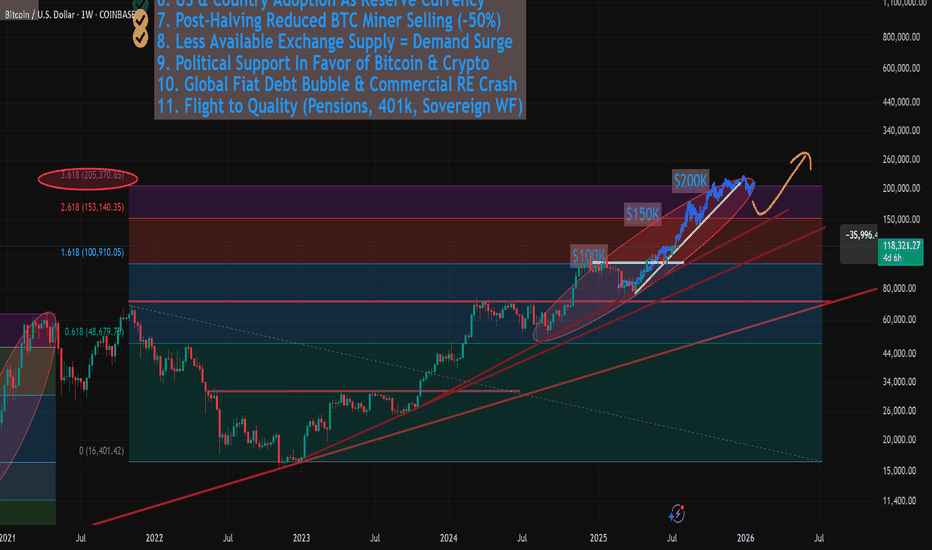

Revsiting $150k - $200k Bitcoin (AND Next Bear Market Bottom)In this video I revisit my 2-year old study showing the potential path for Bitcoin to $150k to $200k and not only how we might get there, but the 11 reasons WHY we can this cycle.

This is the same Fibonacci series that predicted the 2021 cycle high at the 3.618 (Log chart) and used the same way this cycle, with some interesting 2025 forecasts of:

1.618 - $100k

2.618 - $150k

3.618 - $200k

There are quite a few confluences that we get to $150k like the measured moves from both the recent mini bull flag, but also the larger one from earlier this year.

** Also I touch on revisiting my study from 2 years ago where I may have discovered the retracemebnt multiple that correctlty predicted and held the 2022 lowes around $16k. **

It's a VERY interesting number you all will recognize (buy may not agree with).

Let me know what you think.

Bitcointop

LongTerm BITCOIN LINEAR chart & NUPL tells a story -August Top

We can start with the main chart.

This is a LONG TERM LINEAR chart, showing the price action Directly, unaltered by mathmatics,

Long Term charts usualy are shown by logarithmic charts.

Linear and logarithmic trading charts differ in how they represent price changes. Linear charts display equal price changes the same, making them suitable for short-term traders focusing on exact price movements. On the other hand, logarithmic charts show percentage changes, which makes them better for long-term investors or volatile assets, as they help in analyzing trends and patterns more clearly over time.

This chart starts just before the 2017 ATH and you can easily see the line that rejects ATH and how PA is up near that area right now.

Things to note are the day count from 2017 ATH to 2021 Final ATH and the day count between that double Top in 2021.

These numbers are projected to our current cycle and show we are near the projected Top using this style of Chatr, The Log charts project further into the year.

It may also be worth noting how the 50 EMA (red) was used by PA after the Drop after the first ATH, to bounce back up to the next ATH at the end of that year.

We have just done exactly the same again, PA was rejected by that long term Line and Dipped down to the 50 EMA and has since bounced back up to the rejecting line.

IS REJECTION LIKELY NOW? [/b

This is something that is impossible to answer with any real Fact But we can look at data and make eductaed projections.

PA has the ability and strength right now, to range high, running up under this line of rejection until it becomes overbought on the long term MACD, RSI , TSI etc

But something that will absolutely decide when the top is in is the Profit taking by Holders.

We are currently seeing Selling taking place and we can see the potential profit by looking at NUPL

NUPL, or Net Unrealized Profit/Loss, is an indicator used in trading to measure the difference between unrealized profits and losses in the Bitcoin market.

Here is the chart from all the way back to 2010

Lots to see here but to summerise.

See how there are Peaks each cycle of Maximum available profit. The point where profit taking Tops out is arrowed. This area, up to the red line, shows us the TOP zone.

What is VERY noticable this cycle is how we have not yet reached that upper Red line.

Sellers appear to be taking theor profits earlier.

The upper day counts have been consistant in the past, with 2 double tops of potential profit before the selling sold it all off.

Many people, including me, have been saying "This time is different" and this is VERY clearly shown here by the fact that we have already had the 2 peaks of potential profit and we are currently climbing to the 3rd

This has NEVER happened before and, technicaly, this could continue.

The Lower day counts are from Mid Double Tops to the Next Mid double top of potential profits mentioned above,

The Next "Mid point" is projected to be around July.

This NUPL also shows ua how the high level of potentia profits was reached Quicker this cycle than previously. This was helped by the Corporations buying Early and Massive amounts, putting Large numbers of coins into profit

In Conclusion [/i

We have the Linear Bitcoin chart pointing towards a JULY / August Top

We have the NUPL also pointing towards a July / August Mid point of Potential profits.

If you loo cloely, BOTH charts, using differnet data, suggest 28 July

What also maybe worth considering here is how we see that Potential profits are reducing in availability. As the asset becomes more expensive to buy, it also gets harder to push the price higher and so make more profit. I,E. It was eaier to double the price of Bitcoin when it was $50 a coin

Of course, non of this may play out, Things ARE DIFFERNT but I have now decided to have another plan ready for August and we need to wait and see what happens Next

BE PREPARED FOR ALL POSSIBILITIES

Bearish Logscale Butterfly T2 with Bearish MACD & RSI DivergenceBitcoin appears to be set up at the 1.902 HOP for a Type 2 retest of the Logscale Bearish Butterfly that resulted in a major Type 1 reaction from the 1.618 Fibonacci Extension back in 2021, where it dropped from $69,000 to $15,500 over the course of several months before ultimately bottoming at the PCZ of a smaller Log Scale Bullish Butterfly which signaled the Type 2 run up to the 1.902 HOP of the Bearish Butterfly where it is now. As it tests this level the MACD and RSI are both Diverging Bearishly and the RSI especially seems weak as it now struggles to even crack above 70 level. This signals to me that the RSI has confirmed exhaustion after divergence at the HOP and that it is likely ready to start declining further.

Saying as though this is the type 2 test, I'd suspect that we'd make a lower low than our previous Type 1 reaction low at $15k, perhaps landing us around $12-10k; but if those levels don't hold It would be technically viable to assume BTC would go for the 0.886 retrace at around $4.6k

Bitcoin Breakdown, Pi Cycle Top Projections, and USDT.D UpdateIn this video I break down what I'm seeing with Bitcoin and the possibility for an even deeper correction into the Green Buy-Block zones.

I also revsit my Fibonacci projections for this cycle, with initial targets of up to $150k and ulitmately a $200k high target based on the 3.618 Fib retracement projection.

There's confluence with these targets using the measured moves from the recent Bull Flag breakout as well.

The BIG question is, where do we go from here?

Here we check out the Pi Cycle Top indicator, and I make some potential projections...

And propose the idea of a dual-cycle top, like we saw in 2013.

It makes sense, that we see a Jan / February pump to new highs, followed by a recessionary bust in Q2 (March) into the summer and potentially into Q3.

But then rally strongly up from there in Q4 as Oct, November and December are typically very bullish in a 4 year cycle. Either way, I think $200k is the cycle top, if we can get there.

The USDT.D study has also been updated, to show 'sticky' support here on the lower trendline, allowing BTC to push higher again above $100k and even rally higher per above. But then we'll likely see a reversion to the mean, with the USDT.D and Total Market Cap / Bitcoin prices.

Check out the video, and share some love with a Like, Comment, and Share.

Best to luck to everyone!

- Brett

Bitcoin Heading for a Local TOP on 16-17 December 2024These are 3 x Ceres in Aquarius fractals from the past 3 occasions in Bitcoin's life. What I like about these fractals is that 2 of them top on 16 & 17 of December which is a confluence to the Moon cycle topping on 16 December 2024.

This Ceres in Aquarius confluence seems good quality because these cycles repeat only once in 4 years and to get 2 cycles to converge on a top on the same dates 16 & 17 December, it is outstanding.

We need to see a clearly defined top on 16 or 17 December to be able to make the above conclusion. If we don't get a well-shaped top, that would mean more moves to the upside, as there are some other confluences for that. Ceres in Aquarius tops on 16 -17 December until the year's end. After that it continues higher up in January 2025.

Bitcoin: The Final Move Before a Crash to $3000It seems that Bitcoin has started forming an ending diagonal, which serves as the final impulsive waves in Elliott Wave Theory but has a corrective 3-3-3-3-3 structure, also known as a rising wedge. This wave will likely mark the end of a cycle pattern that began with Bitcoin’s inception, correcting all the growth achieved so far. A correction of this magnitude has no strict limit, but it will likely end at the lower-degree fourth wave, around $3000 per Bitcoin. This is also where the power line lies according to the volume profile. This scenario will gain more weight if, in the coming days, instead of heading to new highs, we drop below $66,500 again. In that case, I expect a correction to the $59-60K range, followed by the last upward three-wave move toward $80K. From there, at the first signs of a reversal, I believe it will be prudent to focus exclusively on short positions, targeting extremely low levels below $10,000 per Bitcoin.

Where are we heading for the next cycle?From top to bottom, using log fib extensions:

Cycle 2: 2.272 Fib is the top of 2013

Cycle 3 : 2.272 Fib is the top of 2017

Cycle 4: 1.618 Fib is the top of 2021. Institutions are in since 2017, diminishing returns.

Cycle 5: Will 1.618 or 1.272 fib be the top of 2025? I bet on the 1.618 option.

Max pain will occur before, certainly. But the destination is known, path isn't.

Crypto winter almost over , #BTCUSD to breakout 69k in Nov 2023More data leads to more accurate analysis and forecast. According to my last #bitcoin forecast which was published on tradingview (Link down below) on May 26th 2022, I was expecting a down move to 11.000$ before finding bottom. But more data has prevailed since then that leads me to believe that we have found a bottom and we are aiming for another up (25k - 27k) and down (16k - 18k) and start another #bullrun from february 2023 to breakout the 69k high of 2021. What do you think?

Bitcoin will TOP this year(2021).My thoughts on the current situation.

Bitcoin and the relationship between the bullmarket TOP and HALVING.

In the two previous cycles, the TOP of the entire growth cycle was exactly 820-850 days before the next HALVING.

Taking this into account, theoretically, we should reach TOP in December this year, and then go into

a downward trend and consolidations for the coming years.

It is worth noting that in the previous cycles, after reaching the peak(about 820-830 days before HALVING),

the distribution in the Descending Triangle formation began. In my opinion, it is likely that due to the global crisis,

the top of the current cycle was achieved much faster (64k in March) and currently we are already in distribution phase.

Bitcoin: Pi Cycle Ceiling Model V3This, like my previous two posts, is a model playing with multiplied moving averages. I found that more "spot on" cycle tops were seen when multiplying exponential moving averages, rather than simple moving averages. It appears that the relationship between the length of the moving average and pi is not really present here, as the 100, 200, and 400 day EMA multiplied by pi all correspond to the ceilings for each market cycle (2013, 2017, 2021). One may extrapolate that, if we are amidst a double peak cycle, the bitcoin price respects the 400 day EMA multiplied by pi as a "price ceiling"; And further extrapolation leads me to the idea that the next market cycle may respect the 800 day EMA multiplied by pi as a "price ceiling".

Bitcoin: Alt Alt Pi Cycle Top Based On Diminishing ReturnsUnlike my previous Alternative Pi Cycle Top, I coded the multiplier (the # after close) to be multiplied by pi. Once I added a Pi Multiplier to the same moving averages as previous, I realized it then moved so that the 79 day MA (pi*25) x pi corresponded to the 2014 double peak, and following a 2x to the length of the moving average each market cycle gives you a historically accurate local top sell target.

If you're looking at this, I encourage you to view my previously posted model. This is a slight alteration that seems to make it more accurate. This is pure speculation, and not to be trusted.

Bitcoin price prediction for coming years.

My thoughts on the current situation.

Bitcoin and the relationship between the bullmarket TOP and HALVING.

In the two previous cycles, the TOP of the entire growth cycle was exactly 820-850 days before the next HALVING.

Taking this into account, theoretically, we should reach TOP in December this year, and then go into

a downward trend and consolidations for the coming years.

It is worth noting that in the previous cycles, after reaching the peak(about 820-830 days before HALVING),

the distribution in the Descending Triangle formation began. In my opinion, it is likely that due to the global crisis,

the top of the current cycle was achieved much faster ( 64k in March) and currently we are already in distribution phase.

Taking historical analysis of previous cycles into account, I estimate Bitcoin will find a bottom between $ 16,500 to $ 10,200 over the next 12-18 months.

Bitcoin Potential Wave VHi everyone,

Thank you again for considering reading my idea. Just a disclaimer that I'm not an expert on Elliot Wave Theory but here's what I have in mind.

Let's see the first 4 waves:

Wave I - Initial impulse from March 2020 to May 2020 (161%)

Wave II - Sideways movement from May 2020 to September 2020

Wave III - Huge impulse from September 2020 to April 2021 (535%)

Wave IV - Huge diagonal correction from April 2021 to May 2021 (-53%)

For more zoomed in chart of Wave ABC for Wave IV, please see the updates below.

In my opinion, we have completed the Wave C of Wave IV and we're currently starting Wave 1 of the last and final wave of Wave V for this bull market.

On Elliot Wave Theory, it is a rule that the Wave III is always the biggest impulse compared to Wave I and Wave V. Since Wave III had a huge increase of 535%, we can say that Wave V is LESS than 535%. As for this rule, I am not sure if it's always the case or if it's mostly the case but let's assume that Wave III is bigger than Wave V.

Let's say that from the bottom of Wave IV (30k), we add 535% which gives us 191k. We can say that the top of this bull market would not exceed to 191k.

If we draw a Fib Retracement from the peak of Wave III (64k) and the bottom of Wave IV (30k), we get these levels:

- Level 4.236 at 174k

- Level 3.618 at 153k

- Level 2.618 at 119k

- Level 1.618 at 85k

I think these are the levels that we need to pay attention to in the next few months. We know that a potential top is when we get these euphoria feeling where Bitcoin is pumping hard very fast. Whenever that happens and wherever level that is, we can use the levels above to determine the potential peak.

Thanks for reading. This is not a financial advice.

Bitcoin top only in 2023? or has Bitcoin top at $65k?I think the bull run isn't over, however there is a small probability that the $65K was the top and we are all on the denial phase now.

Remember market act as its own and in most cases acts the opposite of the herd,

- Most is expecting the bull market not to be over

- Most was expecting a blow off top

If $65k was not the top here is my outlook for bitcoin moving forward.

This bull run is fueled buy Institution and we know they move slower then retail investor so that's one reason why the top will take longer then the previous cycles maybe in 2023.

Is Bitcoin Top In?!? 2017 is telling us some secretsThis is a possible scenario.

I enjoy seeing patterns play out over time. I think that the top might be in and we can compare our current position to the same spot in 2018.

I used the bars pattern tool to copy the exact price action from the first wave down after the 2017 top, then pasted it to our current position.

I find it interesting that it even lines up well with my fib retracements of this local swing.

What do you think?

Is the top in?

btc/usd short idea As I've missed the top short on my previous ide a with a few bucks, here's another setup for me.

I'll place my offers on the red area and the stop is 1hr close.

I'll start taking profits on green area but let it flow with 1/3 in case we drop further.

This is still a risky one because the HTF is still bullish, so please manage your risk accordingly.

BTC Market capLooking at BTC market cap we can see that we have reached 200 Billion dollar level and it is exactly the level that we have top out on february 2018. but in price we have some way to go. it is really hard time for shorting bitcoin but i think may be we have topped out in we should see a big big correction or a new bottom below 3100 usd. be cautious.