BJTM May Stay SidewaysBJTM stays on long-term downtrend. It probably will move sideways around 450-580 (February highs and lows) in the foreseeable future as it strives to create new supports.

Nothing particularly unfavorable can be seen on the books. BJTM grew moderately in the first quarter, and that's that. However, several corporate news have increased pressures on BJTM since 2024.

First, the controversial BEKS acquisition plan. Though it was probably arranged by the government, investors did not think it would be favorable for BJTM.

Second, suspected loan fraud. Earlier this year, Jakarta prosecutors detained three suspects on loan manipulation case in its Jakarta office. There are no reports of BJTM direct involvement, but the news soured our mood.

Third, Indonesian central bank most likely will cut rates again. Rate cut itself should not significantly impact BJTM as local government-affiliated bank, but slower growth is on the horizon.

BJTM

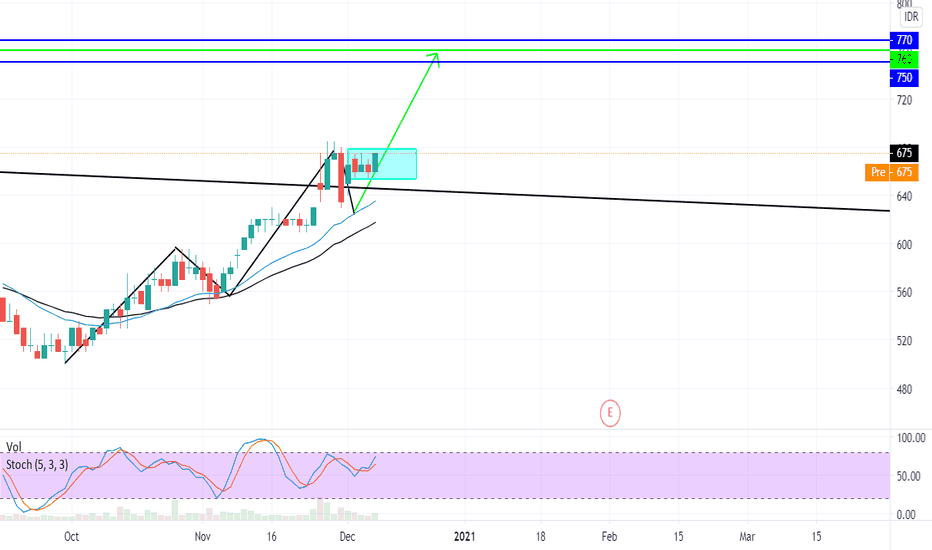

BJTM 13%+ INDONESIA STOCKS EXCHANGEWE KNOW THAT DOW THEORY IS PRIMARY SECONDARY AND PRIMARY AGAIN

THE MARKET ALREADY SECONDARY REACTION AND NOW BJTM IS MAKING A BASE, A BASE IS LIKE A CAGE WHICH THE PRICE TRAP INSIDE THE CAGE, WE HAVE TO WAIT THE CONFIRMATION OF THE BREAKOUT OF THE CAGE, IF BREAKOUT THAN THE PRICE WILL RALLY MAKING HIS PRIMARY REACTION AGAIN,

THE TARGET PRICE AREA WILL BE 750 - 770

AND WHY A GREEN LINE AT 720? WHY THE TARGET PRICCE 750 - 770?

THE REASON IS SIMPLE,

THE GREEN LINE PRICE PROFIT AREA IS BY USING FIBONACCI PRICE PROJECTION (AB = CD) AND IT STOP AT 720, SO IS THE GAP AREA, WE CAN SEE 750 - 770 IS AN OPEN AND CLOSING GAP AREA WHICH CLUSTER TO FIBONACCI AB = CD

STOPLOSS AREA

630

WHY? BECAUSE IF WE BUY AT BREAK OUT AREA, AND THE PRICE ISNT CAPABLE TO RISE, AND DROP TO THE BASE (CAGE) AGAIN AND ALSO BREK THE BOTTOM OF THE BASE WE CAN ASSUME THAT SUPPLY IS MUCH HIGHER THAN THE DEMAND

DISCLAIMER ON!

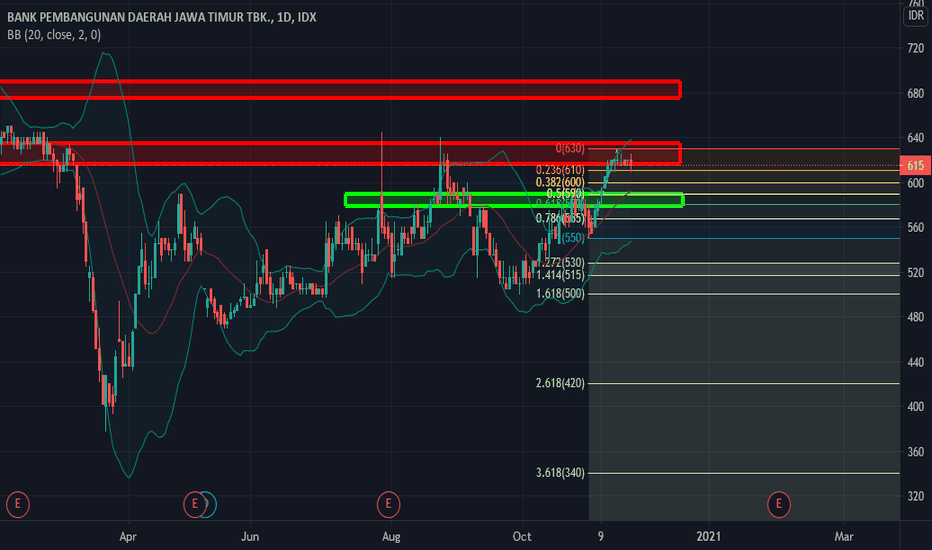

REKOMENDASI BJTM (WAIT OPPORTUNITY TO BUY)TEKNIKAL :

- D1 indikasi double top

- D1 valid market hilang volume

- Candle D1 akhir-akhir ini doji (konsolidasi investor) besar kemungkinan turun

FUNDAMENTAL / RUMOR

-

REKOMENDASI :

* BUY LIMIT :

- area 580 - 590 reason fibo level 50 D1 & RbS

- TARGET PRICE :

- 620, reason resistent double top (indikasi)

- 690-710, reason, resistent tertinggi