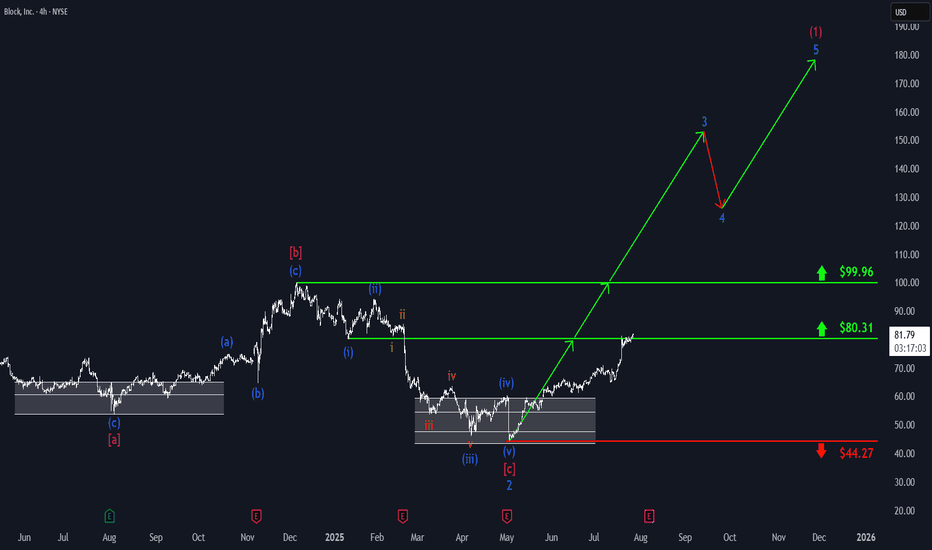

Block: Key Resistance HitBlock has made a strong upward move, reaching resistance at $80.31. Thanks to this positive momentum in our primary scenario, we fully focus on further gains as part of turquoise wave 3, which is expected to push the price decisively above the next resistance at $99.96. The subsequent pullback in wave 4 should also occur above this level, before wave 5 ultimately completes magenta wave (1) – marking the first major leg up in the ongoing bullish impulse.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do (for more: look to the right).

Block

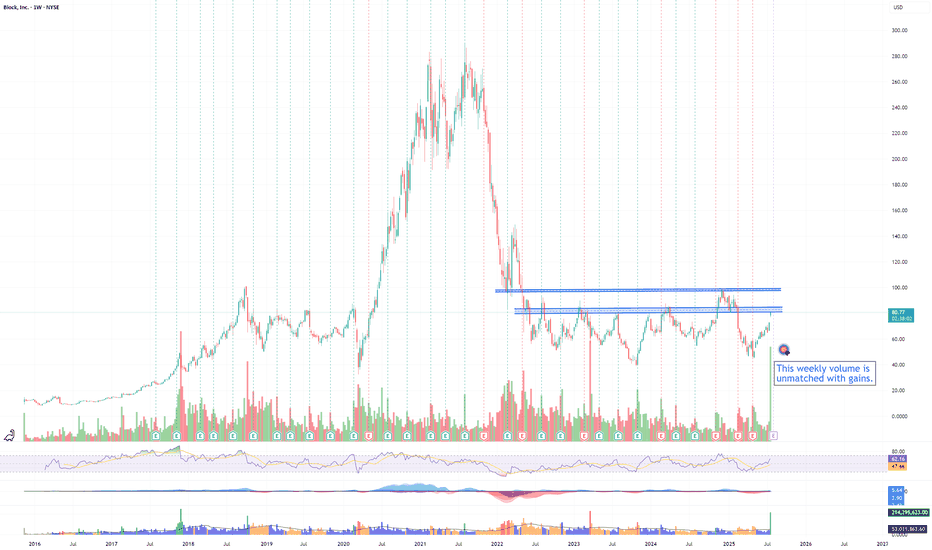

XYZ momentum is buildingXYZ positive weekly volume this week is a first in its history! Even though it has never had this much 'green' volume in its weekly history, there is plenty of resistance to be overcome for this stock

$81-85 will be challenging as sellers all the way from 2022 will begin dumping shares, especially when uncertain market conditions will be pushing them to sell. If it consolidates at 85, plan for a move to 98, where there will be another wave of sellers from Dec 2024 and 2022.

XYZ moves will parallel the BTC market with a lag. When BTC breathes, XYZ will breathe. With a BTC bull, expect XYZ to run.

Rating is neutral as this needs to break through resistance prior to accumulation, not the other way around.

Block | XYZ | Long at $64.84Block's NYSE:XYZ revenue is anticipated to grow from $24 billion in FY2024 to $32 billion in FY2027. With a current price-to-earnings ratio of 13.8x, debt-to-equity ratio of 0.36x, and rising cash flow in the billions, it's a decent value stock at its current price. Understandably, there is some hesitation among investors due to competitive fintech market and economic headwinds. But, like PayPal NASDAQ:PYPL , growth is building.

From a technical analysis perspective, the price dropped to within my historical simple moving average bands. Often, but not always, this signals a momentum change and the historical simple moving average lines indicate an upward change may be ahead. While the open price gaps on the daily chart in the $40s and GETTEX:50S may be closed before a true move up occurs, NYSE:XYZ is in a personal buy zone at $64.84.

Targets:

$80.00

$90.00

$100.00

[*) $134.00 (very long-term)

Overweight $XYZ ; Raising Price Target to $140+- BOATS:XYZ has been included to S&P 500 . It's a big news for BOATS:XYZ , this was one of the undervalued stock, treated like a dog but this company is always innovating and has strong talented employees.

- On top of that now BOATS:XYZ will get passive funds which is massive and bullish for the company.

Strategy & Education: Trading with Fibonacci and Order Blocks🔍 Trading Strategy Based on Fibonacci Levels and Order Blocks

This chart showcases three consecutive sell trades I executed on the BTCUSDT pair, each resulting in a profitable outcome. The purpose of this explanation is to demonstrate how Fibonacci retracement levels can be combined with Order Block zones to identify high-probability trade setups.

🧩 The Foundation: Understanding Price Retracement Behavior

The ABC, abc, and (a)(b)(c) structures marked on the chart are not Elliott Waves. Instead, these labels are used to represent simple retracement movements in the market. The focus here is not wave theory, but recognizing how price reacts and pulls back after a move, and how we can benefit from these reactions.

📌 Trade 1: Primary Fibo-OB Confluence

I drew a Fibonacci retracement from the A wave to the B wave.

The price then retraced to the C area, landing between the 0.618 and 0.786 Fibonacci levels, where an Order Block (OB) was also present.

This overlap created a strong technical and structural resistance zone.

I entered the first sell trade from this confluence.

📌 Trade 2: Internal Retracement and OB Alignment

Inside the first corrective move, a smaller abc pattern formed.

I applied Fibonacci again from small a to small b.

The c leg reached the same key Fibonacci zone (0.618–0.786) and overlapped with a second OB.

This confluence offered a second sell entry.

📌 Trade 3: Micro Structure – Same Logic Reapplied

I repeated the exact same logic one more time on a micro (a)(b)(c) structure.

Fibonacci from (a) to (b), price touched 0.618–0.786, coinciding again with an OB.

This became the third and final sell position.

🧠 The Logic Behind the Strategy:

Price doesn’t move in straight lines—it flows in waves. During pullbacks, if Fibonacci levels align with Order Block zones, the market tends to react strongly. My focus here was to identify these areas of confluence in advance and enter trades at high-probability turning points.

XYZ Block Options Ahead of EarningsIf you haven`t sold XYZ before the previous earnings:

Now analyzing the options chain and the chart patterns of XYZ Block prior to the earnings report this week,

I would consider purchasing the 58usd strike price Calls with

an expiration date of 2025-5-2,

for a premium of approximately $3.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

RENDER Descending Triangle 4HBINANCE:RENDERUSDT seems to be forming a descending triangle on the 4H timeframe.

3 clear touches on resistance, and well-defined two-tap horizontal support at $2.50.

Key Levels to Watch 🔑

• $2.50-$2.75 Main support and daily demand zone

• $3.80-$4.20 Daily sell order block (potential resistance)

• $5.00-$5.20 4H sell order block (potential resistance)

Breakout Targets 🎯

⬆️ $5.00

⬇️ $1.50

Still in a No-Trade Zone, wait for confirmation (breakout candle close with good volume).

BTC - Let's Keep It Simple!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

🏢BTC Building Blocks:

📉 Short-Term Bearish:

BTC is currently trading within a short-term bearish block between $81,200 and $87,500.

📉 Long-Term Bullish:

If the $81,200 low is broken to the downside, BTC is expected to enter the long-term bearish block.

📈 Short-Term Bullish:

If BTC breaks above the short-term bullish block at $87,500, it will enter a short-term bullosh block phase towards the $95,000 structure.

📈 Long-Term Bullish:

If the $95,000 level is broken to the upside, a long-term bullish movement toward the all-time high would be expected.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

XYZ Block Options Ahead of EarningsIf you haven`t sold XYZ before the previous earnings:

Now analyzing the options chain and the chart patterns of XYZ Block prior to the earnings report this week,

I would consider purchasing the 82usd strike price Puts with

an expiration date of 2025-2-21,

for a premium of approximately $3.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

ETH Building Blocks...Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

ETH Building Blocks:

📈 Short-Term Bullish:

ETH is currently trading within a short-term bullish block.

📈 Long-Term Bullish:

If the $3,500 resistance level is broken to the upside, ETH is expected to enter a long-term bullish block, initiating a new bullish phase toward the $4,000 mark.

📉 Short-Term Bearish:

If ETH breaks below the short-term bullish block at $3,250, it will enter a short-term bearish block phase.

📉 Long-Term Bearish:

If the $3,000 level is broken to the downside, a long-term bearish movement toward the lower bound of the long-term bearish block, around the $2,500 mark, is expected.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

BTC Building Blocks...Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

BTC Building Blocks:

📈 Short-Term Bullish:

BTC is currently trading within a short-term bullish block.

📈 Long-Term Bullish:

If the $108,500 level is broken to the upside, BTC is expected to enter a long-term bullish block, initiating a new bullish phase toward the $125,000 mark.

📉 Short-Term Bearish:

If BTC breaks below the short-term bullish block at $100,000, it will enter a short-term bearish block phase.

📉 Long-Term Bearish:

If the $90,000 level is broken to the downside, a long-term bearish movement toward the lower bound of the long-term bearish block, around the $75,000 mark, is expected.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

BTCUSD | 1D SMC Short Setup with Refined SL and TargetsDescription:

This analysis identifies a high-probability short opportunity for BTCUSD on the 1D timeframe using the Smart Money Concepts (SMC) framework. The chart shows clear bearish confluences, including market structure, supply zones, liquidity levels, and Fibonacci retracement zones. I believe the current bullish momentum is merely a manipulation driven by inflation news and the upcoming Trump inauguration. Following these events, I anticipate a significant market correction. Here’s the detailed breakdown and trade plan:

Analysis:

Market Structure:

Break of Structure (BOS): Price has confirmed a bearish trend with BOS to the downside, signaling a continuation of lower highs and lower lows.

Trendline Resistance: A well-defined downward trendline indicates selling pressure, reinforcing the bearish bias.

Key Zones and Liquidity:

Supply Zone: Highlighted in purple at $102,000-$104,000 . This zone represents an area where strong selling previously occurred, creating an imbalance.

Golden Zone (Fibonacci Retracement): Located around $101,000-$103,000 , this area aligns with the 61.8%-78.6% retracement levels and offers a high-probability reversal opportunity.

Weak High: The high near $104,000 represents untapped liquidity, which smart money may target for a liquidity grab before reversing lower.

Equal Lows (EQL): Around $92,000 , these act as a bearish target where liquidity rests, aligning with the continuation of the bearish trend.

Confluences for Short Entry:

Price is approaching the supply zone and Fibonacci Golden Zone , indicating a potential reversal point.

The weak high may trigger a liquidity grab to entice buyers before sellers regain control.

Previous BOS and trendline resistance add further validation to the bearish bias.

Trade Plan:

Short Entry Setup:

Entry Zone: $102,000-$104,000 (inside the supply zone and Golden Zone).

Stop Loss (SL): $105,500 (above the supply zone and imbalance to account for liquidity grabs).

Take Profit Levels:

TP1: $97,000 – Close partial profits at this imbalance mitigation level.

TP2: $92,000 – Target the equal lows and resting liquidity.

TP3: $88,000 – Final target near the blue demand zone for maximum reward.

Risk-Reward Ratio:

With the entry at $103,000 (midpoint of supply), SL at $105,500, and TP at $92,000, the trade offers a 1:4 RR or better, depending on execution and scaling.

Additional Notes:

Monitor the price action closely as BTC approaches the supply zone for confirmation, such as bearish candlestick patterns or lower timeframe CHoCH (Change of Character).

Scaling into the trade in smaller portions across the supply zone can improve overall entry precision.

Adjust stop loss or take profit levels as market conditions evolve

Block (SQ): Preparing for a Breakout Year in 2025NYSE:SQ is shaping up to either become one of the top picks for 2025 or face a potentially challenging year ahead.

From the monthly chart, NYSE:SQ has mostly traded between $100–$35 since its IPO in 2015. While the $35 level seems unlikely to be revisited anytime soon, the current focus is on reclaiming the Value Area High (VAH) at $100. Success here could trigger strong percentage gains over the next few months.

We’re adopting a cautious approach, closely monitoring the chart. On the lower time frame, NYSE:SQ is sitting in a key support/resistance zone (highlighted as a yellow box). Ideally, we want to see a break above the Value Area Low (VAL) and the completion of a smaller 5-wave cycle, marking the end of wave (i). A bearish divergence on the RSI at this stage would add confluence. Following this, a pullback could provide the perfect entry point for a long position.

At this time, we haven’t placed a limit order. A break below $55 would be a critical red flag, suggesting potential bearish developments, though this scenario seems unlikely without unexpected negative news.

Block $SQ Weekly Chart Break Out🚀 **Block ( NYSE:SQ ) Weekly Chart Breakout!** 🚀

Block's weekly chart signals a bullish breakout, hinting at potential upside momentum. Watch for confirmation as key resistance turns to support. Eyes on the next price targets! 📈

#SPX500 AMEX:SPY NASDAQ:QQQ #BITCOIN #CRYPTO

Block text book inverse head and shouldersThe weekly chart of Block, Inc. (SQ) displays a textbook inverse head and shoulders pattern, a classic bullish reversal setup. After consolidating within a range for an extended period, the price appears to have broken above the neckline, signaling potential upward momentum. The target range, indicated by the blue zone, aligns with historical resistance levels.

Key observations:

• Neckline breakout confirms the pattern.

• Support levels to watch: $86.83 and $88.16.

• Potential 🎯 Target: $198.06, aligning with previous highs.

• Indicators such as RSI and Ichimoku Cloud complement the bullish outlook.

This setup suggests a favorable risk-to-reward ratio, but patience is key.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Trading involves significant risk, and you should consult with a qualified financial advisor before making any investment decisions. Always perform your own research and analysis. Past performance does not guarantee future results.

Crypto Stonks Are Booming! Top Crypto Stocks to Watch NowFrom Memecoins to Mega Stocks

While crypto traders have been focused on finding the next big memecoins like Doge , crypto-related stocks have also been performing well this year. In today’s analysis, we’ll dive into some crypto related stocks you might want to keep an eye on

1. Coinbase ( NASDAQ:COIN )

First on our list is Coinbase, the top US crypto exchange with a market cap of $48 billion. Since its IPO in April 2021, Coinbase has gained a reputation as a trusted exchange known for its regulatory compliance.

Besides its exchange services, Coinbase offers a self custody wallet popular among the crypto community, with over 10 million downloads. In February 2023, Coinbase launched its own layer 2 blockchain, Base , which has since recorded over $1 billion in total value locked and averages daily transaction volumes of over $400 million.

Coinbase has also played a part in advancing spot Bitcoin ETF approvals, forming a surveillance-sharing agreement with the Chicago Board Options Exchange in July 2023. Additionally, Coinbase partnered with **Stripe** in June to boost the global adoption of USDC. This partnership enables crypto payouts and a fiat-to-crypto onramp, making it easier for users to buy crypto with credit cards and Apple Pay through Coinbase Wallet. Coin is up over 350% since our first signal

2. MicroStrategy ( NASDAQ:MSTR )

Next up is MicroStrategy, with a market cap of $26 billion. Known for its business analytics software, cloud services, and AI-powered analytics, MicroStrategy is more famous for its Bitcoin holdings, driven by the advocacy of Executive Chairman Michael Saylor.

Under Saylor's leadership, MicroStrategy became the first public company to adopt Bitcoin as a strategic investment in August 2020, citing its potential as a store of value. The company accumulated over 121,000 BTC by late 2021 and continued adding to its holdings, despite price volatility and leverage risks. As of 2024, MicroStrategy’s Bitcoin holdings have reached 226,500 BTC, and the company’s stock hit new all time highs, demonstrating its strong correlation with Bitcoin's performance. Mstr is 100% up since our first signal

3. Block ( NYSE:SQ )

Formerly known as Square, Block is a fintech company founded by Jack Dorsey and Jim McKelvey, with a market cap of $38 billion. Starting with small-business payment solutions like Square POS, Block launched **Cash App** in 2013 to provide a user-friendly platform for consumers, competing with services like PayPal and Venmo.

Cash App generates revenue through transaction fees, subscription payments, and Bitcoin sales. It even supports the Lightning Network for quick Bitcoin transactions. Beyond payments, Block owns a majority stake in Tidal, a music streaming service, showing its diverse portfolio.

4. Robinhood ( NASDAQ:HOOD )

Lastly, we have Robinhood, with a market cap of over $15 billion. Founded in 2013 by Stanford graduates Vladimir Tenev and Baiju Bhatt, Robinhood became known for its free, user-friendly trading app, which gained significant popularity during the COVID19 pandemic

Robinhood found itself in the spotlight during the 2021 GameStop and WallStreetBets saga, where it faced backlash for restricting trades on memestocks like $GME. This led to a lawsuit and a $70 million penalty from FINRA for misleading customers and service outages. Despite this, Robinhood continues to grow, boasting 23.9 million funded accounts and nearly $130 billion in assets under custody as of May 2024.

Robinhood has made some notable moves recently, including acquiring Pluto Capital, which provides AI-driven investment advice, and securing a deal to acquire crypto exchange Bitstamp.

Wrap up

If you’re wondering about Bitcoin mining stocks, don’t worry we had a separate analysis just for that. Crypto Bull market just started and be ready for more analysis

which stock or crypto coins you are bullish now and why?

SQUARE is retesting the Inverse H&S before heading 80% higher! NYSE:SQ SQUARE (BLOCK) is retesting the Inverse H&S before heading 80% higher!

The trading gods have blessed us with a pullback to around $90ish, as requested. This is the retest of the Inverse H&S pattern.

-H5_L indicator is GREEN

-Already broken out of falling wedge.

-Launched off Volume Shelf and filling the GAP.

-Fintech is starting to run

-Stage 2 is just starting!

Buying more here!

🎯$110

🎯$149

🎯$162

NFA

High Five Setup Alert on Block $SQ !! 84% Upside!🔥 Square ( NYSE:SQ ) Ready to Skyrocket! 84% Upside! 🚀

I posted this earlier, but a couple of people requested a video analysis on Square (BLOCK), so here it is; enjoy!

📢 High Five Setup Alert on Block ( NYSE:SQ )!

My H5 Indicator is flashing green, signaling a prime opportunity to take a position in SQ!

Key Highlights:

Bullish Breakout: We’ve broken out of the Bullish Falling Wedge pattern and successfully retested.

Volume Ignition: Launching off the volume shelf with a volume gap to fill, setting up for a powerful move.

📈 Price Targets:

Primary Target: $149

Main Move Target: $162

This setup is primed for action! Will you be adding

SQ

to your watchlist? Stay tuned for more insights!

👍 Like | Follow | Share 👍

Stay updated with weekly trade ideas using my HIGH-FIVE SETUP trading strategy. Don’t miss out on the next big move!