Blockchain

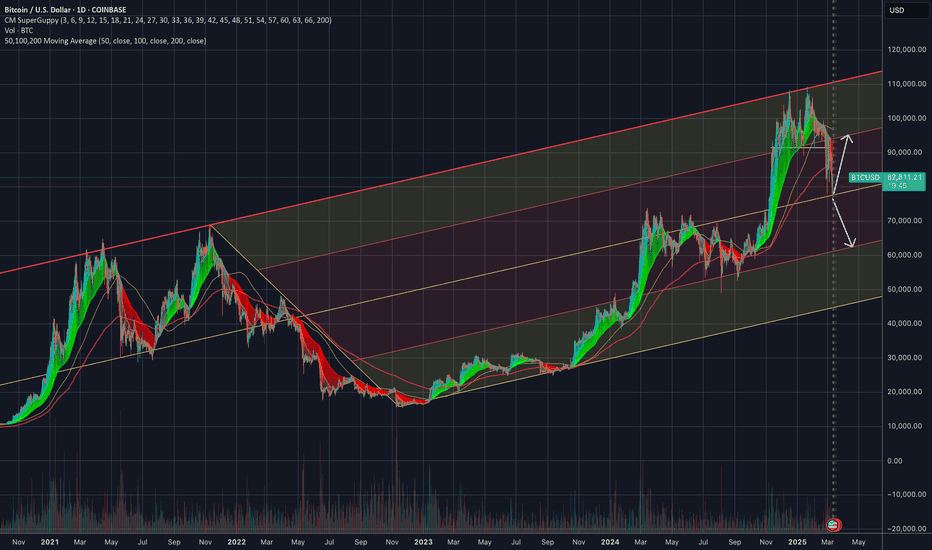

LONG ON BITCOINMarket structure wise Bitcoin looks like its ready to Rise.

Other political and economic factors are also being looked at as to why I am buying bitcoin.

But Its mainly The Market structure shift Im seeing on the charts that has me hitting buy!

Im looking to make about 7-8k points on BTC.

Quantum Doom for Bitcoin?Bitcoin, the leading cryptocurrency known for its promise of a decentralized structure, faces an existential crisis due to advances in quantum computing that threaten its cryptographic foundation. The article "Bitcoin's Imminent Collapse: The Quantum Threat and Cryptographic Vulnerabilities" outlines a convergence of risks – technological breakthroughs, government influence, and market dynamics – that could potentially bring Bitcoin's value to zero.

At the heart of the danger lies the SHA-256 algorithm, which secures the Bitcoin blockchain. Quantum computers, such as those from D-Wave, which claimed to have achieved "quantum supremacy" in 2025, may soon be able to reverse the hashing operation, revealing private keys and destabilizing the entire network. This potential breach, known as "Q-Day," could severely damage trust in Bitcoin and lead to a mass exodus of investors.

The forecast becomes even more alarming given the mysterious origin of SHA-256, developed by the NSA (U.S. National Security Agency) and standardized by the National Institute of Standards and Technology (NIST). The article raises disturbing questions about the possibility that the NSA possesses unknown vulnerabilities or "backdoors" within the algorithm. Past seizures of Bitcoin by the U.S. government, such as the recovery of a hacker's wallet in 2021, suggest an extraordinary ability to bypass its security – perhaps through undisclosed inside knowledge.

Meanwhile, NIST's push for post-quantum cryptography (PQC) hints at the impending obsolescence of SHA-256, but Bitcoin's failure to adopt these alternatives critically exposes it. This lack of preparedness increases the risk, as rivals with quantum computers could act before defenses are strengthened.

Market signals add another layer of concern. The approval of Bitcoin ETFs in 2023 by financial giants like BlackRock and Vanguard suggests a strategic move where institutional players offload risks onto less experienced retail investors. Combined with repeated government seizures that cast doubt on Bitcoin's anonymity, a scenario is emerging where the cryptocurrency stands on the brink.

The conclusion is that Bitcoin's vision of decentralization may not survive this perfect storm – a quantum threat, cryptographic weaknesses, and orchestrated market shifts. For stakeholders, the message is clear: adapt quickly or risk potential collapse.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of March 14, 2025Technical Analysis and Outlook:

In the current week's trading session, Bitcoin has made multiple hits by retesting our completed Outer Coin Dip 78800 on Sunday and Monday. Consequently, the cryptocurrency has experienced a significant uptrend, reaching the inverse (Resistance) Mean Sup 84700 level. This upward oscillation indicates a potential for further price rally and suggests a likelihood of advancing toward the target designated as the Interim Coin Rally 88400. Such developments could facilitate an extension toward the supplementary target of Mean Res 94500 and beyond. If there is a decline from Interim Coin Rally 88400 or its current price level, the coin is expected to retest the completed Outer Coin Dip 78700, potentially reinstating the upward rally.

Fundamental Analysis on MultiversX (EGLD | from $20 to $3,180?Fun experiment on crypto fundamental analysis —

I asked Grok 3 AI to evaluate MultiversX (EGLD) [ CRYPTOCAP:EGLD ].

It was a long conversation with interesting outputs.

MultiversX received an 8/10 score.

For Grok, it's a top pick for building apps and for mid to long-term investing.

I shared the complete results and logic in my account on 𝕏 ( vinibarbosabr ).

You can find it at highlights , if you want.

The conclusion is that, per Grok, CRYPTOCAP:EGLD could hit:

Medium term (1 to 5 years):

$10 billion to $30 billion market cap @ $318 to $955.

Long term (5 to 10 years):

$50 billion to $100 billion mcap @ $1,590 to $3,180.

Now, let's dive into the analysis!

In summary, Grok evaluated a list of objective and well-documented MultiversX attributes, giving it a score 8 out of 10. The AI said EGLD does not make a good short-term buy, due to poor price action at around $500 million of capitalization, while saying it is a top-pick for mid and long term fundamental investing eyeing a $100 billion market cap.

From a tech perspective, Grok 3 agrees MultiversX is one of the most advanced blockchains to date. When asked if it would have MultiversX among its AI top picks to build a project, the answer was yes.

First, Grok 3, one of the most advanced AI models to date, evaluated eight categories of blockchain fundamental analysis. MultiversX scored 7.875 on average, with the AI rounding it up to 8 out of 10 points.

Scalability got a 9/10 score, considering the fully implemented sharding technology, transactions per second (TPS) capacity, and performance. With 30,000 current TPS on mainnet, a 263,000 TPS achieved on a testnet, and a theoretical capacity superior to 1 million TPS thanks to its adaptive sharding—increasing with demand—MultiversX is one of the most scalable blockchain networks.

Decentralization got an 8/10 score, showing strong decentralization, but with room for improvements. The network has over 5,500 nodes, of which, 3,200 are active validators, losing only to Ethereum (ETH). Notably, MultiversX has a Nakamoto Coefficient of 9 for liveness, meaning nine entities have over 33% of all the nodes.

Speed and Finality got an 8/10 score, with sub-second finality in the roadmap for 2025, currently taking 6 seconds. The improvement, according to Grok AI, would put EGLD transactions among the fastest layer-one (L1) blockchains.

Security got an 8/10 score, with its proof of stake architecture, ESDT tokens being native assets, and onchain 2FA. Yet, the model warns against possible stake accumulation above the 51% threshold as a potential risk for the future. Which is the same risk for all blockchain networks’ security.

Cost and Accessibility got a 9/10 score, due to approximately $0.002 cost per transaction, below the industry’s average. MultiversX tech stack also offers developers the possibility to offer gasless (no fees) transactions to the end user. Still in accessibility, the chain has one of the lowest hardware requirements for its capacity in the space, which also contributes to decentralization.

Developer Experience (DevX) got a 9/10 score, with a top-down focus on development and a grassroots “build” culture. MultiversX offers familiar tools like Rust framework and WebAssembly, flexibility in programming languages, and a strong open source ethos. Comprehensive documentation and an active community further support developers, making it attractive for building applications and smart contracts.

Ecosystem and Adoption got a 7/10 score, as a small ecosystem’s size and adoption relative to larger blockchains could limit its current reach and utility. Still, the ecosystem is growing, together with implementations and partnerships, having big names associated with EGLD.

Economic Model (Tokenomics) got an 8/10 score, considering a capped EGLD supply, with full distribution by 2030. Moreover, Grok AI mentions a 30% network fees going to the developer of the used smart contract, incentivizing builders.

All things considered, we asked Grok 3 AI what would be the ideal market cap for EGLD, MultiversX base token. Notably, Grok was considering a $565 million capitalization, ranked 95 in CoinMarketCap, trading around $20 per token.

Based on fundamental analysis, a comparison with other leading blockchains at higher ranks, would put MultiversX among them, Grok said. This, however, looking at the mid and long term, as the market would need time to adjust accordingly.

For the medium term (one to five years), the AI predicts EGLD could reach a market cap between $10 to $30 billion, positioning the cryptocurrency next to Cardano (ADA), Polkadot (DOT), and Avalanche (AVAX).

For the long term (five to ten years), Grok is even more bullish, siding MultiversX with Solana (SOL) and Ethereum. In this case, EGLD could reach between $50 to $100 billion market cap.

In conclusion, Grok AI agrees that MultiversX is one of “the most technically advanced blockchain today.” It has achieved a remarkable fundamental analysis score and offers an interesting investment opportunity for mid and long-term investors.

Furthermore, it features among one of the AI’s top picks of decentralized infrastructures to build applications and smart contracts.

Nevertheless, investing is risky and fundamental analyses can often be complex and highly nuanced. Investors and builders should do proper research and due diligence before making important decisions. The short-term for EGLD is also risky, as mentioned by Grok in the analysis.

2 Options, Keeping it simpleBTC is currently within its long-term ascending channel but has shown strong rejection at the upper boundary (~$100K).

A pullback toward the mid-channel support (~$70K-$75K) seems likely, aligning with historical retracement patterns.

Indicators Show Weakness:

RSI Divergence suggests a slowdown in momentum.

MACD hints at a potential bearish crossover.

📉 Key Levels to Watch:

Resistance: $95K - $100K (Upper trendline)

Support: $75K (Mid-channel), $60K (Lower trendline)

📈 Scenario 1: BTC consolidates and regains strength for a new ATH attempt.

📉 Scenario 2: A deeper correction to the lower trendline before continuation.

Needs to really break $95k first.

(ETH) ethereum "nft land"I was recently looking into NFTs on Opensea and while doing so I noticed there are far more NFTs from people based on the Ethereum blockchain compared to the other offerings on Opensea. Even though Solana (SOL) is on the forefront of popularity with Meme projects Opensea does not offer an exclusive Solana chain to provide NFT ideas. Hence, there is not an easy way to compare to amount of Solana projects to Ethereum projects being built, developed and/or offered. It would be interesting to see the comparison of NFTs on Solana versus Ethereum. Ethereum reduced their transactions with a transition to Proof-Of-Stake and since then the number of Ethereum NFTs must be growing. While the news is on a constant watch for new meme projects, tokens, the Opensea network for many other blockchains is not growing as nearly rapidly as Ethereum.

IOST Breakout Coming? Avoid FOMO & Trade Smart!IOST/USDT 1W chart shows a strong bounce from the support zone, indicating potential bullish momentum. The price is currently approaching the falling resistance trendline, which has acted as a major barrier in previous attempts to rally. The Stoch RSI has formed a bullish crossover, signaling a possible trend reversal.

However, a breakout above the descending resistance trendline is required to confirm further upside. If you missed the entry at the bottom, avoid emotional FOMO—wait for a confirmed breakout to capture the next leg up.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of March 7, 2025Technical Analysis and Outlook:

In the trading session for this week, we observed significant volatility characterized by considerable fluctuations, ultimately culminating in the completion of the coin Interim Coin Rally 94500. The coin experienced a substantial increase, reaching our Mean Resistance level of 92600, before encountering a steep pullback that resulted in its stabilization at the starting point of Mean Support of 84700.

This upward fluctuation indicates a potential for higher prices and suggests a likelihood of retesting the target Mean Resistance levels at 90600, coinciding with the conclusion of Interim Coin Rally 94500. Nonetheless, a retest of the Key Support level at 79000 and the completed of the Outer Coin Dip 78700 may occur prior to any further upward momentum.

$SUI: SUI Blockchain’s Token – Poised for Growth or Overhyped?(1/9)

Good morning, crypto enthusiasts! ☀️ CRYPTOCAP:SUI : SUI Blockchain’s Token – Poised for Growth or Overhyped?

With SUI at $2.70 , is this Layer 1 blockchain’s token set to dominate the crypto market or just another flash in the pan? Let’s dive into the digital realm and find out! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 2.70 as of Mar 7, 2025 💰

• Historical Context: Launched May 3, 2023, with significant growth in 2024 📏

• Sector Trend: Blockchain gaming and NFTs driving demand 🌟

It’s a hot commodity in the crypto space! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $1.2B (based on 1B tokens) 🏆

• Operations: Layer 1 blockchain with focus on speed and scalability ⏰

• Trend: Partnerships with gaming studios, NFT platforms boosting adoption 🎯

Solid, with a clear path to utility and growth! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Recent Partnerships: Collaborations with gaming firms like Mythical Games 🔄

• NFT Sales: Robust growth in NFT transactions on SUI blockchain 🌍

• Market Reaction: Positive sentiment post-launch and recent updates 📋

Thriving, with a focus on real-world applications! 💡

(5/9) – RISKS IN FOCUS ⚡

• Competition: Strong rivals like Solana, Avalanche in the L1 space 🔍

• Regulatory Challenges: Crypto regulations could impact growth 📉

• Volatility: Crypto market’s inherent swings affect price ❄️

Navigating these choppy waters is key! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Performance: High-speed transactions, ideal for gaming and more 🥇

• Partnerships: Growing ecosystem with gaming and NFT projects 📊

• Scalability: Designed for mass adoption, per developers’ claims 🔧

Got the goods to stand out in the blockchain race! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: New project, unproven in long-term stability 📉

• Opportunities: Expanding into metaverse, AI integration 📈

Can it scale and secure its position or get lost in the noise? 🤔

(8/9) –📢SUI at $2.70—your take? 🗳️

• Bullish: $5+ by end of 2025, gaming boom drives growth 🐂

• Neutral: Steady growth, risks balanced ⚖️

• Bearish: $0.50 by year-end, competition overtakes 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

SUI’s at $2.70, with a promising future in blockchain gaming and NFTs. Volatility’s a given, but its strengths could lead to significant gains. DCA on dips, ride the wave! Gem or bust?

ETH has two pending CME Gaps#ETH #Analysis

Description

---------------------------------------------------------------

+ ETH has two pending CME future gaps to filled.

+ First gap is around 2900-3400 range and second gap is around 2500-2600 range.

+ Sooner or later these CME gaps will get filled. I'm expecting Gap2 get filled in this or next month and Gap 1 in the second or third quarter.

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Feel free to share your thoughts and insights. Don't forget to like and follow us for more trading ideas and discussions.

Best Regards,

VectorAlgo

$ADA: Cardano’s Quiet Climb – Ready to Roar or Still Crawling?(1/9)

Good afternoon, crypto enthusiasts! 🌙 Cardano ( CRYPTOCAP:ADA ): Blockchain’s Steady Eddie – Can It Break Out?

ADA’s chugging along at $0.84, with new dApp launches and partnerships. Is it time to stake or wait for a dip? Let’s dive in! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Recent Trend: Holding at $0.84, up from last month’s peak of $0.82 📉

• 2025 Context: New dApp activity and African expansion driving interest 📏

• Sector Trend: Crypto market recovering from February’s 20.57% crash, but volatility persists 🌟

It’s a steady performer, but can it break out? ⚙️

(3/9) – MARKET POSITION 📈

• Ranking: Top 10 cryptocurrency by market cap, per CoinMarketCap 🏆

• Use Case: Smart contract platform with a focus on scalability and security ⏰

• Trend: Increasing adoption in emerging markets, particularly Africa 🎯

Firm, with a solid foundation and growth potential! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Market Reaction: Shares steady, with analysts optimistic about long-term growth 📋

Cookin’ up something big, but the market’s cautious! 💡

(5/9) – RISKS IN FOCUS ⚡

• Competition: Ethereum and Solana offer stiff competition with more established ecosystems 🕳️

• Regulatory: Crypto regulations could impact adoption and growth ⚖️

• Volatility: Crypto market’s unpredictable swings can hit hard ❄️

Tread carefully, but the path looks promising! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Scalability: Hydra and other upgrades promise high throughput and low fees 📊

• Community: Strong, academic-driven community with a focus on long-term development 🥇

• Partnerships: Growing presence in emerging markets, especially Africa 🌍

Got the building blocks for success! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Slower adoption compared to competitors, limited dApp activity 📉

• Opportunities: Expanding into new markets, new dApp developments, and regulatory clarity in some regions 📈

Can it catch up and surpass? 🤔

(8/9) –📢ADA’s at $0.45, with mixed market signals—your take? 🗳️

• Bullish: $1 soon, fundamentals are strong 🐂

• Neutral: Steady, wait for clearer skies ⚖️

• Bearish: Under $0.30, competition’s too fierce 🐻

Vote below! 👇

(9/9) – FINAL TAKEAWAY 🎯

ADA’s holding its ground at $0.83, with promising developments but market headwinds. Volatility’s our friend—dips are DCA gold 💰. Grab ‘em low, ride high! Gem or bust?

$XRP: Ripple’s Rocket – Ready to Soar or Facing Turbulence?(1/9)

Good evening, everyone! 🌙 CRYPTOCAP:XRP : Ripple’s Rocket – Ready to Soar or Facing Turbulence?

CRYPTOCAP:XRP ’s up 8.4% despite a crypto crash, with SEC rumors fueling hope—but will adoption or regulation steer this rocket? Let’s dive in! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Recent Trend: Gained 8.4% despite a crypto market down 20.57% in Feb, per U.Today 📈

• 2025 Context: Speculation of SEC appeal dismissal boosts sentiment 📏

• Sector Trend: Crypto market down, but CRYPTOCAP:XRP bucks the trend 🌟

It’s a fighter, shaking off the bears! ⚙️

(3/9) – MARKET POSITION 📈

• Ranking: Remains a top 10 cryptocurrency, per CoinMarketCap 🏆

• Use Case: Leading in cross-border payments with RippleNet ⏰

• Trend: Regulatory clarity hopes rise, potentially unlocking more adoption 🎯

Firm, a key player in the altcoin arena! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• SEC Case: Closed-door meeting Feb 27 fuels dismissal talk, per Ripple CEO’s X post 🔄

• Adoption: RippleNet partnerships expand, with new banks joining for faster payments 🌍

• Market Reaction: Up 8.4% amid market turmoil, showing resilience 📋

Adapting, with legal and adoption catalysts! 💡

(5/9) – RISKS IN FOCUS ⚡

• Regulation: SEC case uncertainty persists, appeal process ongoing 🕳️

• Market Volatility: Crypto market’s unpredictable swings can hit hard ❄️

• Competition: Other blockchain platforms vying for cross-border payment dominance ⚖️

Tough, but risks are part of the game! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Resilience: Up 8.4% when others fall, showing strong investor confidence 🥇

• Utility: RippleNet’s fast cross-border payments attract banks and institutions 📊

• Community: Robust support from holders and Ripple’s strategic partnerships 🔧

Got fuel in the tank! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: SEC case not fully resolved, adoption slower than hoped 📉

• Opportunities: Potential ETF approval, expanding CBDC projects, and new partnerships 📈

Can it break free and soar? 🤔

(8/9) – 📢 CRYPTOCAP:XRP ’s up 8.4% despite market crash, SEC buzz grows, your take? 🗳️

• Bullish: $3+ soon, legal win sparks rally 🐂

• Neutral: Steady, risks balance ⚖️

• Bearish: Below $2, regulation stalls 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

CRYPTOCAP:XRP ’s resilience amid a market crash shows its mettle 📈, but SEC uncertainty and competition pose challenges 🌿. Volatility’s our friend—dips are DCA gold 💰. Grab ‘em low, climb like pros! Gem or bust? S

UniversOfSignals | ONE: Key Levels and Market AnalysisIn this analysis, I want to review ONE, the token of the Harmony project. Harmony is one of the layer-1 blockchain networks and is considered one of the older crypto projects.

✨ The token currently holds a market cap of $205 million, ranking 198th on CoinMarketCap.

📅 Daily Timeframe

On the daily timeframe, as you can see, there is a large consolidation box between $0.01033 and $0.032724. In the last bullish leg, the price started from the $0.01033 low and moved up to the main resistance at $0.032724.

✅ It even broke above this level, reaching $0.04532, but was rejected and fell back into the range, turning this bullish move into a fake breakout.

⚡️ After returning to the range, the price first corrected to $0.02286. Once this level was broken, the next bearish leg pushed the price down to $0.01346. Currently, we are seeing a smaller consolidation box between $0.01346 and $0.01681.

🧩 Looking at the RSI oscillator, there is also a range between 37.05 and 50. A breakout in either direction could confirm the momentum for that direction. Naturally, a break below 37.05 would be a stronger confirmation for downside movement, as the market momentum is already bearish.

📊 If $0.01346 is broken, the price could move toward the bottom of the large range at 0.01033.If $0.01033 is broken, a new all-time low (ATL) is likely to be registered.

🔼 On the bullish side, if the $0.01346 support holds and the $0.01681 resistance is broken, we can expect the price to rally toward $0.02286 and possibly even $0.03274.

🛒 For spot buying, I prefer to wait until this coin shows strength against Bitcoin and Bitcoin dominance starts declining. My spot trigger is currently at $0.04532, and I will not enter a position before this level is broken.

⏳ 4-Hour Timeframe

On the 4-hour timeframe, the price remains within the same range as identified in the daily timeframe.

🔽 For a short position, if $0.01327 is broken, you can enter a short trade targeting the bottom of the range.

📈 For a high-risk long position, if $0.014825 is broken, you can target the top of the range, but this trade is very risky.The main long position will be confirmed if the price breaks above $0.01681.

🔑 Regarding indicators and oscillators, I don’t have much to say in this ranging market. Volume is also low, making it difficult to rely on momentum indicators in this sideways phase.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Feb 28, 2025Technical Analysis and Outlook:

At the beginning of the week, Bitcoin was observed trading at a lower level, close to the Mean Support level of 95700. It could not reach our predetermined Mean Resistance level marked at 98300, which can be attributed to a substantial decline that occurred, resulting in the completion of our Outer Coin Dip between 89000 and 78700. Following this decline, Bitcoin experienced a robust rebound to the Mean Resistance level of 86200. This upward trend indicates the potential for higher prices as it will target Mean Resistance levels at 89200 and 92600, respectively. However, a retest of the Key Support level at 79000 must occur before further upward movement may take place.

The Crypto Market’s True PowerLet’s shift focus from price volatility to the foundational driver of crypto’s value: network effects. While traditional markets rely on centralized moats (e.g., Facebook’s user base, Visa’s payment rails), crypto’s network effects are decentralized, programmable, and inherently disruptive. This isn’t just theory, it’s a blueprint for identifying asymmetric opportunities.

The Strategic Depth of Network Effects:

- Bitcoin’s Security Flywheel: Metcalfe’s Law quantifies network value as the square of its users, but Bitcoin adds a critical layer: security. Each incremental miner strengthens its Proof-of-Work consensus, exponentially raising the cost of a 51% attack. This isn’t adoption, it’s antifragility.

- Ethereum’s Developer Ecosystem: Ethereum’s dominance isn’t rooted in first-mover advantage alone. Its network effect hinges on developer density. Every new dApp (Uniswap, Aave) attracts liquidity, users, and complementary protocols, creating a self-reinforcing ecosystem. Traditional platforms can’t replicate this composability.

The Uncharted Risk-Reward Dynamic:

- Forks as Network Experiments: Unlike closed systems, crypto’s open-source code allows forks (e.g., Ethereum Classic, Bitcoin Cash) to test value divergence. This isn’t fragmentation, it’s Darwinian market validation.

- Protocol Upgrades as Catalysts: Events like Ethereum’s Merge recalibrate incentives overnight. Leaders must monitor developer momentum and governance alignment; missteps here aren’t setbacks, they’re existential threats.

Why This Matters: Network effects in crypto aren’t linear, they’re recursive. Prioritize ecosystems where liquidity, developer activity, and user growth compound. These are the battlegrounds where 10x returns emerge.

🛠️ Interoperability: The Strategic Race to Unify Crypto’s Fragmented Landscape

The future of blockchain isn’t monocultural, it’s a multi-chain ecosystem. However, interoperability remains crypto’s Gordian Knot. Solving it isn’t technical minutiae; it’s a trillion-dollar opportunity.

The Strategic Challenge:

- Siloed Blockchains = Friction: Bridging assets between chains remains fraught with risk (e.g., Wormhole’s $320M exploit). This isn’t a UX problem, it’s a structural barrier to institutional adoption.

- The Stakes: Interoperability is TCP/IP for Web3. The protocol that standardizes cross-chain communication will capture the foundational layer of crypto’s value stack.

The Contenders:

- Polkadot’s Parachain Model: Auctioning blockchain “slots” to prioritize scalability and security.

- Cosmos’ IBC Protocol: Enabling sovereign chains to interoperate without sacrificing autonomy.

- Layer 2s as Mini-Ecosystems: Ethereum’s rollups (Arbitrum, Optimism) are scaling vertically, but horizontal integration remains unsolved.

The Emerging Frontier:

- Cross-Chain DAOs: Governance systems managing assets across Ethereum, Solana, and Avalanche could redefine organizational infrastructure. This isn’t incremental, it’s revolutionary.

Strategic Insight: Interoperability isn’t a technical checkbox, it’s a power struggle for crypto’s architectural control. Bet on protocols with modular design, robust security audits, and developer traction.

⚖️ Regulatory Arbitrage: Navigating Crypto’s Geopolitical Chessboard

Regulation isn’t a compliance hurdle, it’s a strategic lever reshaping crypto’s geographic and economic frontiers.

The Global Divergence:

- U.S. Uncertainty: The SEC’s “regulation by enforcement” creates a chilling effect. Ripple’s case is precedent-setting: Is crypto a security, currency, or a new asset class? Clarity will unlock, or cripple, innovation.

- EU’s MiCA Framework: While providing regulatory certainty, its stringent stablecoin rules risk stifling DeFi’s permissionless ethos.

- Asia’s Pragmatism: Post-China ban, hubs like Singapore and Dubai are courting crypto enterprises, balancing innovation with oversight.

The Existential Threat: CBDCs

- Central Bank Digital Currencies (e.g., China’s digital yuan) aren’t just digitized fiat, they’re tools for surveillance and monetary control. Crypto’s response? Decentralized governance. Wyoming’s DAO LLC law and decentralized identity solutions (e.g., ENS) are early plays to codify self-sovereignty.

Why This Demands Attention: Regulatory outcomes will determine whether crypto remains a tool for individual empowerment or becomes an instrument of the legacy financial system.

💥 DeFi’s Silent Crisis: The Smart Contract Risk Mispricing

DeFi’s $50B+ ecosystem hinges on one assumption: smart contracts are secure. The data suggests otherwise.

The Reality:

- $1.5B Lost in 2023: Exploits like Euler Finance and Curve’s reentrancy hack highlight systemic fragility. Unlike TradFi, there’s no FDIC insurance, losses are final.

- The Institutional Barrier: Until smart contract risk is mitigated, pension funds and corporates will remain sidelined.

The Mitigation Race:

- Audits ≠ Safety: Firms like CertiK and OpenZeppelin provide baseline checks, but bugs persist.

- Insurance’s Scaling Problem: Nexus Mutual and Cover Protocol lack capacity to underwrite large-scale DeFi.

- Formal Verification: Projects like Chainlink’s Proof of Reserve and algorithmic audits (e.g., Certora) are emerging as non-negotiables for enterprise adoption.

Strategic Takeaway: DeFi’s next phase requires institutional-grade security infrastructure. Allocate capital to protocols prioritizing formal verification and real-time monitoring.

🔮 Quantum Computing: Crypto’s Unspoken Existential Risk

While markets obsess over Fed rates, a stealthier threat looms: quantum decryption.

The Threat Matrix:

- Breaking ECC: Quantum computers could crack Bitcoin’s elliptic-curve cryptography within a decade, exposing private keys.

- Response Timeline: Post-quantum algorithms (e.g., NIST’s Kyber) are in development, but blockchain migration will be chaotic.

The Strategic Play:

Ethereum’s quantum-resistant R&D and privacy chains (e.g., Monero, Zcash) are hedging this risk early. Projects ignoring quantum preparedness risk obsolescence.

Why This Can’t Be Ignored: Quantum risk isn’t hypothetical, it’s actuarial. Leaders must pressure-test portfolios against this scenario.

📊 Tokenomics: Engineering Incentives for Sustainable Growth

Tokenomics isn’t speculative jargon, it’s the economic backbone of crypto projects.

The Levers of Value:

- Supply Dynamics: Bitcoin’s halving cycle vs. Ethereum’s EIP-1559 burn, scarcity narratives matter.

- Governance Centralization: UNI and COMP holders wield power, but low voter turnout risks plutocracy.

- MEV’s Hidden Tax: Front-running bots extract SEED_TVCODER77_ETHBTCDATA:1B + annually from DeFi users. Solutions like Flashbots MEV-Share aim to democratize this value.

The Winning Formula:

Projects like Curve (veToken model) demonstrate how aligned incentives bootstrap liquidity. Conversely, misaligned tokenomics (e.g., Terra’s UST) trigger death spirals.

Strategic Imperative: Scrutinize token distribution, utility, and governance. Sustainable models prioritize long-term holders over mercenary capital.

🌍 Crypto’s Macro Thesis: Hedge Against Fiat Instability

Crypto’s correlation with equities is a red herring. Its true value emerges during systemic crises.

The Data-Driven Case:

- Geopolitical Hedging: Russia and Venezuela’s hyperinflation drove P2P Bitcoin adoption.

- Inflation Response: While BTC’s 2022 performance disappointed “digital gold” proponents, its 2023 rebound amid banking collapses (SVB, Credit Suisse) reaffirmed its safe-haven narrative.

The Long Game:

As central banks test CBDCs and fiscal instability grows, crypto’s role as a hedge against systemic trust erosion will intensify.

✍️ Crypto’s Core Thesis: A New Economic Primitive

Crypto isn’t an asset class, it’s a foundational shift in how value is created, governed, and exchanged.

The Vision:

- Programmable Money: Smart contracts automate value transfer (e.g., streaming salaries via Sablier).

- Decentralized Governance: DAOs like MakerDAO and Aragon are rewriting corporate playbooks.

The Reality Check:

Crypto is a mirror of human coordination, fraught with scams, inefficiencies, and brilliance. The winners will be those who harness its primitives to solve real-world problems, not speculate on narratives.

Final Note: Leaders who dismiss crypto as a speculative toy will miss the forest for the trees. This is the rebuild of the internet’s infrastructure, participation isn’t optional; it’s strategic.

$VIRTUAL – AI x Metaverse x Blockchain

AI-driven gaming agents tokenized for shared ownership & transactions.

Agent-to-Agent Commerce Protocol (ACP) enables autonomous AI trading.

Runs on Ethereum & Solana, expanding interoperability.

Super APP launching soon—simplifying user interaction.

Market Outlook:

Reclaiming $1.06 = buy signal

Current structure looks weak—avoid knife catching.

Entered long at range low, targeting $1.71 & $2.66.

Will AI-powered virtual economies be the next breakout trend?

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Feb 21, 2025Technical Analysis and Outlook:

During last week's trading session, Bitcoin was unable to reach our designated Mean Resistance level at 101300 and has remained stagnant near the Mean Support at 95700. This trend indicates a potential continuation of the pullback, which may cross-check the Mean Support level at 95700, with the prospect of further decline toward the Outer Coin Dip identified at 89000 via additional Mean Support levels at 94400, and 92500. Conversely, should the anticipated pullback not materialize, Bitcoin may experience upward momentum, thereby testing the newly established Mean Resistance level at 98300. This development could facilitate an extension toward 101500 and beyond.

#BTCUSDT #4h (Bitget Futures) descending channel breakoutBitcóin just regained 20EMA support, printing a three-white-soldiers pattern. Looks good for bullish continuation from here.

⚡️⚡️ #BTC/USDT ⚡️⚡️

Exchanges: Bitget Futures

Signal Type: Regular (Long)

Leverage: Isolated (10.0X)

Amount: 4.9%

Entry Zone:

98356.7 - 97312.9

Take-Profit Targets:

1) 102615.4

1) 106215.9

1) 109816.3

Stop Targets:

1) 93834.3

Published By: @Zblaba

CRYPTOCAP:BTC BITGET:BTCUSDT.P #4h #Bitcoin #PoW bitcoin.org

Risk/Reward= 1:1.2 | 1:2.1 | 1:3.0

Expected Profit= +48.9% | +85.7% | +122.5%

Possible Loss= -40.9%

Estimated Gaintime= 1-2 weeks

SOLUSDT - Long Trade IdeaTrade Details:

Entry : Buy at the current market price or place a buy limit at $160

Stop Loss : $152

Take Profit :

Reason for Trade:

SOL is showing strong bullish momentum and trading near a key support level.

Potential rebound from the demand zone around $160.

Favorable risk-to-reward setup with a tight stop-loss.

Disclaimer : This trade plan is for educational purposes only and not financial advice. Always conduct your own research and risk management before trading.

HEDERA’S Q4 2024—$HBAR SURGES ON CHAIN GROWTH & ETF RUMORSHEDERA’S Q4 2024— CRYPTOCAP:HBAR SURGES ON CHAIN GROWTH & ETF RUMORS

(1/9)

Good morning, Tradingview! Hedera’s Q4 2024 is blazing—chain GDP hit $840M, up 213% QoQ 📈🔥. Meme coins and dApps drove the surge, with CRYPTOCAP:HBAR up 30% overnight. Let’s unpack this blockchain beast! 🚀

(2/9) – NETWORK PERFORMANCE

• Q4 Chain GDP: $840M, +213% QoQ 💥

• TVL: $8.6B, DEX Volume: $3.3B/day (+150%)

• Stablecoin Volume: $5.1B/day (+36%)

• Jan ‘25: $517M app revenue, $552M econ value

Hedera’s humming—10k TPS at $0.0001 fees!

(3/9) – BIG MOVES

• Q3 Asset Tokenization Studio: Enterprise appeal soars 🏦

• Feb 9 X Buzz: HBAR ETF rumors, NVIDIA/Intel AI chip embeds 🌍

• Coinbase HBAR Futures: Drops today, Feb 18! 🚗

Speculation and scale are lighting up $HBAR!

(4/9) – SECTOR CHECK

• Market Cap: $11.61B (Jan ‘25), Now $0.39-$0.40 🌟

• Vs. L1s: ETH ($400B), SOL ($88.6B), ADA ( FWB:20B )

• Outpaces in speed/cost, 53% of global L1 fees Dec ‘24

Undervalued sleeper vs. giants? X thinks so!

(5/9) – RISKS TO FLAG

• Volatility: Feb 8 drop hints manipulation 📉

• Regs: ETF hype could flop if SEC stalls ⚠️

• Competition: SOL’s Firedancer, ETH scaling loom 🏛️

• Meme Coin Fade: Speculative juice may dry up

(6/9) – SWOT: STRENGTHS

• Speed: 10k TPS, $0.0001 fees slay 🌟

• Q4 Stats: $840M GDP, $8.6B TVL 🔍

• Enterprise Edge: Nairobi Stock Exchange, SpaceX 🚦

Hedera’s a lean, mean blockchain machine!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Meme coin reliance, smaller dApp pool 💸

• Opportunities: ETF approval, NVIDIA/Intel deals, DeFi push 🌍

Can CRYPTOCAP:HBAR turn hype into lasting heat?

(8/9) – CRYPTOCAP:HBAR ’s Q4 fire—where’s it headed?

1️⃣ Bullish—ETF & tech blast it up.

2️⃣ Neutral—Growth holds, risks bite.

3️⃣ Bearish—Speculation fizzles out.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

Hedera’s Q4 shines—$840M GDP, ETF buzz, and tech leaps fuel CRYPTOCAP:HBAR ’s charge 🌍. Cheap vs. L1s, but volatility lurks. Gem or trap?

SOLANA ($SOL) – ROARING REVENUE & FIREDANCER POTENTIALSOLANA ( CRYPTOCAP:SOL ) – ROARING REVENUE & FIREDANCER POTENTIAL

(1/7)

Ecosystem Revenue: Solana’s Q4 2024 app revenue surged +213% to $840M (vs. $268M in Q3), largely driven by meme coin mania. Network revenue reached new highs—$517M in app revenue & $552M in real economic value in January alone! Let’s dig in. 🚀

(2/7) – ONCHAIN ACTIVITY

• DEX Volume in Jan: $339B

• Stablecoin supply: $11.4B

• TVL: $8.6B—all-time highs

• 18 Firedancer validators deployed in Q4, boosting transaction capacity

(3/7) – SECTOR SNAPSHOT

• Market cap: ~$88.6B (late Dec 2024)

• SOL token trades around $200–$300 per recent posts

• Some speculate SOL could hit $500–$1,000—strong fundamentals + revenue growth might point to undervaluation vs. Ethereum ⚖️

(4/7) – COMPETITIVE EDGE

• Outperforms many L1 peers in transaction volume, speed, and revenue

• Handles more transactions than all other chains combined (per X posts)

• DEX volume +150% to $3.3B daily in Q4—low fees & high throughput = user magnet 🕹️

(5/7) – RISK FACTORS

• Market Volatility: Crypto’s rollercoaster can swing SOL prices wildly

• Regulatory: US policy changes, token classification → potential headwinds

• Competition: Ethereum scaling (rollups) & new L1s (Aptos, Sui) loom

• Technical Risks: Firedancer delays or issues = potential network reliability concerns

(6/7) – SWOT HIGHLIGHTS

Strengths:

High TPS + low fees → leading L1 contender

Robust ecosystem growth (TVL, DEX, stablecoins)

Strong revenue: $840M Q4 app rev, $517M in Jan alone

Weaknesses:

Heavy reliance on meme coin activity for recent revenue

Centralization worries due to validator concentration

Opportunities:

Solana ETF approval → institutional inflows 🌐

Firedancer aiming for 1M TPS, tech superiority

Expansion into DePIN, PayFi → new revenue streams

Threats:

US regulatory clampdowns

Ethereum’s scaling solutions & emerging L1 competition

Meme coin hype dying down, revenue from speculation dips

(7/7) – Is Solana undervalued or overhyped?

1️⃣ Bullish—Firedancer + revenue surge = unstoppable 🚀

2️⃣ Neutral—Impressive growth, but watch the meme factor 🤔

3️⃣ Bearish—Competition, centralization concerns… pass 🐻

Vote below! 🗳️👇