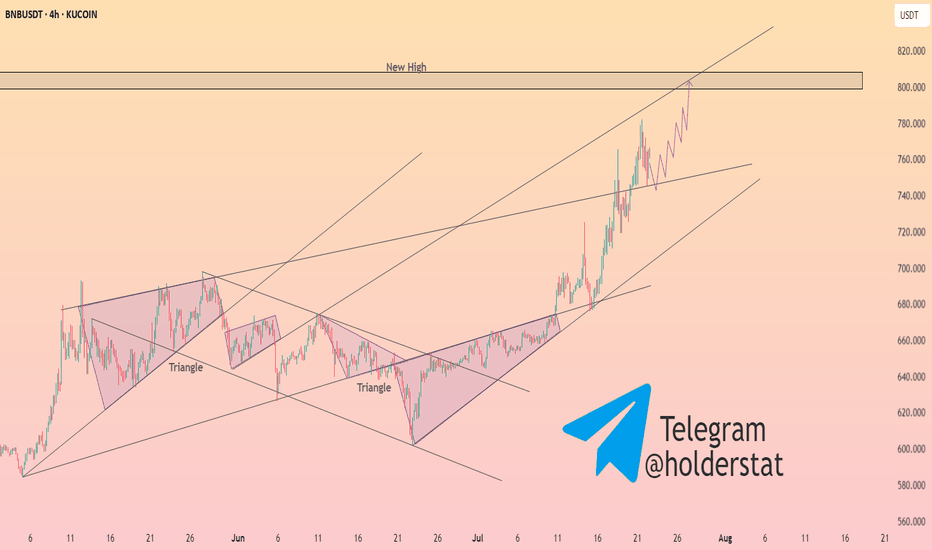

Binance coin has fallen below the resistance line ┆ HolderStatBINANCE:BNBUSDT continues to form clear higher highs and higher lows, trending inside a steep ascending channel. After breaking out of a bullish triangle, momentum remains strong as price eyes the 900 mark. Buyers are clearly in control unless key support levels break.

Bnbchain

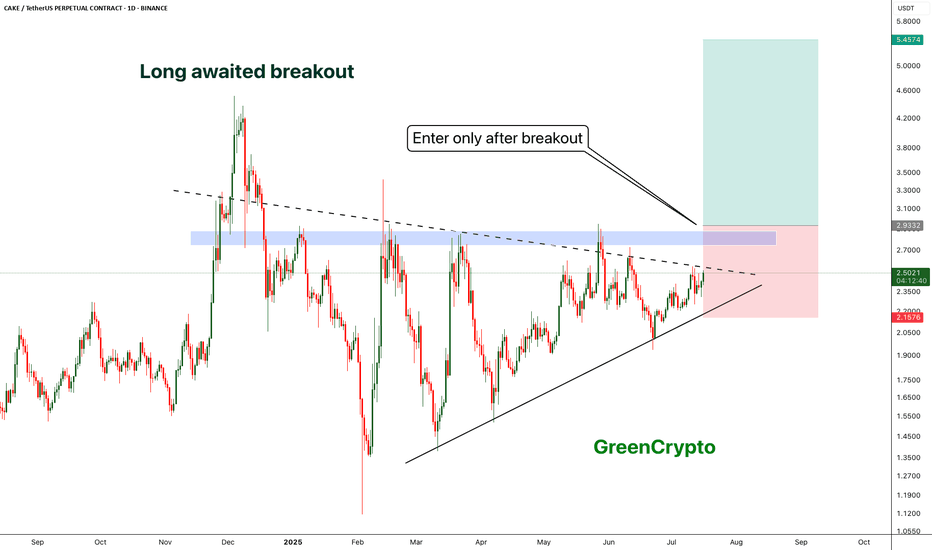

5$ is realistic target for CAKE- CAKE is trading inside the triangle since 2025

- now it seems like there is a possibility of breakout

- A clear breakout with decent volume would push the price towards 5$

- we will enter after the breakout

Entry Price: 2.9

Stop Loss: 2.15

TP1: 3.4371

TP2: 4.2671

TP3: 5.0083

Max Leverage 5x

Don't forget to keep stop loss

cheers

GreenCrypto

HolderStat┆BNBUSD breakoutBINANCE:BNBUSDT has reclaimed $670 support after breaking out from a long-term falling wedge. The bounce has been strong, and the rising structure now targets the $735–$740 resistance zone. Price action confirms bullish intent with consolidation beneath resistance before breakout.

HolderStat┆BNBUSD came out of the wedgeBINANCE:BNBUSDT just cleared a multi-week wedge resistance, signaling a bullish breakout above $635. The price is now poised to retest the upper channel boundary near $700–730. If bulls maintain momentum, this breakout could mirror prior impulsive legs higher, especially following similar consolidation patterns earlier this year.

HolderStat┆BNBUSD coil at 655CRYPTOCAP:BNB compresses in a tight two-hour symmetrical triangle atop the 655 floor. Multiple consolidation shelves plus an intact rising trendline load energy for a burst toward the 700 – 730 supply band. Horizontal support dominance keeps the new-high narrative alive.

HolderStat┆BNBUSD breakout ripple effectCRYPTOCAP:BNB punched through a year-long resistance, tagged “breakthrough” and now coils above the trendline. Consecutive consolidation blocks, rising support and a freshly won channel hint at buyers pressing toward the 740 USDT supply zone, extending the crypto’s bullish narrative.

HolderStat┆BNBUSD breakthrough bastion to 750CRYPTOCAP:BNB — Downtrend line shattered; retest formed a tight rectangle just above 635 neckline. Strong consolidation over rising support signals intent to reach the 720-760 extension zone marked atop former range. Bulls must guard 600-610 to preserve breakout psychology.

HolderStat┆BNBUSD prepare to test $700CRYPTOCAP:BNB surges out of a falling-channel base, then prints twin consolidation pennants that keep hugging an accelerating support rail near 640 USDT. Friday’s fresh thrust through the pennant roof drags price back inside the long-term rising wedge, opening a measured path toward the 720-740 resistance shelf. As long as the inner trendline at 630-635 holds, momentum traders can lean on the channel mid-line; a daily close below 600 would defer—but not defeat—the bullish thesis.

Breaking: $ALPACA Gets Delisted On Binance Tanking 33% Today The price of Alpaca saw a notable dip of 33% Today, albeit the crypto market is in a bullish campaign, news from Binance delisting the altcoin was primarily the factor behind the price plunge.

About Alpaca Finance

Alpaca Finance is the largest lending protocol allowing leveraged yield farming on Binance Smart Chain. It helps lenders earn safe and stable yields, and offers borrowers undercollateralized loans for leveraged yield farming positions, vastly multiplying their farming principals and resulting profits.

Technical Outlook

As of the time of writing, $ALPACA is down 23% trading within a descending triangle formation. However, despite the price plunge the RSI is still holding strong at 59 this might resort to a bullish reversal in the long term as sellers are being filtered by the sell-off.

Alpaca Finance Price Data

The Alpaca Finance price today is $0.174775 USD with a 24-hour trading volume of $381,859,379 USD. Alpaca Finance is down 32.80% in the last 24 hours. The current CoinMarketCap ranking is #734, with a market cap of $26,297,347 USD. It has a circulating supply of 150,464,194 ALPACA coins and a max. supply of 188,000,000 ALPACA coins.

Open Edu Surged 20% Today Gearing to Reclaim $100 Mln Mkt CapOpen Edu ( NYSE:EDU ) native token spike 20% today amidst breaking out of key resistant point setting the coast to reclaim the $100 million market cap.

Built on the BNB chain, The Open Campus Protocol is a decentralized solution for educators, content creators, parents, students, and co-publishers designed to address the major challenges in education today. Despite the critical role of educators in shaping the future generation, they are often undervalued and underpaid.

With growing interest in the world of web3.0 and NFT's, NYSE:EDU might just be a ticking time bomb that is setting the stage for a billion dollar in market cap.

As of the time of writing, NYSE:EDU is up 18% with build up momentum and RSI at 57, NYSE:EDU is gearing for a 50% breakout as conformation for the $100 million market cap sojourn.

Similarly, failure to break further above the resistant level could lead to a sell-off to the $0.096 support point.

Open Campus Price Data

The Open Campus price today is $0.153184 USD with a 24-hour trading volume of $69,244,194 USD. Open Campus is up 17.44% in the last 24 hours. The current CoinMarketCap ranking is #466, with a market cap of $62,914,963 USD. It has a circulating supply of 410,715,985 EDU coins and a max. supply of 1,000,000,000 EDU coins.

CAKEUSDT (PancakeSwap): Sweet Gains or Stale Trade?(1/9)

Good afternoon, everyone! ☀️ CAKEUSDT (PancakeSwap): Sweet Gains or Stale Trade?

With CAKE at $2.599, is this DEX token a tasty treat or a flat pancake? Let’s flip the details! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 2.599 as of Mar 25, 2025 💰

• Recent Move: Consolidating $2.6-$2.8, up from $2.34, per data 📏

• Sector Trend: Crypto steady, DeFi mixed amid trade tensions 🌟

It’s a flip-flop—value might be cookin’! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $760M (292M circulating) 🏆

• Operations: Leading BNB Chain DEX, yield farming, staking ⏰

• Trend: Deflationary model burns 102% minted, per data 🎯

Firm in DeFi, but volatility’s the spice! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Recent Surge: Up 45% earlier in March, per X posts 🌍

• Platform Updates: Expanded NFT marketplace, per web data 📋

• Market Reaction: High volume ($230M daily), showing interest 💡

Adapting to DeFi trends, cooking up growth! 🍳

(5/9) – RISKS IN FOCUS ⚡

• Regulatory Risks: Crypto scrutiny could hit DEXs 🔍

• Market Volatility: Crypto swings could drag price down 📉

• Competition: Other DEXs like Uniswap challenge, per data ❄️

It’s a risky recipe—watch the heat! 🛑

(6/9) – SWOT: STRENGTHS 💪

• DEX Leader: Top on BNB Chain, strong user base 🥇

• Deflationary Model: Burns tokens, potentially boosts value 📊

• High Volume: $230M daily, per data, shows activity 🔧

Got a sweet spot in DeFi! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Price volatility, regulatory fears 📉

• Opportunities: DeFi adoption, new features like lending 📈

Can it rise or get burned? 🤔

(8/9) – POLL TIME! 📢

CAKE at $2.599—your take? 🗳️

• Bullish: $3+ soon, DeFi booms 🐂

• Neutral: Steady, risks balance gains ⚖️

• Bearish: $2 drops, market sours 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

CAKE’s $2.599 price reflects consolidation, with strengths in its platform and deflationary model, but risks from market volatility and competition persist. DCA-on-dips could be a strategy to average in over time, banking on long-term growth. Gem or bust?

Incoming BNB chain forks with 0,75s block time!BNB chain upcoming forks significantly reducing block times, increase TPS and decrease fees!

The Pascal hard fork in March 2025 is a big milestone in BNB Chain’s evolution setting the stage for the two upcoming BNB Chain forks:

1. Lorentz (April 2025): Reduces block intervals to 1.5 seconds

2. Maxwell (June 2025): Further reduces block intervals to 0.75 seconds

Very bullish for all BNB chain projects and it´s main token BNB and defi platforms like CAKE. Finally Ethereum compatible chain's direct hit to Solana's heart and it's performance. The Maxwell fork in June will be game changer for crypto industry.

Almost instant defi experience with decreasing Ethereum activity might lead to 2025 be a BNB chain season.

Incoming BNB chain forks with 0,75s block time!BNB chain upcoming forks significantly reducing block times, increase TPS and decrease fees!

The Pascal hard fork in March 2025 is a big milestone in BNB Chain’s evolution setting the stage for the two upcoming BNB Chain forks:

1. Lorentz (April 2025): Reduces block intervals to 1.5 seconds

2. Maxwell (June 2025): Further reduces block intervals to 0.75 seconds

Very bullish for all BNB chain projects and it´s main token BNB. Finally Ethereum compatible chain's direct hit to Solana's heart and it's performance. The Maxwell fork in June will be game changer for crypto industry.

My short-term prediction once Pascal fork is implemented to main net in the middle of March 2025.