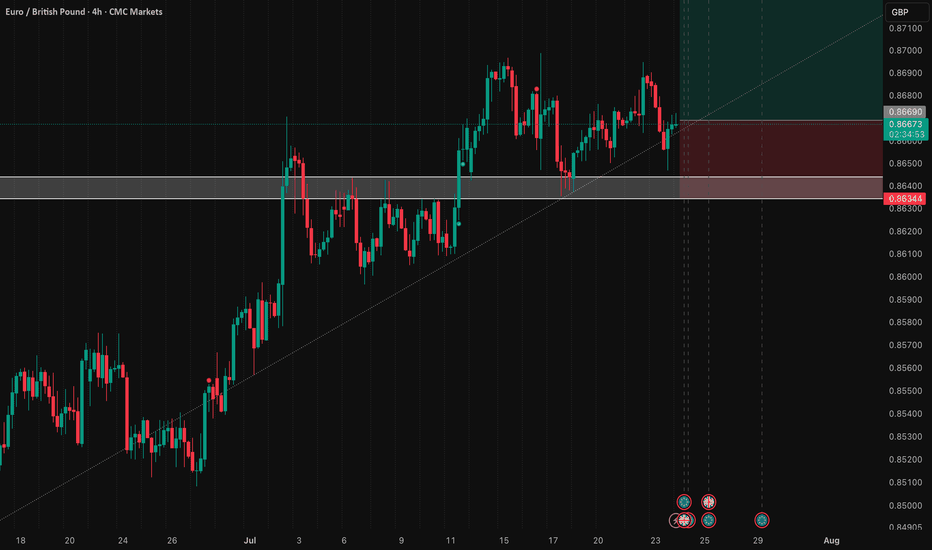

EUR/GBP: Bullish Stance Above 0.8640This signal outlines a tactical long entry on EUR/GBP, positioning for a bullish resolution from today's major fundamental events.

📰 Fundamental Thesis

This position is taken ahead of the two primary market movers: the ECB rate decision and the UK PMI data. The core thesis is that the ECB policy statement will be the dominant catalyst, providing strength to EUR that will outweigh the impact of the UK data release.

📊 Technical Thesis

The trade is defined by a sound technical structure. The stop loss is anchored beneath the critical support zone at 0.8640. The profit target is set to challenge the resistance area just above 0.8722. This setup offers a favorable and clearly defined risk-to-reward profile.

🧠 Risk Management

Execution is timed before extreme event-driven volatility. Adherence to the stop loss is critical to manage the inherent risk of this pre-news strategy.

Trade Parameters

⬆️ Direction: Long (Buy)

➡️ Entry: 0.86690

⛔️ Stop Loss: 0.86344

🎯 Target: 0.87382

✅ Risk/Reward: 1:2

BOE

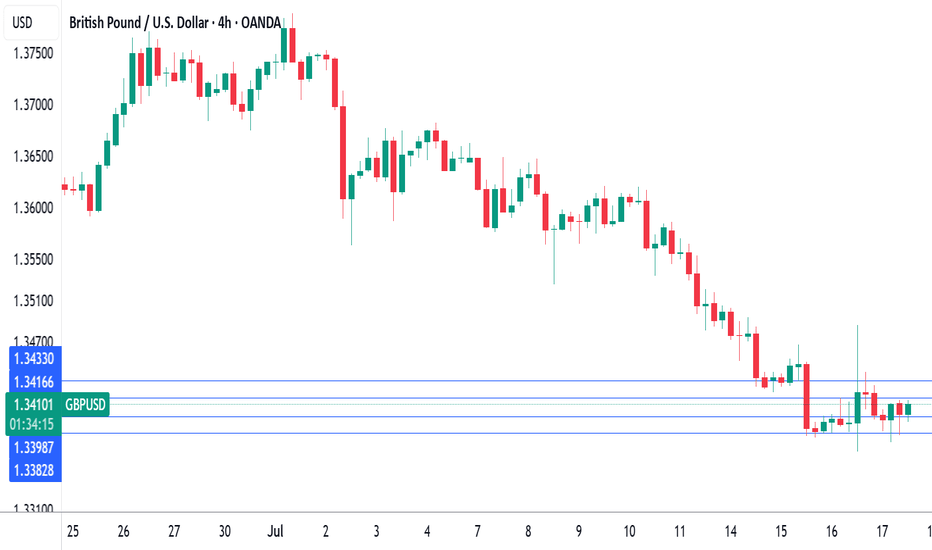

UK employment,wage growth falls, US retail sales shineThe British pound showing limited movement on Thursday. In the North American session, GBP/USD is trading at 1.3406, down 0.09% on the day.

Today's UK employment report pointed to a cooling in the UK labor market. The number of employees on company payrolls dropped by 41 thousand in June after a decline of 25 thousand in May. Still, the May decline was downwardly revised from 109 thousand, easing concerns of a significant deterioration in the labor market.

Wage growth (excluding bonuses) dropped to 5.0% from a revised 5.3%, above the market estimate of 4.9%. The unemployment rate ticked up to 4.7%, up from 4.6% and above the market estimate of 4.6%. This is the highest jobless level since the three months to July 2021.

The latest job data will ease the pressure on the Bank of England to lower rates, as the sharp revision to the May payroll employees means the labor market has not deteriorated as much as had been feared. Still, the employment picture remains weak and the markets are expecting an August rate cut, even though UK inflation was hotter than expected in June.

US retail sales bounced back in June after back-to-back declines. Consumers reacted with a thumbs-down to President Trump's tariffs, which took effect in April and made imported goods more expensive.

The markets had anticipated a marginal gain of just 0.1% m/m in June but retail sales came in at an impressive 0.6%, with most sub-categories recording stronger activity in June. This follows a sharp 0.9% decline in May.

The US tariffs seem to have had a significant impact on retail sales, as consumers continue to time their purchases to minimize the effect of tariffs.

Consumers increased spending before the tariffs took effect and cut back once the tariffs were in place. With a truce in place between the US and China which has slashed tariff rates, consumers have opened their wallets and are spending more on big-ticket items such as motor vehicles, which jumped 1.2% in June.

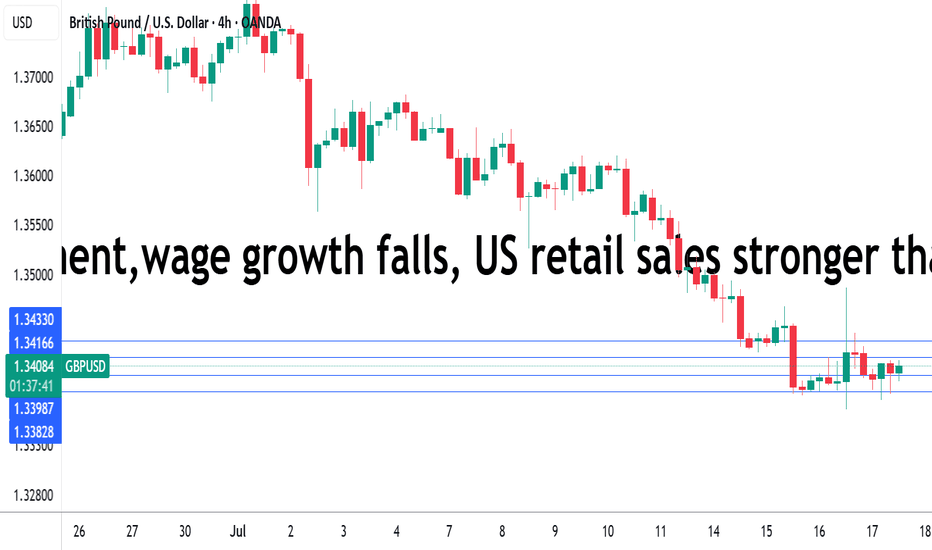

UK employment,wage growth falls, US retail sales shineThe British pound showing limited movement on Thursday. In the North American session, GBP/USD is trading at 1.3406, down 0.09% on the day.

Today's UK employment report pointed to a cooling in the UK labor market. The number of employees on company payrolls dropped by 41 thousand in June after a decline of 25 thousand in May. Still, the May decline was downwardly revised from 109 thousand, easing concerns of a significant deterioration in the labor market.

Wage growth (excluding bonuses) dropped to 5.0% from a revised 5.3%, above the market estimate of 4.9%. The unemployment rate ticked up to 4.7%, up from 4.6% and above the market estimate of 4.6%. This is the highest jobless level since the three months to July 2021.

The latest job data will ease the pressure on the Bank of England to lower rates, as the sharp revision to the May payroll employees means the labor market has not deteriorated as much as had been feared. Still, the employment picture remains weak and the markets are expecting an August rate cut, even though UK inflation was hotter than expected in June.

US retail sales bounced back in June after back-to-back declines. Consumers reacted with a thumbs-down to President Trump's tariffs, which took effect in April and made imported goods more expensive.

The markets had anticipated a marginal gain of just 0.1% m/m in June but retail sales came in at an impressive 0.6%, with most sub-categories recording stronger activity in June. This follows a sharp 0.9% decline in May.

The US tariffs seem to have had a significant impact on retail sales, as consumers continue to time their purchases to minimize the effect of tariffs.

Consumers increased spending before the tariffs took effect and cut back once the tariffs were in place. With a truce in place between the US and China which has slashed tariff rates, consumers have opened their wallets and are spending more on big-ticket items such as motor vehicles, which jumped 1.2% in June.

UK inflation heats up, Pound shrugsThe British pound has stabilized on Wednesday and is trading at 1.3389 in the European session, up 0.07% on the day. This follows a four-day losing streak in which GBP/USD dropped 1.5%. On Tuesday, the pound fell as low as 1.3378, its lowest level since June 23.

Today's UK inflation report brought news that the Bank of England would have preferred not to hear. UK inflation in June jumped to 3.6% y/y, up from 3.4% in May and above the market estimate of 3.4%. This was the highest level since January 2024 and is a stark reminder that inflation is far from being beaten. The main drivers of inflation were higher food and transport prices. Services inflation, which has been persistently high, remained steady at 4.7%. Monthly, CPI ticked up to 0.3% from 0.2%, above the market estimate of 0.2%.

It was a similar story for core CPI, which rose to 3.7% y/y from 3.5% in May, above the market estimate of 3.5%. Monthly, core CPI climbed 0.4%, above 0.2% which was also the market estimate.

The hot inflation report will make it more difficult for the BoE to lower interest rates and the money markets have responded by paring expectations of further rate cuts. Still, expectations are that the BoE will cut rates at the August 7 meeting, with a probability of around 80%, despite today’s higher-than-expected inflation numbers.

The UK releases wage growth on Thursday, which is the final tier-1 event prior to the August meeting. Wage growth has been trending lower in recent months and if that continues in the May reading, that could cement an August rate cut.

Pound under pressure ahead of US, UK inflation reportsThe British pound has edged up higher on Tuesday. In the European session, GBP/USD is trading at 1.3453, up 0.21% on the day. Earlier, GBP/USD touched a low of 1.3416, its lowest level since June 23.

All eyes will be on the UK inflation report for June, which will be released on Wednesday. Headline CPI is expected to remain unchanged at 3.4% y/y, as is core CPI at 3.5%. Monthly, both the headline rates are expected to stay steady at 0.2%.

Has the BoE's battle to lower inflation stalled? The BoE was looking good in March, when inflation eased to 2.6%, but CPI has rebounded to 3.4%, well above the BoE's inflation target of 2%. Services data has been especially sticky, although it dropped to 4.7% in May, down from 5.4% a month earlier.

At 3.4%, inflation is stuck at its highest level since February 2024 and that will complicate plans at the BoE to renew interest rate cuts in order to kick-start the weak UK economy. The central bank has lowered rates twice this year and would like to continue trimming the current cash rate of 4.25%. The Bank meets next on Aug. 7 and Wednesday's inflation data could be a significant factor in the rate decision.

In the US, if June inflation data rises as is expected, fingers will quickly point to President Trump's tariffs as finally having an impact. Recent inflation reports have not shown a significant spike higher due to the tariffs, which were first imposed in April. However, the tariffs may have needed time to filter throughout the economy and could be felt for the first time in the June inflation reading.

The Fed meets next on July 30, with the markets pricing in a 95% chance of a hold, according to CME's FedWatch. For September, the odds of a rate cut stand at 59%. Today's inflation report could cause a shift in these numbers.

GBP/USD tested resistance at 1.3454 earlier. Above, there is resistance at 1.3484

1.3396 and 1.3366 are the next support levels

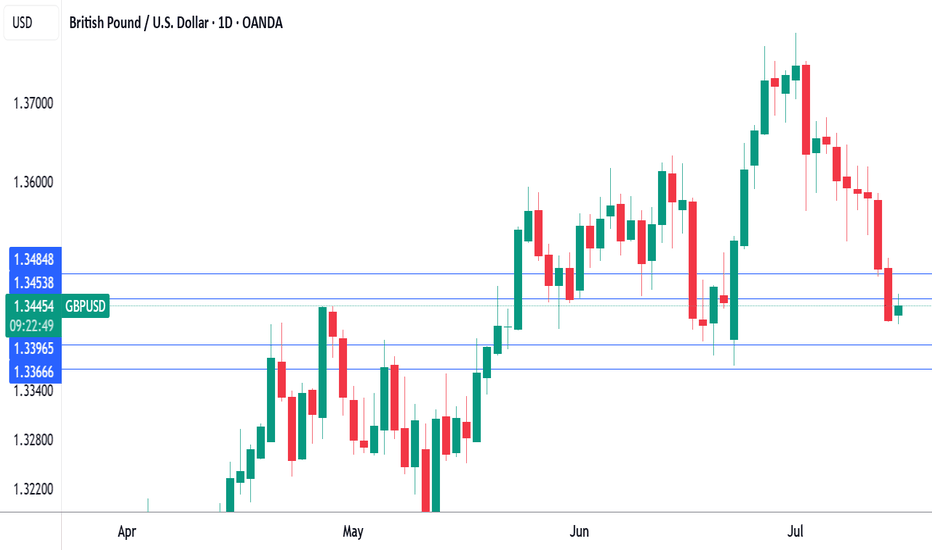

Will The Prospect of a BoE Rate Cut Continue to Dampen GBPUSD?Macro approach:

- GBPUSD has weakened since last week, pressured by disappointing UK economic data and rising expectations of a BoE rate cut. Meanwhile, the US dollar found support amid cautious risk sentiment and anticipation of key US inflation data.

- UK GDP contracted for a second consecutive month in May, and recent labor market surveys signaled further cooling, reinforcing the case for the BoE's monetary easing. Governor Bailey reiterated that the path for rates is "downward," with markets now pricing in a high probability of a cut at the Aug meeting.

- Meanwhile, the US dollar was buoyed by safe-haven flows and firm inflation expectations ahead of the US CPI release, highlighting policy divergence between the Fed and BoE.

- GBPUSD may remain under pressure as traders await UK inflation and employment data, which could influence the BoE's next move. The pair could see further volatility with US CPI and Fed commentary also on the radar as potential catalysts.

Technical approach:

- GBPUSD is retesting the ascending channel's lower bound, confluence with the key support at 1.3420. The price is between both EMAs, indicating a sideways movement. GBPUSD awaits an apparent breakout to determine the short-term trend.

- If GBPUSD breaches below the support at 1.3420, the price may plunge toward the following support at 1.3175.

- On the contrary, holding above 1.3420 may prompt a short correction to retest EMA21.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

UK GBP contracts, pound dipsThe British pound continues to have a quiet week. In the European session, GBP/USD is trading at 1.3530, down 0.30% on the day.

The UK wrapped up the week on a down note, as GDP contracted in May by 0.1% m/m. This followed a 0.3% decline in April and missed the consensus of 0.1%. The decline was driven by a 1% decline in manufacturing and a 0.6% contraction in construction, which cancelled out a 0.1% expansion in services.

The GDP contractions in April and May point to a weak second quarter of growth, after an impressive 0.7% gain in the first quarter. The economic landscape remains uncertain and the Bank of England has projected weak growth of 1% for 2025. Governor Bailey has said that the rate path will be "gradually downwards" but hasn't hinted as to the timing of the next cut.

The weak GDP data supports the case for an August rate cut, even though headline inflation is running at 3.4% and core inflation at 3.5%, well above the BoE's target of 2%. The money markets have priced in a quarter-point cut in August at 80%, which would lower the cash rate to 4.0%.

The BoE released its financial stability report earlier in the week, noting that the outlook for UK growth over the coming year is "a little weaker and more uncertain". The Bank highlighted President Trump's tariffs and the conflict in the Middle East. The UK has recently signed a trade deal with the US but some tariffs on UK products remain in effect.

GBP/USD is testing support at 1.3534. Below, there is support at 1.3491

The next resistance lines are 1.3577 and 1.3620

GBP/USD: Path to 1.3200 on Policy DivergenceThis trade idea outlines a high-conviction bearish thesis for GBP/USD. The core of this analysis is a significant and growing divergence between the fundamental outlooks of the UK and US economies, which is now being confirmed by a bearish technical structure. We anticipate the upcoming UK economic data releases during the week of July 14-18 to act as a catalyst for the next leg down.

The Fundamental Why 📰

The primary driver for this trade is the widening policy and economic divergence. The UK is facing a triad of headwinds while the US economy exhibits greater resilience. This fundamental imbalance favors the US Dollar and is expected to intensify.

Dovish Bank of England: The BoE is clearly signaling a dovish pivot towards monetary easing in response to a weakening labor market and sluggish growth prospects. This contrasts with the Federal Reserve's more patient, data-dependent stance.

Widening Rate Differentials: The divergence in central bank policy is leading to a widening interest rate differential that favors the US Dollar.

Geopolitical Headwinds: Fiscal policy from the new UK government and ongoing trade tensions are creating additional headwinds for the Pound.

The Technical Picture 📊

Price action provides strong confirmation of the bearish fundamental thesis, showing a clear loss of upward momentum and the formation of a new downtrend.

📉 Death Cross: The 50-day moving average has crossed below the 200-day moving average, forming a "death cross," which is a strong bearish indicator.

📉 Key Level Lost: The price has recently broken and is holding below the critical 200-day moving average, a classic bearish signal.

📉 Bearish Momentum: Both the RSI (below 50) and the MACD (below its signal line and zero) indicate that bearish momentum is in control.

The Trade Setup 📉

👉 Entry: 1.3540 - 1.3610

🎯 Take Profit: 1.3200

⛔️ Stop Loss: 1.3665

Sintra Signals: Central Banks Stay Cautious The ECB Forum in Sintra brought together the heads of the world’s most influential central banks—Lagarde (ECB), Powell (Fed), Bailey (BOE), Ueda (BOJ), and Rhee (BOK).

Across the board, central banks are remaining cautious and data-driven, with no firm commitments on timing for rate changes.

Fed Chair Powell said the U.S. economy is strong, with inflation manageable despite expected summer upticks. He noted tariffs have delayed potential rate cuts and confirmed the Fed is proceeding meeting by meeting.

BOE’s Bailey highlighted signs of softening in the UK economy and said policy remains restrictive but will ease over time. He sees the path of rates continuing downward.

BOJ’s Ueda noted headline inflation is above 2%. Any hikes will depend on underlying core inflation which remains below target.

UK retail sales slide, Pound edges higherThe British pound has gained ground for a second straight day. In the European session, GBP/USD is trading at 1.3496, up 0.22% on the day.

UK retail sales took a tumble in May, falling 2.7% m/m. This followed an upwardly revised 1.3% increase in April and was much worse than the market estimate of -0.5%. This marked the steepest decline since December 2023 and was driven by a sharp drop in food store sales.

Consumers are being squeezed by inflation and are pessimistic about economic conditions - Gfk consumer confidence for June rose slightly to -18 from -20. Annually, retail sales dropped 1.3%, following a 5.0% gain in April and missing the market estimate of 1.7%. This was the weakest reading since April 2024.

The dismal retail sales report reflects the volatile economic landscape and there may not be a light at the end of the tunnel for some time. The Israel-Iran war could lead to oil prices continuing to rise and the uncertainty over US tariffs will only add to the worries of the UK consumer.

The Bank of England held rates on Thursday but the weak retail sales report will add pressure on the central bank to lower rates in the summer. The markets expect one or two rate cuts in 2025, but the main impediment to a rate cut is stubbornly high inflation.

Inflation ticked lower to 3.4% y/y in May from 3.5% a month earlier. The core rate dropped to 3.5% from 3.8% but these numbers are still too high, well above the BoE's target of 2%. Without signs that inflation is easing, it will be difficult for the BoE to justify a rate cut.

GBP/USD is testing resistance at 1.3498. Above, there is resistance at 1.3527

1.3440 and 1.3411 are providing support

Pound Steady as BoE holds ratesThe British pound is showing limited movement for a second straight day. In the European session, GBP/USD is trading at 1.3435, up 0.18% on the day.

The Bank of England didn't have any surprises up its sleeve as it held rates at 4.25%. This follows a quarter-point cut at last month's meeting. The MPC vote indicated that six members voted to hold while three voted to lower rates. The markets had projected that the vote would be 7-2 in favor of holding rates.

Today's decision to hold rates was widely expected, but that doesn't mean there aren't economic signals which support a rate cut. The UK economy is in trouble and GDP came in at -0.3% in April, its deepest contraction in 18 months.

The weak economy could desperately use a rate cut, but inflation remains stubbornly high and a rate cut would likely send inflation even higher. Annual CPI remained at 3.4% in May, its highest level in over a year.

The geopolitical tensions, most recently the war between Israel and Iran have led to greater economic uncertainty and complicated any plans to lower rates. The BoE is expected to lower rates one or twice in the second half of the year, with the direction of inflation being a key factor in the Bank's rate path.

The Federal Reserve held rates at Wednesday's meeting for a fourth straight time. The Fed noted that inflation remains higher than the target but said the labor market remains strong. President Trump has pushed hard for the Fed to lower rates but Fed Chair Jerome Powell has stuck to his position and repeated on Wednesday that current policy was the most appropriate to respond to the economic uncertainty.

Pound recovers as UK CPI edges lowerThe British pound has stabilized on Wednesday. In the European session, GBP/USD is trading at 1.3551, up 0.28% on the day. The US dollar showed broad strength on Tuesday and GBP/USD declined 1.05% and fell to a three-week low.

UK inflation for May edged lower to 3.4% y/y, down from 3.5% in April and matching the market estimate. The driver behind the deceleration was lower airline prices and petrol prices. Services inflation, which has been persistently high, eased to 4.7% from 5.4%. Monthly, CPI gained 0.2%, much lower than the 1.2% gain in April and matching the market estimate.

Core CPI, which excludes food and energy, fell to 3.5% in May, down from 3.8% a month earlier and below the market estimate of 3.6%. Monthly, the core rate rose 0.2%, sharply lower than the 1.4% spike in April and in line with the market estimate. This marked the lowest monthly increase in four months.

The Bank of England will be pleased that core CPI moved lower but the inflation numbers are still too high for its liking. Headline CPI had been below 3% for a year but has jumped well above 3% in the past two months.

BoE policymakers won't have much time to digest today's inflation report as the central bank makes its rate announcement on Thursday. The markets are widely expecting the BoE to maintain the cash rate at 4.25%,

Investors will be keeping a close eye on the meeting, looking for hints of a rate cut later in the year. The UK economy contracted in April and with wages falling and unemployment rising, there is pressure for the BoE to lower rates, but that is risky with inflation well above the BoE's 2% inflation target.

US retail sales slumped in May, falling 0.9% m/m. This was well below the revised -0.1% reading in April and worse than the market estimate of -0.7%. Annually, retail sales fell to 3.3%, down sharply from a revised 5.0%.

Consumers are wary about the economy and anxiety over Trump's tariffs has weighed on consumer spending. If additional key US data heads lower, this will increase pressure on the Federal Reserve to lower interest rates.

GBP/US is putting pressure on resistance at 1.3480. Above, there is resistance at 1.3545

1.3364 and 1.3299 are providing support

Central banks dominate calendar this week: Will Fed surprise?A pack of central bank decisions is set to drive market direction this week, with the Bank of Japan (Tuesday), Federal Reserve (Wednesday), Swiss National Bank (Thursday), and Bank of England (Thursday) all scheduled to announce their latest interest rate decisions.

The Federal Reserve will, of course, take center stage.

Despite President Trump’s continued call for a 100-basis point rate cut, Fed officials are widely expected to keep rates unchanged. However, softer-than-expected CPI and PPI data from last week may provide scope for a surprise.

The U.S. Dollar Index (DXY) is trading just above the key support zone at 98.00, a level not seen since early 2022. A decisive break below this area could open the door to further downside, potentially targeting the 96.00 region. However, a surprise from the Fed could trigger a rebound toward the 100.50–101.00 resistance band.

British Pound resumes rally as retail sales jumpThe British pound has posted gains on Friday. In the European session, GBP/USD is trading at 1.3484, up 0.49% on the day. The pound has gained 1.5% this week and is trading at levels not seen since Feb. 2022.

The markets were expecting a banner reading from April retail sales but the actual numbers crushed the forecast. Annual retail sales surged 5%, up from a downwardly revised 1.9% and above the market estimate of 4.5%. This marked the fastest pace of growth since Feb. 2022.

Monthly, retail sales climbed 1.2%, up from a downwardly revised 0.3% in March and blowing past the market estimate of 0.2%. The surge was driven by sharp gains in food store sales and department stores, as favorable weather brought out consumers.

The UK economy has been struggling and strong consumer spending has been a bright spot. Monthly retail sales have now increased for four straight months, which last occurred in 2020.

The UK consumer spending more and is showing more optimism. The GfK consumer confidence index for May improved to -20 from -23 and beat the market estimate of -22. The improvement is likely a result of the de-escalation in global trade tensions as well as the Bank of England rate cut in early May.

The impressive retail sales report, together with higher-than-expected inflation in April will raise expectations for the BoE to hold rates at its next meeting on June 18.

There are no key US releases today but we'll hear from three FOMC members. There has been plenty of Fedspeak this week, with a message that the US tariffs will take a toll on the US economy, even with the temporary deal with China, and that the Fed favors a wait-and-see stance before further rate cuts.

GBP/USD has broken above several resistance lines and is putting pressure in resistance at 1.3493.

There is support at 1.3393 and 1.3367

British PMIs accelerate, retail sales nextIt has been a good week for the British pound, which has gained 1% against the dollar and climbed to levels not seen since Feb. 2022. The pound has rallied for three straight days but is almost unchanged on Thursday, trading at 1.3425 in the North American session.

The UK economy has been struggling but don't blame consumers for not spending. Retail sales for April will be released on Friday and the markets are expecting a massive gain of 4.5% y/y. This follows a 2.6% gain in March which was a three-month high. Monthly, retail sales is expected to ease to 0.2% from 0.4%.

UK PMIs showed improvement in May after downward revisions in April. Services PMI rose to 52.3, up from a revised 50.8 in March and above the market estimate of 50.8. The Manufacturing PMI also improved to 52.3, up from a revised 50.2 and above the market estimate of 49.9. This indicates slight growth in business activity and manufacturing.

UK inflation for April was higher than expected, disappointing the Bank of England which wants to deliver additional rate cuts in order to boost the flagging economy. The BoE lowered rates in April by a quarter-point to 4.25% but a June cut is very unlikely after the hot inflation report.

GBP/USD is testing resistance at 1.3429. Above, there is resistance at 1.3429

1.3410 and 1.3394 are the next support levels

Pound steady as UK inflation surgesThe British pound posted gains earlier but has failed to consolidate. In the European session, GBP/USD is trading at 1.3395, up 0.03% on the day. The pound has gained 1.1% this week and earlier today rose as high as 1.3468, its highest level since Feb. 2022.

UK inflation jumped to 3.5% y/y in April, up sharply from 2.6% in March and above the market estimate of 3.3%. This was the highest annual inflation rate since Jan. 2024 and was driven by higher prices for transport, housing and energy. Monthly, inflation soared to 1.2%, up from 0.3% and above the market estimate of 1.1%.

The news wasn't much better from core CPI, which rose to 3.8% from 3.4% and was higher than the market estimate of 3.6%. This was the highest reading since April 2024. Monthly, the core rate jumped to 1.4%, up from 0.5% and above the market estimate of 1.2%.

The rise in inflation can be partially attributed to the increase in the energy price cap and the Easter holidays, but is a disappointment for the government and for the Bank of England, as inflation had been trending lower.

The BoE will be concerned by the rise in core inflation, which will complicate plans to further reduce rates. The BoE trimmed the cash rate by a quarter-point earlier this month by 0.25%, but rates are still higher than other major central banks, with the exception of the Federal Reserve.

The Federal Reserve is taking a wait-and-see attitude before it lowers rates again, especially with the uncertainty swirling around US tariff policy. Atlanta Fed President Raphael Bostic said this week that even reduced tariffs would be "definitely economically significant" and said he favored one rate cut this year.

Fed pleases everyone, except for one. BoE is next on the watchThe Federal Reserve came out with its rate decision and it seems that all market participants got pleased, except for one.

Today it's the BoE's turn to deliver rates.

Let's dig in!

TVC:DJI

TVC:DXY

FX_IDC:GBPUSD

MARKETSCOM:100UK

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

Will GBP/USD head lower from THIS major resistance zone?Sterling finds itself walking a financial tightrope this week. The GBP/USD is delicately poised between transatlantic central bank decisions and murky trade headlines. As the Federal Reserve holds court across the pond and the Bank of England gets ready to show its hand, traders are bracing for a possible divergence in tone—and in policy. The dollar has taken a softer step into the week, retreating after two weeks of modest gains. But don't be fooled: that weakness could easily reverse if the Trump administration’s trade negotiations result in new agreements. Officials suggest deals with partners beyond China might be inked by week's end. Until then, the markets remain unimpressed. Friday’s US nonfarm payrolls came and went with little fanfare, and Monday’s ISM services PMI barely registered. So far, the macroeconomic data has taken a backseat to geopolitical posturing.

Trade Truce Could Revive the Dollar’s Fortunes

The dollar index has wobbled a little after a brief two-week recovery, helped by an unwind of previous “Sell America” trade. But the big question remains: will Washington and Beijing finally bury the hatchet? Equity markets are behaving as if they expect some form of resolution—however vague—but the greenback hasn't followed suit. Fed independence is also under the microscope, with President Trump’s persistent rate-cut rhetoric raising eyebrows. The political fog isn't helping matters. Yet, a trade breakthrough—particularly with China—could lend support to the dollar, shifting sentiment swiftly.

Sterling's Fate Hinges on Central Bank Theatre

Two heavyweight monetary policy announcements are set to dominate fate for the GBP/USD currency pair over the next 24 hours or so.

• FOMC Rate Decision – Wednesday, 7 May, 19:00 BST

No surprises expected here. The Fed is widely tipped to hold rates steady at 4.25–4.50%. The real drama lies in the messaging. With political noise in the background, Powell may aim to exude calm and control. Markets will scour the statement for hints of June’s outlook.

• Bank of England Rate Decision – Thursday, 8 May, 12:00 BST

Here’s where the action really lies for sterling. A 25bp cut is largely priced in, and a dovish 9-0 vote wouldn’t shock anyone. But traders will pay close attention to the inflation outlook—especially with energy prices softening. A slightly more optimistic growth revision could temper the dovishness. Any hint of hawkish resistance may offer the pound a temporary reprieve, perhaps even lifting GBP/USD to flirt with 1.3500.

Technical Outlook: Cable Bumps Up Against Familiar Ceiling

Technically speaking, GBP/USD is looking a bit overextended, though bears haven’t been vindicated just yet. Last week’s weekly chart printed an inverted hammer—a warning shot, perhaps, but without any firm follow-through so far.

The pair recently tested September’s high at 1.3434 before retreating. But more formidable resistance lurks between 1.35 and 1.40—a zone that’s proved impenetrable since the Brexit saga began. So, the path upward may be limited from here on.

On the downside, keep an eye on 1.3250 for initial support, followed by the psychological barrier at 1.3000.

Final Word

It’s shaping up to be a pivotal week for cable. Trade chatter has failed to energise the dollar, while sterling stands on the edge, waiting for the Bank of England’s cue. With Powell and Bailey both stepping into the spotlight, and global trade deals waiting in the wings, this week could deliver the jolt that the GBP/USD has been waiting for. For now, a cautious stance on sterling feels justified—but everything’s in play, and sentiment may turn quickly.

By Fawad Razaqzada, market analyst with FOREX.com

GBPUSD Forecast: Double Top or Flat?In contrast to EURUSD, the GBPUSD chart reflects a double top or flat rather than a head-and-shoulders pattern. However, unlike DXY and EURUSD, GBPUSD hasn’t broken below its neckline, maintaining a bullish bias as RSI continues to show positive momentum.

• Upside Scenario : If the pair breaks above the 1.3345 high, the next targets are 1.3380, 1.3400, 1.3440, and 1.3500, in the direction of the duplicated channel confirming the possible consolidation as a flat.

• Downside Scenario : A break below the neckline and 1.3200 support could trigger a decline toward 1.3080, confirming a double top formation on the pair.

Volatility catalysts for this week range between the FOMC Outlook and BOE Meeting, between Wednesday and Thursday, following their respective rate decisions

Written by Razan Hilal, CMT

UK retail sales beat forecast, pound edges lowerThe British pound has edged lower on Friday. In the European session, GBP/USD is trading at 1.3214, down 0.17% on the day.

UK retail sales were a ray of sunshine in March. Monthly, retail sales rose 0.4%, beating the market estimate of -0.4% but below the revised 0.7% increase in February. Clothing sales showed strong growth as shoppers took advantage of the sunny weather.

Annualized, retail sales rose 2.6% from a revised 1.8% gain in February and above the market estimate of 1.8%. This was the strongest gain in three months.

The strong retail sales was a pleasant surprise but the consumer economy remains fragile. The GfK consumer confidence index deteriorated in April to -23 from -19 and below the market estimate of -22. This was the lowest level since November 2023.

Consumers are concerned over the rising cost of living and worsening global trade tensions which has been fuelled by President Trump's tariffs. The GfK survey found that consumers are anxious that inflation will continue to rise due to the US tariffs.

The Bank of England is following trade tensions carefully as well. On Thursday, Governor Andrew Bailey said that the BoE was "quite focused on the growth shock" for the UK from the tariffs, although he said the UK was not close to a recession. If the global trade war intensifies, it will weigh on UK growth but will also push inflation lower.

President Trump's tariff policy is expected to raise inflation and consumers are anxious that inflation will rise sharply. The UoM consumer inflation expectations index jumped to 6.7% in the initial April release, up from 5.0% in March. Today's final release is expected to confirm this figure, which would mark the highest level since Nov. 1981.

British pound keeps rolling as UK GDP shinesThe British pound is up sharply on Friday, extending its rally for a fourth straight day. In the European session, GBP/USD is trading at 1.3088, up 0.94% on the day. The pound has surged 2.9% since Monday.

UK GDP higher than expected February with a gain of 0.5% m/m. This followed a revised 0% reading in January and beat the market estimate of 0.1%. This was the fastest pace of growth since March 2024. Services, manufacturing and construction all recorded gains. For the three months to January, GDP expanded 0.6%, above the revised 0.3% gain in January and higher than the market estimate of 0.4%.

The strong GDP data is welcome news amid all the uncertainty created by US President Trump's tariff policy. The UK's largest trading partner is the US and the 10% tariffs on UK products will hurt the UK export sector (Trump has suspended an additional 10% tariff for 90 days).

Bank of England expected to lower rates in May

The turmoil in the financial markets and escalating trade tensions has the Bank of England worried. The markets have priced in a rate cut in May, betting that the BoE will ease policy in order to support the weak economy, even with inflation above the 2% target. The BoE kept rates unchanged in March and meets next on May 8.

The US-China trade war rose up a notch on Friday, as China announced it would raise tariffs on US goods to 125% from 84%. This move was in response to the US lifting tariffs on China by 125% this week, for a total tariff rate at 145%. The trade war will dampen China's economy and Goldman Sachs has lowered its 2025 GDP forecast for China to 4.0% from 4.5%.

UK inflation cools more than expected, GBP/USD loses groundUK inflation for February rose 2.8% y/y, below the market esti mate of 2.9%. This was lower than the 3% gain in January. The main contribution to the drop in inflation was lower prices for clothing and housing. On a monthly basis, CPI rose 0.4%, up from 0.1% in January but lower than the market estimate of 0.5%. Core CPI also eased, falling from 3.7% to 3.5%.

The drop in inflation is good news, but the Bank of England remains concerned about the upside risk of inflation. Services inflation, which has been sticky, was unchanged at 5%.

The BoE will consider a rate cut at the next meeting in May, but will be monitoring the effects of increased employer taxes starting in April as well as today's Spring Statement.

At last week's meeting, the BoE expressed concern over worsening "global trade policy uncertainty" and pointedly mentioned US tariffs. The Trump administration's new trade policy has raised trade tensions and a global trade war would hurt growth and boost inflation.

The slight drop in inflation is also good news for Finance Minister Rachel Reeves, who is delivered the budget update earlier today. The update did not contain any further tax increases and announced deep spending cuts. Borrrowing a phrase from the Bank of England at last week's meeting, Reeves said "increased global uncertainty" had increased borrowing costs and led to economic instability.

GBP/USD has pushed below support at 1.2940. The next support level is 1.2864

There is resistance at 1.2940 and 1.2991

GBP/USD shrugs as UK GDP unexpectedly declineshe British pound has edged lower against the US dollar on Friday. GBP/USD is trading at 1.2928 in the European session, down 0.13% on the day.

The UK economy barely registered any growth in the second half of 2024, rising 0.1% in the third quarter and flatlining in the third quarter. The New Year hasn't seen any improvement, as GDP contracted 0.1% m/m in January, after a 0.4% gain in December and missing the market estimate of 0.1%. The surprise contraction was driven by declines in the production and manufacturing sectors. The economy expanded 0.2% in the three months to January, up from 0.1% in the three months to December but shy of the market estimate of 0.3%.

The weak GDP report won't make things any easier for Finance Minister Rachel Reeves, who will announce the Treasury's "Spring Statement" on March 26. Reeves is expected to outline plans for higher taxes and spending cuts. The tax hikes on British businesses are expected to weigh on investment, hiring and growth.

The Bank of England meets on March 20 and is widely expected to maintain rates at 4.5%. The BoE trimmed rates by a quarter-point in February. Inflation rose sharply in January to 3.0% y/y, up from 2.5% in December. The rise in inflation and weak GDP has raised concerns about stagflation, which is characterized by persistent inflation and weak growth.

Another headache for BoE policymakers is US President Donald Trump's tariff policy. The UK had hoped to avoid the tariffs, but this week the US slapped 25% tariffs on all steel and aluminum imports, including on UK products. That could hurt UK growth and boost inflation.

GBP/USD tested resistance at 1.2949 earlier. Above, there is resistance at 1.2978

1.2923 and 1.2894 are the next support levels