Maximize your Profits with Bollinger BandsBollinger Band Strategy is One of the Most Profitable Strategy Used by the Trades who earn lots of Money!!!

You can't just use Bollinger Bands to Trade and Earn Money as you need to confirm the Break Out Signal that you get after a Bollinger Band Squeeze.

Here are some tips how to confirm that:

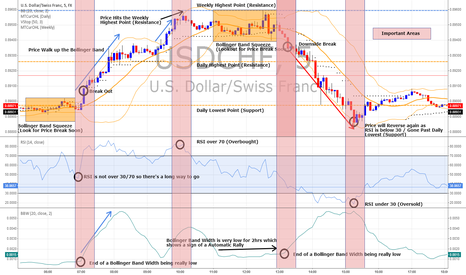

1. Always looks for Bollinger Band Squeezes as you will find Price Break Outs most of the times

2. Use RSI to confirm the Price Break Out

3. Make sure RSI is not Overbought/Oversold to have a Major Price Break Out

4. Look for Bollinger Band Width to see whether its Rising as well

5. When there's a Major Price Break out it will go on for 1 -3hrs so you can take multiple entry points to Maximize your profits

6. Always check the Support/Resistance levels as there's possibility of the Price reversing the other way

7. I would also recommend to check the investing.com and look for Strong Buy/Sell Signal before you enter your Trade

8. There will be fake break outs where the price go the otherway

9. You can have stop losses and enter the Trades on the otherway if there's a fake breakout

Few other Tips to Enhance the above:

1. Use default MACD to reconfirm the Trend Direction (Thanks for the Idea from HamzaLeith)

2. Check the Direction of the Upper/Lower Bands.

For Bullish reversal's and continuations (opposite is true for bearish reversals or continuations)

1.) Price approaches the Buy Zone and the upper and lower bands remain flat. Reversal - Likely a sharp reversal to the lower band. Because both bands are flat this will likely be short lived.

2.) Price approaches the Buy Zone and the upper band goes up and the lower band is flat or moving up slightly. Continuation - Price will likely continue up slowly for a time.

3.) Price approaches the Buy Zone and the upper band goes up and the lower band goes down. Continuation - Price will likely move up fast and furious. This is the best continuation pattern for the bands. This is a rapid expansion of volatility. You will experience "fake out's" sometimes but most of the time this set-up will produce some good profits when executed properly.

4.) Price approaches the Buy Zone and the upper and lower bands both go down. - Reversal - This is likely to result in a reversal

Source: www.eezybooks.com

Summary: Use RSI / Bollinger Band Width & MACD Indicators to Confirm the Signal

Hope this Helps Anyone who like to maximize the profits

Bollinger Bands (BB)

Bearish for now...Overall most of the indicators point to the fact that we are not breaking the trend. There is SOME volume, but not volume the way we saw in the bubble. If anything it's volume that supports price stability around this range, however I think selling could be imminent.

The same pattern of volatility has taken place all the way down the trend line in respect to the bollinger bands, however the bollinger bands have been shrinking and volatility is subsiding. This is a good thing and I believe it may lead to gradual growth. However, this may be like the last bubble in a sense that we may not see any strong movement from here for at least a year. (Great for adoption of bit coin which can drive the price over all)

Stochastic RSI is overbought here. I believe this will drop to oversold before we start to make the slow run up.

Average True Range is an interesting indicator for Bitcoin, as it seems that we're flattening out the way that things were pre-bubble, again somewhat supporting the theory that we're losing volatility.

I'm not exactly sure how to address the MACD in relation to everything else. It supports upward movement, somewhat but not in the manner where you would want to call the bottom and make any type of swing trade.

I'm short until the mid-400s, but as a miner I have every intent on seeing the market from a bullish perspective in the long term.