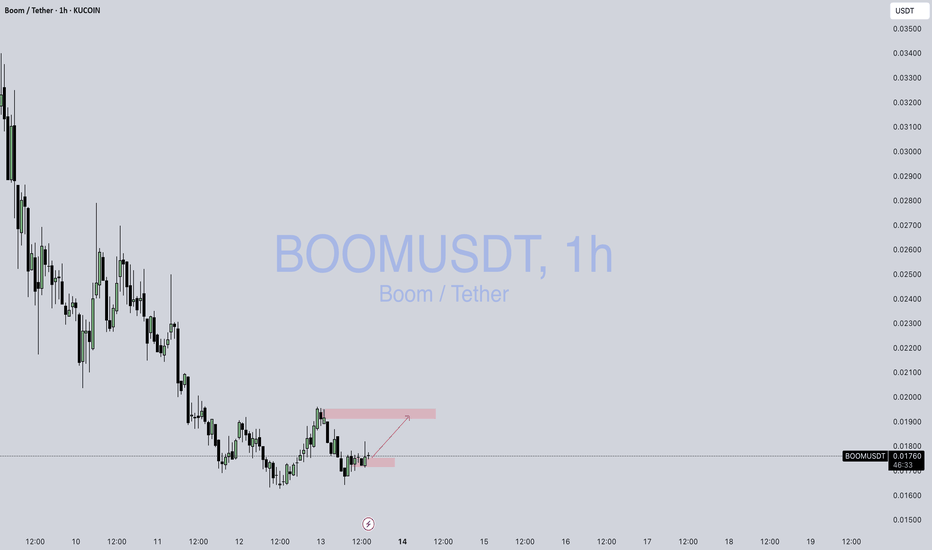

Boom / Usdt KUCOIN:BOOMUSDT

📊 **Technical Outlook – BOOM/USDT (1H):**

* 🟢 **Current Price:** \$0.01760

* 🟩 **Support Zone:** Around \$0.01700 (highlighted in the lower red box) – price recently bounced from this zone.

* 🟥 **Resistance Zone:** Around \$0.01900 – \$0.01950 (upper red box) – price has previously rejected here.

* 📈 **Short-Term Bias:** Bullish attempt – the chart suggests a **potential move upward** toward the resistance area, as shown by the red arrow.

---

🔍 **Key Observations:**

* Recent **higher low formation** suggests bullish interest.

* If momentum holds and volume confirms, price may **retest the \$0.019+ level**.

* However, if the price fails to hold above \$0.01720, the upward setup could be invalidated.

---

⚠️ **Note:** This is **not financial advice** – always manage risk with proper stop-loss levels.

BOOM

BTC next boom beginning I'm going to see boom in btc

Here’s the analysis of Bitcoin’s (BTC) next expected move in English, based on current market conditions and technical indicators:

---

### **1. Short-Term Outlook (Next 24-48 Hours)**

- Bitcoin is currently trading around **$107,400**, with **$108,000-$109,000** acting as a strong resistance zone.

- If BTC breaks above **$109,870** and closes above it, the next target could be **$114,950**.

- If the price fails to break resistance, a pullback to **$105,300** or **$103,900** (support levels) is possible.

- The **30-minute RSI is at 52.22** (neutral-bullish), and the MACD histogram is in positive territory.

---

### **2. Medium-Term Outlook (1 Week to 1 Month)**

- **Coincodex predicts**:

- **$116,914** (+8.98%) by July 2025.

- **$136,858** in the next 3 months.

- **DigitalCoinPrice forecasts**:

- Average price of **$221,961** by late 2025, with a potential high of **$235,354**.

---

### **3. Key Technical Indicators**

- **4-Hour Chart**:

- BTC is testing the **upper Bollinger Band ($108,672)**. A breakout could target **$114,956**.

- **Support Levels**:

- Immediate support: **$105,358** (EMA 100).

- Strong support: **$103,996**.

---

### **4. Market Sentiment**

- The **Fear & Greed Index** is currently at **74 (Greed)**, indicating bullish sentiment but also potential overbought conditions.

- **Volume**: Stable buying volume suggests sustained interest, but a drop could signal consolidation.

---

### **5. Potential Scenarios**

- **Bullish Case**: Break above **$109,870** → Rally toward **$114,950-$116,000**.

- **Bearish Case**: Rejection at resistance → Drop to **$105,300-$103,900**.

Lockheed Martin... Time to move?With tensions rising in the Middle East and the gaining of military activity here in the United States, it could be assumed that the government spending to grow the defense will mostly be seen by large defense firms. Specifically, we will be looking at NYSE:LMT but that doesn't rule out any other defense contractors from this trade ( NYSE:NOC , NASDAQ:HON , NYSE:RTX , NYSE:BA , NYSE:GD ). Firstly, let's examine the charts before reviewing anything fundamental from the company.

This is the 4h chart looking back into late-mid January

Simply put, this is just two of many possible paths that the NYSE:LMT price action could take. However, these two should be the most expected especially considering its violent downtrend that appears to be "cooling" and not "consolidating". It also appears that NYSE:LMT price action likes to reclaim any Fair Value Gap that it creates quite quickly as of recent trading terms. The good news is that two large FVG's have been created by a rather lackluster earnings report.

Now, as for a fundamental analysis POV, we can firstly examine the defense industry's cyclical movement throughout the years. This means that the industry is facing booms and busts. So lets see what the 1 week chart has to say about that...

With the chart shown above, you're probably thinking that a quick rebound seems unlikely as the other "BUST" sequences seem to last longer than the "BOOM" sequences. To this I would agree, however being first (or being early) is something I can settle for as there is no possible way to buy the exact bottom penny. When prompted with this dilemma of timing, think back to the Margin Call famous quote...

"There are only three ways to make a living in this business: be first ; be smarter; or cheat... it sure is a hell of a lot easier to just be first."

is HMSTR booming?????hi everyone, I'm MSNP and today we want to talk about GATEIO:HMSTRUSDT , please follow me and support this idea

after a down trend HMSTR showing potential (26% today)

we had a trend line that you can see here:

and a BO above it. so, what's we excepted for future?

1. in first place we need a prove and confirmation of starting new trend, so we need a bull candle above EMA.

2. we need a pullback: after this down trend (68%), after BO we need a pullback, the pullback area is marked with blue line that you can see here:

3. after pulling back and testing the bottom successfully we need to see more power from bulls, 2,3 good bull bar would be nice and after two bull bars that close on top you can buy above them for a swing

4. target is marked in chart with sky blue line that you can see here:

5. the road that i expect from HMSTR is here:

thank you for reading, ask any questions and i will be there for you

Nvidia - How high is too high?Nvidia (NVDA) continues to defy gravity, hitting $140 in pre-market trading today.

This translates to:

A 23% increase in June alone

A 55% increase in Q2

A staggering 184% increase since the beginning of the year

A 225% year-to-date (YTD) surge

These are the kinds of figures we've come to expect from Nvidia, making even impressive YTD gains of 27% by companies like Microsoft look pedestrian. Nvidia's rise has also propelled it to the top of the market cap rankings, becoming the world's most valuable publicly traded company.

The Question of Sustainability

The burning question is, can this growth be sustained?

So far, Nvidia has the numbers to back it up. The company has already generated more EBITDA this year than in all of FY2023. While its Price/Earnings Growth (PEG) ratio of 1.55 suggests a slight overvaluation, and has been increasing steadily for a year, it remains below the PEG ratios of multi-trillion-dollar peers like Microsoft and Apple.

Technical Indicators Flashing Green

The technical indicators also paint a bullish picture. The stock is well above its short-, mid-, and long-term moving averages, indicating strong momentum. The recent surge in volume further confirms heightened investor interest.

The Bias and Sentiment Strength (BASS) Indicator, a composite tool created by @mattzab combining several technical indicators, also flashes a strong buy signal for Nvidia. (For a detailed explanation, see this page: ).

The Road Ahead: Smooth Sailing or Bumpy Ride?

The big question is whether we'll see a soft landing, a minor pullback, or a significant dip. This will depend on how many investors decide to take profits and the speed at which they do so. A rapid sell-off would likely be triggered by a sudden collapse in the "AI hype" or if companies find themselves unable to effectively utilize their new AI chips, or their efforts to capitalize on LLMs fail.

It's still early days in the AI boom, but parallels have already been drawn with the dot-com bubble which many investors are old enough to remember. It took Apple more than 5 years after the crash to reach its dot-com peak, and Microsoft needed more than 14 years. While there is no looking back for these stocks now, one shouldn't forget that Cisco, which was regarded as a crucial internet infrastructure provider at the turn of the century, never reached its dotcom peak again. But then again, past market crashes do not guarantee future losses, or how did the saying go again?

For now, the status quo remains: everyone is bullish as long as everyone else is bullish as well.

As always, stay vigilant out there!

## Catching Spikes on Boom 300 and Crash 300 with Trendlines## How to Catch Spikes on Boom 300 and Crash 300 Indices on Deriv Using Trendlines in TradingView

Catching spikes on the Boom 300 and Crash 300 indices on Deriv using TradingView involves leveraging trendlines to spot potential breakout points. Here's a brief guide on how to do this effectively:

### 1. Setting Up Your Chart

- Open TradingView and select the Boom 300 or Crash 300 index.

### 2. Drawing Trendlines

- **Identify Highs and Lows**: Locate significant highs and lows on your chart.

- **Draw the Trendline**: Connect at least two significant highs for a downtrend line or two significant lows for an uptrend line.

### 3. Spotting Spikes

- **Boom 300 Index**:

- Look for points where the price breaks above the downtrend line.

- This breakout can signal an upcoming upward spike.

- **Crash 300 Index**:

- Look for points where the price breaks below the uptrend line.

- This breakout can indicate an impending downward spike.

### 4. Confirming the Breakout

- **Volume**: Ensure there is an increase in volume during the breakout.

- **Candlestick Patterns**: Look for bullish reversal patterns for Boom 300 and bearish reversal patterns for Crash 300 near the trendline.

### 5. Risk Management

- **Stop-Loss**: Place a stop-loss slightly below the breakout point for Boom 300 and slightly above for Crash 300.

- **Take-Profit**: Set your target based on previous highs/lows or use a risk-reward ratio.

By using trendlines to identify and confirm breakouts, you can effectively catch spikes on the Boom 300 and Crash 300 indices on Deriv with TradingView.

[enqAIUSD] New Gem, Still unknown and unoticed. added on Dec.BIGHello,

I stumbled upon this one when I was searching for new AI cryptos since I missed the fetch, agix etc pump...

This one is a good project I went though their documentation. They are serious and major plans lay down already.

ONLY on ETH swap and CoinEx(was JUST added 2 day ago chart still NOT on TV) at the moment. as soon as it will be noticed... you should know what's gonna happen.

This is a project that might end up on Binance...

Cheers

$POL - Gap fill awaits! 500M Annual Revenue, 18M MarketcapThey recently posted their restated financial statements for 2021 and 2022 and released Q1 2023 results. 500m annual revenue. 18m marketcap. Due your own research, own your own trades. This is not financial advice.

$RAY - showing a #RAY of PUMPHello my Fellow TraderZ,

$SOL is breaking out, so will its ecosystem.

$RAY is consolidating beautifully here.

If you see price has formed ASCENDING TRIANGLE on DTF.

Break $0.35 and BOOM for ~80% Gains. Look at the GAP till next Resistence level.

Use proper R : R .

Happy Trading. CHEERS!!!