10Y Bond Yield Bottomed?Every time I'm in doubt, I zoom out. The 10 year yield has been Consolidating in a channel for a while and it broke down and now is back in the channel. This is telling me rates may run up to at least the top of the channel around 3%. This will put pressure on the tech sector and high growth stocks. I believe the best place to be in this markets, is either out or the energy sector, the financial sector (banks) and consumer non-durables. I hope some of you see this and get on the right side. Good Luck!

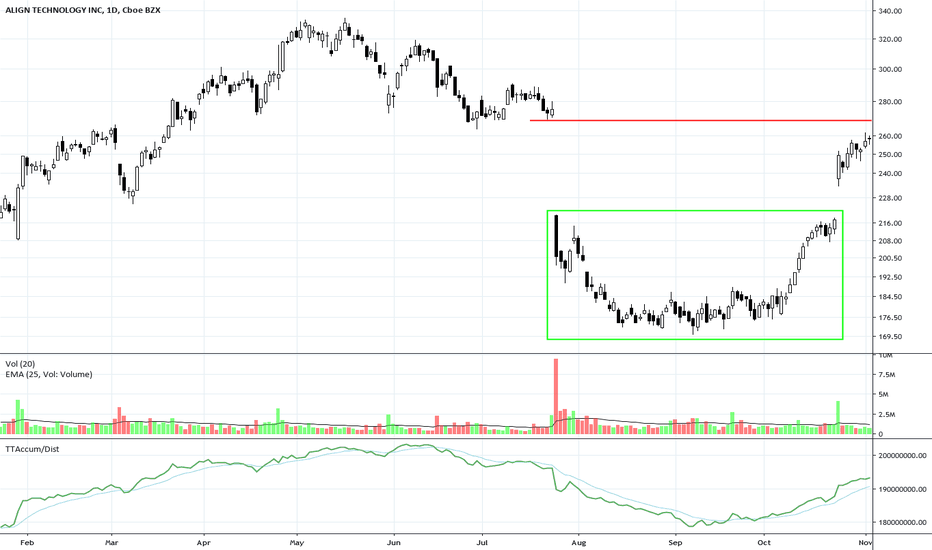

Bottomformation

From ATH to ATL, and back again?DIA dumped hard after an all time high on the 5th of may in 2021. When BTC dumps, most altcoins dump too and it even dipped to the all time low a few weeks ago. Even though there are equal highs getting rejected by a resistance zone from the beginning of 2021, there are higher lows indicating upward price pressure. Some would call it an ascending triangle. Gaining the upside of this zone (1.215) on the daily, and retesting it as support would be a sign of strength and indicates further movement up

Bitcoin Tops and Bottoms Before the S&P500Is Bitcoin a good barometer for the broader market? The chart laid out above suggests this is a possibility - and indeed, it would make a lot of sense, considering how risk tends to peak prior to tactical and cyclical corrections in the stock market, and Bitcoin is broadly considered to be a risk asset.

Note how the 2017 macro top in BTC foretold a top in the S&P just 5 weeks later, and in 2018 BTC bottomed just a few weeks before the S&P. Yet again, this relationship held during the 2020 COVID crash with BTC finding a bottom just two weeks before the S&P. Is the recent top formation in Bitcoin signaling potential weakness in the S&P500 that is yet to come?

With breadth deteriorating across major indices, the almighty dollar (DXY) finding support and shaping up for a potential double bottom, and the least amount of bears on the AAII survey since Feb 2018, it's possible that the S&P is in for a deeper pullback, one that is well-deserved after such an incredible run from the COVID crash lows. One thing I'm looking for to see confirmation of a tactical top in the broader stock market is the Financials Sector (XLF). If we can't hold above that former major resistance, then we are likely in for a messy S&P over the summer. Remember, assets can correct in both price and time. We may just be in for some more sideways rather than an outright move down. If the S&P does begin to correct, it is safe to assume that Bitcoin may once again find a constructive bottom a few weeks before the S&P.

I'll be on the lookout for all of the above and will keep this post updated. Till then, happy trading!

Buying All the DipsKraft Heinz chart screaming "buy our dips" !

This Buffet darling has taken a serious beating since inception, crashing as low as -80% off the all time high. Buying after an 80% crash is generally the right time to begin accumulating an asset if you believe it has long term potential. Evidence of accumulation is also bolstered by the clean H&S bottom forming with lots of volume being traded down at these levels, as evidenced by the volume profile visual range.

Other bullish developments include the 200 dma flattening and beginning to slope up for the first time since the multiyear downtrend began. Additionally, if we invert the chart, we see an incredibly clean topping pattern that is just begging to crash lower and fill the gap.

For these reasons I'm long looking for the gap fill and a move to the .382 fib of entire chart range. I took a position in some relatively cheap long calls, will update this post before they expire. Happy trading!

MJ- Cannabis stocks in the accumulation zoneACB, APHA, CGC, CRON, GTBIF, TLRY are in my Cannabis watchlist. I am bullish on APHA and GTBIF.

MJ is a more conservative approach to capture the gain with limited downside risk.

Ladder buy within the demand zone. Set the stop loss 10% to 15% below the demand zone for the swing to intermediate setup.

XLNX Bottom Formation StrengthensXLNX had a sudden Inverted V Topping Formation during the summer of 2019, but has recently filled the gap down and is moving up to a bottom completion.

CSCO Weakening Bottom FormationCSCO has been struggling with a weaker short-term bottom formation that has gapped several times to form Island Gaps. CSCO recently failed to break to the upside against weak to moderate resistance above the current price. The reason is that the giant Buy Side Institutions are not quietly accumulating CSCO at this time.

MRO Bottoming ImprovementMRO is forming an intermediate-term bottom formation that is slowly improving.

CERN Intermediate-Term BottomCERN is working on completing an intermediate-term bottom formation to resume an uptrend. Resistance is weak at this bottom completion level.

CELG Bottom Completion Tests Higher ResistanceCELG completed a long-term bottoming formation in June and recently moved up to challenge a higher resistance level.

EURUSD, Buy on H1**Disclaimer** the content on this analysis is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

Traders!! if you like my ideas and do take the same trade like i do, please write it in comment so we can manage the trade together.

___________________________________________________________________________________________________________________________________________

Thank you for your support ;)

GWBFX

USOIL, short term forecastNOTE : wait for the price to breakout the falling wedge structure, then you can buy dip for this setup

**Disclaimer** the content on this analysis is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

Traders!! if you like my ideas and do take the same trade like i do, please write it in comment so we can manage the trade together.

___________________________________________________________________________________________________________________________________________

Thank you for your support ;)

GWBFX