BPCL looking strong on Weekly Charts. Bharat Petroleum Corp. Ltd. is a holding company, which engages in the business of refining of crude oil and marketing of petroleum products. It operates through the Downstream Petroleum and Exploration & Production (E&P) segment. The Downstream Petroleum segment includes the refining and marketing of petroleum products. The E&P segment focuses on hydrocarbons.

Bharat Petroleum Corp. Ltd. Closing price is 293.20. The positive aspects of the company are Very Attractive Valuation (P.E. = 9.3), Companies with reducing Debt, Companies with Zero Promoter Pledge, Stocks Outperforming their Industry Price Change in the Quarter, Growth in Net Profit with increasing Profit Margin and MFs increased their shareholding last quarter. The Negative aspects of the company are Declining Net Cash Flow : Companies not able to generate net cash and Companies with growing costs YoY for long term projects.

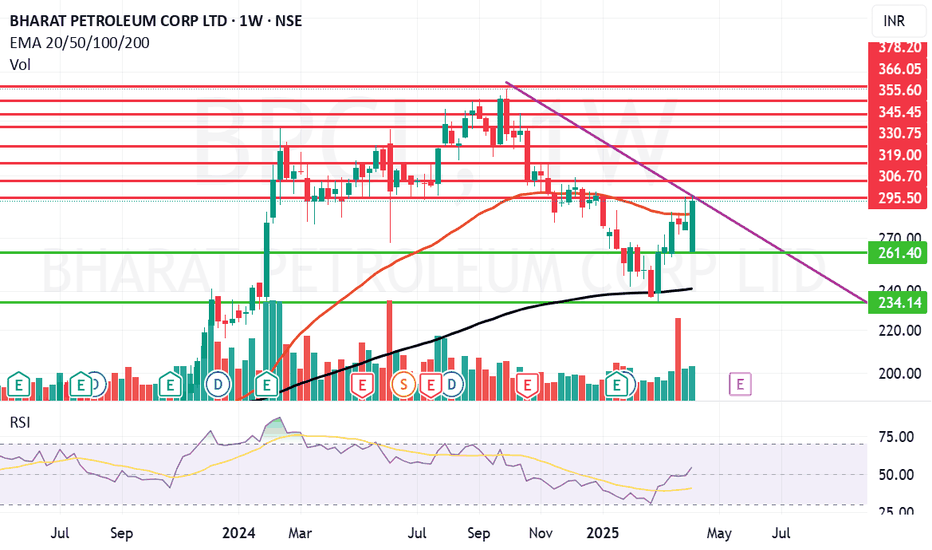

Entry can be taken after closing above 296 Historical Resistance in the stock will be 306, 319 and 330. PEAK Historic Resistance in the stock will be 345, 355 and 366. Stop loss in the stock should be maintained at Closing below 261 or 234 depending upon your risk taking ability.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Bpclanalysis

BPCL : Filling Fuel for recoveryBPCL | Based on Demand Zone and Elliott Wave Analysis

Chart Overview

The chart highlights a completed Elliott Wave 5-structure, with price entering a Valid Demand Zone between ₹270-280.

A potential reversal setup is visible, targeting higher levels if price action confirms buyer strength.

Analysis Breakdown

Key Zones to Watch:

Demand Zone (₹270-280):

A deep retracement zone with strong historical buying activity.

Liquidity likely emerges here after breaking the Major Base Support, trapping weak sellers.

First Target Zone (₹343-355):

Initial resistance where sellers may reappear after a reversal.

Second Target Zone (₹387-400):

Extended retracement supply zone where profit-taking is expected.

Elliott Wave Structure:

The current chart shows a 5-wave bearish structure:

Wave (1): Initial impulsive move down.

Wave (2): Weak corrective pullback upward.

Wave (3): Strongest wave breaking major supports.

Wave (4): Minor correction upward.

Wave (5): Final wave driving price into the demand zone.

Wave 5 completion often signals a potential trend reversal, aligning with this setup.

Confirmation Signals:

Price Action: Look for bullish reversal candlestick patterns (e.g., hammer, bullish engulfing) near ₹270-280.

Volume Spike: Increased buying volume in the demand zone indicates institutional interest.

Change of Character (ChoCH): Shift from lower lows/lower highs to higher highs/higher lows.

Trading Plan

Bullish Reversal Trade:

Entry: Near ₹270-280 upon confirmation of bullish price action or volume signals.

Targets:

Target 1: ₹343-355 (initial resistance).

Target 2: ₹387-400 (supply zone).

Stop Loss: Below ₹265 (invalidation of demand zone).

Bearish Breakdown Trade (If Setup Fails):

Logic: A daily close below ₹265 invalidates the demand zone.

Entry: Short position below ₹265 after a confirmed breakdown.

Target: ₹240-250 (next strong support zone).

Stop Loss: Above ₹270-275 (to avoid false breakdowns).

Risk Management

Position Sizing: Limit risk to 1-2% of total capital.

Stop Loss Discipline: Strictly follow stop-loss levels to prevent emotional trading.

Risk-to-Reward Ratio: Aim for at least 1:2 or higher R:R ratio (risk ₹10 to target ₹20+).

Educational Notes

Demand Zone Reversals: Demand zones often lead to significant reversals when combined with liquidity traps and bullish signals.

Wave 5 Completions: Wave 5 typically completes a trend, offering reversal opportunities.

Patience is Key: Wait for confirmation signals to improve trade probability.

Conclusion:

Bullish Plan: Watch for reversals in the ₹270-280 demand zone, targeting ₹343-355 and ₹387-400.

Bearish Plan: Short below ₹265 if the demand zone fails, targeting ₹240-250.

Stick to the plan, follow risk management rules, and allow the market to confirm your bias before executing trades.

Disclaimer:

I am not a SEBI-registered analyst. The above analysis is for educational purposes only. Please conduct your own research or consult with a financial advisor before making trading decisions.

BPCL with high dividend yield wants to go higher. Bharat Petroleum Corp. Ltd. is a holding company, which engages in the business of refining of crude oil and marketing of petroleum products. It operates through the Downstream Petroleum and Exploration and Production (E&P) segment. The Downstream Petroleum segment includes the refining and marketing of petroleum products. The E&P segment focuses on hydrocarbons.

Bharat Petroleum Corp. CMP is 340.75. The positive aspects of the company are cheap Valuation (P.E. = 7.8), Company reducing Debt, Company with Zero Promoter Pledge, Dividend yield of the company at CMP is 6.2%. and Strong Annual EPS Growth. The Negative aspects of the company are Declining Net Cash Flow : Companies not able to generate net cash, Increasing Trend in Non-Core Income and Companies with growing costs YoY for long term projects.

Entry can be taken after closing above 347 Targets in the stock will be 355 and 363. The long-term target in the stock will be 375. Stop loss in the stock should be maintained at Closing below 320 or 293 depending on your risk taking ability.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

BPCL - Long SetupBPCL has bullish harami setup and already 15m candle has sustained above the price - 337.95 for more than 10 seconds.

Targets are: 352.95, 367.95

Stoploss only when 15min candle closes below the price: 322.95

Disclaimer: This is for educational purpose only and not any financial advice

BPCL is ready for a bullish break outBPCL has been trading with good volumes on the bourses in recent months.

The 52W H/L being INR 484.60 / 314.10

It is consistently trading above its long-term Moving Average for the past 3 months

There is a positive divergence on the oscillators

It is standing right at the resistance level on higher time frames

Resultantly, I believe that the target price should be INR 545-555

Stop Loss should be INR 457.00

Risk to Reward will be 1:3

The time horizon should be 9-12 months

BPCL--Good Buy @340-335 Range??Observations::

--------->> The stock is trending upwards in daily time frame.

--------->> Previous resistance is broken @360 strongly. If this acts as support buy ness is observed.

-------->> we have a demand zone @340-335 levels. where previously strong buy ness is observed.

--------->> if this zones acts as a support, a strong rise towards upside is possible.

If price breaks resistance @375 range we have next resistance placed @385,400 range possible.

if price comes back to this place we will go for buy @375,385,400 . Keep track this levels.

BPCL : Can break box pattern? After down trend, BPCL is now in accumulation phase. Bulls are showing aggressiveness on chart. May be it revers again from here inside box.

but what if it breakout box pattern :). Can we see uptrend back ?

What's your view? My view, i will wait for Box pattern breakout before entering and keep eye on this stock. Best for Swing trading if you know price actions

Like, Share, Comment for regular updates.

Disclaimer

I am not sebi registered analyst

My studies are Educational purpose only

Please consult with your Financial advisor before trading or investing

I may be 100% wrong as its my personal trade.

First Learn and then remove "L"

BPCL view BPCL is currently in a perfect place. We can expect an ideal directional move from this point on either side.

Wait for his stock to confirm either side move with good volumes and follow-up candles.

Trade safe. Manage risk. Be profitable.

Please follow us for more simple trading analysis and setups. Also, let me know in the comment if you have any queries.

Disclaimer:- This is my view. Please analyze the charts yourself and then decide to take any trades.

BPCL1!28-11

Daily chart of BPCL1!

Candles have breached the resistance at 330 with strength (manual).

The strong bullish candle is attempting to breach resistance at 336.15 (200 EMA).

There is a bullish divergence as well.

I have gone long as I think that once the candles manage to break and sustain above 336.15, it may test 368.45 levels.

BPCL Upside IdeaI am expecting a reversal on NSE:BPCL . As per my analysis, best level to take entry is 310 (have to wait for levels to come).

My targets will be 318, 338 & 365.

Can exit if price trade below level of 295 (Stop Loss 295).

Note: This is my personal analysis, only for learning. Thanks.

One last push from BP?BP. (BP.) - 30D expiry - We look to Sell at 463.80 (stop at 475.20)

We are trading at overbought extremes.

Broken out of the triangle formation to the downside.

We look for a temporary move higher.

Daily pivot is at 469.60.

Preferred trade is to sell into rallies.

Risk/Reward would be poor to call a sell from current levels.

Our profit targets will be 433.15 and 424.15

Resistance: 450.00 / 460.00 / 470.00

Support: 440.00 / 430.00 / 420.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis , as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses

Head & shoulder in BPCL. BPCL has formed a head and shoulder pattern on a daily time frame.

The stock had closed just near the neck line and if the level is crossed a nice target of 315 can be achieved in intraday trade.

The stock is trading below 20 and 200 DMA and on the hourly time frame, there is a bearish moving averages cross over.

Confirmation for the trade:-

1. Head & shoulder

2. Bearish cross over (hourly time frame)

3. Closed below 20 and 200 ema (daily time frame

Only enter the trade if a 60 minute candle closes below 320-320.5 price level.

Targets :- 315, 307

Stop loss :- 325

Wait for a clear enter in the trade and for a price action near the levels. A intraday and even a swing trade can be initiated in this stock.

BPCL - long viewThe stock has crested a good base at the level range of 330 levels.

As you can see the stock has taken support around this area and moved upwards.

It reached a high of 503 levels before crumbling to huge selling pressures.

The stock is trying to make its way back to the top.

I have presented my views on the chart with levels that can help you take your trades.

Thanks & Regards,

If you feel you can make use of my and put them to good use, request you to kindly revert with feedback/suggestion/improvement