Brazil

Brazil's Ibovespa Soon To Enter Grand Supercycle Wave 3With the recent plunge in the international markets, Brazils Ibovespa is soon to reach Wave 2 bottoming territory and should stage Grand Supercycle Wave 3 next.

Com a recente queda nos mercados internacionais, o Ibovespa deve em breve chegar no território de fundo de onda 2(Grande Superciclo) e em seguida encenar a onda 3 de Grande Superciclo

Suporte fortíssimo no fundo da onda II da (V)

Brazilian Real under fire - USDBRL Macro OutlookThe Brazilian Real remains under fire due to a weakening commodity outlook, continued coronavirus concerns and impacts on LATAM/emerging market assets, revisions in inflationary outlook (down to 3.25% for 2020) and subsequent shifts in future monetary stimulus, high gross debt to GDP (~80%) and continued capital outflow from asset markets.

All within a risk-off climate supporting dollar bids.

We continue to see compelling evidence for a leg higher from a technical perspective with price supported by its 52-Week Moving Average, completion of the first corrective leg and an extension into our macro swing target of 5.00xx. Around a +16.00% move on the cards from here.

We have added buyside exposure across both our macro and directional portfolios.

-------------------------

We look forward to continuing to provide market leading analysis to traders & investors alike across the TradingView platform.

Like, subscribe and leave your comments below!

Until next time,

Portier Capital

Macro Strategy & Portfolio Management

Global Emerging Markets - Macro Outlook & CommentaryTraders & Investors,

We anticipate emerging markets to be vulnerable to a macro slowdown following the virus outbreak in China. Emerging Markets have a high dependency on Chinese demand and consumption which often creates a very strong correlation between domestic activity/trade and the performance of these markets.

The effects of the virus are prominent with analyst expectations of substantial drops in Chinese Q1 GDP, dovish positioning of the Monetary Authority of Singapore, sell off in Crude/Brent, gaps lower in Asian Equities and flows into risk-off assets.

Following the euphoric bull run in 17'/18' and pullback into fair value, we see price correcting for a move lower into our buyside floor and macro swing targets of 34.0x.

We have added sellside exposure across both our macro and directional portfolios

-------------------------

We look forward to continuing to provide market leading analysis to traders & investors alike across the TradingView platform.

Like, subscribe and leave your comments below!

Until next time,

Portier Capital

Macro Strategy & Portfolio Management

BRZU em cima da M.A. 200Olá investidor,

Seguindo o mercado, a AMEX:BRZU , ETF Bullish do mercado brasileiro, corrigiu e encontrou a média móvel de 200 períodos.

Ponto interessante para entrar na compra.

Vou analisar de perto o desempenho na segunda e terça para determinar a entrada na compra.

Bons trades!!!

HERSHEY: $154 takes the Lead WITH SUGAR at $14/tonHershey (HSY): $154 <-- $83 Kitkat, Kisses, Reese's ETC . this sexy stock rewards those loyal sweet tooth (+70%)

Mondelez (MDLZ): $55 <- $36 makers of our very own OREO NABISCO RITZ etc making decent gains of (+50%)

Tootsie Roll (TR) $$34 <-- $26 Frooties and Classic Tootsie that gave decent gains as well

the underlying asset SUGAR (+28%) provides decent life to PLANTERS TRADERS and DEALERS

for Local Philippines the SUGARLANDERS should be upsizing positions and leveling up lifestyles

with new MANSIONS CARS and lavish parties again..

Listed issues in the business of AGRI AGRO etc..

CAT: ₱16.0

ANI: ₱12.0

DELM: ₱5.0

VMC: ₱2.55

FRUITS: 1.80

RCI: ₱1.75

ridethepig | BRL 2020 Macro MapThis train is picking up speed and as most of those who follow the Brazilian chart updates will know there is now momentum via Bolsonaro's pension reform. This is giving consumers the ability to drive growth into 2020 and beyond via things like credit and the appropriate monetary policy.

Inflation is still coming down which means CB can keep lower rates, this will provide profit taking and reloading opportunities in 2020. For those really wanting to dig deeper into the flows, retail housing market will be a useful gauge to the next chapter as it will highlight the pace / acceleration of the pick-up.

On the technical side, a very clean 5 wave sequence over a multi year period. What we are trading here is the ABC corrective leg via Brazil momentum and capturing a double whammy with USD devaluation. Here tracking 3.70x as the level in play for USDBRL in 2020 macro flows, I also favour BRL on other crosses in particular versus MXN:

Thanks for keeping the support coming with likes, comments, questions and etc. We can open the Brazil conversation here for the year ahead. For those wanting to dig deeper with the 2020 strategies I have attached them in the related charts.

EWZ, iShares Inc. MSCI Brazil ETF - Breakout on Bullish PatternAMEX:EWZ

Bullish set up and resistance breakout on the ETF representing the Brazilian market.

As always the ascending triangles are among our most common traded patterns because they have a profit realization degree of 50% with an average Profit/Loss Ratio of 3:1.

finance.yahoo.com

Brazilian Real to trade higherLooking at the recent changes in Brazil the technicals and fundamentals are lining up for a stronger BRL.

BRL may open stronger Thursday, as the central bank delivered an expected 50bp rate cut, but notably removed the following

sentences from the statement.

“In the Copom evaluation, the evolution of the basic scenario and the balance of risks

prescribes an adjustment in the degree of monetary stimulus, with a reduction of the Selic

rate by 0.50 percentage points. The Committee considers that the consolidation of the benign scenario for prospective inflation should allow an additional adjustment of equal

magnitude."

It also took out the phrase "in any further adjustments in the degree of stimulus" from the

following line in the October statement: “The Copom understands that the current stage of

the economic cycle recommends caution in any further adjustments in the degree of

stimulus.”

- S&P followed the rate decision by upgrading Brazil’s outlook from stable to positive.

Looking at the technicals the EUR/BRL is currently at the Monthly Pivot and is making lower highs and lower lows - finding resistance above.

There is a lot of possible liquidity below the Yearly Pivot as this acted as strong support from the summer.

Coffee is on a rise! It must be the caffeine I have just closed out a +8% trade and I am going long again.

The initial fundamentals where:

Brazillian drought

US-China trade war increasing agriculture exports out of Brazil

Weak $BRLUSD

Although some of these fundamentals are starting to wane, the technicals continue to show that Coffee has more to go

Strange last week, the OPEC decision & near futureThe reasons for the markets getting out of “hibernation” are an active news background interspersed with the news. Recall, it was launched by Trump's decision to impose tariffs on steel from Argentina and Brazil and at the same time accuse these countries of currency manipulation. What was perceived by us as an expansion of the trade war and a possible beginning of the currency war.

Well, the week ended with the publication of statistics on the US labour market, as well as the completion of the OPEC meeting.

Let's start with statistics on the US labour market. Honestly, it surprised us. The numbers came out abnormally high for the current reality of the US economy (+ 266K with a forecast + 180K). Also, the unemployment rate fell to its record low marks (3.5%). The growth of the dollar against the backdrop of such excellent data was logical. But, given the anomalous nature of the given data, we would not be in a hurry to conclude. At least one more confirmation is needed that + 266K is not a coincidence, but a pattern. So on Monday, we will rely on local profit-taking in the dollar after Friday's growth, and therefore we will look for points for its sales.

Note that on Friday our recommendation for news trading in the USDCAD worked out perfectly: excellent US data overlapped with bad figures on the Canadian labour market, as a result, the USDCAD soared by 100 points.

Perhaps the most important event in terms of the consequences of the past week was OPEC’s decision to further reduce oil production from 1.2 million to 1.7 million from January 1, 2020. So, we can talk about the OPEC + agreement №3 (recall, the first one, provided for a reduction of 1.8 million barrels, the second one 1.2 million barrels per day). At the same time, Saudi Arabia made an unexpected statement of readiness on its part to further reduce production by another 400 thousand b / d. That is, the total reduction may reach 2.1 million barrels. This is the highest reduction since the cartel's attempts to stabilize the situation in the oil market. Despite the rather modest oil growth on Friday, such an outcome of the OPEC meeting is a very strong bullish signal. So this week, we will look for points for oil purchases.

It would seem that after such a busy week the markets need a break, but you should not count on it. This week promises to be even more volatile. Key events are the announcement of the Fed decision on monetary policy parameters in the US, the ECB in the Eurozone, as well as elections in the UK.

And although both events seem relatively predictable, there is enough time for surprises. How to make money on each of this news we will write a bit later.

As for our positions, we do not see any reason to change our basic strategy (except oil). Therefore, we will continue to buy safe-haven assets (gold is simply perfectly substituted), sell the dollar, and this week we will actively build up a long position on the pound - the victory of conservatives in the UK parliamentary elections will have to hit the pound higher. we will buy oil.

Getting ready for the Bank of Canada decisionAs we announced, the demand for safe-haven assets increased significantly this week, which provoked both an increase in gold quotes and a strengthening of the Japanese yen. And if the reason for this was an increase in tariffs on imports to the United States of aluminium and steel from Argentina and Brazil on Monday, then on Tuesday Trump intimidated to introduce an additional 15% of tariffs on Chinese imports in the amount of $ 160 billion on December 15.

At the same time, he added that he was not in a hurry and the best time to conclude a trade deal was generally after the 2020 elections.

Of course, Trump should not be taken seriously, such his comments are a clear attempt to force China to be more accommodating in the negotiations. Nevertheless, the reaction of investors can be understood.

Given that gold may easily grow (50-70 dollars per ounce), it is likely that yesterday's growth is only the beginning. So we continue to recommend looking for points of purchase for safe-haven assets.

It is worth noting the decision of the Reserve Bank of Australia to leave the rate unchanged, which is generally a positive sign for the Australian dollar. Although its growth potential so far seems limited, it could still grow (50-70 pips), especially against the background of a weak dollar.

US employment data from ADP traditionally published on the eve of official statistics is what we are waiting for. Although the level of correlation between ADP and NFP data is insignificant, strong deviations of the data from forecasts may well be flustrating to the markets.

The Bank of Canada will announce its decision on monetary policy parameters. We expect the current status quo to be saved. But a change in the nature of the rhetoric of the Central Bank may well provoke a jump in volatility. Recall that our position on the Canadian dollar is to buy. That is, selling a USDCAD above 1.33 is, in our opinion, a great trading idea.

The oil market is getting ready for the OPEC meeting. Globally, we remain supporters of oil sales. But for now, until the end of the week we take a break - the meeting may well surprise, but betting on red or black is not our approach, we prefer to work with facts.

ridethepig | BRLMXN 2020 Macro MapA timely update to my Latam charts as we approach year-end. The bullish BRL theme I have maintained all year long is starting to attract a lot of interest with the idiosyncratic pension reform. Macro data in Brazil is showing signs of finding a floor and BCB have confirmed the end of the easing cycle:

Those with more conservative hands looking to ride this for the long term can comfortably lean on BRL with carry exposure now capped. MXN is showing no signs of improvement and remains as uncertain as ever, whenever I talk to clients on the topic they speak of concerns around Mexico risk and the dovish Banxico weighing on the MXN carry.

If you ask me we are going to see a major flop in policy from Banxico and with Brazil set to recover on all fronts it remains a strategic long in all my LATAM portfolios. This is not a quick 50-100 pip trade where we are shooting blanks hoping one lands, rather this is trading a major macro flow with +11% upside.

Highly recommend all to find a way to find a way to benefit from these flows, the only downside is coming from growth momentum in Brazil fading (unlikely) and overshoots in Mexico (also highly unlikely).

Good luck those on the buy side.

EWZ, iShares Inc. MSCI Brazil ETF - Ascending TriangleAMEX:EWZ

Potential ascending triangle of continuation of an inverted trend at the beginning of 2016 in the Brazilian market.

In this case a breakout of the resistance could lead to interesting profits, and ETFs are volatile assets that have intense price changes in tight time frames, and a liquidity necessary to allow immediate trading in the trade.

finance.yahoo.com

Ibovespa Termina Retração e Mira nos 120 Mil pontosPrezados,

O estudo utiliza conceitos de Ondas de Elliot, Fibonnaci, LInhas de tendência e outros idéias de Fundamentos que servem de alicerce para projetar uma alta.

---Aspectos Fundamentais---

Ao falarmos de Economia temos um Brasil reduzindo seus juros a patamares mínimos históricos, o que obriga as pessoas a buscarem novos investimentos com riscos maiores para buscar um retorno razoável -->Positivo

Com esse pensamento, não só falamos que mais pessoas investiriam em ações, assim como mais fundos de investimento teriam capital para aportar em projetos e investir em empresas, em suma: Há um bom momento para a Economia brasileira. --> Positivo.

Agenda Liberal acabou de passar, temos a Previdência passando, o que geram certa folga nas contas públicas, grande problema da Gestão atual. --> Positivo.

Privatizações estão sendo estudadas e realizadas, atuando mais uma vez na dor formada pelo déficit público atual --> Positivo

Lado negativo: Trade War entre Eua X China está desacelerando a economia global, até aonde isso vai? -> Negativo

Curva de juros dos EUA invertida, recessão pode vir em menos de 1 ano -> Negativo (qual será o impacto em uma possível crise dos EUA?)

-----Análise Técnica ----

Ao observamos a dinâmica dos preços, percebemos claramente o desenho destacado na análise.

IBOV acabou de concluir a retração de uma onda 1, respeitando claramente os níveis de Fibonnacci (o que também ocorreu na primeira leva 1-5 e, posteriormente, na ABC).

Estamos sobre uma Linha de Tendência de Alta (LTA) e sobre nossas Médias Móveis Exponenciais, que servem de apoio para a continuidade da subida.

A onda 3 tem como projeção quase os 120 mil pontos e, posteriormente poderemos passar perto dos 130 Mil pontos.

Essa análise tem um viés educativo.

Gerencie seu próprio risco.

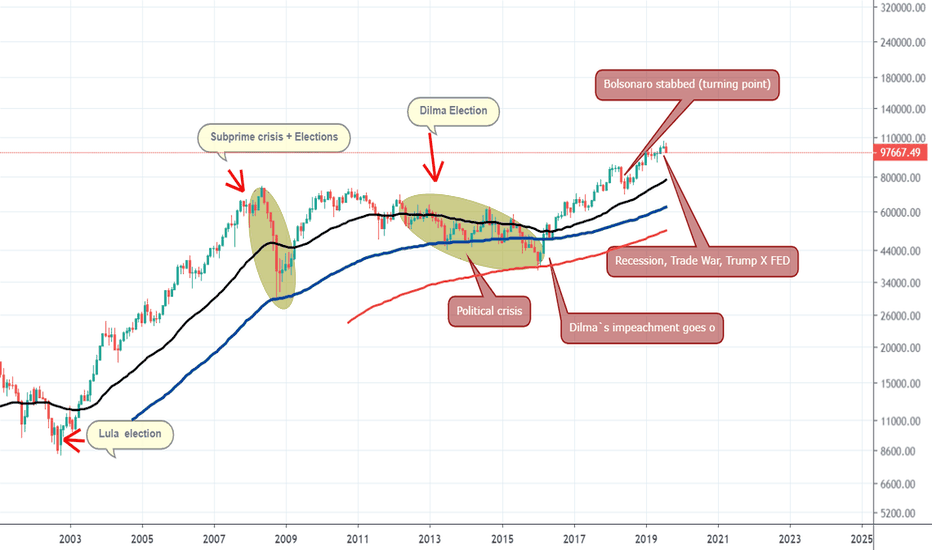

IBOVESPA Historical AnalysisThe following analysis is informative in a fundamentalist way.

I also highlight that in TA Bias, the best purchase occurred in the touch on EMA200 (perfect)

I highlight how political factors are clearly seen in the stock market.

Also note that EXPECTATION is the one that runs the stock market, so if you look at market expectations and how an exchange expectation will influence the market, you will make a lot more money than actually watching the news.

Remember that the Lula government begins with giving a favorable speech to businessmen, saying that Brazil needed them very much at this time (note that previously he had a hate speech against businessmen, which is why the market feared his candidacy).

We then highlight the Subprime Crisis that has affected the world globally, but while it has affected us here, it has not affected our tendency to improve internal conditions for investment and development.

Next, the highlight the change of government and as the political crisis in Dilma Government begins to precarize our national scenario, lack of confidence in the international scenario increases.

Here we clearly see the scenario of EXPECTATIONS, where the movement of Impeachment reflects in the stock market before it happens FACT, that is, the market already priced the fact before.

Note that there is political tension in the last elections, and the stock market falls as Haddad gained ground in election polls.

The market turns when the Bolsonaro takes the stab, at the same time the dollar reverses (uptrend) and falls sharply in the coming weeks.

The stock market has started to rise ever since, with Bolsonaro gaining ground in polls and winning the elections (priced earlier).

At the moment, the market suffers from risk aversion of the international investor.

Trade War has been intensified.

Trump X EDF in heavy clash.

But we have a very positive view for the Brazilian Stock Market and we may aim to 30% or more of upside momentum.