BTCUSD still on an upward trajectory.Guide band range set to = 4 on the weekly chart.

LVDT levels changed from "LINE" to "Area" and colors adjusted accordingly for those levels.

Price needs to stay within the green band shown.

If price moves to the upper bound within the green band, it is more likely to come down.

If price move to the lower bound within the green band, it is more likely to rebound upwards.

If price breaks significantly into the upper red zone above the green band, it is very likely to get strongly rejected downwards (i.e. during the past ATHs).

For price to advance higher, the collective LVDT band levels needs to first climb higher first to provide the upward "channel" for sustainable growth.

Right now, the LVDT bands looks to be on a healthy steady growth trajectory.

Breadth Indicators

Nuls (and most altcoins) stuck in downward trend vs. BTC.Using Nuls as an example: since I was considering if I should buy some now, due to my personal interest in its fundamentals. However its chart, like with most other altcoins, look horrible at the moment.

Here, the chart shows NULs finding support on top of the thick-green LVDT line on the 3hr chart (note, for BTC, the 3hr, as well as 4hr, and especially the 1D chart works better).

However, LVDT guide bands are in an overall downward trend vs. BTC. I will wait till the overall LVDT bands to plateau before I am confident of investing into altcoins again.

My indicators used:

LIVIDITIUM + 2STDEV-AEONDRIFT {EMA}

LVDT guide-bands + 2 level Standard Deviation bands + with a set of detection algorithms implemented.

FUSIONGAPS {EMA} ( color fills removed here)

Net market Bullish/Bearish state oscillator, with DFG and D2FG indicators implemented.

also check out the following accompanying oscillators.

DIFFERENTIAL FUSIONGAPS {DFG} = Momentum oscillator

DOUBLE-DIFFERENTIAL FUSIONGAPS {D2FG} = Accelerator oscillator

Also the FUSIONGAPS{EMA} 50/15-Series = that shows the FG, DFG, and D2FG lines for 50/15 {EMA}

{SMA} version also available.

You wont regret accumulating NEOGASThis serves as a supplement to:

-Hoarding-NEOGAS-speculative-asset-with-towering-reward-risk

I would like to hear your thoughts. If you are intrigued by the argument below give us a like/follow!

_____________________________

Just a follow up on one of my favourite assets NEOGAS.

(CREDIT to Darky999)

A few of us in this sub have been discussing / arguing / debating about the NEO vs GAS price.

It's been a great set of discussions, and I've been deliberately antagonistic to others in order to really get a passionate debate flowing. And we certainly did that! It meant I was able to hear so many different opinions, and also to test ideas and theories.

This culminated in me building a fairly large Excel model to tackle this question I reproduced the 'schedule' of NEO generating GAS - it matches the White Paper's exactly, and I modelled all sorts of scenarios over the next 20-30 years (see below for why).

EDIT: HERE IS LINK TO GOOGLE -0.20% SPREADSHEET: docs.google.com

I want to share some insights from that exercise, as the model itself is not the point here, it's what you learn from building it, and the dependencies that you observe that you simply cannot observe by just using words alone. You really cannot just say things and begin to understand the subtleties of the NEO/GAS dynamics, believe me, it's much more nuanced that you think.

There is no way to model the NEO vs GAS price - lets just be clear on this, right now 99.9% of it is simply speculation. Just like ETH is speculation, hey Crypto is ALL speculation right now.

However, if GAS is worth significantly less than NEO then NEO starts to be worth less and less itself, simply because it generates GAS - and it has actual value due to this GAS.

-------------------------------------------------------------------------

The thread goes on. I recommend you have a read.

BTC [i]low volume[/i] breakout. Will it hold?RSI looking bullish in (1D) chart, but bearish at shorter time-scale charts.

Appeared to find support at the 61.8% level of the specific fib-retrace drawn -- where I've used the 6195 USD level as the bottom instead (which was the level that was held in a long painful sideways trend before the massive dump around 14thNov18 all the way down to 3kUSD) and also where the bottom of the long wick on 17thMay19 again very briefly tested before price strongly moved further up.

BTC low volume breakout of resistance trendline. Will it hold?

FUSIONGAPS {FG} and DIFFERENTIAL FUSIONGAPS {DFG} oscillators looking bullish.

There was a 50/15 sma Death Cross on 26Jul. but a reversal (Rev) looks imminent.

i.e. the Low Reversal "LoRev" signals have already been triggered at lower time-frames.

Because of the low volume breakout of the resistance, will not be in a hurry to buy in.

Will instead wait for the "50/15LoRev" to trigger on the (1D) chart in my FUSIONGAPS {FG} oscillator, confirming a significant momentum turnaround; with the price continuing to remain higher than the previous resistance line (and not fall back lower), before making a move.

Just my own personal opinion. Not an investment/trading/financial advice.

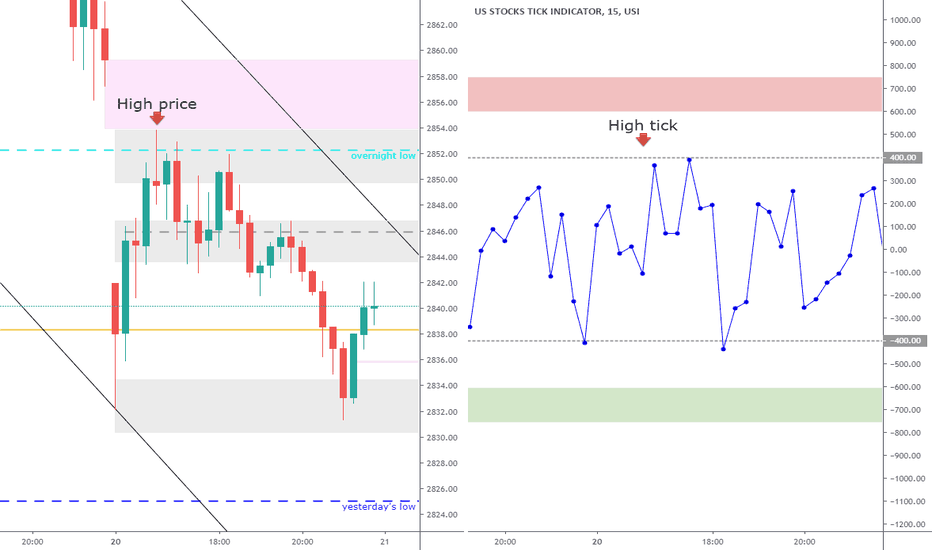

Market internals - Advance/Decline lineThe Advance/Decline Line or ‘A/D Line’ for short, is the second most important of the internals. This indicator tells us the net sum of advancing stocks minus declining stocks.

The A/D Line is expressed: # of Advancing Stocks – # of Declining Stocks

There are roughly 3000 stocks listed on the NYSE and 3000 on the NASDAQ. An A/D Line reading of 1,500+ is very bullish and a reading of over 2,000 is extremely bullish. On the flip-side readings of -1500 and below are very bearish and readings below -2,000 are extremely bearish.

These extreme readings are indicative of trending days where once the market continues to trend all the way into the close. We look to the A/D Line in conjunction with the Breadth Ratio to confirm these trend days.

For example:

A day with 2,500 advancing stocks and only 500 declining stocks would yield a net of +2,000 (an extremely bullish reading). It would take a large catalyst to shift the market direction with a reading this bullish.

If on the open you continue to see the A/D Line moving +500, +700, +900, this is a sign of market strength. If however, the market is moving higher, but the A/D Line is moving lower, a divergence has occurred and could be a sign of a market turn.

It’s important to look to the other market internals for confirmation as one indicator alone is not sufficient to confirm a move.

GJ (GBP/JPY) oversold 2hr o/iGJ (GBP/JPY) oversold at my DeMarker, RSI EMA, MACz-Vwap indicators & oscillators and indicators, at MA's triple, exponential and etc. are "bullish" at Fibonacci 0 (135.371) support since high resistance of 1(200.925) of mid 2015. Entry at low fractals and PSAR for dip-buys lows.

My 2 Cents on #BitcoinHi All,

I do have some long Bitcoin trades on at this time...

The #OBV is testing resistance on the hourly chart, So if it doesn't brake it...

The #RSI is looking at the resistance and support on the hourly chart. I have a feeling that we can see a break out to the upside... Because for now, we have been in a very powerful bull run...

The price action on the hourly chart, has found support for now... Support is in the blue box with the white outside... I can see it re-test $91,00.00 USD soon, I hope it go's to $10,000 USD then come back down...

Guys and Girls, What do you think... Do you agree or not?

Market internals - NYSE TICKThe NYSE Tick Index gives us the relationship of stocks up ticking versus down ticking. The Tick is an extremely useful tool for intraday traders.

For Example:

If there are 3000 stocks trading on the NYSE and 1500 trade higher from their previous price and 500 trade lower than their last price the Tick will read +1000. But wait what about the other 1000 stocks? They could be unchanged from their last price.

When using the Tick we are looking for extremes to enter or exit a trade. Tick readings of +1000 or -1000 are considered very strong as we typically trade between 1000 most of the time on the NYSE.

Tips for Using the Tick:

Tick readings within |400| indicate chop, ignore them

On a range day you can look to fade tick extremes

A 1 period moving average can make it easier to see the trend of the Tick

Note the extreme tick readings for the day:

When we get a high tick and a high in price at the exact same time, this could indicate the high of the day.

When a high tick prints without a simultaneous high price we can continue to make new highs, until a new high tick is reached (the reverse is true for a low tick followed by new lows).

DUAL STRATEGY : Bitcoin and BNB - Live Trading Report Hi guys,

Before I explain the strategy, here is a little story.

Not earlier than yesterday, I got a very constructive comment:

" Why should I buy your scripts ? If really they were working you would be on permanent vacation. "

The guy was right and I think the same towards people who sell their knowledge on the internet.

However what he didn't know is that I was a finished my studies not long ago and that my capital for trading right now is exactly... 393.84 USDT.

This means that in order to make a living with it I'd have to make 300% a month using 100% of my equity.

But he is right.

DO NOT buy my scripts yet !

Let's see if I can become rich using my own script.

In this idea I will post below all my trades, even if they are catastrophic.

This is why I will ask you to smash the like button in order to receive updates and see what happens ! (And if you don't like you can always tell me you how much you hate me in the comments)

Note: I use a trading bot for placing my orders on Binance. Thanks to the TradingView and Autoview teams, I do not have to manualy place the orders.

Let's move on to the strategy.

DUAL STRATEGY : Bitcoin and BNB

Rules: as a hobbyist in trading, I prefer not to use leverage or shorts. This is why I will only buy and sell on Binance.

Initial Capital : 393.84 USDT

Goal : Beat Buy & Hold ie. perform better than a holder during the whole period of the strategy.

How it works :

It is called the Dual Strategy because I use two strategies in parallel.

The idea is to make a bit more Bitcoin than a single strategy would do.

1. a strategy for BTC/USDT in 4h.

When a Buy Alert triggers, I buy BTC with my USDT.

e=binance s=btcusdt b=buy t=market q=97% (Autoview Syntax)

When a Sell Alert triggers, I sell BTC for USDT and I sell BNB for USDT.

e=binance s=bnbusdt b=sell t=market q=97%

e=binance s=btcusdt b=sell t=market q=97%

2. a strategy for BNB/BTC in 5m

When a Buy Alert triggers, I buy BNB with my BTC.

e=binance s=bnbbtc b=buy t=market q=97%

When a Sell Alert triggers, I sell BNB for BTC.

e=binance s=bnbbtc b=sell t=market q=97%

As you can see, the 2nd strategy will automatically stop working when Bitcoin is crashing, because I will simply not have any BTC on my account.

Last signal on the BTC Strategy was a sell so right now I am in USDT : 393.84 USDT

Let's get started ! What will happen next ? I can't wait.

Ethereum Long Strategy - Bands Pro Trader V3Hello,

If you trade Ethereum ( ETH/BTC ) on Binance and want to make more BTC even when the bears take over ETH, then this strategy is for you !

The goal as we do not use shorts or leverage, is to beat the Buy & Hold line ! ( see backtest below )

For this you can use my script Bands Pro Trader :

The configuration is simple.

Set the Bands Lookback to 58 and keep the smoothing to 10 (default value).

Activate a 2% Stop Loss with a Trailing Speed of 1.

Activate a 6% Take Profit.

Note: Profitability ( % profitable) can be increased to 55% by reducing Take Profit to 1%

Get access to the Cyatophilum Indicators today !

Join my Discord channel for more configurations !

Leave a comment and a like if you want a free trial, thanks !